Deck 6: Accounting Information Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/142

العب

ملء الشاشة (f)

Deck 6: Accounting Information Systems

1

Most small businesses commence their operations using manual accounting systems.

True

2

A cash payments journal is an example of a general journal.

False

3

The starting point in the development of an accounting system is the implementation stage where systems are installed and made operational.

False

4

After an accounting information system has been implemented the effectiveness of the system can be checked by monitoring it for weaknesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

5

During the analysis stage of development of an accounting information system, the information needs of internal and external users are determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

6

An effective way to process a large number of transactions is to use control accounts and subsidiary ledgers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

7

The accounts receivable subsidiary ledger is also called the creditors ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

8

Detailed data from a control account are summarised in a subsidiary ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

9

A subsidiary ledger is a group of accounts with a common characteristic such as accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

10

A subsidiary ledger is not part of the general ledger and is not used in preparing a trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

11

A schedule of accounts receivable is a list of all accounts and their balances in a debtors' subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a transaction cannot be recorded in a special journal, it is not necessary to record it at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

13

A special journal is used to record similar types of transactions such as all cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

14

Each entry in a credit sales journal results in one entry at selling price and another entry at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

15

The sum of the subsidiary ledger balances must equal the balance in the control account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

16

The recording of small payments in the form of currency is known as 'petty cash'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

17

Entries in a special purchases journal are made from suppliers' invoices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

18

The symbol 'CP1' used as a posting reference indicates that the transaction has been posted from page 1 of the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

19

Special journals for sales, purchases and cash can substantially increase the number of entries that are made in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

20

In a manual accounting system each of the steps in the process is performed by hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

21

When posting special journal entries there must be a dual posting, once to the control account and once to the subsidiary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a computerised accounting system, there are programs for performing journalising and posting of transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a fully integrated accounting system, data are entered into one module must be manually updated in all other integrated modules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

24

Integrated accounting systems are made up of subsystems for functions such as inventory, non-current assets and accounts receivable and payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

25

Electronic spreadsheets are commonly used to develop budgets and calculate depreciation on non-current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a computerised accounting system, transaction posting to ledgers is performed manually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

27

A major advantage of a computerised accounting system is the ability to process numerous transactions quickly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

28

Computerised accounting systems are much more susceptible to human error than are manual accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

29

Computerised accounting systems can be programmed to automatically produce accounting documents including invoices and financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

30

The high cost of computerised accounting systems may make them less accessible to small business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the accounting system is cost-effective, provides useful output and has the flexibility to meet future needs, it can contribute to both individual and organisational goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

32

A major disadvantage of using a computerised accounting system is the need to have people with the skills to operate the system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

33

A subsidiary ledger replaces the need for a general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the balances in the subsidiary ledger are correct then the corresponding balances in the general ledger must also be correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

35

The cash receipts journal is only used to record collections of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

36

The sales journal is only used to record sales of inventory on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements is false?

A) The same basic principles of accounting apply whether the accounting information system is manual or computerised.

B) Generally small entities require much more sophisticated accounting systems than large entities.

C) Cost-effectiveness is a basic principle underpinning efficient and effective accounting information systems.

D) Cost-effectiveness means that the costs of providing information are less than the benefits from use of that information.

A) The same basic principles of accounting apply whether the accounting information system is manual or computerised.

B) Generally small entities require much more sophisticated accounting systems than large entities.

C) Cost-effectiveness is a basic principle underpinning efficient and effective accounting information systems.

D) Cost-effectiveness means that the costs of providing information are less than the benefits from use of that information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is true?

A) The starting point in the development of an accounting system is the implementation stage where systems are installed and made operational.

B) During the analysis stage of development of an accounting information system, the information needs of internal and external users are determined.

C) After an accounting information system has been implemented the effectiveness of the system is assured.

D) None, all the statements are false.

A) The starting point in the development of an accounting system is the implementation stage where systems are installed and made operational.

B) During the analysis stage of development of an accounting information system, the information needs of internal and external users are determined.

C) After an accounting information system has been implemented the effectiveness of the system is assured.

D) None, all the statements are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

39

The principles of effective accounting systems include:

A) conservatism.

B) flexibility.

C) accrual accounting.

D) solvency.

A) conservatism.

B) flexibility.

C) accrual accounting.

D) solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

40

Implementation of an accounting information system requires that:

A) the system is monitored for weaknesses.

B) the information needs of internal users be identified.

C) documents, procedures and processing equipment be installed and made operational.

D) the job descriptions are prepared and the reports are formatted.

A) the system is monitored for weaknesses.

B) the information needs of internal users be identified.

C) documents, procedures and processing equipment be installed and made operational.

D) the job descriptions are prepared and the reports are formatted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

41

Each of the following is a feature of internal control except:

A) limited access to assets.

B) adequate design of documents.

C) authorisation of transactions.

D) independent internal verifications.

A) limited access to assets.

B) adequate design of documents.

C) authorisation of transactions.

D) independent internal verifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

42

Internal controls are concerned with:

A) safeguarding assets.

B) the extent of government regulations.

C) only manual systems of accounting.

D) preparing income tax returns.

A) safeguarding assets.

B) the extent of government regulations.

C) only manual systems of accounting.

D) preparing income tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

43

Related selling activities do not include:

A) shipping the goods.

B) making a sale.

C) ordering the merchandise.

D) billing the customer.

A) shipping the goods.

B) making a sale.

C) ordering the merchandise.

D) billing the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

44

A business handles a large volume of similar transaction data by using:

A) one general ledger.

B) control accounts and subsidiary ledgers.

C) worksheets.

D) financial statements.

A) one general ledger.

B) control accounts and subsidiary ledgers.

C) worksheets.

D) financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

45

The design of an accounting information system requires that:

A) the information needs of external users are identified.

B) the forms and documents are designed and the methods and procedures are selected.

C) the personnel are closely supervised during training.

D) the sources of the data collection are identified.

A) the information needs of external users are identified.

B) the forms and documents are designed and the methods and procedures are selected.

C) the personnel are closely supervised during training.

D) the sources of the data collection are identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not a common example of a subsidiary ledger?

A) Accounts receivable

B) Accounts payable

C) Sales journal

D) Debtors' ledger

A) Accounts receivable

B) Accounts payable

C) Sales journal

D) Debtors' ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

47

The general ledger account that summarises subsidiary ledger data is called a:

A) general account.

B) control account.

C) summary account.

D) temporary account.

A) general account.

B) control account.

C) summary account.

D) temporary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

48

A subsidiary ledger is a group of:

A) financial statements with a common reporting date.

B) worksheets with a common reporting date.

C) ledgers with a common characteristic.

D) accounts with a common characteristic.

A) financial statements with a common reporting date.

B) worksheets with a common reporting date.

C) ledgers with a common characteristic.

D) accounts with a common characteristic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

49

The accounts receivable account control account in the general ledger can also be called the:

A) purchases control account.

B) debtors' control account.

C) creditors' subsidiary ledger.

D) sales control account.

A) purchases control account.

B) debtors' control account.

C) creditors' subsidiary ledger.

D) sales control account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

50

If Supreme Ltd has the following opening account balances for its debtors of: $6,000, $7,000, $4,000; and cash received from debtors during the period amounted to $5,000 and if no additional sales on account were made to the debtors during the period, then the closing balance of the control account for accounts receivable is:

A) $17,000.

B) $12,000.

C) $22,000.

D) $4,000.

A) $17,000.

B) $12,000.

C) $22,000.

D) $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

51

A list of all accounts and their balance in the accounts payable subsidiary ledger is also known as a:

A) trial balance.

B) schedule of creditors.

C) control account.

D) statement of financial position.

A) trial balance.

B) schedule of creditors.

C) control account.

D) statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

52

When control and subsidiary accounts are included in an accounting information system there must be a dual posting, once to the:

A) control account and once to the general journal.

B) control account and once to the subsidiary account.

C) special journal and once to the cash account.

D) general ledger and once to the trial balance.

A) control account and once to the general journal.

B) control account and once to the subsidiary account.

C) special journal and once to the cash account.

D) general ledger and once to the trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

53

The sum of the account balances in a subsidiary ledger must equal the balance in the:

A) general journal.

B) trial balance.

C) special journal.

D) related control account

A) general journal.

B) trial balance.

C) special journal.

D) related control account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

54

A two-column journal that is used to record a variety of different transactions is also known as a:

A) general journal.

B) special journal.

C) final journal.

D) worksheet.

A) general journal.

B) special journal.

C) final journal.

D) worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

55

A sales journal is used for the recording of all:

A) cash received including cash from debtors.

B) cash paid including cash to creditors.

C) purchases of inventory whether for cash or on account.

D) sales of inventory on account.

A) cash received including cash from debtors.

B) cash paid including cash to creditors.

C) purchases of inventory whether for cash or on account.

D) sales of inventory on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not an example of a special purpose journal?

A) Sales journal.

B) Cash receipts journal.

C) Cash payments journal.

D) General journal.

A) Sales journal.

B) Cash receipts journal.

C) Cash payments journal.

D) General journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

57

A cash payments journal is used to record:

A) sales of inventory on account.

B) purchases of inventory on credit.

C) correcting and adjusting entries.

D) all cash paid out including for cash purchases of inventory.

A) sales of inventory on account.

B) purchases of inventory on credit.

C) correcting and adjusting entries.

D) all cash paid out including for cash purchases of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

58

Cash sales of inventory are entered in the:

A) cash payments journal.

B) sales journal.

C) purchases journal.

D) cash receipts journal.

A) cash payments journal.

B) sales journal.

C) purchases journal.

D) cash receipts journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

59

Credit sales of assets other than inventory are recorded in the:

A) general journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

A) general journal.

B) cash receipts journal.

C) sales journal.

D) purchases journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

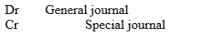

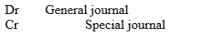

60

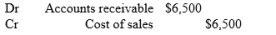

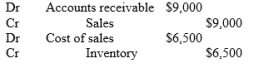

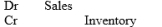

Using a perpetual inventory system, inventory that is sold on account for $9,000 and which had a cost of $6,500 would be recorded using the following entry?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

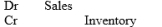

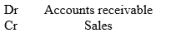

61

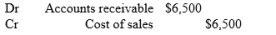

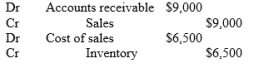

The total of the sales on account column recorded in the sales journal is posted using the following entry:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

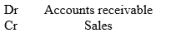

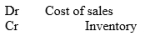

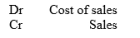

62

The total of the cost of sales on account column recorded in the sales journal, is posted using the following entry:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

63

A cash receipts journal will always include the following column:

A) cash.

B) accrued expenses.

C) unpaid liabilities.

D) depreciation.

A) cash.

B) accrued expenses.

C) unpaid liabilities.

D) depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

64

All receipts of cash are recorded in:

A) the general journal.

B) a cash payments journal.

C) a cash receipts journal.

D) the sales journal.

A) the general journal.

B) a cash payments journal.

C) a cash receipts journal.

D) the sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a cash receipts journal, the amount deducted by a customer for paying within the credit terms is entered in the:

A) cash column.

B) total sales column.

C) bank column.

D) discount allowed column.

A) cash column.

B) total sales column.

C) bank column.

D) discount allowed column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

66

All purchases of inventory are recorded:

A) only in a cash payments journal.

B) in the purchases journal.

C) only in the general journal.

D) directly in the ledger accounts.

A) only in a cash payments journal.

B) in the purchases journal.

C) only in the general journal.

D) directly in the ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

67

Entries in the purchases journal for inventory are made from the following source documents:

A) debtors invoices.

B) cash register receipts.

C) creditors invoices.

D) ledger accounts.

A) debtors invoices.

B) cash register receipts.

C) creditors invoices.

D) ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

68

Credit purchases of equipment or supplies are recorded in the:

A) purchases journal.

B) general journal.

C) cash payments journal.

D) sales journal.

A) purchases journal.

B) general journal.

C) cash payments journal.

D) sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a cash receipts journal the total of the accounts receivable column is posted as a credit to:

A) the cost of sales.

B) the individual customer's accounts.

C) the accounts receivable control account in the general ledger.

D) discount allowed.

A) the cost of sales.

B) the individual customer's accounts.

C) the accounts receivable control account in the general ledger.

D) discount allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following symbols is an appropriate reference to indicate that the postings found in ledger accounts are from page 1 of the purchases journal?

A) CR1

B) CP1

C) GJ1

D) P1

A) CR1

B) CP1

C) GJ1

D) P1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

71

Transactions that cannot be entered in a special journal are:

A) not recorded.

B) recorded in a general journal.

C) deferred until the next reporting period.

D) entered directly into the ledger accounts instead.

A) not recorded.

B) recorded in a general journal.

C) deferred until the next reporting period.

D) entered directly into the ledger accounts instead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

72

Special journals for sales, purchases and cash:

A) significantly increase the number of entries in a general journal.

B) totally eliminate the need for a general journal.

C) substantially reduce the number of entries in the general journal.

D) are only able to be used in a manual accounting information system.

A) significantly increase the number of entries in a general journal.

B) totally eliminate the need for a general journal.

C) substantially reduce the number of entries in the general journal.

D) are only able to be used in a manual accounting information system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

73

In a multicolumn journal, the amounts for debit and credit:

A) must be equal.

B) need not be equal.

C) will always be different.

D) will not be the same.

A) must be equal.

B) need not be equal.

C) will always be different.

D) will not be the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

74

The total amount of a column labelled as 'other' in a cash receipts journal is:

A) posted as a debit.

B) posted as a credit.

C) posted once to the cash account and once to accounts receivable.

D) never posted.

A) posted as a debit.

B) posted as a credit.

C) posted once to the cash account and once to accounts receivable.

D) never posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

75

The amounts recorded in the accounts payable column in a cash payments journal are posted:

A) individually on a daily basis to the subsidiary ledger.

B) individually on a daily basis to the purchases journal.

C) only in total at the end of the reporting period to the income statement.

D) only in total at the end of the reporting period to the statement of financial position.

A) individually on a daily basis to the subsidiary ledger.

B) individually on a daily basis to the purchases journal.

C) only in total at the end of the reporting period to the income statement.

D) only in total at the end of the reporting period to the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

76

Where credit purchases of items other than inventory are numerous which of the following journals is expanded into a multicolumn journal to record the purchases?

A) General journal.

B) Cash payments journal.

C) Purchases journal.

D) Sales journal.

A) General journal.

B) Cash payments journal.

C) Purchases journal.

D) Sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

77

In a computerised accounting information system the steps of journalising, posting and preparing a trial balance are performed:

A) by employees who enter transactions by hand.

B) at low speed by employees.

C) automatically by the computer.

D) manually.

A) by employees who enter transactions by hand.

B) at low speed by employees.

C) automatically by the computer.

D) manually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

78

In a fully integrated accounting information system, data entered into one module:

A) are not automatically updated into other modules within the system.

B) are automatically updated in all other relevant modules.

C) are recorded only as a single entry, either debit or credit.

D) also need to be entered into all other subsystems.

A) are not automatically updated into other modules within the system.

B) are automatically updated in all other relevant modules.

C) are recorded only as a single entry, either debit or credit.

D) also need to be entered into all other subsystems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following would not be regarded as an advantage in an integrated computerised accounting information system?

A) Fast processing time

B) Quick report production

C) Error reduction

D) Slow processing time

A) Fast processing time

B) Quick report production

C) Error reduction

D) Slow processing time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following would be regarded as a disadvantage of an integrated computerised accounting information system?

A) Reduction in processing time

B) Not making full use of the system's capabilities

C) Flexible report production

D) Virtually error-free posting

A) Reduction in processing time

B) Not making full use of the system's capabilities

C) Flexible report production

D) Virtually error-free posting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 142 في هذه المجموعة.

فتح الحزمة

k this deck