Deck 20: Relevant Costs and Short-Term Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 20: Relevant Costs and Short-Term Decision Making

1

Sunk costs are those costs that have already been incurred and cannot be recovered.

True

2

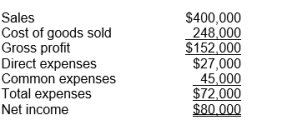

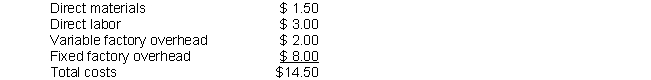

Operating results for Division A of Alpha Company during 2019 are as follows:

If Division A would maintain the same quantity of product sold while raising selling prices by 10%, increasing direct labor costs by $20,000 and implementing a new marketing campaign at a cost of $10,000, what would be the effect on the Division's net income? (Ignore income taxes in your calculations.)

If Division A would maintain the same quantity of product sold while raising selling prices by 10%, increasing direct labor costs by $20,000 and implementing a new marketing campaign at a cost of $10,000, what would be the effect on the Division's net income? (Ignore income taxes in your calculations.)

A) Net income would increase by $10,000.

B) Net income would increase by $20,000.

C) Net income would increase by $30,000.

D) Net income would decrease by $10,000.

E) None of the above.

If Division A would maintain the same quantity of product sold while raising selling prices by 10%, increasing direct labor costs by $20,000 and implementing a new marketing campaign at a cost of $10,000, what would be the effect on the Division's net income? (Ignore income taxes in your calculations.)

If Division A would maintain the same quantity of product sold while raising selling prices by 10%, increasing direct labor costs by $20,000 and implementing a new marketing campaign at a cost of $10,000, what would be the effect on the Division's net income? (Ignore income taxes in your calculations.)A) Net income would increase by $10,000.

B) Net income would increase by $20,000.

C) Net income would increase by $30,000.

D) Net income would decrease by $10,000.

E) None of the above.

Net income would increase by $10,000.

3

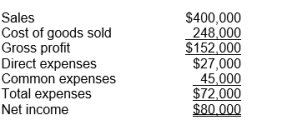

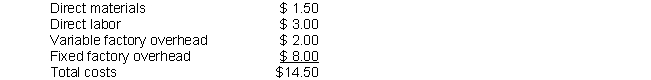

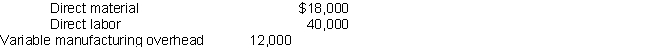

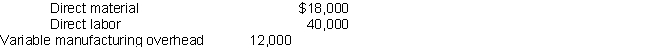

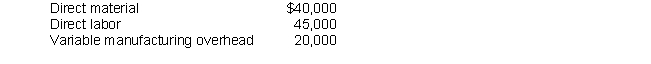

Scott Corporation produces a part that is used in the production of one of its products. The per-unit costs associated with the annual production of 5,000 units of this part are as follows:

Smith Company has offered to sell 5,000 units of the same part to Scott Corporation for $8 per unit.

Smith Company has offered to sell 5,000 units of the same part to Scott Corporation for $8 per unit.

Scott should:

A) Buy the part, thereby saving $6.50 per unit.

B) Buy the part, thereby saving $40,000 annually.

C) Buy the part, thereby saving $1.50 per unit.

D) Make the part, thereby saving $3.50 per unit.

E) Make the part, thereby saving $1.50 per unit.

Smith Company has offered to sell 5,000 units of the same part to Scott Corporation for $8 per unit.

Smith Company has offered to sell 5,000 units of the same part to Scott Corporation for $8 per unit.Scott should:

A) Buy the part, thereby saving $6.50 per unit.

B) Buy the part, thereby saving $40,000 annually.

C) Buy the part, thereby saving $1.50 per unit.

D) Make the part, thereby saving $3.50 per unit.

E) Make the part, thereby saving $1.50 per unit.

Make the part, thereby saving $1.50 per unit.

4

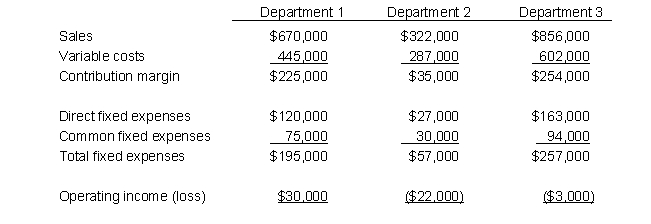

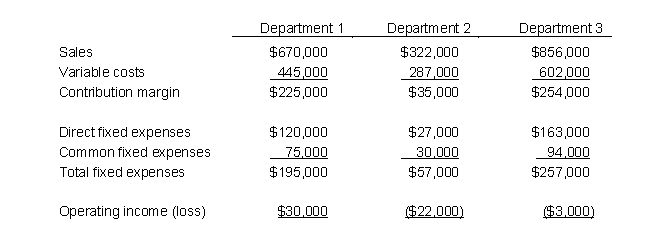

DJH Enterprises has 3 departments. Operating results for 2019 are as follows:

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

What effect would elimination of Department 2 have on DJH's total operating income?

A) It would increase total operating income by $22,000.

B) It would increase total operating income by $30,000.

C) It would decrease total operating income by $35,000.

D) It would decrease total operating income by $8,000.

E) It would decrease total operating income by $5,000.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.What effect would elimination of Department 2 have on DJH's total operating income?

A) It would increase total operating income by $22,000.

B) It would increase total operating income by $30,000.

C) It would decrease total operating income by $35,000.

D) It would decrease total operating income by $8,000.

E) It would decrease total operating income by $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

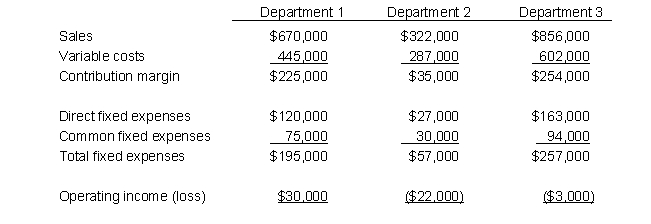

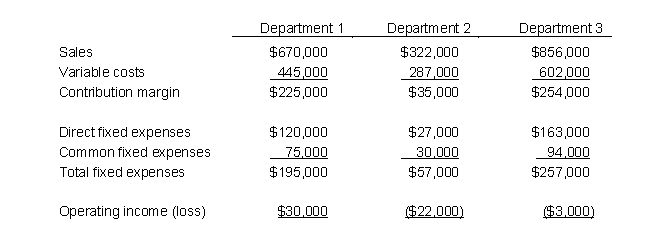

DJH Enterprises has 3 departments. Operating results for 2019 are as follows:

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

What effect would elimination of Department 3 have on DJH's total operating income?

A) It would increase total operating income by $3,000.

B) It would increase total operating income by $94,000.

C) It would decrease total operating income by $254,000.

D) It would decrease total operating income by $91,000.

E) None of the above.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.

DJH is considering eliminating the departments that show losses. Assume that the direct fixed expenses could be avoided if the department is eliminated.What effect would elimination of Department 3 have on DJH's total operating income?

A) It would increase total operating income by $3,000.

B) It would increase total operating income by $94,000.

C) It would decrease total operating income by $254,000.

D) It would decrease total operating income by $91,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

Christensen Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000 feet of one inch strips annually for $72,000. Variable costs for the leather strips are as follows:

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

What would the annual incremental income or loss be if Christensen produces the bridles?

A) $ 700 incremental income

B) $ 700 incremental loss

C) $1,800 incremental income

D) $1,800 incremental loss

E) None of the above

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.What would the annual incremental income or loss be if Christensen produces the bridles?

A) $ 700 incremental income

B) $ 700 incremental loss

C) $1,800 incremental income

D) $1,800 incremental loss

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

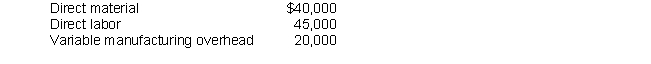

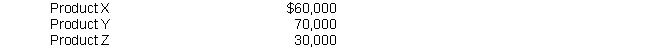

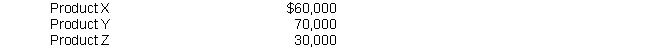

Earthworks Co. produces three products from a common raw material. The joint costs for a typical year are as follows:

The annual revenues from each product are as follows:

Management is considering processing Product Z beyond the split-off point, which would increase the value of Product Z to $57,000. To process Product Z further, Earthworks must rent processing facilities at an annual cost of $17,500 and will incur additional labor of $5,500.

Management is considering processing Product Z beyond the split-off point, which would increase the value of Product Z to $57,000. To process Product Z further, Earthworks must rent processing facilities at an annual cost of $17,500 and will incur additional labor of $5,500.

What will be the effect on annual operating income if Earthworks decides to process Product Z further?

A) $23,000 incremental loss

B) $34,000 incremental income

C) $ 4,000 incremental income

D) $14,312.50 incremental income

E) None of the above

The annual revenues from each product are as follows:

Management is considering processing Product Z beyond the split-off point, which would increase the value of Product Z to $57,000. To process Product Z further, Earthworks must rent processing facilities at an annual cost of $17,500 and will incur additional labor of $5,500.

Management is considering processing Product Z beyond the split-off point, which would increase the value of Product Z to $57,000. To process Product Z further, Earthworks must rent processing facilities at an annual cost of $17,500 and will incur additional labor of $5,500.What will be the effect on annual operating income if Earthworks decides to process Product Z further?

A) $23,000 incremental loss

B) $34,000 incremental income

C) $ 4,000 incremental income

D) $14,312.50 incremental income

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

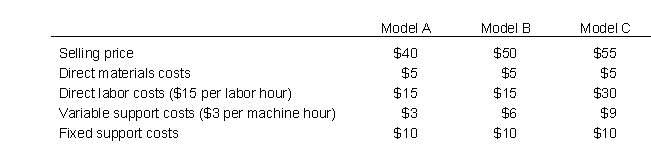

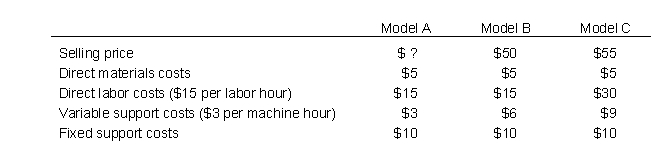

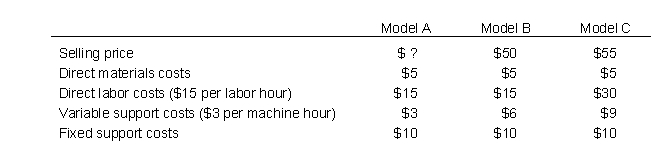

All Terrain Tires manufactures three different off-road ATV tires: Model A, Model B, and Model C. Plenty of market demand exists for all models. The table below reports the prices and costs per unit of each product:

Assuming that machine hours are limited (i.e., this is the constrained resource), which model is the most profitable to produce?

Assuming that machine hours are limited (i.e., this is the constrained resource), which model is the most profitable to produce?

A) Model A

B) Model B

C) Model C

D) Model A and B would be equally profitable

E) Model B and C would be equally profitable

Assuming that machine hours are limited (i.e., this is the constrained resource), which model is the most profitable to produce?

Assuming that machine hours are limited (i.e., this is the constrained resource), which model is the most profitable to produce?A) Model A

B) Model B

C) Model C

D) Model A and B would be equally profitable

E) Model B and C would be equally profitable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

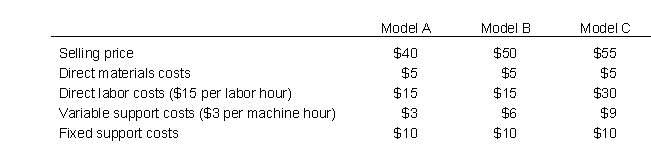

All Terrain Tires manufactures three different off-road ATV tires: Model A, Model B, and Model C. Plenty of market demand exists for all models. The table below reports the prices and costs per unit of each product:

Assuming that machine hours are limited (i.e., this is the constrained resource), at what price does Model A become the most profitable model to produce?

A) Any price above $23

B) Any price above $35

C) Any price above $47

D) Any price above $55

E) None of the above

Assuming that machine hours are limited (i.e., this is the constrained resource), at what price does Model A become the most profitable model to produce?

A) Any price above $23

B) Any price above $35

C) Any price above $47

D) Any price above $55

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

JetTaxi is a passenger airplane line that contracts with larger, well-known lines to provide transportation across the United States. JetTaxi owns 25 aircraft, and currently has contracts for 17 of those aircraft. The other lines pay JetTaxi $7,500,000 per year to provide carrier services for their passengers.

JetTaxi is considering a new contract where they would provide 10 airplanes to a new company for $5,500,000 per year. Each JetTaxi plane incurs yearly costs of $1,800,000 for labor, $600,000 for fuel, $1,200,000 in fixed overhead, and $2,400,000 in variable overhead. Contracts are for 20 years, which will not allow JetTaxi to use planes currently in use for new contracts. The cost of acquiring a new plane is $80,000,000, which is depreciated over the 20-year contract.

What would be the differential gain or loss on this contract?

JetTaxi is considering a new contract where they would provide 10 airplanes to a new company for $5,500,000 per year. Each JetTaxi plane incurs yearly costs of $1,800,000 for labor, $600,000 for fuel, $1,200,000 in fixed overhead, and $2,400,000 in variable overhead. Contracts are for 20 years, which will not allow JetTaxi to use planes currently in use for new contracts. The cost of acquiring a new plane is $80,000,000, which is depreciated over the 20-year contract.

What would be the differential gain or loss on this contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fizzy Drinks Co. produces a soft drink that they sell to the local fast-food restaurants in their rural community. The drink is popular among the locals, and recently caught the attention of a major restaurant chain headquartered nearby. This company wants to sign a contract with Fizzy Drinks to supply their stores around the country.

Fizzy Drinks' factory has the capacity to produce 100,000 gallons of soft-drink concentrate every year, but they are only currently producing 40,000. The restaurant chains wants to contract with Fizzy Drinks to produce 90,000 gallons for their stores, and is willing to pay $5.00 per gallon. Fizzy Drinks does not have the capacity to expand their facilities.

Local customers pay $9.00 per gallon for the drink. To produce one gallon of soft drink, Fizzy Drinks has to pay $1.00 for direct materials, and about $0.80 for direct labor. Overhead is allocated at a rate of $2.00 per gallon for variable overhead, and $4.00 per gallon for fixed overhead.

What would be the differential gain or loss on this contract?

Fizzy Drinks' factory has the capacity to produce 100,000 gallons of soft-drink concentrate every year, but they are only currently producing 40,000. The restaurant chains wants to contract with Fizzy Drinks to produce 90,000 gallons for their stores, and is willing to pay $5.00 per gallon. Fizzy Drinks does not have the capacity to expand their facilities.

Local customers pay $9.00 per gallon for the drink. To produce one gallon of soft drink, Fizzy Drinks has to pay $1.00 for direct materials, and about $0.80 for direct labor. Overhead is allocated at a rate of $2.00 per gallon for variable overhead, and $4.00 per gallon for fixed overhead.

What would be the differential gain or loss on this contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

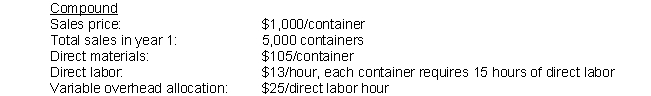

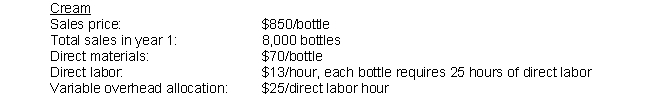

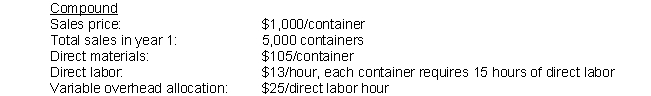

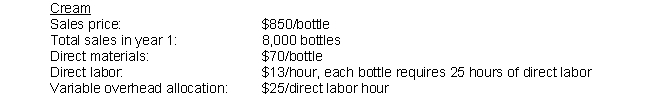

Sparkling Co. produces facial and skincare products. The R&D department has developed two potential new products: one is a new organic chemical compound that aids in the production of collagen, and the other is a plant-based cream that is highly effective in reducing wrinkles. The products are similar enough to be produced on existing equipment, but the company would not be able to produce both of them. Sparkling projects the following revenue and cost information for each of the products:

What would be the net difference in income of producing the cream instead of the compound?

What would be the net difference in income of producing the cream instead of the compound?

What would be the net difference in income of producing the cream instead of the compound?

What would be the net difference in income of producing the cream instead of the compound?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

Bus Lines is a passenger coach line that contracts with larger, well-known lines to provide transportation across the United States. Bus Lines owns 65 buses, and currently has contracts for 55 of those buses. The other lines pay Bus Lines $750,000 per year to provide carrier services for their passengers.

Bus Lines is considering a new contract where they would provide 15 buses to a new company for $300,000 per year. Each Bus Lines bus incurs yearly costs of $90,000 for labor, $50,000 for fuel, $80,000 in fixed overhead, and $150,000 in variable overhead. Contracts are for 5 years, which will not allow Bus Lines to use buses currently in use for new contracts. The cost of acquiring a new bus is $90,000, which is depreciated over the 5-year contract.

What would be the differential gain or loss on this contract?

Bus Lines is considering a new contract where they would provide 15 buses to a new company for $300,000 per year. Each Bus Lines bus incurs yearly costs of $90,000 for labor, $50,000 for fuel, $80,000 in fixed overhead, and $150,000 in variable overhead. Contracts are for 5 years, which will not allow Bus Lines to use buses currently in use for new contracts. The cost of acquiring a new bus is $90,000, which is depreciated over the 5-year contract.

What would be the differential gain or loss on this contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fit Drink Co. produces a sports drink that they sell to the local retailers in their suburban community. The drink is popular among the local athletes, and recently caught the attention of a major gym chain headquartered nearby. This company wants to sign a contract with Fit Drink to supply their gyms around the country.

Fit Drink's factory has the capacity to produce 200,000 gallons of sports drink concentrate every year, but they are currently producing only 100,000 gallons. The gym chain wants to contract with Fit Drink to produce 150,000 gallons for their stores, and is willing to pay $7.50 per gallon. Fit Drink does not have the capacity to expand its facilities, and would have to terminate some current contracts to meet a special order.

Local customers pay $10 per gallon for the drink. To produce one gallon of sports drink, Fit Drink has to pay $1.50 for direct materials, and about $1.30 for direct labor. Overhead is allocated at a rate of $1.50 per gallon for variable overhead, and $1.75 per gallon for fixed overhead.

What would be the differential gain or loss on this contract?

Fit Drink's factory has the capacity to produce 200,000 gallons of sports drink concentrate every year, but they are currently producing only 100,000 gallons. The gym chain wants to contract with Fit Drink to produce 150,000 gallons for their stores, and is willing to pay $7.50 per gallon. Fit Drink does not have the capacity to expand its facilities, and would have to terminate some current contracts to meet a special order.

Local customers pay $10 per gallon for the drink. To produce one gallon of sports drink, Fit Drink has to pay $1.50 for direct materials, and about $1.30 for direct labor. Overhead is allocated at a rate of $1.50 per gallon for variable overhead, and $1.75 per gallon for fixed overhead.

What would be the differential gain or loss on this contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

How are joint costs generally allocated among the different products involved?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

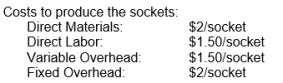

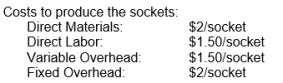

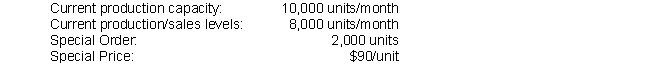

The Consumer Products division of Sweet Dreams has been struggling lately. Management has noticed a steady level of losses being reported, and is concerned about how to turn the division around. The division manager reports that the production of Lamps is causing the issue. As part of an in-depth analysis, management wants you to evaluate the following possible solution: Purchasing rather than producing components.

One of the essential parts of the lamps (the socket) has been produced in-house for a long time; however, management is aware that there are companies that would be able to supply the sockets―and potentially generate significant savings for the company. Below is information relating to the options of whether to purchase or produce the sockets:

Cost to purchase the sockets: $6/socket (ordering costs are included in this amount)

Cost to purchase the sockets: $6/socket (ordering costs are included in this amount)

Would it be cheaper to purchase the sockets or continue producing them in-house?

One of the essential parts of the lamps (the socket) has been produced in-house for a long time; however, management is aware that there are companies that would be able to supply the sockets―and potentially generate significant savings for the company. Below is information relating to the options of whether to purchase or produce the sockets:

Cost to purchase the sockets: $6/socket (ordering costs are included in this amount)

Cost to purchase the sockets: $6/socket (ordering costs are included in this amount)Would it be cheaper to purchase the sockets or continue producing them in-house?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Consumer Products division of Sweet Dreams has been struggling lately. Management has noticed a steady level of losses being reported, and is concerned about how to turn the division around. The division manager reports that the production of Lamps is causing the issue. As part of an in-depth analysis, management wants you to evaluate the following possible solution: Sell unfinished products.

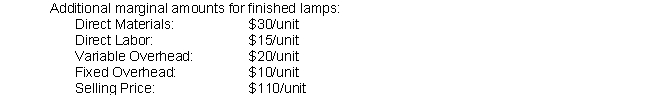

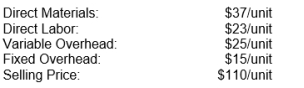

Management is aware that Sweet Dreams has the capability to become a supplier of the internal wiring of lamps for other manufacturing companies, rather than sell the lamps as finished goods to wholesalers. The following information contrasts the costs and revenues that would result from selling the lamps unfinished vs finishing them.

Which option would be the most profitable (without considering other qualitative issues)?

Which option would be the most profitable (without considering other qualitative issues)?

Management is aware that Sweet Dreams has the capability to become a supplier of the internal wiring of lamps for other manufacturing companies, rather than sell the lamps as finished goods to wholesalers. The following information contrasts the costs and revenues that would result from selling the lamps unfinished vs finishing them.

Which option would be the most profitable (without considering other qualitative issues)?

Which option would be the most profitable (without considering other qualitative issues)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

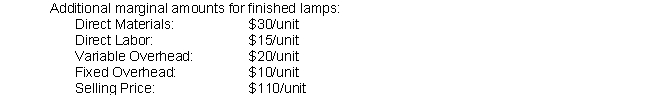

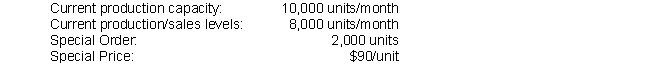

The Consumer Products division of Sweet Dreams has been struggling lately. Management has noticed a steady level of losses being reported, and is concerned about how to turn the division around. The division manager reports that the production of Lamps is causing the issue. As part of an in-depth analysis, management wants you to evaluate the following possible solution: Accept a special order.

The Sales department has received an offer for a new monthly contract for finished lamps. Management wonders if accepting this order would be profitable.

The information below relates to the special order.

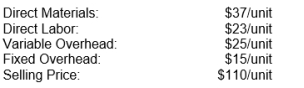

Current costs and revenues from selling the lamps is as follows:

Current costs and revenues from selling the lamps is as follows:

Without considering other cost-saving options, would this new production commitment prove profitable to the company?

Without considering other cost-saving options, would this new production commitment prove profitable to the company?

The Sales department has received an offer for a new monthly contract for finished lamps. Management wonders if accepting this order would be profitable.

The information below relates to the special order.

Current costs and revenues from selling the lamps is as follows:

Current costs and revenues from selling the lamps is as follows: Without considering other cost-saving options, would this new production commitment prove profitable to the company?

Without considering other cost-saving options, would this new production commitment prove profitable to the company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Consumer Products division of Sweet Dreams has been struggling lately. Management has noticed a steady level of losses being reported, and is concerned about how to turn the division around. The division manager reports that the production of Lamps is causing the issue. As part of an in-depth analysis, management wants you to evaluate the following possible solution: Discontinuing the product:

Although a last resort, management is open to the possibility of stopping production of lamps. You are asked to consider all the information from 1-3 as a whole. Additionally, $220,000 of total fixed overhead is allocated to the production of lamps per month.

If the smart financial decision were made with regards to all options considered (Purchase vs Produce, Sell vs Process further, Accept or Decline a special order):

a. What would be your recommendations for each option considered? (Note that some options may affect the information available in other options).

b. Would you recommend that management discontinue producing lamps or not, and what is the overall Gross Profit or Loss that justifies your decision?

Although a last resort, management is open to the possibility of stopping production of lamps. You are asked to consider all the information from 1-3 as a whole. Additionally, $220,000 of total fixed overhead is allocated to the production of lamps per month.

If the smart financial decision were made with regards to all options considered (Purchase vs Produce, Sell vs Process further, Accept or Decline a special order):

a. What would be your recommendations for each option considered? (Note that some options may affect the information available in other options).

b. Would you recommend that management discontinue producing lamps or not, and what is the overall Gross Profit or Loss that justifies your decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck