Deck 10: Oligopoly: Firms in Less Competitive Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/32

العب

ملء الشاشة (f)

Deck 10: Oligopoly: Firms in Less Competitive Markets

1

A key part of the business strategy for Carrefour involved placing stores in big malls where the main competition was from small, locally owned stores. What is the rationale behind this strategy?

A) Allowing small, locally owned stores to benefit from competition with a giant like Carrefour.

B) To maintain a competitive edge - small stores cannot compete with Carrefour's prices because Carrefour is able to pass to consumers some of its cost savings from economies of scale.

C) Carrefour owners -believe that big malls are more attractive to consumers.

D) Carrefour recognizes the need to locate in big malls because it is more cost -efficient.

A) Allowing small, locally owned stores to benefit from competition with a giant like Carrefour.

B) To maintain a competitive edge - small stores cannot compete with Carrefour's prices because Carrefour is able to pass to consumers some of its cost savings from economies of scale.

C) Carrefour owners -believe that big malls are more attractive to consumers.

D) Carrefour recognizes the need to locate in big malls because it is more cost -efficient.

To maintain a competitive edge - small stores cannot compete with Carrefour's prices because Carrefour is able to pass to consumers some of its cost savings from economies of scale.

2

Being among the largest retailers in the world, Carrefour can ignore the pricing decisions of its rivals.

False

3

Throughout 2009 and 2010, Qatar Telecom (Qtel) and Vodafone have been engaging in aggressive promotional tactics that counter each other. They've essentially started a price war amongst each other. Qtel and Vodafone are operating as

A) a duopoly.

B) a monopoly.

C) perfectly competitive firms.

D) None of the above.

A) a duopoly.

B) a monopoly.

C) perfectly competitive firms.

D) None of the above.

a duopoly.

4

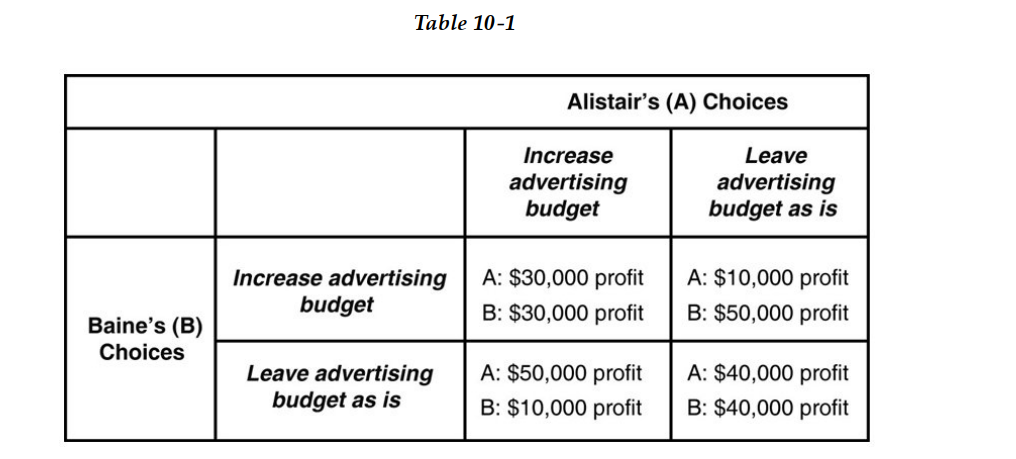

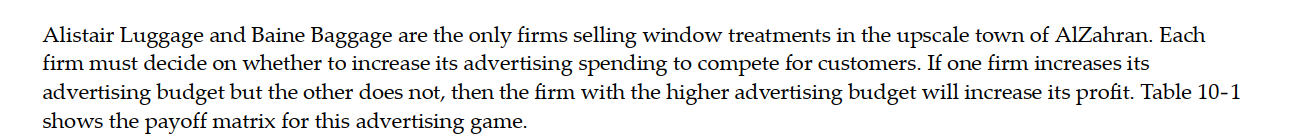

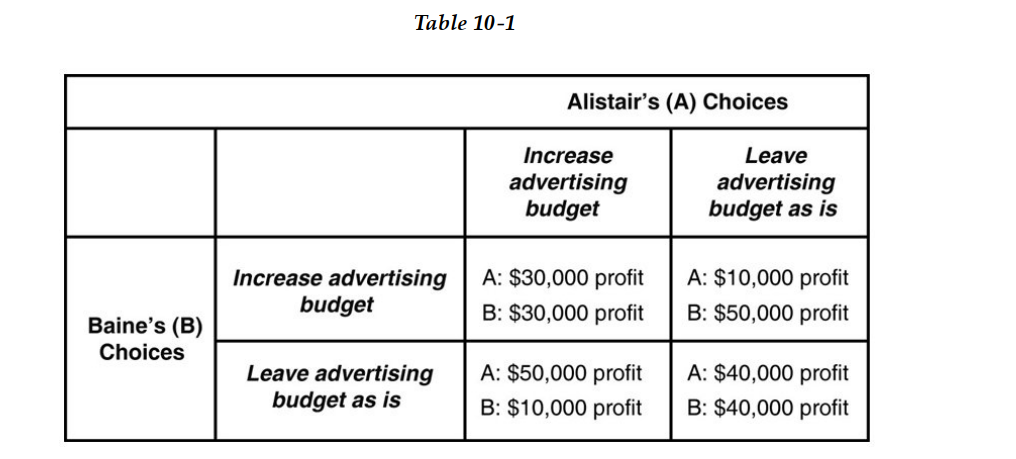

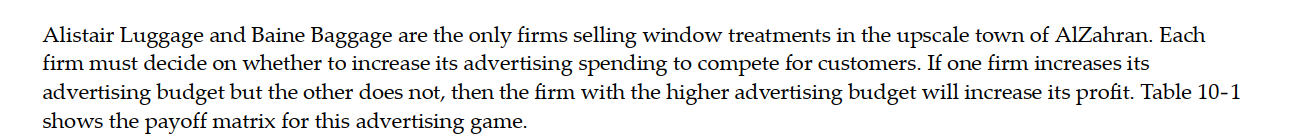

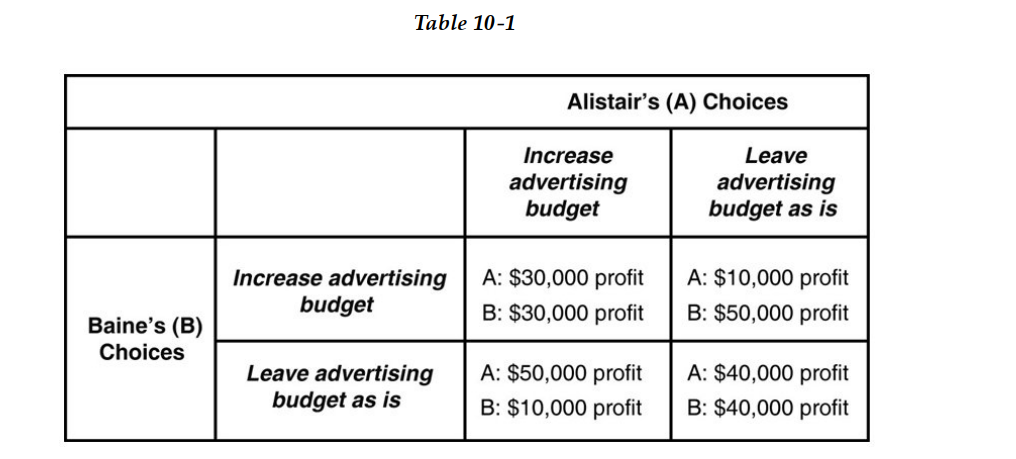

-Refer to Table 10 -1. Does Baine have a dominant strategy and if so, what is it?

A) No, there is no dominant strategy.

B) Yes, Baine should increase its advertising budget.

C) There are two dominant strategies: if Alistair increases its advertising budget, then Baine's best bet is to keep its budget the same but if Alistair does not increase its spending then Baine should raise its advertising budget.

D) Yes, Baine should keep its advertising budget as is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

5

-Refer to Table 10 -1. What is the Nash equilibrium in this game?

A) Both Alistair and Baine increase their advertising budgets.

B) Alistair increases its advertising budget, but Baine does not.

C) There is no Nash equilibrium.

D) Baine increases its advertising budget, but Alistair does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

6

-Refer to Table 10 -1. How are the firms in this advertising game caught in a prisoners' dilemma?

A) Since each firm is uncertain about the other's behavior, each will adopt a wait -and -see attitude which results in no increase in market share and no new customers.

B) Only the first mover is caught in a prisoners' dilemma because the second has a chance to observe and respond.

C) They are not in a prisoners' dilemma because there is one clear strategy for each.

D) They would be more profitable if they refrained from advertising but each fears that if it does not advertise, it will lose customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

7

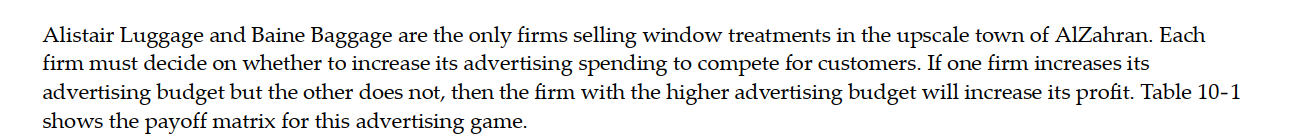

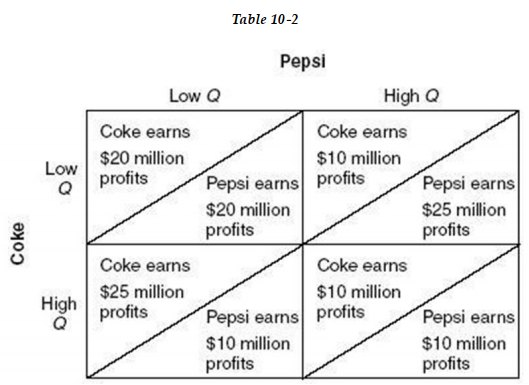

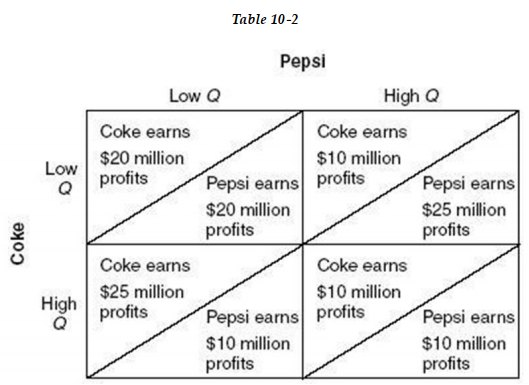

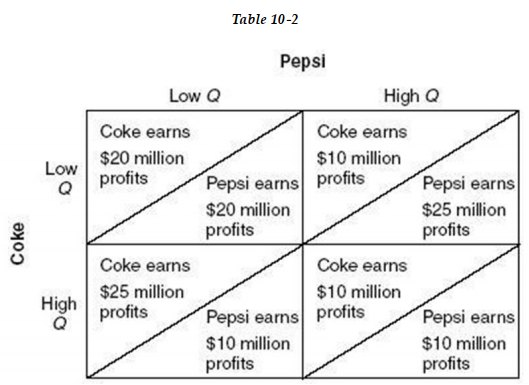

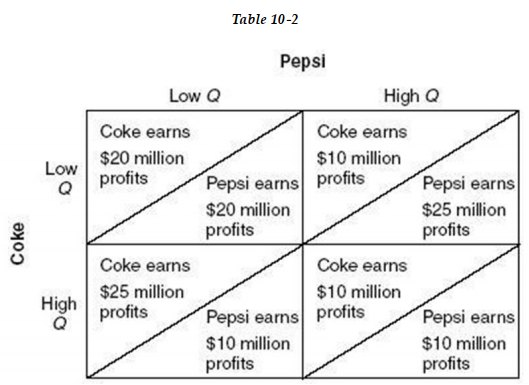

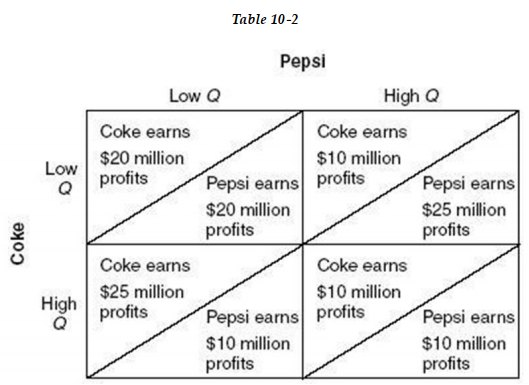

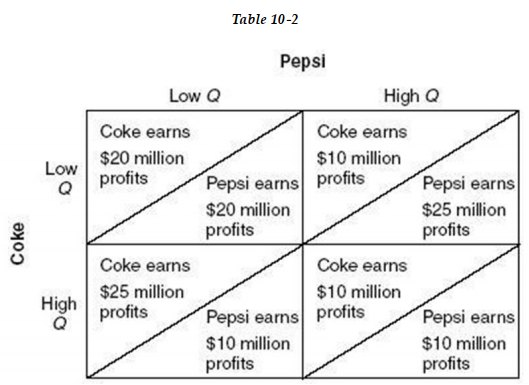

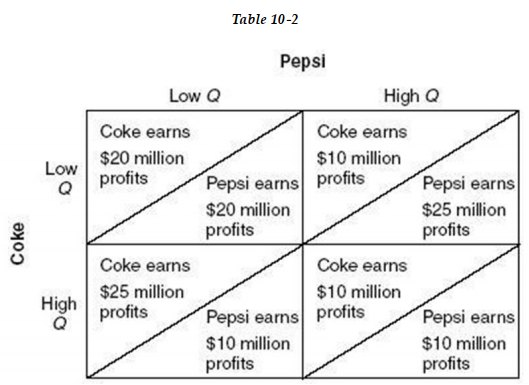

-Refer to Table 10 -2. If Coke produces a low quantity, what is Pepsi's best response?

A) Produce a high quantity and earn a profit of $20 million.

B) Produce a high quantity and earn a profit of $25 million.

C) Produce a low quantity and earn a profit of $20 million.

D) Produce a low quantity earn a profit of $25 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

8

-Refer to Table 10 -2. Is a situation in which Coke produces a low quantity and Pepsi's produces a high quantity an equilibrium?

A) Yes, because each is not earning its highest profit.

B) No, because Coke has an incentive to produce a high quantity.

C) No, because Pepsi has an incentive to produce a low quantity.

D) Yes, because each is earning its highest profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

9

-Refer to Table 10 -2. If Coke produces a high quantity, what is Pepsi's best response?

A) Produce a low quantity and earn a profit of $25 million.

B) It does not matter what Pepsi does; its profit will be $10 million with a low or a high quantity.

C) Produce a high quantity and earn a profit of $25 million.

D) Produce a high quantity and earn a profit of $10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

10

-Refer to Table 10 -2. Is there a dominant strategy for Pepsi and if so, what is it?

A) The dominant strategy is to collude with Coke.

B) The dominant strategy is to produce a high quantity.

C) There is no dominant strategy.

D) The dominant strategy is to produce a low quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

11

-Refer to Table 10 -2. If each firm pursues its dominant strategy, what is the profit earned?

A) Each earns a profit of $20 million.

B) Each earns a profit of $12.5 million.

C) Each earns a profit of $25 million.

D) Each earns a profit of $10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

12

-Refer to Table 10 -2. What is the Nash equilibrium in this game?

A) Each produces a high quantity and earns a profit of $25 million.

B) Each produces a low quantity and earns a profit of $20 million.

C) Each produces a high quantity and earns a profit of $10 million.

D) There is no Nash equilibrium in this game.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

13

-Refer to Table 10 -2. If Coke and Pepsi could collude, what would they do?

A) Coke can produce a low quantity while Pepsi can produce a high quantity.

B) Coke can produce a high quantity while Pepsi can produce a low quantity.

C) Both produce a low quantity.

D) Both produce a high quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

14

Consider two oligopolistic industries selling the same product in different locations. In the first industry, firms always match price changes by any other firm in the industry. In the second industry, firms always ignore price changes by any other firm. Which of the following statements is true about these two industries, holding everything else constant?

A) Market prices are likely to be lower in the first industry where firms always match price changes by rival firms than in the second where firms ignore their rivals' price changes.

B) No conclusions can be drawn about the pricing behavior under these very different firm behavior.

C) Market prices are likely to be higher in the first industry in which firms always match price changes by rival firms than in the second where firms ignore their rivals' price changes.

D) Market prices are likely to be the same in both markets because they are both oligopolistic markets.

A) Market prices are likely to be lower in the first industry where firms always match price changes by rival firms than in the second where firms ignore their rivals' price changes.

B) No conclusions can be drawn about the pricing behavior under these very different firm behavior.

C) Market prices are likely to be higher in the first industry in which firms always match price changes by rival firms than in the second where firms ignore their rivals' price changes.

D) Market prices are likely to be the same in both markets because they are both oligopolistic markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

15

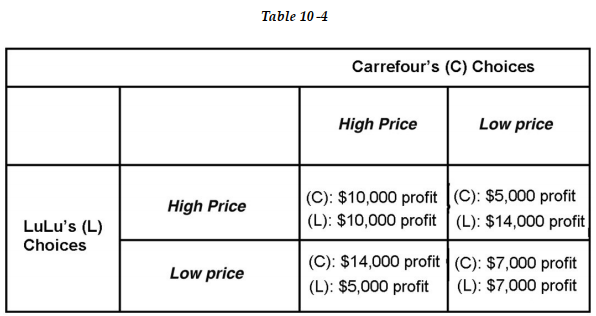

-Refer to Table 10 -4. Is the current strategy in which each firm charges the low price and earns a profit of $7,000 a Nash equilibrium? If not, why and what is the Nash equilibrium?

A) No, it is not a Nash equilibrium because each firm can do better by charging the high price. The Nash equilibrium occurs when each firm charges the high price and earns a profit of $10,000.

B) No, the current situation is not a Nash equilibrium. The Nash equilibrium for each firm is to have the other charge a high price and for the firm in question charge a low price.

C) No, the current situation is not a Nash equilibrium; it is a dominant strategy equilibrium. There is no Nash equilibrium in this game.

D) Yes, the current situation is a Nash equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

16

-Refer to Table 10 -4. Suppose pricing PlayStations is a repeated game in which Carrefour and LuLu will be selling the game system in competition over a long period of time. In this case, what is the most likely outcome?

A) a cooperative equilibrium in which each firm charges the high price.

B) a cooperative equilibrium in which each firm charges the low price.

C) a noncooperative equilibrium in which each firm charges the low price.

D) a noncooperative equilibrium in which each firm charges the high price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

17

Souq.com operates as a price auction. What is a price auction?

A) An auction in which the bidder who visits Souq.com the most wins is awarded all the objects being sold on that day.

B) An auction in which the bidder who submitted the highest bid is awarded the object being sold and pays the highest bidder price.

C) An auction in which the first bidder to sign in to Souq.com on the day of the auction is awarded the object being sold.

D) An auction in which the winner of the auction is selected randomly.

A) An auction in which the bidder who visits Souq.com the most wins is awarded all the objects being sold on that day.

B) An auction in which the bidder who submitted the highest bid is awarded the object being sold and pays the highest bidder price.

C) An auction in which the first bidder to sign in to Souq.com on the day of the auction is awarded the object being sold.

D) An auction in which the winner of the auction is selected randomly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

18

Suppose two firms in a duopoly implicitly collude and charge a high price. How might each firm benefit from advertising that it will match the lowest price offered by its competitor?

A) The offer to match prices is a way of deterring entry by other large firms, thereby keeping the market share of the existing firms intact.

B) The advertisement is meant to suggest to consumers that the offered price is actually the lowest price available.

C) The offer to match prices is a way of signaling to antitrust authorities that the firms are not engaged in illegal collusion.

D) The advertisement ensures that the other firm does not cheat. If a firm cheats on the agreement and charges the lower price, the rival firm will retaliate by doing the same.

A) The offer to match prices is a way of deterring entry by other large firms, thereby keeping the market share of the existing firms intact.

B) The advertisement is meant to suggest to consumers that the offered price is actually the lowest price available.

C) The offer to match prices is a way of signaling to antitrust authorities that the firms are not engaged in illegal collusion.

D) The advertisement ensures that the other firm does not cheat. If a firm cheats on the agreement and charges the lower price, the rival firm will retaliate by doing the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

19

Collusion

A) reduces market concentration in an industry.

B) is more difficult when there are many firms producing differentiated products in an industry.

C) among firms is difficult to maintain because it eliminates long run economic profit.

D) is rampant in perfect competition as all firms charge the same price.

A) reduces market concentration in an industry.

B) is more difficult when there are many firms producing differentiated products in an industry.

C) among firms is difficult to maintain because it eliminates long run economic profit.

D) is rampant in perfect competition as all firms charge the same price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

20

In 2006, Du started operations in the UAE as the second telecom company and the main competitor to Etisalat, the already established telecom company in the region. Until now, the companies have not engaged in a price war as is expected of a duopoly. Why are the two companies actively avoiding a price war?

A) Because price wars would make consumers boycott the companies, bringing down profits.

B) Because price wars destroy value and that's not in the interest of either companies.

C) Because price wars require -talents neither of the companies have.

D) None of the above.

A) Because price wars would make consumers boycott the companies, bringing down profits.

B) Because price wars destroy value and that's not in the interest of either companies.

C) Because price wars require -talents neither of the companies have.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

21

Du and Etisalat are two telecom companies in the UAE. It would be relatively easy for them to go on a long series of price wars because ________?

A) The fixed costs in the telecom industry are very low, leading to a high marginal cost of adding a new subscriber.

B) In the telecom industry, variable costs are very low making the marginal cost of adding a new subscriber low.

C) The UAE government supports price wars.

D) None of the above.

A) The fixed costs in the telecom industry are very low, leading to a high marginal cost of adding a new subscriber.

B) In the telecom industry, variable costs are very low making the marginal cost of adding a new subscriber low.

C) The UAE government supports price wars.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a decision tree, the difference between a decision node and a terminal node is that

A) at a decision node all participants are free to make individual decisions but at a terminal node they must agree on a collective decision.

B) at a decision node all participants make the same decision, while at a terminal node different players may make different decisions.

C) at a decision node a decision must be made, while at a terminal node the final decision must be made.

D) at a decision node, a decision must be made while a terminal node shows the payoff.

A) at a decision node all participants are free to make individual decisions but at a terminal node they must agree on a collective decision.

B) at a decision node all participants make the same decision, while at a terminal node different players may make different decisions.

C) at a decision node a decision must be made, while at a terminal node the final decision must be made.

D) at a decision node, a decision must be made while a terminal node shows the payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

23

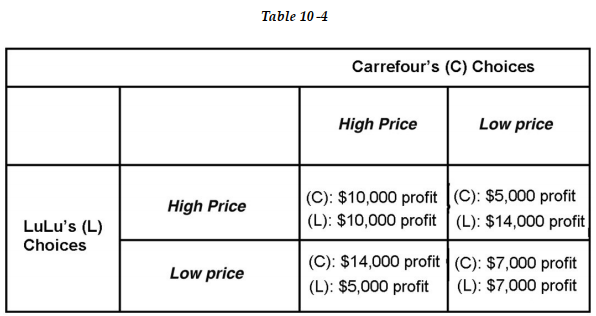

Assume that Lexus (L) is the first automobile company to produce a luxury class hybrid automobile and is the only such company for the past four years. BMW is now considering producing its own luxury hybrid automobile and Lexus must decide whether or not to lower the price of its luxury hybrid to counter BMW's entry into the luxury hybrid niche.

Assume that Lexus (L) is the first automobile company to produce a luxury class hybrid automobile and is the only such company for the past four years. BMW is now considering producing its own luxury hybrid automobile and Lexus must decide whether or not to lower the price of its luxury hybrid to counter BMW's entry into the luxury hybrid niche.-Refer to Figure 10 -1. Should Lexus to lower its price in order to deter BMW's entry into the luxury hybrid automobile market?

A) No, it should keep the same price and work to capitalize on its brand loyalty.

B) In terms of profit earned, it makes no difference whether Lexus lowers its price or no; in either case it will make $280 million profit if BMW enters.

C) No, because BMW will enter the market regardless of Lexus' decision about its price.

D) Yes, it will drive BMW out of the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

24

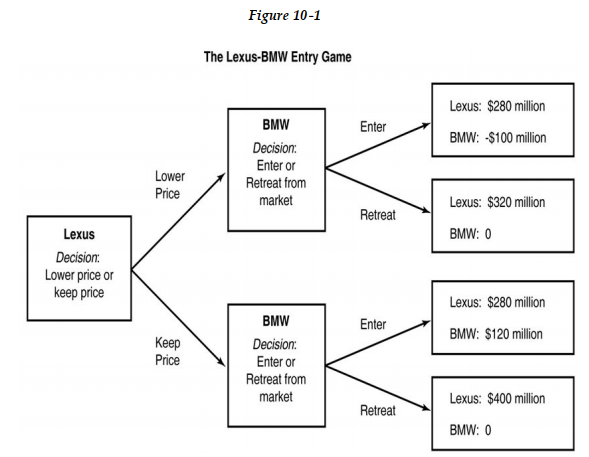

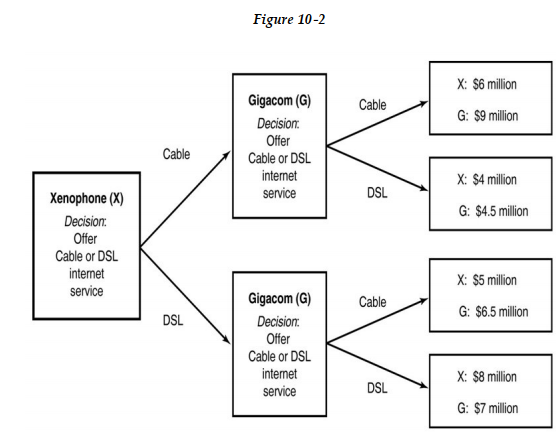

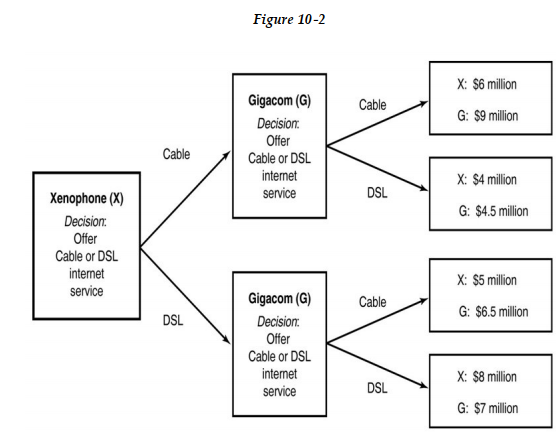

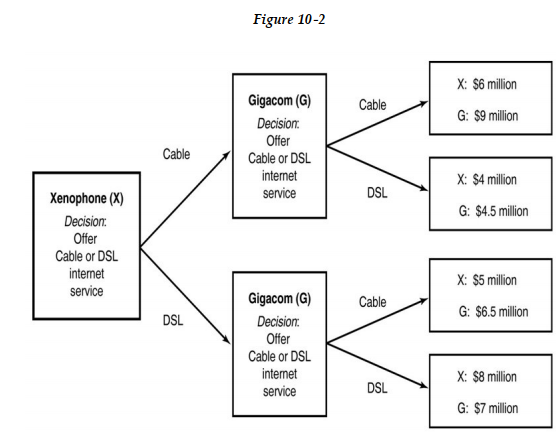

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.-Refer to Figure 10 -2. If the government delays Gigacom's entry and Xenophone moves first, is a threat by Gigacom that it will provide DSL service if Gigacom provides cable service a credible threat?

A) No, because Gigacom will lose $4.5 million in profits if it carries out its threat.

B) No, because as a second mover, it has no choice but to abide by the choices of the first mover.

C) Yes, Xenophone stands to lose $3 million in profit.

D) Yes, because Gigacom's DSL service will drive Xenophone out of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

25

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.-Refer to Figure 10 -2. If the government delays Gigacom's entry and Xenophone moves first, what is the likely outcome in the market?

A) Both offer DSL internet service; Xenophone earns a profit of $8 million and Gigacom earns a profit of $7 million.

B) Both offer internet service via cable line; Xenophone earns a profit of $6 million and Gigacom earns a profit of $9 million.

C) Xenophone offers internet service via cable line and earns a profit of $4 million while Gigacom offers DSL internet service and earns a profit of $4.5 million.

D) Xenophone offers DSL internet service and earns a profit of $5 million while Gigacom offer internet service via cable line and earns a profit of $6.5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

26

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.

The government of a developing country plans to award two firms, Gigacom and Xenophone, the exclusive rights to share the market for high speed internet service. Gigacom and Xenophone can both provide the service either via television cable lines or via direct subscriber line (DSL). Suppose the government is considering a proposal to delay one firm's entry into the market on the grounds that it wants to prevent "harmful" competition. Figure 10-2 shows the decision tree for this game.-Refer to Figure 10 -2. Now suppose that the government delays Xenophone's entry and Gigacom moves first, what is the likely outcome in the market?

A) Both offer DSL internet service; Xenophone earns a profit of $8 million and Gigacom earns a profit of $7 million.

B) Both offer internet service via cable line; Xenophone earns a profit of $6 million and Gigacom earns a profit of $9 million.

C) Xenophone offers DSL internet service and earns a profit of $5 million while Gigacom offer internet service via cable line and earns a profit of $6.5 million.

D) Xenophone offers internet service via cable line and earns a profit of $4 million while Gigacom offers DSL internet service and earns a profit of $4.5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

27

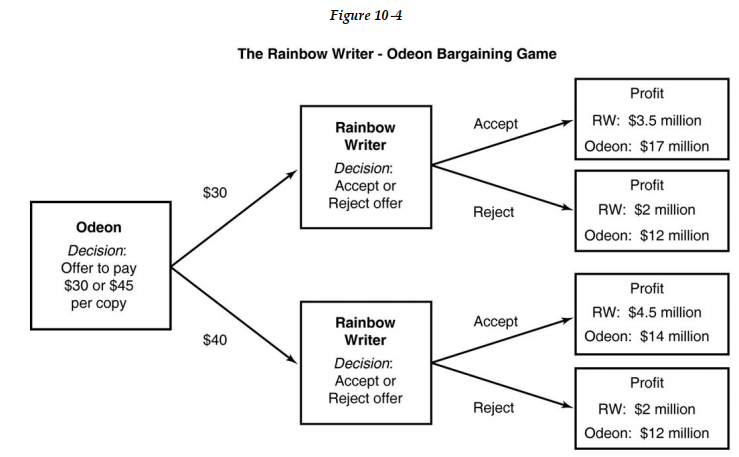

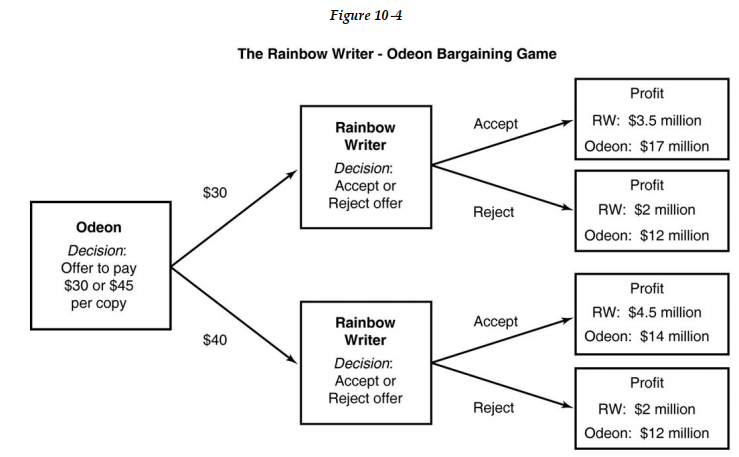

Rainbow Writer (RW) is a small online company selling a highly rated software package for printing color labels directly onto CDs. The firm currently earns a profit of $2 million per year selling its package exclusively on its website. Odeon, the producer of the most popular software package for editing and burning CDs and DVDs, has expressed interest in bundling Rainbow Writer's product into its own package. Odeon expects that bundling would further boost its sales and allow it to sell the new bundled product at a higher price, thus raising its profits beyond its current profit of $12 million. Figure 10-4 shows the decision tree for the Rainbow Writer-Odeon bargaining game.

Rainbow Writer (RW) is a small online company selling a highly rated software package for printing color labels directly onto CDs. The firm currently earns a profit of $2 million per year selling its package exclusively on its website. Odeon, the producer of the most popular software package for editing and burning CDs and DVDs, has expressed interest in bundling Rainbow Writer's product into its own package. Odeon expects that bundling would further boost its sales and allow it to sell the new bundled product at a higher price, thus raising its profits beyond its current profit of $12 million. Figure 10-4 shows the decision tree for the Rainbow Writer-Odeon bargaining game.-Refer to Figure 10-4. What is the equilibrium outcome in this game and is this a subgame-perfect equilibrium?

A) In the equilibrium, neither offer is accepted as Rainbow Writer holds out for a better deal. The two rejection outcomes are subgame -perfect equilibria.

B) In the equilibrium, Odeon offers $40 per copy of the software package and is accepted but this is not a subgame -perfect equilibrium.

C) Either offer of $30 or $40 per copy of the software package is accepted and these two equilibria are subgame -perfect equilibria.

D) Either offer of $30 or $40 per copy of the software package is accepted but these are not are subgame -perfect equilibria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

28

Rainbow Writer (RW) is a small online company selling a highly rated software package for printing color labels directly onto CDs. The firm currently earns a profit of $2 million per year selling its package exclusively on its website. Odeon, the producer of the most popular software package for editing and burning CDs and DVDs, has expressed interest in bundling Rainbow Writer's product into its own package. Odeon expects that bundling would further boost its sales and allow it to sell the new bundled product at a higher price, thus raising its profits beyond its current profit of $12 million. Figure 10-4 shows the decision tree for the Rainbow Writer-Odeon bargaining game.

Rainbow Writer (RW) is a small online company selling a highly rated software package for printing color labels directly onto CDs. The firm currently earns a profit of $2 million per year selling its package exclusively on its website. Odeon, the producer of the most popular software package for editing and burning CDs and DVDs, has expressed interest in bundling Rainbow Writer's product into its own package. Odeon expects that bundling would further boost its sales and allow it to sell the new bundled product at a higher price, thus raising its profits beyond its current profit of $12 million. Figure 10-4 shows the decision tree for the Rainbow Writer-Odeon bargaining game.-Refer to Figure 10 -4. In a real world situation involving Rainbow Writer and Odeon, what scenario below might permit Rainbow Writer to rationally refuse an offer from Odeon of $40 per copy of the software package?

A) Odeon hires a software developer to begin developing its own proprietary color labeling software.

B) Odeon's competitors are also interested in bundling Rainbow Writer's software.

C) Odeon is also negotiating with Swift Colors, Rainbow Writer's chief rival.

D) Odeon is considering new distribution outlets for its products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a new competitor enters the market, which of the following business strategies would be best for firms already operating in the market?

A) focus differentiation on few products that cater to a specific segment of the market to have a firm grip on that segment

B) produce a single product that can be substituted for other firms' products

C) expand the market size and their base before the newcomer launches business

D) cost minimization to maintain a large online presence and a small physical store

A) focus differentiation on few products that cater to a specific segment of the market to have a firm grip on that segment

B) produce a single product that can be substituted for other firms' products

C) expand the market size and their base before the newcomer launches business

D) cost minimization to maintain a large online presence and a small physical store

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the year 2000, Fastlink, who was at the time Jordan's only mobile network operator, faced the threat of a new entrant to the market, Mobilecom. Fastlink prepared for the threat by offering new products and promotions to attract new customers. What was Fastlink trying to achieve?

A) Contract the business in order to be more agile in fighting Mobilecom.

B) They were trying to expand the market size and their base before the newcomer launches business.

C) Merge with Mobilecom.

D) Intimidate Mobilecom to shut down its operations.

A) Contract the business in order to be more agile in fighting Mobilecom.

B) They were trying to expand the market size and their base before the newcomer launches business.

C) Merge with Mobilecom.

D) Intimidate Mobilecom to shut down its operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

31

Lulu Hypermarket is one of the biggest hypermarkets operating in the GCC region. It's rival, Carrefour, has initiated a strategy of aggressive growth in the region by opening branches in different cities. Shortly afterwards, Lulu also started opening new branches in different cities in the GCC. What is Lulu's strategy in this case?

A) Lulu is responding to its rival's (Carrefour) actions in hopes that it will bring higher profits.

B) It is trying to imitate the strategies of Carrefour -after LuLu lost a great market share to Carrefour lately.

C) Appealing to GCC consumers by opening new branches exclusively in the Gulf region.

D) None of the above.

A) Lulu is responding to its rival's (Carrefour) actions in hopes that it will bring higher profits.

B) It is trying to imitate the strategies of Carrefour -after LuLu lost a great market share to Carrefour lately.

C) Appealing to GCC consumers by opening new branches exclusively in the Gulf region.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

32

Carrefour's ability to exploit its relationships with its various suppliers gives Carrefour a competitive edge over its rivals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck