Deck 4: Using Financial Statements to Analyze Value Creation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/34

العب

ملء الشاشة (f)

Deck 4: Using Financial Statements to Analyze Value Creation

1

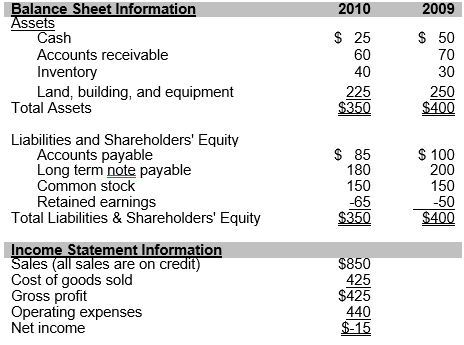

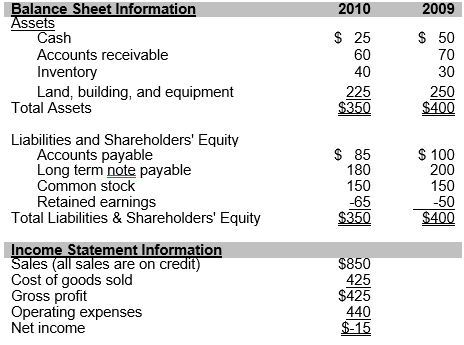

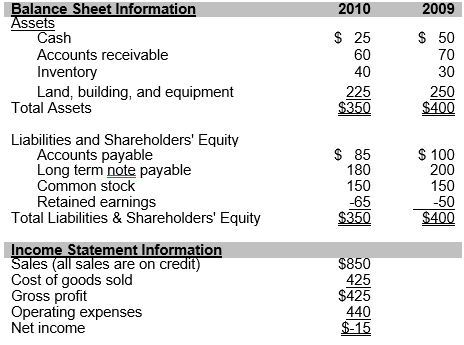

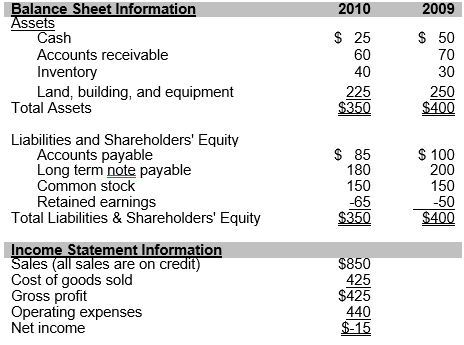

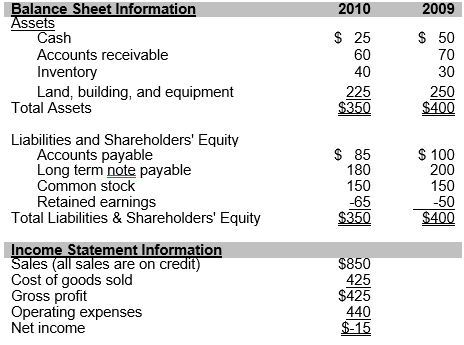

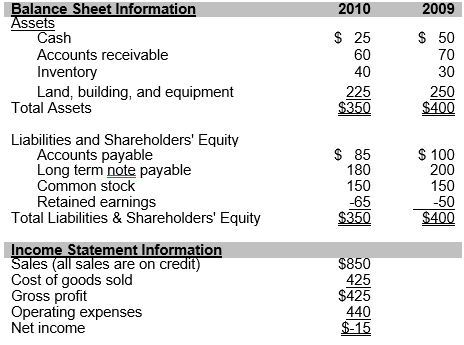

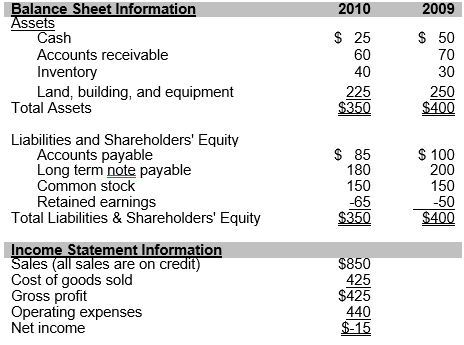

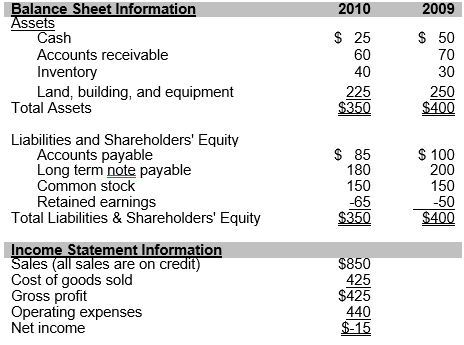

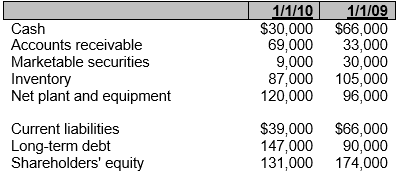

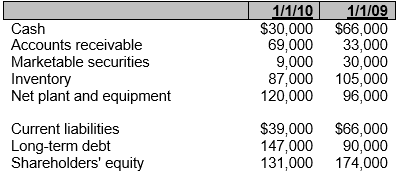

?Use the information that follows taken from Camron Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems

-Calculate Camron's current and quick ratios as of December 31, 2009 and December 31, 2010 and choose the correct answers below:

A) Camron's quick and current ratios improved from December 31, 2009 to December 31, 2010.

B) Camron's quick and current ratios worsened from December 31, 2009 to December 31, 2010.

C) Camron's quick ratio improved but the current ratio worsened December 31, 2009 to December 31, 2010.

D) Camron's quick ratio worsened but the current ratio improved from December 31, 2009 to December 31, 2010.

-Calculate Camron's current and quick ratios as of December 31, 2009 and December 31, 2010 and choose the correct answers below:

A) Camron's quick and current ratios improved from December 31, 2009 to December 31, 2010.

B) Camron's quick and current ratios worsened from December 31, 2009 to December 31, 2010.

C) Camron's quick ratio improved but the current ratio worsened December 31, 2009 to December 31, 2010.

D) Camron's quick ratio worsened but the current ratio improved from December 31, 2009 to December 31, 2010.

Camron's quick and current ratios worsened from December 31, 2009 to December 31, 2010.

2

?Use the information that follows taken from Camron Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems

-Calculate Camron's inventory turnover ratio and accounts receivable turnover ratio for the year ended 2010.Further, assume that in Camron's industry, the industry average inventory turnover ratio is 12 and the industry average receivables turnover ratio is 14.

A) Camron's inventory turnover ratio and accounts receivable turnover ratios are better than average for Camron's industry.

B) Camron's inventory turnover ratio and accounts receivable turnover ratios are worse than average for Camron's industry.

C) Camron's inventory turnover ratio is better but the accounts receivable turnover ratio is worse than average for Camron's industry.

D) Camron's inventory turnover ratio is worse and accounts receivable turnover ratio is better than average for Camron's industry.

-Calculate Camron's inventory turnover ratio and accounts receivable turnover ratio for the year ended 2010.Further, assume that in Camron's industry, the industry average inventory turnover ratio is 12 and the industry average receivables turnover ratio is 14.

A) Camron's inventory turnover ratio and accounts receivable turnover ratios are better than average for Camron's industry.

B) Camron's inventory turnover ratio and accounts receivable turnover ratios are worse than average for Camron's industry.

C) Camron's inventory turnover ratio is better but the accounts receivable turnover ratio is worse than average for Camron's industry.

D) Camron's inventory turnover ratio is worse and accounts receivable turnover ratio is better than average for Camron's industry.

Camron's inventory turnover ratio is better but the accounts receivable turnover ratio is worse than average for Camron's industry.

3

?Use the information that follows taken from Camron Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems

-Calculate Camron's return on equity and return on assets for the year ended December 31, 2010.Assume that the income tax rate is 30%.Also assume that in Camron's industry, the industry average return on equity is 19% and the average return on assets is 11%.

A) Camron's return on equity and return on assets are better than average for Camron's industry.

B) Camron's return on equity and return on assets are worse than average for Camron's industry.

C) Camron's return on equity is better but return on assets is worse than average for Camron's industry.

D) Camron's return on equity is worse but return on assets is better than average for Camron's industry.

-Calculate Camron's return on equity and return on assets for the year ended December 31, 2010.Assume that the income tax rate is 30%.Also assume that in Camron's industry, the industry average return on equity is 19% and the average return on assets is 11%.

A) Camron's return on equity and return on assets are better than average for Camron's industry.

B) Camron's return on equity and return on assets are worse than average for Camron's industry.

C) Camron's return on equity is better but return on assets is worse than average for Camron's industry.

D) Camron's return on equity is worse but return on assets is better than average for Camron's industry.

Camron's return on equity and return on assets are worse than average for Camron's industry.

4

?Use the information that follows taken from Camron Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems

-Calculate Camron's debt to equity ratio as of December 31, 2009 and as of December 31, 2010.Also assume that in Camron's industry, the industry average debt to equity ratio is 2.75 as of December 31, 2009 and as of December 31, 2010.

A) Camron's debt to equity ratio improved from 2009 to 2010.

B) Camron's debt to equity ratio was better than average for the industry both years.

C) Camron's debt to equity is worse than average for the industry for both years.

D) Both a and b above, but not c.

-Calculate Camron's debt to equity ratio as of December 31, 2009 and as of December 31, 2010.Also assume that in Camron's industry, the industry average debt to equity ratio is 2.75 as of December 31, 2009 and as of December 31, 2010.

A) Camron's debt to equity ratio improved from 2009 to 2010.

B) Camron's debt to equity ratio was better than average for the industry both years.

C) Camron's debt to equity is worse than average for the industry for both years.

D) Both a and b above, but not c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

5

Timberlake Company has total assets, liabilities, and shareholders' equity of $28,000, $15,000, and $21,000, respectively, at the beginning of 2010.At the end of 2010, total assets, liabilities, and shareholders' equity were reported at $24,000, $13,000, and $19,000, respectively.

-What is Timberlake's debt to equity ratio?

A) 0. 70

B) 1. 17

C) 0. 71

D) 1. 13

-What is Timberlake's debt to equity ratio?

A) 0. 70

B) 1. 17

C) 0. 71

D) 1. 13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

6

Timberlake Company has total assets, liabilities, and shareholders' equity of $28,000, $15,000, and $21,000, respectively, at the beginning of 2010.At the end of 2010, total assets, liabilities, and shareholders' equity were reported at $24,000, $13,000, and $19,000, respectively.

-How much additional debt can Timberlake Company incur and still have its debt/equity ratio remain less than or equal to 1.00?

A) $6,000

B) $25,000

C) $12,000

D) $24,000

-How much additional debt can Timberlake Company incur and still have its debt/equity ratio remain less than or equal to 1.00?

A) $6,000

B) $25,000

C) $12,000

D) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

7

Fowler Company has current assets, current liabilities, and long-term liabilities of $19,000, $13,000, and $17,000, respectively.Within these amounts, $3,000 is accounts payable, and $3,500 is accounts receivable.If $3,000 of cash were used to pay off the accounts payable, what effect would this have on the current ratio?

A) The current ratio would increase by approximately 0. 14.

B) The current ratio would decrease by approximately 0. 14.

C) The current ratio would decrease by approximately 0. 07.

D) There would be no change in the current ratio.

A) The current ratio would increase by approximately 0. 14.

B) The current ratio would decrease by approximately 0. 14.

C) The current ratio would decrease by approximately 0. 07.

D) There would be no change in the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

8

Dorian Company has a current ratio of 0.27 and return on equity of 0.05.Which of the following statements is the best regarding Dorian's profitability and solvency?

A) Dorian is very profitable, but not very solvent.

B) Dorian is very profitable and very solvent.

C) Dorian is not very profitable, but very solvent.

D) Dorian is not very profitable and not very solvent.

A) Dorian is very profitable, but not very solvent.

B) Dorian is very profitable and very solvent.

C) Dorian is not very profitable, but very solvent.

D) Dorian is not very profitable and not very solvent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

9

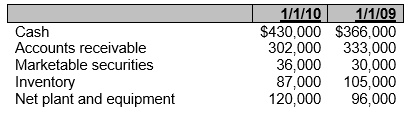

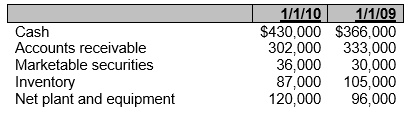

Bonner Company has the following financial data on January 1, 2010 and January 1, 2009.  In terms of the quick and current ratio, which of the following statements is true?

In terms of the quick and current ratio, which of the following statements is true?

A) Bonner's short-term solvency position has improved.

B) Bonner's short-term solvency position has declined.

C) Bonner's short-term solvency position has remained the same

D) Bonner's quick ratio is increasing, but its current ratio is decreasing.

In terms of the quick and current ratio, which of the following statements is true?

In terms of the quick and current ratio, which of the following statements is true?A) Bonner's short-term solvency position has improved.

B) Bonner's short-term solvency position has declined.

C) Bonner's short-term solvency position has remained the same

D) Bonner's quick ratio is increasing, but its current ratio is decreasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

10

Egan Company has the following assets on January 1, 2010 and January 1, 2009.  If Egan's quick ratio is 3.00 for 2010, what is the amount of its current liabilities?

If Egan's quick ratio is 3.00 for 2010, what is the amount of its current liabilities?

A) $325,000

B) $256,000

C) $285,000

D) There is not enough information to answer this question.

If Egan's quick ratio is 3.00 for 2010, what is the amount of its current liabilities?

If Egan's quick ratio is 3.00 for 2010, what is the amount of its current liabilities?A) $325,000

B) $256,000

C) $285,000

D) There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

11

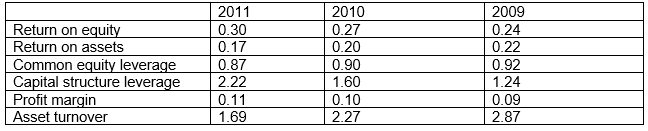

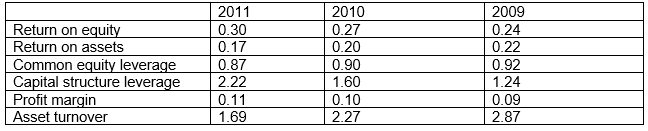

The following ratios were computed from the financial statement of Carlos Technologies:  Which of the following statements is true?

Which of the following statements is true?

A) There has been a steady decline in ROE from 2009 through 2011.

B) The increase in ROA is due primarily to the changes in asset turnover.

C) The changes in ROA could be due to increasing sales.

D) The change in ROA could be due to a large increase in the asset base of the company.

Which of the following statements is true?

Which of the following statements is true?A) There has been a steady decline in ROE from 2009 through 2011.

B) The increase in ROA is due primarily to the changes in asset turnover.

C) The changes in ROA could be due to increasing sales.

D) The change in ROA could be due to a large increase in the asset base of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

12

Match the correct ratio name from the list below labeled a through g with each formula appearing in items

-(Cash + accounts receivable + marketable securities) / current liabilities

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

-(Cash + accounts receivable + marketable securities) / current liabilities

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

13

Match the correct ratio name from the list below labeled a through g with each formula appearing in items

-(Net income + interest expense) / average total assets

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

-(Net income + interest expense) / average total assets

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

14

Match the correct ratio name from the list below labeled a through g with each formula appearing in items

-Current assets / current liabilities

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

-Current assets / current liabilities

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

15

Match the correct ratio name from the list below labeled a through g with each formula appearing in items

-Income tax expense / income before tax

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

-Income tax expense / income before tax

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

16

Match the correct ratio name from the list below labeled a through g with each formula appearing in items

-(Net income + interest expense [1-tax rate]) / sales

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

-(Net income + interest expense [1-tax rate]) / sales

A) Return on sales

B) Quick ratio

C) Average tax rate

D) Current ratio

E) Return on assets

F) Return on equity

G) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

17

Match the correct ratio name from the list below labeled a through f with the ratio formulas appearing in items

-Long-term debt / total assets

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

-Long-term debt / total assets

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

18

Match the correct ratio name from the list below labeled a through f with the ratio formulas appearing in items

-Net income / (net income + interest expense x [1 - tax rate])

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

-Net income / (net income + interest expense x [1 - tax rate])

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

19

Match the correct ratio name from the list below labeled a through f with the ratio formulas appearing in items

-Average total liabilities / average total shareholders' equity

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

-Average total liabilities / average total shareholders' equity

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

20

Match the correct ratio name from the list below labeled a through f with the ratio formulas appearing in items

-Net income / average shareholders' equity

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

-Net income / average shareholders' equity

A) Debt/equity ratio

B) Capital structure leverage

C) Return on sales

D) Long term debt ratio

E) Return on equity

F) Common equity leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

21

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Current ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Current ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

22

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Average tax rate

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Average tax rate

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

23

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Receivables turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Receivables turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

24

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Return on sales

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Return on sales

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

25

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Interest coverage ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Interest coverage ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

26

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Quick ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Quick ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

27

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Debt/equity ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Debt/equity ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

28

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Inventory turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Inventory turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

29

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Accounts payable turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Accounts payable turnover

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

30

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Long-term debt ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Long-term debt ratio

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

31

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Profit margin

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Profit margin

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

32

Match the correct value driver category from the list below labeled a through c with each ratio that appears in items

-Common equity leverage

A) Sales and expense management

B) Working capital management

C) Capital structure management

-Common equity leverage

A) Sales and expense management

B) Working capital management

C) Capital structure management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

33

Jefferson Company has current assets, current liabilities, and long-term liabilities of $9,000, $3,000, and $7,000, respectively.Within these amounts, $1,000 is accounts payable, and $1,500 is accounts receivable.What effect will the payment of the accounts payable have on the current ratio? Should Jefferson pay the accounts payable on the last day of the year? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

34

Madison Company has current assets, current liabilities, and long-term liabilities of $8,000, $4,000, and $6,000, respectively.Within these amounts, inventory was $2,000, receivables were $2,000, cash was $4,000, and payables were $1,000.Calculate Madison's quick ratio.What information does this provide?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck