Deck 12: An AD As Model of the Inflation Rate and Real GDP

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/182

العب

ملء الشاشة (f)

Deck 12: An AD As Model of the Inflation Rate and Real GDP

1

A country's balance of payments is:

A) an accounting record of household incomes and expenditures.

B) the difference between the government's revenues and expenditures.

C) a record of the country's receipts from and payments to other countries.

D) the difference between exports and imports of goods and services.

A) an accounting record of household incomes and expenditures.

B) the difference between the government's revenues and expenditures.

C) a record of the country's receipts from and payments to other countries.

D) the difference between exports and imports of goods and services.

a record of the country's receipts from and payments to other countries.

2

In the balance of payments a net capital outflow from a country is:

A) equal to its deficit in the capital account.

B) always equal to the surplus in the current account.

C) equal to its surplus in the current account.

D) usually greater when interest rates are high.

A) equal to its deficit in the capital account.

B) always equal to the surplus in the current account.

C) equal to its surplus in the current account.

D) usually greater when interest rates are high.

equal to its surplus in the current account.

3

The part of the balance of payments account that records all short-term flows of payments is called the:

A) current account.

B) capital account.

C) official reserves account.

D) balance of trade.

A) current account.

B) capital account.

C) official reserves account.

D) balance of trade.

current account.

4

The part of the balance of payments account that records the amount of foreign currency the government buys or sells is the:

A) current account.

B) capital account.

C) official reserves account.

D) balance of trade.

A) current account.

B) capital account.

C) official reserves account.

D) balance of trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a Canadian company buys steel from Russia, then that purchase will be recorded in the:

A) Canadian current account.

B) Canadian capital account.

C) Canadian official reserves account.

D) Russian capital account.

A) Canadian current account.

B) Canadian capital account.

C) Canadian official reserves account.

D) Russian capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a French billionaire buys stock in the Bank of Montreal, then that purchase will be recorded in the:

A) Canadian current account.

B) French current account.

C) Canadian capital account.

D) Canadian services account.

A) Canadian current account.

B) French current account.

C) Canadian capital account.

D) Canadian services account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the balance on current account and the balance on capital account do not sum to zero:

A) international transactions will cease.

B) the government will run a budget deficit.

C) official reserves will change to offset the difference.

D) current account transactions must be reduced.

A) international transactions will cease.

B) the government will run a budget deficit.

C) official reserves will change to offset the difference.

D) current account transactions must be reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

8

A balance of payments deficit will always occur if:

A) both the current and capital accounts are positive.

B) the official transaction account is negative.

C) the current account is negative.

D) the current and capital (excluding official reserve transactions) are negative.

A) both the current and capital accounts are positive.

B) the official transaction account is negative.

C) the current account is negative.

D) the current and capital (excluding official reserve transactions) are negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

9

During the last decade, Canada ran large balance of trade surpluses. These trade surpluses imply:

A) a balance of payments deficit.

B) a balance of payments surplus.

C) a balance of payments equilibrium.

D) nothing about the overall balance of payments.

A) a balance of payments deficit.

B) a balance of payments surplus.

C) a balance of payments equilibrium.

D) nothing about the overall balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

10

Capital account deals with all of the following except one, which one:

A) Flows of capital funds between countries.

B) Purchases of domestic bonds by foreigners.

C) Payments for buying foreign goods.

D) Inflow and outflow of financial capital.

A) Flows of capital funds between countries.

B) Purchases of domestic bonds by foreigners.

C) Payments for buying foreign goods.

D) Inflow and outflow of financial capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the following terms and determine which of the following choices is wrong? Balance of current account (CA)

Balance in capital account (KA)

Change in official international reserves (?OR)

A) If CA is -5 and KA is +3, then ?OR is -2.

B) CA + KA - ?OR = zero.

C) If CA is +5 and KA is -3, then ?OR is +2.

D) If CA is +5 and KA is -3, then the balance of payment can be positive, negative or zero.

Balance in capital account (KA)

Change in official international reserves (?OR)

A) If CA is -5 and KA is +3, then ?OR is -2.

B) CA + KA - ?OR = zero.

C) If CA is +5 and KA is -3, then ?OR is +2.

D) If CA is +5 and KA is -3, then the balance of payment can be positive, negative or zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose, the nominal exchange rate (er) of US dollar is $1.20, price (GDP deflator) in USA is 115 and the price (GDP deflator) in Canada in 112. The real exchange rate of US dollar is:

A) 1.30.

B) 1.23.

C) 1.14.

D) 1.10.

A) 1.30.

B) 1.23.

C) 1.14.

D) 1.10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

13

Suppose, the purchasing power parity holds and real exchange rate remains constant. If the inflation rate in USA is 10% and Canada's inflation rate is 4%, then the nominal exchange rate of US dollar will:

A) decrease by approximately 10%

B) increase by approximately 10%

C) decrease by approximately 6%

D) increase by approximately 6%

A) decrease by approximately 10%

B) increase by approximately 10%

C) decrease by approximately 6%

D) increase by approximately 6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements is false?

A) The purchasing power parity (PPP) holds in the long-run.

B) Higher the real exchange rate of US dollars, higher is the net exports from Canada.

C) If the purchasing power parity (PPP) holds and if the inflation rate in Canada is higher than that in USA, the nominal exchange rate of US dollars will decrease.

D) If the purchasing power parity (PPP) holds in the long-run, the real exchange rate will be one.

A) The purchasing power parity (PPP) holds in the long-run.

B) Higher the real exchange rate of US dollars, higher is the net exports from Canada.

C) If the purchasing power parity (PPP) holds and if the inflation rate in Canada is higher than that in USA, the nominal exchange rate of US dollars will decrease.

D) If the purchasing power parity (PPP) holds in the long-run, the real exchange rate will be one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

15

A Chinese purchase of a Canadian-made Bombardier aircraft is recorded in the Canadian balance of payments as:

A) a positive entry in the current account.

B) a positive entry in the capital account.

C) a negative entry in the current account.

D) a negative entry in the capital account.

A) a positive entry in the current account.

B) a positive entry in the capital account.

C) a negative entry in the current account.

D) a negative entry in the capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

16

An increase in Canadian real GDP will:

A) increase Canadian exports of goods and services.

B) increase US imports of Canadian goods and services.

C) lower real GDP in Canada's major trading partners.

D) reduce the current account balance in the Canadian balance of payments.

A) increase Canadian exports of goods and services.

B) increase US imports of Canadian goods and services.

C) lower real GDP in Canada's major trading partners.

D) reduce the current account balance in the Canadian balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

17

An increase in US real GDP will:

A) have no effect on Canada's current account balance.

B) reduce the current account balance in the US and increase it in Canada.

C) increase the current account balance in the US and reduce it in Canada.

D) improve the current account balances in both countries.

A) have no effect on Canada's current account balance.

B) reduce the current account balance in the US and increase it in Canada.

C) increase the current account balance in the US and reduce it in Canada.

D) improve the current account balances in both countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

18

Lower transport costs that result in lower prices for Chinese manufactures in the Canadian economy:

A) reduce Chinese domestic consumption of manufactured goods.

B) reduce Canadian imports of Chinese manufactures and increase the Canadian current account balance.

C) reduce Canadian exports of fuels and commodities to China and reduce the Canadian current account balance.

D) increase Canadian imports of Chinese manufactures and reduce the Canadian current account balance.

A) reduce Chinese domestic consumption of manufactured goods.

B) reduce Canadian imports of Chinese manufactures and increase the Canadian current account balance.

C) reduce Canadian exports of fuels and commodities to China and reduce the Canadian current account balance.

D) increase Canadian imports of Chinese manufactures and reduce the Canadian current account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

19

The price of imported goods and services compared to domestic goods and services is:

A) the real exchange rate.

B) the consumer price index.

C) the import price deflator.

D) the nominal exchange rate.

A) the real exchange rate.

B) the consumer price index.

C) the import price deflator.

D) the nominal exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the domestic currency depreciates, raising the nominal exchange rate but leaving other things unchanged, the real exchange rate will:

A) decrease.

B) increase.

C) not be affected.

D) none of the above.

A) decrease.

B) increase.

C) not be affected.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

21

The increase in oil and commodity prices in the last few years caused a strong appreciation in the Canadian dollar lowering the exchange rate from $1.57 (Canadian) to $1.16 (Canadian) for $1 US. As a result, the real exchange rate (er) ____________; and Canada's net export (NX)__________.

A) increased; increased

B) decreased; increased

C) increased, decreased

D) decreased; decreased

A) increased; increased

B) decreased; increased

C) increased, decreased

D) decreased; decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

22

The changes in the exports and imports of goods and services recorded in the current account of the balance of payments are determined by:

A) shifts in climatic conditions.

B) changes in nominal exchange rates alone.

C) changes in real exchange rates and income levels in different countries.

D) changes in relative price levels between countries.

A) shifts in climatic conditions.

B) changes in nominal exchange rates alone.

C) changes in real exchange rates and income levels in different countries.

D) changes in relative price levels between countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose that the Japanese yen appreciates against the U.S. dollar. We would expect:

A) foreign travel by Japanese citizens to the U.S. to decrease.

B) the level of exports from Japan to the U.S. to increase.

C) the level of exports from the U.S. to Japan to increase.

D) the level of imports into the U.S. from Japan to increase.

A) foreign travel by Japanese citizens to the U.S. to decrease.

B) the level of exports from Japan to the U.S. to increase.

C) the level of exports from the U.S. to Japan to increase.

D) the level of imports into the U.S. from Japan to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the euro appreciates against the Canadian dollar, French goods become:

A) less expensive to Canadians.

B) less expensive to the French.

C) more expensive to the French.

D) more expensive to Canadians.

A) less expensive to Canadians.

B) less expensive to the French.

C) more expensive to the French.

D) more expensive to Canadians.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the euro depreciates against the Canadian dollar, French wines become:

A) less expensive to Canadians.

B) less expensive to the French.

C) more expensive to Canadians.

D) more expensive to the French.

A) less expensive to Canadians.

B) less expensive to the French.

C) more expensive to Canadians.

D) more expensive to the French.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

26

A U.S. insurance company buys $10 million worth of Canadian bonds. This transaction causes the Canadian:

A) current account balance to increase.

B) current account balance to decrease.

C) capital account balance to increase.

D) capital account balance to decrease.

A) current account balance to increase.

B) current account balance to decrease.

C) capital account balance to increase.

D) capital account balance to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

27

McCain Foods (Canada) buys $50 million of Japanese securities. This transaction causes the Canadian:

A) current account balance to increase.

B) current account balance to decrease.

C) capital account balance to increase.

D) capital account balance to decrease.

A) current account balance to increase.

B) current account balance to decrease.

C) capital account balance to increase.

D) capital account balance to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

28

Other things being equal, a reduction in Canadian interest rates relative to foreign interest rates should:

A) increase the Canadian capital account balance.

B) increase the Canadian current account balance.

C) reduce the Canadian capital account balance.

D) leave the Canadian current and capital account balances unchanged.

A) increase the Canadian capital account balance.

B) increase the Canadian current account balance.

C) reduce the Canadian capital account balance.

D) leave the Canadian current and capital account balances unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

29

If Canadian interest rates are higher than US interest rates, the Canadian dollar is:

A) expected to appreciate.

B) expected to remain unchanged.

C) expected to depreciate.

D) expected to change in an unpredictable way.

A) expected to appreciate.

B) expected to remain unchanged.

C) expected to depreciate.

D) expected to change in an unpredictable way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is false?

A) If the US dollar depreciates, there will be a capital loss on assets held in US dollars.

B) If US dollar depreciates, interest parity condition requires that US interest rate is higher the Canadian interest rate.

C) Appreciation of US dollars will lead to capital loss on US dollar-based assets.

D) Depreciation of Canadian dollar explains why US interest rate is lower than Canadian interest rate.

A) If the US dollar depreciates, there will be a capital loss on assets held in US dollars.

B) If US dollar depreciates, interest parity condition requires that US interest rate is higher the Canadian interest rate.

C) Appreciation of US dollars will lead to capital loss on US dollar-based assets.

D) Depreciation of Canadian dollar explains why US interest rate is lower than Canadian interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

31

If foreign exchange traders expect the dollar to depreciate in the short run but the economic fundamentals suggest that it will appreciate:

A) the dollar is likely to depreciate in the short run.

B) the dollar is likely to appreciate in the short run.

C) no change in value of the dollar is likely.

D) the change in the value of the dollar cannot be predicted.

A) the dollar is likely to depreciate in the short run.

B) the dollar is likely to appreciate in the short run.

C) no change in value of the dollar is likely.

D) the change in the value of the dollar cannot be predicted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

32

Interest parity holds when:

A) interest rates are the same in all countries.

B) interest rates differ between countries by the differences in national inflation rates.

C) interest rates differ between countries by the expected rates of change in exchange rates.

D) interest rates and exchange rates are unrelated.

A) interest rates are the same in all countries.

B) interest rates differ between countries by the differences in national inflation rates.

C) interest rates differ between countries by the expected rates of change in exchange rates.

D) interest rates and exchange rates are unrelated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

33

Interest rate parity means:

A) goods and services trade at equal prices in domestic currencies.

B) nominal interest rates in all countries are the same.

C) real interest rates in all countries are the same.

D) differences in interest rates among countries reflect expected changes in exchange rates.

A) goods and services trade at equal prices in domestic currencies.

B) nominal interest rates in all countries are the same.

C) real interest rates in all countries are the same.

D) differences in interest rates among countries reflect expected changes in exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is false?

A) Higher the capital account surplus in an economy, higher is the economy's international indebtedness.

B) Larger the current account deficit in USA, larger is the larger is the USA's capital account surplus.

C) Larger the capital account surplus in USA, smaller is the USA's international indebtedness.

D) China's current account surplus implies deficit in the capital account.

A) Higher the capital account surplus in an economy, higher is the economy's international indebtedness.

B) Larger the current account deficit in USA, larger is the larger is the USA's capital account surplus.

C) Larger the capital account surplus in USA, smaller is the USA's international indebtedness.

D) China's current account surplus implies deficit in the capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

35

Larger fiscal deficits in USA in the recent past lead to:

A) appreciation of US dollar.

B) capital account surplus in USA.

C) current account deficit in USA.

D) current account deficit in China.

A) appreciation of US dollar.

B) capital account surplus in USA.

C) current account deficit in USA.

D) current account deficit in China.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

36

If there is a time when interest rate parity does not exist:

A) capital will flow to the country offering the highest expected return.

B) there will be no international capital flows.

C) trade in goods and services will not be possible.

D) no changes in exchange rates are expected.

A) capital will flow to the country offering the highest expected return.

B) there will be no international capital flows.

C) trade in goods and services will not be possible.

D) no changes in exchange rates are expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

37

The balance on capital account in the balance of payments reflects net international capital flows based on:

A) nominal interest rate differentials.

B) real interest rate differentials.

C) portfolio managers' attempts to find the best total return from holdings of domestic and foreign assets.

D) portfolio managers' unwillingness to hold securities issued by foreign business and governments.

A) nominal interest rate differentials.

B) real interest rate differentials.

C) portfolio managers' attempts to find the best total return from holdings of domestic and foreign assets.

D) portfolio managers' unwillingness to hold securities issued by foreign business and governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

38

The foreign exchange rate is defined as:

A) the movement of university students among countries.

B) net exports of goods and services.

C) the price of foreign currency in domestic currency.

D) the cost of changing dollar bills into coins.

A) the movement of university students among countries.

B) net exports of goods and services.

C) the price of foreign currency in domestic currency.

D) the cost of changing dollar bills into coins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

39

The supply of foreign currency on the Canadian foreign exchange market comes from:

A) Canadian imports of goods and services from other countries.

B) Canadian imports of goods, services and securities from other countries.

C) foreign exports of goods, services and securities to Canadians.

D) Canadian exports of goods, services and securities to other countries.

A) Canadian imports of goods and services from other countries.

B) Canadian imports of goods, services and securities from other countries.

C) foreign exports of goods, services and securities to Canadians.

D) Canadian exports of goods, services and securities to other countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the quantity of foreign currency demanded in the foreign exchange market exceeds the quantity supplied, then there is a:

A) balance of payments surplus.

B) balance of payments deficit.

C) balance of payments equilibrium.

D) none of the above since the demand for and supply of a currency are not related to the balance of payments.

A) balance of payments surplus.

B) balance of payments deficit.

C) balance of payments equilibrium.

D) none of the above since the demand for and supply of a currency are not related to the balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

41

Other things remaining the same, US recession will lead to:

A) higher value of Canadian dollar.

B) lower value of US dollar.

C) higher value of US dollar.

D) higher demand for Canadian dollars.

A) higher value of Canadian dollar.

B) lower value of US dollar.

C) higher value of US dollar.

D) higher demand for Canadian dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

42

The supply of US dollars on the foreign exchange market slopes __________ because US consumers spend __________ on Canadian goods when the Canadian dollar price of the US dollar

_____________.

A) upward; less; increases

B) upward; more; increases

C) downward; less; falls

D) downward; more; falls

_____________.

A) upward; less; increases

B) upward; more; increases

C) downward; less; falls

D) downward; more; falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

43

The demand for US dollars on the foreign exchange market slopes __________ because Canadians spend

__________ on US goods when the Canadian dollar price of the US dollar is ________.

A) upward; less; higher

B) upward; more; higher

C) downward; less; lower

D) downward; more; lower

__________ on US goods when the Canadian dollar price of the US dollar is ________.

A) upward; less; higher

B) upward; more; higher

C) downward; less; lower

D) downward; more; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

44

The demand for the US dollar in the foreign exchange market is a derived demand, and it is derived from:

A) imports from the US plus any capital inflows into the country.

B) imports from the US plus any capital outflows from the country.

C) exports to the US plus any capital outflows from the country.

D) exports to the US plus any capital inflows into the country.

A) imports from the US plus any capital inflows into the country.

B) imports from the US plus any capital outflows from the country.

C) exports to the US plus any capital outflows from the country.

D) exports to the US plus any capital inflows into the country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Canadian demand for French goods is:

A) the same as a demand for dollars.

B) equivalent to a demand for euros.

C) prohibited by law.

D) equivalent to a supply of euros.

A) the same as a demand for dollars.

B) equivalent to a demand for euros.

C) prohibited by law.

D) equivalent to a supply of euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

46

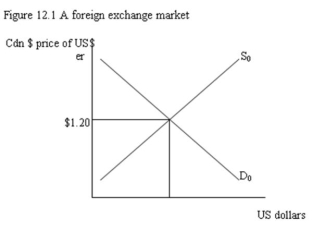

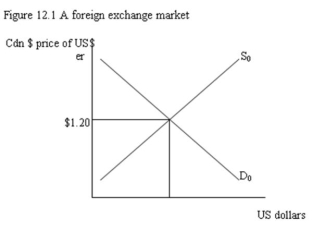

-Refer to Figure 12.1. In terms of the diagram an increase in US interest rates would:

A) shift D0 out and S0 in, causing a rise in the exchange rate.

B) shift D0 out and S0 out, causing a fall in the exchange rate.

C) shift D0 in and S0 in, leaving the exchange rate unchanged.

D) shift D0 in and S0 out, having no effect on the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

47

-Refer to Figure 12.1. In terms of the diagram a rise in commodity prices and Canadian exports of crude oil and commodities would:

A) shift D0 to the right and raise the exchange rate

B) shift S0 to the left and raise the exchange rate.

C) shift S0 to the right and lower the exchange rate.

D) shift S0 and D0 in offsetting ways and leave the exchange rate unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

48

If interest rates in Canada fall relative to interest rates in the US, net capital flows into Canada will

________, causing the supply of US dollars on the Canadian foreign exchange market to ________ and the demand for US dollars to _______.

A) increase, decrease, rise

B) decrease, increase, fall

C) decrease, decrease, rise

D) increase, decrease, fall

________, causing the supply of US dollars on the Canadian foreign exchange market to ________ and the demand for US dollars to _______.

A) increase, decrease, rise

B) decrease, increase, fall

C) decrease, decrease, rise

D) increase, decrease, fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

49

If interest rates in Canada rise relative to interest rates in the US:

A) the US dollar will appreciate against the Canadian dollar.

B) Canadian citizens will buy more US financial assets.

C) the demand for US dollars on the Canadian foreign exchange market will increase.

D) the supply of US dollars on the Canadian foreign exchange market will increase.

A) the US dollar will appreciate against the Canadian dollar.

B) Canadian citizens will buy more US financial assets.

C) the demand for US dollars on the Canadian foreign exchange market will increase.

D) the supply of US dollars on the Canadian foreign exchange market will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which one of the following occurrences would increase the supply of US dollars on the international exchange markets?

A) A German family travels to Disney World for their vacation.

B) An American family travels to Tokyo for their vacation.

C) A German firm purchases some US-built Ford trucks.

D) A group of British investors purchases an American bank.

A) A German family travels to Disney World for their vacation.

B) An American family travels to Tokyo for their vacation.

C) A German firm purchases some US-built Ford trucks.

D) A group of British investors purchases an American bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

51

If capital inflows into Canada decrease, it means that:

A) the supply of foreign currency on the Canadian foreign exchange market has fallen.

B) the demand for foreign currency on the Canadian foreign exchange market has fallen.

C) the supply of foreign currency on the Canadian foreign exchange market has increased.

D) none of the above because the trade in foreign currencies independent of capital inflows.

A) the supply of foreign currency on the Canadian foreign exchange market has fallen.

B) the demand for foreign currency on the Canadian foreign exchange market has fallen.

C) the supply of foreign currency on the Canadian foreign exchange market has increased.

D) none of the above because the trade in foreign currencies independent of capital inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

52

Under the system of freely floating exchange rates, if a country's imports rise to exceed its exports:

A) the country will experience an outflow of gold.

B) the country will have to negotiate a loan from the International Monetary Fund.

C) the country's currency will depreciate enough in relation to other currencies to restore its payments balance.

D) a contractionary monetary policy will be required.

A) the country will experience an outflow of gold.

B) the country will have to negotiate a loan from the International Monetary Fund.

C) the country's currency will depreciate enough in relation to other currencies to restore its payments balance.

D) a contractionary monetary policy will be required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the exchange rate, defined as the Canadian dollar price of other currencies, were below its equilibrium level, then we would expect this to:

A) encourage exports of Canadian-made goods.

B) encourage foreigners to travel to Canada.

C) encourage imports into Canada.

D) discourage Canadian citizens from travelling abroad.

A) encourage exports of Canadian-made goods.

B) encourage foreigners to travel to Canada.

C) encourage imports into Canada.

D) discourage Canadian citizens from travelling abroad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

54

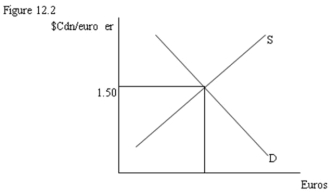

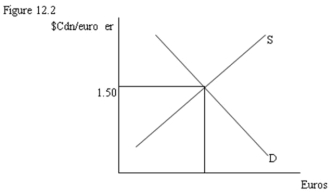

-Refer to Figure 12.2. If the Canadian dollar price of the euro were $1.55, the quantity of euros supplied would be __________ than the quantity demanded. This would cause the euro to __________ value.

A) greater; gain

B) less; gain

C) greater; lose

D) less; lose

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

55

-Refer to Figure 12.2. If the price of euros were $1.45, the quantity of euros supplied would be

__________ than the quantity demanded, causing the euro to __________ value.

A) greater; gain

B) less; gain

C) greater; lose

D) less; lose

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

56

A fall in the value of the Canadian dollar, which raises the exchange rate, is called:

A) an appreciation.

B) a depreciation.

C) a flexible exchange rate.

D) a fixed exchange rate.

A) an appreciation.

B) a depreciation.

C) a flexible exchange rate.

D) a fixed exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

57

A rise in the value of the Canadian dollar is an appreciation that:

A) increases the exchange rate defined as the Canadian dollar price of the US dollar.

B) indicates a fixed exchange rate regime.

C) lowers the exchange rate defined as the Canadian dollar price of the US dollar.

D) has no effect on nominal or real exchange rates.

A) increases the exchange rate defined as the Canadian dollar price of the US dollar.

B) indicates a fixed exchange rate regime.

C) lowers the exchange rate defined as the Canadian dollar price of the US dollar.

D) has no effect on nominal or real exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

58

An exchange rate regime is:

A) the prevailing set of domestic prices.

B) a ranking of foreign currencies purchasing power parity.

C) a policy rule for intervention in the foreign exchange market.

D) the international structure of interest rates.

A) the prevailing set of domestic prices.

B) a ranking of foreign currencies purchasing power parity.

C) a policy rule for intervention in the foreign exchange market.

D) the international structure of interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

59

A(n) _________________ is a policy rule for intervening (or not) in the foreign exchange market.

A) fiscal policy

B) exchange rate regime

C) balance of payments policy

D) current account policy

A) fiscal policy

B) exchange rate regime

C) balance of payments policy

D) current account policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

60

The adoption of a ______________ exchange rate precludes the pursuit of a money supply or an inflation target.

A) floating

B) fixed

C) market determined

D) free

A) floating

B) fixed

C) market determined

D) free

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

61

Refer to Figure 12.4. To maintain the exchange rate $1.18 when demand is D0 and supply S1 the central bank must:

A) buy Q1 - Q2 US dollars.

B) sell Q1 - Q2 US dollars.

C) sell Q2 - Q3 US dollars.

D) do nothing.

A) buy Q1 - Q2 US dollars.

B) sell Q1 - Q2 US dollars.

C) sell Q2 - Q3 US dollars.

D) do nothing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

62

It is not possible to have at the same time:

A) fixed exchange rates and perfect capital mobility.

B) fixed exchange rates and monetary sovereignty.

C) perfect capital mobility and monetary sovereignty.

D) fixed exchange rates, perfect capital mobility and monetary sovereignty.

A) fixed exchange rates and perfect capital mobility.

B) fixed exchange rates and monetary sovereignty.

C) perfect capital mobility and monetary sovereignty.

D) fixed exchange rates, perfect capital mobility and monetary sovereignty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

63

The foreign exchange system in use internationally today is:

A) a gold standard.

B) a fixed exchange system.

C) an adjustable peg system.

D) a "managed float" system.

A) a gold standard.

B) a fixed exchange system.

C) an adjustable peg system.

D) a "managed float" system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

64

In an economy with a fixed exchange rate and no private capital flows, financing a balance of payments

_________ requires that foreign exchange reserves must ____ .

A) deficit, fall

B) deficit, increase

C) surplus, decrease

D) balance, fall

_________ requires that foreign exchange reserves must ____ .

A) deficit, fall

B) deficit, increase

C) surplus, decrease

D) balance, fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

65

In an economy with a _________ exchange rate but no private ______________, financing a balance of payments surplus requires that foreign exchange reserves must increase.

A) flexible, capital flows

B) fixed, capital flows

C) fixed, income flows

D) flexible, income flows

A) flexible, capital flows

B) fixed, capital flows

C) fixed, income flows

D) flexible, income flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under a system of flexible exchange rates, if the price of the US dollar in Canadian dollars falls from $1.20 to $1.15, then:

A) the Canadian dollar has appreciated against the US dollar.

B) the Canadian dollar has depreciated against the US dollar.

C) the Canadian dollar has been devalued.

D) US goods become more expensive in Canada.

A) the Canadian dollar has appreciated against the US dollar.

B) the Canadian dollar has depreciated against the US dollar.

C) the Canadian dollar has been devalued.

D) US goods become more expensive in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

67

In a managed float, central banks intervene in the _____ market to try to _________________ and nudge the exchange rate in the desired direction.

A) money, remain on the floor

B) money, remain on the ceiling

C) foreign exchange, remain on the floor

D) foreign exchange, smooth out fluctuations

A) money, remain on the floor

B) money, remain on the ceiling

C) foreign exchange, remain on the floor

D) foreign exchange, smooth out fluctuations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

68

In _______________, central banks intervene in the foreign exchange market to try to smooth out fluctuations and nudge the exchange rate in the desired direction.

A) a managed float

B) fixed exchange rates

C) flexible exchange rates

D) the event of a current account surplus

A) a managed float

B) fixed exchange rates

C) flexible exchange rates

D) the event of a current account surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

69

Flexible exchange rates may be _________ in the short run because of _____________.

A) predictable, central bank intervention

B) stable, central bank intervention

C) depreciating, speculation

D) volatile, speculation

A) predictable, central bank intervention

B) stable, central bank intervention

C) depreciating, speculation

D) volatile, speculation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is NOT a criticism of a flexible exchange rate system?

A) Flexible exchange rates tend to be variable and therefore cause more uncertainty.

B) Flexible exchange rate systems require discipline on the part of central banks that may not be forthcoming.

C) Under flexible exchange rates, trading countries tend to rely more heavily upon tariffs and other restrictions.

D) The flexible exchange rate system invites more destabilizing speculative forces than the fixed exchange rate system.

A) Flexible exchange rates tend to be variable and therefore cause more uncertainty.

B) Flexible exchange rate systems require discipline on the part of central banks that may not be forthcoming.

C) Under flexible exchange rates, trading countries tend to rely more heavily upon tariffs and other restrictions.

D) The flexible exchange rate system invites more destabilizing speculative forces than the fixed exchange rate system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

71

In recent Canadian experience the flexible exchange rate:

A) made adjustment to external economic shocks more difficult.

B) made domestic monetary policy less effective in controlling inflation.

C) facilitated adjustment to external changes in demand for energy and commodity exports.

D) was unaffected by changes in external economic conditions.

A) made adjustment to external economic shocks more difficult.

B) made domestic monetary policy less effective in controlling inflation.

C) facilitated adjustment to external changes in demand for energy and commodity exports.

D) was unaffected by changes in external economic conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

72

If Canada, with flexible exchange rates, has lower inflation than the US, we would expect the Canadian dollar to __________ .

A) be in short supply

B) appreciate

C) depreciate

D) revalue

A) be in short supply

B) appreciate

C) depreciate

D) revalue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the UK experiences inflation rates higher than in other European countries, the effect will be to:

A) decrease the UK demand for imports.

B) increase the demand for UK exports.

C) shift the UK's demand for foreign currency in the foreign exchange market to the right and cause the pound to depreciate.

D) shift the UK's demand for foreign currency in the foreign exchange market to the left and cause the pound to appreciate.

A) decrease the UK demand for imports.

B) increase the demand for UK exports.

C) shift the UK's demand for foreign currency in the foreign exchange market to the right and cause the pound to depreciate.

D) shift the UK's demand for foreign currency in the foreign exchange market to the left and cause the pound to appreciate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a country operates a fixed exchange rate, external shocks will create balance of payments surpluses or deficits that:

A) improve domestic economic performance at the expense of other countries.

B) call for changes in domestic monetary policy to defend the exchange rate.

C) are automatically accommodated by changes in fiscal policy.

D) a normal part of international transactions.

A) improve domestic economic performance at the expense of other countries.

B) call for changes in domestic monetary policy to defend the exchange rate.

C) are automatically accommodated by changes in fiscal policy.

D) a normal part of international transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

75

Fixed exchange rates offer the benefit of:

A) domestic monetary policy consistent with that of major trading partners.

B) domestic inflation rates equal to those of major trading partners.

C) stable exchange rates and reduced uncertainty in trade receipts and payments.

D) all of the above.

A) domestic monetary policy consistent with that of major trading partners.

B) domestic inflation rates equal to those of major trading partners.

C) stable exchange rates and reduced uncertainty in trade receipts and payments.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

76

Fixed exchange rates impose a discipline to _______________ to maintain the fixed rate.

A) keep inflation down

B) keep interest rates low

C) avoid intervention

D) increase the national debt

A) keep inflation down

B) keep interest rates low

C) avoid intervention

D) increase the national debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Chinese central bank might intervene in foreign exchange markets:

A) to bring an appreciation of the Yuan so that imports are less expensive to the Chinese.

B) to bring a depreciation of the Yuan to make imports more expensive to the Chinese.

C) to bring a depreciation of the Yuan to make Chinese exports cheaper for foreigners.

D) all of the above.

A) to bring an appreciation of the Yuan so that imports are less expensive to the Chinese.

B) to bring a depreciation of the Yuan to make imports more expensive to the Chinese.

C) to bring a depreciation of the Yuan to make Chinese exports cheaper for foreigners.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

78

If Canada and the United States adopted a common currency, then:

A) Canada could no longer run an independent monetary policy.

B) Canada's ability to run an independent monetary policy would be enhanced.

C) the ability of the United States to run an independent monetary policy would be enhanced.

D) neither Canada nor the United States could run independent fiscal policies.

A) Canada could no longer run an independent monetary policy.

B) Canada's ability to run an independent monetary policy would be enhanced.

C) the ability of the United States to run an independent monetary policy would be enhanced.

D) neither Canada nor the United States could run independent fiscal policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

79

Other things remaining the same, higher the GDP deflator in USA,

A) higher is the real exchange rate of US dollar.

B) higher is the real exchange rate of Canadian dollar.

C) higher is the net export of USA.

D) higher is the price of Canadian of Canadian goods relative to the prices of US goods.

A) higher is the real exchange rate of US dollar.

B) higher is the real exchange rate of Canadian dollar.

C) higher is the net export of USA.

D) higher is the price of Canadian of Canadian goods relative to the prices of US goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements is true?

A) Higher energy and commodity prices drove exchange rate of US dollars higher.

B) Higher energy and commodity prices drove exchange rate of US dollars lower.

C) Lower energy and commodity prices drove exchange rate of US dollars lower.

D) Lower energy and commodity prices drove exchange rate of Canadian dollar higher.

A) Higher energy and commodity prices drove exchange rate of US dollars higher.

B) Higher energy and commodity prices drove exchange rate of US dollars lower.

C) Lower energy and commodity prices drove exchange rate of US dollars lower.

D) Lower energy and commodity prices drove exchange rate of Canadian dollar higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck