Deck 22: Appendix E: Accounting for Natural Resources

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/6

العب

ملء الشاشة (f)

Deck 22: Appendix E: Accounting for Natural Resources

1

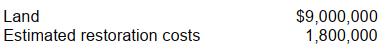

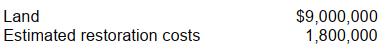

Seymor Resources Company acquired a tract of land containing an extractable natural resource. Seymor is required by its purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 2,000,000 tons, and that the land will have a value of $1,200,000 after restoration. Relevant cost information follows:

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

A) $3.90

B) $4.50

C) $4.80

D) $5.40

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?A) $3.90

B) $4.50

C) $4.80

D) $5.40

$4.80

2

In January, 2008, Pratt Corporation purchased a mineral mine for $3,400,000 with removable ore estimated by geological surveys at 2,000,000 tons. The property has an estimated value of $200,000 after the ore has been extracted. The company incurred $1,000,000 of development costs preparing the mine for production. During 2008, 500,000 tons were removed and 400,000 tons were sold. What is the amount of depletion that Pratt should expense for 2008?

A) $640,000

B) $800,000

C) $840,000

D) $1,120,000

A) $640,000

B) $800,000

C) $840,000

D) $1,120,000

$840,000

3

During 2008, Bolton Corporation acquired a mineral mine for $1,500,000 of which $200,000 was ascribed to land value after the mineral has been removed. Geological surveys have indicated that 10 million units of the mineral could be extracted. During 2008, 1,500,000 units were extracted and 1,200,000 units were sold. What is the amount of depletion expensed for 2008?

A) $130,000

B) $156,000

C) $180,000

D) $195,000

A) $130,000

B) $156,000

C) $180,000

D) $195,000

$156,000

4

In March, 2008, Sauder Mines Co. purchased a coal mine for $6,000,000. Removable coal is estimated at 1,500,000 tons. Sauder is required to restore the land at an estimated cost of $720,000, and the land should have a value of $630,000. The company incurred $1,500,000 of development costs preparing the mine for production. During 2008, 450,000 tons were removed and 300,000 tons were sold. The total amount of depletion that Sauder should record for 2008 is

A) $1,374,000.

B) $1,518,000.

C) $2,061,000.

D) $2,277,000.

A) $1,374,000.

B) $1,518,000.

C) $2,061,000.

D) $2,277,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

5

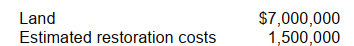

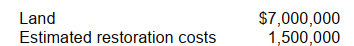

Lane Company acquired a tract of land containing an extractable natural resource. Lane is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 5,000,000 tons, and that the land will have a value of $1,000,000 after restoration. Relevant cost information follows:

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

A) $1.70

B) $1.50

C) $1.40

D) $1.20

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?A) $1.70

B) $1.50

C) $1.40

D) $1.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

6

In January 2008, Jenks Mining Corporation purchased a mineral mine for $4,200,000 with removable ore estimated by geological surveys at 2,500,000 tons. The property has an estimated value of $400,000 after the ore has been extracted. Jenks incurred $1,150,000 of development costs preparing the property for the extraction of ore. During 2008, 340,000 tons were removed and 300,000 tons were sold. For the year ended December 31, 2008, Jenks should include what amount of depletion in its cost of goods sold?

A) $516,800

B) $456,000

C) $594,000

D) $673,200

A) $516,800

B) $456,000

C) $594,000

D) $673,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck