Deck 4: Capital Budgeting and Business Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

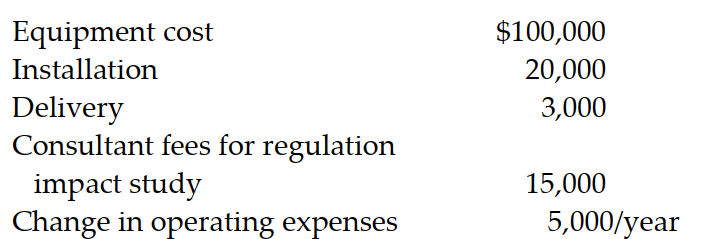

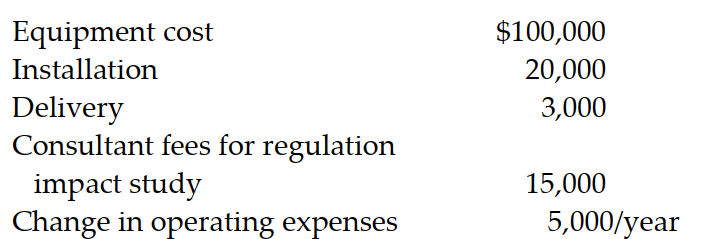

سؤال

سؤال

سؤال

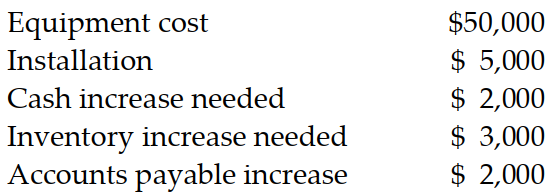

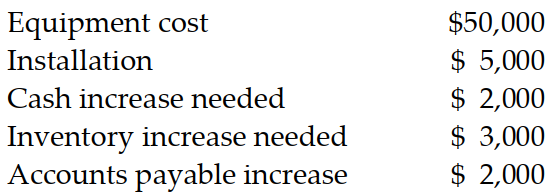

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 4: Capital Budgeting and Business Valuation

1

A problem associated with the payback method is:

A) it doesn't include cash flows after the payback period.

B) it uses the time value of money concept.

C) it assumes that all cash flows are invested at the cost of capital.

D) it usually requires less time than that required by the net present value method.

A) it doesn't include cash flows after the payback period.

B) it uses the time value of money concept.

C) it assumes that all cash flows are invested at the cost of capital.

D) it usually requires less time than that required by the net present value method.

it doesn't include cash flows after the payback period.

2

Calculate the payback period for the following investment: A machine costs $100,000 with installation costs of $15,000. Cash inflows are expected to be 26,000 per year for the next seven years.

A) 3.85 years

B) 4.42 years

C) 5 years

D) greater than 5

A) 3.85 years

B) 4.42 years

C) 5 years

D) greater than 5

4.42 years

3

Given the following information, calculate the net present value: Initial outlay is $50,000; required rate of return is 10%; current prime rate is 12%; and cash inflows for the next 4 years are $60,000, $30,000, $40,000, and $50,000.

A) less than 0

B) equal to 0

C) $93,542

D) $87,734

A) less than 0

B) equal to 0

C) $93,542

D) $87,734

$93,542

4

An acceptable net present value has a value:

A) equal to the IRR

B) = or > 0

C) = or <0

D) <0

A) equal to the IRR

B) = or > 0

C) = or <0

D) <0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

The internal rate of return is best described as that discount rate which:

A) equates the NPV and IRR.

B) equates all cash flows to the current market rate.

C) equals the required rate of return.

D) makes the NPV equal zero.

A) equates the NPV and IRR.

B) equates all cash flows to the current market rate.

C) equals the required rate of return.

D) makes the NPV equal zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

Calculate the IRR for the following investment project: Initial investment is $75,000; inflows are $20,000 for the next five years;Required rate of return is 15%. (Round your answer to the nearest whole percentage)

A) 14%

B) >15%

C) 9%

D) 10%

A) 14%

B) >15%

C) 9%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the NPV of a project is $500 and the required rate of return is 8%, the IRR must be: 8

A) <8%

B) >$500

C) >8%

D) =8%

A) <8%

B) >$500

C) >8%

D) =8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

Given the following information, calculate NPV: Initial investment is $50,000; inflows for the next four years are $12,000, $4,000, $12,000, $13,000; required rate of return is 8%.

A) $83,622

B) - $16,378

C) - $10,427

D) $0

A) $83,622

B) - $16,378

C) - $10,427

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

The project selection method most consistent with the goal of shareholder maximization is:

A) IRR.

B) NPV.

C) payback method.

D) both IRR and NPV.

A) IRR.

B) NPV.

C) payback method.

D) both IRR and NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

The relationship between NPV of a project and the required rate of return is:

A) determined by the relationship of NPV to IRR.

B) positive.

C) negative.

D) random.

A) determined by the relationship of NPV to IRR.

B) positive.

C) negative.

D) random.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

The NPV profile:

A) shows relationship between NPV and IRR.

B) shows how NPV changes for different cash flows.

C) is used to rank mutually exclusive projects.

D) shows a graph of a project's NPV given different discount rates.

A) shows relationship between NPV and IRR.

B) shows how NPV changes for different cash flows.

C) is used to rank mutually exclusive projects.

D) shows a graph of a project's NPV given different discount rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

A project is accepted if its IRR is:

A) greater than the NPV.

B) less than or equal to the hurdle rate.

C) equal to or greater than the hurdle rate.

D) equal to the PV.

A) greater than the NPV.

B) less than or equal to the hurdle rate.

C) equal to or greater than the hurdle rate.

D) equal to the PV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

The IRR is the point on the NPV profile where:

A) the NPV is equal or greater than 0.

B) the NPV equals 0.

C) the cost of capital is equal to the IRR.

D) the cost of capital equals the hurdle rate.

A) the NPV is equal or greater than 0.

B) the NPV equals 0.

C) the cost of capital is equal to the IRR.

D) the cost of capital equals the hurdle rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

Find the IRR for the following project: Outflow is $200,000; required rate of return is 18%; inflows are $50,000, $70,000, $80,000, and $100,000 respectively at the end of each year for the next four years.

A) 13.7%

B) 16.4%

C) 12%

D) 30%

A) 13.7%

B) 16.4%

C) 12%

D) 30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

In cases of conflict among mutually exclusive projects, the one with highest:

A) IRR should be chosen.

B) with mutually exclusive projects, NPV = IRR so the highest of either is appropriate.

C) NPV should be chosen.

D) cost of capital should be chosen.

A) IRR should be chosen.

B) with mutually exclusive projects, NPV = IRR so the highest of either is appropriate.

C) NPV should be chosen.

D) cost of capital should be chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

For a high risk project, the analyst:

A) adjusts the discount rate upward for risk in the NPV form.

B) always rejects the project.

C) adjusts the discount rate upward for risk in the IRR form.

D) uses a risk- free rate of interest .

A) adjusts the discount rate upward for risk in the NPV form.

B) always rejects the project.

C) adjusts the discount rate upward for risk in the IRR form.

D) uses a risk- free rate of interest .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

Given the following information, calculate the NPV: Purchase price is $150,000, setup is $15,000; cash flows will be $15,000, $20,000, ($10,000), $30,000, and $50,000 respectively at the end of each year for the next five years. The required rate of return is 9%.

A) ($88,377)

B) $10,000

C) ($76,442)

D) ($72,934)

A) ($88,377)

B) $10,000

C) ($76,442)

D) ($72,934)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

Given the following information, calculate the IRR: Initial outflow is $20,000, cash inflows for the next six years are $8,000 per year. (Round your answer to the nearest whole percentage)

A) 30%

B) 16%

C) 25%

D) 33%

A) 30%

B) 16%

C) 25%

D) 33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

Given the following information, calculate the payback period. Initial outflow is $20,000, cash inflows for the next six years are $8,000 per year.

A) 4 years

B) 2.5 years

C) 5 years

D) 6 years

A) 4 years

B) 2.5 years

C) 5 years

D) 6 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

The expected return of a current portfolios is 10%. A new project addition is being considered. The new project would comprise 40% of the entire new portfolio. The expected return of the new project is 11%. Calculate the expected return of the entire new portfolio.

A) 10.4%

B) 11%

C) 10.8%

D) 10%

A) 10.4%

B) 11%

C) 10.8%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

Incremental cash flow can best be described as:

A) cash flows that will occur only if an investment is undertaken.

B) relevant cash flows of new projects minus the initial investment.

C) new cash flows plus sunk costs.

D) initial investment of the project.

A) cash flows that will occur only if an investment is undertaken.

B) relevant cash flows of new projects minus the initial investment.

C) new cash flows plus sunk costs.

D) initial investment of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not a major stage in the capital budgeting process?

A) finding projects

B) evaluating and selecting projects

C) estimating the cash flows associated with the project

D) establishing betas for the firm

A) finding projects

B) evaluating and selecting projects

C) estimating the cash flows associated with the project

D) establishing betas for the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

A problem with the NPV method of capital budgeting is:

A) it fails to take into account the time value of money.

B) it can be difficult to explain to non- financial people.

C) you may sometimes have two different values.

D) results are in percentages-not dollars which makes it difficult to understand.

A) it fails to take into account the time value of money.

B) it can be difficult to explain to non- financial people.

C) you may sometimes have two different values.

D) results are in percentages-not dollars which makes it difficult to understand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

The hurdle rate is:

A) the NPV.

B) the number of years required to get the initial investment in the payback period.

C) the IRR.

D) the required rate of return.

A) the NPV.

B) the number of years required to get the initial investment in the payback period.

C) the IRR.

D) the required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

Use the following information to answer the question below.

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's payback?

A) 4.0 years

B) 3.5 years

C) 2.5 years

D) 3.0 years

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's payback?

A) 4.0 years

B) 3.5 years

C) 2.5 years

D) 3.0 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following information to answer the question below.

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's NPV?

A) $10,000

B) $52,252

C) - $2252

D) $2252

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's NPV?

A) $10,000

B) $52,252

C) - $2252

D) $2252

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the following information to answer the question below.

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's IRR?

A) 6.83%

B) 8.63%

C) 11.00%

D) 3.68%

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's IRR?

A) 6.83%

B) 8.63%

C) 11.00%

D) 3.68%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following information to answer the question below.

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's MIRR?

A) 14.43%

B) 8.63%

C) 9.73%

D) 11.00%

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-What is the project's MIRR?

A) 14.43%

B) 8.63%

C) 9.73%

D) 11.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the following information to answer the question below.

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-Should the company accept the project?

A) Yes

B) No

C) It depends on macroeconomic factors such as inflation

D) More information is needed

A project has an initial cost of $50,000. The incremental inflows associated with the project are $20,000 in year one, $15,000 in years two and three, and $10,000 in year four. The appropriate discount rate for this project is 11%.

-Should the company accept the project?

A) Yes

B) No

C) It depends on macroeconomic factors such as inflation

D) More information is needed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is a correct capital budgeting decision rule?

A) Accept a project if the hurdle rate is greater than the IRR.

B) Accept a project if the IRR is greater than the hurdle rate.

C) Accept a project if the hurdle rate is greater than the required rate of return.

D) Accept a project if the required rate of return is greater than the hurdle rate.

A) Accept a project if the hurdle rate is greater than the IRR.

B) Accept a project if the IRR is greater than the hurdle rate.

C) Accept a project if the hurdle rate is greater than the required rate of return.

D) Accept a project if the required rate of return is greater than the hurdle rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is correct?

A) IRR is preferred over NPV when the two methods conflict

B) Payback uses all relevant cash flows in its analysis.

C) Only incremental cash flows are relevant in the capital budgeting decision.

D) Only incremental revenues and costs are relevant in the capital budgeting decision.

A) IRR is preferred over NPV when the two methods conflict

B) Payback uses all relevant cash flows in its analysis.

C) Only incremental cash flows are relevant in the capital budgeting decision.

D) Only incremental revenues and costs are relevant in the capital budgeting decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

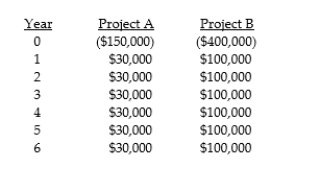

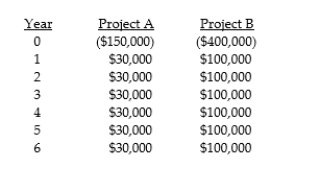

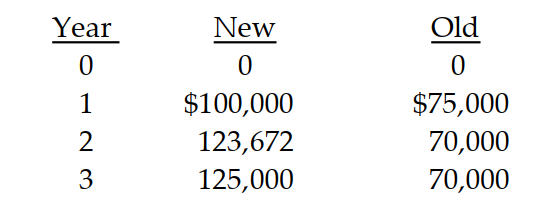

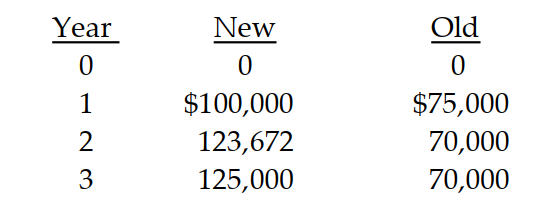

The following net cash flows are projected for two separate projects. Your required rate of return is 12%.

a. Calculate the payback period for each project.

a. Calculate the payback period for each project.

b. Calculate the NPV of each project.

c. Calculate the IRR of each project.

d. Which project(s) would you accept and why?

a. Calculate the payback period for each project.

a. Calculate the payback period for each project.b. Calculate the NPV of each project.

c. Calculate the IRR of each project.

d. Which project(s) would you accept and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is meant by risk adjusted discount rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

Explain why the NPV method of capital budgeting is preferable over the payback method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

In cases of ranking conflict among mutually exclusive projects where the NPV and IRR methods give different results, which project should be chosen? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

Explain what is meant by firm risk in capital budgeting decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

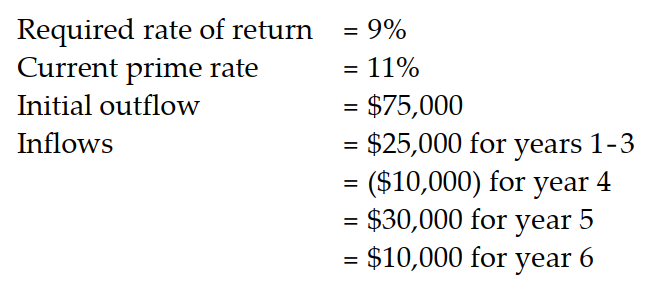

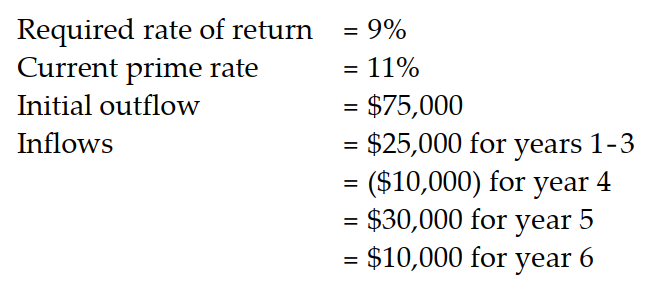

37

Calculate the NPV and the IRR for the following project and state whether or not you would accept the new project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

If there are multiple IRRs, how will you resolve the conflict?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

A firm is considering a project with a net present value of zero. Should the project be rejected? Would it be an automatic decision. Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

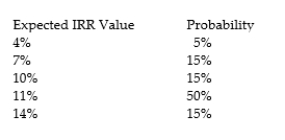

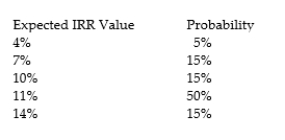

You have estimated the IRR for a new project with the following probabilities:

a. Calculate the mean of the project.

a. Calculate the mean of the project.

b. Calculate the standard deviation of the project.

c. Calculate the coefficient of variation.

d. Calculate the expected IRR of the new portfolio with the new project. The current portfolio has an expected IRR of 9% and a standard deviation of 3% and will represent 60% of the total portfolio.

a. Calculate the mean of the project.

a. Calculate the mean of the project.b. Calculate the standard deviation of the project.

c. Calculate the coefficient of variation.

d. Calculate the expected IRR of the new portfolio with the new project. The current portfolio has an expected IRR of 9% and a standard deviation of 3% and will represent 60% of the total portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

Explain the difference between the accept/reject decision and the ranking decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

Why does capital rationing occur if theory says any project that produces positive net present value should be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

What are some of the problems associated with using the IRR method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

Why may the IRR and NPV methods differ in their ranking of two mutually exclusive projects? Assume both projects are acceptable under either method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is capital rationing? If imposed, what action should financial managers pursue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

Your company uses its WACC as its required rate of return. As the financial manager, you are concerned that some of the components of the WACC may be about to increase. Why would you pay special attention to the IRR of a proposed project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

What are the stages in the capital budgeting process?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

Distinguish between independent projects and mutually exclusive projects. Give examples of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a new machine requires an increase in current assets from $50,000 to $60,000 and current liabilities from $30,000 to $50,000, the dollar change in net working capital is:

A) zero.

B) negative.

C) undefined.

D) positive.

A) zero.

B) negative.

C) undefined.

D) positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the relevant cash flow in year three for the following projected cash flows of a new and an old machine?

A) $125,000

B) $ 55,000

C) $ 25,000

D) $ 50,000

A) $125,000

B) $ 55,000

C) $ 25,000

D) $ 50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the relevant initial cash outflow of the following project for capital budgeting analysis purposes?

A) $138,000

B) $128,000

C) $123,000

D) $120,000

A) $138,000

B) $128,000

C) $123,000

D) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following items would not represent an incremental cash flow?

A) shut- down cash flow

B) existing overhead expense

C) initial investment cash flow

D) operating cash flow

A) shut- down cash flow

B) existing overhead expense

C) initial investment cash flow

D) operating cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

With respect to changes in net working capital, which of the following could likely happen as sales increase?

A) increase in accounts receivables

B) increases in cash and gross fixed equipment

C) increase in long- term debt

D) decrease in payables

A) increase in accounts receivables

B) increases in cash and gross fixed equipment

C) increase in long- term debt

D) decrease in payables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the relevant initial cash outflow for the following project?

A) $62,000

B) $58,000

C) $60,000

D) $55,000

A) $62,000

B) $58,000

C) $60,000

D) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

Depreciation associated with a project will:

A) have no effect on incremental cash flows.

B) only affect the fixed asset account as depreciation is a sunk cost.

C) cause incremental operating cash flows to increase.

D) cause incremental operating cash flows to decrease.

A) have no effect on incremental cash flows.

B) only affect the fixed asset account as depreciation is a sunk cost.

C) cause incremental operating cash flows to increase.

D) cause incremental operating cash flows to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

When an asset is eventually sold for less than its depreciated book value:

A) there are no tax effects.

B) the firm's tax liability is reduced by the amount of the loss times the ordinary income tax rate.

C) there is a capital gain tax.

D) then it is taxed as ordinary income gain.

A) there are no tax effects.

B) the firm's tax liability is reduced by the amount of the loss times the ordinary income tax rate.

C) there is a capital gain tax.

D) then it is taxed as ordinary income gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

When an asset is sold for less than its acquisition cost but for more than its net book value:

A) the difference between the proceeds of disposition and the asset's net book value is reported on the financial statements as a gain on disposal.

B) the difference between the proceeds of disposition and the asset's net book value will generate a tax saving.

C) the difference between the proceeds of disposition and the asset's net book value will generate capital gains tax.

D) the difference between the proceeds of disposition and the asset's net book value will have no effect on the financial statement as all assets are shown as their historical cost less amortization.

A) the difference between the proceeds of disposition and the asset's net book value is reported on the financial statements as a gain on disposal.

B) the difference between the proceeds of disposition and the asset's net book value will generate a tax saving.

C) the difference between the proceeds of disposition and the asset's net book value will generate capital gains tax.

D) the difference between the proceeds of disposition and the asset's net book value will have no effect on the financial statement as all assets are shown as their historical cost less amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

The relevant cash flows in capital budgeting can best be described as:

A) after- tax cash flows.

B) changes in fixed asset cash flows.

C) incremental cash flows.

D) externality cash flows.

A) after- tax cash flows.

B) changes in fixed asset cash flows.

C) incremental cash flows.

D) externality cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

You have purchased a machine for $120,000 and for financial reporting purposes are amortizing it on a straight line basis over four years. At the end of year three you sell it for $10,000. The transaction will show on the financial statements as:

A) a gain on disposal of $10,000

B) a loss on disposal of $110,000

C) a loss on disposal of $20,000

D) a gain on disposal of $20,0000

A) a gain on disposal of $10,000

B) a loss on disposal of $110,000

C) a loss on disposal of $20,000

D) a gain on disposal of $20,0000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

In capital budgeting financing costs associated with incremental cash flows:

A) are not included because they are not relevant cash flows.

B) are factored into the discount rate.

C) need to be included in the discounted cash flows because they will not occur if the project is rejected.

D) lead to distortions in the capital budgeting decision.

A) are not included because they are not relevant cash flows.

B) are factored into the discount rate.

C) need to be included in the discounted cash flows because they will not occur if the project is rejected.

D) lead to distortions in the capital budgeting decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

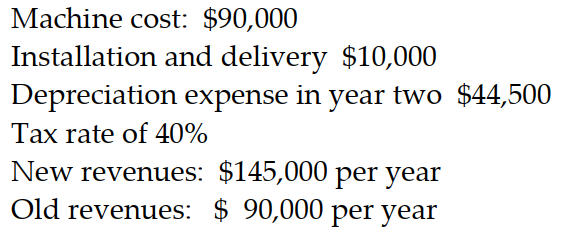

Use the following information to answer the question below.

-Calculate the amortization related tax savings in year two:

A) $6,000

B) $5,400

C) $8,100

D) $7,200

-Calculate the amortization related tax savings in year two:

A) $6,000

B) $5,400

C) $8,100

D) $7,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

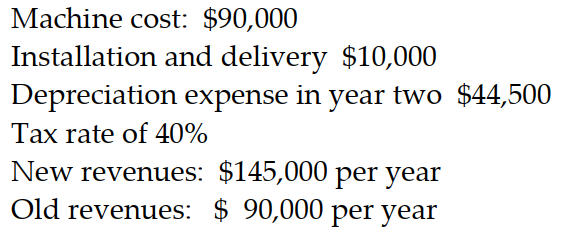

Use the following information to answer the question below.

-What will be the CCA tax savings in year one:

A) $7,500

B) $3,000

C) $1,800

D) $15,000

-What will be the CCA tax savings in year one:

A) $7,500

B) $3,000

C) $1,800

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

The change in net working capital is measured by the change in:

A) total assets minus total liabilities.

B) (current assets plus fixed assets) minus current liabilities.

C) current assets minus current liabilities.

D) total assets minus (total liabilities plus total equity).

A) total assets minus total liabilities.

B) (current assets plus fixed assets) minus current liabilities.

C) current assets minus current liabilities.

D) total assets minus (total liabilities plus total equity).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

An increase in current liabilities that come with the addition of a new project:

A) are not included in capital budgeting analysis because it is not a relevant cash flow.

B) should equal the increase in current assets.

C) should be added to the initial cash outflow.

D) reduce the amount of the initial investment.

A) are not included in capital budgeting analysis because it is not a relevant cash flow.

B) should equal the increase in current assets.

C) should be added to the initial cash outflow.

D) reduce the amount of the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following situations would not be considered as an incremental cash flow for a proposed new machine?

A) tax changes

B) prepaid rent expense

C) spare parts inventory

D) opportunity costs

A) tax changes

B) prepaid rent expense

C) spare parts inventory

D) opportunity costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

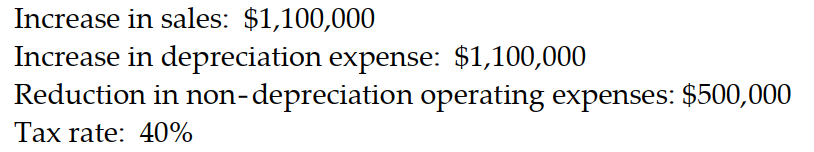

Calculate the incremental operating cash flow for year two for a new proposed project given the following information:

A) $50,800

B) $6,300

C) $60,300

D) $104,800

A) $50,800

B) $6,300

C) $60,300

D) $104,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

An externality can best be described as:

A) something that always represents a negative impact.

B) an example of opportunity costs.

C) an impact, positive or negative, that a new project would have on existing projects.

D) something that should not be considered in the capital budgeting process because it cannot be measured quantifiably.

A) something that always represents a negative impact.

B) an example of opportunity costs.

C) an impact, positive or negative, that a new project would have on existing projects.

D) something that should not be considered in the capital budgeting process because it cannot be measured quantifiably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the last asset in the UCC pool is sold for less than its purchase price but more than its undepreciated capital cost:

A) the asset sale will generate no tax consequences.

B) the difference is taxed as an ordinary loss.

C) the difference is taxed as a capital gain.

D) the difference is taxed at the ordinary income rate.

A) the asset sale will generate no tax consequences.

B) the difference is taxed as an ordinary loss.

C) the difference is taxed as a capital gain.

D) the difference is taxed at the ordinary income rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

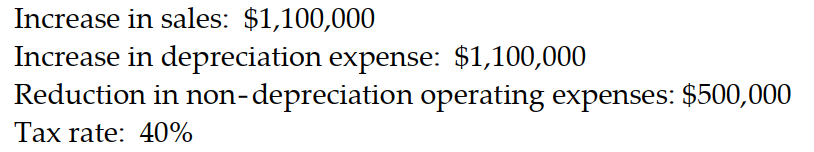

Calculate the incremental operating cash flow for year one for the following information:

A) $1,400,000

B) ($30,000)

C) ($70,000)

D) $1,030,000

A) $1,400,000

B) ($30,000)

C) ($70,000)

D) $1,030,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

The present value of the salvage value is:

A) a sunk cost.

B) an opportunity cost.

C) part of the shut- down cash flows.

D) equal to the sale price of a machine at the end of its life.

A) a sunk cost.

B) an opportunity cost.

C) part of the shut- down cash flows.

D) equal to the sale price of a machine at the end of its life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is not an example of a sunk cost?

A) a soil sample to determine if the land will support the proposed production facility.

B) a marketing demand study to see if demand exists for the proposed product.

C) an environmental impact study to determine if plant emissions will affect the environment.

D) rent forgone on a vacant building that will be used by the project.

A) a soil sample to determine if the land will support the proposed production facility.

B) a marketing demand study to see if demand exists for the proposed product.

C) an environmental impact study to determine if plant emissions will affect the environment.

D) rent forgone on a vacant building that will be used by the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the following information to answer the question below.

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What will be the additional (non operating) non operating cash flow in year 3?

A) $200,000

B) $264,000

C) $390,720

D) $275,000

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What will be the additional (non operating) non operating cash flow in year 3?

A) $200,000

B) $264,000

C) $390,720

D) $275,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information to answer the question below.

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What will be the present value of the of the operating cost savings over the life of the project?

A) $556,111

B) $566,200

C) $370,741

D) $926,851

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What will be the present value of the of the operating cost savings over the life of the project?

A) $556,111

B) $566,200

C) $370,741

D) $926,851

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the following information to answer the question below.

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the net cost of the templater (the year 0 cash flow)?

A) $740,000

B) $1,035,000

C) $960,000

D) $1,135,000

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the net cost of the templater (the year 0 cash flow)?

A) $740,000

B) $1,035,000

C) $960,000

D) $1,135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following information to answer the question below.

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the net operating cash flows in year 3?

A) $390,720

B) $321,600

C) $566,200

D) $436,800

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the net operating cash flows in year 3?

A) $390,720

B) $321,600

C) $566,200

D) $436,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the following information to answer the question below.

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the additional (nonoperating) cash flow in year 3?

A) $146,880

B) $275,000

C) $221,880

D) $125,000

You have been asked by the CEO of Gastric Anxiety Supplier (GAS) to evaluate the proposed acquisition of a new Standardized Test Templater (PowerPoint based) for the firm's accounting area. A recently completed $100,000 marketing survey demonstrates a high demand for the product. The equipment's basic price is $740,000 and it would cost another $220,000 to modify it for high altitude (Wasatch Mountain) use. The templater will be assigned to an asset class with a CCA rate of 60% declining balance. It will be sold after 3 years for $200,000. Use of the equipment would require a one-time increase in net working capital (spare parts inventory) of $75,000. The templater would have no effect on revenues, but it is expected to save the firm $440,000 per year in pre-tax operating costs, mainly labor. The firm's tax rate is 40 percent. Gastric uses a discount rate of 20%.

-What is the additional (nonoperating) cash flow in year 3?

A) $146,880

B) $275,000

C) $221,880

D) $125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

Explain why sunk costs should not be included in a capital budgeting analysis, but opportunity costs should be included. How do we include these opportunity costs into our analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the following information to answer the question below.

You have been asked to render an opinion to your boss as to whether your employer should enter into the short-term capital project described below.

The project requires the purchase of a new piece of equipment for a price of $25,000. The firm has paid a consultant $1,000 to estimate the revenues expected from the project. The firm that ships the equipment and installs it in our plant will charge $500.

The project's incremental operating cashflows before taxes will be $15,000 per year for three years. At the end of three years the equipment will be sold for $7344. The equipment will go into an asset class with a CCA rate of 40%. The tax rate is 34% and the firm's required rate of return is 17%. (Note:this is not the only asset in the pool.)

-a. What is the tax basis for the equipment?

b. What are the depreciation deductions for years 1, 2, and 3?

c. Calculate the total operating cash flow for each of the three years.

You have been asked to render an opinion to your boss as to whether your employer should enter into the short-term capital project described below.

The project requires the purchase of a new piece of equipment for a price of $25,000. The firm has paid a consultant $1,000 to estimate the revenues expected from the project. The firm that ships the equipment and installs it in our plant will charge $500.

The project's incremental operating cashflows before taxes will be $15,000 per year for three years. At the end of three years the equipment will be sold for $7344. The equipment will go into an asset class with a CCA rate of 40%. The tax rate is 34% and the firm's required rate of return is 17%. (Note:this is not the only asset in the pool.)

-a. What is the tax basis for the equipment?

b. What are the depreciation deductions for years 1, 2, and 3?

c. Calculate the total operating cash flow for each of the three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the following information to answer the question below.

You have been asked to render an opinion to your boss as to whether your employer should enter into the short-term capital project described below.

The project requires the purchase of a new piece of equipment for a price of $25,000. The firm has paid a consultant $1,000 to estimate the revenues expected from the project. The firm that ships the equipment and installs it in our plant will charge $500.

The project's incremental operating cashflows before taxes will be $15,000 per year for three years. At the end of three years the equipment will be sold for $7344. The equipment will go into an asset class with a CCA rate of 40%. The tax rate is 34% and the firm's required rate of return is 17%. (Note:this is not the only asset in the pool.)

-Based on your net cash flows that you have calculated in the question above, what is the:

a. payback period

b. net present value

c. internal rate of return

You have been asked to render an opinion to your boss as to whether your employer should enter into the short-term capital project described below.

The project requires the purchase of a new piece of equipment for a price of $25,000. The firm has paid a consultant $1,000 to estimate the revenues expected from the project. The firm that ships the equipment and installs it in our plant will charge $500.

The project's incremental operating cashflows before taxes will be $15,000 per year for three years. At the end of three years the equipment will be sold for $7344. The equipment will go into an asset class with a CCA rate of 40%. The tax rate is 34% and the firm's required rate of return is 17%. (Note:this is not the only asset in the pool.)

-Based on your net cash flows that you have calculated in the question above, what is the:

a. payback period

b. net present value

c. internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Dawn Co. is considering the purchase of new machines in order to expand their business. The machines have a useful life of five years. The required rate of return for the expansion is 17%. The company's tax rate is 40%.

-a. What is the cash outflow at t = 0?

b. What are the deprecation deductions for financial reporting purposes if machines are to be depreciated over 8 years using straight line depreciation?

c. What is the book value of the machines at the end of year five?

d. What is the taxable gain/loss from the sale of the machines at the end of the useful life if they are sold for the estimated salvage value?

e. What is the tax on the sale of the machines at the end of year five ?

-a. What is the cash outflow at t = 0?

b. What are the deprecation deductions for financial reporting purposes if machines are to be depreciated over 8 years using straight line depreciation?

c. What is the book value of the machines at the end of year five?

d. What is the taxable gain/loss from the sale of the machines at the end of the useful life if they are sold for the estimated salvage value?

e. What is the tax on the sale of the machines at the end of year five ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck