Deck 10: The Balancing of Accounts and the Trial Balance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 10: The Balancing of Accounts and the Trial Balance

1

When preparing financial statements, the bad debts account is closed by a transfer to:

A) The statement of financial position

B) The income statement

C) The trading account

D) The provision for bad debts account

A) The statement of financial position

B) The income statement

C) The trading account

D) The provision for bad debts account

The income statement

2

The main purpose of a trial balance is to:

A) Help balance the bank account

B) Help check the arithmetical accuracy of the double entry

C) Help check the bank account with the bank statement

D) Check the accuracy of the books of original entry

A) Help balance the bank account

B) Help check the arithmetical accuracy of the double entry

C) Help check the bank account with the bank statement

D) Check the accuracy of the books of original entry

Help check the arithmetical accuracy of the double entry

3

Which of the following items appear on the same side of the trial balance?

A) Motor vehicles and motor vehicle expenses

B) Fixtures and fittings and capital introduced

C) Drawings and income

D) Purchase returns and property

A) Motor vehicles and motor vehicle expenses

B) Fixtures and fittings and capital introduced

C) Drawings and income

D) Purchase returns and property

Motor vehicles and motor vehicle expenses

4

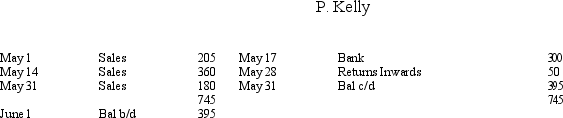

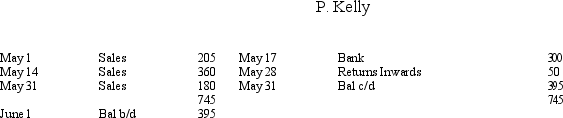

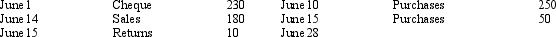

What is the balance brought down on the following account on 31 May?-P. Kelly

A) £380 debit

B) £395 credit

C) £395 debit

D) None of the above

A) £380 debit

B) £395 credit

C) £395 debit

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following errors will cause the trial balance to disagree?

A) Posting stationery purchases to the fixtures and fittings account

B) Posting £100 received from A. Glen to A. Glean's account

C) Casting the motor vehicles expense account incorrectly when extracting the trial balance

D) Debiting £100 received to the sales account and crediting the Bank account with the £100.

A) Posting stationery purchases to the fixtures and fittings account

B) Posting £100 received from A. Glen to A. Glean's account

C) Casting the motor vehicles expense account incorrectly when extracting the trial balance

D) Debiting £100 received to the sales account and crediting the Bank account with the £100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

At the end of the financial year the entries regarding bad debts are:

A) Dr. Income statement account Cr. Bad debts account

B) Dr. Bad debts account Cr. Income statement account

C) Dr Trade receivables account Cr. Provision for bad debts account

D) Dr. Provision for bad debts account Cr. Income statement account

A) Dr. Income statement account Cr. Bad debts account

B) Dr. Bad debts account Cr. Income statement account

C) Dr Trade receivables account Cr. Provision for bad debts account

D) Dr. Provision for bad debts account Cr. Income statement account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

A trial balance failed to agree. The total of the debits amounted to £315,600; the credit balances totalled £310,600. Which of the following might explain the difference?

A) Rent was recorded as (Dr Bank £5,000, Cr. Insurance £5,000)

B) An invoice for the purchase of inventory was omitted from the books

C) A sundry receipt of £2,250 was debited to income and credited to bank

D) An invoice for stationery for £2,250 was debited to stationery and also debited to bank.

A) Rent was recorded as (Dr Bank £5,000, Cr. Insurance £5,000)

B) An invoice for the purchase of inventory was omitted from the books

C) A sundry receipt of £2,250 was debited to income and credited to bank

D) An invoice for stationery for £2,250 was debited to stationery and also debited to bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

A trial balance failed to agree. The total of the debits amounted to £100,600. The credit balances totalled £111,600. Which of the following might explain the difference?

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is an error of omission?

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is a reversal error?

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not an error?

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

A) Rent was recorded as (Cr Bank £500, Cr. Rates £500)

B) An invoice for the sale of goods was omitted from the books

C) A sundry receipt of £250 was debited to income and credited to bank

D) An invoice for stationery for £250 was debited to stationery and credited to bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

It is important to prepare a trial balance in advance of extracting the financial statements because:

A) It assists the accountant in preparing any adjustments that may be required

B) It shows that debits and credits have been posted to the ledger accounts in equal values

C) It confirms that the ledger account balances are correct

D) It provides the figures that are required for the preparation of the final financial statements

A) It assists the accountant in preparing any adjustments that may be required

B) It shows that debits and credits have been posted to the ledger accounts in equal values

C) It confirms that the ledger account balances are correct

D) It provides the figures that are required for the preparation of the final financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

An error of original entry would occur if the sale of goods was:

A) Credited to a non-current asset account

B) Entered correctly to the sales account, but entered in the customer's account using the incorrect amount

C) Debited to the sales account and credited to the supplier's account

D) Debited and credited to the correct accounts using the incorrect amount in both instances.

A) Credited to a non-current asset account

B) Entered correctly to the sales account, but entered in the customer's account using the incorrect amount

C) Debited to the sales account and credited to the supplier's account

D) Debited and credited to the correct accounts using the incorrect amount in both instances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

An error of original entry would occur if the sale of goods was:

A) Credited to a non-current asset account

B) Entered correctly to the sales account, but entered in the customer's account using the incorrect amount

C) Debited to the sales account and credited to the supplier's account

D) Debited and credited to the correct accounts using the incorrect amount in both instances.

A) Credited to a non-current asset account

B) Entered correctly to the sales account, but entered in the customer's account using the incorrect amount

C) Debited to the sales account and credited to the supplier's account

D) Debited and credited to the correct accounts using the incorrect amount in both instances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

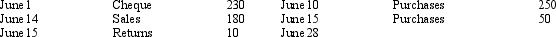

What is the balance carried down on the following account on 30 June?-S. McKee (supplier)

A) £120 debit

B) £120 credit

C) £60 debit

D) None of the above

A) £120 debit

B) £120 credit

C) £60 debit

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

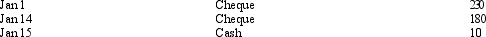

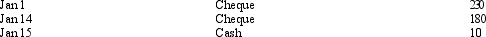

What is the correct closing description for the following account at the year end 31 January?-Drawings account

A) Income statement: £420

B) Balance carried down: £420

C) Balance brought down: £420

D) Capital account: £420

A) Income statement: £420

B) Balance carried down: £420

C) Balance brought down: £420

D) Capital account: £420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck