Deck 11: Setting Performance Expectations in Large, Complex Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 11: Setting Performance Expectations in Large, Complex Organizations

1

One of the benefits of decentralized organizations is their ability to respond quickly to new business opportunities and changing business conditions.

True

2

The financial performance of managers of cost centers can be effectively evaluated using return on investment measures.

False

3

Because common corporate costs must be covered, the manager of a profit center in a decentralized firm is held accountable for allocations of such costs even though that manager has no control over those costs.

False

4

Of the various types of responsibility centers managers, only investment center managers are responsible for allocating financial capital among competing projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

The preparation of an operating budget is typically preceded by the development of a strategic plan and the identification of specific action plans to allocate scarce resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

SWOT analysis refers to the body of techniques commonly used to allocate scarce financial capital among competing investment projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

A cash flow occurring five years from today has a larger present value than the same cash flow occurring three years from today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

The most objective measure of an asset's value is its market price in an arm's length sale between well-informed buyers and sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

A given stream of cash flows will have a larger present value at a discount rate of 8% than it will at a discount rate of 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

The congruence problem can be avoided by assessing managerial performance using financial accounting measures that are grounded in generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company's weighted average cost of capital will increase with the proportion of debt included in its capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

One reason for allocating the costs of service departments to operating departments is to provide an incentive for those service departments to operate efficiently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

The allocation of service department costs to operating departments is more complicated when the service departments consume support from one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

The direct method of service department cost allocation fully accounts for the costs of support that service departments provide to one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

When one division of a decentralized entity transfers product to another, the minimum transfer price should reflect the availability of excess capacity in the selling division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

Transfers of products between divisions should never take place at market prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

A minimum transfer price should cover the marginal cost of producing the transferred product plus any opportunity costs incurred by the selling division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

Allowing buying divisions to make purchases from external suppliers will eliminate transfer pricing problems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

A transfer price should exclude any variable selling costs on outside sales incurred by the selling division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

Residual income measures give investment center managers incentive to invest in all projects that promise returns greater than the corporation's cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

An investment opportunity has an expected 20% rate of return. If the company's cost of capital is 15%, the use of return on investment to measure investment center performance will ensure that this project is undertaken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

The claimed benefits flowing from a decentralized organizational structure include which of the following?

A) A reduction in gamesmanship.

B) Suboptimization by lower-level managers.

C) Better-informed decision makers.

D) A minimum of administration and coordination costs.

A) A reduction in gamesmanship.

B) Suboptimization by lower-level managers.

C) Better-informed decision makers.

D) A minimum of administration and coordination costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

One of the significant costs of decentralization is:

A) A lack of goal congruence.

B) Faster response times to changing economic conditions.

C) Increased motivation levels among managers.

D) Enhanced financial regulation.

A) A lack of goal congruence.

B) Faster response times to changing economic conditions.

C) Increased motivation levels among managers.

D) Enhanced financial regulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Robert Gilligan is the manager of the golf cart production division of the John Fleer Company. The golf cart production division is recognized in the company's organization as a cost center. Of the following budgetary items, which would not be among Mr. Gilligan's responsibilities?

A) Raw materials price variances.

B) Sales prices of golf carts to Fleer's wholesale distributors.

C) Direct labor costs of the golf cart production division.

D) Costs to rework defective golf carts.

A) Raw materials price variances.

B) Sales prices of golf carts to Fleer's wholesale distributors.

C) Direct labor costs of the golf cart production division.

D) Costs to rework defective golf carts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sara Bellows, manager of the telecommunication sales team, has the following department budget.

Billings - long distance $350,000

Billings - phone card 75,000

Billings - toll-free 265,000

Her responsibility center is best described as a:

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

Billings - long distance $350,000

Billings - phone card 75,000

Billings - toll-free 265,000

Her responsibility center is best described as a:

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

Capital budgeting decisions are typically carried out in which type of responsibility center?

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

A) Cost center.

B) Revenue center.

C) Profit center.

D) Investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

A well-designed responsibility accounting system should hold a manager responsible for:

A) Only those line items that appear in a flexible budget.

B) Only those outcomes over which the manager has significant control.

C) Only long-term strategic goals.

D) Deficiencies uncovered in a SWOT analysis.

A) Only those line items that appear in a flexible budget.

B) Only those outcomes over which the manager has significant control.

C) Only long-term strategic goals.

D) Deficiencies uncovered in a SWOT analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

The John Deere Corporation is organized into three divisions: agriculture and turf; construction and forestry; and finance. Each of these divisions sells unique products and services in distinct markets, and each has its own goals and objectives. These three divisions could be most accurately described as:

A) Cost centers.

B) Strategic business units.

C) Revenue centers.

D) Wholly owned subsidiaries.

A) Cost centers.

B) Strategic business units.

C) Revenue centers.

D) Wholly owned subsidiaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

One definition of the value of an economic asset is given by:

A) The present value of the asset's future cash flows.

B) The historic cost of the asset.

C) The remaining undepreciated cost of the asset.

D) The balance sheet valuation of that asset.

A) The present value of the asset's future cash flows.

B) The historic cost of the asset.

C) The remaining undepreciated cost of the asset.

D) The balance sheet valuation of that asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

The most objective measure of economic value is:

A) Full cost of production.

B) Market price.

C) Opportunity cost.

D) The present value of future cash flows.

A) Full cost of production.

B) Market price.

C) Opportunity cost.

D) The present value of future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

If you require a 5% annual rate of return, the present value of $1,000 received three years from today is given by:

A) $1,000 x (1 +0.05)3

B) $1,000 / (0.05)3

C) $1,000 / (1 + 0.05)3

D) (1 + 0.05)3 / $1,000

A) $1,000 x (1 +0.05)3

B) $1,000 / (0.05)3

C) $1,000 / (1 + 0.05)3

D) (1 + 0.05)3 / $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

Among its other assets, your company owns a note receivable from a customer. The terms of the note entitle your company to receive a $50,000 cash payment at the end of each of the next three years. Assuming a market rate of interest of 8%, what is the approximate economic value of your company's note receivable?

A) $150,000

B) $62,986

C) $138,889

D) $128,855

A) $150,000

B) $62,986

C) $138,889

D) $128,855

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

As the interest rate or discount rate falls, the present value of a stream of future cash flows will:

A) Increase.

B) Decrease.

C) Remain unchanged.

D) Change, but in an undetermined direction.

A) Increase.

B) Decrease.

C) Remain unchanged.

D) Change, but in an undetermined direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

A given cash flow to be received 10 years in the future has:

A) The same present value as an equal cash flow to be received today.

B) A smaller present value than an equal cash flow to be received today.

C) A larger present value than an equal cash flow to be received today.

D) No present value.

A) The same present value as an equal cash flow to be received today.

B) A smaller present value than an equal cash flow to be received today.

C) A larger present value than an equal cash flow to be received today.

D) No present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

KHD Industries includes, among others, the following measures in its integrated performance measurement system: operating income, cash flow from operations, customer satisfaction, customer retention, defect rate, number of suppliers, employee retention, and number of patents. KHD Industries seems to have adopted:

A) The balanced scorecard approach to performance measurement.

B) Economic value added to assess management performance.

C) Residual income to assess management performance.

D) Horizontal integration in its performance measurement system.

A) The balanced scorecard approach to performance measurement.

B) Economic value added to assess management performance.

C) Residual income to assess management performance.

D) Horizontal integration in its performance measurement system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

The balanced scorecard provides an action plan for achieving competitive success by focusing management attention on critical success factors. Which one of the following is not one of the competitive success factors commonly focused upon in the balanced scorecard?

A) Competitor business strategies.

B) Financial performance measures.

C) Internal business processes.

D) Employee innovation and learning.

A) Competitor business strategies.

B) Financial performance measures.

C) Internal business processes.

D) Employee innovation and learning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

In the United States, generally accepted accounting principles require that research and development expenditures be charged against income in the periods in which they are incurred. Application of this principle:

A) Is required for internal financial reporting.

B) Is essential to the appropriate evaluation of investment center performance.

C) Can be the cause of the congruence problem.

D) Is critical to the appropriate measurement of return on investment.

A) Is required for internal financial reporting.

B) Is essential to the appropriate evaluation of investment center performance.

C) Can be the cause of the congruence problem.

D) Is critical to the appropriate measurement of return on investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

The congruence problem occurs when:

A) Changes in economic value are not reflected in accounting measures of performance.

B) Managers focus excessive attention on the long run and ignore short-run performance.

C) The performance measurement system lacks vertical integration.

D) Managers confuse corporate strategy with business strategy.

A) Changes in economic value are not reflected in accounting measures of performance.

B) Managers focus excessive attention on the long run and ignore short-run performance.

C) The performance measurement system lacks vertical integration.

D) Managers confuse corporate strategy with business strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

Before becoming a publicly traded corporation, Groupon, Inc., relied on a financial metric it named "adjusted consolidated segment operating income" (ASCOI) to assess performance. ASCOI measured the company's operating income excluding several major expenses, including marketing and acquisition-related costs. One reason Groupon relied on ASCOI to assess performance may have been to:

A) Attract new subscribers to its service.

B) Strengthen its balance sheet.

C) Reduce its weighted average cost of capital.

D) Reduce congruence problems caused by applying traditional accounting measures in a new business environment.

A) Attract new subscribers to its service.

B) Strengthen its balance sheet.

C) Reduce its weighted average cost of capital.

D) Reduce congruence problems caused by applying traditional accounting measures in a new business environment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

Many companies assess performance using what are called non-GAAP measures of income. These measures violate generally accepted accounting principles by excluding some items when computing company income while including others. For example, some measures exclude charges for depreciation and amortization. Using such measures is an attempt to overcome:

A) Excessive financial regulation.

B) The congruence problem.

C) Unexpected shortfalls in reported income.

D) Gamesmanship by management.

A) Excessive financial regulation.

B) The congruence problem.

C) Unexpected shortfalls in reported income.

D) Gamesmanship by management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

Cotton Company has two service departments and three operating departments. In allocating service department costs to the operating departments, which of the following three methods (direct, step-down, reciprocal) will result in the same amount of service department costs being allocated to each operating department, regardless of the order in which the service department costs are allocated?

A) Direct and reciprocal methods only.

B) Step-down and reciprocal methods only.

C) Direct and step-down methods only.

D) Direct method only.

A) Direct and reciprocal methods only.

B) Step-down and reciprocal methods only.

C) Direct and step-down methods only.

D) Direct method only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

Render Inc. has four support departments (maintenance, power, human resources, and legal) and three operating departments. The support departments provide services to the operating departments as well as to the other support departments. The method of allocating the costs of the support departments that best recognizes the mutual services rendered by support departments to other support departments is the:

A) Direct allocation method.

B) Dual-rate allocation method.

C) Step-down allocation method.

D) Reciprocal allocation method.

A) Direct allocation method.

B) Dual-rate allocation method.

C) Step-down allocation method.

D) Reciprocal allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

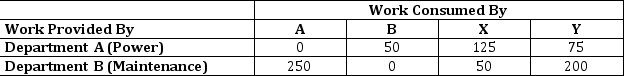

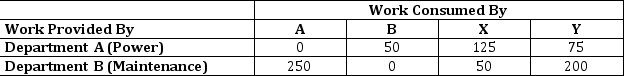

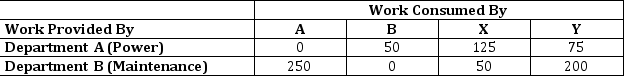

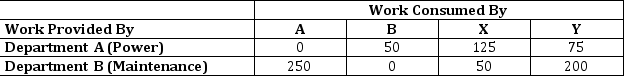

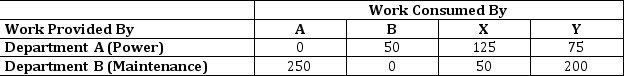

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another.

-Of the following approaches to allocating the costs of the power and equipment departments, which ignores the costs of the work that the support departments consume from one another?

A) The direct method.

B) The step-down method.

C) The reciprocal method.

D) All of the above.

-Of the following approaches to allocating the costs of the power and equipment departments, which ignores the costs of the work that the support departments consume from one another?

A) The direct method.

B) The step-down method.

C) The reciprocal method.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another.

- Of the following approaches to allocating the costs of the power and equipment departments, which fully accounts for the costs of the work that the support departments consume from one another?

A) The direct method.

B) The step-down method.

C) The reciprocal method.

D) The market price method.

- Of the following approaches to allocating the costs of the power and equipment departments, which fully accounts for the costs of the work that the support departments consume from one another?

A) The direct method.

B) The step-down method.

C) The reciprocal method.

D) The market price method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another.

-The work done by Departments A and B is summarized in the table below.

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?

A) 16.67%

B) 50.00%

C) 20.00%

D) 80.00%

-The work done by Departments A and B is summarized in the table below.

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?A) 16.67%

B) 50.00%

C) 20.00%

D) 80.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

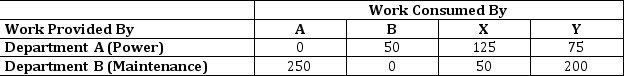

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another. The work done by Departments A and B is summarized in the table below.

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. Of the $80,000 of maintenance cost, what amount would be assigned to Department Y under the direct method?

A) $64,000

B) $40,000

C) $58,182

D) $30,000

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. Of the $80,000 of maintenance cost, what amount would be assigned to Department Y under the direct method?

A) $64,000

B) $40,000

C) $58,182

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

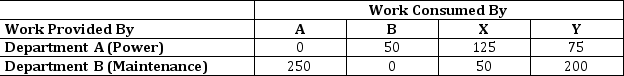

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another. The work done by Departments A and B is summarized in the table below.

- The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M Corporation elects to use the step-down method and begins the allocation with the $80,000 of maintenance cost, what amount of the $80,000 of maintenance cost should be assigned to the power department in the first step?

A) $13,333.33

B) $16,000.00

C) $0.00

D) $40,000.00

- The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M Corporation elects to use the step-down method and begins the allocation with the $80,000 of maintenance cost, what amount of the $80,000 of maintenance cost should be assigned to the power department in the first step?

A) $13,333.33

B) $16,000.00

C) $0.00

D) $40,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

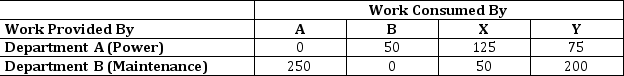

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another. The work done by Departments A and B is summarized in the table below.

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M chooses to use the reciprocal method, which of the following equations would be used to model the power department's total cost?

A) Power Department Costs = $200,000

B) Power Department Costs = $200,000 + 0.5 x Maintenance Costs +

0)5 x Department X Costs + 0.3 x Department Y Costs

C) Power Department Costs = $200,000 + 0.5 x Maintenance Costs

D) Power Department Costs = $200,000 + 0.2 x Maintenance Costs

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M chooses to use the reciprocal method, which of the following equations would be used to model the power department's total cost?

A) Power Department Costs = $200,000

B) Power Department Costs = $200,000 + 0.5 x Maintenance Costs +

0)5 x Department X Costs + 0.3 x Department Y Costs

C) Power Department Costs = $200,000 + 0.5 x Maintenance Costs

D) Power Department Costs = $200,000 + 0.2 x Maintenance Costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

Wilcox Industrial has two support departments, the Information Systems Department and the Personnel Department, and two manufacturing departments, the Machining Department and the Assembly Department. The support departments service each other as well as the two production departments. Company studies have shown that the Personnel Department provides support to a greater number of departments than the Information Systems Department. If Wilcox uses the step-down method of departmental allocation, which one of the following cost allocations would not occur? Some of the costs of the:

A) Personnel Department would be allocated to the Information Systems Department.

B) Information Systems Department would be allocated to the Personnel Department.

C) Personnel Department would be allocated to the Assembly Department.

D) Personnel Department would be allocated to the Assembly Department and the Machining Department.

A) Personnel Department would be allocated to the Information Systems Department.

B) Information Systems Department would be allocated to the Personnel Department.

C) Personnel Department would be allocated to the Assembly Department.

D) Personnel Department would be allocated to the Assembly Department and the Machining Department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

What set of circumstances necessitate the establishment and use of transfer prices?

A) A decentralized organization featuring cost, revenue, profit, and investment centers.

B) The provision of products or services by one profit or investment center to another.

C) The provision of services by internal support departments.

D) The establishment of strategic business units.

A) A decentralized organization featuring cost, revenue, profit, and investment centers.

B) The provision of products or services by one profit or investment center to another.

C) The provision of services by internal support departments.

D) The establishment of strategic business units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

Morrison's Plastics Division, a profit center, sells its products to external customers as well as to other internal profit centers. Which of the following circumstances would justify the Plastics Division selling a product internally to another profit center at a price that is below the market-based transfer price?

A) The buying unit has excess capacity.

B) The selling unit is operating at full capacity.

C) Routine sales commissions and collection costs would be avoided.

D) The profit centers' managers are evaluated on the basis of unit operating income.

A) The buying unit has excess capacity.

B) The selling unit is operating at full capacity.

C) Routine sales commissions and collection costs would be avoided.

D) The profit centers' managers are evaluated on the basis of unit operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

Depending on the circumstances, an adequate transfer price could be based on:

A) Market prices.

B) Full cost.

C) Variable or marginal cost of providing the product or service.

D) Any of the above.

A) Market prices.

B) Full cost.

C) Variable or marginal cost of providing the product or service.

D) Any of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

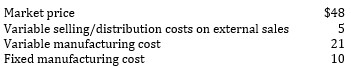

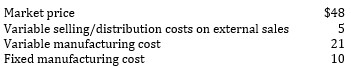

Manhattan Corporation has several divisions that operate as decentralized profit centers. At the present time, the Fabrication Division has excess capacity of 5,000 units with respect to the UT-371 circuit board, a popular item in many digital applications. Information about the circuit board follows.

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:

A) $21.

B) $26.

C) $31.

D) $46.

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:A) $21.

B) $26.

C) $31.

D) $46.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Assembly Division of Ikon Aircraft Corporation purchases hydraulic valves from the company's Machining Division. Assembly is free to purchase one particular valve from vendors outside the company and can do so at a market price of $800 per unit. The Machining Division currently has adequate capacity to supply all of the Assembly Division's needs for the valve, and can produce the valve at a unit variable cost of $500 and unit fixed costs of $200. The Machining Division also incurs variable selling costs of $40 on each unit sold outside the company. Under these circumstances, the maximum transfer price for the valve is:

A) $500.

B) $800.

C) $700.

D) $740.

A) $500.

B) $800.

C) $700.

D) $740.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is an incorrect description of transfer pricing?

A) It measures the value of goods or services furnished by a profit center to other responsibility centers within a company.

B) If a market price exists, this price may be used as a transfer price.

C) It measures exchanges between a company and external customers.

D) If no market price exists, the transfer price may be based on cost.

A) It measures the value of goods or services furnished by a profit center to other responsibility centers within a company.

B) If a market price exists, this price may be used as a transfer price.

C) It measures exchanges between a company and external customers.

D) If no market price exists, the transfer price may be based on cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Kern Manufacturing has several divisions and evaluates performance using segment income. Since sales include transfers to other divisions, Kern has established a price for internal sales as cost plus 10%. Red Division has requested 10,000 units of Green Division's product. Green Division is selling its product externally at a 60% markup over cost. The corporate policy will encourage the Green Division to:

A) Transfer the product to the Red Division because all costs are being covered and the division will earn a 10% profit.

B) Reject the sale to the Red Division because it does not provide the same markup as external sales.

C) Accept the sale to the Red Division if it is operating at full capacity and the sale will contribute to fixed costs.

D) Transfer the product to the Red Division if it does not require the Green Division to give up any external sales.

A) Transfer the product to the Red Division because all costs are being covered and the division will earn a 10% profit.

B) Reject the sale to the Red Division because it does not provide the same markup as external sales.

C) Accept the sale to the Red Division if it is operating at full capacity and the sale will contribute to fixed costs.

D) Transfer the product to the Red Division if it does not require the Green Division to give up any external sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is a drawback to using return on investment (ROI)to assess performance by managers?

A) Managers of investment centers with high ROIs may reject projects with expected returns that exceed the corporation's cost of capital.

B) Managers of investment centers with high ROI's may overinvest in projects with expected returns that exceed the company's cost of capital.

C) Use of ROI measures may induce managers to rely too heavily on equity as opposed to debt when financing projects.

D) All of the above are disadvantages associated with the use of ROI.

A) Managers of investment centers with high ROIs may reject projects with expected returns that exceed the corporation's cost of capital.

B) Managers of investment centers with high ROI's may overinvest in projects with expected returns that exceed the company's cost of capital.

C) Use of ROI measures may induce managers to rely too heavily on equity as opposed to debt when financing projects.

D) All of the above are disadvantages associated with the use of ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

For several years, Northern Division of Marino Company has maintained a positive residual income. Northern is currently considering investing in a new project that will lower the division's overall return on investment (ROI) but increase its residual income. What is the relationship between the expected rate of return on the new project, the firm's cost of capital, and the division's current ROI?

A) The expected rate of return on the new project is higher than the division's current return on investment, but lower than the firm's cost of capital.

B) The firm's cost of capital is higher than the expected rate of return on the new project, but lower than the division's current return on investment.

C) The division's current return on investment is higher than the expected rate of return on the new project, but lower than the firm's cost of capital.

D) The expected rate of return on the new project is higher than the firm's cost of capital, but lower than the division's current return on investment.

A) The expected rate of return on the new project is higher than the division's current return on investment, but lower than the firm's cost of capital.

B) The firm's cost of capital is higher than the expected rate of return on the new project, but lower than the division's current return on investment.

C) The division's current return on investment is higher than the expected rate of return on the new project, but lower than the firm's cost of capital.

D) The expected rate of return on the new project is higher than the firm's cost of capital, but lower than the division's current return on investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

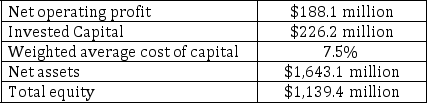

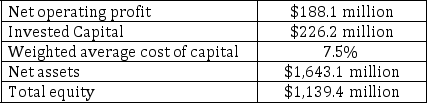

Pinehurst Company has two divisions, Household Appliances and Precision Equipment. Some recent financial metrics for the Household Appliances division are given in the table below.

What is the division's residual income?

What is the division's residual income?

A) 83.2%

B) $64.87 million

C) 16.5%

D) 11.4%

What is the division's residual income?

What is the division's residual income?A) 83.2%

B) $64.87 million

C) 16.5%

D) 11.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

Oakmont Company has two divisions, Household Appliances and Construction Equipment. The manager of the Household Appliances division is evaluated on the basis of return on investment (ROI). The manager of the Construction Equipment division is evaluated on the basis of residual income. The cost of capital has been 12% and the ROI has been 16% for the two divisions. Each manager is currently considering a project with a 14% rate of return. According to the current evaluation system for managers, which manager(s) would have incentive to undertake the project?

A) Both managers would have incentive to undertake the project.

B) Neither manager would have incentive to undertake the project.

C) The manager of the Household Appliances division would have incentive to undertake the project, while the manager of the Construction Equipment division would not have incentive to undertake the project.

D) The manager of the Construction Equipment division would have incentive to undertake the project, while the manager of the Household Appliances division would not have incentive to undertake the project.

A) Both managers would have incentive to undertake the project.

B) Neither manager would have incentive to undertake the project.

C) The manager of the Household Appliances division would have incentive to undertake the project, while the manager of the Construction Equipment division would not have incentive to undertake the project.

D) The manager of the Construction Equipment division would have incentive to undertake the project, while the manager of the Household Appliances division would not have incentive to undertake the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

A drawback to the use of residual income when comparing the performance of corporate divisions is that:

A) The use of residual income induces managers to use debt rather than equity financing.

B) The use of residual income leads to divisional investment decisions that are suboptimal from the perspective of the corporation.

C) Higher residual income may only indicate a larger but not better-performing division.

D) Residual income fails to take into account the corporation's weighted average cost of capital.

A) The use of residual income induces managers to use debt rather than equity financing.

B) The use of residual income leads to divisional investment decisions that are suboptimal from the perspective of the corporation.

C) Higher residual income may only indicate a larger but not better-performing division.

D) Residual income fails to take into account the corporation's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

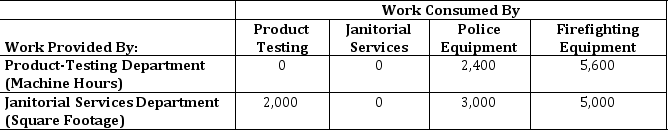

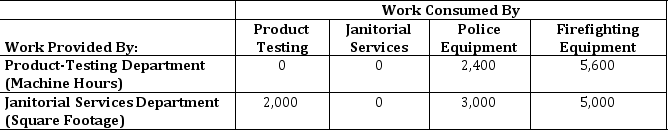

Star Products, Inc., produces safety equipment for first responders in both police and fire departments. The company has two operating departments: one specializing in equipment for police and the other in equipment for firefighters. The company also has two service departments. The product-testing department subjects the products of both operating divisions to exhaustive testing since external product failures are totally unacceptable. The janitorial department performs general cleaning for the other departments. The work in product testing is highly automated and, as a result, its cost is allocated based on machine hours. The costs of janitorial support are allocated based on the square footage occupied by the consuming departments. Budgeted costs for the coming year are $840,000 for the product-testing department and $420,000 for the janitorial services department. The table below contains data regarding budgeted measures of support to be provided by the service departments in the coming year.

Required:

Required:

a) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using direct allocation.

b) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using sequential allocation.

c) Which method of allocating the service department costs should be used? Why?

Required:

Required:a) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using direct allocation.

b) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using sequential allocation.

c) Which method of allocating the service department costs should be used? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

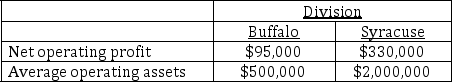

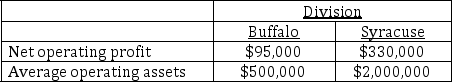

AP Industries has two divisions, located in Buffalo and Syracuse. Financial metrics for each division for the most recently concluded year are given in the table below:

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

Required:

a) Compute ROI for both the Buffalo and Syracuse divisions.

b) Compute residual income for both the Buffalo and Syracuse divisions.

c) How does the performance of the divisions compare? Discuss the shortcoming of residual income as a comparative measure of divisional performance.

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.Required:

a) Compute ROI for both the Buffalo and Syracuse divisions.

b) Compute residual income for both the Buffalo and Syracuse divisions.

c) How does the performance of the divisions compare? Discuss the shortcoming of residual income as a comparative measure of divisional performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

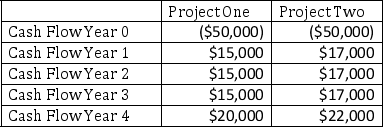

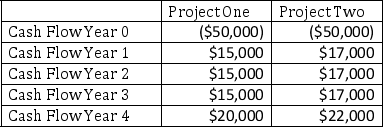

Steif Corporation has two investment projects it is considering. Financial capital is scarce, so Steif wants to choose the project that promises the highest returns to the company and its shareholders. The company's weighted average cost of capital is 14%. The projected cash flows from both projects are given below.

Required:

Required:

a) Calculate the present value of each of the projects using the 14% weighted average cost of capital as the discount rate.

b) Which, if either, of the projects should the company choose? Why?

Required:

Required:a) Calculate the present value of each of the projects using the 14% weighted average cost of capital as the discount rate.

b) Which, if either, of the projects should the company choose? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

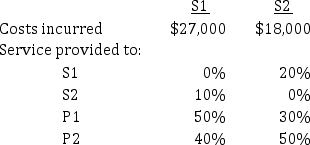

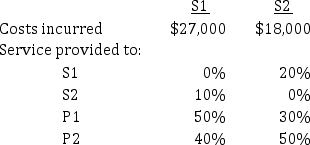

A company has two service departments, S1 and S2, and two production departments, P1 and P2. Departmental data for January is shown below.

Required:

Required:

What are the total allocated service department costs to P1 and P2 if the company uses the reciprocal method of allocating its service department costs?

Required:

Required:What are the total allocated service department costs to P1 and P2 if the company uses the reciprocal method of allocating its service department costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck