Deck 4: Financial Statement Analysis, Options and Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 4: Financial Statement Analysis, Options and Risk Management

1

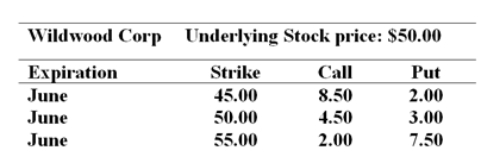

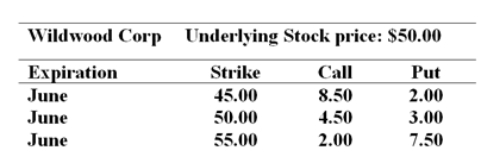

You are cautiously bullish on the common share of the Wildwood Corporation over the next several months. The current price of the share is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A) $1 050

B) $650

C) $400

D) $400 income rather than cost

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.A) $1 050

B) $650

C) $400

D) $400 income rather than cost

$650

2

An investor purchases a long call at a price of $2.50. The expiration price is $35.00. If the current share price is $35.10, what is the break-even point for the investor?

A) $32.50

B) $35.00

C) $37.50

D) $37.60

A) $32.50

B) $35.00

C) $37.50

D) $37.60

$37.50

3

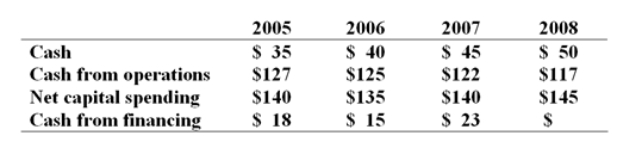

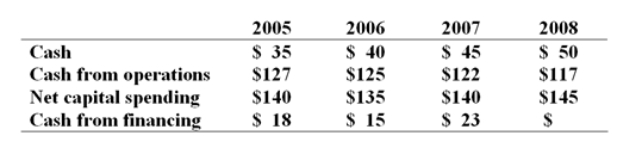

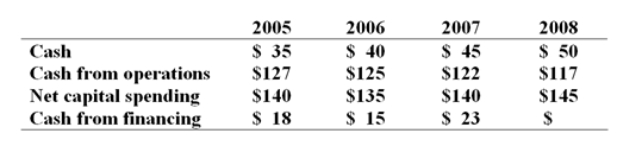

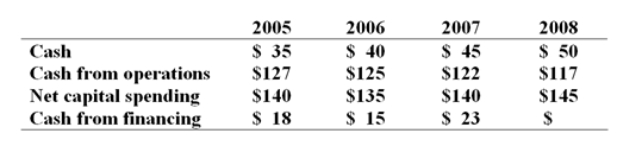

Consider the following information relating to Interceptors Ltd.  What must cash flow from financing have been in 2008 for Interceptors Ltd.?

What must cash flow from financing have been in 2008 for Interceptors Ltd.?

A) $5

B) $28

C) $30

D) $33

What must cash flow from financing have been in 2008 for Interceptors Ltd.?

What must cash flow from financing have been in 2008 for Interceptors Ltd.?A) $5

B) $28

C) $30

D) $33

$33

4

Consider the following information relating to Interceptors Ltd.  Based on the cash flow data in the table, which of the following statements is/are correct?

Based on the cash flow data in the table, which of the following statements is/are correct?

I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has only been able to generate growing cash flows by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

A) I only

B) II and III only

C) II only

D) I and II only

Based on the cash flow data in the table, which of the following statements is/are correct?

Based on the cash flow data in the table, which of the following statements is/are correct?I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has only been able to generate growing cash flows by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

A) I only

B) II and III only

C) II only

D) I and II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm has a tax burden of 0.7, a leverage ratio of 1.3, an interest burden of 0.8, and a return on sales ratio of 10%. The firm generates $2.28 in sales per dollar of assets. What is the firm's ROE?

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

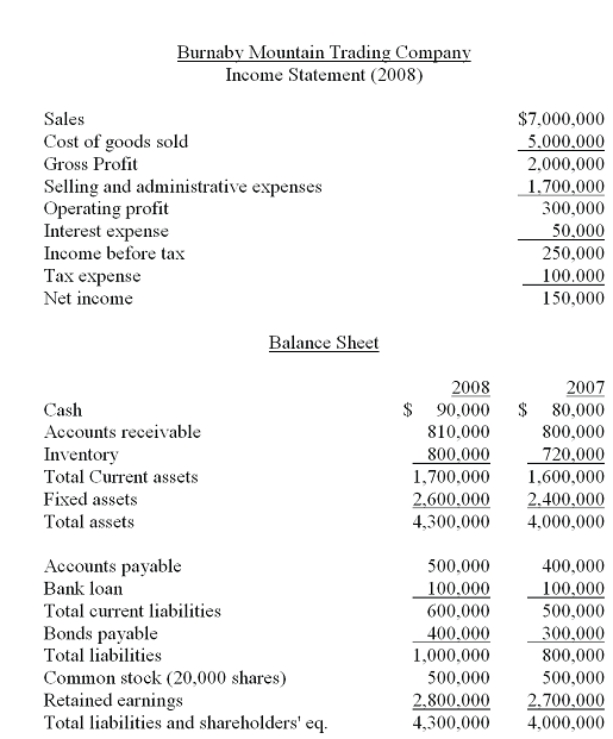

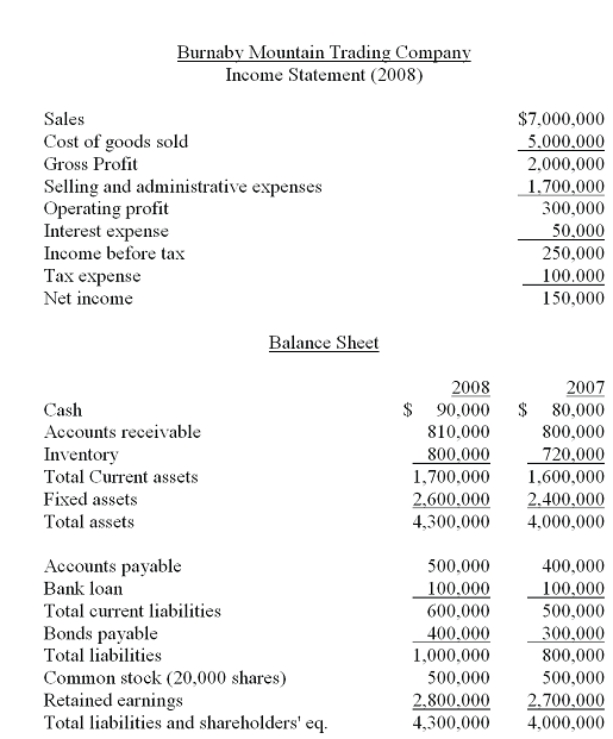

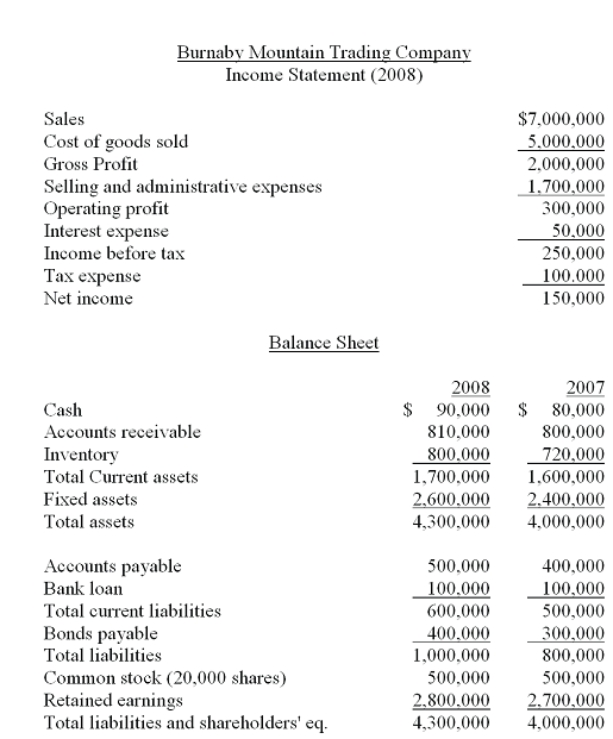

The financial statements of Burnaby Mountain Trading Company are given below  .

.

Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's current ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

.

.Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's current ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

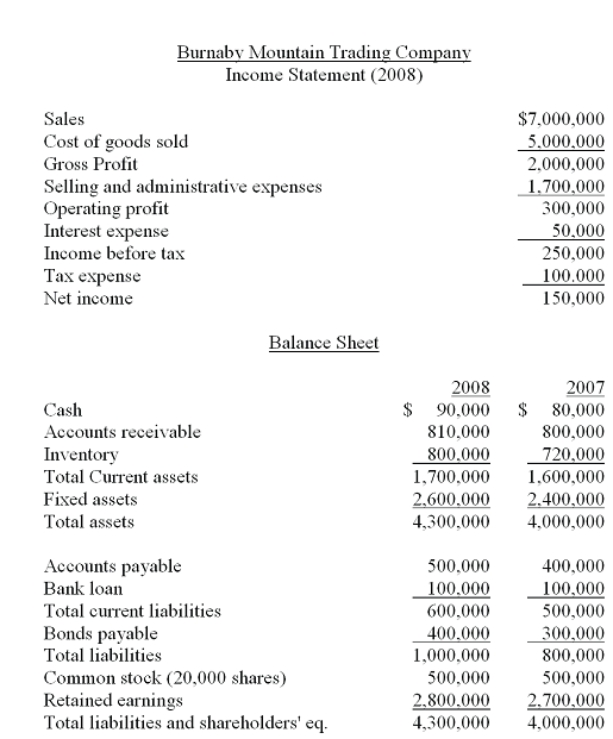

The financial statements of Burnaby Mountain Trading Company are given below.

Note: The common shares are trading in the share market for $27 each.

Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's quick ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the share market for $27 each.

Note: The common shares are trading in the share market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company. The firm's quick ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

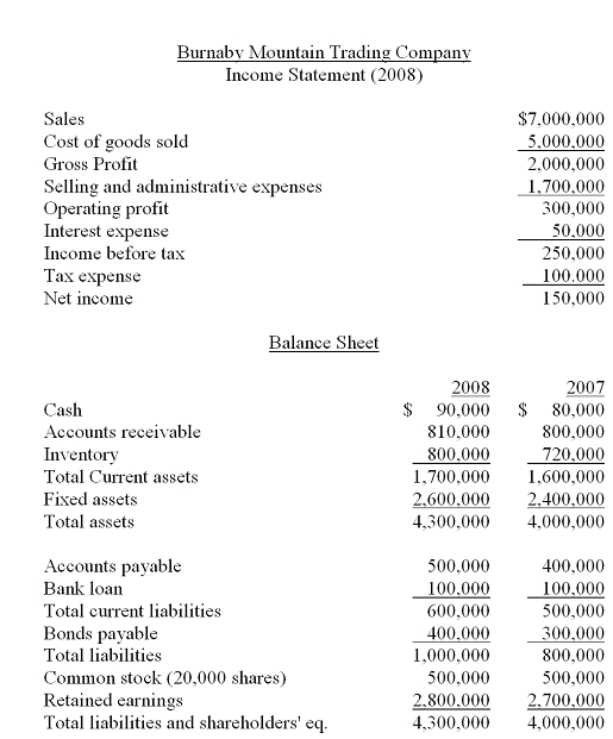

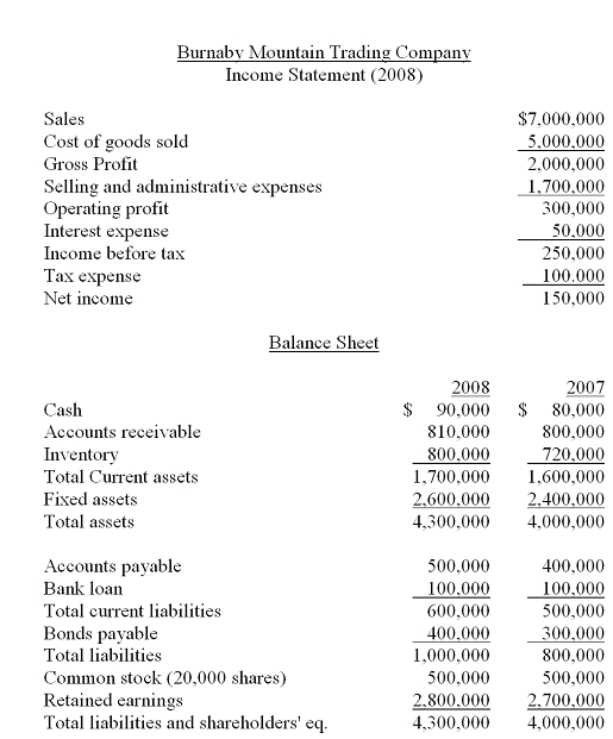

The financial statements of Burnaby Mountain Trading Company are given below.

Note: The common shares are trading in the share market for $27 each.

Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's leverage ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the share market for $27 each.

Note: The common shares are trading in the share market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company. The firm's leverage ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

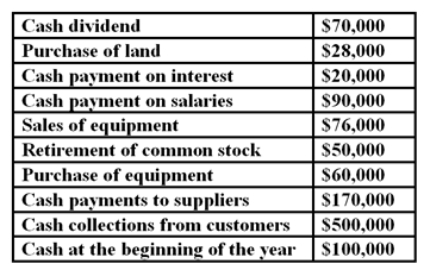

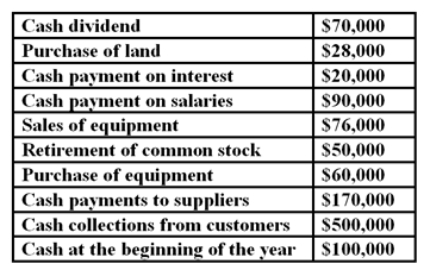

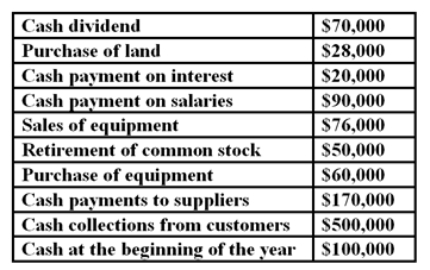

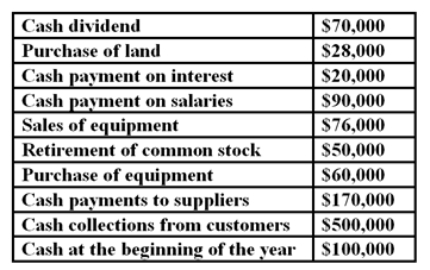

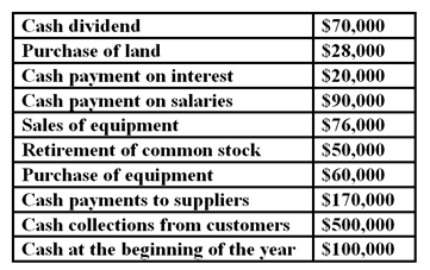

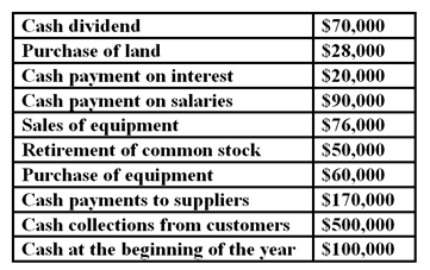

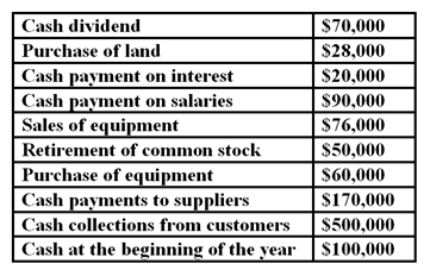

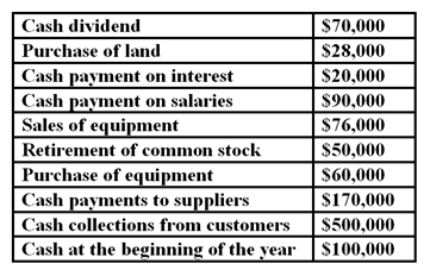

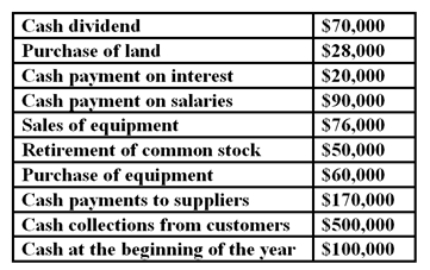

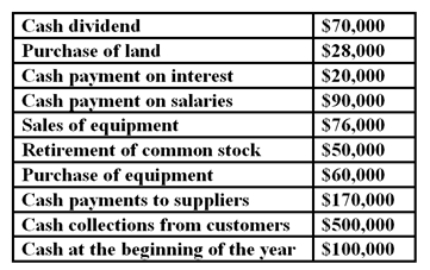

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.

What is the net cash provided by operating activities of Haven Hardware?

What is the net cash provided by operating activities of Haven Hardware?

A) ($30 000)

B) $220 000

C) $320 000

D) $780 000

What is the net cash provided by operating activities of Haven Hardware?

What is the net cash provided by operating activities of Haven Hardware?A) ($30 000)

B) $220 000

C) $320 000

D) $780 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.

What is the net cash provided by or used in investing activities of Haven Hardware?

What is the net cash provided by or used in investing activities of Haven Hardware?

A) ($12 000)

B) ($62 000)

C) $12 000

D) $164 000

What is the net cash provided by or used in investing activities of Haven Hardware?

What is the net cash provided by or used in investing activities of Haven Hardware?A) ($12 000)

B) ($62 000)

C) $12 000

D) $164 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.

What is the net cash provided by or used in financing activities of Haven Hardware?

What is the net cash provided by or used in financing activities of Haven Hardware?

A) ($10 000)

B) ($120 000)

C) $10 000

D) $120 000

What is the net cash provided by or used in financing activities of Haven Hardware?

What is the net cash provided by or used in financing activities of Haven Hardware?A) ($10 000)

B) ($120 000)

C) $10 000

D) $120 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.

What is the net increase or decrease in cash for Haven Hardware for 2013?

What is the net increase or decrease in cash for Haven Hardware for 2013?

A) ($94 000)

B) ($88 000)

C) $88 000

D) $188 000

What is the net increase or decrease in cash for Haven Hardware for 2013?

What is the net increase or decrease in cash for Haven Hardware for 2013?A) ($94 000)

B) ($88 000)

C) $88 000

D) $188 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.

What is the cash at the end of 2013 for Haven Hardware?

What is the cash at the end of 2013 for Haven Hardware?

A) $6 000

B) $94 000

C) $736 000

D) $188 000

What is the cash at the end of 2013 for Haven Hardware?

What is the cash at the end of 2013 for Haven Hardware?A) $6 000

B) $94 000

C) $736 000

D) $188 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

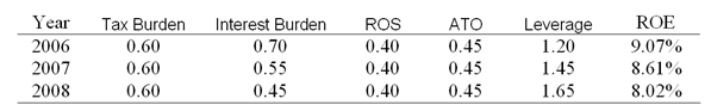

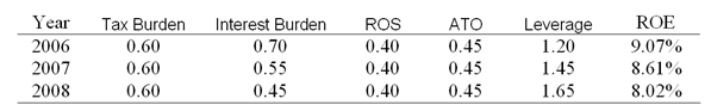

Look at the following table of data for Key Biscuit Company:

What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

A) The firm began using more debt as a percentage of financing.

B) The firm began using less debt as a percentage of financing.

C) The compound leverage ratio was less than 1.

D) The operating ROA was declining.

What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?A) The firm began using more debt as a percentage of financing.

B) The firm began using less debt as a percentage of financing.

C) The compound leverage ratio was less than 1.

D) The operating ROA was declining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

The tax burden of the firm is .4, the interest burden is 0.65, the return on sales is 0.05, the asset turnover is 0.90, and the leverage ratio is 1.35. What is the ROE of the firm?

A) 1.58%

B) 5.68%

C) 12.20%

D) 13.33%

A) 1.58%

B) 5.68%

C) 12.20%

D) 13.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck