Deck 1: Financial Accounting and Business Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

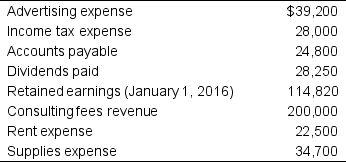

سؤال

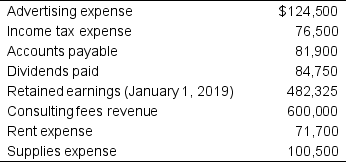

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

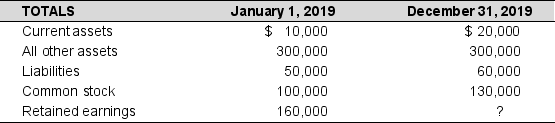

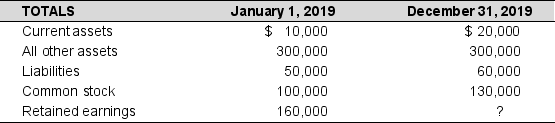

سؤال

سؤال

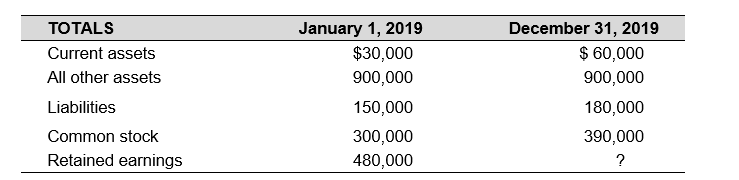

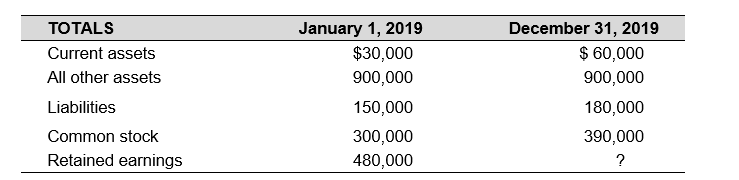

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/113

العب

ملء الشاشة (f)

Deck 1: Financial Accounting and Business Decisions

1

The cost principle states that assets are initially recorded at the amounts paid or obligated to pay to acquire the assets.

True

2

The going concern concept assumes that an entity will be going out of business within the next several years.

False

3

Under the accrual basis of accounting, revenue may be recorded even though cash has not yet been received from a customer or client.

True

4

The three principal forms of business organization are:

A) A sole proprietorship, a stockholder, and a corporation

B) A partnership, a sub-S corporation, and a labor union

C) A corporation, a partnership, and a sole proprietorship

D) A labor union, a stockholder, and a partnership

A) A sole proprietorship, a stockholder, and a corporation

B) A partnership, a sub-S corporation, and a labor union

C) A corporation, a partnership, and a sole proprietorship

D) A labor union, a stockholder, and a partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not an advantage of the corporate form of business organization?

A) The ease with which capital can be raised

B) The protection afforded stockholders against personal liability

C) Both the business and the owners are taxed

D) The relative ease of selling ownership shares

A) The ease with which capital can be raised

B) The protection afforded stockholders against personal liability

C) Both the business and the owners are taxed

D) The relative ease of selling ownership shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

6

The three types of business activities in which every business, regardless of organizational form, its industry or its size, is involved are:

A) Financing activities, banking activities, financial accounting activities

B) Operating activities, banking activities, financing activities

C) Financing activities, investing activities, financial accounting activities

D) Financing activities, operating activities, investing activities

A) Financing activities, banking activities, financial accounting activities

B) Operating activities, banking activities, financing activities

C) Financing activities, investing activities, financial accounting activities

D) Financing activities, operating activities, investing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

7

Financing activities are generally categorized as:

A) Debt financing

B) Bond financing

C) Equity financing

D) Either debt or equity financing

A) Debt financing

B) Bond financing

C) Equity financing

D) Either debt or equity financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

8

Equity financing involves:

A) Selling shares of stock to investors

B) Borrowing money from a bank

C) Issuing bonds payable

D) Repayment of principal and interest to a creditor

A) Selling shares of stock to investors

B) Borrowing money from a bank

C) Issuing bonds payable

D) Repayment of principal and interest to a creditor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements about operating activities is not correct?

A) Operating activities refers to the day-to-day activities of producing and selling a product or providing a service.

B) Creditors and stockholders beliefs about a company's ability to generate a profit are unimportant.

C) Operating activities are critical for a business.

D) If a company is unable to generate income from its operations it is very likely that it will fail.

A) Operating activities refers to the day-to-day activities of producing and selling a product or providing a service.

B) Creditors and stockholders beliefs about a company's ability to generate a profit are unimportant.

C) Operating activities are critical for a business.

D) If a company is unable to generate income from its operations it is very likely that it will fail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following activities is an example of an operating activity?

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Issuing shares of stock in exchange for cash

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Issuing shares of stock in exchange for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following activities is an example of an investing activity?

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Issuing shares of stock in exchange for cash

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Issuing shares of stock in exchange for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following activities is an example of a financing activity?

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Paying employee salaries

A) Receiving a loan from a bank

B) Selling merchandise online

C) Purchasing a delivery truck

D) Paying employee salaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following is not an internal user of financial information?

A) The Marketing Department

B) Creditors

C) The Finance Department

D) Senior company management

A) The Marketing Department

B) Creditors

C) The Finance Department

D) Senior company management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

14

The branch of accounting which is involved in criminal investigations related to areas such as financial statement fraud, money laundering, or investment fraud is called:

A) Internal auditing

B) Cost accounting.

C) Forensic accounting.

D) All of the above

E) None of the above

A) Internal auditing

B) Cost accounting.

C) Forensic accounting.

D) All of the above

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

15

The measurement activity of the accounting process must do all of the following except:

A) Identify the relevant economic activities of a business

B) Prepare financial reports to meet the needs of the user

C) Quantify the economic activities of a business

D) Record the resulting measures in a systematic manner

A) Identify the relevant economic activities of a business

B) Prepare financial reports to meet the needs of the user

C) Quantify the economic activities of a business

D) Record the resulting measures in a systematic manner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

16

The communication activity of the accounting process must:

A) Identify the relevant economic activities of a business

B) Record the resulting measures in a systematic manner

C) Quantify the economic activities of a business

D) Prepare financial reports and help interpret financial results to meet users' needs

A) Identify the relevant economic activities of a business

B) Record the resulting measures in a systematic manner

C) Quantify the economic activities of a business

D) Prepare financial reports and help interpret financial results to meet users' needs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

17

Financial accounting oversight in the United States is provided by all of the following organizations except the:

A) International Accounting Standards Board (IASB)

B) Financial Accounting Standards Board (FASB)

C) Public Company Accounting Oversight Board (PCAOB)

D) U.S. Securities Exchange Commission (SEC)

A) International Accounting Standards Board (IASB)

B) Financial Accounting Standards Board (FASB)

C) Public Company Accounting Oversight Board (PCAOB)

D) U.S. Securities Exchange Commission (SEC)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

18

What are the economics resources of a business that can be expressed in monetary and how are they reported?

A) Assets on the balance sheet

B) Stockholders' equity on the balance sheet

C) Dividends on the statement of retained earnings

D) Liabilities on the balance sheet

A) Assets on the balance sheet

B) Stockholders' equity on the balance sheet

C) Dividends on the statement of retained earnings

D) Liabilities on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

19

A financial statement either presents information covering a period of time (for example, a month, a quarter, or a year) or it presents information as of a particular date (for example, as of December 31, 2016). Which of the following financial statements presents information as of a particular date?

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Both the balance sheet and the income statement

E) None of the above

A) Balance sheet

B) Income statement

C) Statement of retained earnings

D) Both the balance sheet and the income statement

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the following information to answer:

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-The net income reported by Marvin's Mechanical Repair Shop for the year was:

A) $180,000

B) $ 40,000

C) $ 50,000

D) $ 30,000

E) None of the above

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-The net income reported by Marvin's Mechanical Repair Shop for the year was:

A) $180,000

B) $ 40,000

C) $ 50,000

D) $ 30,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following information to answer:

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-Marvin's balance of stockholders' equity at the start of the year was:

A) $ 2,000

B) $ 20,000

C) $100,000

D) $ 15,000

E) None of the above

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-Marvin's balance of stockholders' equity at the start of the year was:

A) $ 2,000

B) $ 20,000

C) $100,000

D) $ 15,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following information to answer:

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-Marvin's balance of retained earnings at the end of the year was:

A) $50,000

B) $42,000

C) $33,000

D) $70,000

E) None of the above

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-Marvin's balance of retained earnings at the end of the year was:

A) $50,000

B) $42,000

C) $33,000

D) $70,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the following information to answer:

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-If Marvin's Mechanical Repair Shop ends the year with total assets of $80,000, and total liabilities of $35,000, what must be the amount of common stock issued during the year?

A) $ 10,000

B) $ 14,000

C) $ 5,000

D) $ 3,000

E) None of the above

Marvin's Mechanical Repair Shop started the year with total assets of $60,000, total liabilities of $40,000, and retained earnings of $18,000. During the year, the business recorded $100,000 in auto repair revenues, $70,000 in expenses, and the company paid dividends of $15,000.

-If Marvin's Mechanical Repair Shop ends the year with total assets of $80,000, and total liabilities of $35,000, what must be the amount of common stock issued during the year?

A) $ 10,000

B) $ 14,000

C) $ 5,000

D) $ 3,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

24

Use the following information to answer:

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The net income reported by The Williams Model Aircraft Repair Shop for the year was:

A) $ 90,000

B) $ 540,000

C) $ 120,000

D) $ 150,000

E) None of the above

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The net income reported by The Williams Model Aircraft Repair Shop for the year was:

A) $ 90,000

B) $ 540,000

C) $ 120,000

D) $ 150,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the following information to answer:

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The Williams' balance of stockholders' equity at the start of the year was:

A) $ 45,000

B) $ 6,000

C) $ 60,000

D) $300,000

E) None of the above

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The Williams' balance of stockholders' equity at the start of the year was:

A) $ 45,000

B) $ 6,000

C) $ 60,000

D) $300,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following information to answer:

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The Williams' balance of retained earnings at the end of the year was:

A) $210,000

B) $150,000

C) $126,000

D) $ 99,000

E) None of the above

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-The Williams' balance of retained earnings at the end of the year was:

A) $210,000

B) $150,000

C) $126,000

D) $ 99,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the following information to answer:

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-If The Williams Model Aircraft Repair Shop ends the year with total assets of $240,000, and total liabilities of $105,000, what must be the amount of common stock issued during the year?

A) $ 9,000

B) $30,000

C) $42,000

D) $15,000

E) None of the above

The Williams Model Aircraft Repair Shop started the year with total assets of $180,000, total liabilities of $120,000, and retained earnings of $54,000. During the year, the business recorded $300,000 in repair revenues, $210,000 in expenses, and the company paid dividends of $45,000.

-If The Williams Model Aircraft Repair Shop ends the year with total assets of $240,000, and total liabilities of $105,000, what must be the amount of common stock issued during the year?

A) $ 9,000

B) $30,000

C) $42,000

D) $15,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

28

The transactions carried out by Melon Corporation during the year caused an increase in total assets of $50,000 and a decrease in total liabilities of $20,000.

If no additional investment was made by the investors during the year and dividends of $14,000 were paid, what was the net income for the year?

A) $106,000

B) $ 42,000

C) $ 84,000

D) $ 60,000

E) None of the above

If no additional investment was made by the investors during the year and dividends of $14,000 were paid, what was the net income for the year?

A) $106,000

B) $ 42,000

C) $ 84,000

D) $ 60,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

29

The transactions carried out by Papaya Corporation during the year caused an increase in total assets of $150,000 and a decrease in total liabilities of $60,000.

If no additional investment was made by the investors during the year and dividends of $42,000 were paid, what was the net income for the year?

A) $180,000

B) $318,000

C) $126,000

D) $252,000

E) None of the above

If no additional investment was made by the investors during the year and dividends of $42,000 were paid, what was the net income for the year?

A) $180,000

B) $318,000

C) $126,000

D) $252,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following information to answer:

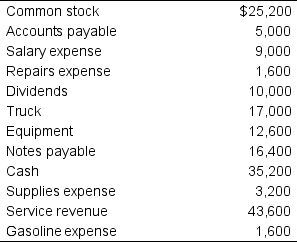

The following information was taken from the records of Easter Corporation for the year ended December 31, 2019.

-The retained earnings reported by Easter Corporation as of December 31, 2019 is:

A) $158,490

B) $158,090

C) $111,590

D) $162,520

The following information was taken from the records of Easter Corporation for the year ended December 31, 2019.

-The retained earnings reported by Easter Corporation as of December 31, 2019 is:

A) $158,490

B) $158,090

C) $111,590

D) $162,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following information to answer:

The following information was taken from the records of Easter Corporation for the year ended December 31, 2019.

-The net income reported by Easter Corporation for the year ended December 31, 2019 was:

A) $ 76,800

B) $102,800

C) $ 72,800

D) $ 49,900

The following information was taken from the records of Easter Corporation for the year ended December 31, 2019.

-The net income reported by Easter Corporation for the year ended December 31, 2019 was:

A) $ 76,800

B) $102,800

C) $ 72,800

D) $ 49,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following information to answer:

The following information was taken from the records of Rectangle Corporation for the year ended December 31, 2019.

-The retained earnings reported by Rectangle Corporation as of December 31, 2019 is:

A) $487,560

B) $457,470

C) $474,270

D) $324,770

The following information was taken from the records of Rectangle Corporation for the year ended December 31, 2019.

-The retained earnings reported by Rectangle Corporation as of December 31, 2019 is:

A) $487,560

B) $457,470

C) $474,270

D) $324,770

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following information to answer:

The following information was taken from the records of Rectangle Corporation for the year ended December 31, 2019.

-The net income reported by Rectangle Corporation for the year ended December 31, 2019 was:

A) $149,700

B) $230,400

C) $308,400

D) $218,400

The following information was taken from the records of Rectangle Corporation for the year ended December 31, 2019.

-The net income reported by Rectangle Corporation for the year ended December 31, 2019 was:

A) $149,700

B) $230,400

C) $308,400

D) $218,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

34

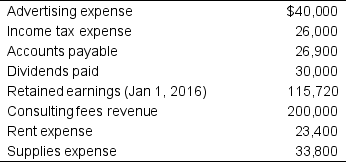

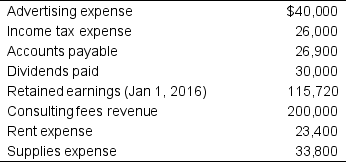

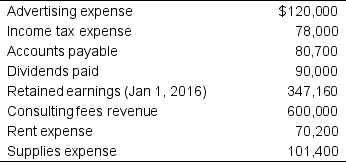

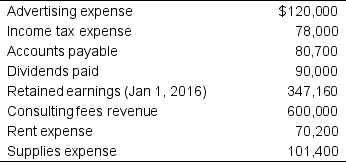

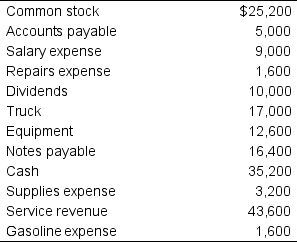

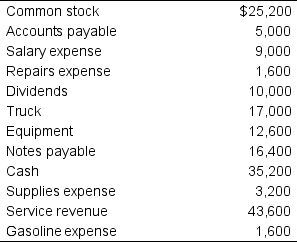

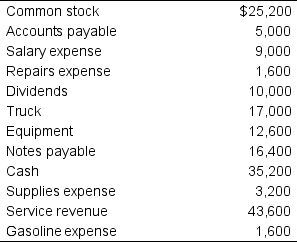

The following information was taken from the records of J. Weasley Corporation for the month ended December 31, 2019.

Given the above information, net income for the year is:

Given the above information, net income for the year is:

A) $75,600

B) $34,120

C) $88,560

D) $70,620

Given the above information, net income for the year is:

Given the above information, net income for the year is:A) $75,600

B) $34,120

C) $88,560

D) $70,620

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

35

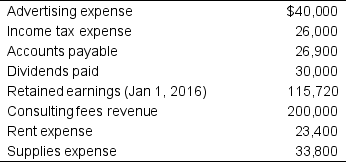

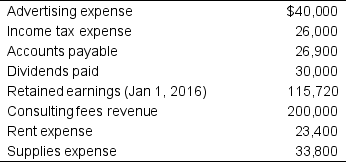

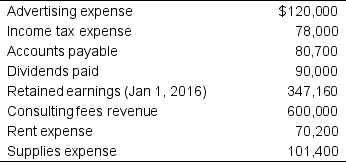

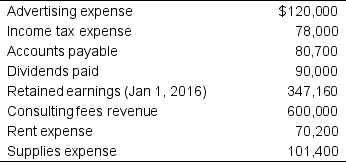

The following information was taken from the records of H. Granger Corporation for the month ended December 31, 2019.

Given the above information, net income for the year is:

Given the above information, net income for the year is:

A) $211,860

B) $226,800

C) $102,360

D) $265,680

Given the above information, net income for the year is:

Given the above information, net income for the year is:A) $211,860

B) $226,800

C) $102,360

D) $265,680

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information to answer:

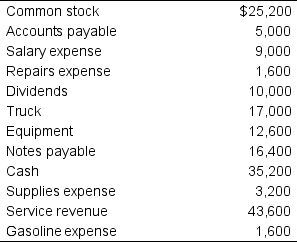

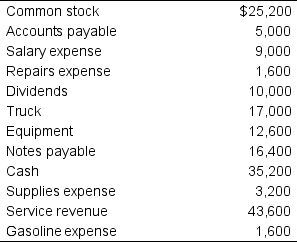

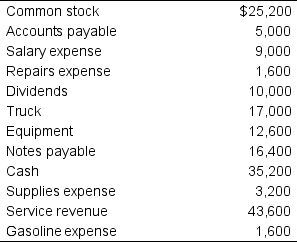

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Competitive Landscaping for the year was:

A) $11,400

B) $11,800

C) $28,200

D) $25,600

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Competitive Landscaping for the year was:

A) $11,400

B) $11,800

C) $28,200

D) $25,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information to answer:

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Competitive Landscaping on December 31, 2019 are:

A) $37,800

B) $23,400

C) $21,400

D) $73,000

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Competitive Landscaping on December 31, 2019 are:

A) $37,800

B) $23,400

C) $21,400

D) $73,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information to answer:

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Competitive Landscaping on December 31, 2019 are:

A) $56,200

B) $63,200

C) $43,200

D) $64,800

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Competitive Landscaping on December 31, 2019 are:

A) $56,200

B) $63,200

C) $43,200

D) $64,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following information to answer:

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Competitive Landscaping on December 31, 2019 are:

A) $1,400

B) $18,200

C) $28,200

D) $6,300

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Competitive Landscaping on December 31, 2019 are:

A) $1,400

B) $18,200

C) $28,200

D) $6,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following information to answer:

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Competitive Landscaping on December 31, 2019 is:

A) $55,400

B) $43,400

C) $45,200

D) $45,000

Competitive Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Competitive Landscaping on December 31, 2019 is:

A) $55,400

B) $43,400

C) $45,200

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following information to answer:

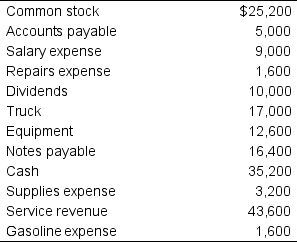

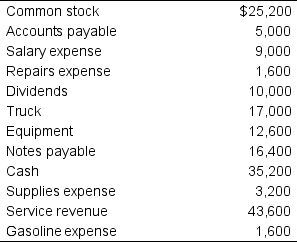

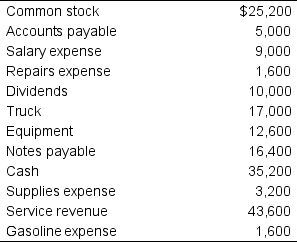

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Susie Lane's Landscaping for the year was:

A) $76,800

B) $34,200

C) $34,400

D) $84,600

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The net income for Susie Lane's Landscaping for the year was:

A) $76,800

B) $34,200

C) $34,400

D) $84,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following information to answer:

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Susie Lane's Landscaping on December 31, 2019 are:

A) $219,000

B) $113,400

C) $ 70,200

D) $ 64,200

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total liabilities for Susie Lane's Landscaping on December 31, 2019 are:

A) $219,000

B) $113,400

C) $ 70,200

D) $ 64,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the following information to answer:

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Susie Lane's Landscaping on December 31, 2019 are:

A) $194,400

B) $168,600

C) $189,600

D) $129,600

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The total assets for Susie Lane's Landscaping on December 31, 2019 are:

A) $194,400

B) $168,600

C) $189,600

D) $129,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information to answer:

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Susie Lane's Landscaping on December 31, 2019 are:

A) $18,900

B) $ 4,200

C) $54,600

D) $84,600

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The retained earnings for Susie Lane's Landscaping on December 31, 2019 are:

A) $18,900

B) $ 4,200

C) $54,600

D) $84,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following information to answer:

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Susie Lane's Landscaping on December 31, 2019 is:

A) $135,000

B) $166,200

C) $130,200

D) $135,600

Susie Lane's Landscaping Company has compiled the following list of account balances of various assets, liabilities, revenues and expenses on December 31, 2019, the end of its first year of operations.

-The stockholders' equity for Susie Lane's Landscaping on December 31, 2019 is:

A) $135,000

B) $166,200

C) $130,200

D) $135,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

46

Stockholders' equity and total assets were $64,000 and $158,000 respectively at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period.

A) $ 90,000

B) $ 94,000

C) $199,400

D) $223,400

A) $ 90,000

B) $ 94,000

C) $199,400

D) $223,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

47

Stockholders' equity and total assets were $192,000 and $474,000 respectively at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period.

A) $670,200

B) $270,000

C) $282,000

D) $598,200

A) $670,200

B) $270,000

C) $282,000

D) $598,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

48

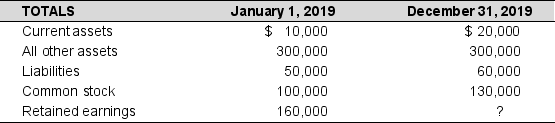

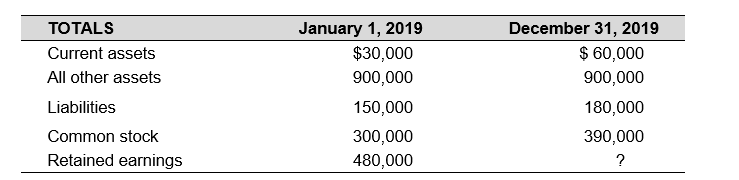

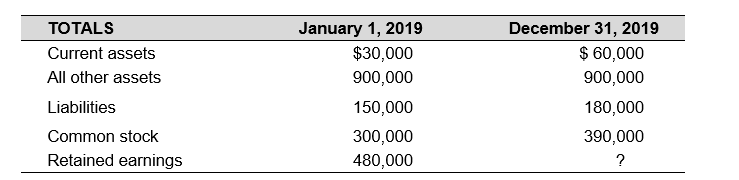

Use the following information to answer:

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

-Stockholders' equity and total assets were $192,000 and $474,000 respectively at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period.

A) $150,000

B) $170,000

C) $110.000

D) $130,000

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.-Stockholders' equity and total assets were $192,000 and $474,000 respectively at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period.

A) $150,000

B) $170,000

C) $110.000

D) $130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information to answer:

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

-Using the above table, determine the revenues for the year ending on December 31, 2019?

A) $56,000

B) $44,000

C) $32,000

D) $74,000

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.

Additional data: Total expenses for the year were $70,000; Dividends paid during the year were $16,000.-Using the above table, determine the revenues for the year ending on December 31, 2019?

A) $56,000

B) $44,000

C) $32,000

D) $74,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

50

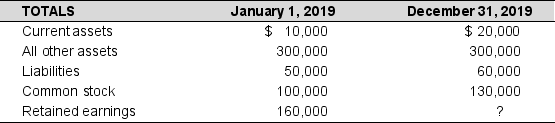

Use the following information to answer:

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

-Using the above table, determine the retained earnings as of December 31, 2019?

A) $390,000

B) $450,000

C) $510,000

D) $330,000

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.-Using the above table, determine the retained earnings as of December 31, 2019?

A) $390,000

B) $450,000

C) $510,000

D) $330,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following information to answer:

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

-Using the above table, determine the revenues for the year ending on December 31, 2019?

A) $222,000

B) $168,000

C) $132,000

D) $ 96,000

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.

Additional data: Total expenses for the year were $210,000; Dividends paid during the year were $48,000.-Using the above table, determine the revenues for the year ending on December 31, 2019?

A) $222,000

B) $168,000

C) $132,000

D) $ 96,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

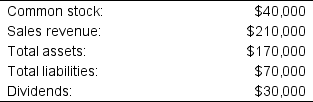

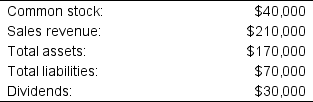

52

Chelsea Corporation reported the following information at the end of its first year of operations:

What must have been the expenses for the year?

What must have been the expenses for the year?

A) $120,000

B) $130,000

C) $ 32,000

D) $150,000

What must have been the expenses for the year?

What must have been the expenses for the year?A) $120,000

B) $130,000

C) $ 32,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

53

Kimick Corporation reported the following information at the end of its first year of operations:

What must have been the expenses for the year?

What must have been the expenses for the year?

A) $450,000

B) $360,000

C) $390,000

D) $ 51,000

What must have been the expenses for the year?

What must have been the expenses for the year?A) $450,000

B) $360,000

C) $390,000

D) $ 51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

54

On January 1, 2019, Little Robot invested $300,000 to start Bot Corporation. During the year, Bot Corporation had total revenues of $60,000 and total expenses of $16,000. Cash dividends paid totaled $12,000.

What was the balance in Bot Corporation's retained earnings account at the end of the year?

A) $314,000

B) $ 32,000

C) $302,000

D) $ 14,000

What was the balance in Bot Corporation's retained earnings account at the end of the year?

A) $314,000

B) $ 32,000

C) $302,000

D) $ 14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

55

On January 1, 2019, Les Holt invested $900,000 to start Holt Corporation. During the year, Holt Corporation had total revenues of $180,000 and total expenses of $48,000. Cash dividends paid totaled $36,000.

What was the balance in Holt Corporation's retained earnings account at the end of the year?

A) $ 42,000

B) $942,000

C) $ 96,000

D) $906,000

What was the balance in Holt Corporation's retained earnings account at the end of the year?

A) $ 42,000

B) $942,000

C) $ 96,000

D) $906,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1, 2019, Little Robot invested $300,000 to start Bot Corporation. During the year, Bot Corporation had total revenues of $60,000 and total expenses of $16,000. Cash dividends paid totaled $12,000.

What must have been the balance in Bot Corporation's total assets at the end of the year, assuming no liabilities?

A) $300,000

B) $ 32,000

C) $332,000

D) $268,000

What must have been the balance in Bot Corporation's total assets at the end of the year, assuming no liabilities?

A) $300,000

B) $ 32,000

C) $332,000

D) $268,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

57

On January 1, 2019, Les Holt invested $900,000 to start Holt Corporation. During the year, Holt Corporation had total revenues of $180,000 and total expenses of $48,000. Cash dividends paid totaled $36,000.

What must have been the balance in Holt Corporation's total assets at the end of the year, assuming no liabilities?

A) $804,000

B) $900,000

C) $ 96,000

D) $996,000

What must have been the balance in Holt Corporation's total assets at the end of the year, assuming no liabilities?

A) $804,000

B) $900,000

C) $ 96,000

D) $996,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1, 2019, R. Lupin Corporation's retained earnings account had a balance of $1,570,000. During 2019 the company had revenues of $270,000 and expenses of $186,000. On December 31, the company's retained earnings had a balance of $1,601,000.

Determine the amount of dividends paid during 2019.

A) $53,000

B) $26,500

C) $85,000

D) $61,500

Determine the amount of dividends paid during 2019.

A) $53,000

B) $26,500

C) $85,000

D) $61,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, 2019, Pigwidgeon Corporation's retained earnings account had a balance of $4,710,000. During 2019 the company had revenues of $810,000 and expenses of $558,000. On December 31, the company's retained earnings had a balance of $4,803,000.

Determine the amount of dividends paid during 2019.

A) $184,500

B) $159,000

C) $ 79,500

D) $255,000

Determine the amount of dividends paid during 2019.

A) $184,500

B) $159,000

C) $ 79,500

D) $255,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

60

Nichole Company's balance sheet as of December 31, 2019 showed total assets of $170,000, and total liabilities of $70,000, and common stock of $64,000. During 2020, the company reported revenues of $64,000, expenses of $50,000, and paid dividends of $16,000.

What was the balance in the Retained Earnings account on January 1, 2021?

A) $34,000

B) $56,000

C) $36,000

D) $28,000

What was the balance in the Retained Earnings account on January 1, 2021?

A) $34,000

B) $56,000

C) $36,000

D) $28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

61

CN Company's balance sheet as of December 31, 2019 showed total assets of $510,000, and total liabilities of $210,000, and common stock of $192,000. During 2020, the company reported revenues of $192,000, expenses of $150,000, and paid dividends of $48,000.

What was the balance in the Retained Earnings account on January 1, 2021?

A) $ 84,000

B) $102,000

C) $168,000

D) $108,000

What was the balance in the Retained Earnings account on January 1, 2021?

A) $ 84,000

B) $102,000

C) $168,000

D) $108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assuming no other changes except a decrease in assets of $100,000, increase in liabilities of $20,000, and expenses of $120,000, by how much did stockholders' equity increase or decrease and what were revenues for the period?

A) Stockholders' equity increased $80,000; revenues were $200,000

B) Stockholders' equity decreased $80,000; revenues were $200,000

C) Stockholders' equity increased $120,000; revenues were $240,000

D) Stockholders' equity decreased $120,000; revenues were $0

A) Stockholders' equity increased $80,000; revenues were $200,000

B) Stockholders' equity decreased $80,000; revenues were $200,000

C) Stockholders' equity increased $120,000; revenues were $240,000

D) Stockholders' equity decreased $120,000; revenues were $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

63

Assuming no other changes except a decrease in assets of $300,000, increase in liabilities of $60,000, and expenses of $360,000, by how much did stockholders' equity increase or decrease and what were revenues for the period?

A) Stockholders' equity decreased $360,000; revenues were $0

B) Stockholders' equity increased $240,000; revenues were $600,000

C) Stockholders' equity decreased $240,000; revenues were $600,000

D) Stockholders' equity increased $360,000; revenues were $360,000

A) Stockholders' equity decreased $360,000; revenues were $0

B) Stockholders' equity increased $240,000; revenues were $600,000

C) Stockholders' equity decreased $240,000; revenues were $600,000

D) Stockholders' equity increased $360,000; revenues were $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

64

At the beginning of the year, the Stephen Company had total assets of $1,800,000 and total stockholders' equity of $690,000. During the year, total assets increased by $270,000, and total liabilities increased by $126,000. The company also paid $21,000 in dividends.

How much was the net income for the year?

A) $144,000

B) $195,000

C) $ 93,000

D) $165,000

How much was the net income for the year?

A) $144,000

B) $195,000

C) $ 93,000

D) $165,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

65

Takahashi Company reported the following the following statement of cash flows:

Determine the missing amount (cash flows from financing activities)?

Determine the missing amount (cash flows from financing activities)?

A) $232,740

B) $158,320

C) $ 49,900

D) $ 84,420

Determine the missing amount (cash flows from financing activities)?

Determine the missing amount (cash flows from financing activities)?A) $232,740

B) $158,320

C) $ 49,900

D) $ 84,420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

66

Tomato Company reported the following the following statement of cash flows:

Determine the missing amount (cash flows from financing activities)?

Determine the missing amount (cash flows from financing activities)?

A) $253,260

B) $698,220

C) $474,960

D) $149,700

Determine the missing amount (cash flows from financing activities)?

Determine the missing amount (cash flows from financing activities)?A) $253,260

B) $698,220

C) $474,960

D) $149,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is the name of the annual report which all publically traded companies in the United States must file with the Securities and Exchange Commission?

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

68

In which of the following would information regarding the procedures followed to value a company's assets appear?

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

69

In which of the following would an opinion regarding the fair presentation of financial statements appear?

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

70

In which of the following would a discussion of new markets that a company plans to enter appear?

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

A) Auditor's report

B) Form 10-K

C) Management Discussion and Analysis

D) Notes to the Financial Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is not a component of the annual report which some companies provide to their shareholders?

A) Auditor's report

B) Statement of SEC Compliance

C) Management Discussion and Analysis

D) Notes to the Financial Statements

A) Auditor's report

B) Statement of SEC Compliance

C) Management Discussion and Analysis

D) Notes to the Financial Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which one of the following is not a quality of faithful representation of accounting information?

A) Timeliness

B) Free from error

C) Verifiable

D) Complete

A) Timeliness

B) Free from error

C) Verifiable

D) Complete

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

73

The assumption that an entity will continue to operate indefinitely and will not be sold or liquidated is called:

A) Objectivity principle

B) Going concern concept

C) Cost principle

D) Accounting entity concept

E) None of the above

A) Objectivity principle

B) Going concern concept

C) Cost principle

D) Accounting entity concept

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

74

The accounting entity:

A) Is a fundamental concept in accounting

B) May be a sole proprietorship, a partnership, or a corporation

C) Is an economic unit with identifiable boundaries for which financial information is accumulated and reported

D) Maintains a record of activities separate from the economic and personal activities of its owners

E) All of the above

A) Is a fundamental concept in accounting

B) May be a sole proprietorship, a partnership, or a corporation

C) Is an economic unit with identifiable boundaries for which financial information is accumulated and reported

D) Maintains a record of activities separate from the economic and personal activities of its owners

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

75

The revenue recognition principle:

A) States that the recording of revenue should be based on reliable and verifiable evidence.

B) Only requires that sales revenue must be earned before it is recorded on the income statement.

C) Only requires that sales revenue must be realized or realizable before it is recorded on the income statement.

D) States that sales revenue should be recorded when services are performed or goods are sold.

E) None of the above

A) States that the recording of revenue should be based on reliable and verifiable evidence.

B) Only requires that sales revenue must be earned before it is recorded on the income statement.

C) Only requires that sales revenue must be realized or realizable before it is recorded on the income statement.

D) States that sales revenue should be recorded when services are performed or goods are sold.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

76

The full disclosure principle:

A) States that personal contact and financial information for each member of senior management for the company be disclosed.

B) Requires that company maintain a record of activities separate from the economic and personal activities of its owners.

C) Requires that a business disclose all significant financial facts and circumstances in a company's annual report.

D) States that sales revenue should be recorded when services are performed or goods are sold.

E) None of the above

A) States that personal contact and financial information for each member of senior management for the company be disclosed.

B) Requires that company maintain a record of activities separate from the economic and personal activities of its owners.

C) Requires that a business disclose all significant financial facts and circumstances in a company's annual report.

D) States that sales revenue should be recorded when services are performed or goods are sold.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which basic principle of accounting states that assets are initially recorded at the amounts paid to acquire the assets?

A) Objectivity principle

B) Cost principle

C) Measuring unit concept

D) Going concern concept

E) None of the above

A) Objectivity principle

B) Cost principle

C) Measuring unit concept

D) Going concern concept

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

78

The qualitative characteristics of accounting information:

A) Include relevance which means that information must be timely and contribute to the predictive and evaluative decisions made by investors and creditors.

B) Are intended to contribute to the usefulness of financial reporting for investment and credit decisions.

C) Include faithful representation which has the characteristic of being complete, neutral, free from error (reliable), and verifiable.

D) Include comparability and understandability.

E) All of the above

A) Include relevance which means that information must be timely and contribute to the predictive and evaluative decisions made by investors and creditors.

B) Are intended to contribute to the usefulness of financial reporting for investment and credit decisions.

C) Include faithful representation which has the characteristic of being complete, neutral, free from error (reliable), and verifiable.

D) Include comparability and understandability.

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

79

Implementation of the monetary unit concept:

A) Permits all economic resources and obligations to be brought into the accounting information system

B) Permits all assets, liabilities, and stockholders' equity to be easily added or subtracted, as necessary, when preparing financial statements

C) Means that high rates of inflation cannot cause any distortion in a firm's financial statements

D) All of the above

E) None of the above

A) Permits all economic resources and obligations to be brought into the accounting information system

B) Permits all assets, liabilities, and stockholders' equity to be easily added or subtracted, as necessary, when preparing financial statements

C) Means that high rates of inflation cannot cause any distortion in a firm's financial statements

D) All of the above

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

80

The going concern concept:

A) Applies to entities that are bankrupt and in the process of liquidating

B) Dictates that the recording of transactions should be based on reliable and verifiable evidence

C) Presumes that an entity will continue to operate indefinitely and will not be sold or liquidated

D) Establishes the boundaries of the unit to be accounted for

E) None of the above

A) Applies to entities that are bankrupt and in the process of liquidating

B) Dictates that the recording of transactions should be based on reliable and verifiable evidence

C) Presumes that an entity will continue to operate indefinitely and will not be sold or liquidated

D) Establishes the boundaries of the unit to be accounted for

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck