Deck 21: Appendix D: Retail Inventory Method

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/6

العب

ملء الشاشة (f)

Deck 21: Appendix D: Retail Inventory Method

1

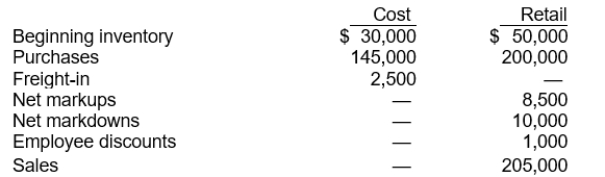

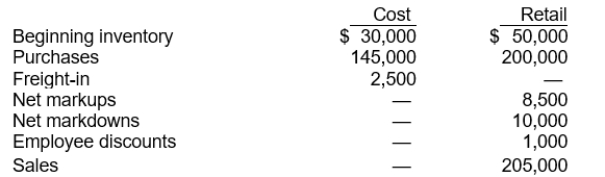

Flynn Sales Company uses the retail inventory method to value its merchandise inventory. The following information is available for the current year:

If the ending inventory is to be valued at the lower-of-cost-or-market, what is the cost to retail ratio?

If the ending inventory is to be valued at the lower-of-cost-or-market, what is the cost to retail ratio?

A) $177,500 ÷ $250,000

B) $177,500 ÷ $258,500

C) $175,000 ÷ $260,000

D) $177,500 ÷ $248,500

If the ending inventory is to be valued at the lower-of-cost-or-market, what is the cost to retail ratio?

If the ending inventory is to be valued at the lower-of-cost-or-market, what is the cost to retail ratio?A) $177,500 ÷ $250,000

B) $177,500 ÷ $258,500

C) $175,000 ÷ $260,000

D) $177,500 ÷ $248,500

$177,500 ÷ $258,500

2

The following data concerning the retail inventory method are taken from the financial records of Stone Company.

-The ending inventory at retail should be

A) $74,000.

B) $60,000.

C) $64,000.

D) $42,000.

-The ending inventory at retail should be

A) $74,000.

B) $60,000.

C) $64,000.

D) $42,000.

$60,000.

3

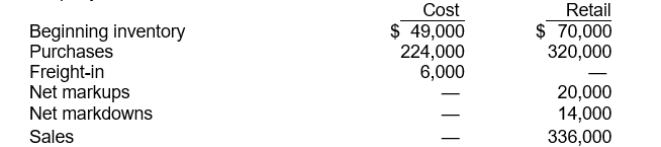

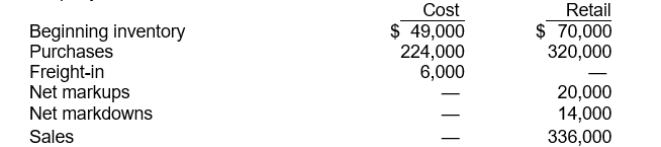

Trent Co. uses the retail inventory method. The following information is available for the current year.

-If the ending inventory is to be valued at approximately lower of average cost or market, the calculation of the cost ratio should be based on cost and retail of

A) $300,000 and $430,000.

B) $300,000 and $428,000.

C) $373,000 and $550,000.

D) $378,000 and $552,000.

-If the ending inventory is to be valued at approximately lower of average cost or market, the calculation of the cost ratio should be based on cost and retail of

A) $300,000 and $430,000.

B) $300,000 and $428,000.

C) $373,000 and $550,000.

D) $378,000 and $552,000.

$378,000 and $552,000.

4

Trent Co. uses the retail inventory method. The following information is available for the current year.

-The ending inventory at retail should be

A) $160,000.

B) $150,000.

C) $144,000.

D) $140,000.

-The ending inventory at retail should be

A) $160,000.

B) $150,000.

C) $144,000.

D) $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

5

Trent Co. uses the retail inventory method. The following information is available for the current year.

-The approximate cost of the ending inventory by the conventional retail method is

A) $95,900.

B) $94,920.

C) $98,000.

D) $102,480.

-The approximate cost of the ending inventory by the conventional retail method is

A) $95,900.

B) $94,920.

C) $98,000.

D) $102,480.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

6

At December 31, 2008, the following information was available from Goff Co.'s accounting records:

Sales for the year totaled $1,050,000. Markdowns amounted to $ 10,000. Under the lower-of-cost-or-market method, Goff's inventory at December 31, 2008 was

Sales for the year totaled $1,050,000. Markdowns amounted to $ 10,000. Under the lower-of-cost-or-market method, Goff's inventory at December 31, 2008 was

A) $294,000.

B) $245,000.

C) $252,000.

D) $238,000.

Sales for the year totaled $1,050,000. Markdowns amounted to $ 10,000. Under the lower-of-cost-or-market method, Goff's inventory at December 31, 2008 was

Sales for the year totaled $1,050,000. Markdowns amounted to $ 10,000. Under the lower-of-cost-or-market method, Goff's inventory at December 31, 2008 wasA) $294,000.

B) $245,000.

C) $252,000.

D) $238,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck