Deck 3: Essential Concepts in Finance: Part B

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/153

العب

ملء الشاشة (f)

Deck 3: Essential Concepts in Finance: Part B

1

The expected return on an investment is:

A) equivalent to the actual return.

B) the mean of the distribution of possible returns.

C) equal to the required return.

D) less than the required return.

A) equivalent to the actual return.

B) the mean of the distribution of possible returns.

C) equal to the required return.

D) less than the required return.

the mean of the distribution of possible returns.

2

Standard deviation is a:

A) numerical indicator of how widely dispersed possible values are distributed around the mean.

B) numerical measure of the spread between the means.

C) numerical indicator of how widely dispersed possible values are distributed around the correlation coefficient.

D) numerical indicator of how widely dispersed possible values are distributed around the coefficient of variation.

A) numerical indicator of how widely dispersed possible values are distributed around the mean.

B) numerical measure of the spread between the means.

C) numerical indicator of how widely dispersed possible values are distributed around the correlation coefficient.

D) numerical indicator of how widely dispersed possible values are distributed around the coefficient of variation.

numerical indicator of how widely dispersed possible values are distributed around the mean.

3

A risk averse manager:

A) will take a risk if he knows it is going to provide a good return.

B) will only take very small risks.

C) will be willing to take big risks if the potential return is high enough.

D) will avoid risk at all costs.

A) will take a risk if he knows it is going to provide a good return.

B) will only take very small risks.

C) will be willing to take big risks if the potential return is high enough.

D) will avoid risk at all costs.

will be willing to take big risks if the potential return is high enough.

4

If the distribution of possible future sales values is normal, then the probability that actual sales will be the expected calculated value plus or minus one standard deviation is approximately?

A) 30%

B) 68%

C) 95%

D) 50%

A) 30%

B) 68%

C) 95%

D) 50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

5

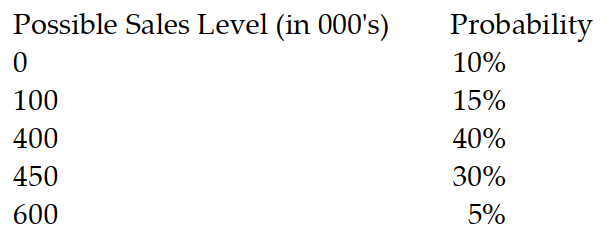

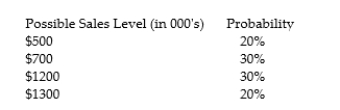

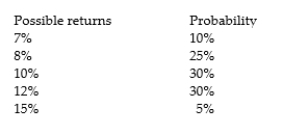

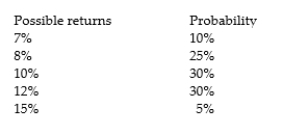

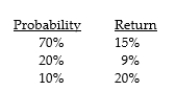

What is the standard deviation of the following income statement sales projection given the following information?

A) $400

B) $340

C) $169.26

D) $387.50

A) $400

B) $340

C) $169.26

D) $387.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

6

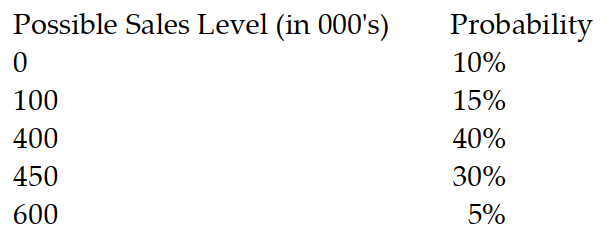

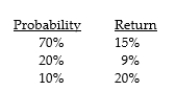

What is the coefficient of variation of the following income statement sales projection given the following information?

A) 18.2x

B) 0.22

C) 1.41

D) 12%

A) 18.2x

B) 0.22

C) 1.41

D) 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

7

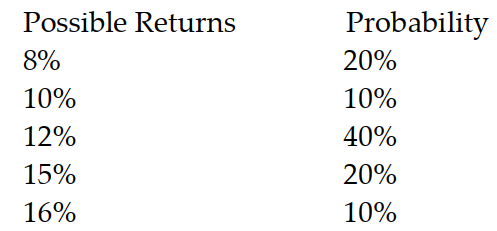

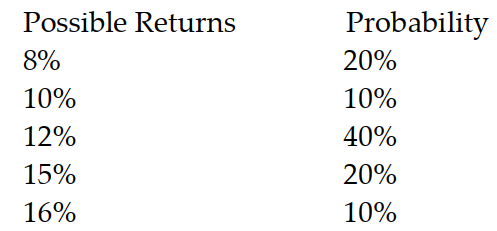

What is the expected return given the following information?

A) 0.12%

B) 12%

C) 18.2%

D) 12.2%

A) 0.12%

B) 12%

C) 18.2%

D) 12.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

8

When we compare the risk of two investments that have the same expected return, the coefficient of variation:

A) always gives us a value between 0 and 1.

B) adjusts for the correlation between the two instruments.

C) gives conflicting results compared to the standard deviation.

D) provides no additional information when compared with the standard deviation.

A) always gives us a value between 0 and 1.

B) adjusts for the correlation between the two instruments.

C) gives conflicting results compared to the standard deviation.

D) provides no additional information when compared with the standard deviation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

9

You are trying to diversify your portfolio and reduce risk. Which of the following correlations between the returns of your portfolio and those of a proposed addition would give the most diversification benefit (other things equal)?

A) - .5

B) +1

C) 0

D) - 1

A) - .5

B) +1

C) 0

D) - 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

10

The beta of the market is:

A) 2

B) 0

C) 1

D) - 1

A) 2

B) 0

C) 1

D) - 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

11

The coefficient of variation is best represented by:

A) mean/standard deviation.

B) the square root of P(V- u)2.

C) standard deviation/mean.

D) - 1 to +1

A) mean/standard deviation.

B) the square root of P(V- u)2.

C) standard deviation/mean.

D) - 1 to +1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

12

Business risk is best measured after the fact as:

A) volatility added by interest expense.

B) volatility of operating income.

C) the operating leverage of the firm.

D) the systematic risk of the firm.

A) volatility added by interest expense.

B) volatility of operating income.

C) the operating leverage of the firm.

D) the systematic risk of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

13

Given the following information, calculate the required return on this firm's securities: beta is 1.5, the risk- free rate is 6%, and the required return on the overall market is 9.

A) 10.5%

B) 12%

C) 13.5%

D) 4.5%

A) 10.5%

B) 12%

C) 13.5%

D) 4.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the beta for an investment given the following information? Investment's required return is 9.5%; market return is 13%; and the risk free rate is 6%.

A) 0.50

B) 1.5

C) 0.75

D) 1.0

A) 0.50

B) 1.5

C) 0.75

D) 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the market return given the following information? The investment's required return is 12%; the risk free rate is 7% and the investment's beta is 1.

A) 5%

B) 10%

C) 19%

D) 12%

A) 5%

B) 10%

C) 19%

D) 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

16

The variability of a company's operating income can be measured by calculating:

A) the standard deviation of operating income.

B) the coefficient of variation of net income.

C) the correlation coefficient between operating income and sales.

D) the beta of the company.

A) the standard deviation of operating income.

B) the coefficient of variation of net income.

C) the correlation coefficient between operating income and sales.

D) the beta of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

17

The higher the coefficient of variation of possible operating income values:

A) the lower the financial risk of the firm.

B) the greater the financial risk of the firm.

C) the greater the operating leverage of the firm.

D) the greater the business risk of the firm.

A) the lower the financial risk of the firm.

B) the greater the financial risk of the firm.

C) the greater the operating leverage of the firm.

D) the greater the business risk of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

18

All else equal, an increase in fixed operating expenses:

A) increases financial risk.

B) increases business risk.

C) decreases business risk.

D) decreases operating leverage.

A) increases financial risk.

B) increases business risk.

C) decreases business risk.

D) decreases operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

19

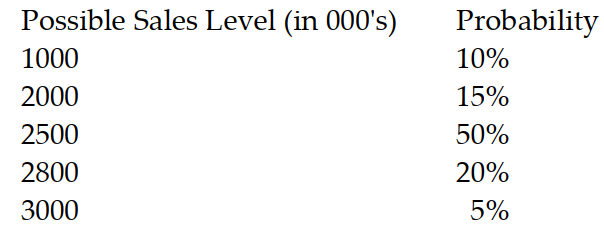

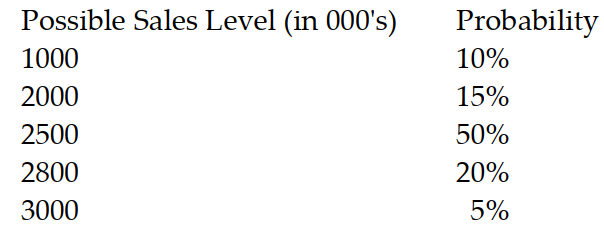

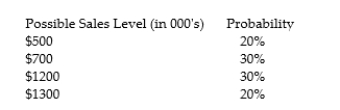

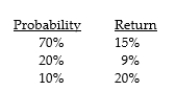

What is the standard deviation of following income statement sales projection given the following information?

A) $930

B) $500

C) $320

D) $230

A) $930

B) $500

C) $320

D) $230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

20

If two investments are perfectly positively correlated, it means:

A) they have a correlation coefficient of zero.

B) they have a correlation coefficient of - 1.

C) they change values proportionately in the same direction at the same time.

D) their values will change inversely to each other.

A) they have a correlation coefficient of zero.

B) they have a correlation coefficient of - 1.

C) they change values proportionately in the same direction at the same time.

D) their values will change inversely to each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following methods would NOT result in a reduction of business risk?

A) increase fixed operating costs

B) diversification

C) reduce operating leverage

D) reduce sales volatility

A) increase fixed operating costs

B) diversification

C) reduce operating leverage

D) reduce sales volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is the best representation of the CAPM model?

A) kp = RFR - (km + RFR) x bp

B) kp = RFR + (km + RFR) x bp

C) kp = RFR + (km - RFR) x bp

D) kp = RFR - (km - RFR) x bp

A) kp = RFR - (km + RFR) x bp

B) kp = RFR + (km + RFR) x bp

C) kp = RFR + (km - RFR) x bp

D) kp = RFR - (km - RFR) x bp

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

23

The CAPM risk measure reflects:

A) diversifiable risk.

B) total risk.

C) nonsystematic risk.

D) nondiversifiable risk.

A) diversifiable risk.

B) total risk.

C) nonsystematic risk.

D) nondiversifiable risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

24

The expected mean of the normal probability distribution of possible returns for XYZ Corporation is 15%. The standard deviation is 2%. Calculate the range of possible values allowing you a 67% confidence interval around the expected retur

A) 13% - 17%

B) 10% - 20%

C) 11% - 19%

D) 14% - 16%

A) 13% - 17%

B) 10% - 20%

C) 11% - 19%

D) 14% - 16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

25

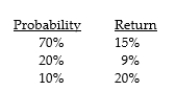

What is the standard deviation of returns for the following possibilities?

A) 2.085%

B) 2085

C) 0.2085%

D) 0.02085%

A) 2.085%

B) 2085

C) 0.2085%

D) 0.02085%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

26

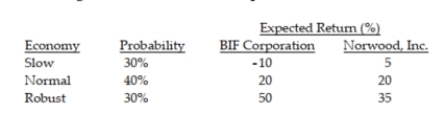

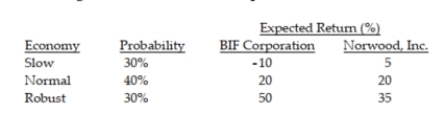

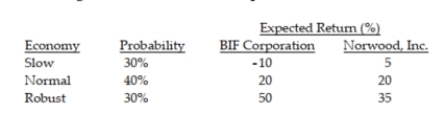

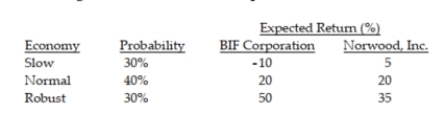

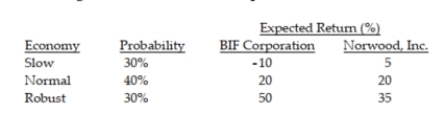

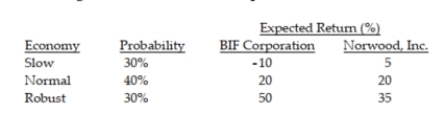

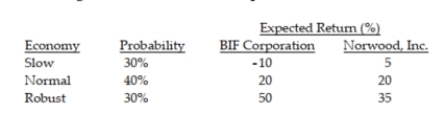

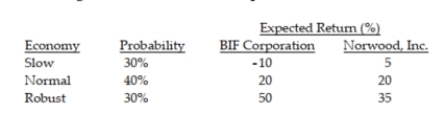

Use the following information to answer the question below.

-What are the expected returns for BIF Corporation and Norwood, Inc.?

A) 26%, 26%

B) 26%, 20%

C) 20%, 20%

D) 20%, 26%

-What are the expected returns for BIF Corporation and Norwood, Inc.?

A) 26%, 26%

B) 26%, 20%

C) 20%, 20%

D) 20%, 26%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the following information to answer the question below.

-What are the standard deviations for BIF Corporation and Norwood, Inc.?

A) 23.24%, 11.62%

B) 17.90%, 11.62%

C) 11.62%, 17.90%

D) 23.24%, 17.90%

-What are the standard deviations for BIF Corporation and Norwood, Inc.?

A) 23.24%, 11.62%

B) 17.90%, 11.62%

C) 11.62%, 17.90%

D) 23.24%, 17.90%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following information to answer the question below.

-What are the coefficients of variation for BIF Corporation and Norwood, Inc.?

A) 0.69, 0.58

B) 0.58, 1.16

C) 0.69, 1.16

D) 1.16, 0.58

-What are the coefficients of variation for BIF Corporation and Norwood, Inc.?

A) 0.69, 0.58

B) 0.58, 1.16

C) 0.69, 1.16

D) 1.16, 0.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the following information to answer the question below.

-Which investment is preferred?

A) Norwood, Inc. is preferred due to its lower coefficient of variation.

B) BIF Corporation is preferred due to its higher coefficient of variation.

C) A rational investor would be indifferent in investment choice.

D) Either investment would be suitable since they both have positive expected returns.

-Which investment is preferred?

A) Norwood, Inc. is preferred due to its lower coefficient of variation.

B) BIF Corporation is preferred due to its higher coefficient of variation.

C) A rational investor would be indifferent in investment choice.

D) Either investment would be suitable since they both have positive expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

30

Your portfolio consists of two assets X and Y. Asset X is 40% of your holdings and has an expected return of 10% and asset Y is 60% of your holdings and has an expected return of 8%. What is the expected return for your portfolio?

A) 9%

B) 8.8%

C) 8.75%

D) 8.4%

A) 9%

B) 8.8%

C) 8.75%

D) 8.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

31

What are the two main factors of "external risk"?

A) competitors and government

B) unexpected occurrences like 9/11 and NAFTA

C) unions and the banking system

D) foreign exchange and inflation

A) competitors and government

B) unexpected occurrences like 9/11 and NAFTA

C) unions and the banking system

D) foreign exchange and inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

32

After ________ stocks, the addition of more stocks does little to reduce the portfolio's standard deviation.

A) 100

B) 20

C) 50

D) 10

A) 100

B) 20

C) 50

D) 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is (are) true?

A) High risk investments should have a higher potential return than low risk investments.

B) Low risk investments are always preferred over higher risk investments.

C) A high risk investment will pay higher returns than a low risk investment of the same size.

D) A low risk investment will pay lower returns than a high risk investment of the same size.

A) High risk investments should have a higher potential return than low risk investments.

B) Low risk investments are always preferred over higher risk investments.

C) A high risk investment will pay higher returns than a low risk investment of the same size.

D) A low risk investment will pay lower returns than a high risk investment of the same size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is the best definition of operating leverage?

A) The effect that volatility has on a company's sales.

B) The risk of incorporating fixed income expense.

C) The uncertainty that a company has with regard to its operating income.

D) The tendency of fixed expenses to magnify risk.

A) The effect that volatility has on a company's sales.

B) The risk of incorporating fixed income expense.

C) The uncertainty that a company has with regard to its operating income.

D) The tendency of fixed expenses to magnify risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

35

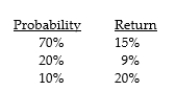

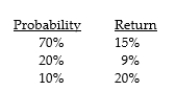

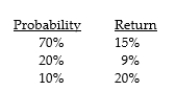

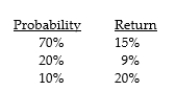

Use the following information to answer the question below.

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-What is the expected return for XYZ?

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.-What is the expected return for XYZ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the following information to answer the question below.

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-What is the standard deviation for XYZ?

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.-What is the standard deviation for XYZ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information to answer the question below.

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-Why is the standard deviation of possible returns for XYZ not an important statistic in this situation?

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.-Why is the standard deviation of possible returns for XYZ not an important statistic in this situation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information to answer the question below.

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-What is the required return for XYZ according to the CAPM?

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.-What is the required return for XYZ according to the CAPM?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following information to answer the question below.

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-Based on your calculations in the three questions above, should you buy this stock? Why or why not?

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.-Based on your calculations in the three questions above, should you buy this stock? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assume your existing portfolio is valued at $9,000 and its beta is 1.0. You plan to buy an additional $3,000 of a particular stock that has a beta of 1.8 (without selling any other stock). What is the beta of the new portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

41

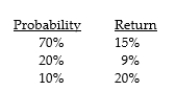

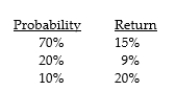

Use the following information to answer the question below.

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the expected rate of return for LC?

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the expected rate of return for LC?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following information to answer the question below.

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the required rate of return for LC?

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the required rate of return for LC?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the following information to answer the question below.

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the coefficient of variation for LC?

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-What is the coefficient of variation for LC?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following information to answer the question below.

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-Based on the calculations in the three questions above, should you buy the stocks of LC? Why?

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-Based on the calculations in the three questions above, should you buy the stocks of LC? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following information to answer the question below.

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-Your portfolio has a value of $1,800,000 with a beta of 1. Then, you buy$200,000 of the LC stock without selling any existing stock. What is the new beta of your portfolio?

As an investor, you are considering investing in the Locke Corporation (LC). According to your estimation there is a 75% probability that the return will be 17%, a 15% probability that the return will be 20%, and a 10% probability that the return will be 8%. You have also estimated LC's beta as 1.7.The market required rate of return is 15% and the risk free rate is 9%.

-Your portfolio has a value of $1,800,000 with a beta of 1. Then, you buy$200,000 of the LC stock without selling any existing stock. What is the new beta of your portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

46

Distinguish between business risk and financial risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is risk aversion? How does the assumption of risk aversion affect the risk/return tradeoff?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

48

Compare diversifiable and nondiversifiable risk. What are some examples of each type of risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

49

You deposit $10,000 in a bank and plan to keep it there for five years. The bank pays 8% annual interest compounded continuously. Calculate the future value at the end of five years.

A) $15,000

B) $14,918

C) $14,500

D) $14,693

A) $15,000

B) $14,918

C) $14,500

D) $14,693

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

50

An annuity is best defined as:

A) a series of payments for a specified period of time.

B) a series of equal payments for a specified number of years.

C) a series of equal payments occurring at equal intervals for a specified number of periods.

D) any series of payments.

A) a series of payments for a specified period of time.

B) a series of equal payments for a specified number of years.

C) a series of equal payments occurring at equal intervals for a specified number of periods.

D) any series of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

51

As the discount rate increases, the present value of a positive cash flow to be received at a particular time in the future:

A) gets smaller without limit.

B) gets larger without limit.

C) becomes smaller

D) stays unchanged.

A) gets smaller without limit.

B) gets larger without limit.

C) becomes smaller

D) stays unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

52

As the discount rate decreases , the present value of a positive cash flow to be received at a particular time in the future:

A) gets larger.

B) gets smaller without limit.

C) gets closer to zero.

D) stays unchanged.

A) gets larger.

B) gets smaller without limit.

C) gets closer to zero.

D) stays unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

53

Company XYZ purchased some machinery and gave a five-year note with a maturity value of $20,000. The discount rate is 8% annually and the interest is discounted monthly. How much did the company borrow?

A) $13,612

B) $12,000

C) $19,346

D) $13,424

A) $13,612

B) $12,000

C) $19,346

D) $13,424

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the present value of an annual annuity payment of $7,000 made for 12 years with a required return of 5% per year with the first payment starting today?

A) $65,145

B) $ 3,898

C) $62,043

D) $11,200

A) $65,145

B) $ 3,898

C) $62,043

D) $11,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is the present value of a semi- annual ordinary annuity payment of $7,000 made for 12 years with a required annual return of 5%compounded semi annually?

A) $ 62,043

B) $128,325

C) $ 65,145

D) $125,195

A) $ 62,043

B) $128,325

C) $ 65,145

D) $125,195

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

56

How long will it take $10,000 to grow to $50,000 if it earns 10% interest compounded semiannually?

A) 17 years

B) 8.5 years

C) 33 years

D) 16.5 year

A) 17 years

B) 8.5 years

C) 33 years

D) 16.5 year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

57

How long will it take to triple your money at 8% interest compounded quarterly?

A) 13.9 years

B) 30 years

C) 14.3 years

D) 55.5 years

A) 13.9 years

B) 30 years

C) 14.3 years

D) 55.5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

58

You take out a twenty-year amortized loan of $100,000 with a 5% annual interest rate. What are the annual payments?

A) $ 8,024

B) $ 8,718

C) $ 4,762

D) $37,689

A) $ 8,024

B) $ 8,718

C) $ 4,762

D) $37,689

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

59

You take out a 25- year loan of $150,000 with a 8% annual interest rate. What are the annual payments?

A) $13,965

B) $13,427

C) $ 2,052

D) $14,052

A) $13,965

B) $13,427

C) $ 2,052

D) $14,052

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the present value of $100,000 received in fifteen years with an annual discount rate of 5% compounded monthly?

A) $ 48,102

B) $ 47,310

C) $207,893

D) $ 25,000

A) $ 48,102

B) $ 47,310

C) $207,893

D) $ 25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

61

Compound interest can best be described as:

A) interest on interest only.

B) the discount rate.

C) interest on interest and interest on original principal.

D) interest earned on the original principal.

A) interest on interest only.

B) the discount rate.

C) interest on interest and interest on original principal.

D) interest earned on the original principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

62

To calculate the present value of an investment the following formula is used:

A) 1/(1 + i)n

B) discount rate used in present value cash flow calculations.

C) 1/(1 + i)n times the future value.

D) (1 + i)n

A) 1/(1 + i)n

B) discount rate used in present value cash flow calculations.

C) 1/(1 + i)n times the future value.

D) (1 + i)n

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

63

The future value of an investment is:

A) 1/(1 + i)n

B) discount rate used in future value cash flow calculations.

C) (1 + i)n times the present value.

D) (1 + i)n

A) 1/(1 + i)n

B) discount rate used in future value cash flow calculations.

C) (1 + i)n times the present value.

D) (1 + i)n

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

64

When we consider the time value of money, a dollar received in the future:

A) is worth less than a dollar received today.

B) is worth the same as a dollar received today.

C) is worth more than a dollar received today.

D) depends on the compounding used to determine the relationship to a dollar received today.

A) is worth less than a dollar received today.

B) is worth the same as a dollar received today.

C) is worth more than a dollar received today.

D) depends on the compounding used to determine the relationship to a dollar received today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

65

You require an 8% annual return on all investments. You have been offered an investment which will pay you $1,000 in one years time, $2,000 in two years time, and $3,000 in three years time. What is the most you would be willing to pay for this investment?

A) $6,000

B) $2,577

C) $5,022

D) $4,763

A) $6,000

B) $2,577

C) $5,022

D) $4,763

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

66

As a gift from your parents, you have just received $50,000 for your education for the next four years. You can earn an annual rate of 8% on your investments. How much can you withdraw each year (end of year) just using up the $50,000?

A) $11,096

B) $11,750

C) $12,500

D) $15,096

A) $11,096

B) $11,750

C) $12,500

D) $15,096

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

67

You borrow $95,000 for 12 years at an annual rate of 12%. What are the monthly payments required to amortize this loan?

A) $ 1,248

B) $15,336

C) $ 3,936

D) $11,400

A) $ 1,248

B) $15,336

C) $ 3,936

D) $11,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

68

A perpetuity can be described as:

A) an annuity that lasts longer than 25 years.

B) an annuity that goes on forever.

C) an amount of interest that is annually adjusted and is paid forever.

D) paid until the principal has been repaid.

A) an annuity that lasts longer than 25 years.

B) an annuity that goes on forever.

C) an amount of interest that is annually adjusted and is paid forever.

D) paid until the principal has been repaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

69

How much would you be willing to pay for a preferred share that pays a yearly dividend of $2.80? Current yields on similar preferreds are 6%

A) $46.67

B) $28.00

C) $59.09

D) $29.68

A) $46.67

B) $28.00

C) $59.09

D) $29.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

70

You would like to have $500,000 put away in 20 years for your retirement. You plan to put away $14,000 each year (end of year). What is the minimum interest rate that you would need to receive $500,000?

A) 4.5%

B) 5.72%

C) 6.5%

D) 5%

A) 4.5%

B) 5.72%

C) 6.5%

D) 5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

71

Calculate the present value of $100,000 received in six months. Use an annual discount rate of 10%. Do not adjust the discount rate to a semi-annual rate. Keep it annual and adjust "n" to the appropriate value.

A) $ 56,447

B) $ 90,909

C) $100,000

D) $ 95,346

A) $ 56,447

B) $ 90,909

C) $100,000

D) $ 95,346

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

72

You would like to retire with $1,000,000. You plan on a 7% annual investment rate (3.5% semi-annually) and will put away $7,500 twice a year at the end of each semi-annual period. How long before you can retire? Round to the nearest figure.

A) 25 years

B) 35 years

C) 51 years

D) 66 years

A) 25 years

B) 35 years

C) 51 years

D) 66 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

73

If you (1) decrease your required return and (2) decrease the number of compounding periods, what effect would this have on your present value?

A) (1)decrease; (2)increase

B) (1)increase; (2)decrease

C) (1)increase; (2)increase

D) (1)decrease; (2)decrease

A) (1)decrease; (2)increase

B) (1)increase; (2)decrease

C) (1)increase; (2)increase

D) (1)decrease; (2)decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

74

What is the future value of an annuity due if your required return is 10%, and payments are $1,000 for 10 years?

A) $11,000

B) $17,531

C) $15,937

D) $16,145

A) $11,000

B) $17,531

C) $15,937

D) $16,145

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

75

To calculate the present value of an annuity due you would take the present value of an ordinary annuity answer and whereas to calculate the future value of an annuity due you would take the future value of an ordinary annuity answer and .

A) divide by (1 + i); multiply by (1 + i)

B) multiply by (1 + i); multiply by (1 + i)

C) multiply by (1 + i); divide by (1 + i)

D) multiply by i; divide by i

A) divide by (1 + i); multiply by (1 + i)

B) multiply by (1 + i); multiply by (1 + i)

C) multiply by (1 + i); divide by (1 + i)

D) multiply by i; divide by i

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

76

To settle a debt you have agreed to make payments of $200, $500, $700, $900, and $1,200 at the end of years 1- 5 respectively. The appropriate discount rate is 8%. What is the present value of your debt?

A) $2,427

B) $3,500

C) $2,100

D) $2,648

A) $2,427

B) $3,500

C) $2,100

D) $2,648

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

77

Four liters of milk cost $3.59 today. How much will it cost you to buy four liters of milk for your grandchildren in 35 years if inflation averages 5% per year?

A) $19.80

B) $12.34

C) $3.77

D) $6.28

A) $19.80

B) $12.34

C) $3.77

D) $6.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

78

Your parents have promised to give you $25,000 on your wedding day if you wait 10 years to get married. Your sister is getting married today. What amount should she receive in today's dollars to match your gift? The appropriate discount rate is 12%

A) $10,000

B) $22,321

C) $8,049

D) $25,000

A) $10,000

B) $22,321

C) $8,049

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

79

You want to start saving for retirement. If you deposit $2000 each year at the end of the next 60 years and earn 11% on the investment, how much will you have when you retire?

A) $9,510,132

B) $10,556,246

C) $1,048,114

D) $792,000

A) $9,510,132

B) $10,556,246

C) $1,048,114

D) $792,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

80

You want to start saving for retirement. If you deposit $2,000 each year at the beginning of the next 60 years and earn 11% on the investment, how much will you have when you retire?

A) $9,510,132

B) $10,556,246

C) $792,000

D) $1,048,114

A) $9,510,132

B) $10,556,246

C) $792,000

D) $1,048,114

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck