Deck 14: Money, Banking, and Financial Institutions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 14: Money, Banking, and Financial Institutions

1

What function is money serving when you take it on a trip and keep it in your wallet or purse in case you need it?

A) A flow of funds.

B) A unit of account.

C) A store of value.

D) A medium of exchange.

A) A flow of funds.

B) A unit of account.

C) A store of value.

D) A medium of exchange.

A store of value.

2

The principal advantage money has over barter is its function as:

A) a store of value.

B) a medium of exchange.

C) a unit of account.

D) debt.

A) a store of value.

B) a medium of exchange.

C) a unit of account.

D) debt.

a medium of exchange.

3

One of the principal defects of using a commodity as money is that its worth as a:

A) medium of exchange may exceed its worth as a standard of account, causing it to cease being useful as money.

B) unit of account may exceed its worth as a store of value, causing it to cease being useful as money.

C) medium of exchange may exceed its worth as a store of value, causing it to cease being useful as money.

D) commodity may exceed its worth as money, causing it to cease functioning as a medium of exchange.

A) medium of exchange may exceed its worth as a standard of account, causing it to cease being useful as money.

B) unit of account may exceed its worth as a store of value, causing it to cease being useful as money.

C) medium of exchange may exceed its worth as a store of value, causing it to cease being useful as money.

D) commodity may exceed its worth as money, causing it to cease functioning as a medium of exchange.

commodity may exceed its worth as money, causing it to cease functioning as a medium of exchange.

4

All coins in circulation within the United States are:

A) near monies.

B) checkable deposits.

C) token money.

D) time deposits.

A) near monies.

B) checkable deposits.

C) token money.

D) time deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

A major component of the money supply (M1) is:

A) savings bonds.

B) checkable deposits.

C) gold certificates.

D) savings deposits.

A) savings bonds.

B) checkable deposits.

C) gold certificates.

D) savings deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

As of 2016, the largest component of the money supply (M1) is:

A) checkable deposits.

B) currency.

C) small time deposits.

D) savings deposits.

A) checkable deposits.

B) currency.

C) small time deposits.

D) savings deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

The M1 money supply is composed of:

A) money market mutual funds held by individuals.

B) money market mutual funds held by businesses.

C) savings deposits and time deposits.

D) checkable deposits and currency.

A) money market mutual funds held by individuals.

B) money market mutual funds held by businesses.

C) savings deposits and time deposits.

D) checkable deposits and currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which would be included in the definition of the money supply? Currency and checkable deposits owned by:

A) the Federal Reserve Banks.

B) the U.S. Treasury.

C) commercial banks.

D) the public.

A) the Federal Reserve Banks.

B) the U.S. Treasury.

C) commercial banks.

D) the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

Tony Lai deposits $200 in currency in his checking account at a bank. This deposit is treated as:

A) a subtraction of $200 from the money supply because the $200 in currency is no longer in circulation.

B) an addition of $200 to the money supply because of the creation of a checkable deposit of $200.

C) an addition of $200 to the money supply because the bank holds $200 in currency and the checking account has been increased by $200.

D) no change in the money supply because the $200 in currency has been converted to a $200 increase in checkable deposits.

A) a subtraction of $200 from the money supply because the $200 in currency is no longer in circulation.

B) an addition of $200 to the money supply because of the creation of a checkable deposit of $200.

C) an addition of $200 to the money supply because the bank holds $200 in currency and the checking account has been increased by $200.

D) no change in the money supply because the $200 in currency has been converted to a $200 increase in checkable deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

Paper money in the United States comes in the form of:

A) U.S. Treasury bills.

B) U.S. Treasury bonds.

C) federal legal tender.

D) Federal Reserve Notes.

A) U.S. Treasury bills.

B) U.S. Treasury bonds.

C) federal legal tender.

D) Federal Reserve Notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

How are the following items treated in the calculation of M1?

A) Small time deposits and currency are both included.

B) Small time deposits and money market mutual funds of individuals are both included.

C) Checkable deposits are excluded and currency is included.

D) Checkable deposits and currency are both included.

A) Small time deposits and currency are both included.

B) Small time deposits and money market mutual funds of individuals are both included.

C) Checkable deposits are excluded and currency is included.

D) Checkable deposits and currency are both included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

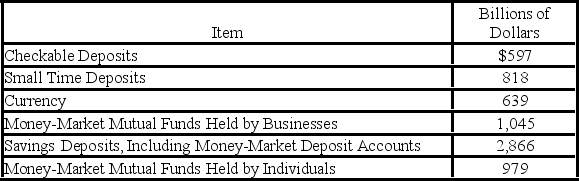

12

Refer to the above table. The size of the M2 money supply is:

Refer to the above table. The size of the M2 money supply is:A) $2054 billion.

B) $2696 billion.

C) $5899 billion.

D) $6792 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

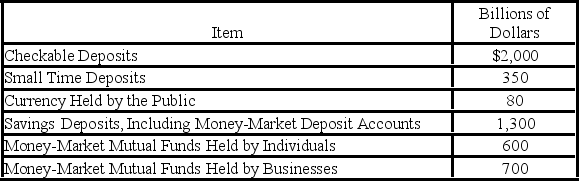

13

- Refer to the above table. The size of the M1 money supply is:

A) $1,940.

B) $2,080.

C) $2,220.

D) $2,730.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

- Refer to the above table. The size of the M2 money supply is:

A) $3,730.

B) $3,980.

C) $4,330.

D) $4,470.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

Generally speaking, the greater the amount of financial wealth people hold in the form of near-monies, the:

A) greater is their willingness to spend out of their money incomes.

B) less is their willingness to spend out of their money incomes.

C) greater is the transactions demand for money.

D) less is the asset demand for money.

A) greater is their willingness to spend out of their money incomes.

B) less is their willingness to spend out of their money incomes.

C) greater is the transactions demand for money.

D) less is the asset demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

One reason that "near-monies" are important is because:

A) they simplify the definition of money and therefore the formulation of monetary policy.

B) they can be easily converted into money or vice versa, and thereby can influence the stability of the economy.

C) they do not reflect the level of consumer spending, but they have a critical impact on saving and investment in the economy.

D) credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold.

A) they simplify the definition of money and therefore the formulation of monetary policy.

B) they can be easily converted into money or vice versa, and thereby can influence the stability of the economy.

C) they do not reflect the level of consumer spending, but they have a critical impact on saving and investment in the economy.

D) credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

U.S. currency has value primarily because it:

A) is legal tender, is generally acceptable in exchange for goods or services, and is backed by the gold and silver of the federal government.

B) is generally acceptable in exchange for goods or services, is backed by the gold and silver of the federal government, and facilitates trade.

C) is relatively scarce, is legal tender, and is generally acceptable in exchange for goods and services.

D) facilitates trade, is legal tender, and permits the use of credit cards and near-monies.

A) is legal tender, is generally acceptable in exchange for goods or services, and is backed by the gold and silver of the federal government.

B) is generally acceptable in exchange for goods or services, is backed by the gold and silver of the federal government, and facilitates trade.

C) is relatively scarce, is legal tender, and is generally acceptable in exchange for goods and services.

D) facilitates trade, is legal tender, and permits the use of credit cards and near-monies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

The federal backing for the money in the United States comes from:

A) providing sufficient quantities of precious metals such as gold and silver to cover the amount of paper money in circulation.

B) pledging physical assets, such as land, natural resources, and public buildings as collateral for outstanding currency.

C) control over the money supply designed to keep the value of money relatively stable over time.

D) protecting checkable deposits at financial institutions with deposit guarantees.

A) providing sufficient quantities of precious metals such as gold and silver to cover the amount of paper money in circulation.

B) pledging physical assets, such as land, natural resources, and public buildings as collateral for outstanding currency.

C) control over the money supply designed to keep the value of money relatively stable over time.

D) protecting checkable deposits at financial institutions with deposit guarantees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

In which of the following U.S. cities is one of the 12 Federal Reserve Banks located?

A) New York City

B) Seattle

C) Miami

D) Denver

A) New York City

B) Seattle

C) Miami

D) Denver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements best describes the 12 Federal Reserve Banks?

A) They are privately owned and privately controlled central banks whose basic goal is to provide an ample and orderly market for U.S. Treasury securities.

B) They are privately owned and publicly controlled central banks whose basic function is to minimize the risks in commercial banking in order to make it a reasonably profitable industry.

C) They are privately owned and publicly controlled central banks whose basic goal is to control the money supply and interest rates in promoting the general economic welfare.

D) They are privately owned and publicly controlled central banks whose basic goal is to earn profits for their owners.

A) They are privately owned and privately controlled central banks whose basic goal is to provide an ample and orderly market for U.S. Treasury securities.

B) They are privately owned and publicly controlled central banks whose basic function is to minimize the risks in commercial banking in order to make it a reasonably profitable industry.

C) They are privately owned and publicly controlled central banks whose basic goal is to control the money supply and interest rates in promoting the general economic welfare.

D) They are privately owned and publicly controlled central banks whose basic goal is to earn profits for their owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which is the most important function of the Federal Reserve System?

A) Setting reserve requirements.

B) Controlling the money supply.

C) Lending money to banks and thrifts.

D) Acting as the fiscal agent for the U.S. government.

A) Setting reserve requirements.

B) Controlling the money supply.

C) Lending money to banks and thrifts.

D) Acting as the fiscal agent for the U.S. government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

The primary responsibility of the Federal Open Market Committee (FOMC) is:

A) issuing currency and acting as the fiscal agent for the federal government.

B) handling the Fed's collection of checks and adjusting legal reserves among banks.

C) setting the Fed's monetary policy and directing the buying and selling of government securities.

D) supervising bank operations to make sure they follow regulations and monitoring banks for fraud.

A) issuing currency and acting as the fiscal agent for the federal government.

B) handling the Fed's collection of checks and adjusting legal reserves among banks.

C) setting the Fed's monetary policy and directing the buying and selling of government securities.

D) supervising bank operations to make sure they follow regulations and monitoring banks for fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Approximately how many commercial banks are there in the United States as of 2017?

A) 8,500

B) 7,300

C) 14,500

D) 6,000

A) 8,500

B) 7,300

C) 14,500

D) 6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

The use of a credit card is most similar to:

A) creating legal tender.

B) reducing the value of the U.S. dollar.

C) purchasing a certificate of deposit at a commercial bank.

D) obtaining a short-term loan from a financial institution.

A) creating legal tender.

B) reducing the value of the U.S. dollar.

C) purchasing a certificate of deposit at a commercial bank.

D) obtaining a short-term loan from a financial institution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

In the United States, credit cards account for about what percentage of the dollar volume of transactions for goods and services?

A) 10 percent

B) 25 percent

C) 40 percent

D) 65 percent

A) 10 percent

B) 25 percent

C) 40 percent

D) 65 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following were factors in the financial crisis of 2007-2008?

A) Mortgage default crisis.

B) Securitization.

C) Subprime mortgage loans.

D) All of these.

A) Mortgage default crisis.

B) Securitization.

C) Subprime mortgage loans.

D) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the current level of FDIC deposit insurance per account, as of 2017?

A) $50,000

B) $100,000

C) $250,000

D) $500,000

A) $50,000

B) $100,000

C) $250,000

D) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

Within the financial services industry, which of the following is an example of a financial institution?

A) Thrifts

B) Insurance companies

C) Pension funds

D) All of these

A) Thrifts

B) Insurance companies

C) Pension funds

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Commercial banks, mutual fund companies, and securities firms are all part of the ________ services industry.

A) government

B) economic

C) financial

D) political

A) government

B) economic

C) financial

D) political

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Firms that pool deposits by customers to purchase stocks or bonds are known as:

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

Firms that help corporations and governments raise money by selling stocks and bonds are known as:

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Firms that offer contracts through which individuals pay premiums to insure against some loss are known as:

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

For which of the following types of firms is the buying and selling of stocks and bonds not a primary function?

A) securities firms

B) thrifts

C) mutual fund companies

D) investment banks

A) securities firms

B) thrifts

C) mutual fund companies

D) investment banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Cash held by a bank is sometimes called:

A) token money.

B) legal tender.

C) vault cash.

D) fractional reserves.

A) token money.

B) legal tender.

C) vault cash.

D) fractional reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

A commercial bank has checkable-deposit liabilities of $50,000 and a reserve ratio of 20 percent. What is the amount of required reserves?

A) $10,000

B) $50,000

C) $250,000

D) $1 million

A) $10,000

B) $50,000

C) $250,000

D) $1 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

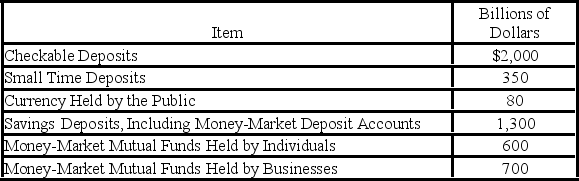

36

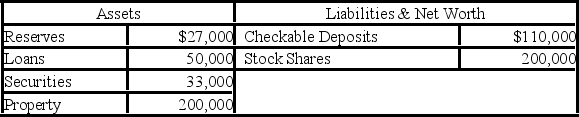

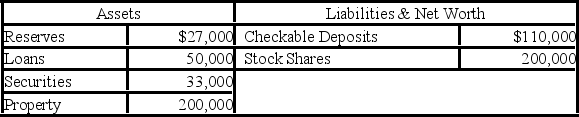

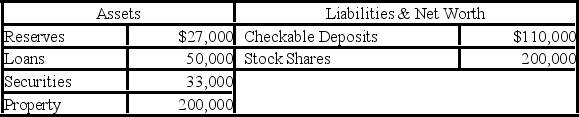

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

-Refer to the above data. This commercial bank has excess reserves of:

A) $0

B) $3,000.

C) $12,000.

D) $5,000.

-Refer to the above data. This commercial bank has excess reserves of:

A) $0

B) $3,000.

C) $12,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

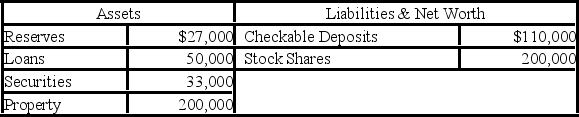

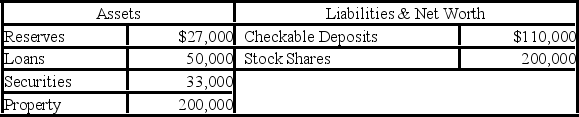

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

-Refer to the above data. This bank can safely expand its loans by a maximum of:

A) $7,000.

B) $25,000.

C) $12,000.

D) $5,000.

-Refer to the above data. This bank can safely expand its loans by a maximum of:

A) $7,000.

B) $25,000.

C) $12,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

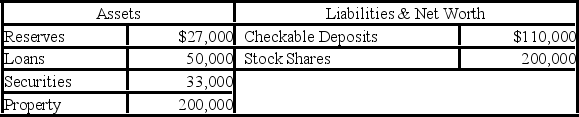

38

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

- Refer to the above data. Assuming the bank loans out all of its remaining excess reserves as a checkable deposit, and has a check cleared against it for that amount, its reserves and checkable deposits will now be:

A) $25,000 and $122,000 respectively.

B) $22,000 and $110,000 respectively.

C) $32,000 and $115,000 respectively.

D) $22,000 and $105,000 respectively.

- Refer to the above data. Assuming the bank loans out all of its remaining excess reserves as a checkable deposit, and has a check cleared against it for that amount, its reserves and checkable deposits will now be:

A) $25,000 and $122,000 respectively.

B) $22,000 and $110,000 respectively.

C) $32,000 and $115,000 respectively.

D) $22,000 and $105,000 respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

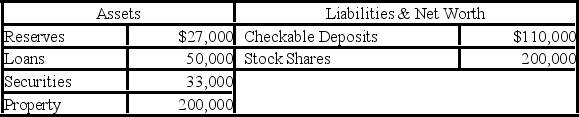

39

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

-Refer to the above data. Assuming the bank loans out all of its remaining excess reserves as a checkable deposit and has a check cleared against it for that amount, the bank will now have excess reserves of:

A) $0.

B) $3,000.

C) $12,000.

D) $5,000.

-Refer to the above data. Assuming the bank loans out all of its remaining excess reserves as a checkable deposit and has a check cleared against it for that amount, the bank will now have excess reserves of:

A) $0.

B) $3,000.

C) $12,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

-Refer to the above data. If the original balance sheet was for the commercial banking system, rather than a single bank, loans and checkable deposits could have been expanded by a maximum of:

A) $8,000.

B) $15,000.

C) $48,000.

D) $25,000.

-Refer to the above data. If the original balance sheet was for the commercial banking system, rather than a single bank, loans and checkable deposits could have been expanded by a maximum of:

A) $8,000.

B) $15,000.

C) $48,000.

D) $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

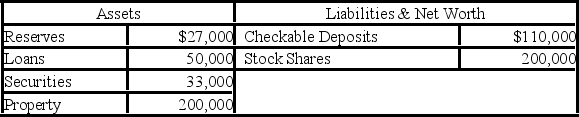

41

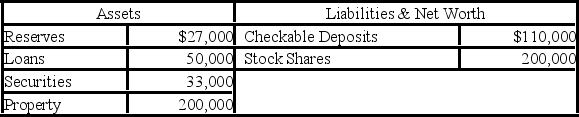

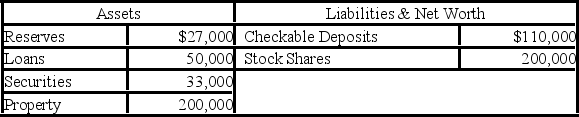

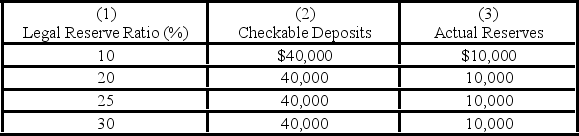

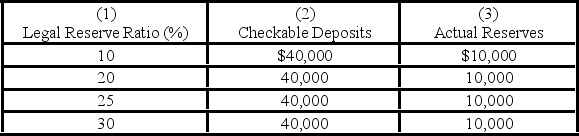

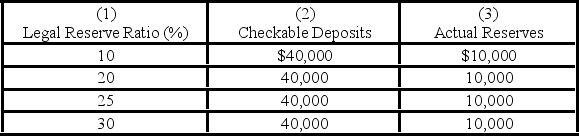

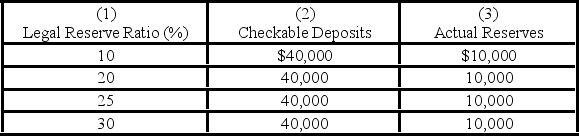

Answer the next question on the basis of the following table for a commercial bank or thrift:

-Refer to the above table. When the legal reserve ratio is 25 percent, the excess reserves of this single bank are:

A) $0.

B) $1,000.

C) $5,000.

D) $30,000.

-Refer to the above table. When the legal reserve ratio is 25 percent, the excess reserves of this single bank are:

A) $0.

B) $1,000.

C) $5,000.

D) $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer the next question on the basis of the following table for a commercial bank or thrift:

-Refer to the above table. When the legal reserve ratio is 20 percent, the money-creating potential of the entire banking system is:

A) $4,000.

B) $6,000.

C) $8,000.

D) $10,000.

-Refer to the above table. When the legal reserve ratio is 20 percent, the money-creating potential of the entire banking system is:

A) $4,000.

B) $6,000.

C) $8,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Answer the next question on the basis of the following table for a commercial bank or thrift:

-Refer to the above table. When the legal reserve ratio is 30 percent, the monetary multiplier is:

A) 5.

B) 4.

C) 3.33.

D) 2.5.

-Refer to the above table. When the legal reserve ratio is 30 percent, the monetary multiplier is:

A) 5.

B) 4.

C) 3.33.

D) 2.5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

Answer the next question on the basis of the following table for a commercial bank or thrift:

-Refer to the above table. If the legal reserve ratio falls from 25 percent to 10 percent, excess reserves of this single bank will:

A) rise by $6,000 and the monetary multiplier will increase from 4 to 10.

B) rise by $60,000 and the monetary multiplier will increase from 4 to 10.

C) fall by $6,000 and the monetary multiplier will decline from 30 to 10.

D) fall by $2,000 and the monetary multiplier will decline from 10 to 4.

-Refer to the above table. If the legal reserve ratio falls from 25 percent to 10 percent, excess reserves of this single bank will:

A) rise by $6,000 and the monetary multiplier will increase from 4 to 10.

B) rise by $60,000 and the monetary multiplier will increase from 4 to 10.

C) fall by $6,000 and the monetary multiplier will decline from 30 to 10.

D) fall by $2,000 and the monetary multiplier will decline from 10 to 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

If excess reserves in the banking system are $4,000, checkable deposits are $40,000, and the legal reserve ratio is 10 percent, then actual reserves are:

A) $4,000.

B) $6,000.

C) $8,000.

D) $5,000.

A) $4,000.

B) $6,000.

C) $8,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

If actual reserves in the banking system are $8,000, checkable deposits are $70,000, and the legal reserve ratio is 10 percent, then excess reserves are:

A) zero.

B) $1,000.

C) $2,000.

D) $500.

A) zero.

B) $1,000.

C) $2,000.

D) $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

A small time deposit is one that is less than $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Federal Open Market Committee (FOMC) is made up of the presidents of the Federal Reserve Banks, the secretary of the Treasury, and the chair of the President's Council of Economic Advisers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Federal Open Market Committee (FOMC) serves as the fiscal agent for the U.S. government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

Federal Reserve Banks are bankers' banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Federal Reserve is responsible for issuing currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Federal Reserve is prohibited from lending money to banks and thrifts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Since the 1980s, banks and thrifts have lost their share of the financial services industry and control over financial assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Electronic money and smart cards will increase the problems for the Federal Reserve in controlling the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Without an acceptable domestic currency to serve as a medium of exchange, a nation might try to substitute a more stable currency from another nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

Federal deposit insurance discourages but does not prevent bank runs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

The United States faced the most serious financial crisis since the Great Depression during the period of 2007-2008.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Federal deposit insurance is currently capped at $100,000 per account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck