Deck 3: Product Design and Development

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

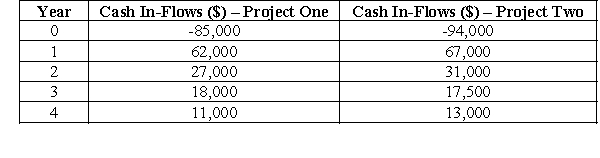

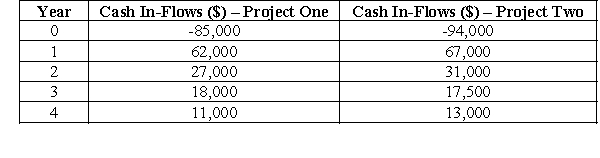

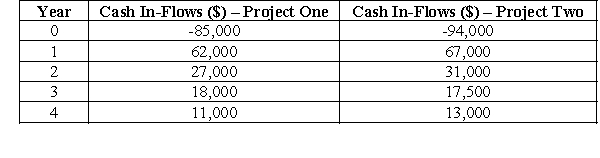

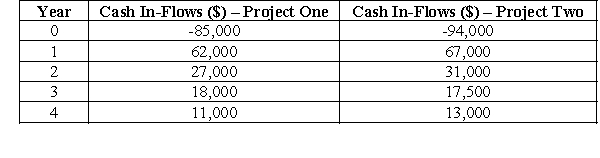

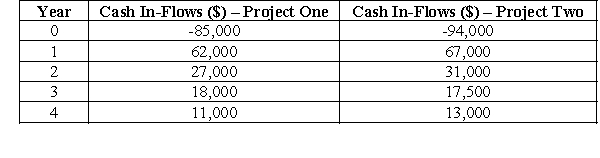

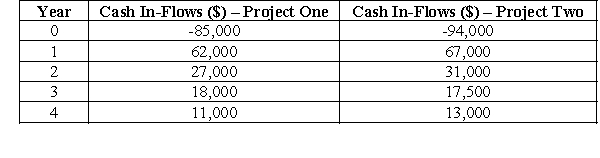

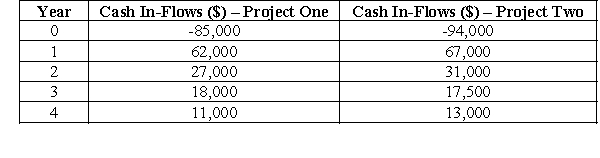

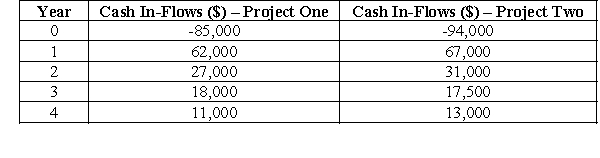

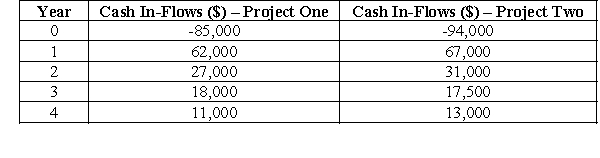

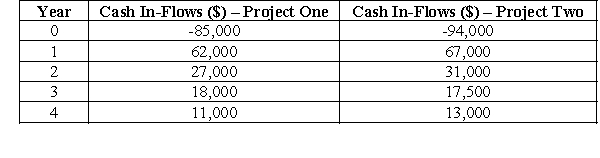

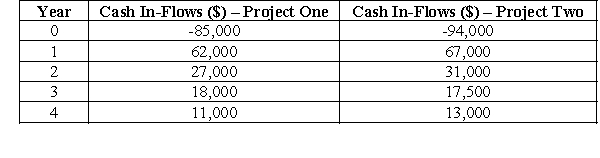

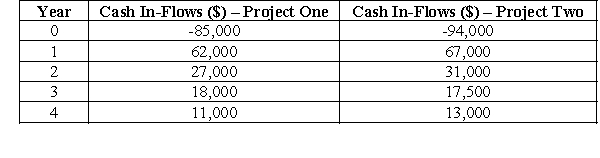

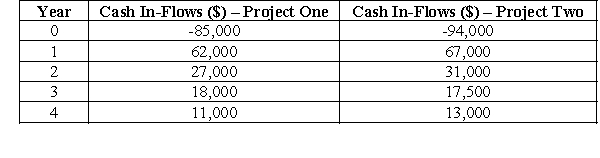

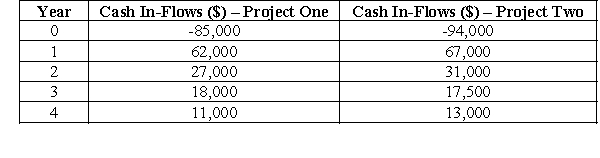

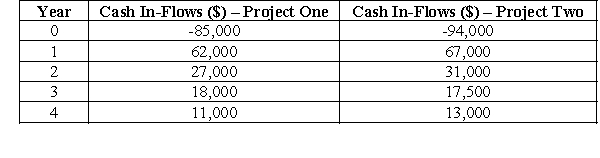

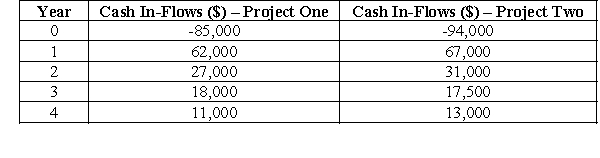

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 3: Product Design and Development

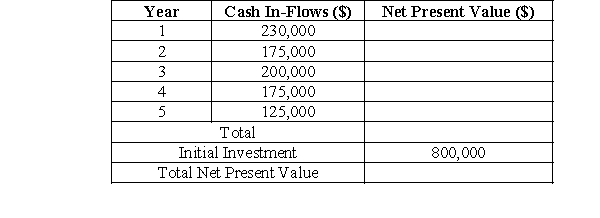

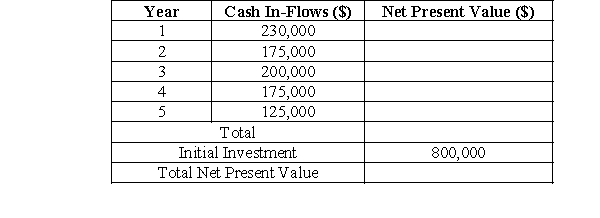

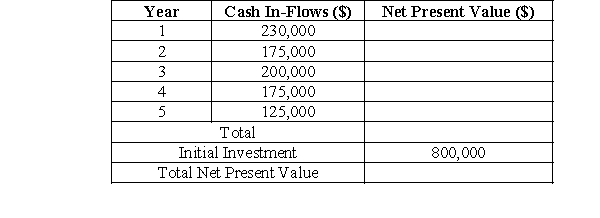

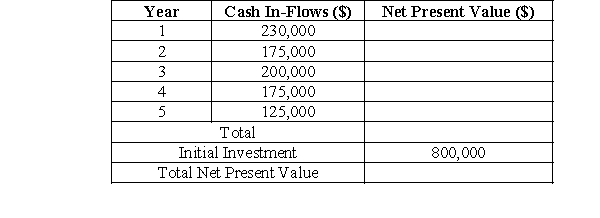

1

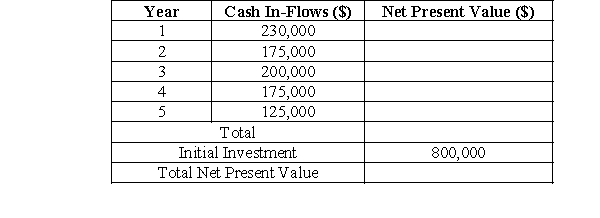

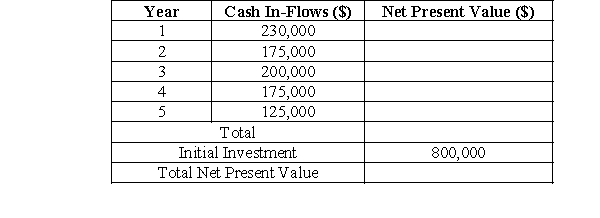

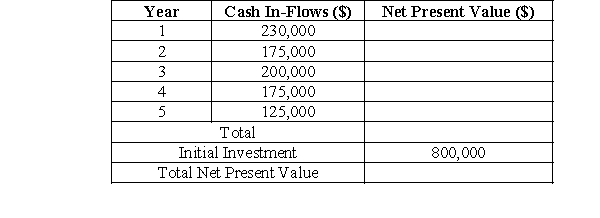

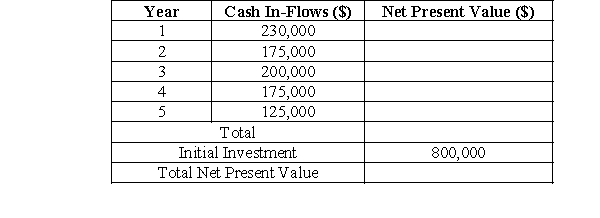

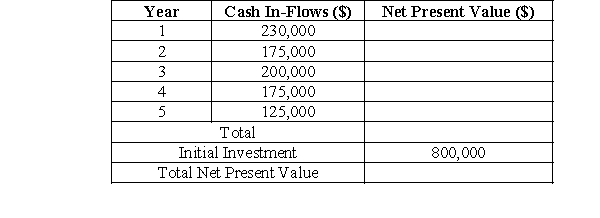

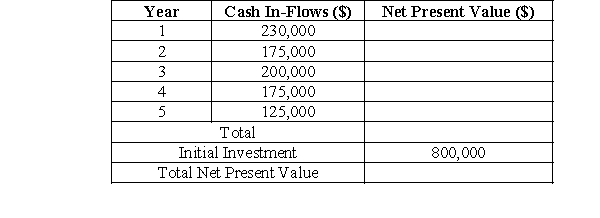

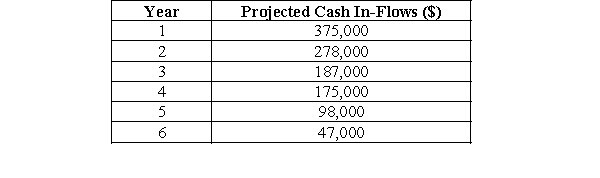

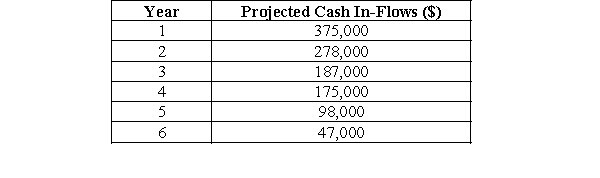

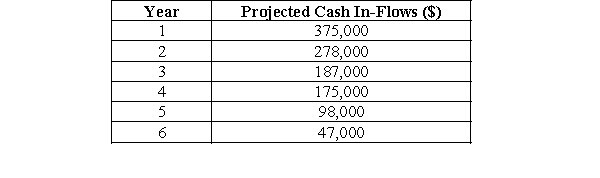

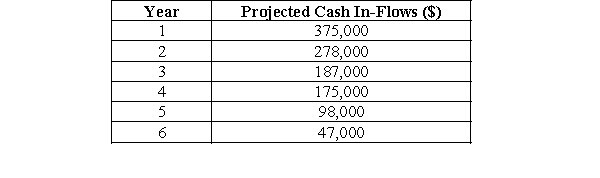

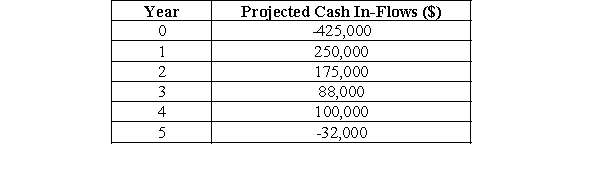

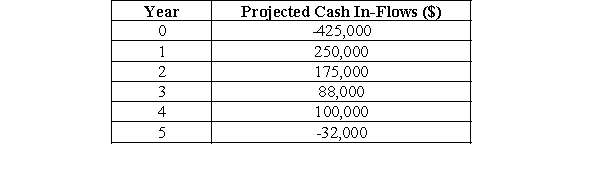

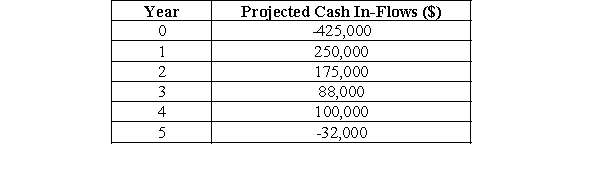

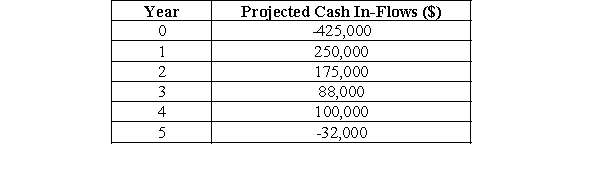

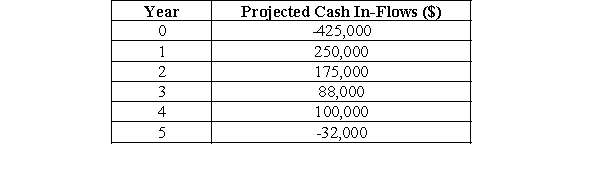

-What is the net present value of cash flows using a 7% discount rate for Year 1?

A)$214,953.27

B)$246,100.00

C)$230,000.00

D)$200,000.00

E)Do not have enough information to compute

$214,953.27

2

-What is the net present value of cash flows using a 7% discount rate for Year 2?

A)$163,551.00

B)$187,250.00

C)$152,851.78

D)$200,357.50

E)Do not have enough information to compute

$152,851.78

3

-What is the net present value of cash flows using a 7% discount rate for Year 3?

A)$186,915.89

B)$163,259.58

C)$214,000.00

D)$245,008.60

E)Do not have enough information to compute

$163,259.58

4

-What is the net present value of cash flows using a 7% discount rate for Year 4?

A)$163,551.40

B)$229,389.30

C)$187,250.00

D)$133,506.66

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

-What is the net present value of cash flows using a 7% discount rate for Year 5?

A)$116,822.43

B)$89,123.27

C)$133,750.00

D)$133,506.66

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

-Calculate the total net present value for the project.

A)$446,174.37

B)$46,305.44

C)$103,694.56

D)$318,350.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

-For the project, how long will it take to recover the initial investments?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)More than five years

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

-If the discount rate for the project is changed to 10%, find the total net present value.

A)$98,875.51

B)$345,500.00

C)$538,481.25

D)$172,727.27

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

-If the discount rate for the project is changed to 11%, find the total net present value.

A)$165,315.32

B)$570,738.29

C)$354,550.00

D)$115,061.25

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

-The internal rate of return for the project is

A)Under 10%

B)Between 10% and 12%

C)Between 12% and 13%

D)Between 13% and 14%

E)Over 14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

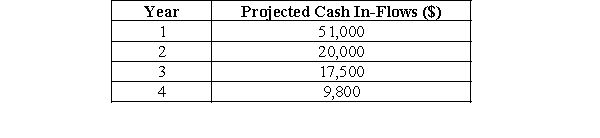

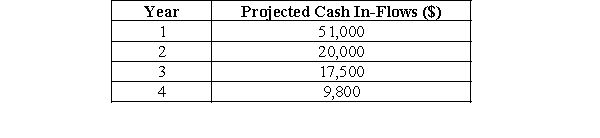

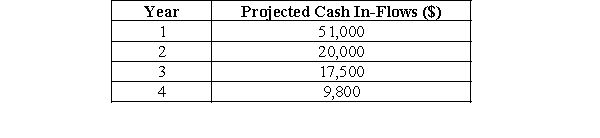

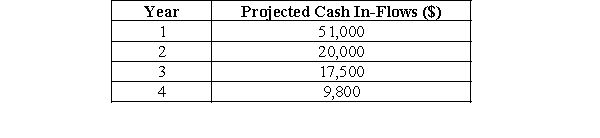

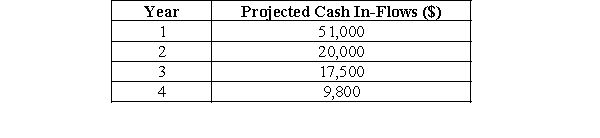

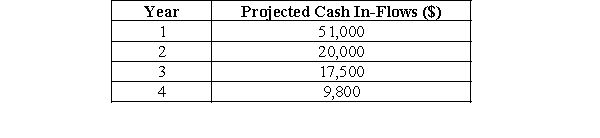

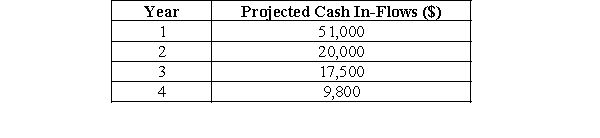

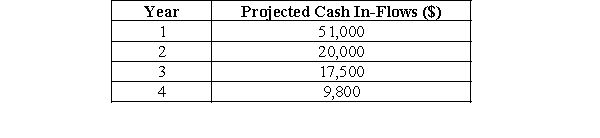

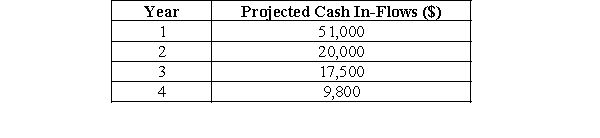

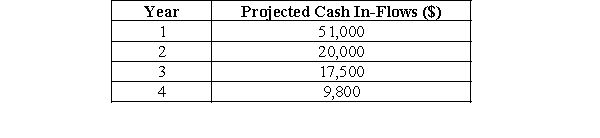

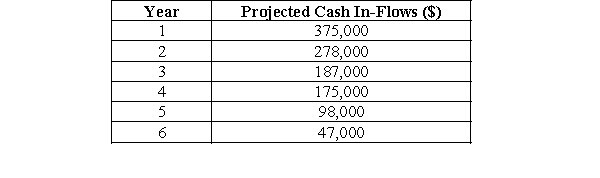

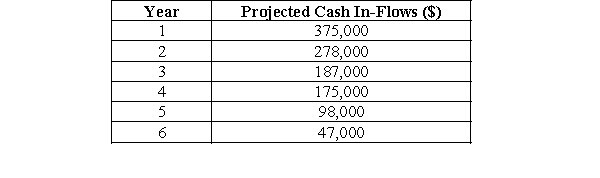

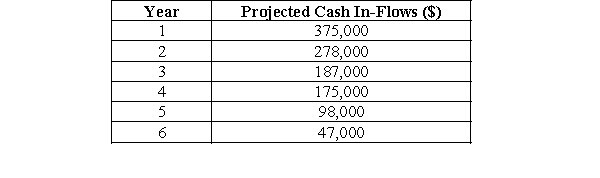

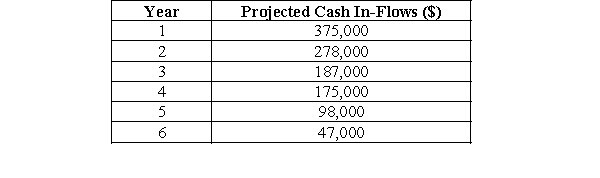

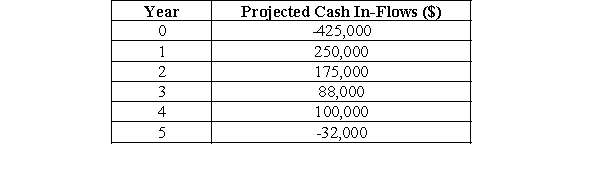

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-Calculate the total net present value for the project using a discount rate of 9%.

A)$51,000.00

B)$75,000.00

C)$9,078.37

D)$46,788.99

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 9%.

A)$51,000.00

B)$75,000.00

C)$9,078.37

D)$46,788.99

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-For the project, how long will it take to recover the initial investments?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

-For the project, how long will it take to recover the initial investments?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-Calculate the total net present value for the project using a discount rate of 12%.

A)$5,163.82

B)$75,000.00

C)$9,078.37

D)$51,000.00

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 12%.

A)$5,163.82

B)$75,000.00

C)$9,078.37

D)$51,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-Calculate the total net present value for the project using a discount rate of 15%.

A)$5,163.82

B)$1,580.42

C)$9,078.37

D)$51,000.00

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 15%.

A)$5,163.82

B)$1,580.42

C)$9,078.37

D)$51,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-The internal rate of return for the project is

A)Under 10%

B)Between 10% and 12%

C)Between 12% and 14%

D)Between 14% and 16%

E)Over 16%

-The internal rate of return for the project is

A)Under 10%

B)Between 10% and 12%

C)Between 12% and 14%

D)Between 14% and 16%

E)Over 16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

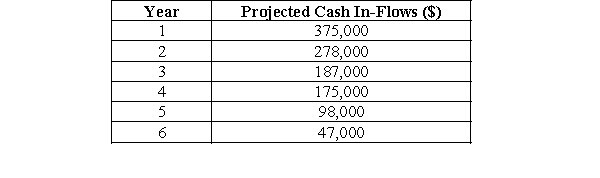

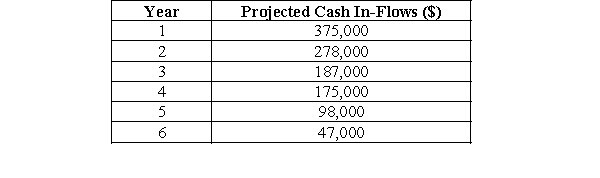

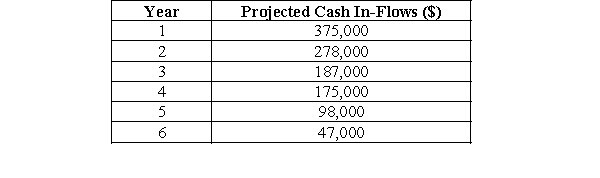

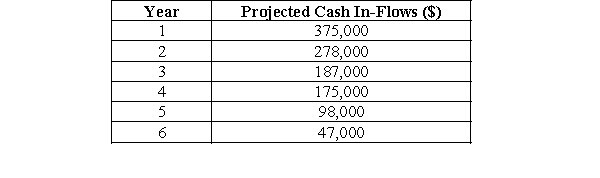

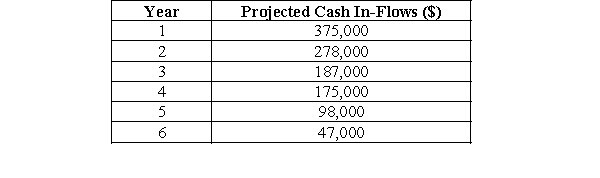

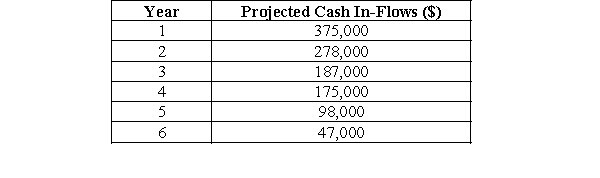

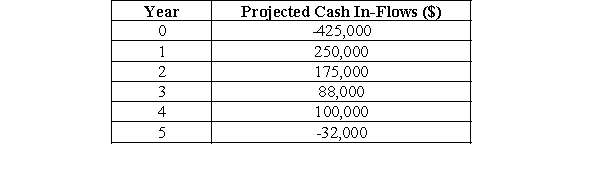

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-Calculate the total net present value for the project using a discount rate of 14%.

A)$725,000.00

B)$328,947.37

C)$120,003.76

D)$845,003.76

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 14%.

A)$725,000.00

B)$328,947.37

C)$120,003.76

D)$845,003.76

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-For the project, how long will it take to recover the initial investments?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

-For the project, how long will it take to recover the initial investments?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-Calculate the total net present value for the project using a discount rate of 17%.

A)$71,762.95

B)$320,512.82

C)$796,762.95

D)$725,000.00

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 17%.

A)$71,762.95

B)$320,512.82

C)$796,762.95

D)$725,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-For the project, how long will it take to recover the initial investments using a discount rate of 17%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

-For the project, how long will it take to recover the initial investments using a discount rate of 17%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-Calculate the total net present value for the project using a discount rate of 20%.

A)$312,500.00

B)$28,291.65

C)$753,291.65

D)$725,000.00

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 20%.

A)$312,500.00

B)$28,291.65

C)$753,291.65

D)$725,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-For the project, how long will it take to recover the initial investments using a discount rate of 20%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

-For the project, how long will it take to recover the initial investments using a discount rate of 20%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-Calculate the total net present value for the project using a discount rate of 25%.

A)$689,777.41

B)$300,000.00

C)$725,000.00

D)-$35,222.59

E)Do not have enough information to compute

-Calculate the total net present value for the project using a discount rate of 25%.

A)$689,777.41

B)$300,000.00

C)$725,000.00

D)-$35,222.59

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-The internal rate of return for the project is

A)Under 14%

B)Between 14% and 17%

C)Between 17% and 20%

D)Between 20% and 25%

E)Over 25%

-The internal rate of return for the project is

A)Under 14%

B)Between 14% and 17%

C)Between 17% and 20%

D)Between 20% and 25%

E)Over 25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-The internal rate of return for the project is

A)14%

B)17%

C)20%

D)22.13%

E)25%

-The internal rate of return for the project is

A)14%

B)17%

C)20%

D)22.13%

E)25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

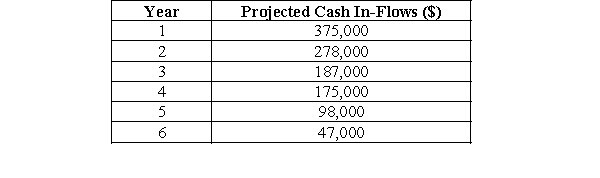

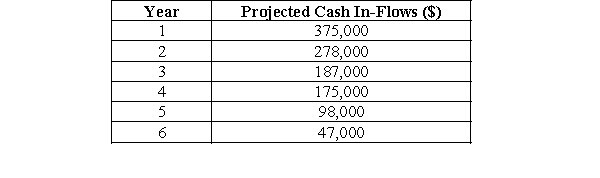

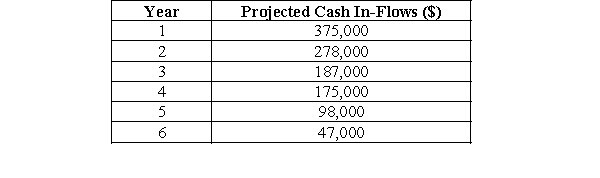

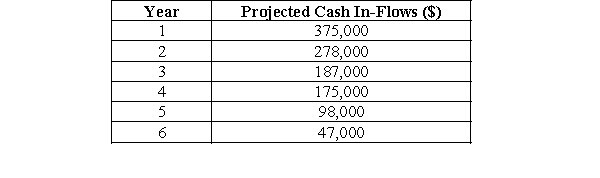

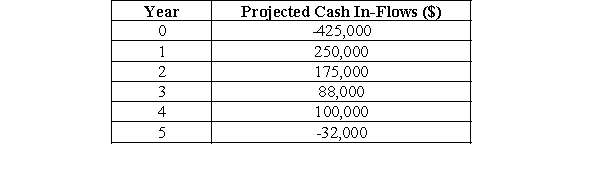

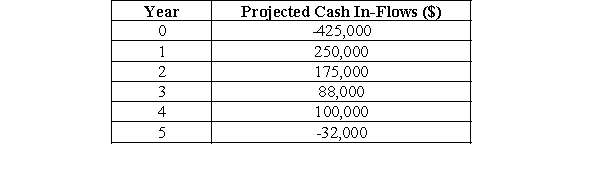

-Calculate the total net present value for the project using a discount rate of 10%.

A)$61,448.39

B)$486,448.39

C)$425,000.00

D)-$32,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

-For the project, how long will it take to recover the initial investments using a discount rate of 20%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

-Calculate the total net present value for the project using a discount rate of 15%.

A)-$32,000.00

B)$448,843.54

C)$425,000.00

D)$23,843.54

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

-For the project, how long will it take to recover the initial investments using a discount rate of 15%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

-Calculate the total net present value for the project using a discount rate of 18%.

A)-$32,000.00

B)$425,000.00

C)$3,697.59

D)$428,697.59

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

-For the project, how long will it take to recover the initial investments using a discount rate of 18%?

A)Less than two years

B)Between two years and three years

C)Between three years and four years

D)Between four years and five years

E)More than five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

-Calculate the total net present value for the project using a discount rate of 20%.

A)-$32,000.00

B)-$8,847.74

C)$416,152.26

D)$425,000.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

-The internal rate of return for the project is

A)Under 10%

B)Between 10% and 15%

C)Between 15% and 18%

D)Between 18% and 20%

E)Over 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

-The internal rate of return for the project is

A)22.13%

B)18.58%

C)15%

D)10%

E)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

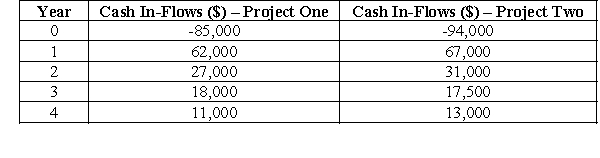

-Calculate the total net present value for Project One using a discount rate of 12%.

A)$55,357.14

B)$11,684.12

C)$85,000.00

D)$96.684.00

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

-For Project One, how long will it take to recover the initial investments using a discount rate of 12%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

-Calculate the total net present value for Project One using a discount rate of 15%.

A)$92,453.50

B)$53,913.04

C)$85,000.00

D)$7,453.50

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

-For Project One, how long will it take to recover the initial investments using a discount rate of 15%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

-Calculate the total net present value for Project One using a discount rate of 20%.

A)$85,000.00

B)$5,304.78

C)$1,138.12

D)$51,666.67

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

-For Project One, how long will it take to recover the initial investments using a discount rate of 20%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

-The internal rate of return for Project One is

A)Under 12%

B)Between 12% and 15%

C)Between 15% and 18%

D)Between 18% and 20%

E)Over 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

-The internal rate of return for Project One is

A)22.13%

B)18.58%

C)15.64%

D)12.35%

E)20.98%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

-Calculate the total net present value for Project Two using a discount rate of 12%.

A)$11,252.33

B)$105,252.33

C)$94,000.00

D)$59,821.43

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

-For Project Two, how long will it take to recover the initial investments using a discount rate of 12%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

-Calculate the total net present value for Project Two using a discount rate of 15%.

A)$100,640.65

B)$94,000.00

C)$6,640.65

D)$58,260.87

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

-For Project Two, how long will it take to recover the initial investments using a discount rate of 15%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

-Calculate the total net present value for Project Two using a discount rate of 20%.

A)$94,000.00

B)$6,269.29

C)$93,757.72

D)-$242.28

E)Do not have enough information to compute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

-For Project Two, how long will it take to recover the initial investments using a discount rate of 20%?

A)Less than one year

B)Between one year and two years

C)Between two years and three years

D)Between three years and four years

E)More than four years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

-The internal rate of return for Project Two is

A)Under 12%

B)Between 12% and 15%

C)Between 15% and 18%

D)Between 18% and 20%

E)Over 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

-The internal rate of return for Project Two is

A)22.13%

B)19.81%

C)15.64%

D)12.35%

E)20.98%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

-Which of the following statement is TRUE?

A)The internal rates of return for both the projects are identical.

B)The internal rate of return for Project One is higher than the internal rate of return for Project Two.

C)The internal rate of return for Project One is lower than the internal rate of return for Project Two.

D)None of these statements are true.

E)Need additional information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck