Deck 16: Bad Debts and Provisions for Bad Debts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 16: Bad Debts and Provisions for Bad Debts

1

An increase in the provision for doubtful debts results in

A) A decrease in current liabilities.

B) An increase in net profit.

C) An increase in working capital.

D) A decrease in working capital.

A) A decrease in current liabilities.

B) An increase in net profit.

C) An increase in working capital.

D) A decrease in working capital.

A decrease in working capital.

2

Which of the following statements about trade receivables, bad debts and provisions for bad debts is incorrect?

A) Trade receivables usually appear as a current asset in the statement of financial position

B) Provisions for bad debts usually have a debit balance in the ledger

C) The bad debts account usually has a debit balance in the ledger

D) An increase in the provision for bad debts account will reduce the profit of the entity.

A) Trade receivables usually appear as a current asset in the statement of financial position

B) Provisions for bad debts usually have a debit balance in the ledger

C) The bad debts account usually has a debit balance in the ledger

D) An increase in the provision for bad debts account will reduce the profit of the entity.

Provisions for bad debts usually have a debit balance in the ledger

3

Increases in the provision for doubtful debts will affect the income statement as follows:

A) The income statement will be credited with the movement and the amount will appear under expenses

B) The income statement will be debited with the movement and the amount will appear under expenses

C) The income statement will be credited with the new balance on the provision for doubtful debts account under expenses

D) The income statement will be debited with the new balance on the provision for doubtful debts account under expenses

A) The income statement will be credited with the movement and the amount will appear under expenses

B) The income statement will be debited with the movement and the amount will appear under expenses

C) The income statement will be credited with the new balance on the provision for doubtful debts account under expenses

D) The income statement will be debited with the new balance on the provision for doubtful debts account under expenses

The income statement will be debited with the movement and the amount will appear under expenses

4

Entities make provision for bad debts in order to:

A) Avoid having any bad debts

B) Get their credit customers to pay more quickly

C) Keep the trade receivables figure approximately the same value each year

D) Obtain a 'true and fair' trade receivables figure for the statement of financial position.

A) Avoid having any bad debts

B) Get their credit customers to pay more quickly

C) Keep the trade receivables figure approximately the same value each year

D) Obtain a 'true and fair' trade receivables figure for the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

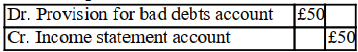

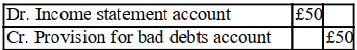

5

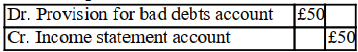

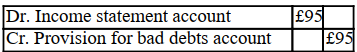

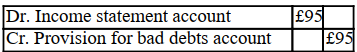

To make a provision for bad debts the correct procedure is to:

A) Dr. Provision for bad debts account Cr. Bad debts account

B) Dr. Trade receivables account Cr. Provision for bad debts account

C) Dr Provision for bad debts account Cr. Income statement account

D) Dr. Income statement account Cr. Provision for bad debts account

A) Dr. Provision for bad debts account Cr. Bad debts account

B) Dr. Trade receivables account Cr. Provision for bad debts account

C) Dr Provision for bad debts account Cr. Income statement account

D) Dr. Income statement account Cr. Provision for bad debts account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

A company has been informed that a credit customer has just been declared bankrupt. The balance on his account was £1,000. Which of the following is the correct double entry?

A) Dr. Bad debts a/c £1,000.

B) Cr. Trade receivables a/c £1,000

C) Dr. Trade receivables a/c £1,000.

D) Cr. Bad debts a/c £1,000

E) Dr. Provision for doubtful debts a/c £1,000

F) Cr. Trade receivables a/c £1,000 .

G) Dr. Trade receivables a/c £1,000 .

H) Cr. Provision for doubtful debts a/c £1,000.

A) Dr. Bad debts a/c £1,000.

B) Cr. Trade receivables a/c £1,000

C) Dr. Trade receivables a/c £1,000.

D) Cr. Bad debts a/c £1,000

E) Dr. Provision for doubtful debts a/c £1,000

F) Cr. Trade receivables a/c £1,000 .

G) Dr. Trade receivables a/c £1,000 .

H) Cr. Provision for doubtful debts a/c £1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

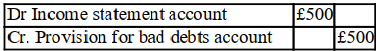

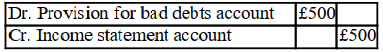

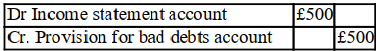

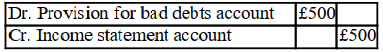

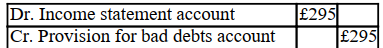

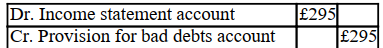

7

The entity has trade receivables of £5,000 and a provision for bad debts of £450. The entity wishes to increase its provision to 10% of the trade receivables. The correct procedure would be to:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

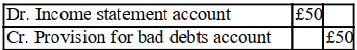

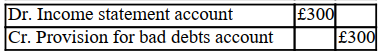

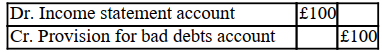

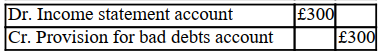

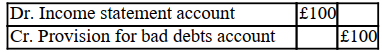

8

On 31 December the following balances existed in an entity's books. Trade receivables £3,000, bad debts written off £50, provision for bad debts £200. The entity requires a provision for bad debts to be made of 10% of the trade receivables. It should:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

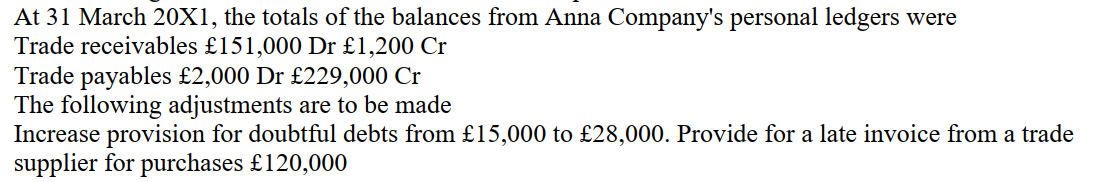

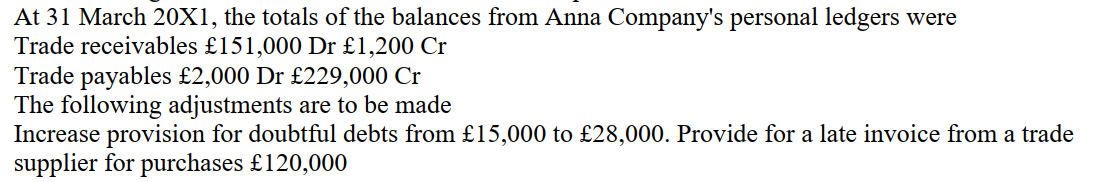

-In Anna Company's statement of financial position at 31 March 20X1 net trade receivables should be:

A) £121,800

B) £125,000

C) £136,800

D) £153,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

-In Anna Company's statement of financial position at 31 March 20X1 net trade payables should be:

A) £147,000

B) £349,000

C) £350,200

D) £107,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a bad debt recovered is not adjusted for:

A) Profits are overstated and current assets are overstated

B) Profits are overstated and current assets are understated

C) Profits are understated and current assets are overstated

D) Profits are understated and current assets are understated.

A) Profits are overstated and current assets are overstated

B) Profits are overstated and current assets are understated

C) Profits are understated and current assets are overstated

D) Profits are understated and current assets are understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

A company has been informed that a credit customer has just been declared bankrupt, though it is probable that the customer's trade payables will get 50p for every pound outstanding, when the assets of his business are sold. The balance on his account was £1,000. Which of the following is the correct double entry to deal with this information?

A) Dr. Bad debts a/c £1000

B) Cr. Trade receivables a/c £1,000.

C) Dr. Bad debts a/c £500

D) Cr. Trade receivables a/c £500

E) Dr. Provision for doubtful debts a/c £1,000

F) Cr. Trade receivables a/c £1,000

G) Dr. Provision for doubtful debts a/c £500

H) Cr. Trade receivables a/c £500.

A) Dr. Bad debts a/c £1000

B) Cr. Trade receivables a/c £1,000.

C) Dr. Bad debts a/c £500

D) Cr. Trade receivables a/c £500

E) Dr. Provision for doubtful debts a/c £1,000

F) Cr. Trade receivables a/c £1,000

G) Dr. Provision for doubtful debts a/c £500

H) Cr. Trade receivables a/c £500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

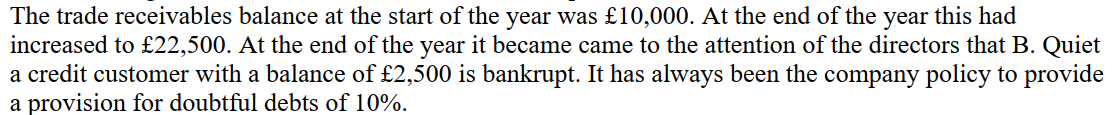

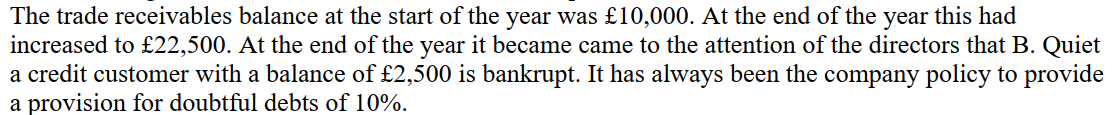

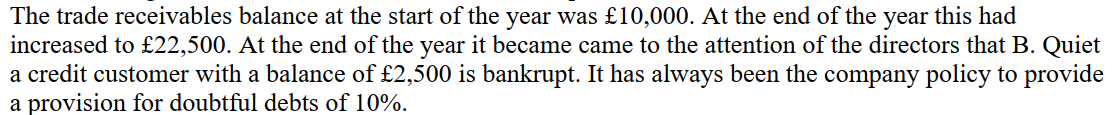

-What will the balance on the provision for doubtful debts and the bad debts accounts be at the end of the year?

A) Provision for doubtful debts £4,750;

B) Bad debts £0

C) Provision for doubtful debts £4,750

D) Bad debts £0 .

E) Provision for doubtful debts £2,250

F) Bad debts £2,500.

G) Provision for doubtful debts £2,000;

H) Bad debts £2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

-Which of the following is the correct entry to the income statement account in respect of bad and doubtful debts for the period?

A) Increase in provision for doubtful debts £4,750; bad debts £0

B) Increase in provision for doubtful debts £2,250; bad debts £2,500

C) Increase in provision for doubtful debts £1,250; bad debts £2,500

D) Increase in provision for doubtful debts £1,000; bad debts £2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

- What is the balance in the sales ledger at the end of the year?

A) £18,000

B) £17,750

C) £18,750

D) £20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

The balance on an entity's sales ledger control account is £36,000. It is company policy to maintain a provision for bad debts of 10% of trade receivable balances in addition to any specific amounts that are noted. You are told that two credit customers (Alfie who has a balance owing of £1,500 and Wilfred who has a balance owing of £2,500) are experiencing financial difficulties due to the recession.

Given this information what will the balance on the provision for doubtful debts be at the end of the year?

A) £3,600

B) £4,000

C) £7,200

D) £7,600

Given this information what will the balance on the provision for doubtful debts be at the end of the year?

A) £3,600

B) £4,000

C) £7,200

D) £7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck