Deck 5: Choices Involving Time and Profit Maximization

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/12

العب

ملء الشاشة (f)

Deck 5: Choices Involving Time and Profit Maximization

1

Suppose you borrow $1,000 at 8% for 2 years. If the interest is compounded annually, how much money will you owe at the end of those 2 years?

A) $1,080.00

B) $1,160.00

C) $1,166.40

D) $1,345.60

A) $1,080.00

B) $1,160.00

C) $1,166.40

D) $1,345.60

$1,166.40

2

Suppose you lend $2,500 at 11.5% for 3 years. If the interest is compounded annually, how much interest will you receive in those 3 years?

A) $862.50

B) $965.49

C) $3,362.50

D) $2,465.49

A) $862.50

B) $965.49

C) $3,362.50

D) $2,465.49

$965.49

3

Suppose the interest rate is 6% and compounded annually. What is the present discounted value of 6 monthly payments of $150?

A) $855.00

B) $877.50

C) $884.46

D) $900.00

A) $855.00

B) $877.50

C) $884.46

D) $900.00

$884.46

4

Assume the interest rate is 5%. What is the present discounted value of a $1,000 bond that pays a $50 coupon each year for 10 years?

A) $989.91

B) $999.91

C) $1,000.00

D) $1,009.99

A) $989.91

B) $999.91

C) $1,000.00

D) $1,009.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a bank is lending money at 6.25% while the government is lending money at 8.25% and the rate of inflation is 3.5%, what is the real interest being earned by the bank?

A) 2.00%

B) 2.66%

C) 2.75%

D) 6.25%

A) 2.00%

B) 2.66%

C) 2.75%

D) 6.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the real interest rate is 7.5% and the rate of inflation is 3%, what is the nominal interest rate?

A) 4.50%

B) 4.57%

C) 10.50%

D) 10.73%

A) 4.50%

B) 4.57%

C) 10.50%

D) 10.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose you make a $5,000 investment that will return $3,000 in year 2 and another $3,500 in year 4. With an interest rate of 4.5%, what is the NPV of this project?

A) $247.34

B) $682.15

C) $1,500.00

D) $2,162.50

A) $247.34

B) $682.15

C) $1,500.00

D) $2,162.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

8

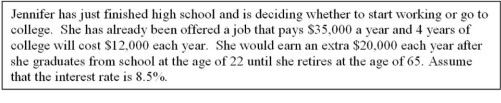

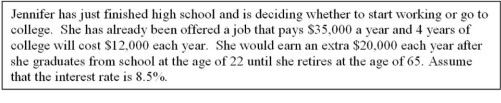

-Refer to Scenario above. What is Jennifer's opportunity cost of one year of college?

A) $12,000

B) $17,000

C) $35,000

D) $47,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

9

-Refer to Scenario above. What is the net present value of the decision to go to invest in college?

A) $10,742.71

B) $11,141.18

C) $11,655.84

D) $12,088.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

10

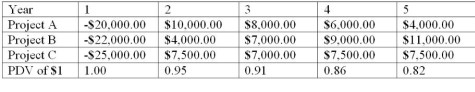

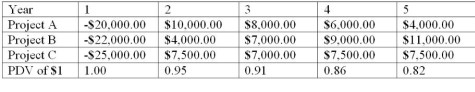

The Table below shows net cash flows for 3 mutually exclusive projects from which a company can choose. Each project requires an investment in the first year, then produces a positive net cash flow for each of the following four years. Assuming an interest rate of 5%, which project would the company choose?

Does the best project have the highest total net cash flow?

The shortest payback period?

Does the best project have the highest total net cash flow?

The shortest payback period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

11

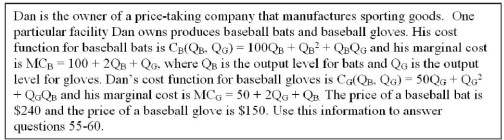

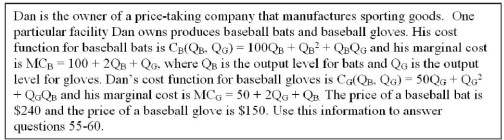

-Refer to Figure above. What is Dan's total profit assuming he is producing both products at their profit-maximizing sales quantities?

A) $3,600

B) $4,000

C) $4,400

D) $4,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

12

-Refer to Figure above. If he only produced gloves, what would Dan's profit be if he produces the profit-maximizing quantity?

A) $2,000

B) $2,200

C) $2,500

D) $3,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck