Deck 2: Essential Concepts in Finance: Part A

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

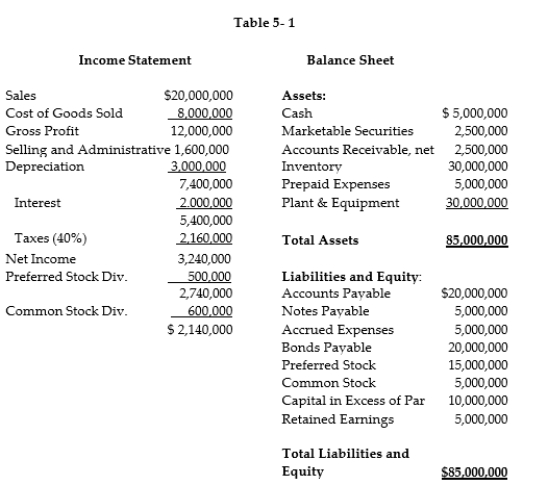

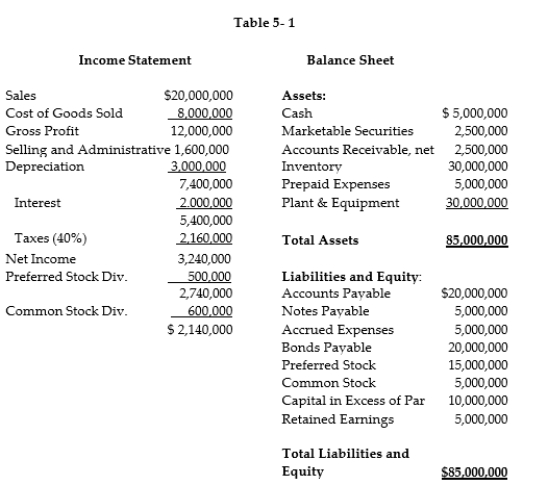

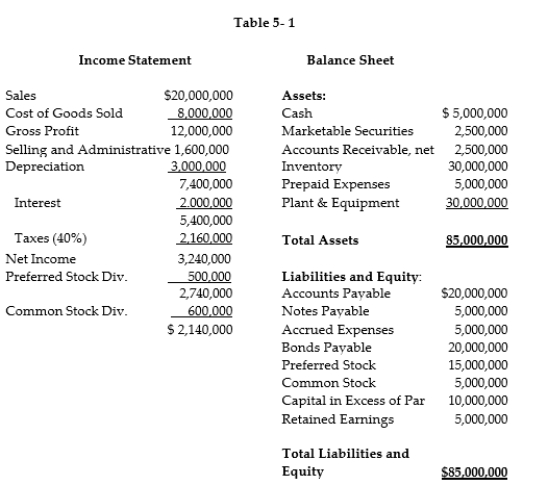

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/144

العب

ملء الشاشة (f)

Deck 2: Essential Concepts in Finance: Part A

1

The income statement:

A) details the firm's assets and liabilities over a period of time.

B) is a financial statement that summarizes a firm's revenues and expenses over a period of time.

C) is a financial statement that shows the firm's financial position at a particular point in time.

D) is a financial statement that summarizes a firm's revenues and expenses at a particular point in time.

A) details the firm's assets and liabilities over a period of time.

B) is a financial statement that summarizes a firm's revenues and expenses over a period of time.

C) is a financial statement that shows the firm's financial position at a particular point in time.

D) is a financial statement that summarizes a firm's revenues and expenses at a particular point in time.

is a financial statement that summarizes a firm's revenues and expenses over a period of time.

2

All of the following items represent liabilities with the exception of:

A) prepaid expenses.

B) accrued expenses.

C) notes payable.

D) long- term debt.

A) prepaid expenses.

B) accrued expenses.

C) notes payable.

D) long- term debt.

prepaid expenses.

3

Which of the following is a use of cash that would appear on the statement of cash flows?

A) purchase of marketable securities

B) decrease in accounts receivable

C) receipt of interest payments

D) accumulated depreciation

A) purchase of marketable securities

B) decrease in accounts receivable

C) receipt of interest payments

D) accumulated depreciation

purchase of marketable securities

4

Common equity includes all of the following except:

A) common stock.

B) preferred stock.

C) retained earnings.

D) capital in excess of par.

A) common stock.

B) preferred stock.

C) retained earnings.

D) capital in excess of par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

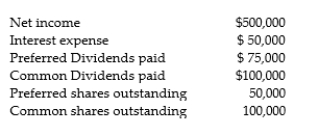

5

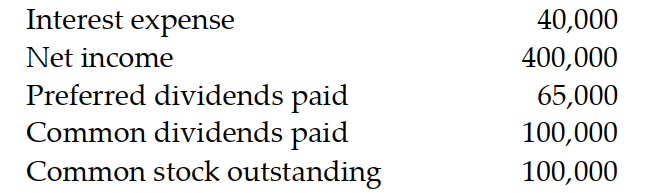

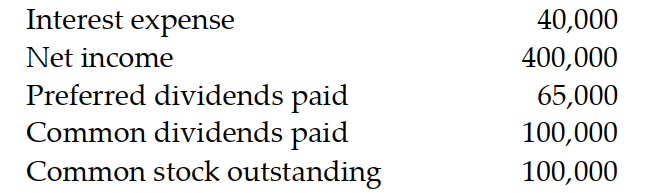

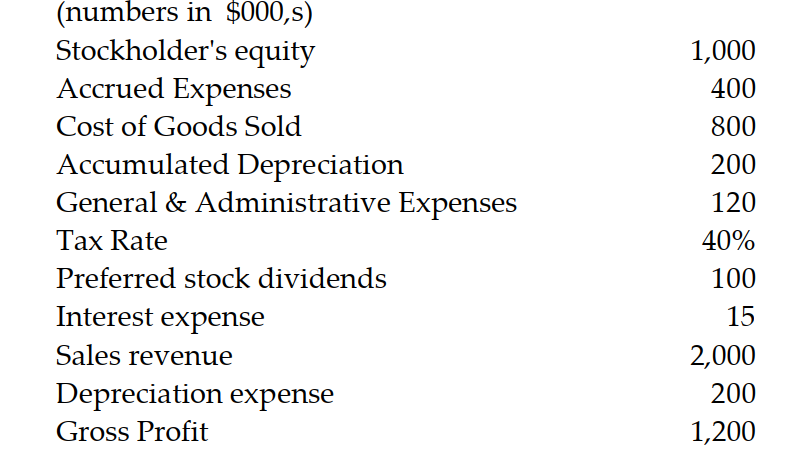

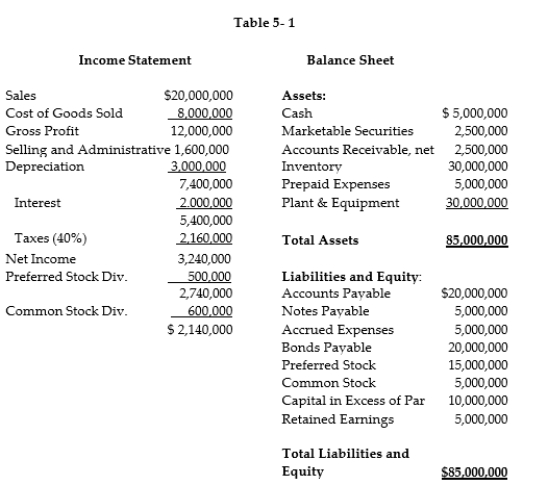

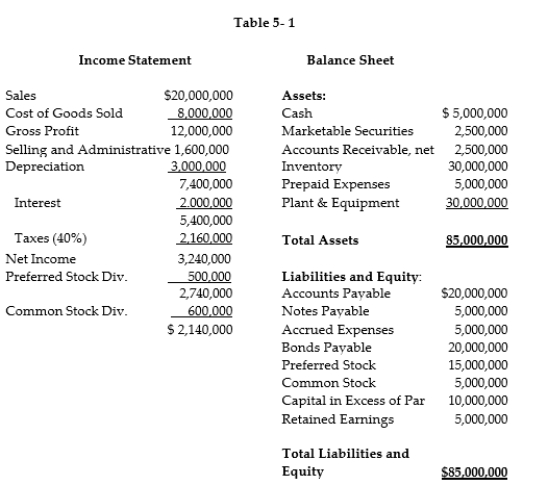

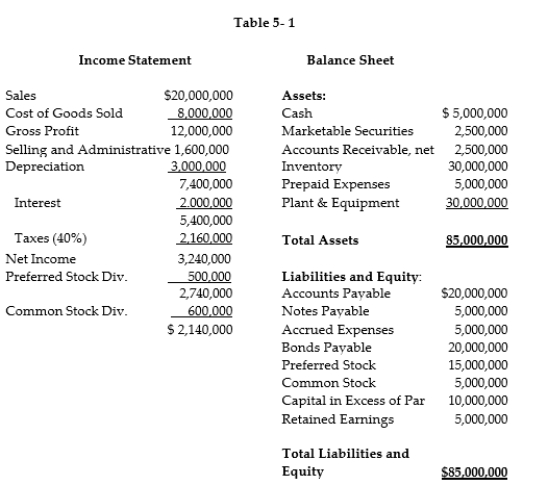

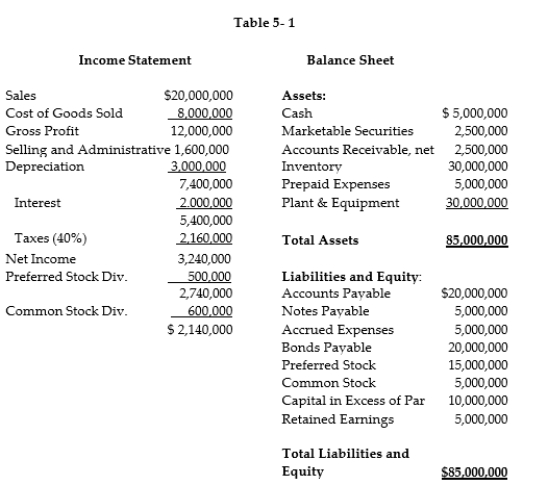

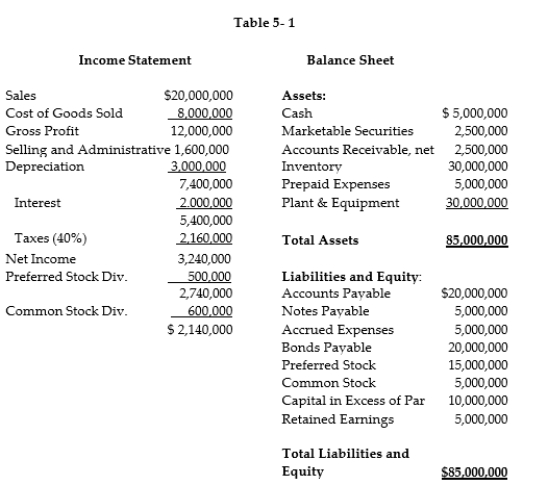

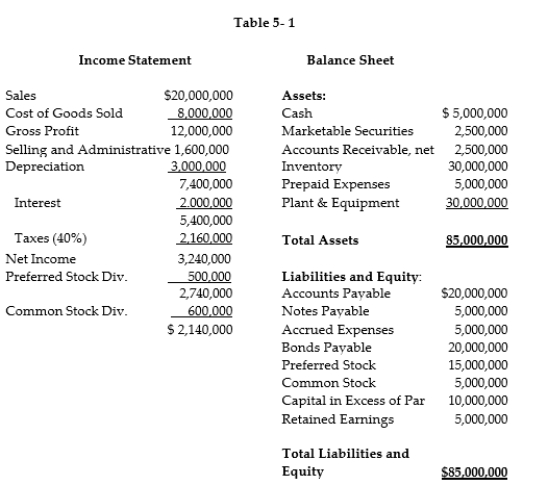

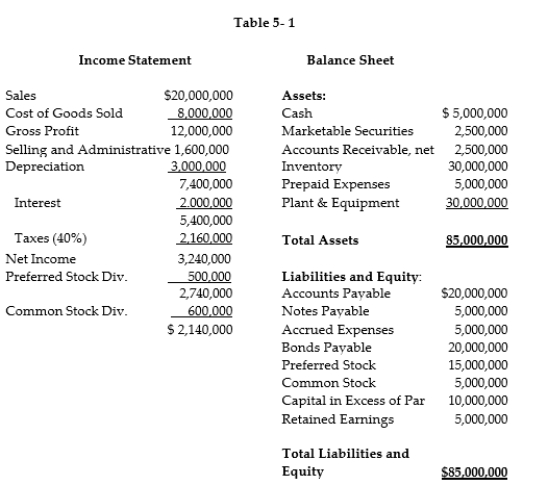

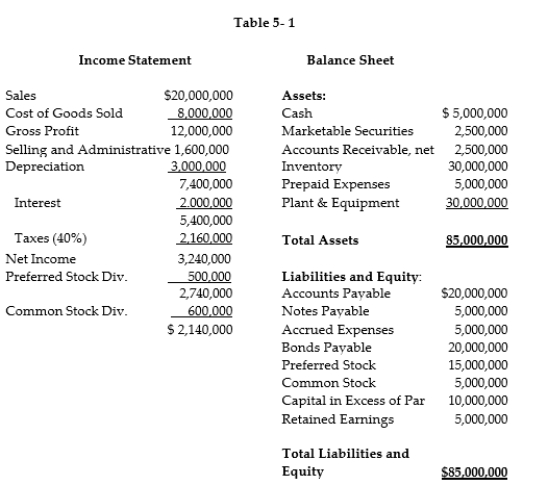

Given the following information, calculate earnings per share:

A) $3.35

B) $1.95

C) $3.60

D) $2.35

A) $3.35

B) $1.95

C) $3.60

D) $2.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

6

According to accounting principles:

A) operating expenses during the year are tied to revenues they helped to generate.

B) net working capital should equal zero.

C) current assets should equal current liabilities.

D) depreciation is a cash expense.

A) operating expenses during the year are tied to revenues they helped to generate.

B) net working capital should equal zero.

C) current assets should equal current liabilities.

D) depreciation is a cash expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which is TRUE about the Canadian tax system?

A) businesses are taxed at the same rate in all of the provinces.

B) small businesses tend to pay less taxes per dollar earned than larger businesses.

C) corporations cannot claim contributions made to political parties even if they are registered political parties.

D) the Canadian government does not use tax incentives to encourage scientific research.

A) businesses are taxed at the same rate in all of the provinces.

B) small businesses tend to pay less taxes per dollar earned than larger businesses.

C) corporations cannot claim contributions made to political parties even if they are registered political parties.

D) the Canadian government does not use tax incentives to encourage scientific research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Canadian government encourages certain types of business activity by:

A) letting businesses in certain areas pay their taxes one year late with no penalties.

B) using moral suasion.

C) offering tax credits.

D) regularly lowering the general tax rate for all businesses.

A) letting businesses in certain areas pay their taxes one year late with no penalties.

B) using moral suasion.

C) offering tax credits.

D) regularly lowering the general tax rate for all businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following equations best describes net working capital?

A) total assets - total liabilities

B) cash + inventory- accounts payables

C) fixed assets - long- term liabilities

D) current assets - current liabilities

A) total assets - total liabilities

B) cash + inventory- accounts payables

C) fixed assets - long- term liabilities

D) current assets - current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

10

With respect to preferred stock:

A) it is an obligation and must be paid before debt.

B) it is similar to long- term debt.

C) shareholders are paid a dividend based on net income.

D) the dividends paid are tax deductible to the firm.

A) it is an obligation and must be paid before debt.

B) it is similar to long- term debt.

C) shareholders are paid a dividend based on net income.

D) the dividends paid are tax deductible to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

11

Retained earnings are:

A) the value of the claim that all shareholders have against the assets of the company.

B) the sum of all the earnings available to common shareholders for the history of the company less any common dividends that have been paid out.

C) cash available to be paid out to common shareholders.

D) the equity capital of the corporation.

A) the value of the claim that all shareholders have against the assets of the company.

B) the sum of all the earnings available to common shareholders for the history of the company less any common dividends that have been paid out.

C) cash available to be paid out to common shareholders.

D) the equity capital of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

12

Retained earnings were $1,500,000 at the beginning of the year and $1,800,000 at the end of the year. Net income for the year was $400,000.The company paid $60,000 in preferred dividends. What did they pay in common share dividends?

A) $60,000

B) $100,000

C) $300,000

D) $40,000

A) $60,000

B) $100,000

C) $300,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

13

Net income is $1,000,000 for the year, EBT is $2,500,000, retained earnings in January were $5,000,000, preferred dividends paid for the year are $100,000, common stock dividends paid for the year are $300,000, and common shares outstanding are 1,000,000. What are end- of- year retained earnings?

A) $5,600,000

B) $5,900,000

C) $6,000,000

D) $7,100,000

A) $5,600,000

B) $5,900,000

C) $6,000,000

D) $7,100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

14

Gross profit equal:

A) Revenues - cost of goods sold - interest expense

B) Revenues - cost of goods sold

C) Revenues - cost of goods sold - depreciation

D) Revenues - cost of goods sold - operating expenses

A) Revenues - cost of goods sold - interest expense

B) Revenues - cost of goods sold

C) Revenues - cost of goods sold - depreciation

D) Revenues - cost of goods sold - operating expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

15

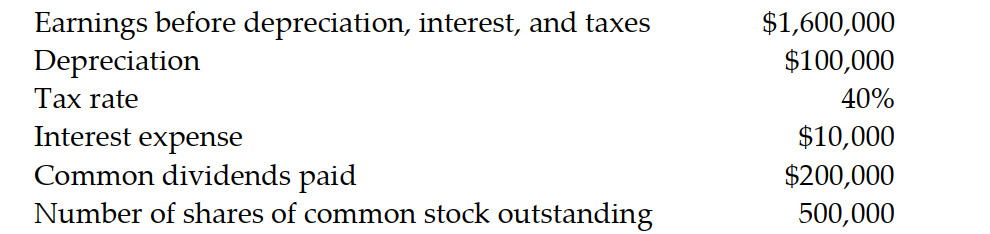

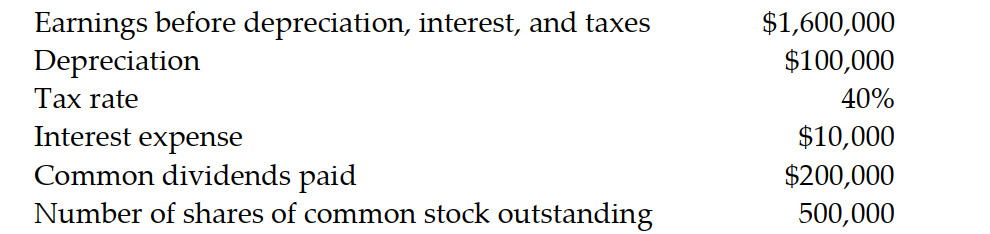

Given the following information, calculate earnings per share. Round to the nearest cent.

A) 1.20

B) 3.20

C) 1.79

D) 1.39

A) 1.20

B) 3.20

C) 1.79

D) 1.39

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

16

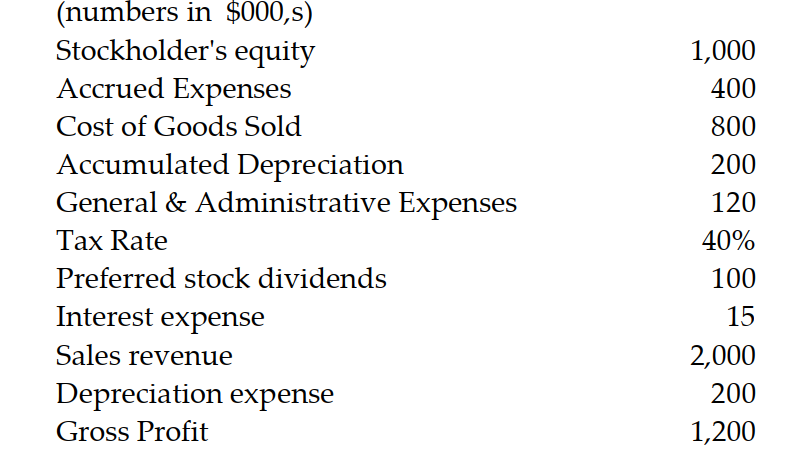

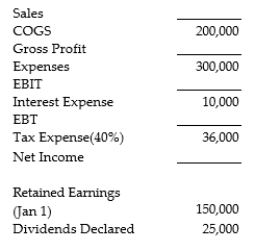

Use the following information to answer the question:  Calculate net income.

Calculate net income.

A) $459,000

B) $519,000

C) $ 99,000

D) $279,000

Calculate net income.

Calculate net income.A) $459,000

B) $519,000

C) $ 99,000

D) $279,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

17

Retained earning:

A) belong to the debt holders.

B) are usually paid out within the year.

C) belong to the common shareholders.

D) belong to all shareholders.

A) belong to the debt holders.

B) are usually paid out within the year.

C) belong to the common shareholders.

D) belong to all shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

18

Net income is $100,000 and preferred dividends paid are $100,000 and common stock dividends paid are $100,000. Beginning retained earnings were $500,000. The ending balance in retained earnings would b:

A) $500,000

B) $300,000

C) $600,000

D) $400,000

A) $500,000

B) $300,000

C) $600,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amortization:

A) is deducted from net income.

B) is a tax deductible non- cash expense.

C) represents a cash outflow on the cash flow statement.

D) is not a true expense.

A) is deducted from net income.

B) is a tax deductible non- cash expense.

C) represents a cash outflow on the cash flow statement.

D) is not a true expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

20

Selling expenses are subtracted:

A) before operating income.

B) after net income.

C) from depreciation expense.

D) before gross profit.

A) before operating income.

B) after net income.

C) from depreciation expense.

D) before gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest expense is deducted:

A) before gross profit is calculated.

B) before taxes are calculated but after operating expenses.

C) after preferred dividends but before common stock dividends.

D) before operating income is calculated.

A) before gross profit is calculated.

B) before taxes are calculated but after operating expenses.

C) after preferred dividends but before common stock dividends.

D) before operating income is calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

22

Preferred stock dividends:

A) are deducted after net income is calculated.

B) are deducted from retained earnings.

C) are subtracted from operating income.

D) are deducted before net income but after interest expense is calculated.

A) are deducted after net income is calculated.

B) are deducted from retained earnings.

C) are subtracted from operating income.

D) are deducted before net income but after interest expense is calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

23

The basic accounting equation:

A) says that current and non- current assets = current and non- current liabilities.

B) is an economic and not an accounting concept.

C) is a secret known only by CPAs.

D) says that all assets of the firm are funded by the liabilities and equity of the firm.

A) says that current and non- current assets = current and non- current liabilities.

B) is an economic and not an accounting concept.

C) is a secret known only by CPAs.

D) says that all assets of the firm are funded by the liabilities and equity of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

24

Earnings per share are:

A) are those earnings that belong to the common shareholders divided by the number of shares outstanding.

B) are those earnings calculated before preferred stock dividends are deducted divided by the number of shares outstanding.

C) are the change in retained earnings divided by the number of shareholders.

D) are earnings available to all shareholders divided by the number of preferred shares outstanding.

A) are those earnings that belong to the common shareholders divided by the number of shares outstanding.

B) are those earnings calculated before preferred stock dividends are deducted divided by the number of shares outstanding.

C) are the change in retained earnings divided by the number of shareholders.

D) are earnings available to all shareholders divided by the number of preferred shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements is true of the statement of cash flows?

A) It is very similar to the income statement.

B) It includes changes in net working capital only.

C) It includes dividends paid.

D) It measures changes in profit from one year to the next year.

A) It is very similar to the income statement.

B) It includes changes in net working capital only.

C) It includes dividends paid.

D) It measures changes in profit from one year to the next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

26

Amortization is:

A) the new value assigned to historically priced assets.

B) a balance sheet item that results in lower cash flow.

C) another term for bad debts profision.

D) the allocation of an asset's initial cost over time.

A) the new value assigned to historically priced assets.

B) a balance sheet item that results in lower cash flow.

C) another term for bad debts profision.

D) the allocation of an asset's initial cost over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the matching principle?

A) The average amount of taxes a corporation pays should match exactly their reported income.

B) Cash inflows should be matched with cash outflows.

C) Assets should always equal liabilities plus owners equity.

D) Expenses should be matched to the revenues they help generate.

A) The average amount of taxes a corporation pays should match exactly their reported income.

B) Cash inflows should be matched with cash outflows.

C) Assets should always equal liabilities plus owners equity.

D) Expenses should be matched to the revenues they help generate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

28

When Canadian corporations are calculating their amortization expenses for income tax purposes:

A) they must use the Capital Cost Allowance Rate.

B) any method may be used if it qualifies under generally accepted accounting principles.

C) they must use straight line amortization.

D) they must use the declining balance method.

A) they must use the Capital Cost Allowance Rate.

B) any method may be used if it qualifies under generally accepted accounting principles.

C) they must use straight line amortization.

D) they must use the declining balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

29

Amortization is non cash expense that increases cash flow because:

A) love is not a factor in cash flows except in Italy.

B) any expenses that do not use cash will increase the effective net income on the balance sheet.

C) it can be classified as a prepaid expense.

D) it decreases taxes payable.

A) love is not a factor in cash flows except in Italy.

B) any expenses that do not use cash will increase the effective net income on the balance sheet.

C) it can be classified as a prepaid expense.

D) it decreases taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

30

When a company issues new stock it, it would appear on the cash flow statement as:

A) Cash from operations.

B) Cash from investments.

C) Cash from financing.

D) It would not appear on the cash flow statement only the Balance sheet.

A) Cash from operations.

B) Cash from investments.

C) Cash from financing.

D) It would not appear on the cash flow statement only the Balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

31

A firm expects to have earnings before amortization and taxes of $150,000 in each of the next three years. There are no interest payments and taxes are at a rate of 40%. It is considering the purchase of an asset costing $120,000 requiring $15,000 in installation costs and having a recovery period of three years.

a. Calculate the amortization expense for year three using straight line amortization.

b. If preferred dividends paid are $20,000, common stock dividends paid are $20,000, and the number of shares of common stock outstanding is 10,000, what are the reported EPS in year three?

a. Calculate the amortization expense for year three using straight line amortization.

b. If preferred dividends paid are $20,000, common stock dividends paid are $20,000, and the number of shares of common stock outstanding is 10,000, what are the reported EPS in year three?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

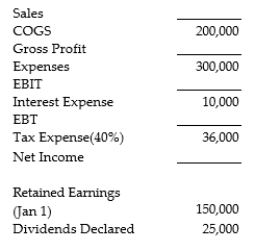

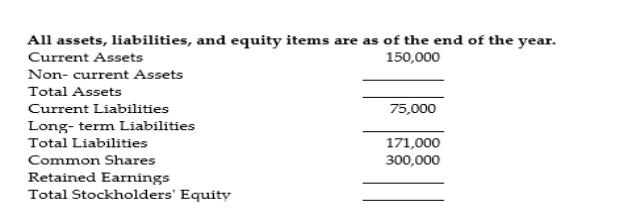

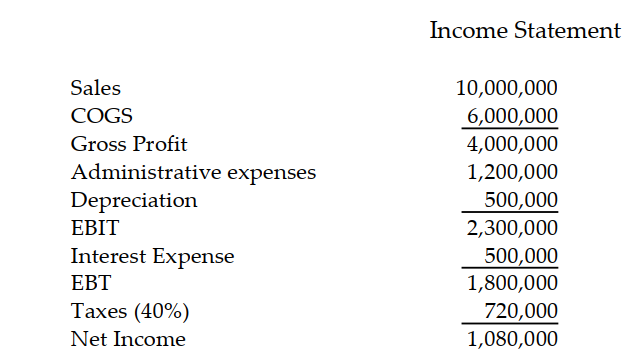

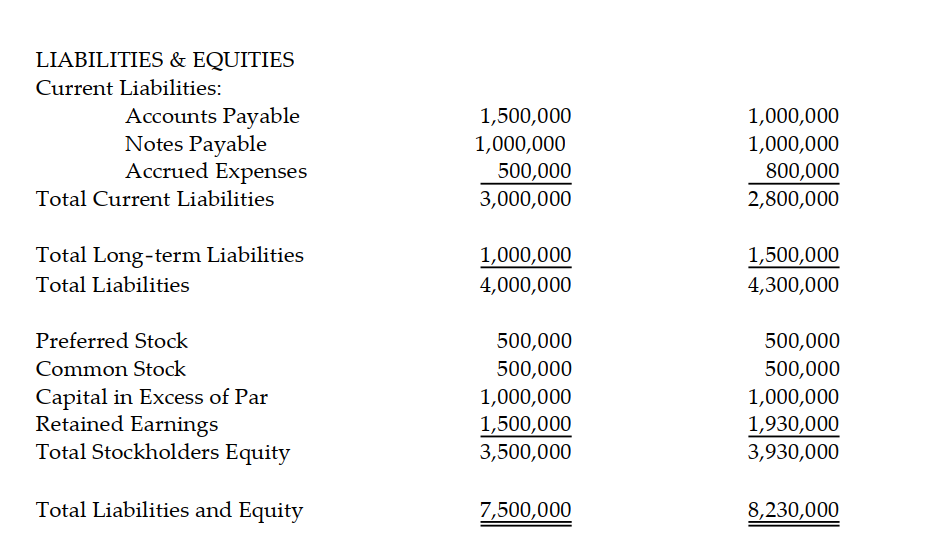

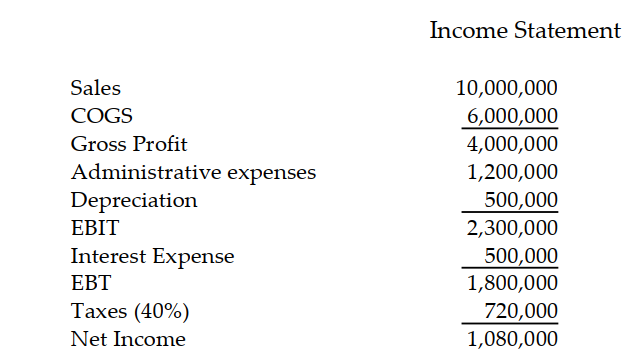

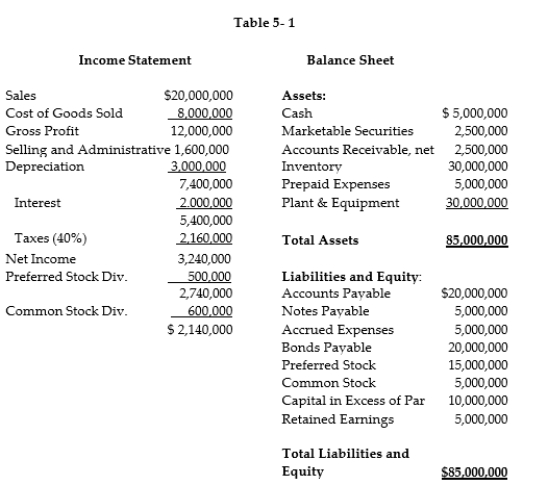

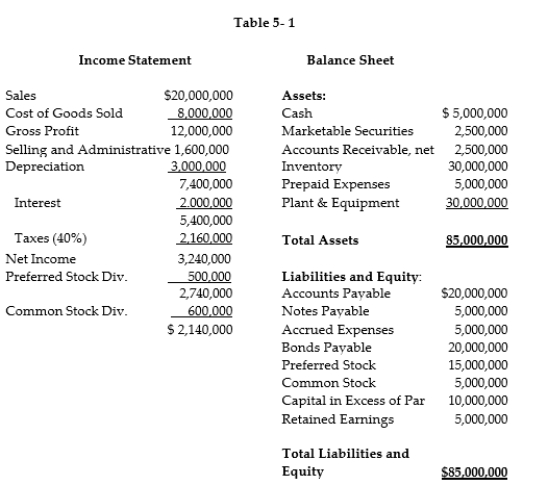

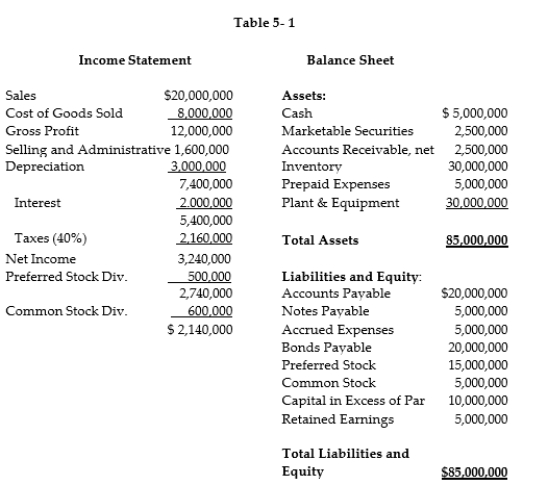

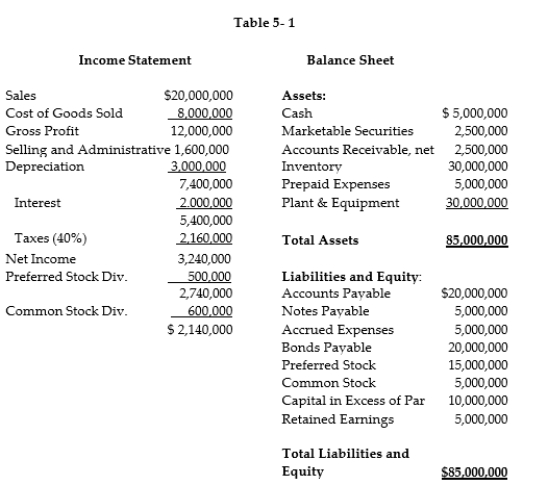

32

For the following income statement and balance sheet, fill in the missing information for the calendar year ending December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

33

This year your company bought a piece of equipment for $60,000. the Canada Customs and revenue Agency have classified it as a Cl. 8 asset with an allocated capital cost allowance rate of 20%. The company's tax rate is 30%.

a) What will be your maximum allowable amortization expense for tax purposes for the year of purchase? What will it be in the second year?

b) If your company normally uses straight line depreciation for financial reporting purchases and this asset is to be amortized over 8 years, what amortization expense will appear on the financial statements in year one and year two?

c) Will the taxes paid entry in the income statements for the two years be equal to taxes actually paid to the government? If not briefly discuss why.

a) What will be your maximum allowable amortization expense for tax purposes for the year of purchase? What will it be in the second year?

b) If your company normally uses straight line depreciation for financial reporting purchases and this asset is to be amortized over 8 years, what amortization expense will appear on the financial statements in year one and year two?

c) Will the taxes paid entry in the income statements for the two years be equal to taxes actually paid to the government? If not briefly discuss why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

34

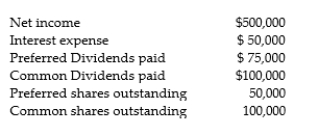

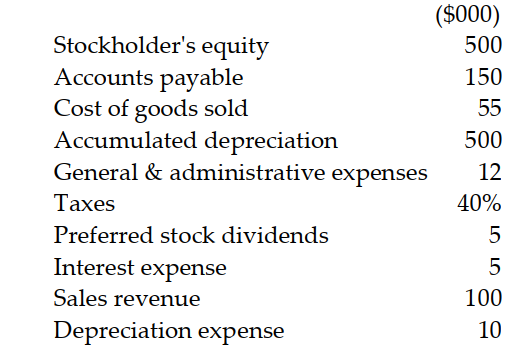

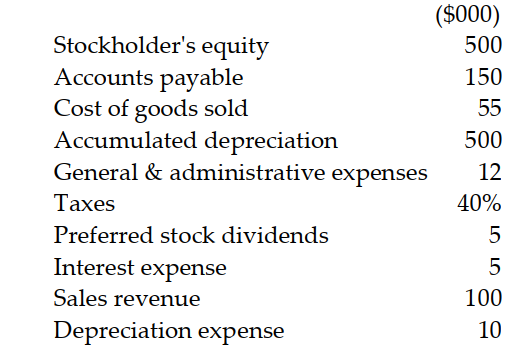

Calculate earnings per share for the followin:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

35

Working capital includes both current and non- current assets. Do you agree or disagree with this statement? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

36

Explain why preferred stock is a difficult item to classify.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

37

Company A has increased its yearly amortization expense by $13,000 resulting in a yearly $4,810 increase in cash flow. Company B has also increased its amortization expense by $13,000 but their yearly increase in cash flow is only $3,770. Assume in both cases that all non- amortization related cash flows are unchanged year over year. Why would this happen?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

38

We always add back common stock dividends paid to the balance sheet item retained earnings. Common stock dividends were paid out from the net income because they were paid to the owners and as such are considered residual profits. Explain whether you agree or disagree with this statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

39

Explain why prepaid expenses are considered to be an asse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

40

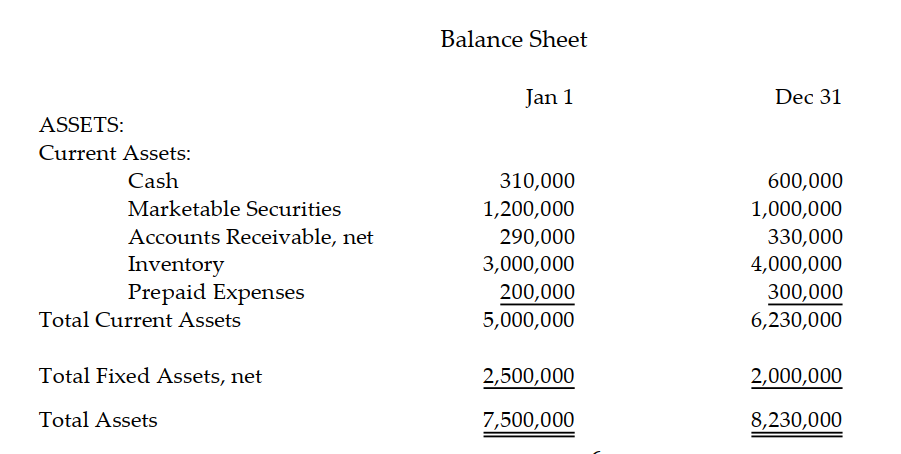

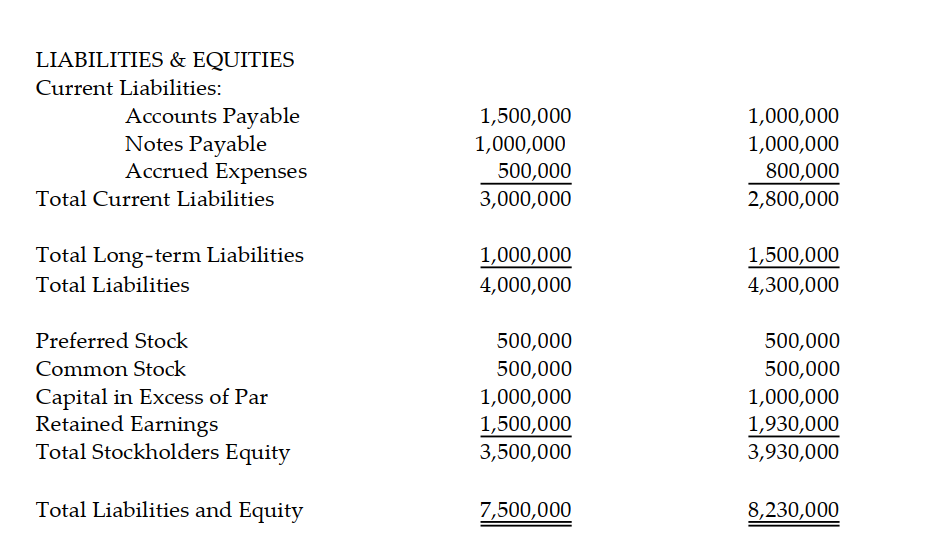

a. Prepare a cash flow statement for the following information.

b. Include a cash reconciliation statement.

b. Include a cash reconciliation statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

41

Explain the difference between debt and equity. Why must the two equal total assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

42

Why do we need a cash flow statement? Can't we just use net income as a proxy for cash flow?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

43

There is a special earnings category called EBITA(Earnings before interest, taxes and amortization):

a) why might this number be of interest to an analyst?

b) why might this number be a poor indicator of the future of the company?

a) why might this number be of interest to an analyst?

b) why might this number be a poor indicator of the future of the company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

44

In the current year Spruce Corp. and Cedar Corp. will have earnings of $150,000 before interest, taxes and amortization. Both companies have $10,000 in interest costs and a tax rate of 40%. Spruce Corp. has amortization expense of $50,000 whereas Cedar Corp. has only $10,000 in amortization expense.

a. Calculate the annual net income for each company.

b. Calculate annual cash flow for each company.

c. Does the the company with the higher net income also have the higher cash flow, if not why is this happening?

a. Calculate the annual net income for each company.

b. Calculate annual cash flow for each company.

c. Does the the company with the higher net income also have the higher cash flow, if not why is this happening?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

45

Given the following information, prepare an income statement for year ended December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

46

Ajax Inc. had profits of $200,000 for the year. Their retained earnings account grew from $800,000 at the beginning of the year to $950,000 by year end. How much did the firm pay out in dividend?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

47

Why is there considered to be a decrease in operating cash flow if there is a increase in Accounts Receivable on a year over year basis and an increase in cash flow if Accounts Payable increase on a year over year basis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is EBITA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

49

Compare the information supplied by an income statement, a balance sheet, and a statement of cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

50

What assets are current assets? Which of these assets are least liquid? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

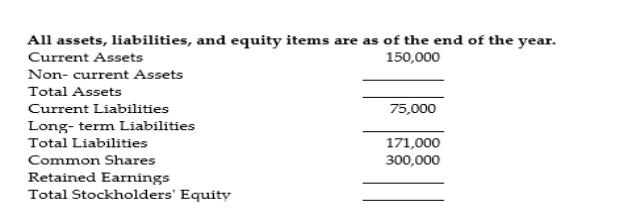

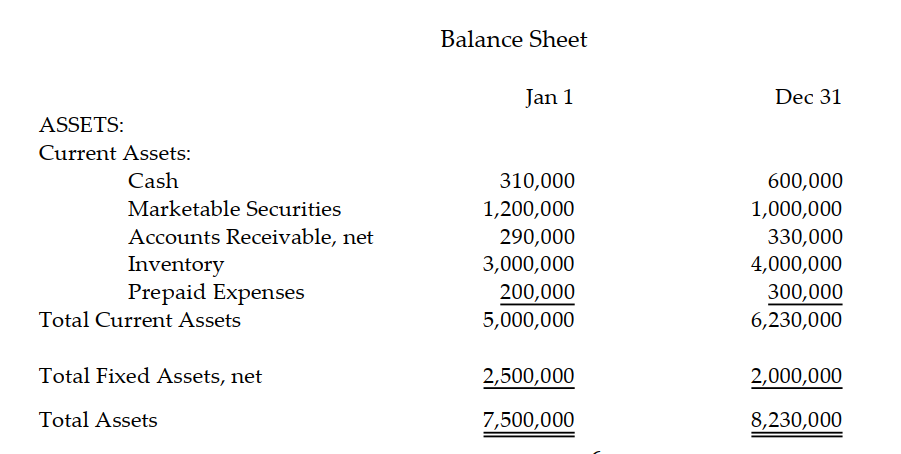

51

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Current Ratio is:

A) 1.83

B) 0.183

C) 0.55

D) 0.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

52

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Net Profit margin is:

A) 16.2%

B) 60%

C) 13.7%

D) 37%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

53

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Quick Ratio is:

A) 0.29

B) 0.667

C) 1.20

D) .833

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

54

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Times Interest Earned ratio is:

A) 3.7

B) 2.7

C) 0.27

D) 0.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

55

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Earnings Per Share are:

A) $2.14

B) $2.74

C) $1.83

D) $3.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

56

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Gross Profit Margin is:

A) 60%

B) 37%

C) 16.2%

D) 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

57

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Total Debt to Total Asset ratio is:

A) 58.82%

B) 0.59

C) 0.7647%

D) 1.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

58

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-Return on Assets ratio is:

A) 3.22%

B) 13.7%

C) 16.2%

D) 0.162%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

59

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Total Asset Turnover ratio is:

A) 4.25 times

B) 0.235 times

C) 2.35 times

D) 4.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

60

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Operating Profit Margin is:

A) 13.6%

B) 37%

C) 60%

D) 16.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

61

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Average Collection Period (365 day year) is:

A) 12.5%

B) 12.5 days

C)4)563 days

D) 45.63 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

62

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Market to Book ratio is:

A) 0.15

B) 0.51

C) 6.57

D) 0.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

63

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Debt to Equity ratio is:

A) 0.31%

B) 2.5 times

C) 1.43 times

D) 0.70%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

64

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Inventory Turnover ratio is:

A) 0.67 times

B) 1.5 times

C) 67%

D) 1.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

65

Shares outstanding of common stock = 1,000,000

Shares outstanding of common stock = 1,000,000 Shares outstanding of preferred stock = 500,000

Market price of common stock = $18.

-The Return on Equity is:

A) 16.2%

B)0)162%

C)3)81%

D) 13.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Modified DuPont equation is most accurately described as a function of:

A) return on equity.

B) asset utilization.

C) profitability and debt.

D) return on assets and debt load.

A) return on equity.

B) asset utilization.

C) profitability and debt.

D) return on assets and debt load.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

67

A significantly higher average collection period than the industry average might suggest:

A) poor credit decisions.

B) high profit levels.

C) rapid collection of accounts.

D) low liquidity levels.

A) poor credit decisions.

B) high profit levels.

C) rapid collection of accounts.

D) low liquidity levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

68

Return on equity is most accurately described as a measure of:

A) return on assets combined with liquidity.

B) is the amount of net income paid to retained earnings after allowing for dividends paid.

C) the return available to all stockholders in the company.

D) the return on capital based on common stockholder investment.

A) return on assets combined with liquidity.

B) is the amount of net income paid to retained earnings after allowing for dividends paid.

C) the return available to all stockholders in the company.

D) the return on capital based on common stockholder investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

69

A current ratio of 0.9 means:

A) the firm has a debt ratio of 90%.

B) the firm has $0.90 of current assets for every $1.00 of current liabilities.

C) the firm has $0.90 of current liabilities for every $1.00 of current assets.

D) the firm has $0.90 of fixed assets for every $1.00 of current assets.

A) the firm has a debt ratio of 90%.

B) the firm has $0.90 of current assets for every $1.00 of current liabilities.

C) the firm has $0.90 of current liabilities for every $1.00 of current assets.

D) the firm has $0.90 of fixed assets for every $1.00 of current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

70

A debt/total asset ratio of 75% and a ROE of 12% means:

A) the owners of XYZ are financing 75% of the firm's assets in order to receive a 12% return on their personal investment in the company's stock.

B) 25% of assets are financed with owners' equity.

C) the firm can cover interest payments with $0.25 of every dollar left for profit.

D) 12% of the firm's profits are financed with equity.

A) the owners of XYZ are financing 75% of the firm's assets in order to receive a 12% return on their personal investment in the company's stock.

B) 25% of assets are financed with owners' equity.

C) the firm can cover interest payments with $0.25 of every dollar left for profit.

D) 12% of the firm's profits are financed with equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

71

A debt/equity ratio of 8.1 means:

A) debt is turning over 8.1 times a year.

B) the firm is financing the company with 81% borrowed funds.

C) the firm has 8.1 times more debt than equity.

D) the firm has 81 times more equity than debt.

A) debt is turning over 8.1 times a year.

B) the firm is financing the company with 81% borrowed funds.

C) the firm has 8.1 times more debt than equity.

D) the firm has 81 times more equity than debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

72

If the inventory turnover ratio is very low relative to industry averages:

A) the firm may have too many items that the customers probably do not want.

B) the firm has good total assets management practices.

C) the firm has too low a level of inventory.

D) the firm may be losing sales if its inventory is too low.

A) the firm may have too many items that the customers probably do not want.

B) the firm has good total assets management practices.

C) the firm has too low a level of inventory.

D) the firm may be losing sales if its inventory is too low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company that is running "lean and mean:"

A) has a high liquidity ratio.

B) has a low gross profit margin.

C) should have a total asset turnover ratio that is high relative to the industry.

D) is utilizing fewer of its assets for generation of sales.

A) has a high liquidity ratio.

B) has a low gross profit margin.

C) should have a total asset turnover ratio that is high relative to the industry.

D) is utilizing fewer of its assets for generation of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Return on Assets ratio is most vulnerable to misinterpretation because:

A) a company may have owned many of their fixed assets for a very long period of time.

B) accounting for revenue recognition is very conservative.

C) current assets are not included in the calculation.

D) it is based on earnings before interest and taxes and tends to overstate earnings.

A) a company may have owned many of their fixed assets for a very long period of time.

B) accounting for revenue recognition is very conservative.

C) current assets are not included in the calculation.

D) it is based on earnings before interest and taxes and tends to overstate earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

75

Return on equity represents a measurement of the firm's:

A) debt level.

B) profitability.

C) asset utilization.

D) liquidity.

A) debt level.

B) profitability.

C) asset utilization.

D) liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

76

Return on assets can best be explained as:

A) how much working capital is provided by the stockholders.

B) how much income each dollar of assets generates.

C) how much income each dollar of working capital assets generates.

D) how many dollars of sales each dollar of assets generates.

A) how much working capital is provided by the stockholders.

B) how much income each dollar of assets generates.

C) how much income each dollar of working capital assets generates.

D) how many dollars of sales each dollar of assets generates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

77

Times interest earned is best described by:

A) how much net profit is available for every dollar of interest expense.

B) how much operating income is available for every dollar of interest expense.

C) how many sales are generated by debt.

D) how much income is generated by debt.

A) how much net profit is available for every dollar of interest expense.

B) how much operating income is available for every dollar of interest expense.

C) how many sales are generated by debt.

D) how much income is generated by debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Net Profit Margin represents a measurement of the firm's:

A) liquidity.

B) debt level.

C) asset utilization.

D) profitability.

A) liquidity.

B) debt level.

C) asset utilization.

D) profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

79

Given the following information for XYZ Corporation, calculate the P/E ratio:

EPS = $2.50

BVS = $7.00

Shares outstanding = 100,000

Market price = $30.00

A) 12.00

B) 4.29

C) 18.00

D) 20.00

EPS = $2.50

BVS = $7.00

Shares outstanding = 100,000

Market price = $30.00

A) 12.00

B) 4.29

C) 18.00

D) 20.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

80

Given the following information for XYZ Corporation, calculate the Market to Book Ratio: EPS = $2.50

BVS = $7.00

Shares outstanding = 100,000

Market price = $30.00

A) 10

B) 6

C) 4.29

D) 2

BVS = $7.00

Shares outstanding = 100,000

Market price = $30.00

A) 10

B) 6

C) 4.29

D) 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck