Deck 3: Accrual Basis of Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/167

العب

ملء الشاشة (f)

Deck 3: Accrual Basis of Accounting

1

The adjusted trial balance includes only accounts whose balances are changed by adjustments.

False

2

At the end of the accounting period, the dividends account is closed to the Income Summary account.

False

3

A debit balance in the Income Summary account just prior to closing it indicates there is a net loss for the period.

True

4

When a worksheet is used, all adjustments are first entered on the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

5

On a worksheet, net income appears in the income statement columns as a credit and in the balance sheet columns as a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

6

On a worksheet, a net loss appears in the income statement as a credit and in the balance sheet columns as a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

7

The total of the balance sheet debit column on the worksheet must equal the total assets presented in the formal balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the balance sheet columns of the worksheet, the amount shown in the retained earnings account is generally not the same amount that appears as retained earnings on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

9

A completed worksheet contains sufficient information to prepare an income statement and a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

10

As of the beginning of 2019, the Logistics Company had equipment totaling $1,800,000 which was depreciated at $150,000 per year. If Let's Move makes the appropriate adjusting entry at year end, which of the following is one part of the journal entry that will be made?

A) Debit Equipment for $150,000

B) Credit Depreciation Expense for $150,000

C) Debit Depreciation Expense for $150,000

D) Debit Accumulated Depreciation for $150,000

A) Debit Equipment for $150,000

B) Credit Depreciation Expense for $150,000

C) Debit Depreciation Expense for $150,000

D) Debit Accumulated Depreciation for $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sue Baker received $5,000 from a tenant on December 1 for five months' rent of an office. This rent was for December, January, February, March, and April. If Sue debited Cash and credited Unearned Rental Income for $5,000 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

12

Pam Harper received $15,000 from a tenant on December 1 for five months' rent of an office. This rent was for December, January, February, March, and April.

If Pam debited Cash and credited Unearned Rental Income for $15,000 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

If Pam debited Cash and credited Unearned Rental Income for $15,000 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

13

Campus Rentals, Inc. received $4,800 from a tenant on December 1 for three months' rent of an office. This rent was for December, January, and February.

If Campus Rentals debited Cash and credited Unearned Rental Income for $4,800 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

If Campus Rentals debited Cash and credited Unearned Rental Income for $4,800 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

14

Condo Rental, Inc. received $14,400 from a tenant on December 1 for three months' rent of an apartment. This rent was for December, January, and February.

If Condo Rental debited Cash and credited Unearned Rental Income for $14,400 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

If Condo Rental debited Cash and credited Unearned Rental Income for $14,400 on December 1, what necessary adjustment would be made on December 31?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

15

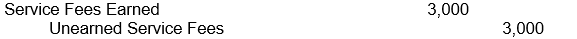

Early in the accounting period, Ms. Client paid $3,000 for services in advance of receiving them; Cash was debited and Unearned Service Fees was credited for $3,000. At the end of the accounting period, two-thirds of the services paid for had yet to be performed.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

16

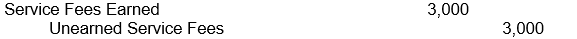

Early in the accounting period, Ed Sheer, a client, paid $9,000 for services in advance of receiving them; Cash was debited and Unearned Service Fees was credited for $9,000. At the end of the accounting period, two-thirds of the services paid for had yet to be performed.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

17

On September 1, Tree Company began a contract to provide services to Willow Company for six months, with the total $21,600 payment to be made at the end of the six-month period. Equal services are provided each month. The firm uses the account Fees Receivable to reflect amounts due but not yet billed.

What proper adjusting entry would Tree Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What proper adjusting entry would Tree Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

18

On September 1, Knowledgeable Company began a contract to provide services to Guidance Required Company for six months, with the total $64,800 payment to be made at the end of the six-month period. Equal services are provided each month. The firm uses the account Fees Receivable to reflect amounts due but not yet billed.

What proper adjusting entry would Knowledgeable Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What proper adjusting entry would Knowledgeable Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

19

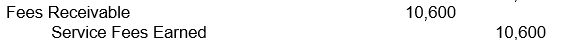

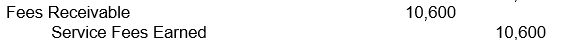

On December 31, the end of the accounting period, $10,600 in service fees had been earned but not billed or received. The Wilk Company uses the account Fees Receivable to reflect amounts due but not yet billed.

The proper adjusting entry would be:

A)

B)

C)

D)

The proper adjusting entry would be:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

20

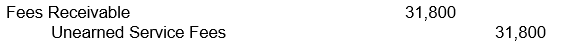

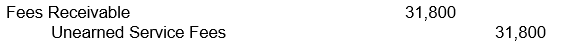

On December 31, the end of the accounting period, $31,800 in service fees had been earned but not billed or received. The Marietta Company uses the account Fees Receivable to reflect amounts due but not yet billed.

The proper adjusting entry would be:

A)

B)

C)

D)

The proper adjusting entry would be:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

21

Huntley Company paid $52,800 for a four-year insurance policy on September 1 and recorded the $52,800 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Huntley make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Huntley make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

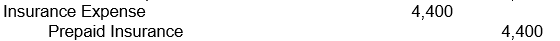

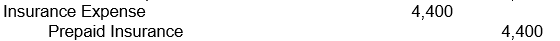

22

Hot Rod Company paid $158,400 for a four-year insurance policy on September 1 and recorded the $158,400 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Hot Rod Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Hot Rod Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

23

Williams Company paid $48,000 for a two-year insurance policy on October 1 and recorded the $48,000 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Fred make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Fred make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

24

Nair Company paid $144,000 for a two-year insurance policy on October 1 and recorded the 144,000 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Nair make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Nair make on December 31, the end of the accounting period (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Green Grape Company's Office Supplies account had a beginning balance of $16,000. During the month, purchases of office supplies totaling $4,000 were debited to the Office Supplies account.

If $6,000 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

If $6,000 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Yellow Apple Company's Office Supplies account had a beginning balance of $6,000. During the month, purchases of office supplies totaling $1,500 were debited to the Office Supplies account.

If $2,250 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

If $2,250 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

27

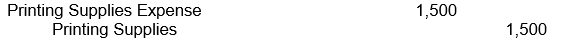

The Green Grape Company's Printing Supplies account had a beginning balance of $8,000. During the month, purchases of printing supplies totaling $6,000 were debited to the Printing Supplies account.

If $4,000 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

If $4,000 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

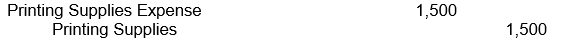

28

The Yellow Apple Company's Printing Supplies account had a beginning balance of $3,000. During the month, purchases of printing supplies totaling $2,250 were debited to the Printing Supplies account.

If $1,500 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

If $1,500 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

29

During their first year, Adrian & Associates bought $32,000 worth of supplies for their CPA firm. When purchased, the supplies were debited to Supplies and credited to Accounts Payable.

What adjusting entry would Adrian & Associates make if $8,000 worth of supplies were on hand at year-end?

A)

B)

C)

D)

What adjusting entry would Adrian & Associates make if $8,000 worth of supplies were on hand at year-end?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

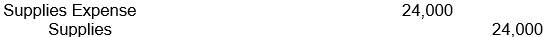

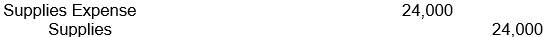

30

During their first year, Ann Zi & Associates bought $96,000 worth of supplies for their CPA firm. When purchased, the supplies were debited to Supplies and credited to Accounts Payable.

What adjusting entry would Ann Zi & Associates make if $24,000 worth of supplies were on hand at year-end?

A)

B)

C)

D)

What adjusting entry would Ann Zi & Associates make if $24,000 worth of supplies were on hand at year-end?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Boston Company's Supplies account balance at the end of the period is $44,000. Supplies totaling $37,600 have been purchased during the period and debited to Supplies. A physical count shows $10,000 worth of supplies on hand at the end of the period.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Tracey Real Estate Company's Supplies account balance at the end of the period is $132,000. Supplies totaling $112,800 have been purchased during the period and debited to Supplies. A physical count shows $30,000 worth of supplies on hand at the end of the period.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

33

Champaign Company signed a one-year lease on April 1, 2019, and paid the $22,800 total year's rent in advance. Champaign recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Champaign make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Champaign make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

34

Dennison Company signed a one-year lease on April 1, 2019, and paid the $68,400 total year's rent in advance. Dennison recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Dennison make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Dennison make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

35

Happy Company signed a two-year lease on July 1, 2019, and paid the $34,800 total rent in advance. Happy recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Happy make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Happy make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

36

Subariffic Company signed a two-year lease on July 1, 2019, and paid the $104,400 total rent in advance. Subariffic recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Subariffic make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

What adjusting entry should Subariffic make on December 31, 2019 (no previous adjustment has been made)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

37

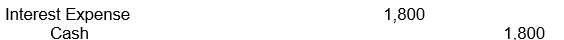

Art Company calculates that interest of $1,800 has accrued at December 31 on outstanding notes payable. How should Art record this on December 31?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

38

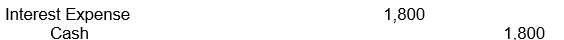

Owl Company calculates that interest of $5,400 has accrued at December 31 on outstanding notes payable. How should Owl record this on December 31?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

39

Assume December 31 is a Wednesday. Rite Weld Company's wages are paid every Friday, and the weekly payroll (for five days) amounts to $6,000.

To record the correct amount of expense for December, Rite Weld makes the following entry on December 31:

A)

B)

C)

D)

To record the correct amount of expense for December, Rite Weld makes the following entry on December 31:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assume December 31 is a Wednesday. Circlewood Company's wages are paid every Friday, and the weekly payroll (for five days) amounts to $18,000.

To record the correct amount of expense for December, Circlewood makes the following entry on December 31:

A)

B)

C)

D)

To record the correct amount of expense for December, Circlewood makes the following entry on December 31:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

41

Border Company calculates it has earned (but not yet collected or recorded) interest of $1,050 at December 31 on outstanding notes receivable.

How should Borders record this on December 31?

A)

B)

C)

D)

How should Borders record this on December 31?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

42

Runner Company calculates it has earned (but not yet collected or recorded) interest of $3,150 at December 31 on outstanding notes receivable.

How should Runner record this on December 31?

A)

B)

C)

D)

How should Runner record this on December 31?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume December 31 is a Monday. Rite Weld Company's wages are paid every Friday, and the weekly payroll (for five days) amounts to $12,000.

To record the correct amount of expense for December Rite Weld makes the following entry on December 31:

A)

B)

C)

D)

To record the correct amount of expense for December Rite Weld makes the following entry on December 31:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

44

Assume December 31 is a Monday. Circlewood Company's wages are paid every Friday, and the weekly payroll (for five days) amounts to $36,000.

To record the correct amount of expense for December Circlewood makes the following entry on December 31:

A)

B)

C)

D)

To record the correct amount of expense for December Circlewood makes the following entry on December 31:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

45

On July 1, Saboni paid $48,000 for a two-year insurance policy, debiting Prepaid Insurance for the full amount. If the adjusting entry is not made at December 31, the end of the accounting period, how does the error affect this year's financial statements?

A) Overstates assets

B) Overstates revenue

C) Understates common stock

D) Overstates expenses

A) Overstates assets

B) Overstates revenue

C) Understates common stock

D) Overstates expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

46

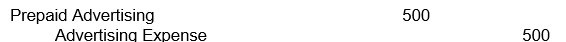

During the current accounting period, Montana Ridge Company paid $2,000 for advertising services in advance of receiving them. Prepaid Advertising was debited and Cash was credited for $2,000. At the end of the accounting period, three-fourths of the services paid for had yet to be received.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

47

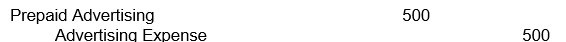

During the current accounting period, Cherry Creek Company paid $6,000 for advertising services in advance of receiving them. Prepaid Advertising was debited and Cash was credited for $6,000. At the end of the accounting period, three-fourths of the services paid for had yet to be received.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

48

During the current accounting period, Kenyon Farms Company paid $2,000 for advertising services in advance of receiving them. Prepaid Advertising was debited and Cash was credited for $2,000. At the end of the accounting period, three-fourths of the services paid for had been received.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

49

During the current accounting period, Ohio Company paid $6,000 for advertising services in advance of receiving them. Prepaid Advertising was debited and Cash was credited for $6,000. At the end of the accounting period, three-fourths of the services paid for had been received.

The proper adjusting entry is:

A)

B)

C)

D)

The proper adjusting entry is:

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

50

At the end of the accounting period, the Gardening Advice Company's Service Fees Earned account has a normal balance of $152,000. The accountant makes two adjustments--one to accrue unbilled service fees of $12,000, and the other to reduce the Unearned Service Fees liability account by $1,800.

After the adjustments are posted, the Service Fees Earned account has a balance of:

A) $159,800

B) $144,200

C) $150,800

D) $165,800

After the adjustments are posted, the Service Fees Earned account has a balance of:

A) $159,800

B) $144,200

C) $150,800

D) $165,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

51

At the end of the accounting period, the Bright Future Company's Service Fees Earned account has a normal balance of $456,000. The accountant makes two adjustments--one to accrue unbilled service fees of $36,000, and the other to reduce the Unearned Service Fees liability account by $5,400.

After the adjustments are posted, the Service Fees Earned account has a balance of:

A) $497,400

B) $479,400

C) $432,600

D) $452,400

After the adjustments are posted, the Service Fees Earned account has a balance of:

A) $497,400

B) $479,400

C) $432,600

D) $452,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

52

At the end of the accounting period, the Lisa Yoke, LLC's Legal Fees Earned account has a normal balance of $150,000. The accountant makes two adjustments--one to accrue unbilled legal fees earned of $5,000, and the other to reduce the Unearned Legal Fees liability account by $1,000.

After the adjustments are posted, the Legal Fees Earned account has a balance of:

A) $163,000

B) $165,000

C) $155,000

D) $156,000

After the adjustments are posted, the Legal Fees Earned account has a balance of:

A) $163,000

B) $165,000

C) $155,000

D) $156,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

53

At the end of the accounting period, the MLY, LLC's Legal Fees Earned account has a normal balance of $450,000. The accountant makes two adjustments--one to accrue unbilled legal fees earned of $15,000, and the other to reduce the Unearned Legal Fees liability account by $3,000.

After the adjustments are posted, the Legal Fees Earned account has a balance of:

A) $468,000

B) $489,000

C) $495,000

D) $465,000

After the adjustments are posted, the Legal Fees Earned account has a balance of:

A) $468,000

B) $489,000

C) $495,000

D) $465,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

54

On the last day of December 2019, Gilgen & Sons entered into a transaction that resulted in a receipt of $108,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $64,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $1,600,000 at December 31, 2019. There are no other prepaid services yet to be delivered.

If Peter & Sons makes the appropriate adjusting entry, how much will service revenue will be reflected on the December 31, 2019 income statement?

A) $1,623,000

B) $1,664,000

C) $1,451,000

D) $1,515,000

If Peter & Sons makes the appropriate adjusting entry, how much will service revenue will be reflected on the December 31, 2019 income statement?

A) $1,623,000

B) $1,664,000

C) $1,451,000

D) $1,515,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

55

On the last day of December 2019, Frischmuth Construction entered into a transaction that resulted in a receipt of $324,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $192,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $4,800,000 at December 31, 2019. There are no other prepaid services yet to be delivered.

If Frischmuth Construction makes the appropriate adjusting entry, how much will service revenue will be reflected on the December 31, 2019 income statement?

A) $4,545,000

B) $4.869,000

C) $4,992,000

D) $4,353,000

If Frischmuth Construction makes the appropriate adjusting entry, how much will service revenue will be reflected on the December 31, 2019 income statement?

A) $4,545,000

B) $4.869,000

C) $4,992,000

D) $4,353,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

56

On the last day of December 2019, Dan Matthews Aviators entered into a transaction that resulted in a receipt of $108,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $64,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $1,600,000 at December 31, 2019. There are no other prepaid services yet to be delivered.

If Dan Matthews Aviators makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as unearned revenue?

A) $ 64,000

B) $152,000

C) $108,000

D) $ 14,000

If Dan Matthews Aviators makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as unearned revenue?

A) $ 64,000

B) $152,000

C) $108,000

D) $ 14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

57

On the last day of December 2019, Frederick Aviators entered into a transaction that resulted in a receipt of $324,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $192,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $4,800,000 at December 31, 2019. There are no other prepaid services yet to be delivered.

If Frederick Aviators makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as unearned revenue?

A) $ 42,000

B) $192,000

C) $456,000

D) $324,000

If Frederick Aviators makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as unearned revenue?

A) $ 42,000

B) $192,000

C) $456,000

D) $324,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

58

On the last day of December 2019, Zion Inc. entered into a transaction that resulted in a receipt of $108,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $68,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $1,600,000 at December 31, 2019. There are no other prepaid services yet to be delivered, and during the month all outstanding accounts receivable from prior months were collected.

If Zion Inc. makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as accounts receivable?

A) $ 68,000

B) $152,000

C) $108,000

D) $ 44,000

If Zion Inc. makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as accounts receivable?

A) $ 68,000

B) $152,000

C) $108,000

D) $ 44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

59

On the last day of December 2019, Verde Inc. entered into a transaction that resulted in a receipt of $324,000 cash in advance related to services that will be provided during January 2020. During December of 2019, the company also performed $204,000 of services which were neither billed nor paid. Prior to December adjustments and before these two transactions were recorded, the company's trial balance showed service revenue of $4,800,000 at December 31, 2019. There are no other prepaid services yet to be delivered, and during the month all outstanding accounts receivable from prior months were collected.

If Mesa Inc. makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as accounts receivable?

A) $132,000

B) $204,000

C) $456,000

D) $324,000

If Mesa Inc. makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as accounts receivable?

A) $132,000

B) $204,000

C) $456,000

D) $324,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

60

On April 1, 2019, China Technologies paid $80,000 for rent on warehouse space one year in advance. If China makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement for rent expense?

A) $15,000

B) $50,000

C) $45,000

D) $60,000

A) $15,000

B) $50,000

C) $45,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

61

On April 1, 2019, Exceed Technologies paid $240,000 for rent on warehouse space one year in advance. If Above and Beyond makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement for rent expense?

A) $180,000

B) $ 45,000

C) $150,000

D) $135,000

A) $180,000

B) $ 45,000

C) $150,000

D) $135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

62

On April 1, 2019, Gilgen & Sons paid $60,000 for rent on warehouse space one year in advance. If Gilgen & Sons makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as prepaid rent?

A) $-0-

B) $15,000

C) $45,000

D) $60,000

A) $-0-

B) $15,000

C) $45,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

63

On April 1, 2019, Cooper paid $180,000 for rent on warehouse space one year in advance. If Justin makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as prepaid rent?

A) $180,000

B) $ 0

C) $ 45,000

D) $135,000

A) $180,000

B) $ 0

C) $ 45,000

D) $135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

64

On October 1, 2019, Feldman entered into a lease agreement to rent out its old warehouse space it was no longer using. This agreement calls for Feldman to receive $6,000 per month from the lessee, due and payable at the end of the 4-month lease term. At December 31, 2019, none of the rental payments from the lessee had yet been received.

If Feldman makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as rent receivable?

A) $ 8,000

B) $18,000

C) $ 4,000

D) $16,000

If Feldman makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as rent receivable?

A) $ 8,000

B) $18,000

C) $ 4,000

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

65

On October 1, 2019, A. Karikomi entered into a lease agreement to rent out its old warehouse space it was no longer using. This agreement calls for Karikomi to receive $18,000 per month from the lessee, due and payable at the end of the 4-month lease term. At December 31, 2019, none of the rental payments from the lessee had yet been received.

If Kushner makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as rent receivable?

A) $48,000

B) $24,000

C) $54,000

D) $12,000

If Kushner makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 balance sheet as rent receivable?

A) $48,000

B) $24,000

C) $54,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

66

Beth's Bagels has 6 employees who are paid $24 per hour. At December 31, 2019, each of Beth's employees had worked 18 hours which had not been paid or recorded. Prior to adjustments, the company's trial balance showed $171,400 in the wages expense account.

If Beth makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement as wage expense?

A) $ 2,592

B) $173,992

C) $171,400

D) $168,808

If Beth makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement as wage expense?

A) $ 2,592

B) $173,992

C) $171,400

D) $168,808

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

67

Remi's Burritos has 6 employees who are paid $27 per hour. At December 31, 2019, each of Remi's employees had worked 18 hours which had not been paid or recorded. Prior to adjustments, the company's trial balance showed $192,825 in the wages expense account.

If Remi's Burritos makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement as wage expense?

A) $189,909

B) $ 2,916

C) $195,741

D) $192,825

If Remi's Burritos makes the appropriate adjusting entry, how much will be reported on the December 31, 2019 income statement as wage expense?

A) $189,909

B) $ 2,916

C) $195,741

D) $192,825

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

68

Beth's Bagels purchases its inventory, on account, daily. At December 31, 2019, the company had taken receipt of $80,000 of inventory from its suppliers which had not been recorded in the accounts.

If Beth makes the appropriate adjusting entry, how much will be reported on the December 31, 2019, balance sheet as accounts payable?

A) $64,992

B) $59,808

C) $-0-

D) $80,000

If Beth makes the appropriate adjusting entry, how much will be reported on the December 31, 2019, balance sheet as accounts payable?

A) $64,992

B) $59,808

C) $-0-

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

69

Remi's Burritos purchases its inventory, on account, daily. At December 31, 2019, the company had taken receipt of $240,000 of inventory from its suppliers which had not been recorded in the accounts.

If Remi's Burritos makes the appropriate adjusting entry, how much will be reported on the December 31, 2019, balance sheet as accounts payable?

A) $240,000

B) $194,976

C) $179,424

D) $-0-

If Remi's Burritos makes the appropriate adjusting entry, how much will be reported on the December 31, 2019, balance sheet as accounts payable?

A) $240,000

B) $194,976

C) $179,424

D) $-0-

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

70

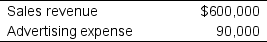

Bee Corporation has the following normal account balances in its general ledger at the end of a period:

Which of the following gives the correct entry required to close only the accounts above?

Which of the following gives the correct entry required to close only the accounts above?

A)

B)

C)

D) None of the above. These accounts are not closed.

Which of the following gives the correct entry required to close only the accounts above?

Which of the following gives the correct entry required to close only the accounts above?A)

B)

C)

D) None of the above. These accounts are not closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

71

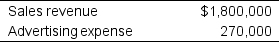

Sage Corporation has the following normal account balances in its general ledger at the end of a period:

Which of the following gives the correct entry required to close only the accounts above?

Which of the following gives the correct entry required to close only the accounts above?

A) Advertising Expense 270,000

Retained Earnings 1,530,000

Sales Revenue 1,800,000

B) Sales Revenue 1,800,000

Advertising Expense 270,000

Retained Earnings 1,530,000

C) Retained Earnings 1,530,000

Net Income 1,530,000

D) None of the above. These accounts are not closed.

Which of the following gives the correct entry required to close only the accounts above?

Which of the following gives the correct entry required to close only the accounts above?A) Advertising Expense 270,000

Retained Earnings 1,530,000

Sales Revenue 1,800,000

B) Sales Revenue 1,800,000

Advertising Expense 270,000

Retained Earnings 1,530,000

C) Retained Earnings 1,530,000

Net Income 1,530,000

D) None of the above. These accounts are not closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

72

A series of journal entries at the end of the accounting period to remove the balances from the temporary accounts so that they can accumulate data for the following accounting period are called:

A) Adjusting entries

B) Closing entries

C) Connecting entries

D) Reversing entries

A) Adjusting entries

B) Closing entries

C) Connecting entries

D) Reversing entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following entry closes the Depreciation Expense account at the end of the accounting period:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following accounts is closed to Income Summary at the end of the accounting period?

A) Accumulated Depreciation

B) Advertising Expense

C) Common Stock

D) Cash Dividends

A) Accumulated Depreciation

B) Advertising Expense

C) Common Stock

D) Cash Dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following entries could not be a closing entry?

A) Service Fees Earned

Income Summary

B) Income Summary

Salary Expense

C) Retained Earnings

Dividends

D) Dividends

Cash

A) Service Fees Earned

Income Summary

B) Income Summary

Salary Expense

C) Retained Earnings

Dividends

D) Dividends

Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Income Summary account:

A) Appears in a post-closing trial balance

B) Receives entries only at year-end, even though income or loss is assumed to be incurred throughout the year

C) Reflects the net balance of all revenues, expenses, and dividends just before the account is closed

D) Is closed by a debit entry when there is a loss for the period

A) Appears in a post-closing trial balance

B) Receives entries only at year-end, even though income or loss is assumed to be incurred throughout the year

C) Reflects the net balance of all revenues, expenses, and dividends just before the account is closed

D) Is closed by a debit entry when there is a loss for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

77

In the closing process for a corporation, the Income Summary account is closed to:

A) Retained Earnings

B) Common Stock

C) Cash Dividends

D) Service Revenue

A) Retained Earnings

B) Common Stock

C) Cash Dividends

D) Service Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

78

Koontz & Sons Company, Inc., has a net income for the current year. The entry to close the company's Income Summary account would be:

A) Debit Income Summary; Common Stock

B) Debit Income Summary; credit Retained Earnings

C) Debit Common Stock; credit Income Summary

D) Debit Retained Earnings; credit Income Summary

A) Debit Income Summary; Common Stock

B) Debit Income Summary; credit Retained Earnings

C) Debit Common Stock; credit Income Summary

D) Debit Retained Earnings; credit Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following entries is a closing entry?

A) Wages Payable 960

Wages Expense 960

B) Retained Earnings 4,530

Income Summary 4,530

C) Fees Receivable 1,500

Service Fees Revenue 1,500

D) Depreciation Expense 820

Accumulated Depreciation 820

A) Wages Payable 960

Wages Expense 960

B) Retained Earnings 4,530

Income Summary 4,530

C) Fees Receivable 1,500

Service Fees Revenue 1,500

D) Depreciation Expense 820

Accumulated Depreciation 820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following entries is a closing entry?

A) Wages Payable 2,880

Wages Expense 2,880

B) Retained Earnings 13,590

Income Summary 13,590

C) Fees Receivable 5,250

Service Fees Revenue 5,250

D) Depreciation Expense 2,460

Accumulated Depreciation 2,460

A) Wages Payable 2,880

Wages Expense 2,880

B) Retained Earnings 13,590

Income Summary 13,590

C) Fees Receivable 5,250

Service Fees Revenue 5,250

D) Depreciation Expense 2,460

Accumulated Depreciation 2,460

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck