Deck 8: Cash and Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 8: Cash and Receivables

1

Cash consists of coin, currency, money market funds, certificates of deposit and other available funds on deposit at the bank.

False

2

Because the bank has the legal right to demand notice before withdrawal, savings accounts usually are not classified on an entity's balance sheet as cash.

False

3

Bond sinking fund cash should not be classified as a current asset because its use is restricted.

True

4

Bank overdrafts occur when a check is written for less than the amount in the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

Accounts receivable are frequently accepted from customers who need to extend the payment period of an outstanding note receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

When a sale and the related receivable are initially recorded at the gross amount, sales discounts will be recognized in the accounts only when payment is received within the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

The percentage-of-receivables approach is also referred to as the income statement approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

It is improper to offset assets and liabilities in the balance sheet, except where a right of offset exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

A trade receivable due two years hence should never be classified as a current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

Factoring is the term used to describe the pledging of receivables as collateral for a loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

The present value of a note is measured by the fair value of the property, goods, or services exchanged for the note or by an amount that reasonably approximates the market value of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

The replenishment of the petty cash fund under an imprest system requires a debit to the Petty Cash account for the amount of the replenishment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

Of the two bank reconciliation formats used by a business entity, the more widely used form reconciles both the bank balance and the book balance to a correct cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

When preparing a bank reconciliation for the purpose of arriving at a correct cash balance, NSF (not sufficient funds) checks are subtracted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is properly classified as cash?

A) Customer's postdated checks on hand

B) Certificates of deposit

C) Savings accounts

D) Bond sinking fund cash

A) Customer's postdated checks on hand

B) Certificates of deposit

C) Savings accounts

D) Bond sinking fund cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

A compensating balance as defined by the SEC is best reflected by which of the following?

A) A savings account maintained at the bank equal to the amount of all outstanding loans.

B) An amount of capital stock held in the company's treasury equal to outstanding loan commitments.

C) The portion of any demand deposit, time deposit, or certificate of deposit maintained by a corporation which constitutes support for existing borrowing arrangements of the corporation with the lending institution.

D) A balance held in a time or demand deposit account that is equal to the interest currently due on a loan.

A) A savings account maintained at the bank equal to the amount of all outstanding loans.

B) An amount of capital stock held in the company's treasury equal to outstanding loan commitments.

C) The portion of any demand deposit, time deposit, or certificate of deposit maintained by a corporation which constitutes support for existing borrowing arrangements of the corporation with the lending institution.

D) A balance held in a time or demand deposit account that is equal to the interest currently due on a loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following methods of determining bad debt expense does not properly match expense and revenue?

A) Charging bad debts with a percentage of sales under the allowance method.

B) Charging bad debts with an amount derived from a percentage of accounts receivable under the allowance method.

C) Charging bad debts with an amount derived from aging accounts receivable under the allowance method.

D) Charging bad debts as accounts are written off as uncollectible.

A) Charging bad debts with a percentage of sales under the allowance method.

B) Charging bad debts with an amount derived from a percentage of accounts receivable under the allowance method.

C) Charging bad debts with an amount derived from aging accounts receivable under the allowance method.

D) Charging bad debts as accounts are written off as uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Green Company wrote off a client's account receivable of $400 as uncollectible. What will be the effect on net income under the following methods of recognizing bad debt expense?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements is not correct regarding uncollectible accounts receivable?

A) The direct write-off method records the bad debt in the year that it is determined that a specific receivable cannot be collected.

B) The allowance method is based on the assumption that the percentage of receivables that will not be collected can be predicted from past experiences, present market conditions, and an analysis of outstanding balances.

C) The direct write-off method will provide for a proper matching of costs with revenues of the period when the average monthly accounts receivable balance is consistent throughout the year.

D) An uncollectible account receivable is a loss of revenue that requires through proper entry in the accounts a decrease in the asset accounts receivable and a related decrease in income and stockholders' equity.

A) The direct write-off method records the bad debt in the year that it is determined that a specific receivable cannot be collected.

B) The allowance method is based on the assumption that the percentage of receivables that will not be collected can be predicted from past experiences, present market conditions, and an analysis of outstanding balances.

C) The direct write-off method will provide for a proper matching of costs with revenues of the period when the average monthly accounts receivable balance is consistent throughout the year.

D) An uncollectible account receivable is a loss of revenue that requires through proper entry in the accounts a decrease in the asset accounts receivable and a related decrease in income and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

The allowance method is preferable to the direct write-off method because the allowance method

A) relies on estimates which are always accurate and stable among years.

B) reflects the real facts.

C) recognizes the expense of a bad debt in the year in which the account is determined to be uncollectible.

D) recognizes the expense of a bad debt in the same period as the sale.

A) relies on estimates which are always accurate and stable among years.

B) reflects the real facts.

C) recognizes the expense of a bad debt in the year in which the account is determined to be uncollectible.

D) recognizes the expense of a bad debt in the same period as the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

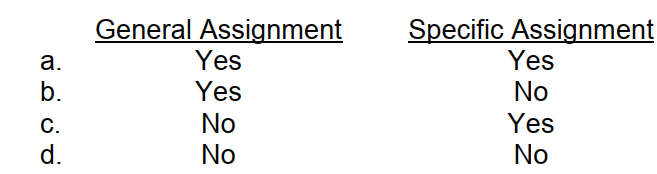

The basic accounting issues for both accounts receivable and notes receivable would center around which of the following?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

At the beginning of 2007, Finney Company received a three-year, zero-interest-bearing $1,000 trade note. The market rate for equivalent notes was 8% at that time. Finney reported this note as a $1,000 trade note receivable on its 2007 year-end statement of financial position and $1,000 as sales revenue for 2007. What effect did this accounting for the note have on Finney's net earnings for 2007, 2008, 2009, and its retained earnings at the end of 2009, respectively?

A) Overstate, overstate, understate, zero

B) Overstate, understate, understate, understate

C) Overstate, overstate, overstate, overstate

D) None of these

A) Overstate, overstate, understate, zero

B) Overstate, understate, understate, understate

C) Overstate, overstate, overstate, overstate

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is true when accounts receivable are factored without recourse?

A) The transaction may be accounted for either as a secured borrowing or as a sale, depending upon the substance of the transaction.

B) The receivables are used as collateral for a promissory note issued to the factor by the owner of the receivables.

C) The factor assumes the risk of collectibility and absorbs any credit losses in collecting the receivables.

D) The financing cost (interest expense) should be recognized ratably over the collection period of the receivables.

A) The transaction may be accounted for either as a secured borrowing or as a sale, depending upon the substance of the transaction.

B) The receivables are used as collateral for a promissory note issued to the factor by the owner of the receivables.

C) The factor assumes the risk of collectibility and absorbs any credit losses in collecting the receivables.

D) The financing cost (interest expense) should be recognized ratably over the collection period of the receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is incorrect regarding the classification of accounts and notes receivable?

A) Segregation of the different types of receivables is required if they are material.

B) Disclose any loss contingencies that exist on the receivables.

C) Any discount or premium resulting from the determination of present value in notes receivable transactions is an asset or liability, respectively.

D) Valuation accounts should be appropriately offset against the proper receivable accounts.

A) Segregation of the different types of receivables is required if they are material.

B) Disclose any loss contingencies that exist on the receivables.

C) Any discount or premium resulting from the determination of present value in notes receivable transactions is an asset or liability, respectively.

D) Valuation accounts should be appropriately offset against the proper receivable accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

Of the following conditions, which is the only one that is not required if the transfer of receivables with recourse is to be accounted for as a sale?

A) The transferor is obligated to make a genuine effort to identify those receivables that are uncollectible.

B) The transferor surrenders control of the future economic benefits of the receivables.

C) The transferee cannot require the transferor to repurchase the receivables.

D) The transferor's obligation under the recourse provisions can be reasonably estimated.

A) The transferor is obligated to make a genuine effort to identify those receivables that are uncollectible.

B) The transferor surrenders control of the future economic benefits of the receivables.

C) The transferee cannot require the transferor to repurchase the receivables.

D) The transferor's obligation under the recourse provisions can be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Thresher Corporation sold its accounts receivable outright to Kari Company, a financing company which normally buys accounts receivable of other companies without recourse. The accounts receivable have been

A) collateralized.

B) pledged.

C) factored.

D) assigned.

A) collateralized.

B) pledged.

C) factored.

D) assigned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

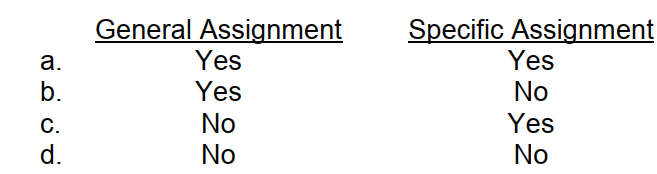

In which of the following accounts receivable assignment arrangements do all receivables serve as collateral for the promissory note given by the assignor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

When preparing a bank reconciliation for the purpose of arriving at the correct cash balance

A) outstanding checks can be added to the balance per books.

B) NSF checks should be deducted from the balance per books.

C) deposits in transit are deducted from the balance per bank.

D) notes collected by the bank should be added to the balance per bank.

A) outstanding checks can be added to the balance per books.

B) NSF checks should be deducted from the balance per books.

C) deposits in transit are deducted from the balance per bank.

D) notes collected by the bank should be added to the balance per bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

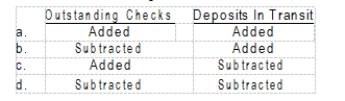

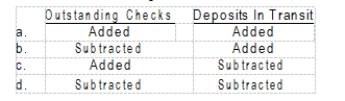

In a bank reconciliation that attempts to reconcile the bank balance to the corrected cash balance, the following items would affect the reconciliation in what way?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

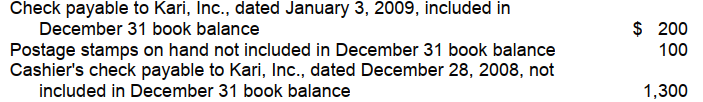

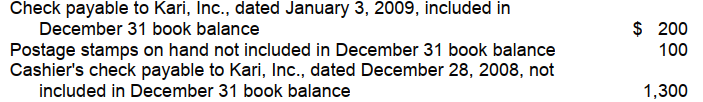

Kari, Inc.'s cash book balance on December 31, 2008, was $5,000. In addition, Kari had the following items on its premises on December 31:

The proper amount to be shown as Cash on Kari's balance sheet at December 31, 2008, is

The proper amount to be shown as Cash on Kari's balance sheet at December 31, 2008, is

A) $6,100.

B) $6,200.

C) $6,300.

D) $6,400.

The proper amount to be shown as Cash on Kari's balance sheet at December 31, 2008, is

The proper amount to be shown as Cash on Kari's balance sheet at December 31, 2008, isA) $6,100.

B) $6,200.

C) $6,300.

D) $6,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

Hamilton Company has cash in bank of $10,000, restricted cash in a separate account of $3,000, and a bank overdraft in an account at another bank of $1,000. Hamilton should report cash of

A) $9,000.

B) $10,000.

C) $12,000.

D) $13,000.

A) $9,000.

B) $10,000.

C) $12,000.

D) $13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

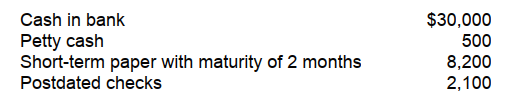

Horvath Company has the following items at year end:

Horvath should report cash and cash equivalents of

Horvath should report cash and cash equivalents of

A) $20,000.

B) $20,300.

C) $25,800.

D) $27,200.

Horvath should report cash and cash equivalents of

Horvath should report cash and cash equivalents ofA) $20,000.

B) $20,300.

C) $25,800.

D) $27,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Marshell Company has cash in bank of $15,000, restricted cash in a separate account of $4,000, and a bank overdraft in an account at another bank of $2,000. Marshell should report cash of

A) $13,000.

B) $15,000.

C) $18,000.

D) $19,000.

A) $13,000.

B) $15,000.

C) $18,000.

D) $19,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

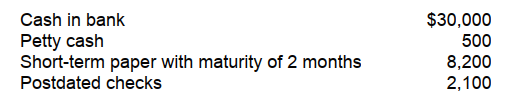

Peterson Company has the following items at year end:

Peterson should report cash and cash equivalents of

Peterson should report cash and cash equivalents of

A) $30,000.

B) $30,500.

C) $38,700.

D) $40,800.

Peterson should report cash and cash equivalents of

Peterson should report cash and cash equivalents ofA) $30,000.

B) $30,500.

C) $38,700.

D) $40,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

At the close of its first year of operations, December 31, 2008, Linn Company had accounts receivable of $540,000, after deducting the related allowance for doubtful accounts. During 2008, the company had charges to bad debt expense of $90,000 and wrote off, as uncollectible, accounts receivable of $40,000. What should the company report on its balance sheet at December 31, 2008, as accounts receivable before the allowance for doubtful accounts?

A) $670,000

B) $590,000

C) $490,000

D) $440,000

A) $670,000

B) $590,000

C) $490,000

D) $440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

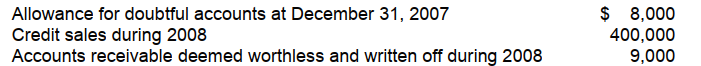

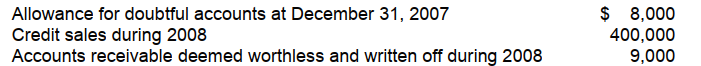

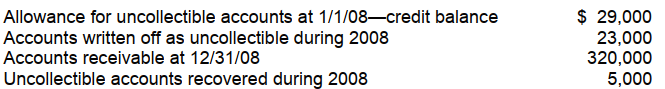

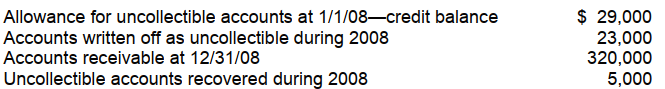

The following information is available for Reagan Company:

As a result of a review and aging of accounts receivable in early January 2009, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2008. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2008?

As a result of a review and aging of accounts receivable in early January 2009, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2008. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2008?

A) $4,500

B) $5,500

C) $6,500

D) $13,500

As a result of a review and aging of accounts receivable in early January 2009, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2008. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2008?

As a result of a review and aging of accounts receivable in early January 2009, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2008. What amount should Reagan record as "bad debt expense" for the year ended December 31, 2008?A) $4,500

B) $5,500

C) $6,500

D) $13,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

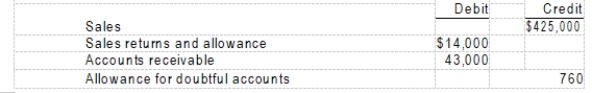

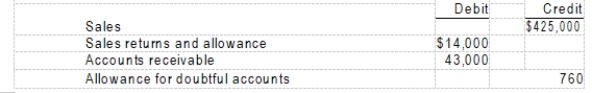

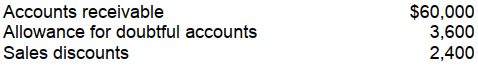

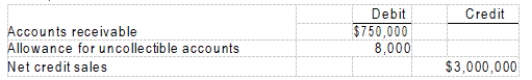

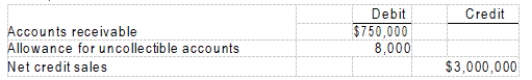

A trial balance before adjustments included the following:

-If the estimate of uncollectibles is made by taking 2% of net sales, the amount of the adjustment is

A) $6,700.

B) $8,220.

C) $8,500.

D) $9,740.

-If the estimate of uncollectibles is made by taking 2% of net sales, the amount of the adjustment is

A) $6,700.

B) $8,220.

C) $8,500.

D) $9,740.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

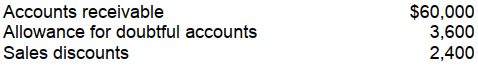

Simpson Company has the following account balances at year end:

Simpson should report accounts receivable at a net amount of

Simpson should report accounts receivable at a net amount of

A) $54,000.

B) $56,400.

C) $57,600.

D) $60,000.

Simpson should report accounts receivable at a net amount of

Simpson should report accounts receivable at a net amount ofA) $54,000.

B) $56,400.

C) $57,600.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Rusch Corporation had a 1/1/08 balance in the Allowance for Doubtful Accounts of $12,000. During 2008, it wrote off $8,640 of accounts and collected $2,520 on accounts previously written off. The balance in Accounts Receivable was $240,000 at 1/1 and $288,000 at 12/31. At 12/31/08, Rusch estimates that 5% of accounts receivable will prove to be uncollectible. What should Rusch report as its Allowance for Doubtful Accounts at 12/31/08?

A) $5,760

B) $5,880

C) $8,280

D) $14,400

A) $5,760

B) $5,880

C) $8,280

D) $14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

Sandler Company has the following account balances at year end:

Sandler should report accounts receivable at a net amount of

Sandler should report accounts receivable at a net amount of

A) $72,000.

B) $75,200.

C) $76,800.

D) $80,000.

Sandler should report accounts receivable at a net amount of

Sandler should report accounts receivable at a net amount ofA) $72,000.

B) $75,200.

C) $76,800.

D) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Burnett Corporation had a 1/1/08 balance in the Allowance for Doubtful Accounts of $15,000. During 2008, it wrote off $10,800 of accounts and collected $3,150 on accounts previously written off. The balance in Accounts Receivable was $300,000 at 1/1 and $360,000 at 12/31. At 12/31/08, Burnett estimates that 5% of accounts receivable will prove to be uncollectible. What should Burnett report as its Allowance for Doubtful Accounts at 12/31/08?

A) $7,200

B) $7,350

C) $10,350

D) $18,000

A) $7,200

B) $7,350

C) $10,350

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Gardin Corporation uses the allowance method of accounting for uncollectible accounts. During 2008 Gardin had charges to Bad Debts Expense of $20,000 and wrote off as uncollectible, accounts receivable totaling $16,000. These transactions decreased the net receivable's realizable value by

A) $20,000.

B) $16,000.

C) $4,000.

D) $0.

A) $20,000.

B) $16,000.

C) $4,000.

D) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Moluf Corporation receives a 5-year, $20,000 zero-interest-bearing note, the present value of which is $11,348.60. What is the implicit interest rate that equates the total cash to be received to the present value of the future cash flows?

A) 8%

B) 9%

C) 10%

D) 12%

A) 8%

B) 9%

C) 10%

D) 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

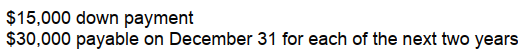

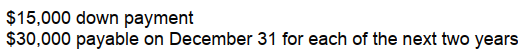

On December 31, 2008, Eller Corporation sold for $75,000 an old machine having an original cost of $135,000 and a book value of $60,000. The terms of the sale were as follows:

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2008 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at 9% for 2 years is 1.75911.)

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2008 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at 9% for 2 years is 1.75911.)

A) $52,773

B) $67,773

C) $60,000

D) $105,546

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2008 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at 9% for 2 years is 1.75911.)

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2008 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at 9% for 2 years is 1.75911.)A) $52,773

B) $67,773

C) $60,000

D) $105,546

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

Marley Company received a seven-year, zero-interest-bearing note on February 22, 2008, in exchange for property it sold to O'Rear Company. There was no established exchange price for this property and the note has no ready market. The prevailing rate of interest for a note of this type was 7% on February 22, 2008, 7.5% on December 31, 2008, 7.7% on February 22, 2009, and 8% on December 31, 2009. What interest rate should be used to calculate the interest revenue from this transaction for the years ended December 31, 2008 and 2009, respectively?

A) 0% and 0%

B) 7% and 7%

C) 7% and 7.7%

D) 7.5% and 8%

A) 0% and 0%

B) 7% and 7%

C) 7% and 7.7%

D) 7.5% and 8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Pinkowski sold land to Ewell for $100,000 cash and a zero-interest-bearing note with a face amount of $400,000. The fair value of the land at the date of sale was $450,000. Pinkowski should value the note receivable at

A) $450,000.

B) $400,000.

C) $350,000.

D) $500,000.

A) $450,000.

B) $400,000.

C) $350,000.

D) $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Henry Co. assigned $400,000 of accounts receivable to Easy Finance Co. as security for a loan of $335,000. Easy charged a 2% commission on the amount of the loan; the interest rate on the note was 10%. During the first month, Henry collected $110,000 on assigned accounts after deducting $380 of discounts. Henry accepted returns worth $1,350 and wrote off assigned accounts totaling $2,980.

-The amount of cash Henry received from Easy at the time of the transfer was

A) $301,500.

B) $327,000.

C) $328,300.

D) $335,000.

-The amount of cash Henry received from Easy at the time of the transfer was

A) $301,500.

B) $327,000.

C) $328,300.

D) $335,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Mike McKinney Corporation had accounts receivable of $100,000 at 1/1. The only transactions affecting accounts receivable were sales of $600,000 and cash collections of $550,000. The accounts receivable turnover is

A) 4.0.

B) 4.4.

C) 4.8.

D) 6.0.

A) 4.0.

B) 4.4.

C) 4.8.

D) 6.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Nottingham Corporation had accounts receivable of $100,000 at 1/1. The only transactions affecting accounts receivable were sales of $900,000 and cash collections of $850,000. The accounts receivable turnover is

A) 6.0.

B) 6.6.

C) 7.2.

D) 9.0.

A) 6.0.

B) 6.6.

C) 7.2.

D) 9.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

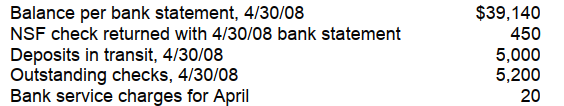

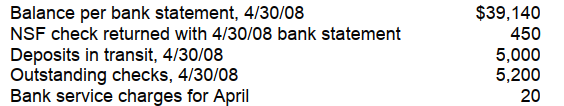

In preparing its bank reconciliation for the month of April 2008, Gregg, Inc. has available the following information.

What should be the correct balance of cash at April 30, 2008?

What should be the correct balance of cash at April 30, 2008?

A) $39,370

B) $38,940

C) $38,490

D) $38,470

What should be the correct balance of cash at April 30, 2008?

What should be the correct balance of cash at April 30, 2008?A) $39,370

B) $38,940

C) $38,490

D) $38,470

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Tanner, Inc.'s checkbook balance on December 31, 2008 was $21,200. In addition, Tanner held the following items in its safe on December 31.

(1) A check for $450 from Peters, Inc. received December 30, 2008, which was not included in the checkbook balance.

(2) An NSF check from Garner Company in the amount of $900 that had been deposited at the bank, but was returned for lack of sufficient funds on December 29. The check was to be redeposited on January 3, 2009. The original deposit has been included in the December 31 checkbook balance.

(3) Coin and currency on hand amounted to $1,450.

The proper amount to be reported on Tanner's balance sheet for cash at December 31, 2008 is

A) $21,300.

B) $20,400.

C) $22,200.

D) $21,750.

(1) A check for $450 from Peters, Inc. received December 30, 2008, which was not included in the checkbook balance.

(2) An NSF check from Garner Company in the amount of $900 that had been deposited at the bank, but was returned for lack of sufficient funds on December 29. The check was to be redeposited on January 3, 2009. The original deposit has been included in the December 31 checkbook balance.

(3) Coin and currency on hand amounted to $1,450.

The proper amount to be reported on Tanner's balance sheet for cash at December 31, 2008 is

A) $21,300.

B) $20,400.

C) $22,200.

D) $21,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

In preparing its May 31, 2008 bank reconciliation, Dogg Co. has the following information available:

The correct balance of cash at May 31, 2008 is

The correct balance of cash at May 31, 2008 is

A) $35,400.

B) $29,250.

C) $30,500.

D) $31,750.

The correct balance of cash at May 31, 2008 is

The correct balance of cash at May 31, 2008 isA) $35,400.

B) $29,250.

C) $30,500.

D) $31,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

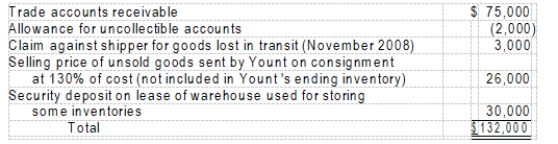

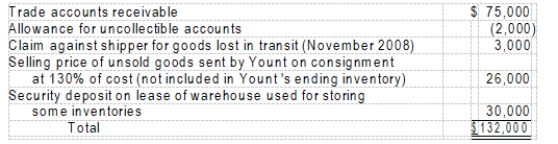

On the December 31, 2008 balance sheet of Yount Co., the current receivables consisted of the following:

At December 31, 2008, the correct total of Yount 's current net receivables was

At December 31, 2008, the correct total of Yount 's current net receivables was

A) $76,000.

B) $102,000.

C) $106,000.

D) $132,000.

At December 31, 2008, the correct total of Yount 's current net receivables was

At December 31, 2008, the correct total of Yount 's current net receivables wasA) $76,000.

B) $102,000.

C) $106,000.

D) $132,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

May Co. prepared an aging of its accounts receivable at December 31, 2008 and determined that the net realizable value of the receivables was $300,000. Additional information is available as follows:

For the year ended December 31, 2008, May's uncollectible accounts expense would be

For the year ended December 31, 2008, May's uncollectible accounts expense would be

A) $25,000.

B) $23,000.

C) $16,000.

D) $9,000.

For the year ended December 31, 2008, May's uncollectible accounts expense would be

For the year ended December 31, 2008, May's uncollectible accounts expense would beA) $25,000.

B) $23,000.

C) $16,000.

D) $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

The following accounts were abstracted from Todd Co.'s unadjusted trial balance at December 31, 2008:

Todd estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2008, the allowance for uncollectible accounts should have a credit balance of

Todd estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2008, the allowance for uncollectible accounts should have a credit balance of

A) $60,000.

B) $52,000.

C) $23,000.

D) $15,000.

Todd estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2008, the allowance for uncollectible accounts should have a credit balance of

Todd estimates that 2% of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2008, the allowance for uncollectible accounts should have a credit balance ofA) $60,000.

B) $52,000.

C) $23,000.

D) $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

On June 1, 2008, Watt Corp. loaned Hall $300,000 on a 12% note, payable in five annual installments of $60,000 beginning January 2, 2009. In connection with this loan, Hall was required to deposit $3,000 in a zero-interest-bearing escrow account. The amount held in escrow is to be returned to Hall after all principal and interest payments have been made. Interest on the note is payable on the first day of each month beginning July 1, 2008. Hall made timely payments through November 1, 2008. On January 2, 2009, Watt received payment of the first principal installment plus all interest due. At December 31, 2008, Watt's interest receivable on the loan to Hall should be

A) $0.

B) $3,000.

C) $6,000.

D) $9,000.

A) $0.

B) $3,000.

C) $6,000.

D) $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

In preparing its August 31, 2008 bank reconciliation, Adel Corp. has available the follow-ing information:

At August 31, 2008, Adel's correct cash balance is

At August 31, 2008, Adel's correct cash balance is

A) $22,800

B) $22,200

C) $22,100

D) $20,500

At August 31, 2008, Adel's correct cash balance is

At August 31, 2008, Adel's correct cash balance isA) $22,800

B) $22,200

C) $22,100

D) $20,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

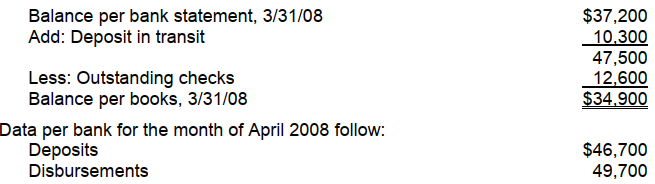

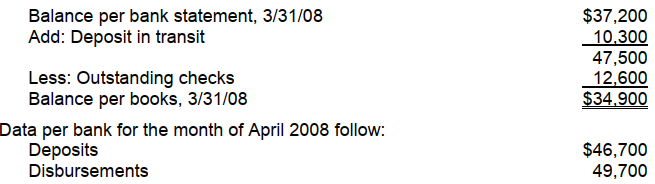

Sandy, Inc. had the following bank reconciliation at March 31, 2008:  All reconciling items at March 31, 2008 cleared the bank in April. Outstanding checks at April 30, 2008 totaled $6,000. There were no deposits in transit at April 30, 2008. What is the cash balance per books at April 30, 2008?

All reconciling items at March 31, 2008 cleared the bank in April. Outstanding checks at April 30, 2008 totaled $6,000. There were no deposits in transit at April 30, 2008. What is the cash balance per books at April 30, 2008?

A) $28,200

B) $31,900

C) $34,200

D) $38,500

All reconciling items at March 31, 2008 cleared the bank in April. Outstanding checks at April 30, 2008 totaled $6,000. There were no deposits in transit at April 30, 2008. What is the cash balance per books at April 30, 2008?

All reconciling items at March 31, 2008 cleared the bank in April. Outstanding checks at April 30, 2008 totaled $6,000. There were no deposits in transit at April 30, 2008. What is the cash balance per books at April 30, 2008?A) $28,200

B) $31,900

C) $34,200

D) $38,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck