Deck 4: Inventories

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 4: Inventories

1

Sales revenue less cost of sales is called:

A) gross profit.

B) profit (loss).

C) operating expense.

D) net sales.

A) gross profit.

B) profit (loss).

C) operating expense.

D) net sales.

gross profit.

2

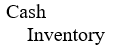

Under a perpetual inventory system, which of the following accounts would be used to record purchases?

A) Sales.

B) Purchases.

C) Cost of sales.

D) Inventory.

A) Sales.

B) Purchases.

C) Cost of sales.

D) Inventory.

Inventory.

3

Billy's Boots purchased inventory with an invoice price of $5,000 and credit terms of 2/10, n/30. What is the net cost of the goods if Billy's Boots pays within the discount period?

A) $5,000.

B) $5,100.

C) $4,800.

D) $4,900.

A) $5,000.

B) $5,100.

C) $4,800.

D) $4,900.

$4,900.

4

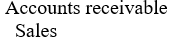

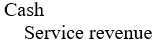

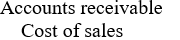

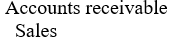

The journal entry to record a credit sale is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Sales returns and allowances account is classified as an:

A) asset account.

B) contra asset account.

C) expense account.

D) contra revenue account.

A) asset account.

B) contra asset account.

C) expense account.

D) contra revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

Expenses that are associated with sales are classified as:

A) financial expenses.

B) other expenses.

C) selling expenses.

D) administrative expenses.

A) financial expenses.

B) other expenses.

C) selling expenses.

D) administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

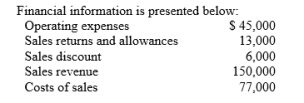

-The amount of net sales on the income statement would be:

A) $131,000.

B) $137,000.

C) $144,000.

D) $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

-The amount of gross profit on the income statement would be:

A) $60,000.

B) $54,000.

C) $76,000.

D) $73,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

The operating expenses to sales ratio is computed by dividing:

A) operating expenses by gross profit.

B) operating expenses by selling expenses.

C) operating expenses by net sales.

D) sales by operating expenses.

A) operating expenses by gross profit.

B) operating expenses by selling expenses.

C) operating expenses by net sales.

D) sales by operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following does not affect the gross profit?

A) Selling products with a lower mark up.

B) An increase in rental of storage space.

C) Being forced to pay higher prices for inventory.

D) Increased competition resulting in having to lower selling prices.

A) Selling products with a lower mark up.

B) An increase in rental of storage space.

C) Being forced to pay higher prices for inventory.

D) Increased competition resulting in having to lower selling prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a retailer makes a sale to a customer, the amount of GST that needs to be remitted to the Australian Taxation Office from the sale is determined by taking the total sale amount including GST and:

A) multiplying by 11.

B) dividing by 11.

C) subtracting 10%.

D) adding 10%.

A) multiplying by 11.

B) dividing by 11.

C) subtracting 10%.

D) adding 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consumers are not required to pay goods and services tax on the following item:

A) luxury motor vehicles.

B) imported textiles.

C) commercial rents.

D) basic foods.

A) luxury motor vehicles.

B) imported textiles.

C) commercial rents.

D) basic foods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

Hammer Hardware sold goods to James Brown on credit at a price of $2,750.00 including GST. What is the correct accounting entry to record this transaction in Hammer Hardware's books?

A) Debit Accounts receivable $2,750; credit Sales $2,750.

B) Debit accounts receivable $2,750; credit Sales $2,500; credit GST collections $250.

C) Debit Accounts receivable $2,500; credit Sales $2,500.

D) Debit Accounts receivable $2,500; debit GST collections $250; credit Sales $2,750.

A) Debit Accounts receivable $2,750; credit Sales $2,750.

B) Debit accounts receivable $2,750; credit Sales $2,500; credit GST collections $250.

C) Debit Accounts receivable $2,500; credit Sales $2,500.

D) Debit Accounts receivable $2,500; debit GST collections $250; credit Sales $2,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the perpetual inventory system what is the correct entry for the credit purchase of 5 washing machines at $300 per washing machine plus GST of $30 each?

A) Debit Inventory $1,650; Credit Accounts payable $1,500, Credit GST $150

B) Debit Inventory $1,650; Credit Accounts payable $1,650

C) Debit Accounts payable $1,650; Credit Inventory $1,500, Credit GST $150

D) Debit Inventory $1,500, Debit GST $150; Credit Accounts payable $1,650

A) Debit Inventory $1,650; Credit Accounts payable $1,500, Credit GST $150

B) Debit Inventory $1,650; Credit Accounts payable $1,650

C) Debit Accounts payable $1,650; Credit Inventory $1,500, Credit GST $150

D) Debit Inventory $1,500, Debit GST $150; Credit Accounts payable $1,650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

Complete the following statements:

-A useful measure for evaluating operating expenses is the ratio of operating expenses to _____________.

-A useful measure for evaluating operating expenses is the ratio of operating expenses to _____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

Complete the following statements:

-A manufacturer acts as a GST collecting agent for the _____________________.

-A manufacturer acts as a GST collecting agent for the _____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

Complete the following statements:

-The amount of goods and services tax collected by a business is recorded in a(n) _____________ account.

-The amount of goods and services tax collected by a business is recorded in a(n) _____________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

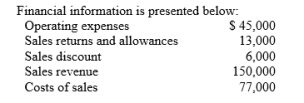

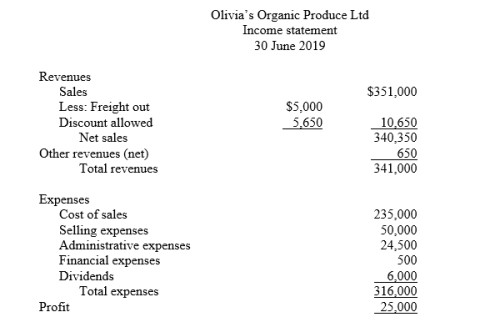

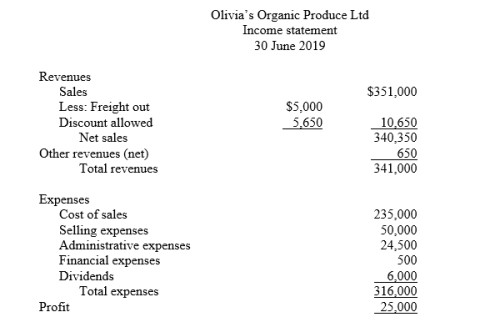

Your friend owns a small business supplying restaurants with fresh, organically grown produce. She prepares her own financial statements and has asked you to review the income statement she prepared for the financial year ended 30 June 2019:

As an experienced accountant, you review the statement and determine the following facts:

As an experienced accountant, you review the statement and determine the following facts:

1. Sales include $5,000 of deposits from customers for future sales orders.

2. Other revenues contain two items: interest expense $2,000 and interest revenue $2,650.

3. Selling expenses consist of sales salaries $38,000; advertising $5,000; depreciation on storage equipment $3,750; and sales commissions expense $3,250.

4. Administrative expenses consist of office salaries $9,500; electricity expense $4,000; rent expense $8,000; and insurance expense $3,500. Insurance expense includes $600 of prepaid insurance.

5. Financial expenses consist of $500 bank charges.

Required: Prepare a corrected fully classified income statement. You do not need to calculate income taxes.

As an experienced accountant, you review the statement and determine the following facts:

As an experienced accountant, you review the statement and determine the following facts:1. Sales include $5,000 of deposits from customers for future sales orders.

2. Other revenues contain two items: interest expense $2,000 and interest revenue $2,650.

3. Selling expenses consist of sales salaries $38,000; advertising $5,000; depreciation on storage equipment $3,750; and sales commissions expense $3,250.

4. Administrative expenses consist of office salaries $9,500; electricity expense $4,000; rent expense $8,000; and insurance expense $3,500. Insurance expense includes $600 of prepaid insurance.

5. Financial expenses consist of $500 bank charges.

Required: Prepare a corrected fully classified income statement. You do not need to calculate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

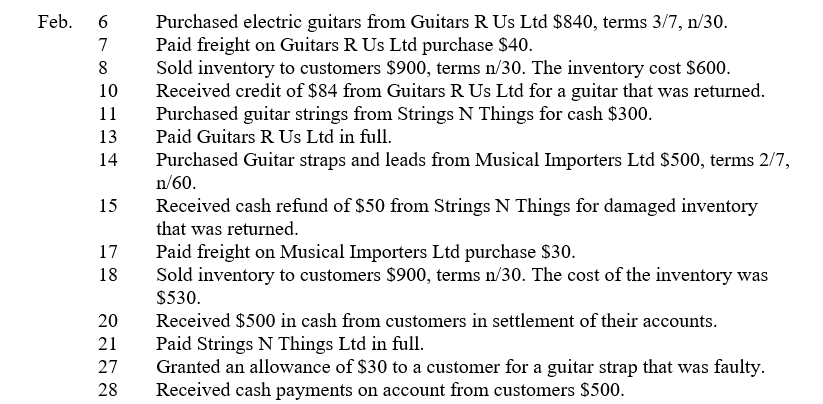

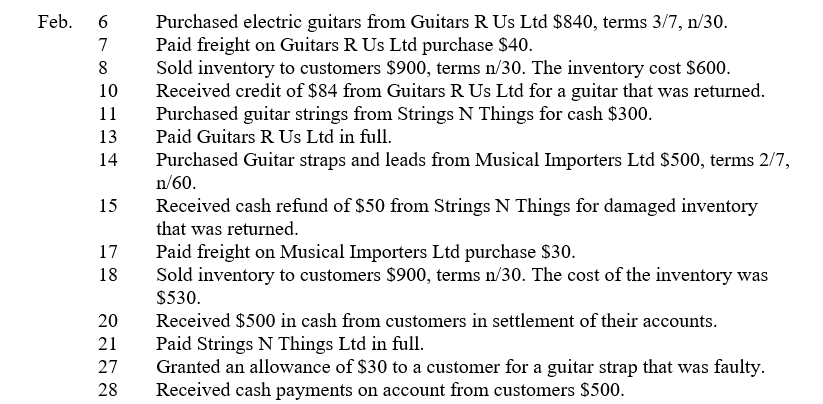

Metal Music Ltd is a retail store specialising in musical instruments and consumables for rock and metal musicians. At the beginning of February 2019, the ledger of Metal Music Ltd showed Cash $2,500; Inventory $1,700; and Share capital $4,200. The following transactions were completed during February:

Required:

Required:

(a) Journalise the February transactions (ignore GST).

(b) Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions.

(c) Prepare a trial balance on 28 February 2019.

(d) Prepare an income statement up to gross profit.

Required:

Required:(a) Journalise the February transactions (ignore GST).

(b) Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions.

(c) Prepare a trial balance on 28 February 2019.

(d) Prepare an income statement up to gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

Match the items below by choosing the appropriate code letter .

-A reduction given by the seller for prompt payment of a credit sale.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-A reduction given by the seller for prompt payment of a credit sale.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

Match the items below by choosing the appropriate code letter .

-Provides evidence of a credit sale.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Provides evidence of a credit sale.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

Match the items below by choosing the appropriate code letter .

-Gross profit divided by net sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Gross profit divided by net sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

Match the items below by choosing the appropriate code letter .

-Sales less sales returns and allowances and cash discounts.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Sales less sales returns and allowances and cash discounts.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

Match the items below by choosing the appropriate code letter .

-These specify the amount of cash discount and the time period during which it is offered.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-These specify the amount of cash discount and the time period during which it is offered.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

Match the items below by choosing the appropriate code letter .

-Net sales less cost of sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Net sales less cost of sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

Match the items below by choosing the appropriate code letter .

-Cost to deliver goods to customers reported as a selling expense.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Cost to deliver goods to customers reported as a selling expense.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

Match the items below by choosing the appropriate code letter .

-Requires a physical count of goods on hand to compute cost of sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-Requires a physical count of goods on hand to compute cost of sales.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

Match the items below by choosing the appropriate code letter .

-A cash discount claimed by a buyer for prompt payment of a balance due.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-A cash discount claimed by a buyer for prompt payment of a balance due.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

Match the items below by choosing the appropriate code letter .

-An account that is offset against a revenue account on the income statement.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-An account that is offset against a revenue account on the income statement.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

Match the items below by choosing the appropriate code letter .

-A credit received by registered suppliers for all the GST paid on goods purchased.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-A credit received by registered suppliers for all the GST paid on goods purchased.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

Match the items below by choosing the appropriate code letter .

-A report used to provide GST information to the Australian Taxation Office.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

-A report used to provide GST information to the Australian Taxation Office.

A) Net sales

B) Cash discount

C) Credit terms

D) Periodic inventory system

E) Gross profit ratio

F) Contra revenue

G) Freight-out

H) Gross profit

I) Sales invoice

J) Business activity statement

K) Input tax credit

L) Purchase discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

The gross profit is generally considered to be more informative than the gross profit amount when expressing the relationship between gross profit and net sales. Provide the gross profit ratio, and briefly explain why it is considered more informative than the amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

The goods and services tax is commonly described as a broad-based tax. Explain the meaning of the term 'broad-based' tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

Ethics: Glasco Ltd manufactures electronic components for use in many consumer products. Their raw materials are purchased literally from all over the world. Depending on the country involved, purchase terms vary widely. Some suppliers, for example, require full prepayment, while others are content to receive payment within six months of receipt of the goods.

Because of this situation, Glasco never closes its books until at least ten days after month end. In this way, it can sort out ownership of goods in transit, and document which goods were received by month end, and which were not.

Annie Reilly, a new accountant, was asked to record about $50,000 in inventory as having been received before month end. She argued that the shipping documents clearly showed that the goods were actually received on the 8th of the current month. Her boss, busy with month end reports, curtly tells Annie to check the shipping terms. She did so, and found the notation 'FOB (free on board) shipper's dock' on the document. She hadn't seen that particular notation before, but she reasoned that if the selling company considered it shipped when it reached their dock, Glasco should consider it received when it reached Glasco's dock. She did not record the sale until after month end.

Required:

(a) Why are accountants concerned with the timing in the recording of purchases?

(b) Was there a violation of ethical standards here? Explain.

Because of this situation, Glasco never closes its books until at least ten days after month end. In this way, it can sort out ownership of goods in transit, and document which goods were received by month end, and which were not.

Annie Reilly, a new accountant, was asked to record about $50,000 in inventory as having been received before month end. She argued that the shipping documents clearly showed that the goods were actually received on the 8th of the current month. Her boss, busy with month end reports, curtly tells Annie to check the shipping terms. She did so, and found the notation 'FOB (free on board) shipper's dock' on the document. She hadn't seen that particular notation before, but she reasoned that if the selling company considered it shipped when it reached their dock, Glasco should consider it received when it reached Glasco's dock. She did not record the sale until after month end.

Required:

(a) Why are accountants concerned with the timing in the recording of purchases?

(b) Was there a violation of ethical standards here? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

Communication: Jacqui Marx and Melissa Clark, two salespersons in adjoining territories, regularly compete for bonuses. During the last month, their dollar volume of sales, on which the bonuses are based, was nearly equal. On the last day of the month, both made a large sale. Both orders were shipped on the last day of the month and both were received by the customer on the fifth day of the following month. Jacqui's sale was FOB shipping point (ownership passes to buyer at time of shipping), and Melissa's was FOB destination (ownership passes to buyer at time of receipt). The company 'counts' sales for purposes of calculating bonuses on the date that ownership passes to the purchaser. Jacqui's sale was therefore counted in her monthly total of sales, Melissa's was not. Melissa is quite upset. She has asked you to just include it, or to take Jacqui's off as well. She also has told you that you are being unethical for allowing Jacqui to get a bonus just for choosing a particular shipping method.

Write a memo to Melissa. Explain your position.

Write a memo to Melissa. Explain your position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck