Deck 3: Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/110

العب

ملء الشاشة (f)

Deck 3: Financial Statements

1

Generally accepted accounting principles (GAAP) are best described as a(n):

A) organization that establishes the accounting principles for U.S. financial reporting.

B) accounting standards promulgated by the International Accounting Standards Board (IASB.)

C) set of basic principles and conventions that are applied in the preparation of financial statements.

D) organization that establishes the accounting principles for business entities in the European Economic Community.

A) organization that establishes the accounting principles for U.S. financial reporting.

B) accounting standards promulgated by the International Accounting Standards Board (IASB.)

C) set of basic principles and conventions that are applied in the preparation of financial statements.

D) organization that establishes the accounting principles for business entities in the European Economic Community.

set of basic principles and conventions that are applied in the preparation of financial statements.

2

When doing business in Japan, one should use which of the following accounting principles, which are governed by which of the following boards?

A) Generally accepted accounting principles (GAAP), Financial Accounting Standards Board (FASB)

B) International financial reporting standards (IFRS), Financial Accounting Standards Board (FASB)

C) Generally accepted accounting principles (GAAP), International Accounting Standards Board (IASB)

D) International financial reporting standards (IFRS), International Accounting Standards Board (IASB)

A) Generally accepted accounting principles (GAAP), Financial Accounting Standards Board (FASB)

B) International financial reporting standards (IFRS), Financial Accounting Standards Board (FASB)

C) Generally accepted accounting principles (GAAP), International Accounting Standards Board (IASB)

D) International financial reporting standards (IFRS), International Accounting Standards Board (IASB)

International financial reporting standards (IFRS), International Accounting Standards Board (IASB)

3

Which of the following auditor's opinions would be issued if the auditor concludes that the financial statements are not presented fairly according to GAAP?

A) Adverse opinion

B) Qualified opinion

C) Unqualified opinion

D) Disclaimer of opinion

A) Adverse opinion

B) Qualified opinion

C) Unqualified opinion

D) Disclaimer of opinion

Adverse opinion

4

Which auditors' opinion is most desired and means that the financial statements are presented fairly in accordance with GAAP?

A) Adverse opinion

B) Qualified opinion

C) Unqualified opinion

D) Disclaimer of opinion

A) Adverse opinion

B) Qualified opinion

C) Unqualified opinion

D) Disclaimer of opinion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which reporting convention requires recording revenue and expenses when the transaction occurs, regardless of when cash changes hands?

A) Cost basis

B) Cash basis

C) Accrual basis

A) Cost basis

B) Cash basis

C) Accrual basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the bases for reporting monetary amounts uses what the company would get for the asset if it had to dispose of it in an orderly sale?

A) Fair value

B) Current cost

C) Present value

D) Net Realizable value

A) Fair value

B) Current cost

C) Present value

D) Net Realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

7

Adjusting the reported value of an asset to reflect current market value is best described as:

A) mark-to-book.

B) accrual costing.

C) mark-to-market.

D) historical costing.

A) mark-to-book.

B) accrual costing.

C) mark-to-market.

D) historical costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following would not be true in relation to marking assets to market?

A) Lessens volatility in equity.

B) Applied to marketable securities.

C) Results in unrealized gains or losses.

D) Writing the value of the asset up or down depending on its current market price.

A) Lessens volatility in equity.

B) Applied to marketable securities.

C) Results in unrealized gains or losses.

D) Writing the value of the asset up or down depending on its current market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a company has losses in its marketable securities, it would most likely want to report the securities using what method?

A) Held-to-maturity

B) Trading securities

C) Available-for-sale

A) Held-to-maturity

B) Trading securities

C) Available-for-sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

10

An independent director on a company's board of directors is best described as:

A) the CEO.

B) an employee.

C) someone not employed by the company.

A) the CEO.

B) an employee.

C) someone not employed by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a company has gains in its marketable securities, it would most likely want to report the securities using what method?

A) Held-to-maturity

B) Trading securities

C) Available-for-sale

A) Held-to-maturity

B) Trading securities

C) Available-for-sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

12

Your boss has asked you to analyze Wal-Mart stock. Which statement would you go to if you need a snapshot of Wal-Mart's financial position, with a listing of assets, liabilities, and equity?

A) Balance sheet

B) Income Statement

C) Cash flow statement

A) Balance sheet

B) Income Statement

C) Cash flow statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

13

Assets are equal to liabilities plus equity. This is best described as:

A) net worth

B) working capital

C) accounting identity

D) checks and balances

A) net worth

B) working capital

C) accounting identity

D) checks and balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

14

The accounting identity is best described as:

A) assets = liabilities + equity.

B) Invested capital = debt + equity.

C) net plant and equipment = gross plant and equipment - accumulated depreciation.

A) assets = liabilities + equity.

B) Invested capital = debt + equity.

C) net plant and equipment = gross plant and equipment - accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a company has assets of $4 million and shareholders' equity of $1 million. This company has liabilities closest to:

A) $3 million.

B) $4 million.

C) $5 million.

A) $3 million.

B) $4 million.

C) $5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

16

The amounts due to a company's suppliers is best described as:

A) working capital.

B) operating capital.

C) accounts payable.

D) prepaid expenses.

A) working capital.

B) operating capital.

C) accounts payable.

D) prepaid expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not true regarding EBITDA?

A) EBITDA is less than or equal to EBIT.

B) EBITDA is not affected by a company's capital structure.

C) EBITDA is operating earnings before depreciation and amortization.

D) EBITDA is useful when comparing companies that operate in the same line of business.

A) EBITDA is less than or equal to EBIT.

B) EBITDA is not affected by a company's capital structure.

C) EBITDA is operating earnings before depreciation and amortization.

D) EBITDA is useful when comparing companies that operate in the same line of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

18

The minority interest on a company's balance sheet represents:

A) equity of independent directors.

B) income not yet due the company.

C) small, non-controlling interests in another company.

D) proportion of another company's equity not owned by the company.

A) equity of independent directors.

B) income not yet due the company.

C) small, non-controlling interests in another company.

D) proportion of another company's equity not owned by the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

19

Current assets include all of the following except:

A) Inventory.

B) accounts receivable.

C) cash and equivalents.

D) property, plant and equipment.

A) Inventory.

B) accounts receivable.

C) cash and equivalents.

D) property, plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

20

Assets that are expected to be converted into cash within a year are best described as:

A) total assets.

B) current assets

C) long-term assets

D) net working capital.

A) total assets.

B) current assets

C) long-term assets

D) net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements regarding working capital is not true?

A) Current assets represent the working capital of the company.

B) Current assets less current liabilities are equal to net working capital.

C) Working capital is the sum of the book values of all physical, long-lived assets.

D) Working capital is the assets that are used in the day-to-day operation of the business.

A) Current assets represent the working capital of the company.

B) Current assets less current liabilities are equal to net working capital.

C) Working capital is the sum of the book values of all physical, long-lived assets.

D) Working capital is the assets that are used in the day-to-day operation of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

22

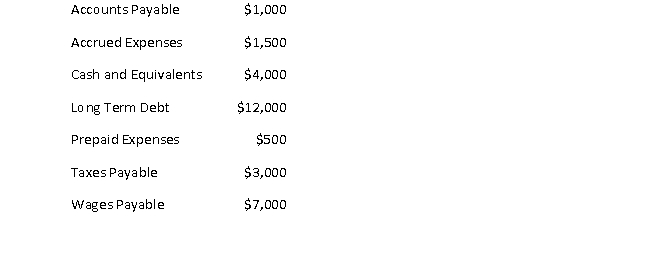

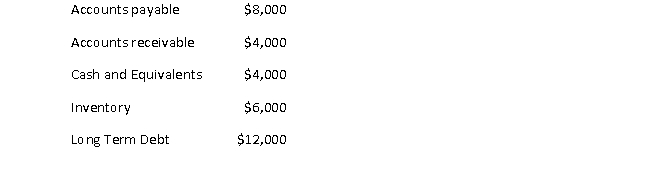

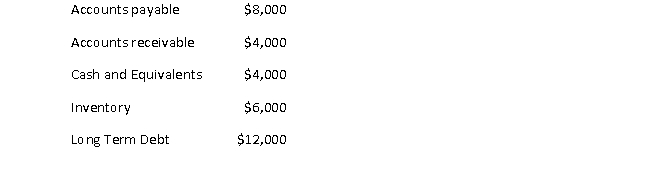

You have the following information regarding ABC Company:

Total of current liabilities are closest to:

Total of current liabilities are closest to:

A) $11,000

B) $12,500

C) $13,000

D) $29,000

Total of current liabilities are closest to:

Total of current liabilities are closest to:A) $11,000

B) $12,500

C) $13,000

D) $29,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

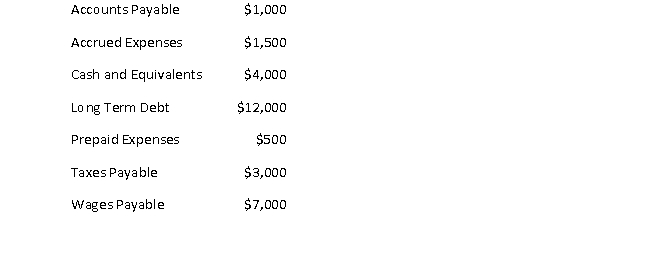

23

You have the following information regarding ABC Company:

Total of current liabilities are closest to:

Total of current liabilities are closest to:

A) $11,000

B) $12,000

C) $13,000

D) $25,000

Total of current liabilities are closest to:

Total of current liabilities are closest to:A) $11,000

B) $12,000

C) $13,000

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

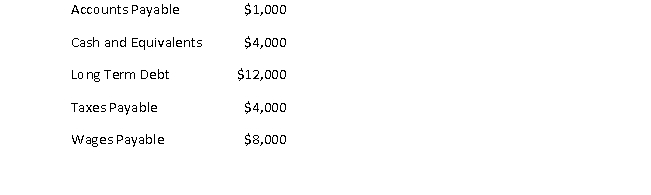

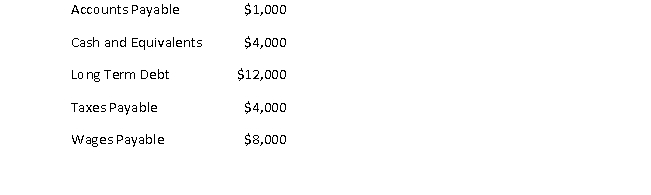

24

You have the following information regarding Cleveland Company:

Total of current assets of Cleveland are closest to:

Total of current assets of Cleveland are closest to:

A) $6,000

B) $10,000

C) $14,000

D) $34,000

Total of current assets of Cleveland are closest to:

Total of current assets of Cleveland are closest to:A) $6,000

B) $10,000

C) $14,000

D) $34,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

25

Consider a company in which current assets are $48,116, long-term assets are $65,334, current liabilities are $40,562, long-term liabilities are $49,716, and total equity is $23,172. Net working capital is closest to:

A) $7,554

B) $15,618

C) $23,172

D) $88,678

A) $7,554

B) $15,618

C) $23,172

D) $88,678

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements about accrued expenses not true?

A) Accrued expenses include taxes payable.

B) Accrued expenses include wages payable.

C) Accrued expenses are the same things as prepaid expenses.

D) Accrued expenses are amounts owed from transactions that have occurred but for which payments are not yet due.

A) Accrued expenses include taxes payable.

B) Accrued expenses include wages payable.

C) Accrued expenses are the same things as prepaid expenses.

D) Accrued expenses are amounts owed from transactions that have occurred but for which payments are not yet due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

27

Taxes that are anticipated to be paid in future years are best described as:

A) prepaid taxes.

B) taxes payable.

C) long-term taxes.

D) deferred income tax.

A) prepaid taxes.

B) taxes payable.

C) long-term taxes.

D) deferred income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Phillipses own a minority interest in a sushi restaurant. If the Phillipses own a 2% minority interest, and the sushi restaurant has $3,000,000 of assets, which of the following statements is not true?

A) The minority interest does not show up on the financial statements.

B) The $60,000 is reported on the financial statements as minority interest.

C) The minority interest is reported between the debt and equity of the company.

D) The minority interest of the Phillipses represents the interest in a company that is not owned by the controlling, parent company.

A) The minority interest does not show up on the financial statements.

B) The $60,000 is reported on the financial statements as minority interest.

C) The minority interest is reported between the debt and equity of the company.

D) The minority interest of the Phillipses represents the interest in a company that is not owned by the controlling, parent company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the order of earnings before taxes (EBT), earnings before interest and taxes (EBIT), and earnings before interest, taxes, depreciation, and amortization (EBITDA) on the income statement from the top down?

A) Earnings before interest, taxes, depreciation, and amortization (EBITDA), earnings before interest and taxes (EBIT), earnings before taxes (EBT)

B) Earnings before taxes (EBT), earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA)

C) Earnings before interest and taxes (EBIT), earnings before taxes (EBT), earnings before interest, taxes, depreciation, and amortization (EBITDA)

D) Earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), earnings before taxes (EBT)

A) Earnings before interest, taxes, depreciation, and amortization (EBITDA), earnings before interest and taxes (EBIT), earnings before taxes (EBT)

B) Earnings before taxes (EBT), earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA)

C) Earnings before interest and taxes (EBIT), earnings before taxes (EBT), earnings before interest, taxes, depreciation, and amortization (EBITDA)

D) Earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), earnings before taxes (EBT)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

30

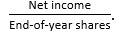

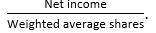

Which of the following statements is not true regarding earnings per share?

A) Earnings per share is calculated as net income divided by weighted average number of shares.

B) Earnings per share is calculated as dividends paid divided by weighted average number of shares.

C) If a company has convertible bonds or stock options outstanding, diluted earnings per share would be beneficial to the analyst.

D) Diluted earnings per share is the adjusted net income divided by the total possible number of shares that could be outstanding if all potentially dilutive securities outstanding were converted into common shares.

A) Earnings per share is calculated as net income divided by weighted average number of shares.

B) Earnings per share is calculated as dividends paid divided by weighted average number of shares.

C) If a company has convertible bonds or stock options outstanding, diluted earnings per share would be beneficial to the analyst.

D) Diluted earnings per share is the adjusted net income divided by the total possible number of shares that could be outstanding if all potentially dilutive securities outstanding were converted into common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

31

You have been asked to analyze Yum Brands. Your objective is to remove the effects of judgment on the financial statements as much as possible. If you can only look at one statement, which statement of Yum Brands will most remove the effects of judgment?

A) Balance sheet

B) Income statement

C) Statement of cash flows

A) Balance sheet

B) Income statement

C) Statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

32

Net income + Non-cash expenses - Change in working capital measures:

A) simple cash flow.

B) cash flow for/from financing.

C) cash flow for / from investing.

D) cash flow for/from operations.

A) simple cash flow.

B) cash flow for/from financing.

C) cash flow for / from investing.

D) cash flow for/from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

33

A start-up company is, on net, acquiring funds from outside the company through the issuing of new securities, including both stocks and bonds. This company's cash flow for / from financing from this transaction will:

A) be zero.

B) be positive.

C) be negative.

D) not be affected.

A) be zero.

B) be positive.

C) be negative.

D) not be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

34

Net income plus depreciation, amortization, and depletion is best described as:

A) free cash flow.

B) simple cash flow.

C) traditional cash flow.

D) free cash flow of equity.

A) free cash flow.

B) simple cash flow.

C) traditional cash flow.

D) free cash flow of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not a noncash item?

A) Goodwill

B) Amortization

C) Depreciation

D) Purchase of new equipment

A) Goodwill

B) Amortization

C) Depreciation

D) Purchase of new equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not a primary source or a use of cash on the statement of cash flows?

A) Financing

B) Operations

C) Investment

D) Development

A) Financing

B) Operations

C) Investment

D) Development

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

37

The cash flow measure that considers depreciation, amortization, and depletion, but also considers other noncash expenses and income that affect net income is best described as:

A) free cash flow.

B) simple cash flow.

C) traditional cash flow.

D) free cash flow of equity.

A) free cash flow.

B) simple cash flow.

C) traditional cash flow.

D) free cash flow of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is the difference between free cash flow and free cash flow of equity?

A) There is no difference.

B) Free cash flow includes net borrowing and free cash flow of equity does not.

C) Free cash flow of equity includes net borrowing and free cash flow does not.

A) There is no difference.

B) Free cash flow includes net borrowing and free cash flow of equity does not.

C) Free cash flow of equity includes net borrowing and free cash flow does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose a company acquires an asset at the beginning of this year for $100,000. If the asset has a salvage value of $10,000 and is depreciated using straight-line over ten years, the depreciation in the first year is closest to:

A) $9,000.

B) $9,900.

C) $10,000.

A) $9,000.

B) $9,900.

C) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose a company acquires an asset at the beginning of this year for $500,000. If the asset has a salvage value of $60,000 and is depreciated using straight-line over six years, the depreciation in the second year is closest to:

A) $60,000.

B) $73,333.

C) $83,333.

A) $60,000.

B) $73,333.

C) $83,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

41

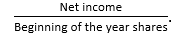

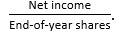

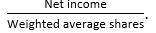

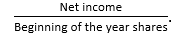

Basic earnings per share is best described as

A)

B)

C)

A)

B)

C)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cash flow from operations for the Albert Company is $4 million. If the cash flow from financing is $1 million and the cash flow for investment is $2 million, the change in cash for the fiscal period is closest to:

A) $1 million.

B) $3 million.

C) $4 million.

D) $7 million.

A) $1 million.

B) $3 million.

C) $4 million.

D) $7 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

43

Cash flow from operations for the Albert Company is $5 million. If the cash flow from financing is $2 million and the cash flow from investment is $1 million, the change in cash for the fiscal period is closest to:

A) $1 million.

B) $2 million.

C) $6 million.

D) $8 million.

A) $1 million.

B) $2 million.

C) $6 million.

D) $8 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

44

The end of year balance of cash for the Foosball Company for 2012 was $10 million, and the end of year cash balance for 2013 was $12 million. If Foosball had cash flow for financing of $1 million and cash flow for investment of $3 million, its cash flow from operations is closest to:

A) $1 million.

B) $2 million.

C) $3 million.

D) $6 million.

A) $1 million.

B) $2 million.

C) $3 million.

D) $6 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which method of depreciation is required for tax purposes?

A) Straight-line depreciation

B) Declining balance depreciation

C) Double declining balance depreciation

D) Modified accelerated cost recovery system (MACRS)

A) Straight-line depreciation

B) Declining balance depreciation

C) Double declining balance depreciation

D) Modified accelerated cost recovery system (MACRS)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

46

The U.S. tax system is a progressive tax system means:

A) it is very forward thinking

B) the rich pay higher tax rates than the poor

C) increasing amounts of income are taxed at higher rates

A) it is very forward thinking

B) the rich pay higher tax rates than the poor

C) increasing amounts of income are taxed at higher rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose the dividends received deduction is 70 percent. If a company with a tax rate on dividend income of 20 percent receives dividends of $10 million in dividends, the effective rate of tax on a $1 of dividends is closest to:

A) 1.4%.

B) 2.4%.

C) 6%.

D) 20%.

A) 1.4%.

B) 2.4%.

C) 6%.

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

48

Suppose the dividends received deduction is 80 percent. If a company with a tax rate on dividend income of 15 percent receives dividends of $10 million in dividends, the effective rate of tax on a $1 of dividends is closest to:

A) 1.2%.

B) 3%.

C) 15%

D) 20%.

A) 1.2%.

B) 3%.

C) 15%

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

49

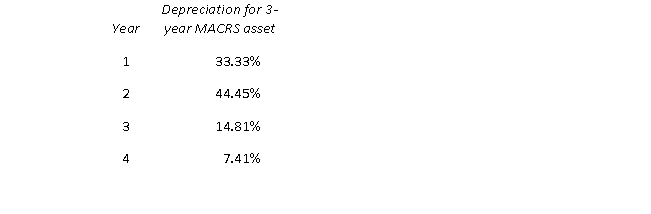

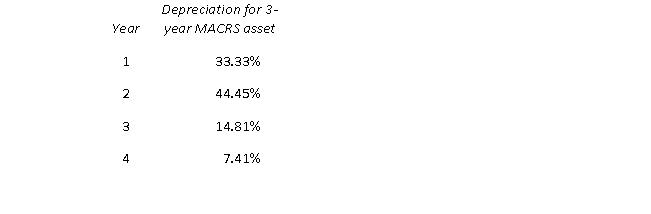

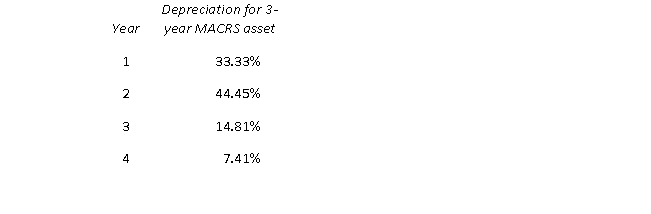

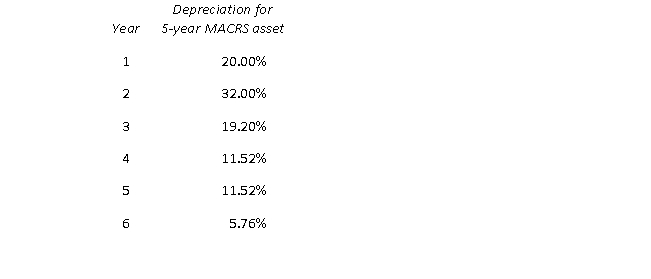

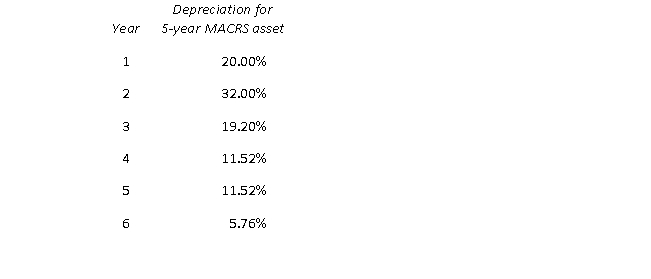

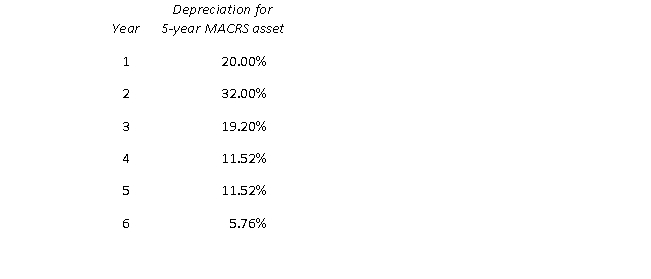

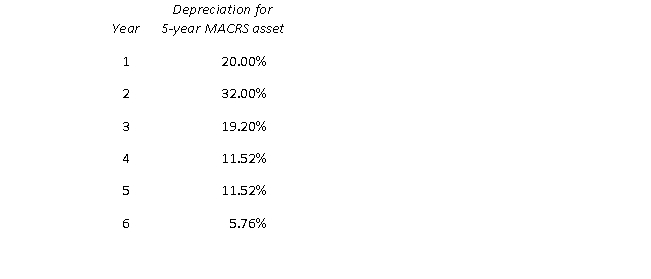

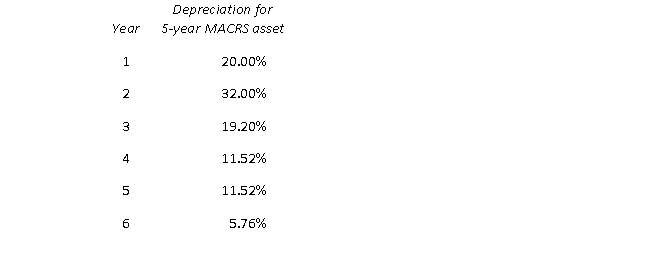

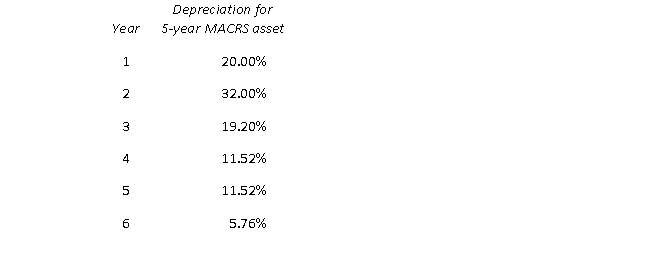

Suppose the Dallas Donut Company buys a donut fryer that costs $50,000. If the donut fryer is classified as a 3-year MACRS asset, the second year's depreciation for tax purposes on this fryer, given the MACRS rates:

is closest to:

is closest to:

A) $11,110.

B) $16,665.

C) $22,225.

D) $38,890.

is closest to:

is closest to:A) $11,110.

B) $16,665.

C) $22,225.

D) $38,890.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

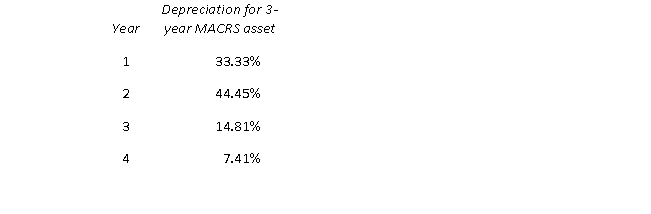

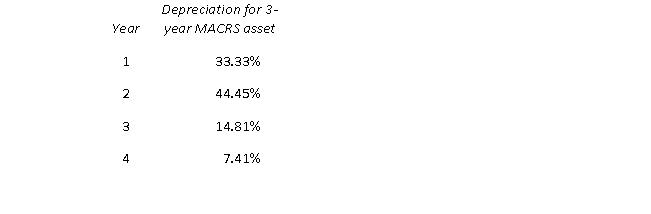

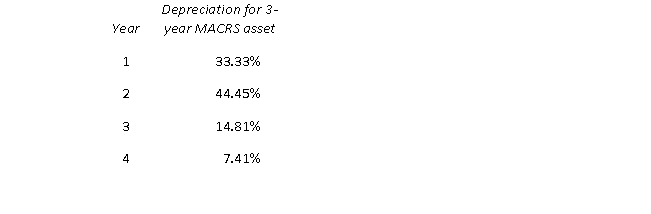

50

Suppose the Dallas Donut Company buys a donut fryer that costs $50,000. If the donut fryer is classified as a 3-year MACRS asset, the book value of the fryer for tax purposes at the end of the third year, given the MACRS rates:

is closest to:

is closest to:

A) $3,705

B) $11,110.

C) $16,665.

D) $22,225.

is closest to:

is closest to:A) $3,705

B) $11,110.

C) $16,665.

D) $22,225.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

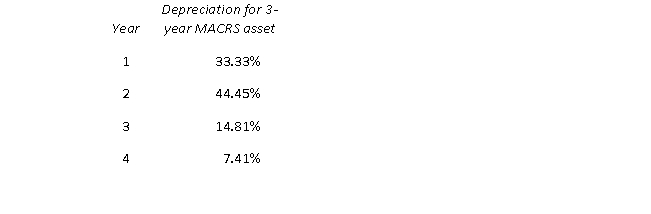

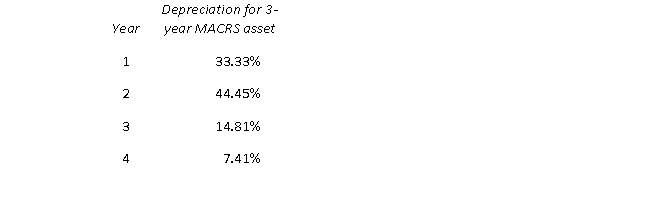

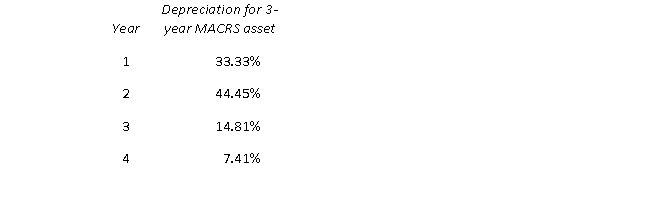

51

Suppose the Apple Company buys a boiler that costs $100,000. If the boiler is classified as a 3-year MACRS asset, the second year's depreciation for tax purposes on this fryer, given the MACRS rates:

is closest to:

is closest to:

A) $7,410.

B) $33,330.

C) $44,450.

D) $77,780.

is closest to:

is closest to:A) $7,410.

B) $33,330.

C) $44,450.

D) $77,780.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

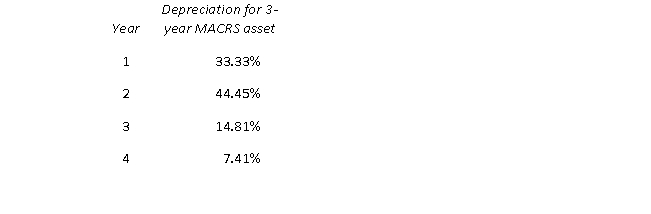

52

Suppose the Apple Company buys a boiler that costs $100,000. If the boiler is classified as a 3-year MACRS asset, the book value for tax purposes on this boiler at the end of the second year, given the MACRS rates:

is closest to:

is closest to:

A) $0.

B) $7,410.

C) $14,810.

D) $22,220.

is closest to:

is closest to:A) $0.

B) $7,410.

C) $14,810.

D) $22,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

53

Suppose the Apple Company buys a boiler that costs $100,000. If the boiler is classified as a 3-year MACRS asset, the book value for tax purposes on this boiler at the end of the third year, given the MACRS rates:

is closest to:

is closest to:

A) $0.

B) $7,410.

C) $14,810.

D) $22,220.

is closest to:

is closest to:A) $0.

B) $7,410.

C) $14,810.

D) $22,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

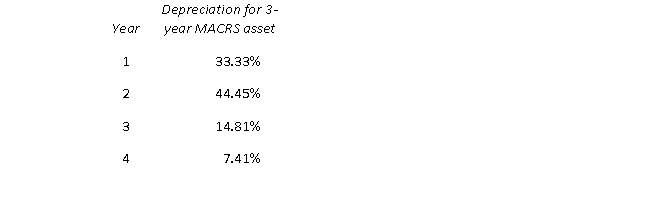

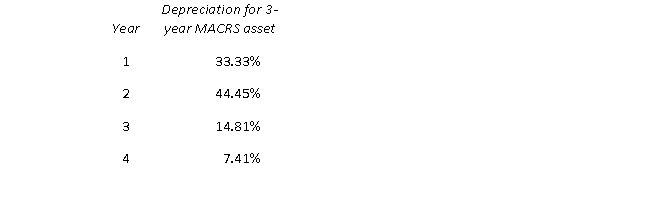

54

Suppose the Cement Company has a mixer that originally cost $100,000. Suppose the mixer is classified as a 3-year MACRS asset, with the MACRS rates:

If the Cement Company sells the mixer at the end of three years for $10,000, recapture of depreciation is closest to:

If the Cement Company sells the mixer at the end of three years for $10,000, recapture of depreciation is closest to:

A) $0.

B) $2,590.

C) $7,410.

D) $10,000.

If the Cement Company sells the mixer at the end of three years for $10,000, recapture of depreciation is closest to:

If the Cement Company sells the mixer at the end of three years for $10,000, recapture of depreciation is closest to:A) $0.

B) $2,590.

C) $7,410.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

55

Suppose the Machine Company has production equipment that originally cost $1 million, and is classified as a 5-year MACRS asset, with the MACRS rates:

If the Machine Company sells the equipment at the end of two years for $1.1 million, the capital gain and recapture of depreciation, respectively, are:

If the Machine Company sells the equipment at the end of two years for $1.1 million, the capital gain and recapture of depreciation, respectively, are:

A) $0; $520,000.

B) $0; $620,000.

C) $100,000, $520,000.

D) $100,000; $620,000.

If the Machine Company sells the equipment at the end of two years for $1.1 million, the capital gain and recapture of depreciation, respectively, are:

If the Machine Company sells the equipment at the end of two years for $1.1 million, the capital gain and recapture of depreciation, respectively, are:A) $0; $520,000.

B) $0; $620,000.

C) $100,000, $520,000.

D) $100,000; $620,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

56

Suppose the Prune Company has equipment that originally cost $1 million, and is classified as a 5-year MACRS asset, with the MACRS rates:

If the Prune Company sells the equipment at the end of two years for $1 million, the capital gain and recapture of depreciation, respectively, are:

If the Prune Company sells the equipment at the end of two years for $1 million, the capital gain and recapture of depreciation, respectively, are:

A) $0; $520,000.

B) $0; $620,000.

C) $100,000, $520,000.

D) $100,000; $620,000.

If the Prune Company sells the equipment at the end of two years for $1 million, the capital gain and recapture of depreciation, respectively, are:

If the Prune Company sells the equipment at the end of two years for $1 million, the capital gain and recapture of depreciation, respectively, are:A) $0; $520,000.

B) $0; $620,000.

C) $100,000, $520,000.

D) $100,000; $620,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

57

Suppose the Tucson Tuxedo Company has equipment that originally cost $1.2 million, and is classified as a 5-year MACRS asset, with the MACRS rates:

If the Tucson Tuxedo Company sells the equipment at the end of five years for $0.2 million, the capital gain and recapture of depreciation, respectively, are closest to:

A) $0; $1,130,880.

B) $0; $1,200,000.

C) $69,120; $1,130,880.

D) $69,120; $1,200,000.

If the Tucson Tuxedo Company sells the equipment at the end of five years for $0.2 million, the capital gain and recapture of depreciation, respectively, are closest to:

A) $0; $1,130,880.

B) $0; $1,200,000.

C) $69,120; $1,130,880.

D) $69,120; $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

58

Auditors, such as Deloitte & Touche L.L.P., prepare the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

59

Generally accepted accounting principles (GAAP) vary from country to country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

60

The establishment of Financial Accounting Standards Board (FASB) was necessitated by the globalization of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

61

The auditor will issue a disclaimer of opinion if the auditor's examination is severely restricted or the auditor finds some condition is present that prevents the application of generally accepted auditing standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

62

The objective of the financial statements is to provide information about an entity's financial performance and changes in financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

63

The method for measuring and reporting different monetary amounts for various elements in the financial statements that uses what it would cost to replace the asset or settle the liability would best be described as current cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

64

The method for measuring and reporting different monetary amounts for various elements in the financial statements that uses the amount reasonably expected to be received for an asset, or settled in the case of a liability, between knowledgeable, willing parties to the transaction, which may be based on present value or market valuations is best described as current cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

65

Three years ago ABC Company paid $4,500 for a new copier, which would cost $6,000 to replace today. If it is on the books at $4,500 this would be an example of using historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sarbanes -Oxley Act (SOX) was passed in reaction to the financial crisis of 2007 - 2008.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

67

As a result of the Sarbanes-Oxley Act, the audit committee must be composed of independent directors, who have the power to engage outside consultants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

68

Accounts payable are also known as trade payables, and represent the amounts owed the suppliers of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

69

The difference between Gross Property, Plant, and Equipment, and Net Property, Plant, and Equipment is the debt on the Property, Plant, and Equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

70

Patents, trademarks, and goodwill are examples of tangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

71

Capital leases are treated as liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

72

The operating profit, which is calculated as gross profit, less operating expenses is called earnings before interest and taxes (EBIT).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

73

Depreciation is the reduction in value of a long-lived intangible asset over a specified period of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

74

Straight-line, declining balance, and double declining balance are all reasonable methods for calculating depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

75

The choice of depreciations method chosen affects the balance sheet, but not the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

76

If an enterprise's cash flow for / from investing is negative this means the company on net is investing in long-lived assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

77

If an enterprise's cash flow for / from investing is negative this means the company on net is disposing of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

78

Taxes that the company reasonably expects to pay in the future are called deferred tax liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

79

Capital losses are generated when both depreciable and non-depreciable assets are sold below value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck

80

A loss generated when a company's tax deductions are greater than its taxable income is called a capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 110 في هذه المجموعة.

فتح الحزمة

k this deck