Deck 3: Exchange Rate Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 3: Exchange Rate Analysis

1

If the inflation rate in the United States is greater than the inflation rate in Canada, other things held constant, the Canadian dollar will

A) Appreciate against the U.S. dollar.

B) Depreciate against the U.S. dollar.

C) Remain unchanged against the U.S. dollar.

D) Appreciate against other major currencies.

E) Appreciate against the U.S. dollar and other major currencies.

A) Appreciate against the U.S. dollar.

B) Depreciate against the U.S. dollar.

C) Remain unchanged against the U.S. dollar.

D) Appreciate against other major currencies.

E) Appreciate against the U.S. dollar and other major currencies.

Appreciate against the U.S. dollar.

2

What is the common currency of the EMU?

A) U.S. dollar.

B) British pound.

C) Euro.

D) French franc.

E) German deutsche mark.

A) U.S. dollar.

B) British pound.

C) Euro.

D) French franc.

E) German deutsche mark.

Euro.

3

The need to use numerous national currencies in the conduct of global business operations is a fact of life for MNEs. For what purpose(s) do they use the foreign exchange markets?

A) Reducing the profit volatility that can arise from exchange rate fluctuations.

B) Providing credit to finance worldwide operations.

C) Conducting day-to-day operations.

D) All of the statements above are uses of the foreign exchange markets.

E) Only statements a and c are uses of the foreign exchange markets.

A) Reducing the profit volatility that can arise from exchange rate fluctuations.

B) Providing credit to finance worldwide operations.

C) Conducting day-to-day operations.

D) All of the statements above are uses of the foreign exchange markets.

E) Only statements a and c are uses of the foreign exchange markets.

All of the statements above are uses of the foreign exchange markets.

4

The balance of payments report is recorded using the rules of double-entry accounting and most closely resembles a(n) ______________.

A) Income statement.

B) Balance sheet.

C) Flow of funds statement.

D) Statement of retained earnings.

E) Bank statement.

A) Income statement.

B) Balance sheet.

C) Flow of funds statement.

D) Statement of retained earnings.

E) Bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following balance of payment report groups would include purchases and sales of fixed assets?

A) Current account.

B) Capital account.

C) Financial account.

D) Net errors and omissions.

E) Reserves and related items.

A) Current account.

B) Capital account.

C) Financial account.

D) Net errors and omissions.

E) Reserves and related items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

Looking at patterns in price and volume data to predict exchange rate fluctuations is called a(n) ___________.

A) Technical analysis.

B) Asset market approach.

C) Current rate method.

D) Temporal method.

E) Purchasing power parity approach.

A) Technical analysis.

B) Asset market approach.

C) Current rate method.

D) Temporal method.

E) Purchasing power parity approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

A U.S. investor just received a foreign exchange rate quote for $0.7855/€. What kind of quote is this?

A) European term quotation.

B) American term quotation.

C) Forward rate quotation.

D) Indirect quotation.

E) Cross rate quotation.

A) European term quotation.

B) American term quotation.

C) Forward rate quotation.

D) Indirect quotation.

E) Cross rate quotation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is most correct?

A) If one knows how many U.S. dollars it takes to buy one euro, and how many euros it takes to buy 100 Japanese yen, then it is easy to calculate the exchange rate between the dollar and the yen.

B) If the currency market is in equilibrium, and if you know how many dollars it takes to buy one euro, then it is easy to calculate the number of euros it takes to buy one dollar.

C) "European terms" means the number of units of any currency it takes to buy one U.S. dollar.

D) All of the statements above are correct.

E) Only statements a and b are correct.

A) If one knows how many U.S. dollars it takes to buy one euro, and how many euros it takes to buy 100 Japanese yen, then it is easy to calculate the exchange rate between the dollar and the yen.

B) If the currency market is in equilibrium, and if you know how many dollars it takes to buy one euro, then it is easy to calculate the number of euros it takes to buy one dollar.

C) "European terms" means the number of units of any currency it takes to buy one U.S. dollar.

D) All of the statements above are correct.

E) Only statements a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements about the balance of payments report is most correct?

A) The balance of payments report records all of a country's internal economic transactions.

B) Flows recorded in the current account are generally not reversible.

C) The net flow on the balance of payments report shows the effect of international transactions on the country's monetary reserves.

D) Both statements a and c are correct.

E) Both statements b and c are correct.

A) The balance of payments report records all of a country's internal economic transactions.

B) Flows recorded in the current account are generally not reversible.

C) The net flow on the balance of payments report shows the effect of international transactions on the country's monetary reserves.

D) Both statements a and c are correct.

E) Both statements b and c are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is most correct?

A) The section of the balance of payments (BOP) that records income flows into and out of a country is called the current account.

B) Transactions in the capital account are not usually reversible, but those in the financial account are reversible.

C) Current account transactions are usually made in anticipation of future profit.

D) All government transactions, including gifts, grants, loans, and changes in monetary reserves, are recorded in section E of the BOP.

E) Net errors and omissions are calculated using statistical sampling and the estimated amount is included in the BOP to make the overall balance more meaningful.

A) The section of the balance of payments (BOP) that records income flows into and out of a country is called the current account.

B) Transactions in the capital account are not usually reversible, but those in the financial account are reversible.

C) Current account transactions are usually made in anticipation of future profit.

D) All government transactions, including gifts, grants, loans, and changes in monetary reserves, are recorded in section E of the BOP.

E) Net errors and omissions are calculated using statistical sampling and the estimated amount is included in the BOP to make the overall balance more meaningful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is most correct?

A) The term "parity conditions" refers to five economic theories that interact with each other to mutually define consistent values for interest rates in two countries and the exchange rates for their currencies.

B) If the real, risk-free interest rate is the same in the two countries, then nominal interest rates in the two countries and the exchange rate for the two currencies are driven by the rates of inflation in the two countries.

C) Because it is possible to measure expected inflation rates in the two countries quite accurately using an index such as the Consumer Price Index (CPI), the parity conditions usually hold quite closely and any deviations are usually small and short-lived.

D) All of the statements above are correct

E) Only statements a and b are correct.

A) The term "parity conditions" refers to five economic theories that interact with each other to mutually define consistent values for interest rates in two countries and the exchange rates for their currencies.

B) If the real, risk-free interest rate is the same in the two countries, then nominal interest rates in the two countries and the exchange rate for the two currencies are driven by the rates of inflation in the two countries.

C) Because it is possible to measure expected inflation rates in the two countries quite accurately using an index such as the Consumer Price Index (CPI), the parity conditions usually hold quite closely and any deviations are usually small and short-lived.

D) All of the statements above are correct

E) Only statements a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the markets in two countries are in equilibrium, the parity conditions ensure which of the following?

A) The forecasted inflation rate differential between the two countries is exactly equal to the interest rate differential between those same countries.

B) The currency of the country with the higher inflation rate will sell at a discount to the other currency.

C) The forward discount will exactly cancel out the forecasted inflation differential.

D) If the information about future inflation is unbiased and the markets are in equilibrium, then the forward rate will be an unbiased predictor of the expected future spot rate.

E) All of the above conditions are ensured by the parity conditions.

A) The forecasted inflation rate differential between the two countries is exactly equal to the interest rate differential between those same countries.

B) The currency of the country with the higher inflation rate will sell at a discount to the other currency.

C) The forward discount will exactly cancel out the forecasted inflation differential.

D) If the information about future inflation is unbiased and the markets are in equilibrium, then the forward rate will be an unbiased predictor of the expected future spot rate.

E) All of the above conditions are ensured by the parity conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is not correct?

A) A quotation in American terms can be a direct quotation.

B) A quotation in American terms can be an indirect quotation.

C) Most interbank quotations are given in American terms.

D) One does not have to designate a "home" currency to know if a quotation is in American terms or European terms.

E) If quotations for two currencies are given in European terms, it is easier to calculate the cross rate than if they are given in American terms.

A) A quotation in American terms can be a direct quotation.

B) A quotation in American terms can be an indirect quotation.

C) Most interbank quotations are given in American terms.

D) One does not have to designate a "home" currency to know if a quotation is in American terms or European terms.

E) If quotations for two currencies are given in European terms, it is easier to calculate the cross rate than if they are given in American terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statement is not correct?

A) A technique for forecasting future exchange rates that relies solely on the relationship between the prices of gold (a real asset) in the two currencies is called the asset market approach.

B) Technical analysis looks for repeating patterns in exchange rate movements in order to forecast what will happen in the future.

C) The asset market approach to exchange rate forecasting assumes that, in the short-run, exchange rate movements are probably driven by real and nominal interest rates, expectations for future growth and profitability in the economy, and investment opportunities for investment in the country.

D) The balance of payments approach to exchange rate forecasting is more useful for currencies subject to a fixed rate regime, but can still offer useful signals when a managed float is used.

E) Purchasing power parity is thought to hold reasonably well over the long run and interest rate parity is most useful to short-run predictions.

A) A technique for forecasting future exchange rates that relies solely on the relationship between the prices of gold (a real asset) in the two currencies is called the asset market approach.

B) Technical analysis looks for repeating patterns in exchange rate movements in order to forecast what will happen in the future.

C) The asset market approach to exchange rate forecasting assumes that, in the short-run, exchange rate movements are probably driven by real and nominal interest rates, expectations for future growth and profitability in the economy, and investment opportunities for investment in the country.

D) The balance of payments approach to exchange rate forecasting is more useful for currencies subject to a fixed rate regime, but can still offer useful signals when a managed float is used.

E) Purchasing power parity is thought to hold reasonably well over the long run and interest rate parity is most useful to short-run predictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is most correct?

A) Most interbank foreign exchange quotations are given in American terms.

B) Transactions in the capital account (section B) of the balance of payments are usually not reversible.

C) If the real, risk-free interest rate is the same in two countries, then nominal interest rates in the two countries and the exchange rate for the two currencies are driven by the rate of inflation in the two countries.

D) Covered interest arbitrage is a technique for earning a riskless profit without having to commit one's own money when purchasing power parity does not hold.

E) All of the statements above are correct.

A) Most interbank foreign exchange quotations are given in American terms.

B) Transactions in the capital account (section B) of the balance of payments are usually not reversible.

C) If the real, risk-free interest rate is the same in two countries, then nominal interest rates in the two countries and the exchange rate for the two currencies are driven by the rate of inflation in the two countries.

D) Covered interest arbitrage is a technique for earning a riskless profit without having to commit one's own money when purchasing power parity does not hold.

E) All of the statements above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements regarding foreign exchange markets is most correct?

A) Foreign exchange markets are "free" of government interferences.

B) Foreign exchange brokers act as agents in currency transactions and often take direct positions in transactions.

C) Anonymity is important for the parties of a brokered currency transaction because knowledge of the parties might affect the quote offered.

D) Currency speculation is not a major concern for central and commercial bank managers, and hence little of the bank's risk management program deals with currency risk.

E) None of the above statements correctly characterize foreign exchange markets.

A) Foreign exchange markets are "free" of government interferences.

B) Foreign exchange brokers act as agents in currency transactions and often take direct positions in transactions.

C) Anonymity is important for the parties of a brokered currency transaction because knowledge of the parties might affect the quote offered.

D) Currency speculation is not a major concern for central and commercial bank managers, and hence little of the bank's risk management program deals with currency risk.

E) None of the above statements correctly characterize foreign exchange markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the bid rate is given as $1.270293/€ and the offer rate is $1.270294/€, then which of the following statements is correct?

A) A person who wishes to buy euros for dollars will receive a rate of $1.270293/€.

B) A person who wishes to sell dollars for euros will receive a rate of $1.270293/€.

C) A person who wishes to sell euros for dollars will receive a rate of $1.270294/€.

D) A person who wishes to buy dollars for euros will receive a rate of $1.270293/€.

E) All of the statements above are correct.

A) A person who wishes to buy euros for dollars will receive a rate of $1.270293/€.

B) A person who wishes to sell dollars for euros will receive a rate of $1.270293/€.

C) A person who wishes to sell euros for dollars will receive a rate of $1.270294/€.

D) A person who wishes to buy dollars for euros will receive a rate of $1.270293/€.

E) All of the statements above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

Assume that a country is running a net credit balance on the balance of payments (BOP) and that the country is trying to maintain a fixed exchange rate against the currencies of its major trading partner. Under these conditions, which of the following statements is incorrect?

A) The country is required to intervene in the market to buy up the excess foreign currency.

B) The country is required to intervene in the market to supply foreign currencies from reserves.

C) The country will have to make changes in its domestic economy, most likely to lower interest rates, to increase demand for imports.

D) The country will have to make changes in its domestic economy, most likely to raise interest rates, to decrease demand for imports.

E) Statements b and d are incorrect.

A) The country is required to intervene in the market to buy up the excess foreign currency.

B) The country is required to intervene in the market to supply foreign currencies from reserves.

C) The country will have to make changes in its domestic economy, most likely to lower interest rates, to increase demand for imports.

D) The country will have to make changes in its domestic economy, most likely to raise interest rates, to decrease demand for imports.

E) Statements b and d are incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

Covered interest arbitrage

A) Is a technique for earning a riskless profit without having to commit one's own money when purchasing power parity does not hold.

B) Involves borrowing one currency at that country's interest rate, converting the loan proceeds into another country's currency at the spot rate, and investing the proceeds at that country's interest rate. A forward contract is used to lock in the future exchange rate when one wants to reconvert the proceeds into the original currency for use in repaying the loan.

C) Requires that one have sufficient funds available from other sources to "cover" the amount of the transactions just in case the market turns around and exchange rates go against the arbitrageur before the position can be reversed.

D) All of the statements above are correct.

E) Only statements a and b are correct.

A) Is a technique for earning a riskless profit without having to commit one's own money when purchasing power parity does not hold.

B) Involves borrowing one currency at that country's interest rate, converting the loan proceeds into another country's currency at the spot rate, and investing the proceeds at that country's interest rate. A forward contract is used to lock in the future exchange rate when one wants to reconvert the proceeds into the original currency for use in repaying the loan.

C) Requires that one have sufficient funds available from other sources to "cover" the amount of the transactions just in case the market turns around and exchange rates go against the arbitrageur before the position can be reversed.

D) All of the statements above are correct.

E) Only statements a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is most correct?

A) The Fisher equation demonstrates that the ratio of prices on identical products in two countries determines the exchange rate between two currencies.

B) Most theorists agree that the Fisher effect is valid and that liquidity premia, and not inflation, drive interest rate determination.

C) If the forward currency premium or discount is equal in sign and magnitude to the interest rate differential, the spot and forward rates are said to be "at interest rate parity."

D) According to the unbiased predictor condition, the forward rate is the best estimate of the future spot rate, which is equally likely to be higher or lower than the forward rate.

E) For the parity conditions to hold, it is imperative that the real risk-free rate (r*) be determined by the market and be allowed to fluctuate freely.

A) The Fisher equation demonstrates that the ratio of prices on identical products in two countries determines the exchange rate between two currencies.

B) Most theorists agree that the Fisher effect is valid and that liquidity premia, and not inflation, drive interest rate determination.

C) If the forward currency premium or discount is equal in sign and magnitude to the interest rate differential, the spot and forward rates are said to be "at interest rate parity."

D) According to the unbiased predictor condition, the forward rate is the best estimate of the future spot rate, which is equally likely to be higher or lower than the forward rate.

E) For the parity conditions to hold, it is imperative that the real risk-free rate (r*) be determined by the market and be allowed to fluctuate freely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

If one euro can purchase 1.27 U.S. dollars, how many euros can one U.S. dollar buy?

A) 0.721

B) 0.787

C) 0.843

D) 1.277

E) 2.544

A) 0.721

B) 0.787

C) 0.843

D) 1.277

E) 2.544

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

Bristow Home Improvement imports lumber from Canada. Each unit of lumber costs 8 Canadian dollars. The company sells the lumber in its European stores for 8 euros. Currently, exchange rates are:

$1 Canadian = $0.6784 U.S.

1 euro = $0.7900 U.S.

How much profit measured in U.S. dollars does Bristow make on each unit of lumber sold?

A) $0.89

B) $0.94

C) $0.99

D) $1.06

E) $1.13

$1 Canadian = $0.6784 U.S.

1 euro = $0.7900 U.S.

How much profit measured in U.S. dollars does Bristow make on each unit of lumber sold?

A) $0.89

B) $0.94

C) $0.99

D) $1.06

E) $1.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

Maria Elena Sanchez, a young accountant in Madrid, is about to take the trip of a lifetime to Tahiti. She is trying to plan her expenses carefully so that she can afford to buy some exotic black pearls while she is there, so she needs to know how many French Polynesian francs she can buy with her euros. The euro spot rate in the newspaper today is $1.2115/€. She called a friend at a bank who told her that the franc was selling at a rate of XPF92.15/$. What is the exchange rate of francs per euro?

A) XPF76.06/€

B) XPF92.35/€

C) XPF111.64/€

D) XPF121.22/€

E) XPF130.73/€

A) XPF76.06/€

B) XPF92.35/€

C) XPF111.64/€

D) XPF121.22/€

E) XPF130.73/€

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

A computer costs $1,100 in the United States. The same computer costs 1,265 euros in France. Assuming that purchasing power parity (PPP) strictly holds, what is the spot exchange rate between the dollar and the euro?

A) $3.75 = 1 euro

B) $1.00 = 2.50 euros

C) $1.00 = 0.869565 euro

D) $1.15 = 1 euro

E) $1.00 = 1.15 euros

A) $3.75 = 1 euro

B) $1.00 = 2.50 euros

C) $1.00 = 0.869565 euro

D) $1.15 = 1 euro

E) $1.00 = 1.15 euros

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

Currently, in the spot market $1 = 116.55 Japanese yen, 1 Japanese yen = 0.00956 euro, and 1 euro = 9.3616 Mexican pesos. How many U.S. dollars will one peso buy?

A) 0.0959

B) 0.1190

C) 0.8430

D) 8.4000

E) 10.430

A) 0.0959

B) 0.1190

C) 0.8430

D) 8.4000

E) 10.430

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

Maria Elena Sanchez, a young accountant in Madrid, is about to take the trip of a lifetime to Tahiti. She is trying to plan her expenses carefully so that she can afford to buy some exotic black pearls while she is there. Her friend at a Madrid bank tells her that the spot exchange rate for the French Polynesian franc is XPF92.15/$, but there are no forward quotations. Maria Elena is not going for six months, so she is afraid that the exchange rate will change before she leaves. Her friend tells her that expected inflation in the U.S. for the next year is 3.5 percent (1.75 percent for six months), and for French Polynesia it is 8 percent (4.00 percent for six months). According to purchasing power parity, what is the future spot rate?

A) XPF96.1565/$

B) XPF94.1877/$

C) XPF92.3506/$

D) XPF90.1564/$

E) XPF88.3104/$

A) XPF96.1565/$

B) XPF94.1877/$

C) XPF92.3506/$

D) XPF90.1564/$

E) XPF88.3104/$

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the spot market, 1 U.S. dollar can be exchanged for 114 Japanese yen. In the 1-year forward market, 1 U.S. dollar can be exchanged for 119 Japanese yen. The 1-year, risk-free rate of interest is 5.2 percent in the United States. If interest rate parity holds, what is the yield today on 1-year, risk-free Japanese securities?

A) 1.83%

B) 4.71%

C) 5.37%

D) 8.68%

E) 9.81%

A) 1.83%

B) 4.71%

C) 5.37%

D) 8.68%

E) 9.81%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tahia Meyers, the chief accountant of the Black Pearl Jewelry Company in Moorea, French Polynesia, expects that the company will need to borrow money in six months to finance new inventory before the start of the main tourist season. Her main bank is unwilling to hazard a guess about the interest rate she will have to pay at that time, but she knows several other pieces of information. The current spot exchange rate is XPF92.15/$ and the Minister of Finance was recently quoted as forecasting the exchange rate in six months to depreciate to XPF95.00/$. She also knows that the risk-free interest rate in the U.S. is 6.5 percent per annum, or 3.25 percent for six months. According to interest rate parity, what is the forecasted equilibrium value for rRF in French Polynesia in six months?

A) 19.588% per annum

B) 17.357% per annum

C) 15.936% per annum

D) 14.187% per annum

E) 12.887% per annum

A) 19.588% per annum

B) 17.357% per annum

C) 15.936% per annum

D) 14.187% per annum

E) 12.887% per annum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

Tahia Meyers, the chief accountant of the Black Pearl Jewelry Company in Moorea, French Polynesia, is planning for the tourist high season that will start at the conclusion of the rainy season. She heard a statement by the local Minister of Economic Affairs in which he suggested that the French Polynesian franc could lose up to ten percent of its value in the upcoming six months. Tahia thinks that this might be just rhetoric directed at the French government, but she would like to look more closely at the issue. She knows that the current spot rate is XPF92.15/$ and has calculated the expected spot rate in six months as XPF95.00/$. What is the percent per annum discount or premium on the franc?

A) 6.00% per annum discount

B) 6.00% per annum premium

C) 6.19% per annum discount

D) 6.19% per annum premium

E) None of the above.

A) 6.00% per annum discount

B) 6.00% per annum premium

C) 6.19% per annum discount

D) 6.19% per annum premium

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Chinese government's official position on the value of the yuan renminbi is that it is neither overvalued nor undervalued, so there is no expectation that the fixed exchange rate will change from its current value of CNY8.28/$ anytime soon. However, many Western currency traders believe that the Chinese government will soon be forced to revalue the yuan by at least 15 percent. What exchange rate would reflect a 15 percent revaluation of the yuan renminbi?

A) CNY9.74/$

B) CNY7.20/$

C) CNY9.52/$

D) CNY7.04/$

E) None of the above.

A) CNY9.74/$

B) CNY7.20/$

C) CNY9.52/$

D) CNY7.04/$

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

From a country's perspective, what is the significance of the balance of payments report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

Explain why it is important to keep track of direct and indirect quotations when calculating percentage changes in exchange rates or forward premiums or discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a country uses a fixed exchange rate system, what actions can it take in response to the balance of payments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is covered interest arbitrage and what conditions must exist for it to occur?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

Explain how supply, demand, and the balance of payments report interact to help determine exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

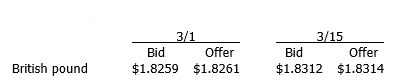

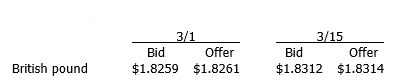

Jenna just got back from a two week vacation to England. She started her vacation on March 1 and had $2,000 in spending money. While in England, she spent 80 percent of her money. On March 15, she returned from England and exchanged her remaining British pounds for U.S. dollars. Below are the currency exchange rates offered by her bank on the dates in question.

How many U.S. dollars did she have after her vacation?

How many U.S. dollars did she have after her vacation?

How many U.S. dollars did she have after her vacation?

How many U.S. dollars did she have after her vacation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

37

Last year, the exchange rate between the U.S. dollar and Australian dollar was $0.7678/A$. Today, the exchange rate is $0.7801/A$. If a U.S. investor had invested $100 last year in a one-year Australian security that yielded 9 percent, what is the U.S. dollar rate of return on this investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

Owens Technology has a product that requires raw materials purchased and produced at a Mexican subsidiary at a cost of 56 pesos, and is then sold to a European customer at a price of 6 euros. Last year, exchange rates stood at $0.092/peso and $1.26/euro and Owens' CEO commented that she was unhappy with the current dollar profit on this product. However, she knew that raising prices could be catastrophic to sales, so Owens embarked on an ambitious cost-cutting plan that dropped the cost of the materials and production to 48 pesos. Currently, exchange rates are $0.102/peso and $1.16/euro. What is the U.S. dollar profit on the product now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

A particular tennis racquet costs $160 in the United States. The same racquet currently costs ¥17,500 in Japan. In addition, an investor has observed that 3-month interest rates in the United States and Japan are currently 2.00 percent and 0.40 percent, respectively. If purchasing power and interest rate parity both hold, what do these data imply about the 3-month forward rate between yen and U.S. dollars expressed in American terms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck