Deck 9: Appendix A: The Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 9: Appendix A: The Time Value of Money

1

The following computation took place:

$20,000 divided by the future value of a 12-year, 4% ordinary annuity

What question will this computation answer?

A) How much must be invested now so that equal payments can be withdrawn at the end of each year for 12 years?

B) How much must be invested now so that $20,000 is accumulated by the end of the 12th year?

C) How much will be available at the end of the12th year if a payment of $20,000 is deposted now?

D) How much must be deposited at the end of every year so that $20,000 is available at the end of 12 years?

$20,000 divided by the future value of a 12-year, 4% ordinary annuity

What question will this computation answer?

A) How much must be invested now so that equal payments can be withdrawn at the end of each year for 12 years?

B) How much must be invested now so that $20,000 is accumulated by the end of the 12th year?

C) How much will be available at the end of the12th year if a payment of $20,000 is deposted now?

D) How much must be deposited at the end of every year so that $20,000 is available at the end of 12 years?

How much must be deposited at the end of every year so that $20,000 is available at the end of 12 years?

2

Interest is compounded annually.What is the total amount of interest on a $7,000 note payable at the end of five years at 8%?

A) $3,000

B) $3,285

C) $7,000

D) $3,791

E) $7,100

A) $3,000

B) $3,285

C) $7,000

D) $3,791

E) $7,100

$3,285

3

Calculate the future value of equal semiannual payments of $9,000 at 12% compounded semiannually for 4 years.The answer is

A) $43,014.

B) $55,888.

C) $89,077.

D) $114,757.

A) $43,014.

B) $55,888.

C) $89,077.

D) $114,757.

$89,077.

4

Miracle Corporation wants to withdraw $60,000 from a savings account at the end of each year for ten years beginning one year from now.The savings earns 10% and is compounded annually.Which one of the following reflects the correct procedure to determine the required initial investment at the beginning of the first year?

A) $60,000 times the present value of a 10-year, 10% ordinary annuity.

B) $60,000 divided by the future value of a 10-year, 10% ordinary annuity.

C) $60,000 times the future value of a 10-year, 10% ordinary annuity.

D) $6,000 divided by the present value of a 10-year, 10% ordinary annuity.

A) $60,000 times the present value of a 10-year, 10% ordinary annuity.

B) $60,000 divided by the future value of a 10-year, 10% ordinary annuity.

C) $60,000 times the future value of a 10-year, 10% ordinary annuity.

D) $6,000 divided by the present value of a 10-year, 10% ordinary annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

An annuity due and an ordinary annuity have equal payments, the same interest rates, and the amount of time between the payments is equal.Which statement is true?

A) The present value of the annuity due is less than the present value of the ordinary annuity.

B) The future value of the annuity due is less than the future value of the ordinary annuity.

C) The future value of the annuity due is equal to the future value of the ordinary annuity.

D) The present value of the annuity due is greater than the present value of the ordinary annuity.

A) The present value of the annuity due is less than the present value of the ordinary annuity.

B) The future value of the annuity due is less than the future value of the ordinary annuity.

C) The future value of the annuity due is equal to the future value of the ordinary annuity.

D) The present value of the annuity due is greater than the present value of the ordinary annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

This morning Roseland Inc.purchased a land for a new manufacturing facility at a price of $750,000.However, the seller is financing the transaction and equal quarterly payments will be made starting today, July 1, 2005.The last semi-annual payment will be made on December 31, 2024.The applicable interest rate is 8%.How much is each semi-annual payment?

A) $35,365

B) $36,435

C) $37,893

D) None of the above

A) $35,365

B) $36,435

C) $37,893

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

Carter Holding Co.intends to purchase a new accounting system, including hardware, software and a complete package of services needed to get the new system up and running.Carter has for options for paying for the new system.Which of the four options is the least costly if the applicable interest rate is 12%?

A) Make a lump sum payment of $100,000 today

B) Make 10 annual payments of $16,000, starting today

C) Make 40 quarterly payments of $4,000, starting today

D) Make one lump sum payment of $150,000 four years from today

A) Make a lump sum payment of $100,000 today

B) Make 10 annual payments of $16,000, starting today

C) Make 40 quarterly payments of $4,000, starting today

D) Make one lump sum payment of $150,000 four years from today

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

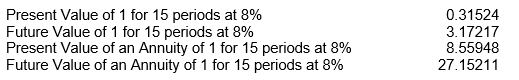

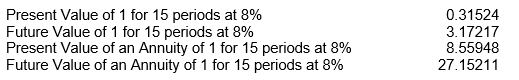

Karla Simpson Carson invested $12,000 at 8% annual interest and left the money invested without withdrawing any of the interest for 15 years.At the end of the 15 years, Karla decided to withdraw the accumulated amount of money.Karla has found the following values in various tables related to the time value of money.  Which factor would she use to compute the amount she would withdraw, assuming that the investment earns interest compounded annually?

Which factor would she use to compute the amount she would withdraw, assuming that the investment earns interest compounded annually?

A) 0. 31524

B) 3. 17217

C) 8. 55948

D) 27. 15211

Which factor would she use to compute the amount she would withdraw, assuming that the investment earns interest compounded annually?

Which factor would she use to compute the amount she would withdraw, assuming that the investment earns interest compounded annually?A) 0. 31524

B) 3. 17217

C) 8. 55948

D) 27. 15211

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

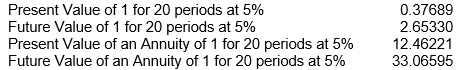

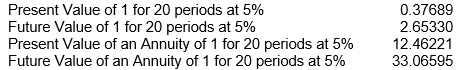

Rowan and Lisa Sharp invested $10,000 in a savings account paying 5% annual interest when their son, Jeremy, was born.They also deposited $500 on each of his birthdays until he was 20 (including his 20th birthday).Rowan and Lisa have obtained the following values related to the time value of money to help them with their planning process for their compounded interest decisions.  To the closest dollar, how much was in the savings account on his 20th birthday (after the last deposit)?

To the closest dollar, how much was in the savings account on his 20th birthday (after the last deposit)?

A) $53,066

B) $43,066

C) $30,000

D) $26,533

To the closest dollar, how much was in the savings account on his 20th birthday (after the last deposit)?

To the closest dollar, how much was in the savings account on his 20th birthday (after the last deposit)?A) $53,066

B) $43,066

C) $30,000

D) $26,533

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

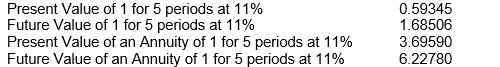

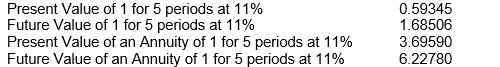

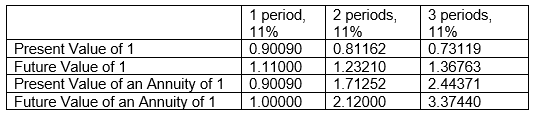

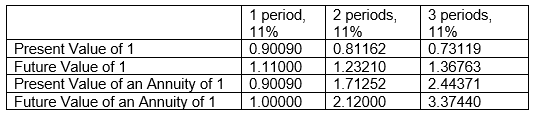

Morgan Company earns 11% on an investment that pays back $220,000 at the end of each of the next 5 years.Morgan's finance department has the following values related to the time value of money to help in its planning process and compounded interest decisions.

To the closest dollar, what is the amount Nathan invested to earn the 11% rate of return?

To the closest dollar, what is the amount Nathan invested to earn the 11% rate of return?

A) $370,713

B) $130,559

C) $59,525

D) $141,935

To the closest dollar, what is the amount Nathan invested to earn the 11% rate of return?

To the closest dollar, what is the amount Nathan invested to earn the 11% rate of return?A) $370,713

B) $130,559

C) $59,525

D) $141,935

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

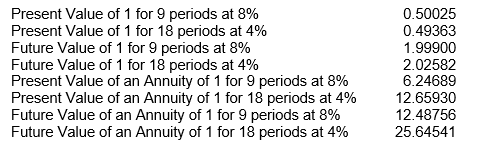

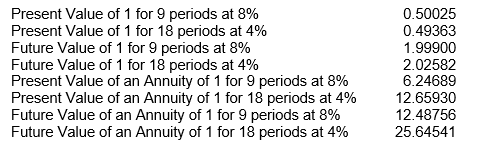

Everett Corporation issues a 8%, 9-year mortgage note on January 1, 2009, to obtain financing for new equipment.Land is used as collateral for the note.The terms provide for semiannual installment payments of $131,600.The following values related to the time value of money were available to Everett to help them with their planning process and compounded interest decisions.  To the closest dollar, what were the cash proceeds received from the issuance of the note?

To the closest dollar, what were the cash proceeds received from the issuance of the note?

A) $822,091

B) $947,520

C) $1,665,964

D) $1,643,363

To the closest dollar, what were the cash proceeds received from the issuance of the note?

To the closest dollar, what were the cash proceeds received from the issuance of the note?A) $822,091

B) $947,520

C) $1,665,964

D) $1,643,363

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Gaynor Company is considering purchasing equipment.The equipment will produce the following cash flows: Year 1, $25,000; Year 2, $45,000; Year 3, $60,000.Below is some of the time value of money information that Gaynor has compiled that might help them in their planning and compounded interest decisions.  Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

A) $317,682

B) $102,917

C) $165,253

D) $246,209

Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?

Gaynor requires a minimum rate of return of 11%.To the closest dollar, what is the maximum price Gaynor should pay for the equipment?A) $317,682

B) $102,917

C) $165,253

D) $246,209

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Mitch has been offered three different contracts for a service he provides.

Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today.The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6.The relevant annual interest rate is 10 percent.

What is the present value of Contract 1?

A) $66,240. 81

B) $118,627. 11

C) $70,215. 21

D) $125,744. 76

Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today.The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6.The relevant annual interest rate is 10 percent.

What is the present value of Contract 1?

A) $66,240. 81

B) $118,627. 11

C) $70,215. 21

D) $125,744. 76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

Mitch has been offered three different contracts for a service he provides.

Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today.The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6.The relevant annual interest rate is 10 percent.

What is the present value of Contract 3?

A) $18,497. 15

B) $16,815. 56

C) $24,619. 68

D) $22,381. 52

Contract 1: $9,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate.

Contract 2: $9,000 received today and $20,000 received ten years from today.The relevant interest rate is 12 percent.

Contract 3: $9,000 received at the end of Years 4, 5, and 6.The relevant annual interest rate is 10 percent.

What is the present value of Contract 3?

A) $18,497. 15

B) $16,815. 56

C) $24,619. 68

D) $22,381. 52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

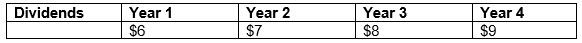

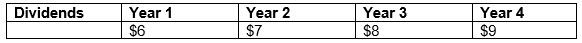

Kaitlin is contemplating investing in Cocoa Beach Tans.She estimates that the company will pay the following dividends per share at the end of the next four years and that the current price of the company's common stock, which is $100 per share, will remain unchanged.  If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

A) $130. 00

B) $119. 07

C) $85. 90

D) $82. 00

If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)A) $130. 00

B) $119. 07

C) $85. 90

D) $82. 00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

For each of the following situations in A through D, indicate the abbreviation of the table that should be used to solve for the solution requested.Place the abbreviation of the respective table in the space provided.You may use each table more than once or not at all.

-How much would an investor deposit today in order to withdraw $12,000 at the beginning of each of the next four years, assuming that the first payment is withdrawn one year from today?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

-How much would an investor deposit today in order to withdraw $12,000 at the beginning of each of the next four years, assuming that the first payment is withdrawn one year from today?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

For each of the following situations in A through D, indicate the abbreviation of the table that should be used to solve for the solution requested.Place the abbreviation of the respective table in the space provided.You may use each table more than once or not at all.

-If interest rates are compounded semi-annually, how much will a company accumulate in three years after making six equal semi-annual payments of $15,000 each? The first payment will be made today.

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

-If interest rates are compounded semi-annually, how much will a company accumulate in three years after making six equal semi-annual payments of $15,000 each? The first payment will be made today.

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

For each of the following situations in A through D, indicate the abbreviation of the table that should be used to solve for the solution requested.Place the abbreviation of the respective table in the space provided.You may use each table more than once or not at all.

-If interest rates are compounded monthly, how much can a company withdraw per month for 6 months beginning one month from now if $100,000 is deposited today?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

-If interest rates are compounded monthly, how much can a company withdraw per month for 6 months beginning one month from now if $100,000 is deposited today?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

For each of the following situations in A through D, indicate the abbreviation of the table that should be used to solve for the solution requested.Place the abbreviation of the respective table in the space provided.You may use each table more than once or not at all.

-You want to buy a house for $200,000 and finance it with interest compounded monthly.If it is financed over a 12?year period, what will be the amount of each annual payment, the first of which will be due at the beginning of the first year?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

-You want to buy a house for $200,000 and finance it with interest compounded monthly.If it is financed over a 12?year period, what will be the amount of each annual payment, the first of which will be due at the beginning of the first year?

A) PVOA Present value of an ordinary annuity

B) PVAD Present value of an annuity due

C) PV Present value of a sum

D) FVOA Future value of an ordinary annuity

E) FVAD Future value of an annuity due

F) FV Future value of a sum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

The phone rings.You answer, "Hello." Is this Billy Bob?" "Yes, it is." "This is Ed McMahon.Congratulations! You have just won the Just Kidding Clearing House sweepstakes! How would you like us to pay you?"

You ponder over the best choice of accepting your winnings:

1. Equal payments of $250,000 at the end of each year for twenty years

2. A lump-sum payment of $2,400,000 today

3. A lump-sum payment of $100,000 today and payments of $400,000 at the end of every year for 10 years

All earnings can be invested at 10 percent.Make a choice of one of the three options.Show calculations.

You ponder over the best choice of accepting your winnings:

1. Equal payments of $250,000 at the end of each year for twenty years

2. A lump-sum payment of $2,400,000 today

3. A lump-sum payment of $100,000 today and payments of $400,000 at the end of every year for 10 years

All earnings can be invested at 10 percent.Make a choice of one of the three options.Show calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck