Deck 1: Payroll Administration

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/21

العب

ملء الشاشة (f)

Deck 1: Payroll Administration

1

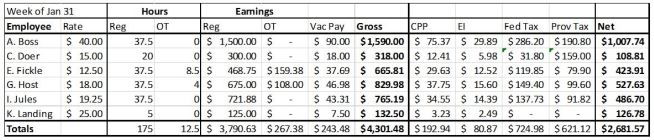

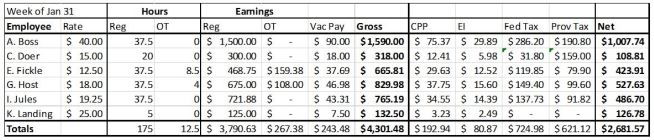

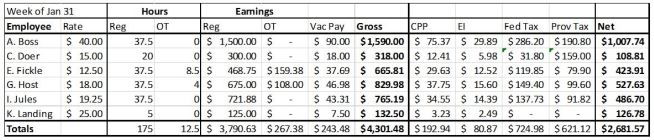

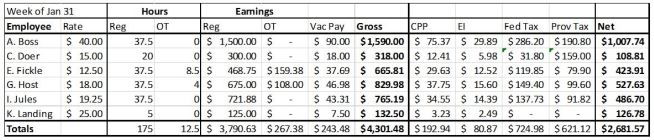

Here is a sample Payroll Register for a weekly payroll of an Ontario company:

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.

-Assuming this company uses direct deposit, how much money will need to be deposited to pay all of the employees what they are owed for this pay cycle?

A) $1,007.74

B) $3,790.63

C) $1,619.91

D) $4,301.48

E) $2,681.57

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.-Assuming this company uses direct deposit, how much money will need to be deposited to pay all of the employees what they are owed for this pay cycle?

A) $1,007.74

B) $3,790.63

C) $1,619.91

D) $4,301.48

E) $2,681.57

$2,681.57

2

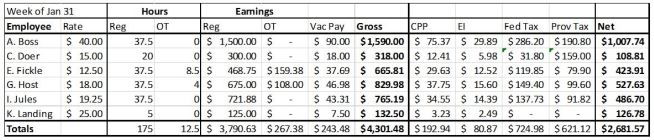

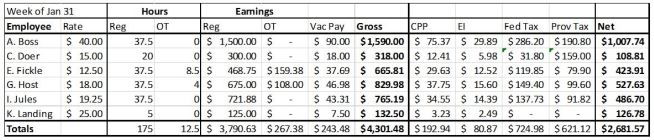

Here is a sample Payroll Register for a weekly payroll of an Ontario company:

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.

-How much will C. Doer have deposited into her bank account for this pay cycle?

A) $108.81

B) $159.00

C) $423.91

D) $318.00

E) $300.00

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.-How much will C. Doer have deposited into her bank account for this pay cycle?

A) $108.81

B) $159.00

C) $423.91

D) $318.00

E) $300.00

$108.81

3

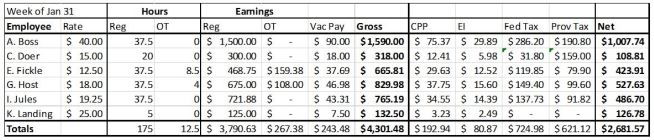

Here is a sample Payroll Register for a weekly payroll of an Ontario company:

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.

-How much does K. Landing earn per hour?

A) $15.00

B) $40.00

C) $25.00

D) $19.25

E) $12.50

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.-How much does K. Landing earn per hour?

A) $15.00

B) $40.00

C) $25.00

D) $19.25

E) $12.50

$25.00

4

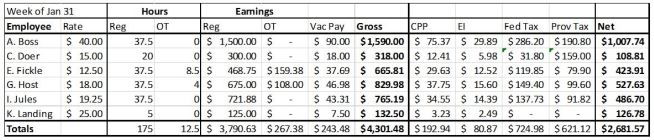

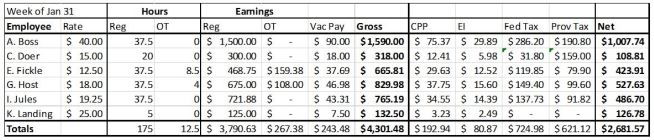

Here is a sample Payroll Register for a weekly payroll of an Ontario company:

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.

-How much will the company owe for the employer portion of Employment Insurance premiums for this pay cycle?

A) $192.94

B) $194.09

C) $385.88

D) $80.87

E) $113.22

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.-How much will the company owe for the employer portion of Employment Insurance premiums for this pay cycle?

A) $192.94

B) $194.09

C) $385.88

D) $80.87

E) $113.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

5

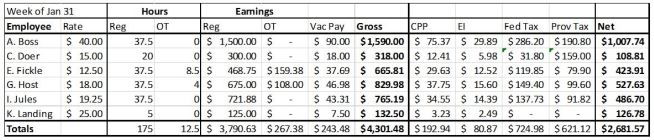

Here is a sample Payroll Register for a weekly payroll of an Ontario company:

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.

-How much will the company owe for the employer portion of Canada Pension Plan deductions for this pay cycle?

A) $192.94

B) $194.09

C) $385.88

D) $80.87

E) $113.22

Use the information in this table to answer the following questions.

Use the information in this table to answer the following questions.-How much will the company owe for the employer portion of Canada Pension Plan deductions for this pay cycle?

A) $192.94

B) $194.09

C) $385.88

D) $80.87

E) $113.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

6

Employees in Quebec contribute to the Quebec Pension Plan at a rate of _.

A) 5.25%

B) 1.88%

C) 4.95%

D) 0.559%

E) 1.54%

A) 5.25%

B) 1.88%

C) 4.95%

D) 0.559%

E) 1.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

7

Employees in Quebec contribute Employment Insurance premiums at a rate of ________.

A) 5.25%

B) 0.559%

C) 4.95%

D) 1.88%

E) 1.54%

A) 5.25%

B) 0.559%

C) 4.95%

D) 1.88%

E) 1.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

8

An employee earns $55,000 per year and is paid on a semi-monthly pay schedule. The employee enjoys the benefit of a company paid cell phone for personal use (cost is $150 per month) and receives 6% vacation pay on each payment. This pay cycle included 15 hours of approved overtime worked over the normal 40 hour work week and a reimbursement for travel expenses in the amount of $434.20. The employee contributes 5% of their regular wages to a Registered Retirement Savings Plan each pay cycle.

-Calculate the Gross Earnings.

-Calculate the Gross Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

9

Name the 3 Statutory Deductions in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

10

What steps are recommended when a Garnishment Order is received by the employer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

11

What should be acknowledged in the employee written permission for employer optional deductions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

12

List 3 examples of employer optional deductions that may be authorized by the employer for the employee's benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

13

List the order of priority of deductions for an employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the amount of the exemption for Canada Pension Plan applied to a semi-monthly pay cycle?

A) $134.61

B) $66.03

C) $3500.00

D) $67.30

E) $145.83

A) $134.61

B) $66.03

C) $3500.00

D) $67.30

E) $145.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the amount of the exemption for Canada Pension Plan applied to a weekly pay cycle?

A) $66.03

B) $145.83

C) $3500.00

D) $67.30

E) $134.61

A) $66.03

B) $145.83

C) $3500.00

D) $67.30

E) $134.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is the amount of the exemption for Employment Insurance applied to a semi-monthly pay cycle?

A) $145.83

B) $134.61

C) $66.03

D) $67.30

E) $0.00

A) $145.83

B) $134.61

C) $66.03

D) $67.30

E) $0.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the Canada Pension Plan deduction for an employee is $57.45 for the pay cycle, how much must the employer pay for the same period?

A) $28.73

B) $0.00

C) $57.45

D) $114.90

E) $80.43

A) $28.73

B) $0.00

C) $57.45

D) $114.90

E) $80.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the Employment Insurance deduction for an employee is $57.45 for the pay cycle, how much must the employer pay for the same period?

A) $28.73

B) $57.45

C) $0.00

D) $80.43

E) $114.90

A) $28.73

B) $57.45

C) $0.00

D) $80.43

E) $114.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

19

If an employee earns a salary of $58,500 per year, their weekly pay cycle salary would be:

A) $562.50

B) $4,875.00

C) $1,125.00

D) $2,437.50

E) $2,250.00

A) $562.50

B) $4,875.00

C) $1,125.00

D) $2,437.50

E) $2,250.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

20

If an employee earns a salary of $58,500 per year, their semi-monthly pay cycle salary would be:

A) $2,437.50

B) $1,125.00

C) $562.50

D) $2,250.00

E) $4,875.00

A) $2,437.50

B) $1,125.00

C) $562.50

D) $2,250.00

E) $4,875.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

21

If Mary earns $260,000 per year how much does she earn per week?

A) $10,000

B) $2,500

C) $5,000

D) $6,000

E) $260,000

A) $10,000

B) $2,500

C) $5,000

D) $6,000

E) $260,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck