Deck 10: Setting Performance Expectations at the Entity Level

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 10: Setting Performance Expectations at the Entity Level

1

Before any organization, whether small, divisional, or functional, can develop plans and budgets, the board of directors and key managers must agree on the organization's mission and objectives.

True

2

Because of their relative complexity, functional and divisional organizations experience more serious cash constraints than small organizations and must plan accordingly.

False

3

A small organization is more likely to feature participation in planning and decision making by lower-level managers and employees.

False

4

In any period in which the budgeted ending inventory of finished goods exceeds the budgeted beginning inventory, production of units will need to exceed budgeted sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

The sequence of budgeting schedules will always begin with the sales forecast and sales budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a scenario-planning exercise, the computation of an expected value assigns equal probabilities of occurrence to the outcomes of each of the scenarios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

Preparation of a budgeted income statement is a necessary prerequisite to the development of a budgeted balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cash shortages and surpluses occur due to a lack of synchronization between the rate at which customer receivables are collected and the rate at which disbursements must be made for raw materials, direct labor, overhead, and selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

Sandbagging or creating slack in an operational plan is a common problem in small organizations, but rarely in functional or divisional ones.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

A flexible budget is a more effective tool for performance evaluation than is a static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

No matter the size or nature of an organization, the absolute prerequisite for successful planning and budgeting by management is:

A) The development of a cohesive business plan.

B) An understanding of the market in which the organization will operate.

C) Agreement on the organization's mission and objectives.

D) A corporate charter.

A) The development of a cohesive business plan.

B) An understanding of the market in which the organization will operate.

C) Agreement on the organization's mission and objectives.

D) A corporate charter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

Top-down management in which employees are given little to no discretion is most indicative of which type of business organization?

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Not-for-profit organizations

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Not-for-profit organizations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which type of business organization is most likely to suffer from significant cash flow constraints and therefore require careful cash planning?

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Multinational companies

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Multinational companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

The evolution of an organization into a functional structure with subunits performing different processes would most likely result from:

A) A need to deal with more complex markets.

B) A need to deal with a more challenging regulatory environment.

C) Increasing legal liabilities.

D) A required division of management tasks as the organization expands in size.

A) A need to deal with more complex markets.

B) A need to deal with a more challenging regulatory environment.

C) Increasing legal liabilities.

D) A required division of management tasks as the organization expands in size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which type of business organization has the greatest need for a performance measurement system to coordinate actions across the organization?

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Not-for-profit organizations

A) Small organizations

B) Functional organizations

C) Divisionally organized entities

D) Not-for-profit organizations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

A primary purpose of developing multiple plans or budgets based on a variety of future scenarios would be to:

A) Predict the future as accurately as possible.

B) Demonstrate how differently the organization would be affected and respond to a variety of potential forces.

C) Make the organization attractive to a greater variety of investors.

D) Accelerate growth of the organization over time.

A) Predict the future as accurately as possible.

B) Demonstrate how differently the organization would be affected and respond to a variety of potential forces.

C) Make the organization attractive to a greater variety of investors.

D) Accelerate growth of the organization over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following benefits accrue to planning in small organizations?

A) Planning forces the organization to consider the future.

B) Planning helps to determine resources that will be required by operations.

C) Planning provides a standard against which to judge performance.

D) All of the above are benefits of the planning process.

A) Planning forces the organization to consider the future.

B) Planning helps to determine resources that will be required by operations.

C) Planning provides a standard against which to judge performance.

D) All of the above are benefits of the planning process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

The term "expected value" refers to:

A) A best guess of an outcome.

B) A most pessimistic estimate of an outcome.

C) An estimate that takes into account the probabilities of all possible outcomes.

D) The outcome experienced in the last time period.

A) A best guess of an outcome.

B) A most pessimistic estimate of an outcome.

C) An estimate that takes into account the probabilities of all possible outcomes.

D) The outcome experienced in the last time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

Top Cat Ventures, Inc., explores for natural gas. The company is considering a particular drilling site with a geological structure that has a 65% probability of yielding enough natural gas to produce revenue of $2 million. The probability is 35% that the site will yield zero revenue and result in a loss of $500,000. What is the expected value of drilling at this site?

A) $1.125 million

B) $1.6 million

C) A $500,000 loss

D) $1.5 million

A) $1.125 million

B) $1.6 million

C) A $500,000 loss

D) $1.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

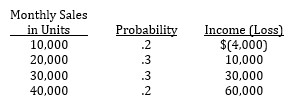

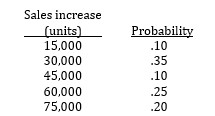

Johnson Software has developed a new software package. Johnson's sales manager has prepared the following probability distribution describing the relative likelihood of monthly sales levels and relative income (loss) for the company's new software package.

If Johnson decides to market its new software package, the expected value of additional monthly income will be:

If Johnson decides to market its new software package, the expected value of additional monthly income will be:

A) $23,200

B) $24,000

C) $24,800

D) $25,000

If Johnson decides to market its new software package, the expected value of additional monthly income will be:

If Johnson decides to market its new software package, the expected value of additional monthly income will be:A) $23,200

B) $24,000

C) $24,800

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

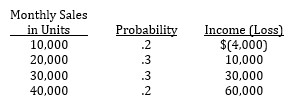

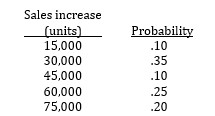

The sales manager of Serito Doll Company has suggested that an expanded advertising campaign costing $40,000 would increase the sales and profits of the company. He has developed the following probability distribution for the effect of the advertising campaign on company sales.

The company sells the dolls at $5.20 each. The cost of each doll is $3.20. Serito's expected incremental profit, if the advertising campaign is adopted, would be:

The company sells the dolls at $5.20 each. The cost of each doll is $3.20. Serito's expected incremental profit, if the advertising campaign is adopted, would be:

A) $6,500

B) $46,500

C) $53,000

D) $93,000

The company sells the dolls at $5.20 each. The cost of each doll is $3.20. Serito's expected incremental profit, if the advertising campaign is adopted, would be:

The company sells the dolls at $5.20 each. The cost of each doll is $3.20. Serito's expected incremental profit, if the advertising campaign is adopted, would be:A) $6,500

B) $46,500

C) $53,000

D) $93,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

In developing a budget for a manufacturing firm with a functional organization, which of the following must be prepared first?

A) A production budget

B) A finished goods inventory budget

C) A sales budget

D) A materials purchases budget

A) A production budget

B) A finished goods inventory budget

C) A sales budget

D) A materials purchases budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following best describes the order in which budgets should be prepared when developing the annual master operating budget?

A) Production budget, direct material budget, revenue budget.

B) Production budget, revenue budget, direct material budget.

C) Revenue budget, production budget, direct material budget.

D) Revenue budget, direct material budget, production budget.

A) Production budget, direct material budget, revenue budget.

B) Production budget, revenue budget, direct material budget.

C) Revenue budget, production budget, direct material budget.

D) Revenue budget, direct material budget, production budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Streeter Company produces plastic microwave turntables. Sales for the next year are expected to be 65,000 units in the first quarter, 72,000 units in the second quarter, 84,000 units in the third quarter, and 66,000 units in the fourth quarter. Streeter maintains a finished goods inventory at the end of each quarter equal to one-half of the units expected to be sold in the next quarter. How many units should Streeter produce in the second quarter?

A) 72,000 units

B) 75,000 units

C) 78,000 units

D) 84,000 units

A) 72,000 units

B) 75,000 units

C) 78,000 units

D) 84,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following equations is the correct formula to determine the required number of units to be produced in a given period?

A) Projected sales + Desired ending inventory - Beginning inventory

B) Projected sales - Desired ending inventory + Beginning inventory

C) Projected sales + Desired ending inventory + Beginning inventory

D) Beginning inventory + Purchases - Desired ending inventory

A) Projected sales + Desired ending inventory - Beginning inventory

B) Projected sales - Desired ending inventory + Beginning inventory

C) Projected sales + Desired ending inventory + Beginning inventory

D) Beginning inventory + Purchases - Desired ending inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

Based on existing orders and forecasts, Foster Corporation expects sales of 18,000 units in the first quarter of the coming year and an additional 24,000 units in the second quarter. The company always maintains a finished goods inventory sufficient to supply 20% of the following quarter's sales needs, and has that quantity on hand as the first quarter is about to begin. What number of units must Foster Corporation produce in the first quarter of the coming year?

A) 22,800

B) 19,200

C) 26,400

D) 38,400

A) 22,800

B) 19,200

C) 26,400

D) 38,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

EP Products has 2,000 units of its product on hand at the beginning of January. Sales in January and February are forecast to be 16,000 units and 12,000 units, respectively. The company plans to end January with sufficient inventory to provide 25% of February's sales needs. What number of units must EP Products schedule for production in January?

A) 17,000

B) 16,000

C) 19,000

D) 15,000

A) 17,000

B) 16,000

C) 19,000

D) 15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

Highland Corporation has budgeted production of 94,000 units for the upcoming three-month period. Each unit requires 4.5 kilograms of a particular raw material. As the quarter is about to begin, Highland holds an inventory of 84,600 kilograms of this material and has targeted an ending inventory of 90,000 kilograms. What amount of this raw material will need to be purchased during the upcoming quarter?

A) 99,400

B) 423,000

C) 417,600

D) 428,400

A) 99,400

B) 423,000

C) 417,600

D) 428,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

Swan Company is a maker of men's slacks. The company would like to maintain 20,000 yards of fabric in ending inventory. The beginning fabric inventory is expected to contain 25,000 yards. The expected yards of fabric needed for sales is 90,000. Compute the yards of fabric that Swan needs to purchase.

A) 85,000

B) 90,000

C) 95,000

D) 135,000

A) 85,000

B) 90,000

C) 95,000

D) 135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

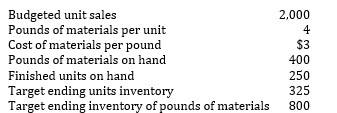

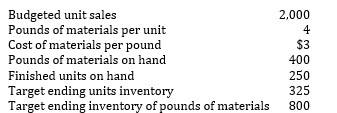

In preparing the direct material purchases budget for next quarter, the plant controller has the following information available:

How many pounds of materials must be purchased?

How many pounds of materials must be purchased?

A) 2,475

B) 7,900

C) 8,700

D) 9,300

How many pounds of materials must be purchased?

How many pounds of materials must be purchased?A) 2,475

B) 7,900

C) 8,700

D) 9,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

Carmen Products Incorporated plans to produce 5,000 units of product in the coming month. At an expected wage rate of $25 per hour, budgeted direct labor wages total $75,000. What amount of budgeted direct labor time is required per unit of output produced?

A) 200 hours

B) 3,000 hours

C) 1.67 hours

D) 0.60 hours

A) 200 hours

B) 3,000 hours

C) 1.67 hours

D) 0.60 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

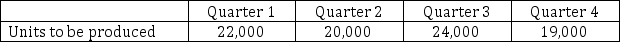

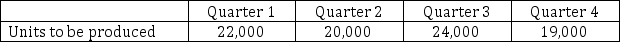

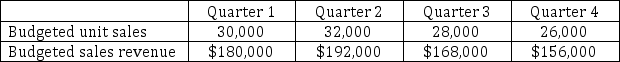

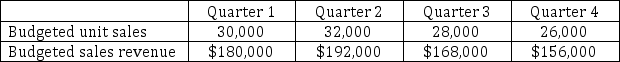

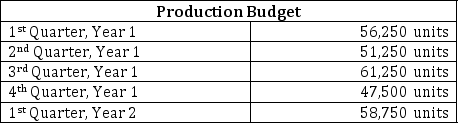

Howe Industries has prepared the quarterly production budget that appears below:

The production budget is consistent with the company's inventory policy requiring ending inventories of finished goods equal to 10% of the following quarter's needs. The company is currently preparing its budget for direct labor. It is known that 1.5 hours of direct labor is required per unit produced and that the direct labor wage rate is $25 per hour. What number of direct labor hours and wages will be required in the second quarter?

The production budget is consistent with the company's inventory policy requiring ending inventories of finished goods equal to 10% of the following quarter's needs. The company is currently preparing its budget for direct labor. It is known that 1.5 hours of direct labor is required per unit produced and that the direct labor wage rate is $25 per hour. What number of direct labor hours and wages will be required in the second quarter?

A) 30,000 hours and $750,000

B) 33,600 hours and $840,000

C) 36,000 hours and $900,000

D) 20,000 hours and $500,000

The production budget is consistent with the company's inventory policy requiring ending inventories of finished goods equal to 10% of the following quarter's needs. The company is currently preparing its budget for direct labor. It is known that 1.5 hours of direct labor is required per unit produced and that the direct labor wage rate is $25 per hour. What number of direct labor hours and wages will be required in the second quarter?

The production budget is consistent with the company's inventory policy requiring ending inventories of finished goods equal to 10% of the following quarter's needs. The company is currently preparing its budget for direct labor. It is known that 1.5 hours of direct labor is required per unit produced and that the direct labor wage rate is $25 per hour. What number of direct labor hours and wages will be required in the second quarter?A) 30,000 hours and $750,000

B) 33,600 hours and $840,000

C) 36,000 hours and $900,000

D) 20,000 hours and $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

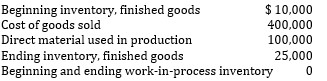

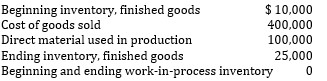

Petersons Planters, Inc., budgeted the following amounts for the coming year:

Overhead is estimated to be two times the amount of direct labor dollars. The amount that should be budgeted for direct labor for the coming year is:

Overhead is estimated to be two times the amount of direct labor dollars. The amount that should be budgeted for direct labor for the coming year is:

A) $315,000

B) $210,000

C) $157,500

D) $105,000

Overhead is estimated to be two times the amount of direct labor dollars. The amount that should be budgeted for direct labor for the coming year is:

Overhead is estimated to be two times the amount of direct labor dollars. The amount that should be budgeted for direct labor for the coming year is:A) $315,000

B) $210,000

C) $157,500

D) $105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company that manufactures furniture is establishing its budget for the upcoming year. All of the following items would appear in its overhead budget except for the:

A) Overtime paid to the workers who perform production scheduling.

B) Cost of glue used to secure the attachment of the legs to the tables.

C) Fringe benefits paid to the production supervisor.

D) Freight charges paid for the delivery of raw materials to the company.

A) Overtime paid to the workers who perform production scheduling.

B) Cost of glue used to secure the attachment of the legs to the tables.

C) Fringe benefits paid to the production supervisor.

D) Freight charges paid for the delivery of raw materials to the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

Madison Company produces a single product in a highly automated process. Virtually all of the company's manufacturing overhead costs are driven by its consumption of machine hours. Each unit of output requires 2.5 hours of machine time, and the company estimates that each hour of machine time requires $30 of variable overhead. Fixed overhead is budgeted at $600,000 annually and incurred evenly throughout the year. What amount of manufacturing overhead should the company budget for January when it plans to produce 200 units of product?

A) $87,500

B) $65,000

C) $40,500

D) $637,500

A) $87,500

B) $65,000

C) $40,500

D) $637,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

Monroe Company has developed the quarterly sales budget for the upcoming year that appears below:

The company's variable selling and administrative expenses consist of a 5% selling commission paid on sales revenues plus shipping expenses of $3 per unit. Fixed annual selling and administrative costs consisting of executive salaries, advertising, and depreciation occur evenly throughout the year and are budgeted at a total of $126,000. In addition, the company will make insurance payments of $7,500 in each of the first and third quarters. What amount of selling and administrative expense will Monroe budget for the third quarter?

The company's variable selling and administrative expenses consist of a 5% selling commission paid on sales revenues plus shipping expenses of $3 per unit. Fixed annual selling and administrative costs consisting of executive salaries, advertising, and depreciation occur evenly throughout the year and are budgeted at a total of $126,000. In addition, the company will make insurance payments of $7,500 in each of the first and third quarters. What amount of selling and administrative expense will Monroe budget for the third quarter?

A) $103,400

B) $102,900

C) $27,800

D) $110,400

The company's variable selling and administrative expenses consist of a 5% selling commission paid on sales revenues plus shipping expenses of $3 per unit. Fixed annual selling and administrative costs consisting of executive salaries, advertising, and depreciation occur evenly throughout the year and are budgeted at a total of $126,000. In addition, the company will make insurance payments of $7,500 in each of the first and third quarters. What amount of selling and administrative expense will Monroe budget for the third quarter?

The company's variable selling and administrative expenses consist of a 5% selling commission paid on sales revenues plus shipping expenses of $3 per unit. Fixed annual selling and administrative costs consisting of executive salaries, advertising, and depreciation occur evenly throughout the year and are budgeted at a total of $126,000. In addition, the company will make insurance payments of $7,500 in each of the first and third quarters. What amount of selling and administrative expense will Monroe budget for the third quarter?A) $103,400

B) $102,900

C) $27,800

D) $110,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

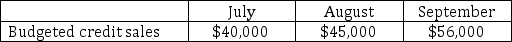

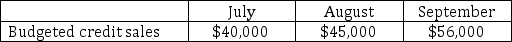

Fit and Tight Plumbing Supply Company makes all sales on a credit basis. The company has forecast sales for the upcoming quarter as follows:

Experience has shown that 60% of a month's sales are collected in the month the sales take place, 25% are collected in the month that follows the sale, and the final 15% is collected in the second month following sale. Bad debts are negligible and are ignored for budgeting purposes. May and June actual sales were $45,000 and $50,000, respectively. What amount of cash receipts from sales will the company budget for August?

Experience has shown that 60% of a month's sales are collected in the month the sales take place, 25% are collected in the month that follows the sale, and the final 15% is collected in the second month following sale. Bad debts are negligible and are ignored for budgeting purposes. May and June actual sales were $45,000 and $50,000, respectively. What amount of cash receipts from sales will the company budget for August?

A) $27,000

B) $44,500

C) $43,250

D) $45,000

Experience has shown that 60% of a month's sales are collected in the month the sales take place, 25% are collected in the month that follows the sale, and the final 15% is collected in the second month following sale. Bad debts are negligible and are ignored for budgeting purposes. May and June actual sales were $45,000 and $50,000, respectively. What amount of cash receipts from sales will the company budget for August?

Experience has shown that 60% of a month's sales are collected in the month the sales take place, 25% are collected in the month that follows the sale, and the final 15% is collected in the second month following sale. Bad debts are negligible and are ignored for budgeting purposes. May and June actual sales were $45,000 and $50,000, respectively. What amount of cash receipts from sales will the company budget for August?A) $27,000

B) $44,500

C) $43,250

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

Dougan Paint and Supply sells exclusively to building contractors on a credit basis. The company collects 75% of its credit sales in the month of sale and the remaining 25% in the month following sale. April's actual sales totaled $32,500 and the sales budget forecasts sales of $55,000 for May and another $60,000 for June. What amount of cash receipts will Dougan budget from May and June sales respectively?

A) $55,000 from May and $60,000 for June.

B) $41,250 from May and $45,000 for June.

C) $13,750 from May and $15,000 for June.

D) $49,375 from May and $58,750 for June.*

A) $55,000 from May and $60,000 for June.

B) $41,250 from May and $45,000 for June.

C) $13,750 from May and $15,000 for June.

D) $49,375 from May and $58,750 for June.*

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

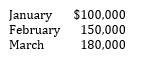

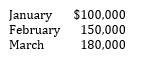

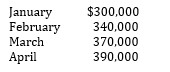

Brown Company estimates that monthly sales will be as follows:

Historical trends indicate that 40% of sales is collected during the month of sale, 50% is collected in the month following the sale, and 10% is collected two months after the sale. Brown's accounts receivable balance as of December 31 totals $80,000 ($72,000 from December's sales and $8,000 from November's sales). The amount of cash Brown can expect to collect during the month of January is:

Historical trends indicate that 40% of sales is collected during the month of sale, 50% is collected in the month following the sale, and 10% is collected two months after the sale. Brown's accounts receivable balance as of December 31 totals $80,000 ($72,000 from December's sales and $8,000 from November's sales). The amount of cash Brown can expect to collect during the month of January is:

A) $76,800

B) $84,000

C) $108,000

D) $133,000

Historical trends indicate that 40% of sales is collected during the month of sale, 50% is collected in the month following the sale, and 10% is collected two months after the sale. Brown's accounts receivable balance as of December 31 totals $80,000 ($72,000 from December's sales and $8,000 from November's sales). The amount of cash Brown can expect to collect during the month of January is:

Historical trends indicate that 40% of sales is collected during the month of sale, 50% is collected in the month following the sale, and 10% is collected two months after the sale. Brown's accounts receivable balance as of December 31 totals $80,000 ($72,000 from December's sales and $8,000 from November's sales). The amount of cash Brown can expect to collect during the month of January is:A) $76,800

B) $84,000

C) $108,000

D) $133,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

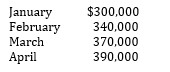

Projected monthly sales of Wallstead Corporation for January, February, March, and April are as follows:

.The company bills each month's sales on the last day of the month.

.Receivables are booked gross and credit terms of sale are: 2/10, n/30.

.50% of the billings is collected within the discount period, 30% is collected by the end of the month, 15% is collected by the end of the second month, and 5% becomes uncollectible.

Budgeted cash collections for Wallstead Company during April would be:

A) $343,300

B) $347,000

C) $349,300

D) $353,000

.The company bills each month's sales on the last day of the month.

.Receivables are booked gross and credit terms of sale are: 2/10, n/30.

.50% of the billings is collected within the discount period, 30% is collected by the end of the month, 15% is collected by the end of the second month, and 5% becomes uncollectible.

Budgeted cash collections for Wallstead Company during April would be:

A) $343,300

B) $347,000

C) $349,300

D) $353,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

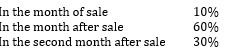

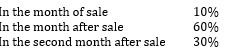

ANNCO sells products on account and experiences the following collection schedule:

On December 31, ANNCO reports accounts receivable of $211,500. Of that amount, $162,000 is due from December sales, and $49,500 from November sales. ANNCO is budgeting $170,000 of sales for January. If so, what amount of cash should be collected in January?

On December 31, ANNCO reports accounts receivable of $211,500. Of that amount, $162,000 is due from December sales, and $49,500 from November sales. ANNCO is budgeting $170,000 of sales for January. If so, what amount of cash should be collected in January?

A) $129,050

B) $174,500

C) $211,500

D) $228,500

On December 31, ANNCO reports accounts receivable of $211,500. Of that amount, $162,000 is due from December sales, and $49,500 from November sales. ANNCO is budgeting $170,000 of sales for January. If so, what amount of cash should be collected in January?

On December 31, ANNCO reports accounts receivable of $211,500. Of that amount, $162,000 is due from December sales, and $49,500 from November sales. ANNCO is budgeting $170,000 of sales for January. If so, what amount of cash should be collected in January?A) $129,050

B) $174,500

C) $211,500

D) $228,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

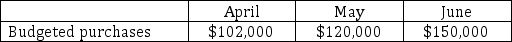

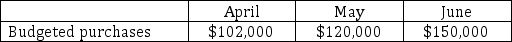

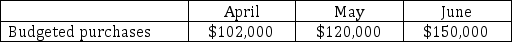

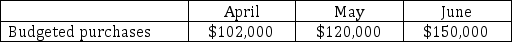

Walsh Enterprises, Inc., is a retailer of parts for exotic automobiles. The company has budgeted parts purchases for the next three months as follows:

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What amount of cash disbursement for parts purchases will be budgeted for May?

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What amount of cash disbursement for parts purchases will be budgeted for May?

A) $112,800

B) $141,200

C) $93,200

D) $72,000

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What amount of cash disbursement for parts purchases will be budgeted for May?

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What amount of cash disbursement for parts purchases will be budgeted for May?A) $112,800

B) $141,200

C) $93,200

D) $72,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

Walsh Enterprises, Inc., is a retailer of parts for exotic automobiles. The company has budgeted parts purchases for the next three months as follows:

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What will be the budgeted balance in accounts payable at the end of June?

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What will be the budgeted balance in accounts payable at the end of June?

A) $90,000

B) $60,000

C) $108,000

D) $150,000

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What will be the budgeted balance in accounts payable at the end of June?

All purchases are made on a credit basis. The company expects that 60% of its payables related to purchases will be paid in the month of purchase, with the remaining 40% paid in the following month. The ending balance in accounts payable related to parts purchases on March 31 was $80,000. What will be the budgeted balance in accounts payable at the end of June?A) $90,000

B) $60,000

C) $108,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

Preparation of the budgeted income statement must precede the budgeted balance sheet in order to provide:

A) An ending balance for budgeted retained earnings.

B) A beginning cash balance.

C) An updated balance for common stock.

D) An estimate of significant planned capital expenditures for new equipment.

A) An ending balance for budgeted retained earnings.

B) A beginning cash balance.

C) An updated balance for common stock.

D) An estimate of significant planned capital expenditures for new equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

Compared to a static budget, a flexible budget based on varying levels of sales volume provides a better basis for performance evaluation because:

A) It explicitly accounts for forecast errors.

B) It is presented at a greater level of detail.

C) It can be adjusted to allow for the impact of changing volume on variable costs.

D) It is less susceptible to sandbagging by lower-level managers.

A) It explicitly accounts for forecast errors.

B) It is presented at a greater level of detail.

C) It can be adjusted to allow for the impact of changing volume on variable costs.

D) It is less susceptible to sandbagging by lower-level managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

One potential drawback to a bottom-up planning process is that:

A) Lower-level managers may fail to disclose private information in order to create budget slack.

B) It may induce top-level management to mandate stretch goals.

C) It precludes benchmarking or other means of targeting.

D) It is inherently inefficient.

A) Lower-level managers may fail to disclose private information in order to create budget slack.

B) It may induce top-level management to mandate stretch goals.

C) It precludes benchmarking or other means of targeting.

D) It is inherently inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

A disparity that occurs when top management's performance desires exceed the performance figures in a plan prepared in bottom-up fashion is referred to as:

A) Sandbagging

B) A planning gap

C) A benchmark

D) Ratcheting

A) Sandbagging

B) A planning gap

C) A benchmark

D) Ratcheting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

Playtime Toys estimates that it will sell 200,000 dolls during the coming year. The beginning inventory is 12,000 dolls; the target ending inventory is 15,000 dolls. Each doll requires two shoes that are purchased from an outside supplier. The beginning inventory of shoes is 20,000; the target ending inventory is 18,000 shoes. The number of shoes that should be purchased during the year is:

A) 396,000 shoes

B) 398,000 shoes

C) 402,000 shoes

D) 404,000 shoes

A) 396,000 shoes

B) 398,000 shoes

C) 402,000 shoes

D) 404,000 shoes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

Granite Company sells products exclusively on account, and has experienced the following collection pattern: 60% in the month of sale, 25% in the month after sale, and 15% in the second month after sale. Uncollectible accounts are negligible. Customers who pay in the month of sale are given a 2% discount. If sales are $220,000 in January, $200,000 in February, $280,000 in March, and $260,000 in April, Granite's accounts receivable balance on May 1 will be:

A) $107,120

B) $143,920

C) $146,000

D) $204,000

A) $107,120

B) $143,920

C) $146,000

D) $204,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

Myers Company uses a calendar year and prepares a cash budget for each month of the year. Which one of the following items should be considered when developing July's cash budget?

A) Federal income tax and social security tax withheld from employees' June paychecks to be remitted to the Internal Revenue Service in July.

B) Quarterly cash dividends scheduled to be declared on July 15 and paid on August 6 to shareholders of record as of July 25.

C) Property taxes levied in the last calendar year scheduled to be paid quarterly in the coming year during the last month of each calendar quarter.

D) Recognition that 0.5% of the July sales on account will be uncollectible.

A) Federal income tax and social security tax withheld from employees' June paychecks to be remitted to the Internal Revenue Service in July.

B) Quarterly cash dividends scheduled to be declared on July 15 and paid on August 6 to shareholders of record as of July 25.

C) Property taxes levied in the last calendar year scheduled to be paid quarterly in the coming year during the last month of each calendar quarter.

D) Recognition that 0.5% of the July sales on account will be uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

Side Spin has begun production of a new lightweight tennis racket. For the coming year, it predicts that it will sell 125,000 units in the first quarter, 156,250 units in the second quarter, 175,000 units in the third quarter, and 187,500 in the fourth quarter. It also expects that it will sell 187,500 units in the first quarter of the following year. The company's inventory policy is to retain 20% of next quarter's sales on hand as ending inventory. Opening inventory is 25,000 units.

Required. Prepare in good form a production budget for Side Spin's coming year.

Required. Prepare in good form a production budget for Side Spin's coming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

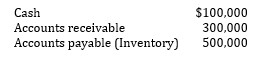

Scott Industries has estimated that production for the next five quarters will be:

Finished units of production require four pounds of raw material per unit. The raw material cost is $2.50 per pound. There are 45,000 pounds of raw material on hand at the beginning of the first quarter of Year 1. Scott Industries desires to have on hand 20 percent of next quarter's raw material needs at the beginning of each quarter.

Finished units of production require four pounds of raw material per unit. The raw material cost is $2.50 per pound. There are 45,000 pounds of raw material on hand at the beginning of the first quarter of Year 1. Scott Industries desires to have on hand 20 percent of next quarter's raw material needs at the beginning of each quarter.

Required. Prepare in good form a materials purchases budget for Scott Industries for each quarter of Year 1. Make sure your budget shows both the quantities and dollar costs of the raw materials required.

Finished units of production require four pounds of raw material per unit. The raw material cost is $2.50 per pound. There are 45,000 pounds of raw material on hand at the beginning of the first quarter of Year 1. Scott Industries desires to have on hand 20 percent of next quarter's raw material needs at the beginning of each quarter.

Finished units of production require four pounds of raw material per unit. The raw material cost is $2.50 per pound. There are 45,000 pounds of raw material on hand at the beginning of the first quarter of Year 1. Scott Industries desires to have on hand 20 percent of next quarter's raw material needs at the beginning of each quarter.Required. Prepare in good form a materials purchases budget for Scott Industries for each quarter of Year 1. Make sure your budget shows both the quantities and dollar costs of the raw materials required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

Joe Foster and his wife, Monica, are both fabric artists. Joe has begun a small business to raise additional cash by producing and selling screen-printed T-shirts, decorated caps, and other accessories at local weekend regattas. He is considering expanding this venture and producing and selling similar merchandise at lacrosse tournaments in the same region. Joe has reasoned that the expanded venture only makes sense if weekend revenue at a lacrosse event is at least $10,000, and has begun planning scenarios to consider the feasibility of this level of success. Based on his experience at the regattas, and information regarding the size and demographics of the lacrosse population, he feels the most likely weekend sales will be $7,000 and that this will occur with a probability of 60%. Joe's estimate of the most pessimistic outcome is $3,000, but he is confident that this will only occur 10% of the time.

Required. Given these above estimates, how large must Joe's most optimistic revenue outcome be to justify the lacrosse venture?

Required. Given these above estimates, how large must Joe's most optimistic revenue outcome be to justify the lacrosse venture?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

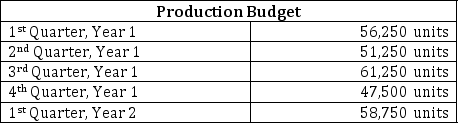

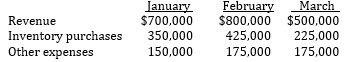

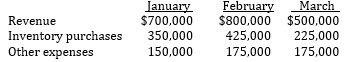

Cooper Company's management team is preparing a cash budget for the coming quarter. The following budgeted information is under review.

The company expects to collect 40% of its monthly sales in the month of sale and 60% in the following month. Fifty percent of inventory purchases are paid in the month of purchase, and the other 50% in the following month. All payments for other expenses are made in the month incurred.

The company expects to collect 40% of its monthly sales in the month of sale and 60% in the following month. Fifty percent of inventory purchases are paid in the month of purchase, and the other 50% in the following month. All payments for other expenses are made in the month incurred.

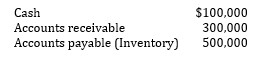

Cooper forecasts the following account balances at the beginning of the quarter.

Required. Given the above information, compute the projected change in cash during the coming quarter.

Required. Given the above information, compute the projected change in cash during the coming quarter.

The company expects to collect 40% of its monthly sales in the month of sale and 60% in the following month. Fifty percent of inventory purchases are paid in the month of purchase, and the other 50% in the following month. All payments for other expenses are made in the month incurred.

The company expects to collect 40% of its monthly sales in the month of sale and 60% in the following month. Fifty percent of inventory purchases are paid in the month of purchase, and the other 50% in the following month. All payments for other expenses are made in the month incurred.Cooper forecasts the following account balances at the beginning of the quarter.

Required. Given the above information, compute the projected change in cash during the coming quarter.

Required. Given the above information, compute the projected change in cash during the coming quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck