Deck 2: The Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/22

العب

ملء الشاشة (f)

Deck 2: The Time Value of Money

1

How much do you have to invest today at an annual rate of 8%, if you need to have $5,000 six years from today?

A) $3,150.85

B) $4,236.75

C) $7,934.37

D) $2,938.48

A) $3,150.85

B) $4,236.75

C) $7,934.37

D) $2,938.48

$3,150.85

2

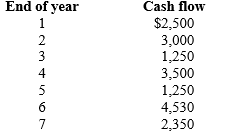

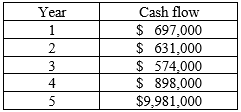

What is the future value of cash flows 1-5 at the end of year 5, assuming a 6% interest rate (compounded annually)? ?

A) $13,879.36

B) $13,093.74

C) $9,7844.40

D) $11,548.48

A) $13,879.36

B) $13,093.74

C) $9,7844.40

D) $11,548.48

$13,093.74

3

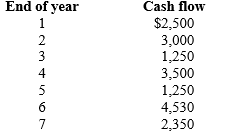

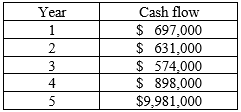

What is the present value of these cash flows, if the discount rate is 10% annually? ?

A) $18,380.00

B) $12,620.90

C) $22,358.69

D) $14,765.52

A) $18,380.00

B) $12,620.90

C) $22,358.69

D) $14,765.52

$12,620.90

4

If you invested $2,000 in an account that pays 12% interest, compounded continuously, how much would be in the account in 5 years?

A) $3,524.68

B) $3,644.24

C) $3,581.70

D) $3,200.00

A) $3,524.68

B) $3,644.24

C) $3,581.70

D) $3,200.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements are TRUE?

Statement I: As you increase the interest rate, the future value of an investment increases.

Statement II: As you increase the length of the investment (to receive some lump sum), the present value of the investment increases.

Statement III: The present value of an ordinary annuity is larger than the present value of an annuity due. (all else equal)

A) Statement I only

B) Statements I and II

C) Statement II only

D) Statements I and III only

Statement I: As you increase the interest rate, the future value of an investment increases.

Statement II: As you increase the length of the investment (to receive some lump sum), the present value of the investment increases.

Statement III: The present value of an ordinary annuity is larger than the present value of an annuity due. (all else equal)

A) Statement I only

B) Statements I and II

C) Statement II only

D) Statements I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

6

A bank is offering a new savings account that pays 8% per year. Which formula below shows the calculation for determining how long it will take a $100 investment to double?

A) ?

B) ?

C) ?

D) ?

A) ?

B) ?

C) ?

D) ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

7

In five years, you plan on starting graduate school to earn your MBA. You know that graduate school can be expensive and you expect you will need $15,000 per year for tuition and other school expenses. These payments will be made at the BEGINNING of the school year. To have enough money to attend graduate school, you decide to start saving TODAY by investing in a money market fund that pays 4% APR with monthly compounding. You will make monthly deposits into the account starting TODAY for the next five years. How much will you need to deposit each month to have enough savings for graduate school? (Assume that money that is not withdrawn remains in the account during graduate school and the MBA will take two years to complete.)

A) $438.15

B) $440.26

C) $442.16

D) $443.64

A) $438.15

B) $440.26

C) $442.16

D) $443.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

8

As a young graduate, you have plans on buying your dream car in three years. You believe the car will cost $50,000. You have two sources of money to reach your goal of $50,000. First, you will save money for the next three years in a money market fund that will return 8% annually. You plan on making $5,000 annual payments to this fund. You will make yearly investments at the BEGINNING of the year. The second source of money will be a car loan that you will take out on the day you buy the car. You anticipate the car dealer to offer you a 6% APR loan with monthly compounding for a term of 60 months. To buy your dream car, what monthly car payment will you anticipate?

A) $483.99

B) $540.15

C) $627.73

D) $652.83

A) $483.99

B) $540.15

C) $627.73

D) $652.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

9

A $100 investment yields $112.55 in one year. The interest on the investment was compounded quarterly. From this information, what was the stated rate or APR of the investment?

A) 12.55%

B) 12.25%

C) 12.15%

D) 12.00%

A) 12.55%

B) 12.25%

C) 12.15%

D) 12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

10

You inherit $15,000 from your aunt. You decide to invest the money in a three-year CD that pays 4% interest to use as a down payment on a house. How much money will you have when the CD matures?

A) $13,334.95

B) $15,600.00

C) $16,800.00

D) $16,872.96

A) $13,334.95

B) $15,600.00

C) $16,800.00

D) $16,872.96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

11

If you need $35,000 for a down payment on a house in six years, how much money must you invest today at 7% interest compounded annually to achieve your goal?

A) $14,700.00

B) $20,300.00

C) $23,321.98

D) $24,954.52

A) $14,700.00

B) $20,300.00

C) $23,321.98

D) $24,954.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

12

If you deposit $9,000 at the end of each year in an account earning 8% interest, what will be the value of the account in 25 years?

A) $600,882.83

B) $657,953.46

C) $710,589.74

D) $719,589.74

A) $600,882.83

B) $657,953.46

C) $710,589.74

D) $719,589.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

13

If you deposit $9,000 at the beginning of each year in an account earning 8% interest, what will be the value of the account in 25 years?

A) $609,216.17

B) $657,953.46

C) $710,589.74

D) $774,823.46

A) $609,216.17

B) $657,953.46

C) $710,589.74

D) $774,823.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

14

If you invest $2,500 in a bank account that pays 6% interest compounded quarterly, how much will you have in five years?

A) $2,546.96

B) $3,367.14

C) $8,017.84

D) $13,267.04

A) $2,546.96

B) $3,367.14

C) $8,017.84

D) $13,267.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

15

Your credit card carries a 9.9% annual percentage rate, compounded daily. What is the effective annual rate, or annual percentage yield?

A) 0.03%

B) 9.90%

C) 10.41%

D) 18.00%

A) 0.03%

B) 9.90%

C) 10.41%

D) 18.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

16

Atlas Map Co. has purchased a new building for $45 million. If the value of the building increases at a rate of 5% per year, how much will the building be worth in 20 years?

A) $119,398,397

B) $113,712,759

C) $16,960,027

D) $16,131,867

A) $119,398,397

B) $113,712,759

C) $16,960,027

D) $16,131,867

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

17

If you deposit $10,000 today in an account that pays 5% interest compounded annually for five years, how much interest will you earn?

A) $2,500.00

B) $2,762.82

C) $3,400.96

D) $12,762.82

A) $2,500.00

B) $2,762.82

C) $3,400.96

D) $12,762.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

18

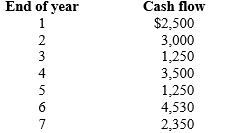

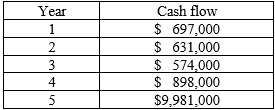

Herbilux Botanicals forecasts the following cash flows at the end of each year for a project. If the firm's discount rate is 9%, what is the present value of the project? Year

A) $7,634,980

B) $8,015,517

C) $8,736,914

D) $12,268,998

A) $7,634,980

B) $8,015,517

C) $8,736,914

D) $12,268,998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

19

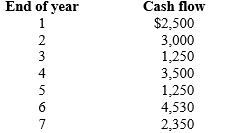

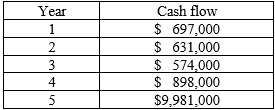

Mayfield Development, LLC forecasts the following cash flows at the beginning of each year for a project. If the firm's discount rate is 9%, what is the present value of the project?

A) $7,634,980

B) $8,736,914

C) $9,523,236

D) $12,268,998

A) $7,634,980

B) $8,736,914

C) $9,523,236

D) $12,268,998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

20

If you invest $2,500 in a bank account that pays 6% interest compounded monthly, how much will you have in five years?

A) $1,853.43

B) $3,345.56

C) $2,505.20

D) $3,372.13

A) $1,853.43

B) $3,345.56

C) $2,505.20

D) $3,372.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

21

You invest $10,000 in August 2004. In August 2009, the investment is worth $12,000. What was your compound annual rate of return over the period?

A) 3.09%

B) 3.71%

C) 4.00%

D) 4.21%

A) 3.09%

B) 3.71%

C) 4.00%

D) 4.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a bank lends you $10,000 and requires that you make payments of $2,500 at the end of each of the next five years, what interest rate is the bank charging?

A) 4.56%

B) 5.61%

C) 7.93%

D) 11.18%

A) 4.56%

B) 5.61%

C) 7.93%

D) 11.18%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck