Deck 4: Understanding Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 4: Understanding Financial Statements

1

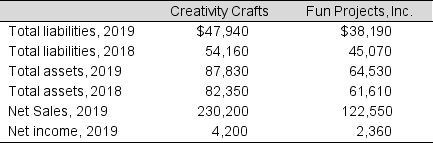

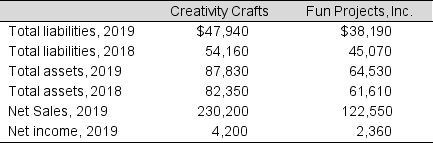

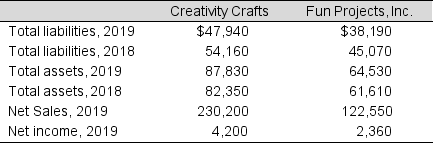

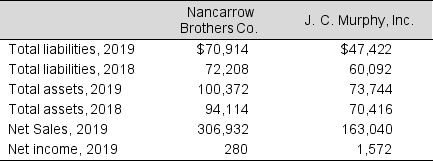

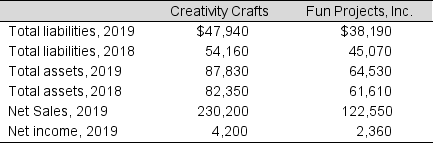

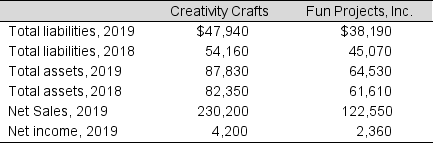

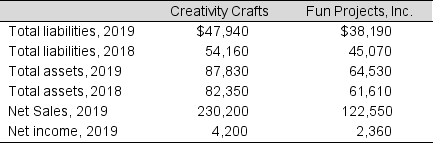

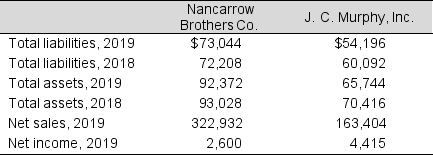

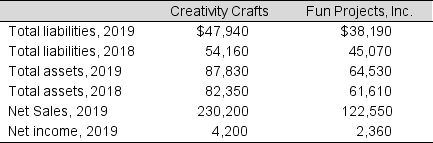

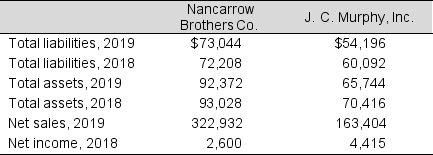

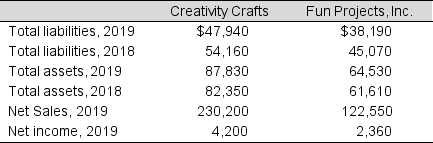

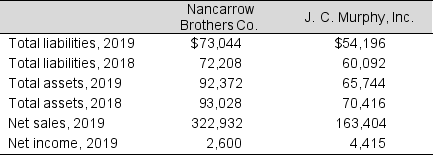

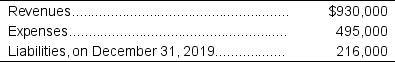

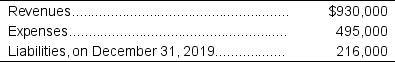

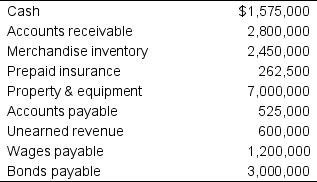

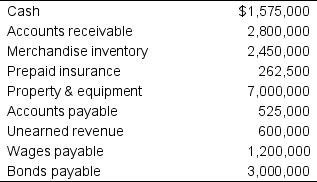

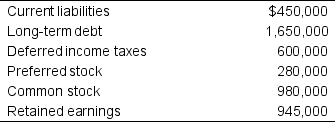

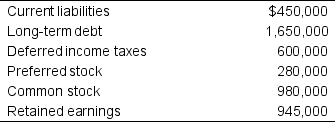

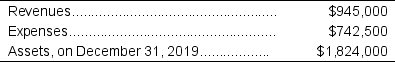

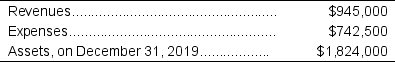

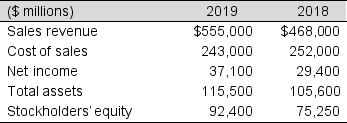

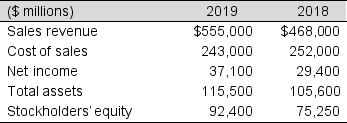

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Creativity Crafts?

A) 0.55

B) 0.22

C) 3.25

D) 37.93

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Creativity Crafts?

A) 0.55

B) 0.22

C) 3.25

D) 37.93

0.55

2

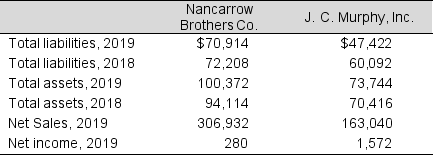

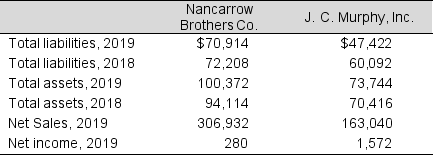

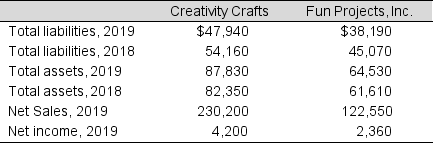

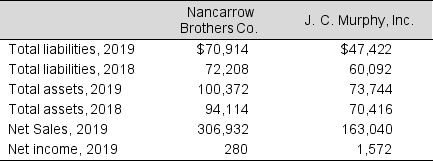

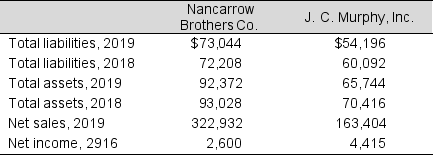

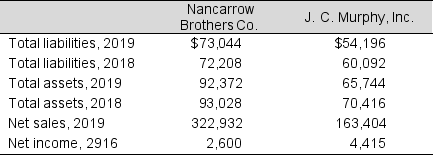

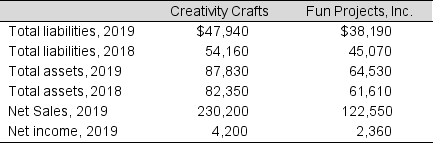

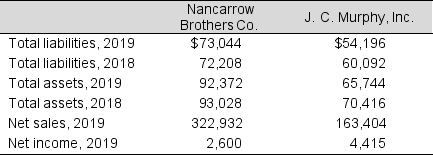

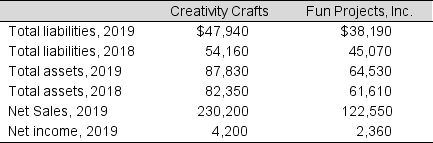

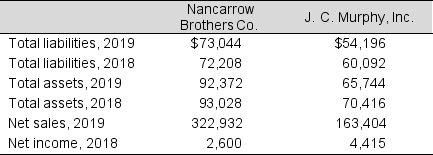

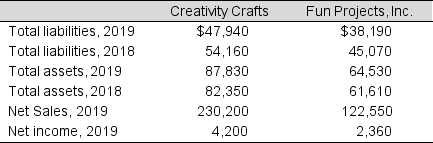

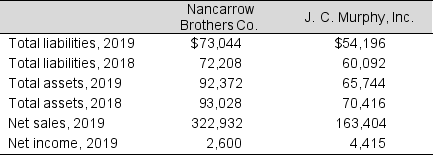

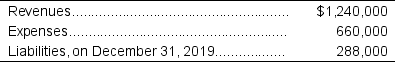

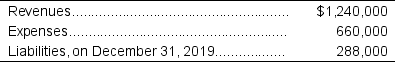

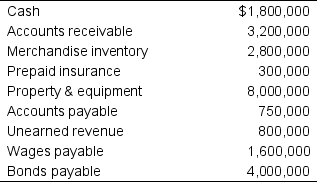

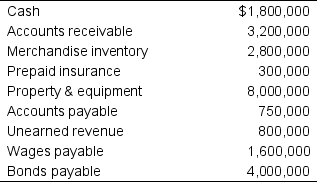

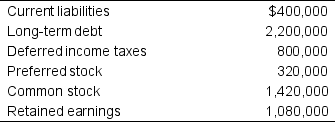

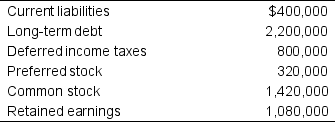

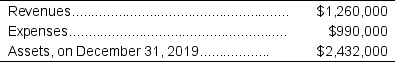

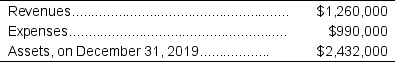

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Nancarrow Brothers Co.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Nancarrow Brothers Co.?

A) 0.71

B) 0.26

C) 3.78

D) 44.16

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Nancarrow Brothers Co.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Nancarrow Brothers Co.?A) 0.71

B) 0.26

C) 3.78

D) 44.16

0.71

3

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Fun Projects , Inc.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Fun Projects , Inc.?

A) 0.18

B) 0.59

C) 4.24

D) 4.00

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Fun Projects , Inc.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for Fun Projects , Inc.?A) 0.18

B) 0.59

C) 4.24

D) 4.00

0.59

4

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for J. C. Murphy, Inc.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for J. C. Murphy, Inc.?

A) 0.21

B) 0.64

C) 4.96

D) 4.69

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for J. C. Murphy, Inc.?

To the nearest hundredth, what is the 2019 debt-to-total-assets ratio for J. C. Murphy, Inc.?A) 0.21

B) 0.64

C) 4.96

D) 4.69

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

Best Ball Bearings has a debt-to-total-assets ratio of 0.915 and Amazing Automotive has 0.99. Which of the following statements is true?

A) Amazing Automotive reported more dollars of profit than Best Ball Bearings.

B) Amazing Automotive has more total debt than does Best Ball Bearings.

C) Amazing Automotive is able to bring its product to market more efficiently than Best Ball Bearings.

D) Best Ball Bearings would likely be able to borrow money at a lower interest rate than would Amazing Automotive.

A) Amazing Automotive reported more dollars of profit than Best Ball Bearings.

B) Amazing Automotive has more total debt than does Best Ball Bearings.

C) Amazing Automotive is able to bring its product to market more efficiently than Best Ball Bearings.

D) Best Ball Bearings would likely be able to borrow money at a lower interest rate than would Amazing Automotive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Creativity Crafts?

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Creativity Crafts?

A) 4.78%

B) 10.68%

C) 6.91%

D) Not enough information provided

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Creativity Crafts?

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Creativity Crafts?A) 4.78%

B) 10.68%

C) 6.91%

D) Not enough information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Nancarrow Brothers Co.?

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Nancarrow Brothers Co.?

A) 6.72%

B) 2.81%

C) 3.56%

D) Not enough information provided

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Nancarrow Brothers Co.?

To the nearest hundredth of a percent, what is the 2019 return on assets ratio for Nancarrow Brothers Co.?A) 6.72%

B) 2.81%

C) 3.56%

D) Not enough information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Creativity Crafts?

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Creativity Crafts?

A) 0.86%

B) 1.09%

C) 1.83%

D) Not enough information provided

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Creativity Crafts?

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Creativity Crafts?A) 0.86%

B) 1.09%

C) 1.83%

D) Not enough information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Nancarrow Brothers Co.?

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Nancarrow Brothers Co.?

A) 0.30%

B) 0.38%

C) 0.81%

D) Not enough information provided

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Nancarrow Brothers Co.?

To the nearest hundredth of a percent, what is the 2019 return on sales ratio for Nancarrow Brothers Co.?A) 0.30%

B) 0.38%

C) 0.81%

D) Not enough information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for Fun Projects, Inc.?

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for Fun Projects, Inc.?

A) 0.02%

B) 4.72%

C) 3.66%

D) Not enough information is provided

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for Fun Projects, Inc.?

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for Fun Projects, Inc.?A) 0.02%

B) 4.72%

C) 3.66%

D) Not enough information is provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for J. C. Murphy, Inc.?

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for J. C. Murphy, Inc.?

A) 6.72%

B) 2.81%

C) 8.15%

D) Not enough information is provided

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for J. C. Murphy, Inc.?

To the nearest hundredth of a percent, what is the return on assets ratio 2019 for J. C. Murphy, Inc.?A) 6.72%

B) 2.81%

C) 8.15%

D) Not enough information is provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

Data from the financial statements of Creativity Crafts and Fun Projects, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for Fun Projects, Inc.?

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for Fun Projects, Inc.?

A) 1.93%

B) 2.20%

C) 2.67%

D) Not enough information is provided

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for Fun Projects, Inc.?

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for Fun Projects, Inc.?A) 1.93%

B) 2.20%

C) 2.67%

D) Not enough information is provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

Data from the financial statements of Nancarrow Brothers Co. and J. C. Murphy, Inc. are presented below (in millions):

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for J. C. Murphy, Inc.?

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for J. C. Murphy, Inc.?

A) 2.70%

B) 2.39%

C) 2.90%

D) Not enough information is provided

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for J. C. Murphy, Inc.?

To the nearest hundredth of a percent, what is the return on sales ratio 2019 for J. C. Murphy, Inc.?A) 2.70%

B) 2.39%

C) 2.90%

D) Not enough information is provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

Best Ball Bearings has a ROS of 24.60% and Amazing Automotive has an ROS of 27.45%. Which of the following statements is true?

A) Amazing Automotive reported more dollars of profit than Best Ball Bearings.

B) Amazing Automotive has more of the firm financed with debt than Best Ball Bearings does.

C) Amazing Automotive is able to bring its product to market more efficiently than Best Ball Bearings.

D) Best Ball Bearings would likely be able to borrow money at a lower interest rate than would Amazing Automotive.

A) Amazing Automotive reported more dollars of profit than Best Ball Bearings.

B) Amazing Automotive has more of the firm financed with debt than Best Ball Bearings does.

C) Amazing Automotive is able to bring its product to market more efficiently than Best Ball Bearings.

D) Best Ball Bearings would likely be able to borrow money at a lower interest rate than would Amazing Automotive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

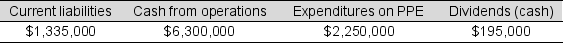

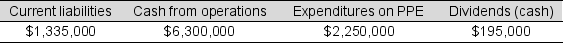

The following amounts have been taken from the recent financial statements for Daniel Enterprises:

Which of the following amounts is the free cash flow for Daniel Enterprises?

Which of the following amounts is the free cash flow for Daniel Enterprises?

A) $ 795,000

B) $ 990,000

C) $3,075,000

D) $4,050,000

Which of the following amounts is the free cash flow for Daniel Enterprises?

Which of the following amounts is the free cash flow for Daniel Enterprises?A) $ 795,000

B) $ 990,000

C) $3,075,000

D) $4,050,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

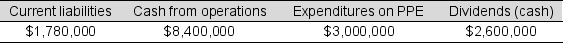

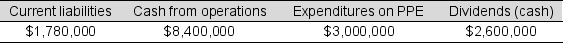

The following amounts have been taken from the recent financial statements for Junnion Foundation:

Which of the following amounts is the free cash flow for Junnion Foundation?

Which of the following amounts is the free cash flow for Junnion Foundation?

A) $1,600,000

B) $1,320,000

C) $4,100,000

D) $5,400,000

Which of the following amounts is the free cash flow for Junnion Foundation?

Which of the following amounts is the free cash flow for Junnion Foundation?A) $1,600,000

B) $1,320,000

C) $4,100,000

D) $5,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

Colorado Company has beginning equity of $900,000, net income of $150,000, dividends of $90,000 and investments by owners in exchange for stock of $30,000. Its ending equity is:

A) $669,000

B) $720,000

C) $804,000

D) $990,000

A) $669,000

B) $720,000

C) $804,000

D) $990,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

Mountain Company has beginning equity of $1,200,000, net income of $200,000, dividends of $120,000 and investments by owners in exchange for stock of $40,000. Its ending equity is:

A) $ 892,000

B) $ 960,000

C) $1,072,000

D) $1,320,000

A) $ 892,000

B) $ 960,000

C) $1,072,000

D) $1,320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

During 2019, Wayneright Company's total assets increased $75,000, and total liabilities decreased $45,000. During the same year, the company's investors invested an additional $90,000 and the company paid dividends of $45,000.

What must have been the company's net income for 2019?

A) $75,000

B) $45,000

C) $60,000

D) $30,000

What must have been the company's net income for 2019?

A) $75,000

B) $45,000

C) $60,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

During 2019, Duncan Company's total assets increased $100,000, and total liabilities decreased $60,000. During the same year, the company's investors invested an additional $120,000 and the company paid dividends of $60,000.

What must have been the company's net income for 2019?

A) $100,000

B) $ 60,000

C) $ 80,000

D) $ 40,000

What must have been the company's net income for 2019?

A) $100,000

B) $ 60,000

C) $ 80,000

D) $ 40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company reported total stockholders' equity of $435,000 on its Dec 31, 2018, balance sheet. The following information is available for the year ended Dec 31, 2019:

What are the total assets of the company on December 31, 2019?

What are the total assets of the company on December 31, 2019?

A) $ 276,000

B) $ 57,000

C) $ 630,000

D) $1,086,000

What are the total assets of the company on December 31, 2019?

What are the total assets of the company on December 31, 2019?A) $ 276,000

B) $ 57,000

C) $ 630,000

D) $1,086,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company reported total stockholders' equity of $580,000 on its Dec 31, 2018, balance sheet. The following information is available for the year ended Dec 31, 2019:

What are the total assets of the company on December 31, 2019?

What are the total assets of the company on December 31, 2019?

A) $ 368,000

B) $ 76,000

C) $ 840,000

D) $1,448,000

What are the total assets of the company on December 31, 2019?

What are the total assets of the company on December 31, 2019?A) $ 368,000

B) $ 76,000

C) $ 840,000

D) $1,448,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

Ivey Company began operations on January 1, 2019, with an investment of $186,000 by each of its two stockholders, or a total of $372,000. Net income for its first year of business was $654,000. During the year, the company paid dividends of $90,000 each to its two stockholders.

How much is the company's ending Stockholders' Equity on December 31, 2019?

A) $834,000

B) $648,000

C) $744,000

D) $846,000

How much is the company's ending Stockholders' Equity on December 31, 2019?

A) $834,000

B) $648,000

C) $744,000

D) $846,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

Melvin Company began operations on January 1, 2019, with an investment of $248,000 by each of its two stockholders, or a total of $496,000. Net income for its first year of business was $872,000. During the year, the company paid dividends of $120,000 each to its two stockholders.

How much is the company's ending Stockholders' Equity on December 31, 2019?

A) $1,112,000

B) $ 864,000

C) $ 992,000

D) $1,128,000

How much is the company's ending Stockholders' Equity on December 31, 2019?

A) $1,112,000

B) $ 864,000

C) $ 992,000

D) $1,128,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

As of December 31, 2018, Foxfire Company had assets of $2,775,000 and liabilities of $855,000. During 2019, the stockholders invested an additional $150,000 and paid dividends of $90,000 from the business.

What is the net income for the company during 2019, assuming that as of December 31, 2019, assets were $2,940,000, and liabilities were $765,000?

A) $ 225,000

B) $ 195,000

C) $ 315,000

D) $ 60,000

What is the net income for the company during 2019, assuming that as of December 31, 2019, assets were $2,940,000, and liabilities were $765,000?

A) $ 225,000

B) $ 195,000

C) $ 315,000

D) $ 60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

As of December 31, 2018, Lincolnshire Company had assets of $3,700,000 and liabilities of $1,140,000. During 2019, the stockholders invested an additional $200,000 and paid dividends of $120,000 from the business.

What is the net income for the company during 2019, assuming that as of December 31, 2019, assets were $3,920,000, and liabilities were $1,020,000?

A) $ 340,000

B) $ 260,000

C) $ 420,000

D) $ 80,000

What is the net income for the company during 2019, assuming that as of December 31, 2019, assets were $3,920,000, and liabilities were $1,020,000?

A) $ 340,000

B) $ 260,000

C) $ 420,000

D) $ 80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

On September 1, 2019, Chartreuse Dog, Inc. reported Retained Earnings of $408,000. During the month of September, Chartreuse Dog generated revenues of $60,000, incurred expenses of $36,000, purchased equipment for $15,000 and paid dividends of $18,000.

What is the balance in Retained Earnings on September 30, 2019?

A) $408,000 debit

B) $ 24,000 credit

C) $411,000 credit

D) $414,000 credit

What is the balance in Retained Earnings on September 30, 2019?

A) $408,000 debit

B) $ 24,000 credit

C) $411,000 credit

D) $414,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

On September 1, 2019, Might Dog, Inc. reported Retained Earnings of $544,000. During the month of September, Bulldog generated revenues of $80,000, incurred expenses of $48,000, purchased equipment for $20,000 and paid dividends of $24,000.

What is the balance in Retained Earnings on September 30, 2019?

A) $544,000 debit

B) $ 32,000 credit

C) $548,000 credit

D) $552,000 credit

What is the balance in Retained Earnings on September 30, 2019?

A) $544,000 debit

B) $ 32,000 credit

C) $548,000 credit

D) $552,000 credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

Chelsea Company presented the following data at the end of 2019:

Determine the current ratio for Chelsea Company (rounded).

Determine the current ratio for Chelsea Company (rounded).

A) 5.15

B) 4.94

C) 3.05

D) 2.78

Determine the current ratio for Chelsea Company (rounded).

Determine the current ratio for Chelsea Company (rounded).A) 5.15

B) 4.94

C) 3.05

D) 2.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

Kirsten Company presented the following data at the end of 2019:

Determine the current ratio for Kirsten Company (rounded).

Determine the current ratio for Kirsten Company (rounded).

A) 4.41

B) 4.23

C) 2.57

D) 2.38

Determine the current ratio for Kirsten Company (rounded).

Determine the current ratio for Kirsten Company (rounded).A) 4.41

B) 4.23

C) 2.57

D) 2.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

Darmstadt Company presented the following data at the end of 2019:

Determine the debt-to-total assets ratio for Darmstadt Company (rounded).

Determine the debt-to-total assets ratio for Darmstadt Company (rounded).

A) 0.55

B) 0.35

C) 0.07

D) 0.61

Determine the debt-to-total assets ratio for Darmstadt Company (rounded).

Determine the debt-to-total assets ratio for Darmstadt Company (rounded).A) 0.55

B) 0.35

C) 0.07

D) 0.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

Buick Company presented the following data at the end of 2019:

Determine the debt-to-total assets ratio for Buick Company (rounded).

Determine the debt-to-total assets ratio for Buick Company (rounded).

A) 0.55

B) 0.38

C) 0.08

D) 0.66

Determine the debt-to-total assets ratio for Buick Company (rounded).

Determine the debt-to-total assets ratio for Buick Company (rounded).A) 0.55

B) 0.38

C) 0.08

D) 0.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

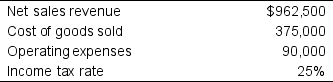

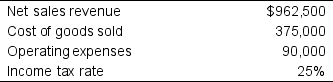

Herbst Company presented the following data at the end of 2019:

Determine the company's return on sales (rounded)

Determine the company's return on sales (rounded)

A) 37%

B) 33%

C) 30%

D) 39%

Determine the company's return on sales (rounded)

Determine the company's return on sales (rounded)A) 37%

B) 33%

C) 30%

D) 39%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

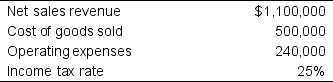

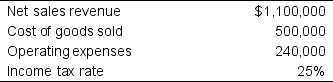

34

Fruhling Company presented the following data at the end of 2019:

Determine the company's return on sales (rounded)

Determine the company's return on sales (rounded)

A) 31%

B) 28%

C) 33%

D) 25%

Determine the company's return on sales (rounded)

Determine the company's return on sales (rounded)A) 31%

B) 28%

C) 33%

D) 25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

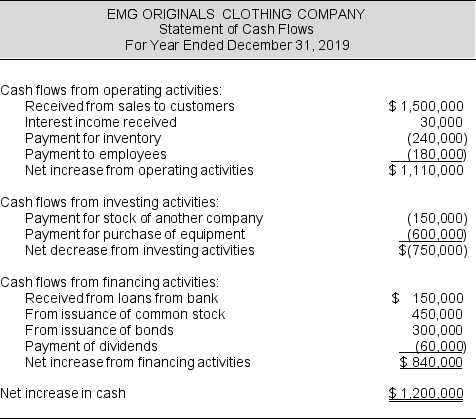

Presented below is the Statement of Cash Flows for EMG Originals Clothing Company:

Determine the company's free cash flow:

Determine the company's free cash flow:

A) ($450,000)

B) $360,000

C) $540,000

D) $510,000

Determine the company's free cash flow:

Determine the company's free cash flow:A) ($450,000)

B) $360,000

C) $540,000

D) $510,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

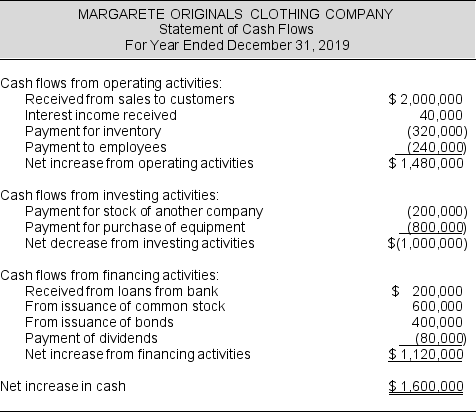

Presented below is the Statement of Cash Flows for Margarete Originals Clothing Company:

Determine the company's free cash flow:

Determine the company's free cash flow:

A) ($600,000)

B) ($520,000)

C) $480,000

D) $680,000

Determine the company's free cash flow:

Determine the company's free cash flow:A) ($600,000)

B) ($520,000)

C) $480,000

D) $680,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

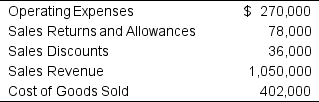

The accounting record for Katzen Company reported the following selected information:

Determine Katzen Company's gross profit.

Determine Katzen Company's gross profit.

A) $462,000

B) $534,000

C) $420,000

D) $498,000

Determine Katzen Company's gross profit.

Determine Katzen Company's gross profit.A) $462,000

B) $534,000

C) $420,000

D) $498,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

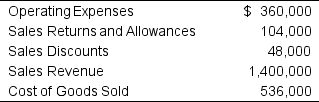

38

The accounting record for Hardware Company reported the following selected information:

Determine Hardware Company's gross profit.

Determine Hardware Company's gross profit.

A) $616,000

B) $712,000

C) $560,000

D) $664,000

Determine Hardware Company's gross profit.

Determine Hardware Company's gross profit.A) $616,000

B) $712,000

C) $560,000

D) $664,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

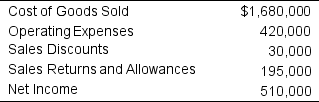

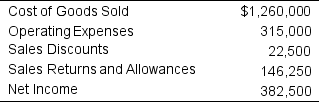

Determine Sales Revenue for Mountainstone Company with the following data:

A) $2,385,000

B) $2,445,000

C) $2,835,000

D) $2,775,000

A) $2,385,000

B) $2,445,000

C) $2,835,000

D) $2,775,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

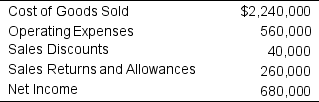

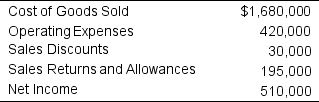

Determine Sales Revenue for Cadillac Company with the following data:

A) $3,180,000

B) $3,260,000

C) $3,780,000

D) $3,700,000

A) $3,180,000

B) $3,260,000

C) $3,780,000

D) $3,700,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

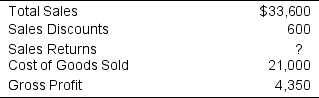

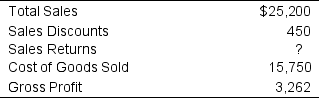

Marshall F. Company reported the following year-end amounts:

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?

A) $ 2,160

B) $ 2,970

C) $ 7,650

D) $10,860

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?A) $ 2,160

B) $ 2,970

C) $ 7,650

D) $10,860

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

42

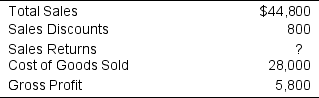

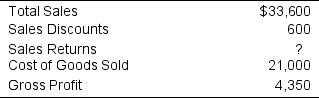

Fabulous Mints Company reported the following year-end amounts:

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?

A) $ 2,880

B) $ 3,960

C) $10,200

D) $14,480

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?A) $ 2,880

B) $ 3,960

C) $10,200

D) $14,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

Mountain Company has beginning retained earnings of $450,000, earns a net income of $75,000, and pays dividends of $9,000 during the period.

The balance in Mountain's ending retained earnings is:

A) $516,000

B) $366,000

C) $534,000

D) $525,000

The balance in Mountain's ending retained earnings is:

A) $516,000

B) $366,000

C) $534,000

D) $525,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

44

Rock Springs Company has beginning retained earnings of $600,000, earns a net income of $100,000, and pays dividends of $12,000 during the period.

The balance in Rock Springs' ending retained earnings is:

A) $688,000

B) $488,000

C) $712,000

D) $700,000

The balance in Rock Springs' ending retained earnings is:

A) $688,000

B) $488,000

C) $712,000

D) $700,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

Mountain Company has Beginning retained earnings of $450,000, earns a net income of $112,500, and has an Ending retained earnings balance of $552,000 during the period.

The amount which Mountain paid in dividends must have been:

A) $ 6,000

B) $112,500

C) $ 10,500

D) $102,000

The amount which Mountain paid in dividends must have been:

A) $ 6,000

B) $112,500

C) $ 10,500

D) $102,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

Rock Springs Company has Beginning retained earnings of $600,000, earns a net income of $150,000, and has an Ending retained earnings balance of $736,000 during the period.

The amount which Rock Springs paid in dividends must have been:

A) $ 8,000

B) $150,000

C) $ 14,000

D) $136,000

The amount which Rock Springs paid in dividends must have been:

A) $ 8,000

B) $150,000

C) $ 14,000

D) $136,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

Mountain Company earns a net income of $430,500 and pays dividends of $39,000 during the period. Mountain has ending retained earnings of $733,500.

The balance in Mountain's beginning retained earnings must have been:

A) $516,000

B) $391,500

C) $469,500

D) $342,000

The balance in Mountain's beginning retained earnings must have been:

A) $516,000

B) $391,500

C) $469,500

D) $342,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

Rock Springs Company earns a net income of $574,000 and pays dividends of $52,000 during the period. Rock Springs has ending retained earnings of $978,000.

The balance in Rock Springs' beginning retained earnings must have been:

A) $688,000

B) $522,000

C) $626,000

D) $456,000

The balance in Rock Springs' beginning retained earnings must have been:

A) $688,000

B) $522,000

C) $626,000

D) $456,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

Chopper Company reported total stockholders' equity of $652,500 on its Dec 31, 2018, balance sheet. The following information is available for the year ended Dec 31, 2019:

What are the total liabilities of the company on December 31, 2019?

What are the total liabilities of the company on December 31, 2019?

A) $ 969,000

B) $ 945,000

C) $1,824,000

D) $ 414,000

What are the total liabilities of the company on December 31, 2019?

What are the total liabilities of the company on December 31, 2019?A) $ 969,000

B) $ 945,000

C) $1,824,000

D) $ 414,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

Henrietta Company reported total stockholders' equity of $870,000 on its Dec 31, 2018, balance sheet. The following information is available for the year ended Dec 31, 2019:

What are the total liabilities of the company on December 31, 2019?

What are the total liabilities of the company on December 31, 2019?

A) $1,292,000

B) $1,260,000

C) $2,432,000

D) $ 562,000

What are the total liabilities of the company on December 31, 2019?

What are the total liabilities of the company on December 31, 2019?A) $1,292,000

B) $1,260,000

C) $2,432,000

D) $ 562,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

Determine Sales revenue for Barko Company with the following data:

A) $1,788,750

B) $1,833,750

C) $2,126,250

D) $2,081,250

A) $1,788,750

B) $1,833,750

C) $2,126,250

D) $2,081,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

52

Determine Sales revenue for Merema Company with the following data:

A) $2,385,000

B) $2,445,000

C) $2,835,000

D) $2,775,000

A) $2,385,000

B) $2,445,000

C) $2,835,000

D) $2,775,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

Marshall Company reported the following year-end amounts:

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?

A) $1,620

B) $2,228

C) $5,738

D) $8,146

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?A) $1,620

B) $2,228

C) $5,738

D) $8,146

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

Skokie Company reported the following year-end amounts:

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?

A) $ 2,160

B) $ 2,970

C) $ 7,650

D) $10,860

What is the company's Sales Returns for the year?

What is the company's Sales Returns for the year?A) $ 2,160

B) $ 2,970

C) $ 7,650

D) $10,860

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

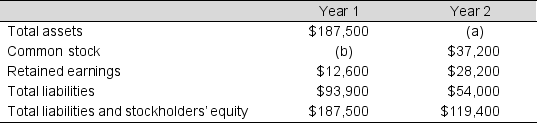

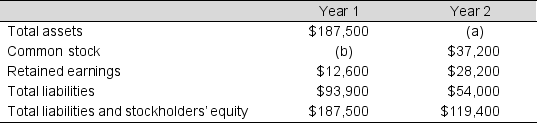

Compute the missing amounts in the table below:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

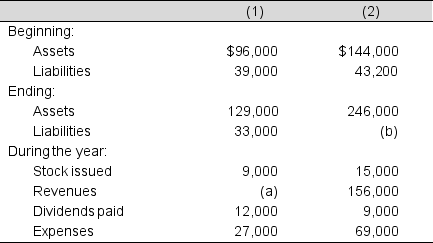

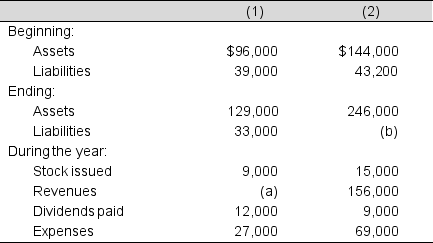

For the two unrelated situations below, compute the unknown amounts indicated by the letters (a) and (b).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

Elk, Inc. has a debt-to-total-assets ratio of 0.56 and a ROS of 13.4%. The median ROS for similar companies in the same industry as Elk is about 6.3%. The median debt-to-total-assets ratio for similar companies in the same industry is 0.31.

Based on this industry information, how does Elk compare to similar companies and what are the causes of these differences?

Based on this industry information, how does Elk compare to similar companies and what are the causes of these differences?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

Alvin's Audio reported the following amounts in its December 31, 2019, and 2018 financial statements.

Calculate to the nearest hundredth:

Calculate to the nearest hundredth:

(a) Return on sales for 2019

(b) Return on assets for 2019

(c) Debt-to-total-assets ratio as of December 31, 2019

Calculate to the nearest hundredth:

Calculate to the nearest hundredth:(a) Return on sales for 2019

(b) Return on assets for 2019

(c) Debt-to-total-assets ratio as of December 31, 2019

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

59

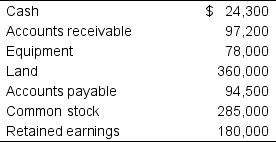

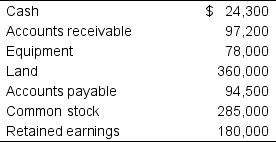

At the end of 2019, LoMo Manufacturing reported the following amounts on its balance sheet:

Answer each of the following independent questions:

Answer each of the following independent questions:

a. Assume that LoMo's stockholders' equity on January 1, 2019 was $396,000. LoMo did not issue common stock during the year, but it paid $54,000 cash in dividends. How much is LoMo's net income or loss for 2019?

b. Assume that LoMo's stockholders' equity on January 1, 2019 was $354,000, and that LoMo issued additional common stock of $105,000 and paid $90,000 in cash dividends before the end of 2019. What was LoMo's net income or net loss for 2019?

Answer each of the following independent questions:

Answer each of the following independent questions:a. Assume that LoMo's stockholders' equity on January 1, 2019 was $396,000. LoMo did not issue common stock during the year, but it paid $54,000 cash in dividends. How much is LoMo's net income or loss for 2019?

b. Assume that LoMo's stockholders' equity on January 1, 2019 was $354,000, and that LoMo issued additional common stock of $105,000 and paid $90,000 in cash dividends before the end of 2019. What was LoMo's net income or net loss for 2019?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

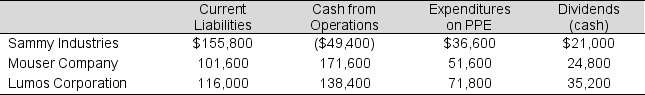

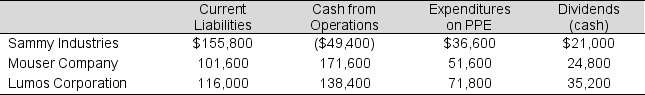

Consider the following 2019 data for three manufacturing firms ($ in millions):

Compute the free cash flow for each firm for 2019.

Compute the free cash flow for each firm for 2019.

Compute the free cash flow for each firm for 2019.

Compute the free cash flow for each firm for 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

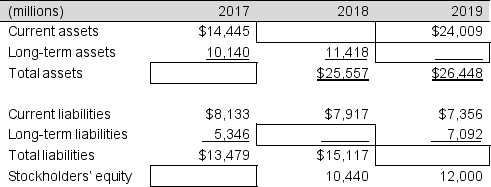

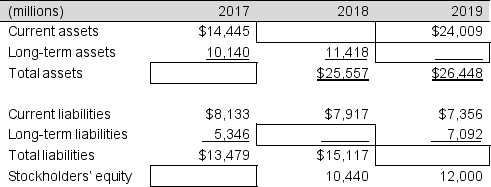

Compute the missing amounts for each of the last 3 years for the Gilgen Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

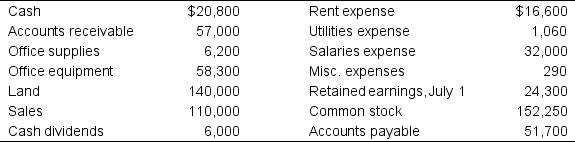

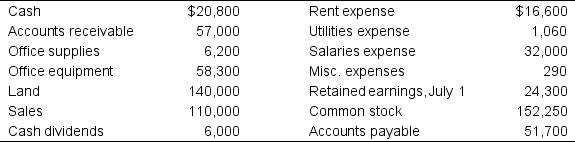

Prepare a statement of stockholders' equity for the month ended July 31, 2019 for Foster Toys. Foster's account balances for the month ending July 31, 2019 are:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

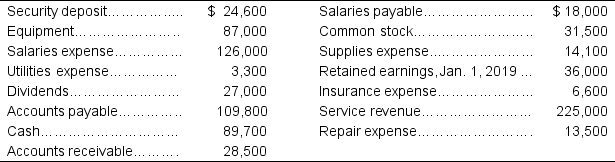

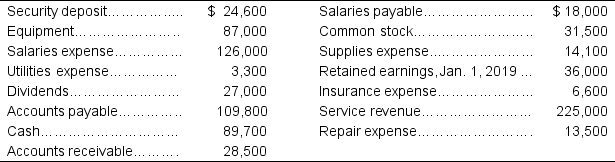

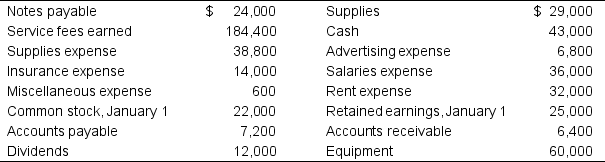

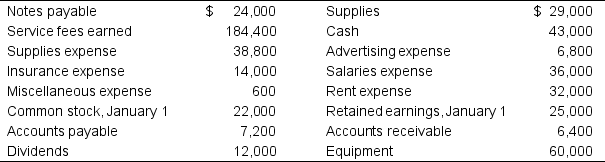

The following items and amounts are taken from the 2019 financial records of Lumos Corporation:

Prepare a statement of stockholders' equity for Lumos Corporation for the year ending December 31, 2019.

Prepare a statement of stockholders' equity for Lumos Corporation for the year ending December 31, 2019.

Prepare a statement of stockholders' equity for Lumos Corporation for the year ending December 31, 2019.

Prepare a statement of stockholders' equity for Lumos Corporation for the year ending December 31, 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

64

The records of Manhattan T's show the following information after all transactions are recorded for 2019.

Manhattan T's raised $16,000 cash through the issuance of additional common stock during the year. Based on this information, prepare Manhattan T's statement of stockholders' equity for the year ending December 31, 2019.

Manhattan T's raised $16,000 cash through the issuance of additional common stock during the year. Based on this information, prepare Manhattan T's statement of stockholders' equity for the year ending December 31, 2019.

Manhattan T's raised $16,000 cash through the issuance of additional common stock during the year. Based on this information, prepare Manhattan T's statement of stockholders' equity for the year ending December 31, 2019.

Manhattan T's raised $16,000 cash through the issuance of additional common stock during the year. Based on this information, prepare Manhattan T's statement of stockholders' equity for the year ending December 31, 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck