Deck 18: Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 18: Budgeting

1

Long-range planning usually encompasses a period of at least:

A) six months.

B) one year.

C) three to five years.

D) ten years.

A) six months.

B) one year.

C) three to five years.

D) ten years.

three to five years.

2

The effectiveness of a budget is related to its acceptance by:

A) top management only.

B) lower level management only.

C) all levels of management.

D) shareholders.

A) top management only.

B) lower level management only.

C) all levels of management.

D) shareholders.

all levels of management.

3

A set of interrelated budgets that constitutes a plan of action for a specified period of time is known as a(n):

A) master budget.

B) madam budget.

C) authoritarian budget.

D) centralised budget.

A) master budget.

B) madam budget.

C) authoritarian budget.

D) centralised budget.

master budget.

4

A master budget includes two classes of budget. These are:

A) a sales budget and a purchases budget.

B) operating budgets and capital budgets.

C) budgeted financial statements and operating budgets.

D) cash budgets and accrual budgets.

A) a sales budget and a purchases budget.

B) operating budgets and capital budgets.

C) budgeted financial statements and operating budgets.

D) cash budgets and accrual budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

If there were 30,000 kilograms of raw material on hand on 1 January, 60,000 kilograms are desired for inventory at 31 January and 180,000 kilograms are required for January production, how many kilograms of raw material should be purchased in January?

A) 150,000 kilograms.

B) 240,000 kilograms.

C) 120,000 kilograms.

D) 210,000 kilograms.

A) 150,000 kilograms.

B) 240,000 kilograms.

C) 120,000 kilograms.

D) 210,000 kilograms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is not a part of the operating budgets?

A) Capital expenditure budget.

B) Cash budget.

C) Manufacturing overhead budget.

D) Budgeted statements of financial position.

Learning objective 18.2 - Identify and describe the components of the master budget.

A) Capital expenditure budget.

B) Cash budget.

C) Manufacturing overhead budget.

D) Budgeted statements of financial position.

Learning objective 18.2 - Identify and describe the components of the master budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

The production budget shows expected unit sales of 16,000. Beginning finished goods units are 2,800. Required production units are 16,800. What are the desired ending finished goods units?

A) 2,000.

B) 2,800.

C) 3,200.

D) 3,600.

A) 2,000.

B) 2,800.

C) 3,200.

D) 3,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

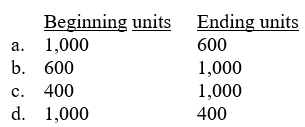

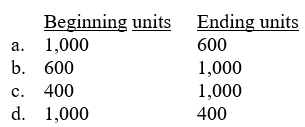

The production budget shows expected unit sales are 10,000. The required production units are 10,400. What are the beginning and desired ending finished goods units, respectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

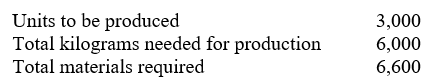

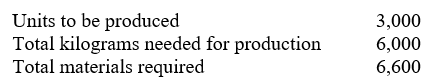

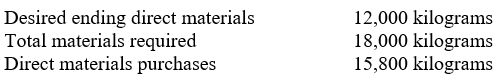

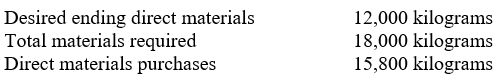

The direct materials budget shows:  What are the direct materials per unit?

What are the direct materials per unit?

A) 1.08 kilograms

B) 2.0 kilograms

C) 2.2 kilograms

D) cannot be determined from the data

What are the direct materials per unit?

What are the direct materials per unit?A) 1.08 kilograms

B) 2.0 kilograms

C) 2.2 kilograms

D) cannot be determined from the data

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

The direct materials budget shows:  The total direct materials needed for production is:

The total direct materials needed for production is:

A) 6,000 kilograms.

B) 2,200 kilograms.

C) 3,800 kilograms.

D) 33,800 kilograms.

The total direct materials needed for production is:

The total direct materials needed for production is:A) 6,000 kilograms.

B) 2,200 kilograms.

C) 3,800 kilograms.

D) 33,800 kilograms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the required direct materials purchases are 8,000 kilograms and the direct materials required for production is three times the direct materials purchases, and the beginning direct materials are three and a half times the direct materials purchases, what are the desired ending direct materials in kilograms?

A) 20,000.

B) 4,000.

C) 12,000.

D) 8,000.

A) 20,000.

B) 4,000.

C) 12,000.

D) 8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

A company budgeted unit sales of 51,000 units for January 2019 and 60,000 units for February 2019. The company has a policy of having an inventory of units on hand at the end of each month equal to 30% of next month's budgeted unit sales. If there were 15,300 units of inventory on hand on 31 December 2018, how many units should be produced in January 2019 in order for the company to meet its goals?

A) 53,700 units.

B) 51,000 units.

C) 48,300 units.

D) 69,000 units.

A) 53,700 units.

B) 51,000 units.

C) 48,300 units.

D) 69,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

A company determined that the budgeted cost of producing a product is $20 per unit. On 1 June there were 20,000 units on hand, the sales department budgeted sales of 75,000 units in June, and the company desires to have 30,000 units on hand on 30 June. The budgeted cost of goods manufactured for June would be:

A) $1,300,000.

B) $1,900,000.

C) $1,500,000.

D) $1,700,000.

A) $1,300,000.

B) $1,900,000.

C) $1,500,000.

D) $1,700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

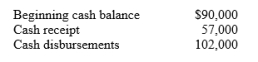

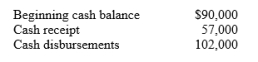

The following information was taken from Sloan Ltd's cash budget for the month of July:  If the company has a policy of maintaining a minimum end of the month cash balance of $75,000, the amount the company would have to borrow is:

If the company has a policy of maintaining a minimum end of the month cash balance of $75,000, the amount the company would have to borrow is:

A) $30,000.

B) $15,000.

C) $45,000.

D) $18,000.

If the company has a policy of maintaining a minimum end of the month cash balance of $75,000, the amount the company would have to borrow is:

If the company has a policy of maintaining a minimum end of the month cash balance of $75,000, the amount the company would have to borrow is:A) $30,000.

B) $15,000.

C) $45,000.

D) $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

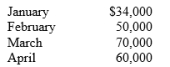

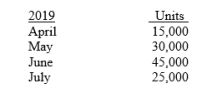

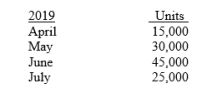

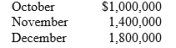

The following credit sales are budgeted by Roswell Company:

The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is:

The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is:

A) $61,720.

B) $56,000.

C) $60,000.

D) $58,800.

The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is:

The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is:A) $61,720.

B) $56,000.

C) $60,000.

D) $58,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

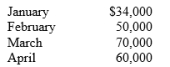

A company's past experience indicates that 60% of its credit sales are collected in the month of sale, 30% in the next month, and 5% in the second month after the sale; the remainder is never collected. Budgeted credit sales were:

The cash inflow in the month of March is expected to be:

The cash inflow in the month of March is expected to be:

A) $90,400.

B) $68,400.

C) $72,000.

D) $86,400.

The cash inflow in the month of March is expected to be:

The cash inflow in the month of March is expected to be:A) $90,400.

B) $68,400.

C) $72,000.

D) $86,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

All of the following statements about the cash budget are correct except that it:

A) can show managers when additional financing will be necessary.

B) contributes to more efficient cash management.

C) can indicate when excess cash will be available for investments.

D) replaces the statement of cash flows.

A) can show managers when additional financing will be necessary.

B) contributes to more efficient cash management.

C) can indicate when excess cash will be available for investments.

D) replaces the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

All data for the budgeted income statement are obtained from the individual operating budgets and the cash budget except:

A) direct materials.

B) income tax expense.

C) sales.

D) selling and administrative expenses.

A) direct materials.

B) income tax expense.

C) sales.

D) selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

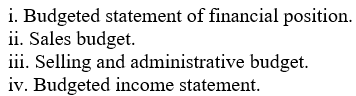

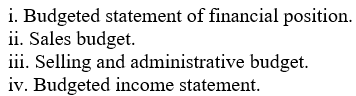

What is the proper preparation sequencing of the following budgets?

A) i, ii, iii, iv

B) ii, iii, i, iv

C) ii, iii, iv, i

D) ii, iv, i, iii

A) i, ii, iii, iv

B) ii, iii, i, iv

C) ii, iii, iv, i

D) ii, iv, i, iii

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

The budgeted statement of financial position is:

A) developed from the current year budgets.

B) developed from the budgeted statement of financial position sheet for the preceding year

C) prepared before the cash budget.

D) A and B.

A) developed from the current year budgets.

B) developed from the budgeted statement of financial position sheet for the preceding year

C) prepared before the cash budget.

D) A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

Budgets may be used by all of the following except:

A) merchandisers.

B) not-for-profit organisations.

C) service enterprises.

D) all of these use budgets.

A) merchandisers.

B) not-for-profit organisations.

C) service enterprises.

D) all of these use budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Not-for-profit entities may budget on:

A) a revenue and expense basis.

B) an accrual basis.

C) the basis of cash flows.

D) a modified accrual basis.

A) a revenue and expense basis.

B) an accrual basis.

C) the basis of cash flows.

D) a modified accrual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

The use of budgets in controlling operations is known as:

A) budgetary control.

B) budget manipulation.

C) decentralised budgeting.

D) centralised budgeting.

A) budgetary control.

B) budget manipulation.

C) decentralised budgeting.

D) centralised budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

Budgetary control involves all of the following components except:

A) budget development.

B) analysis of budget.

C) slashing of budget.

D) modification of budget.

A) budget development.

B) analysis of budget.

C) slashing of budget.

D) modification of budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

A projection of budget data at one level of activity is found in a:

A) flexible budget.

B) service budget.

C) control budget.

D) static budget.

A) flexible budget.

B) service budget.

C) control budget.

D) static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

A projection of budget data at various levels of activity is presented in a(n):

A) favourable budget.

B) flexible budget

C) unfavourable budget.

D) static budget.

A) favourable budget.

B) flexible budget

C) unfavourable budget.

D) static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Management by exception is an approach in which managers review budgets:

A) on a random basis throughout the budget period.

B) of exceptional managers only.

C) that have material differences between actual and budgeted objectives.

D) that are flexible.

A) on a random basis throughout the budget period.

B) of exceptional managers only.

C) that have material differences between actual and budgeted objectives.

D) that are flexible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

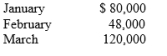

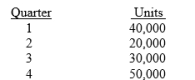

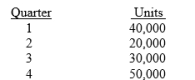

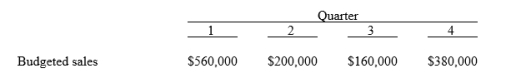

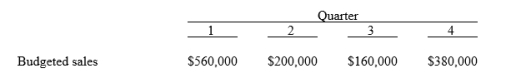

Rolling Stone Ltd has budgeted the following unit sales:

Of the units budgeted, 40% are sold in the Southern Region at an average price of $15 per unit and the remainder are sold by the Eastern Region at an average price of $12 per unit.

Of the units budgeted, 40% are sold in the Southern Region at an average price of $15 per unit and the remainder are sold by the Eastern Region at an average price of $12 per unit.

Instructions : Prepare separate sales budgets for each region and for the company in total for the second quarter of 2019.

Of the units budgeted, 40% are sold in the Southern Region at an average price of $15 per unit and the remainder are sold by the Eastern Region at an average price of $12 per unit.

Of the units budgeted, 40% are sold in the Southern Region at an average price of $15 per unit and the remainder are sold by the Eastern Region at an average price of $12 per unit.Instructions : Prepare separate sales budgets for each region and for the company in total for the second quarter of 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

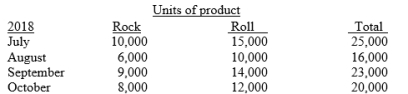

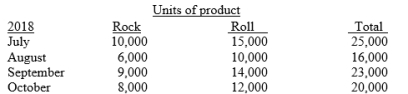

Led Zeppelin Ltd manufactures two products, (1) Rock and (2) Roll. The budgeted units to be produced are as follows:

It takes 2 kilograms of direct materials to produce the Rock product and 4 kilograms of direct materials to produce the Roll product. It is the company's policy to maintain an inventory of direct materials on hand at the end of each month equal to 20% of the next month's production needs for the Rock product and 10% of the next month's production needs for the Roll product. Direct materials inventory on hand at June 30 were 4,000 kilograms for the Rock product and 6,000 kilograms for the Roll product. The cost per kilogram of materials is $5 Rock and $7 Roll.

It takes 2 kilograms of direct materials to produce the Rock product and 4 kilograms of direct materials to produce the Roll product. It is the company's policy to maintain an inventory of direct materials on hand at the end of each month equal to 20% of the next month's production needs for the Rock product and 10% of the next month's production needs for the Roll product. Direct materials inventory on hand at June 30 were 4,000 kilograms for the Rock product and 6,000 kilograms for the Roll product. The cost per kilogram of materials is $5 Rock and $7 Roll.

Instructions : Prepare separate direct materials budgets for each product for the third quarter of 2018.

It takes 2 kilograms of direct materials to produce the Rock product and 4 kilograms of direct materials to produce the Roll product. It is the company's policy to maintain an inventory of direct materials on hand at the end of each month equal to 20% of the next month's production needs for the Rock product and 10% of the next month's production needs for the Roll product. Direct materials inventory on hand at June 30 were 4,000 kilograms for the Rock product and 6,000 kilograms for the Roll product. The cost per kilogram of materials is $5 Rock and $7 Roll.

It takes 2 kilograms of direct materials to produce the Rock product and 4 kilograms of direct materials to produce the Roll product. It is the company's policy to maintain an inventory of direct materials on hand at the end of each month equal to 20% of the next month's production needs for the Rock product and 10% of the next month's production needs for the Roll product. Direct materials inventory on hand at June 30 were 4,000 kilograms for the Rock product and 6,000 kilograms for the Roll product. The cost per kilogram of materials is $5 Rock and $7 Roll.Instructions : Prepare separate direct materials budgets for each product for the third quarter of 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Pink Floyd Ltd has budgeted the following unit sales:

The finished goods units on hand on 31 December 2017, was 2,000 units. Each unit requires 3 kilograms of raw materials, which is estimated to cost an average of $4 per kilogram. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 30% of the kilograms needed for the following month's production. There were 8,640 kilograms of raw materials on hand at 31 December 2017.

The finished goods units on hand on 31 December 2017, was 2,000 units. Each unit requires 3 kilograms of raw materials, which is estimated to cost an average of $4 per kilogram. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 30% of the kilograms needed for the following month's production. There were 8,640 kilograms of raw materials on hand at 31 December 2017.

Instructions : For the first quarter of 2018, prepare (1) a production budget and (2) a direct materials budget.

The finished goods units on hand on 31 December 2017, was 2,000 units. Each unit requires 3 kilograms of raw materials, which is estimated to cost an average of $4 per kilogram. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 30% of the kilograms needed for the following month's production. There were 8,640 kilograms of raw materials on hand at 31 December 2017.

The finished goods units on hand on 31 December 2017, was 2,000 units. Each unit requires 3 kilograms of raw materials, which is estimated to cost an average of $4 per kilogram. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 30% of the kilograms needed for the following month's production. There were 8,640 kilograms of raw materials on hand at 31 December 2017.Instructions : For the first quarter of 2018, prepare (1) a production budget and (2) a direct materials budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

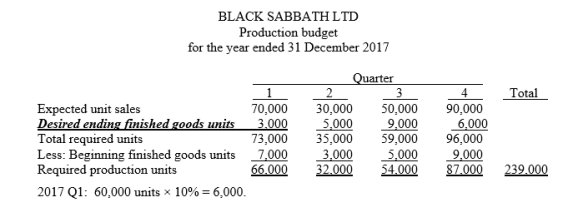

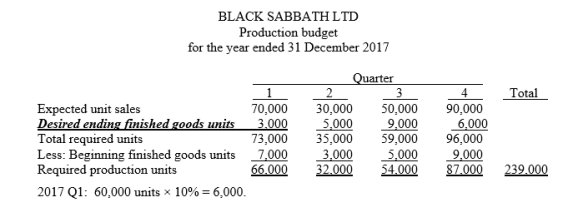

Black Sabbath Ltd has budgeted the following unit sales:

The finished goods inventory on hand on 31 December 2016 was 7,000 units. It is the company's policy to maintain a finished goods inventory at the end of each quarter equal to 10% of the next quarter's anticipated sales.

The finished goods inventory on hand on 31 December 2016 was 7,000 units. It is the company's policy to maintain a finished goods inventory at the end of each quarter equal to 10% of the next quarter's anticipated sales.

Instructions: Prepare a production budget for 2017.

The finished goods inventory on hand on 31 December 2016 was 7,000 units. It is the company's policy to maintain a finished goods inventory at the end of each quarter equal to 10% of the next quarter's anticipated sales.

The finished goods inventory on hand on 31 December 2016 was 7,000 units. It is the company's policy to maintain a finished goods inventory at the end of each quarter equal to 10% of the next quarter's anticipated sales.Instructions: Prepare a production budget for 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following facts are known:

•The total kilograms needed for production are 2 times the units to be produced.

•The total kilograms needed for production are 2 times the units to be produced.

•The desired ending direct materials inventory is 20% of the total kilograms needed for production.

•The beginning direct materials inventory is equal in number to 10% of the units to be produced.

•Cost per kilogram is $10.

•Total cost of the direct materials purchases is $1,610,000.

Instructions: Create the direct materials budget for the period

•The total kilograms needed for production are 2 times the units to be produced.

•The total kilograms needed for production are 2 times the units to be produced.•The desired ending direct materials inventory is 20% of the total kilograms needed for production.

•The beginning direct materials inventory is equal in number to 10% of the units to be produced.

•Cost per kilogram is $10.

•Total cost of the direct materials purchases is $1,610,000.

Instructions: Create the direct materials budget for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

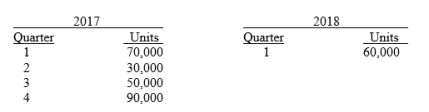

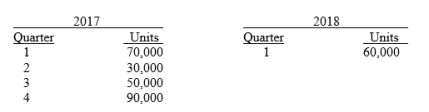

Credence Ltd is preparing its direct labour budget for 2018 from the following production budget based on a calendar year:

Each unit requires 1.5 hours of direct labour. The union contract provides for a 10% increase in wage rate to $11 per hour on 1 October.

Each unit requires 1.5 hours of direct labour. The union contract provides for a 10% increase in wage rate to $11 per hour on 1 October.

Instructions: Prepare a direct labour budget for 2018.

Each unit requires 1.5 hours of direct labour. The union contract provides for a 10% increase in wage rate to $11 per hour on 1 October.

Each unit requires 1.5 hours of direct labour. The union contract provides for a 10% increase in wage rate to $11 per hour on 1 October.Instructions: Prepare a direct labour budget for 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

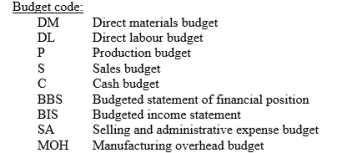

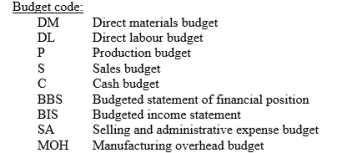

For each item given, identify the budget in which it will appear. If an item will appear on more than one budget, then indicate as many budgets as are relevant.

1. Ending cash balance

1. Ending cash balance

2. Total selling and administrative expenses

3. Total sales (in dollars)

4. Interest expense

5. Ending raw materials inventory (in dollars)

6. Ending finished goods inventory (in dollars)

1. Ending cash balance

1. Ending cash balance2. Total selling and administrative expenses

3. Total sales (in dollars)

4. Interest expense

5. Ending raw materials inventory (in dollars)

6. Ending finished goods inventory (in dollars)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Korn Company is preparing its master budget for 2018. Relevant data pertaining to its sales budget are as follows:

Sales for the year are expected to total 4,000,000 units. Quarterly sales are 25%, 30%, 15%, and 30%, respectively. The sales price is expected to be $1.50 per unit for the first quarter and then be increased to $1.75 per unit in the second quarter.

Prepare a sales budget for 2018 for Korn Company.

Sales for the year are expected to total 4,000,000 units. Quarterly sales are 25%, 30%, 15%, and 30%, respectively. The sales price is expected to be $1.50 per unit for the first quarter and then be increased to $1.75 per unit in the second quarter.

Prepare a sales budget for 2018 for Korn Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

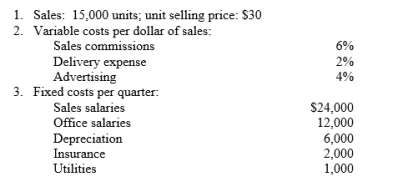

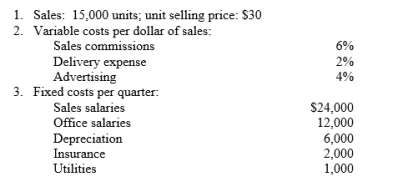

Linkin Park Ltd combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first quarter of 2017, the following data are developed:

Instructions: Prepare a selling and administrative expense budget for the first quarter of 2017.

Instructions: Prepare a selling and administrative expense budget for the first quarter of 2017.

Instructions: Prepare a selling and administrative expense budget for the first quarter of 2017.

Instructions: Prepare a selling and administrative expense budget for the first quarter of 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

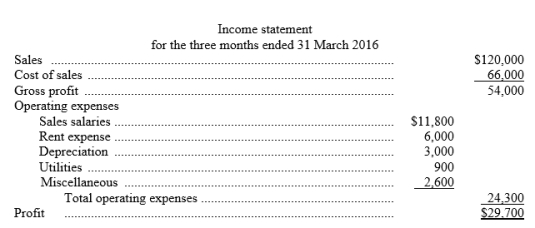

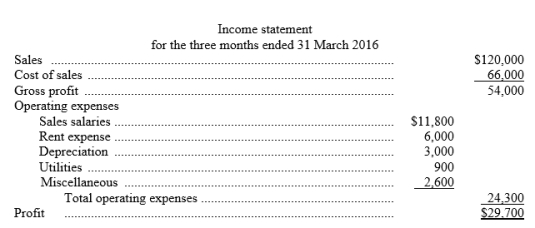

The Victorian Division of Irwin Ltd has been requested to prepare a quarterly budgeted income statement for 2017. The state manager expects that sales in the first quarter of 2017 will increase by 10% over the same quarter of the preceding year and will then increase by 5% for each succeeding quarter in 2017.

The head office has requested that the state manager maintain an inventory in dollars equal to 25% of the next quarter's sales. Quarterly purchases average 55% of quarterly sales. Budgeted ending inventory on December 31, 2015 is $33,000. Quarterly salaries are $5,000 plus 5% of sales. All salaries are classified as sales salaries. Other quarterly expenses are estimated to be as follows:

The income statement for the first quarter of 2016 was as follows:

The income statement for the first quarter of 2016 was as follows:

Instructions : Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2017. (Show computations.)

Instructions : Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2017. (Show computations.)

The head office has requested that the state manager maintain an inventory in dollars equal to 25% of the next quarter's sales. Quarterly purchases average 55% of quarterly sales. Budgeted ending inventory on December 31, 2015 is $33,000. Quarterly salaries are $5,000 plus 5% of sales. All salaries are classified as sales salaries. Other quarterly expenses are estimated to be as follows:

The income statement for the first quarter of 2016 was as follows:

The income statement for the first quarter of 2016 was as follows: Instructions : Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2017. (Show computations.)

Instructions : Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2017. (Show computations.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

In September 2019, the budget committee of ZZ Topp Ltd assembles the following data:

1.

"

"

2. Cost of sales is expected to be 60% of sales."

3. Desired ending merchandise inventory is 20% of the next month's cost of sales."

4. The beginning inventory at 1 October will be the desired amount.

Instructions : Prepare the budgeted income statement for October through gross profit on sales, including a cost of sales schedule."

1.

"

"2. Cost of sales is expected to be 60% of sales."

3. Desired ending merchandise inventory is 20% of the next month's cost of sales."

4. The beginning inventory at 1 October will be the desired amount.

Instructions : Prepare the budgeted income statement for October through gross profit on sales, including a cost of sales schedule."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

Beatles Ltd has budgeted sales revenue as follows:

Past experience has indicated that 80% of sales each month are on credit and that collection of credit sales occurs as follows: 60% in the month of sale, 30% in the month following the sale, and 5% in the second month following the sale. The other 5% is uncollectable.

Past experience has indicated that 80% of sales each month are on credit and that collection of credit sales occurs as follows: 60% in the month of sale, 30% in the month following the sale, and 5% in the second month following the sale. The other 5% is uncollectable.

Instructions :Prepare a schedule which shows expected cash receipts from sales for the months of April, May, and June.

Past experience has indicated that 80% of sales each month are on credit and that collection of credit sales occurs as follows: 60% in the month of sale, 30% in the month following the sale, and 5% in the second month following the sale. The other 5% is uncollectable.

Past experience has indicated that 80% of sales each month are on credit and that collection of credit sales occurs as follows: 60% in the month of sale, 30% in the month following the sale, and 5% in the second month following the sale. The other 5% is uncollectable.Instructions :Prepare a schedule which shows expected cash receipts from sales for the months of April, May, and June.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

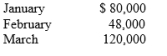

Kiss Ltd has budgeted sales revenues as follows:

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are:

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are:

Other cash disbursements budgeted: (a) selling and administrative expenses of $19,000 each month, (b) dividends of $41,400 will be paid in July, and (c) purchase of a computer in August for $12,000 cash.

Other cash disbursements budgeted: (a) selling and administrative expenses of $19,000 each month, (b) dividends of $41,400 will be paid in July, and (c) purchase of a computer in August for $12,000 cash.

The company wishes to maintain a minimum cash balance of $20,000 at the end of each month. The company borrows money from the bank at 9% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $20,000. Assume that borrowed money in this case is for one month.

Instructions :Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory.

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are:

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are: Other cash disbursements budgeted: (a) selling and administrative expenses of $19,000 each month, (b) dividends of $41,400 will be paid in July, and (c) purchase of a computer in August for $12,000 cash.

Other cash disbursements budgeted: (a) selling and administrative expenses of $19,000 each month, (b) dividends of $41,400 will be paid in July, and (c) purchase of a computer in August for $12,000 cash.The company wishes to maintain a minimum cash balance of $20,000 at the end of each month. The company borrows money from the bank at 9% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $20,000. Assume that borrowed money in this case is for one month.

Instructions :Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Brisbane National Bank has asked Elemenop Ltd. for a budgeted balance sheet for the year ended 31 December 2019. The following information is available:

1. The cash budget shows an expected cash balance of $50,000 at 31 December 2019.

2. The 2019 sales budget shows total annual sales of $600,000. All sales are made on account and accounts receivable at 31 December 2019 are expected to be 15% of annual sales.

3. The merchandise purchases budget shows budgeted cost of sales for 2019 of $300,000 and ending merchandise inventory of $70,000. Twenty per cent of the ending inventory is expected to have not yet been paid at 31 December 2019.

4. The 31 December 2018 balance sheet includes the following balances: Equipment $196,000, Accumulated depreciation $80,000, Share capital $180,000 and Retained earnings $32,000.

5. The budgeted profit for 2019 includes the following: depreciation on equipment $10,000, income taxes $16,000, and profit $74,000. The income taxes will not be paid until 2018.

6. In 2019, management does not expect to purchase additional equipment or to declare any dividends. It does expect to pay all operating expenses, other than depreciation, in cash.

Instructions : Prepare an unclassified statement of financial position at 31 December 2019.

1. The cash budget shows an expected cash balance of $50,000 at 31 December 2019.

2. The 2019 sales budget shows total annual sales of $600,000. All sales are made on account and accounts receivable at 31 December 2019 are expected to be 15% of annual sales.

3. The merchandise purchases budget shows budgeted cost of sales for 2019 of $300,000 and ending merchandise inventory of $70,000. Twenty per cent of the ending inventory is expected to have not yet been paid at 31 December 2019.

4. The 31 December 2018 balance sheet includes the following balances: Equipment $196,000, Accumulated depreciation $80,000, Share capital $180,000 and Retained earnings $32,000.

5. The budgeted profit for 2019 includes the following: depreciation on equipment $10,000, income taxes $16,000, and profit $74,000. The income taxes will not be paid until 2018.

6. In 2019, management does not expect to purchase additional equipment or to declare any dividends. It does expect to pay all operating expenses, other than depreciation, in cash.

Instructions : Prepare an unclassified statement of financial position at 31 December 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

The management of Steppenwolf Ltd estimates that credit sales for August, September, October and November will be $180,000, $210,000, $230,000 and $160,000, respectively. Experience has shown that collections are made as follows:

Instructions : Determine the collections from customers in October and November. Show all computations.

Instructions : Determine the collections from customers in October and November. Show all computations.

Instructions : Determine the collections from customers in October and November. Show all computations.

Instructions : Determine the collections from customers in October and November. Show all computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

Magic Balls Ltd specialises in football memorabilia. Therefore, the company's sales are seasonal. Budgeted figures are presented below.

From past experience, Magic Balls Ltd has learned that of credit sales, 70% are collected in the month of sale and 30% are collected in the month following the sale.

From past experience, Magic Balls Ltd has learned that of credit sales, 70% are collected in the month of sale and 30% are collected in the month following the sale.

Instructions : Assuming the fourth quarter sales for the previous year totalled $420,000, determine Magic Balls' cash collections for each of the four quarters.

From past experience, Magic Balls Ltd has learned that of credit sales, 70% are collected in the month of sale and 30% are collected in the month following the sale.

From past experience, Magic Balls Ltd has learned that of credit sales, 70% are collected in the month of sale and 30% are collected in the month following the sale.Instructions : Assuming the fourth quarter sales for the previous year totalled $420,000, determine Magic Balls' cash collections for each of the four quarters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Joan Jett Ltd needs a cash budget for the month of April. The company's financial officer has provided you with the following information and assumptions:

a. The 1 April cash balance is expected to be $14,560.

b. All sales are on account. Credit sales are collected over a three-month period - 60 per cent in the month of sale, 30 per cent in the month following sale, and 10 per cent in the second month following sale. Actual sales for February and March were $60,000 and $55,000, respectively. April's sales are budgeted at $70,000.

c. Marketable securities are expected to be sold for $38,000 during the month of April.

d. The controller estimates that direct materials totalling $53,000 will be purchased during April. Fifty per cent of a month's raw materials purchases are paid in the month of purchase with the remaining 50 per cent paid in the following month. Accounts payable for March purchases total $16,150, which will be paid in April.

e. During April, direct labour costs are estimated to be $28,000.

f. Manufacturing overhead is estimated to be 50 per cent of direct labour costs, Further, the controller estimates that approximately 10 per cent of the manufacturing overhead is depreciation on the factory building and equipment.

g. Selling and administrative expenses are budgeted at $34,000 for April. Of this amount, $16,000 is for depreciation.

h. During April, Joan Jett Ltd plans to buy a new delivery van costing $17,500. The company will pay cash for the van.

i. Joan Jett Ltd owes $9,000 in income tax, which must be paid in April.

j. Joan Jett Ltd must maintain a minimum cash balance of $10,000. To bolster the cash position as needed, an open line of credit is available from the bank.

Instructions: Prepare the following:

(1) a schedule of cash collections

(2) a schedule of cash payments for raw materials

(3) a cash budget for the month of April. Indicate in the financing section any borrowing that will be necessary during the month.

a. The 1 April cash balance is expected to be $14,560.

b. All sales are on account. Credit sales are collected over a three-month period - 60 per cent in the month of sale, 30 per cent in the month following sale, and 10 per cent in the second month following sale. Actual sales for February and March were $60,000 and $55,000, respectively. April's sales are budgeted at $70,000.

c. Marketable securities are expected to be sold for $38,000 during the month of April.

d. The controller estimates that direct materials totalling $53,000 will be purchased during April. Fifty per cent of a month's raw materials purchases are paid in the month of purchase with the remaining 50 per cent paid in the following month. Accounts payable for March purchases total $16,150, which will be paid in April.

e. During April, direct labour costs are estimated to be $28,000.

f. Manufacturing overhead is estimated to be 50 per cent of direct labour costs, Further, the controller estimates that approximately 10 per cent of the manufacturing overhead is depreciation on the factory building and equipment.

g. Selling and administrative expenses are budgeted at $34,000 for April. Of this amount, $16,000 is for depreciation.

h. During April, Joan Jett Ltd plans to buy a new delivery van costing $17,500. The company will pay cash for the van.

i. Joan Jett Ltd owes $9,000 in income tax, which must be paid in April.

j. Joan Jett Ltd must maintain a minimum cash balance of $10,000. To bolster the cash position as needed, an open line of credit is available from the bank.

Instructions: Prepare the following:

(1) a schedule of cash collections

(2) a schedule of cash payments for raw materials

(3) a cash budget for the month of April. Indicate in the financing section any borrowing that will be necessary during the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

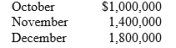

In September the management of The Skynard Group assembles the following data in preparation of budgeted merchandise purchases for the months of October and November.

1.Expected sales

2.Cost of sales is expected to be 60% of sales.

2.Cost of sales is expected to be 60% of sales.

3.Desired ending merchandise inventory is 25% of the next month's cost of sales.

4.The beginning inventory at 1 October will be the desired amount.

Instructions: Compute the budgeted merchandise purchases for October and November. Use a columnar format with separate columns for each month.

1.Expected sales

2.Cost of sales is expected to be 60% of sales.

2.Cost of sales is expected to be 60% of sales.3.Desired ending merchandise inventory is 25% of the next month's cost of sales.

4.The beginning inventory at 1 October will be the desired amount.

Instructions: Compute the budgeted merchandise purchases for October and November. Use a columnar format with separate columns for each month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Match the items below by choosing the appropriate code letter :

-A selection of strategies to achieve long-term goals.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-A selection of strategies to achieve long-term goals.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Match the items below by choosing the appropriate code letter :

-An estimate of expected sales for the budget period.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-An estimate of expected sales for the budget period.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Match the items below by choosing the appropriate code letter :

-Budgets that indicate the financial performance and financial position at the end of the budget period.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-Budgets that indicate the financial performance and financial position at the end of the budget period.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Match the items below by choosing the appropriate code letter :

-The projection of potential sales for the industry and the company's expected share of such sales.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-The projection of potential sales for the industry and the company's expected share of such sales.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

Match the items below by choosing the appropriate code letter :

-Management's plans expressed in financial terms for a specified future time period

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-Management's plans expressed in financial terms for a specified future time period

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Match the items below by choosing the appropriate code letter :

-A projection of anticipated cash flows.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-A projection of anticipated cash flows.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

Match the items below by choosing the appropriate code letter :

-A group responsible for coordinating the preparation of the budget.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-A group responsible for coordinating the preparation of the budget.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

Match the items below by choosing the appropriate code letter :

-A projection of production requirements to meet expected sales.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-A projection of production requirements to meet expected sales.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

Match the items below by choosing the appropriate code letter :

-A set of interrelated budgets that constitute a plan of action for a specified time period

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-A set of interrelated budgets that constitute a plan of action for a specified time period

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

Match the items below by choosing the appropriate code letter :

-An estimate of the quantity and cost of direct materials to be purchased.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

-An estimate of the quantity and cost of direct materials to be purchased.

A)Budget

B)Budgeted financial statements

C)Budget committee

D)Master budget

E)Sales forecast

F)Production budget

G)Cash budget

H)Long-range planning

I)Direct materials budget

J)Sales budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ethics: Ken Clarke is a new production manager. After a great deal of effort, including considerable market research, he completes his budget and submits it to his boss, Diane Jackson. Without even looking at it, she asks him what his 'fudge factor' was, and which items contained the most slack. Ken, very surprised, responds that he doesn't use any 'fudge factor', and that all his figures are honest. Ms Jackson counters by asking him how he would respond if he had to cut about 20% from his budget, as it is. She tells him that most budgets are trimmed in committee, and he had better be ready. She returns the budget to him, and tells him to come back with something reasonable.

-Is it ethical to build slack into a budget? Explain.

-Is it ethical to build slack into a budget? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ethics: Ken Clarke is a new production manager. After a great deal of effort, including considerable market research, he completes his budget and submits it to his boss, Diane Jackson. Without even looking at it, she asks him what his 'fudge factor' was, and which items contained the most slack. Ken, very surprised, responds that he doesn't use any 'fudge factor', and that all his figures are honest. Ms Jackson counters by asking him how he would respond if he had to cut about 20% from his budget, as it is. She tells him that most budgets are trimmed in committee, and he had better be ready. She returns the budget to him, and tells him to come back with something reasonable.

-Was it ethical for Ms Jackson to refuse to accept a budget without slack? Briefly explain.

-Was it ethical for Ms Jackson to refuse to accept a budget without slack? Briefly explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck