Deck 14: International Short-Term Financing and Investment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 14: International Short-Term Financing and Investment

1

A multinational business firm with international subsidiaries can utilise internal financing by:

A) requesting a transfer of surplus funds from one of its subsidiaries.

B) arranging a parallel loan with one of its subsidiaries.

C) increasing markups on supplies sent to subsidiaries with surplus funds.

D) both requesting a transfer of surplus funds from one of its subsidiaries and increasing markups on supplies sent to subsidiaries with surplus funds.

A) requesting a transfer of surplus funds from one of its subsidiaries.

B) arranging a parallel loan with one of its subsidiaries.

C) increasing markups on supplies sent to subsidiaries with surplus funds.

D) both requesting a transfer of surplus funds from one of its subsidiaries and increasing markups on supplies sent to subsidiaries with surplus funds.

both requesting a transfer of surplus funds from one of its subsidiaries and increasing markups on supplies sent to subsidiaries with surplus funds.

2

Which of the following is not a means of raising short-term funds in the Eurocurrency market?

A) Eurocurrency lines of credit.

B) Eurocurrency revolving commitments.

C) Note issuance facilities.

D) Treasury bills.

A) Eurocurrency lines of credit.

B) Eurocurrency revolving commitments.

C) Note issuance facilities.

D) Treasury bills.

Treasury bills.

3

Which of the following is a means of raising short-term funds in the Eurocurrency market?

A) Domestic bank lines of credit.

B) Treasury bonds.

C) Note issuance facilities.

D) Treasury bills.

A) Domestic bank lines of credit.

B) Treasury bonds.

C) Note issuance facilities.

D) Treasury bills.

Note issuance facilities.

4

Business firms resort to foreign currency financing because:

A) it reduces the volatility of the cost of borrowing.

B) it may be cheaper than domestic currency financing.

C) it eliminates long foreign exchange exposures.

D) all of the given answers.

A) it reduces the volatility of the cost of borrowing.

B) it may be cheaper than domestic currency financing.

C) it eliminates long foreign exchange exposures.

D) all of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

An appreciation of a foreign currency makes the effective financing rate in this currency:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

A depreciation of a foreign currency makes the effective financing rate in this currency:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

An appreciation of the domestic currency makes the effective financing rate in the foreign currency against which it has appreciated:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

A depreciation of the domestic currency makes the effective financing rate in the foreign currency against which it has depreciated:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

An increase in the bid-offer spread in the exchange rate leads to:

A) a decline in the effective financing rate.

B) an increase in the effective financing rate.

C) no change in the effective financing rate.

D) anything, depending on other factors.

A) a decline in the effective financing rate.

B) an increase in the effective financing rate.

C) no change in the effective financing rate.

D) anything, depending on other factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

A decrease in the bid-offer spread in the exchange rate leads to:

A) a decline in the effective financing rate.

B) an increase in the effective financing rate.

C) no change in the effective financing rate.

D) anything, depending on other factors.

A) a decline in the effective financing rate.

B) an increase in the effective financing rate.

C) no change in the effective financing rate.

D) anything, depending on other factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

Domestic currency financing is more desirable to foreign currency financing when:

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the spot rate is smaller than the interest differential.

D) CIP holds but UIP is violated in either direction.

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the spot rate is smaller than the interest differential.

D) CIP holds but UIP is violated in either direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

Foreign currency financing is more desirable to domestic currency financing when:

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the spot rate is larger than the interest differential.

D) UIP holds but CIP is violated in either direction.

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the spot rate is larger than the interest differential.

D) UIP holds but CIP is violated in either direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

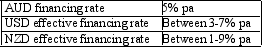

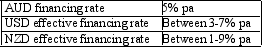

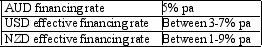

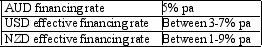

If the firm chooses Australian dollar financing then it is: An Australian firm is faced with the following financing alternatives:

A) risk averse.

B) risk neutral.

C) risk seeker.

D) any of the given answers, depending on the circumstances.

A) risk averse.

B) risk neutral.

C) risk seeker.

D) any of the given answers, depending on the circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

If the firm chooses NZ dollar financing then it is: An Australian firm is faced with the following financing alternatives:

A) risk averse.

B) risk neutral.

C) risk seeker.

D) Either risk neutral or a risk seeker.

A) risk averse.

B) risk neutral.

C) risk seeker.

D) Either risk neutral or a risk seeker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

It is possible to lock in a lower cost by financing in a low interest rate foreign currency if the firm has:

A) no other cash flows in the same currency.

B) future cash outflows in the same currency.

C) offsetting cash inflows and outflows in the base currency.

D) future cash inflows in the same currency.

A) no other cash flows in the same currency.

B) future cash outflows in the same currency.

C) offsetting cash inflows and outflows in the base currency.

D) future cash inflows in the same currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

When an Australian firm borrows a foreign currency in which it has no offsetting position, the effective financing rate will be higher than the:

A) foreign interest rate if the currency appreciates.

B) foreign interest rate if the currency depreciates.

C) domestic interest rate if the currency depreciates.

D) domestic interest rate if the currency appreciates.

A) foreign interest rate if the currency appreciates.

B) foreign interest rate if the currency depreciates.

C) domestic interest rate if the currency depreciates.

D) domestic interest rate if the currency appreciates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

When an Australian firm borrows a foreign currency in which it has no offsetting position, the effective financing rate will be lower than the:

A) foreign interest rate if the currency appreciates.

B) foreign interest rate if the currency depreciates.

C) domestic interest rate if the currency depreciates.

D) domestic interest rate if the currency appreciates.

A) foreign interest rate if the currency appreciates.

B) foreign interest rate if the currency depreciates.

C) domestic interest rate if the currency depreciates.

D) domestic interest rate if the currency appreciates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

The effective financing rate is the foreign nominal interest rate adjusted for:

A) inflation.

B) changes in the spot exchange rate.

C) the forward spread.

D) changes in the forward rate.

A) inflation.

B) changes in the spot exchange rate.

C) the forward spread.

D) changes in the forward rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

A negative effective financing rate implies that:

A) a loss will be incurred on the project financed with the borrowed funds.

B) the borrower paid more interest than would have been paid in the case of domestic currency financing.

C) the borrower will not be able to repay the loan.

D) the gains on the foreign exchange transaction more than offset the cost of borrowing at the foreign rate of interest.

A) a loss will be incurred on the project financed with the borrowed funds.

B) the borrower paid more interest than would have been paid in the case of domestic currency financing.

C) the borrower will not be able to repay the loan.

D) the gains on the foreign exchange transaction more than offset the cost of borrowing at the foreign rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

'Placement of funds' means:

A) lending.

B) depositing.

C) investing.

D) all of the given answers.

A) lending.

B) depositing.

C) investing.

D) all of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

A CD is:

A) a commercial deposit.

B) a compact disc.

C) some kind of negotiable deposit.

D) a commercial document.

A) a commercial deposit.

B) a compact disc.

C) some kind of negotiable deposit.

D) a commercial document.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

CDs are more appealing to investors than time deposits because they:

A) are the liabilities of low-risk financial institutions.

B) are negotiable.

C) are the liabilities of NBFIs.

D) have shorter maturities.

A) are the liabilities of low-risk financial institutions.

B) are negotiable.

C) are the liabilities of NBFIs.

D) have shorter maturities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a kind of CD?

A) Tap CD

B) Fixed CD

C) Tranche CD

D) Rollover CD

A) Tap CD

B) Fixed CD

C) Tranche CD

D) Rollover CD

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

The effective rate of return on a foreign currency investment is the nominal foreign interest rate adjusted for:

A) foreign inflation.

B) forward spread.

C) the change in the exchange rate.

D) the inflation differential.

A) foreign inflation.

B) forward spread.

C) the change in the exchange rate.

D) the inflation differential.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

The effective rate of return on a domestic currency investment is the nominal domestic interest rate adjusted for:

A) foreign inflation.

B) forward spread.

C) the change in the exchange rate.

D) none of the given answers.

A) foreign inflation.

B) forward spread.

C) the change in the exchange rate.

D) none of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

An appreciation of a foreign currency makes the effective rate of return on this currency:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

A depreciation of a foreign currency makes the effective rate of return on this currency:

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

A) higher than the domestic interest rate.

B) lower than the domestic interest rate.

C) lower than the foreign interest rate.

D) higher than the foreign interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

An increase in the bid-offer spread in the exchange rate leads to:

A) a decline in the effective rate of return.

B) an increase in the effective rate of return.

C) no change in the effective rate of return.

D) anything, depending on other factors.

A) a decline in the effective rate of return.

B) an increase in the effective rate of return.

C) no change in the effective rate of return.

D) anything, depending on other factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

A decrease in the bid-offer spread in the exchange rate leads to:

A) a decline in the effective rate of return.

B) an increase in the effective rate of return.

C) no change in the effective rate of return.

D) anything, depending on other factors.

A) a decline in the effective rate of return.

B) an increase in the effective rate of return.

C) no change in the effective rate of return.

D) anything, depending on other factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

Foreign currency investment is more desirable when:

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the exchange rate is smaller than the interest differential.

D) CIP holds but UIP is violated in either direction.

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential.

C) UIP is violated such that the expected change in the exchange rate is smaller than the interest differential.

D) CIP holds but UIP is violated in either direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

Domestic currency investment is more desirable when:

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential

C) UIP is violated such that the expected change in the exchange rate is larger than the interest differential.

D) CIP holds but UIP is violated in either direction.

A) CIP is violated such that the forward spread is larger than the interest differential.

B) CIP is violated such that the forward spread is smaller than the interest differential

C) UIP is violated such that the expected change in the exchange rate is larger than the interest differential.

D) CIP holds but UIP is violated in either direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not an advantage of centralised cash management?

A) Diversification

B) Pooling.

C) Hedging.

D) Netting.

A) Diversification

B) Pooling.

C) Hedging.

D) Netting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following are advantages of decentralised cash management?

A) Overcoming difficulties associated with the transfer of funds to countries with inefficient banking systems.

B) Local currency diversification.

C) Boosting local representation.

D) Both overcoming difficulties associated with the transfer of funds to countries with inefficient . banking systems and boosting local representation.

A) Overcoming difficulties associated with the transfer of funds to countries with inefficient banking systems.

B) Local currency diversification.

C) Boosting local representation.

D) Both overcoming difficulties associated with the transfer of funds to countries with inefficient . banking systems and boosting local representation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under decentralised cash management, funds denominated in a particular currency are kept in the same currency if:

A) UIP holds.

B) political risk is high.

C) no forward market in the underlying currency exists.

D) a futures market in the underlying currency exists.

A) UIP holds.

B) political risk is high.

C) no forward market in the underlying currency exists.

D) a futures market in the underlying currency exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume that there are several foreign currencies offering higher interest rates than the Australian dollar. An Australian firm has a higher probability of generating a higher effective rate of return on a portfolio of currencies than on the domestic interest rate if the exchange rates between the Australian dollar and the foreign currencies are:

A) highly correlated.

B) perfectly positively correlated.

C) weakly correlated.

D) none of the given answers.

A) highly correlated.

B) perfectly positively correlated.

C) weakly correlated.

D) none of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

An Australian firm borrowed USD100 000 for a year. U.S. interest rates were 1.25/1.75%. The AUD/ USD rate at the time of borrowing was 1.5400/600 and at maturity was expected to be 1.8624/864. Calculate the effective financing rate.

A) +1.75% pa

B) +21.47% pa

C) +24.02% pa

D) +22.49% pa

A) +1.75% pa

B) +21.47% pa

C) +24.02% pa

D) +22.49% pa

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

37

An Australian company wishes to invest AUD100 000 surplus cash for three months. Three-month interest rates in the U.S. are 1.00% pa, the AUD/USD spot rate is 0.6600 and the estimated spot rate at maturity is 0.6700. What is the estimated rate of return per annum?

A) 2.53% pa

B) 1.77% pa

C) 7.08% pa

D) 1.00% pa

A) 2.53% pa

B) 1.77% pa

C) 7.08% pa

D) 1.00% pa

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

An Australian firm borrowed USD100 000 for a year. U.S. interest rates were 0.5%. The AUD/USD rate at the time of borrowing was 1.1000 and at maturity was expected to be 1.2000. Calculate the effective financing rate.

A) +92.63% pa

B) +10.10% pa

C) +1.10% pa

D) +9.64% pa

A) +92.63% pa

B) +10.10% pa

C) +1.10% pa

D) +9.64% pa

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

An Australian firm wishes to invest USD100 000 for a year. U.S. interest rates are 0.5%. The AUD/ USD rate at the time of the investment is 1.1000 and at maturity is expected to be 1.2000. Calculate the effective financing rate.

A) +92.63% pa

B) +10.10% pa

C) +1.10% pa

D) +9.64% pa

A) +92.63% pa

B) +10.10% pa

C) +1.10% pa

D) +9.64% pa

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck