Deck 4: Cost Pools, Capacity, and Activity- Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 4: Cost Pools, Capacity, and Activity- Based Costing

1

A machine, the factory space it occupies, and its operator are all specialized to produce a particular part of a firm's product. These resources may be characterized as a homogeneous cost pool.

True

2

Homogeneity among resources in a cost pool makes it more difficult to trace resource costs.

False

3

If a cost pool is heterogeneous, it contains only resources from which the pool directly benefits.

False

4

If a cost pool contains resources shared with other cost pools, use of the shared resources will have to be estimated and not traced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

Overhead describes product costs that are indirect to all cost pools and cannot be traced or assigned to those pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

As the amount of work performed by a cost pool is reduced, resource costs classified as avoidable will continue unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

All managed capacity costs are avoidable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Depreciation on the machinery in a cost pool cannot be managed by reducing the work done by the machine center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

During a period of idle capacity, the firm wastes both managed and committed capacity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

The capacity of a machine center can be conveniently expressed in units of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

Capacity of a machine center expressed in time can be translated into units of product or service if the firm can measure its cycle time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

Competitive cost can be reduced by process improvements that reduce cycle time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

The presence of idle capacity in a machine center results in the loss of both managed and committed capacity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Although based on estimates, cost assignments are more arbitrary than cost allocations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

Activity based costing traces resources to cost pools based on a common type of work performed by those resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Care Plaza Dialysis Center provides kidney dialysis services to two distinct patient groups. The first group receives all treatments and support directly at the center, while those in the second group self-administer their treatments at home under the center's supervision using equipment leased from third parties. The center also provides nursing support, assistance with ordering supplies, and periodic checkups to patients in the second group. Of the resources listed below, which would most likely be included in a cost pool for the in-house patient group?

A) Labor hours provided by nursing staff

B) Dialysis machines on-site at the clinic

C) Administrative staff

D) Telecommunications equipment

A) Labor hours provided by nursing staff

B) Dialysis machines on-site at the clinic

C) Administrative staff

D) Telecommunications equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

The most critical feature of resources included in a cost pool is:

A) Traceability

B) Avoidability

C) Causality

D) Homogeneity

A) Traceability

B) Avoidability

C) Causality

D) Homogeneity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

The most common term to describe costs that are indirect to all of a company's cost pools is:

A) Manageable

B) Committed

C) Overhead

D) Traceable

A) Manageable

B) Committed

C) Overhead

D) Traceable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

Mullin Tree Services, Inc., provides a wide variety of landscaping services to residential and commercial clients. The company has defined one cost pool that relates to grinding the stumps of trees it has removed. The resources in this pool included a machine specialized to the grinding task, an operator who works only on stump grinding, and a vehicle used to remove the waste generated by grinding and removal. Mullin is considering no longer offering this service. If it does so, the machine and vehicle would be sold and the operator offered work in another division of the company. Expenditures on the above resources may be described as:

A) Avoidable

B) Indirect

C) Committed

D) Fixed

A) Avoidable

B) Indirect

C) Committed

D) Fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

If a resource is shared between two cost pools, their use will have to be estimated because they lack:

A) Avoidability

B) Traceability

C) A common driver

D) Definition

A) Avoidability

B) Traceability

C) A common driver

D) Definition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

Managed capacity costs differ from committed capacity costs in that:

A) Managed costs are found only in homogeneous and never in heterogeneous cost pools.

B) Managed costs are always strictly variable while committed costs are strictly fixed.

C) Managed costs will be avoided when the cost pool performs no work while committed costs will continue.

D) Managed costs are always traceable while committed costs will have to be assigned via some method of estimation.

A) Managed costs are found only in homogeneous and never in heterogeneous cost pools.

B) Managed costs are always strictly variable while committed costs are strictly fixed.

C) Managed costs will be avoided when the cost pool performs no work while committed costs will continue.

D) Managed costs are always traceable while committed costs will have to be assigned via some method of estimation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

Vulcan Tool and Die Company has developed a cost pool for a machine center that bores holes into cast iron material. The costs in the pool include depreciation on the boring machine, electricity needed to run the machine, depreciation on the factory space required by the machine center, and the wages of the machine operator. Of these costs, which would be classified as manageable?

A) Only the operator's wages.

B) The operator's wages and the electricity consumed by machine operations.

C) Depreciation on the machine, but not on the factory space.

D) All of these costs are manageable due to the homogeneity of the resources in the pool.

A) Only the operator's wages.

B) The operator's wages and the electricity consumed by machine operations.

C) Depreciation on the machine, but not on the factory space.

D) All of these costs are manageable due to the homogeneity of the resources in the pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount of time that elapses between completed units coming off the end of the production line or completing a process is referred to as:

A) Idle time

B) Cycle time

C) Productive capacity

D) Nonproductive capacity

A) Idle time

B) Cycle time

C) Productive capacity

D) Nonproductive capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

Bye-Bye Varmint Company produces a liquid rodent repellant that is packaged and sold in one-liter spray bottles. A single machine that is operated for two, 8-hour daily shifts, five days per week for 50 weeks each year blends the ingredients in the repellant. The annual committed costs of running the machine are $2,628,000, and the managed costs are $1,600,000.

-Determine the managed cost per hour.

A) $400

B) $800

C) $1,057

D) $2,114

-Determine the managed cost per hour.

A) $400

B) $800

C) $1,057

D) $2,114

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bye-Bye Varmint Company produces a liquid rodent repellant that is packaged and sold in one-liter spray bottles. A single machine that is operated for two, 8-hour daily shifts, five days per week for 50 weeks each year blends the ingredients in the repellant. The annual committed costs of running the machine are $2,628,000, and the managed costs are $1,600,000.

- Determine the committed cost per hour.

A) $300

B) $657

C) $1,314

D) $700

- Determine the committed cost per hour.

A) $300

B) $657

C) $1,314

D) $700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

Bye-Bye Varmint Company produces a liquid rodent repellant that is packaged and sold in one-liter spray bottles. A single machine that is operated for two, 8-hour daily shifts, five days per week for 50 weeks each year blends the ingredients in the repellant. The annual committed costs of running the machine are $2,628,000, and the managed costs are $1,600,000.

-The company has determined that its competitive cost per one-liter spray bottle unit in this machine center is $1.94. What cycle time does this imply?

A) 17.46 seconds

B) 23.28 seconds

C) 10 seconds

D) 5 seconds

-The company has determined that its competitive cost per one-liter spray bottle unit in this machine center is $1.94. What cycle time does this imply?

A) 17.46 seconds

B) 23.28 seconds

C) 10 seconds

D) 5 seconds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

Management at Integrated Controls, Inc., has identified a reduction of competitive cost in a critical machine center as a key objective. Which of the following tactics would be successful in reducing competitive cost?

A) A reduction in a significant manageable cost.

B) An increase in cycle time.

C) A reduction in idle time in the form of waste.

D) All of the above would reduce competitive cost.

A) A reduction in a significant manageable cost.

B) An increase in cycle time.

C) A reduction in idle time in the form of waste.

D) All of the above would reduce competitive cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

Howe Paper, Inc., produces a number of products, including a replacement filter bag for a popular vacuum cleaner. The filter bags pass through a machine center where the paper pieces are joined with an adhesive. This machine center operates a single eight-hour daily shift totaling 2,000 hours in each 8,760-hour year. Cycle time for each bag is 10 seconds, and in the just-concluded year, 600,000 filter bags were produced. The total committed costs of running the machine center for the year were $70,080, and the total managed costs were $80,000.

-What was the productive capacity for the year just concluded?

A) 7,200,000 seconds

B) 31,536,000 seconds

C) 6,000,000 seconds

D) 720,000 seconds

-What was the productive capacity for the year just concluded?

A) 7,200,000 seconds

B) 31,536,000 seconds

C) 6,000,000 seconds

D) 720,000 seconds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

Howe Paper, Inc., produces a number of products, including a replacement filter bag for a popular vacuum cleaner. The filter bags pass through a machine center where the paper pieces are joined with an adhesive. This machine center operates a single eight-hour daily shift totaling 2,000 hours in each 8,760-hour year. Cycle time for each bag is 10 seconds, and in the just-concluded year, 600,000 filter bags were produced. The total committed costs of running the machine center for the year were $70,080, and the total managed costs were $80,000.

-What was the nonproductive capacity for the year just concluded?

A) 7,200,000 seconds

B) 6,000,000 seconds

C) 24,336,000 seconds

D) 1,200,000 seconds

-What was the nonproductive capacity for the year just concluded?

A) 7,200,000 seconds

B) 6,000,000 seconds

C) 24,336,000 seconds

D) 1,200,000 seconds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

Howe Paper, Inc., produces a number of products, including a replacement filter bag for a popular vacuum cleaner. The filter bags pass through a machine center where the paper pieces are joined with an adhesive. This machine center operates a single eight-hour daily shift totaling 2,000 hours in each 8,760-hour year. Cycle time for each bag is 10 seconds, and in the just-concluded year, 600,000 filter bags were produced. The total committed costs of running the machine center for the year were $70,080, and the total managed costs were $80,000.

-What was the idle capacity for the year just concluded?

A) 1,200,000 seconds

B) 24,336,000 seconds

C) 25,536,000 seconds

D) 30,336,000 seconds

-What was the idle capacity for the year just concluded?

A) 1,200,000 seconds

B) 24,336,000 seconds

C) 25,536,000 seconds

D) 30,336,000 seconds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

Howe Paper, Inc., produces a number of products, including a replacement filter bag for a popular vacuum cleaner. The filter bags pass through a machine center where the paper pieces are joined with an adhesive. This machine center operates a single eight-hour daily shift totaling 2,000 hours in each 8,760-hour year. Cycle time for each bag is 10 seconds, and in the just-concluded year, 600,000 filter bags were produced. The total committed costs of running the machine center for the year were $70,080, and the total managed costs were $80,000.

-What amount of total nonproductive cost (to the nearest whole dollar) did Howe suffer for the year?

A) $16,000

B) $25,013

C) $324,480

D) $54,080

-What amount of total nonproductive cost (to the nearest whole dollar) did Howe suffer for the year?

A) $16,000

B) $25,013

C) $324,480

D) $54,080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

Howe Paper, Inc., produces a number of products, including a replacement filter bag for a popular vacuum cleaner. The filter bags pass through a machine center where the paper pieces are joined with an adhesive. This machine center operates a single eight-hour daily shift totaling 2,000 hours in each 8,760-hour year. Cycle time for each bag is 10 seconds, and in the just-concluded year, 600,000 filter bags were produced. The total committed costs of running the machine center for the year were $70,080, and the total managed costs were $80,000.

-What total cost of idleness (to the nearest whole dollar) did Howe suffer for the year?

A) $16,000

B) $25,013

C) $324,480

D) $54,080 *

-What total cost of idleness (to the nearest whole dollar) did Howe suffer for the year?

A) $16,000

B) $25,013

C) $324,480

D) $54,080 *

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

Layton Manufacturing Company maintains its own electricity-generating facility to provide power to the firm's various divisions. Layton has no metering facility to precisely measure the amount of power consumed by the divisions of the firm, but feels there is a high degree of correlation between power consumption and machine hours consumed at the divisional level. Under these circumstances, the cost of power attached to divisions may best be described as:

A) Traced to the divisions.

B) Assigned to the divisions.

C) Allocated to the divisions.

D) Disregarded at the divisional level.

A) Traced to the divisions.

B) Assigned to the divisions.

C) Allocated to the divisions.

D) Disregarded at the divisional level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fisher and Caplan Company has identified eight employees who are in some way involved with obtaining the raw materials used in the firm's products and has grouped these individuals into a cost pool. These employees' activities range from ordering materials, taking receipt of incoming shipments, and preparing materials for use on the factory floor. Of the following events, which would be a reasonable activity driver for the employees in this cost pool?

A) Labor hours

B) Production runs

C) Machine setups

D) Receipts of raw material shipments

A) Labor hours

B) Production runs

C) Machine setups

D) Receipts of raw material shipments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

An assigned indirect cost differs from an allocated indirect cost in that:

A) An assigned cost can be attached to a cost object by way of an estimate, while the amount of an allocated cost attached to an object is entirely arbitrary.

B) Assigned costs are traceable; allocated costs are not.

C) Assigned costs can always be classified as manufacturing, while allocated costs are always associated with selling and administration.

D) Appropriate cost allocations always improve costing accuracy, unlike the estimates used to assign costs.

A) An assigned cost can be attached to a cost object by way of an estimate, while the amount of an allocated cost attached to an object is entirely arbitrary.

B) Assigned costs are traceable; allocated costs are not.

C) Assigned costs can always be classified as manufacturing, while allocated costs are always associated with selling and administration.

D) Appropriate cost allocations always improve costing accuracy, unlike the estimates used to assign costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

The 195 Factory produces replacement parts and assemblies for vintage Cessna aircraft. Fred Weems has ordered a new rudder assembly for his Cessna 190. The 195 Factory needs to develop an estimate of its cost to produce the assembly so that it can quote a sales price to Weems. The rudder assembly may be considered by the 195 Factory as a:

A) Cost pool

B) Cost object

C) Cost driver

D) Resource driver

A) Cost pool

B) Cost object

C) Cost driver

D) Resource driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

The 195 Factory produces replacement parts and assemblies for vintage Cessna aircraft. The company's current costing system traces direct material and direct labor costs into individual jobs and assigns overhead costs to jobs using a predetermined overhead rate based on direct labor hours required by the job. All direct labor is paid at the same rate of $30 per hour.

-This year's overhead rate is based on estimated total overhead on $2,000,000 and 10,000 direct labor hours. What is the current overhead rate per labor hour in use?

A) $300,000 per hour

B) $6.67 per hour

C) $200 per hour

D) $333.33 per hour

-This year's overhead rate is based on estimated total overhead on $2,000,000 and 10,000 direct labor hours. What is the current overhead rate per labor hour in use?

A) $300,000 per hour

B) $6.67 per hour

C) $200 per hour

D) $333.33 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

The 195 Factory produces replacement parts and assemblies for vintage Cessna aircraft. The company's current costing system traces direct material and direct labor costs into individual jobs and assigns overhead costs to jobs using a predetermined overhead rate based on direct labor hours required by the job. All direct labor is paid at the same rate of $30 per hour.

- This year's overhead rate is based on estimated total overhead on $2,000,000 and 10,000 direct labor hours. Two jobs are currently complete and ready for delivery to the customer. One is a wing assembly that required raw material costing $5,000 and consumed 40 hours of direct labor time. The other is a wheel strut that required raw materials of $2,000 and consumed 20 hours of direct labor time. Under the current cost system, what amount of overhead will be charged to the wing assembly job?

A) $8,000

B) $4,000

C) $1,200

D) $1,000,000

- This year's overhead rate is based on estimated total overhead on $2,000,000 and 10,000 direct labor hours. Two jobs are currently complete and ready for delivery to the customer. One is a wing assembly that required raw material costing $5,000 and consumed 40 hours of direct labor time. The other is a wheel strut that required raw materials of $2,000 and consumed 20 hours of direct labor time. Under the current cost system, what amount of overhead will be charged to the wing assembly job?

A) $8,000

B) $4,000

C) $1,200

D) $1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

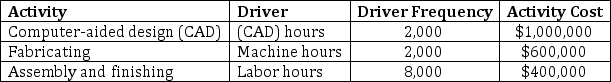

The 195 Factory produces replacement parts and assemblies for vintage Cessna aircraft. The company is considering replacing its current costing system with an activity-based approach. It has identified three activities: computer-aided design; fabrication; and assembly and finishing. Data regarding these activities has been collected in the table below.

- What is the activity cost rate for the computer-aided design activity?

A) $500 per computer hour

B) $300 per machine hour

C) $250 per labor hour

D) $1,000 per computer hour

- What is the activity cost rate for the computer-aided design activity?

A) $500 per computer hour

B) $300 per machine hour

C) $250 per labor hour

D) $1,000 per computer hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

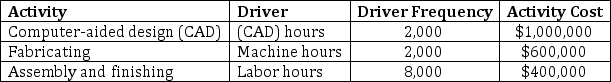

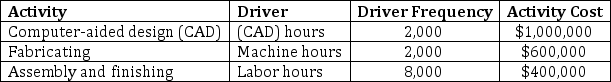

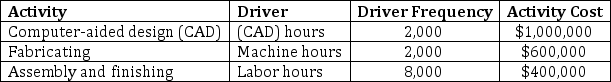

The 195 Factory produces replacement parts and assemblies for vintage Cessna aircraft. The company is considering replacing its current costing system with an activity-based approach. It has identified three activities: computer-aided design; fabrication; and assembly and finishing. Data regarding these activities has been collected in the table below.

-Two jobs are currently complete and ready for delivery to the customer. One is a wing assembly that required raw materials costing $5,000 and consumed 40 hours of direct labor time. The wing assembly is a standard product that required only one hour of CAD time and three hours of machine time. What amount of overhead would the proposed activity-based costing system assign to this job?

A) $500

B) $3,400

C) $2,000

D) $900

-Two jobs are currently complete and ready for delivery to the customer. One is a wing assembly that required raw materials costing $5,000 and consumed 40 hours of direct labor time. The wing assembly is a standard product that required only one hour of CAD time and three hours of machine time. What amount of overhead would the proposed activity-based costing system assign to this job?

A) $500

B) $3,400

C) $2,000

D) $900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company is considering the implementation of an activity-based costing and management program. The company:

A) Should focus on manufacturing activities and avoid implementation with service-type functions.

B) Would probably find a lack of software in the marketplace to assist with the related record keeping.

C) Would normally gain added insights into causes of cost.

D) Would likely use fewer cost pools than it did under more traditional accounting methods.

A) Should focus on manufacturing activities and avoid implementation with service-type functions.

B) Would probably find a lack of software in the marketplace to assist with the related record keeping.

C) Would normally gain added insights into causes of cost.

D) Would likely use fewer cost pools than it did under more traditional accounting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

The most important criterion in accurate cost allocations is:

A) Using a simple allocation method.

B) Allocating fixed and variable costs by using the same allocation base.

C) Using homogeneous cost pools.

D) Using multiple drivers for each cost pool.

A) Using a simple allocation method.

B) Allocating fixed and variable costs by using the same allocation base.

C) Using homogeneous cost pools.

D) Using multiple drivers for each cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

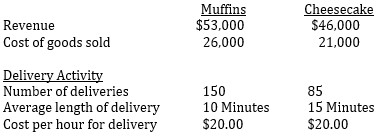

The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firm's new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Listed below are activity and cost information relating to two of The Chocolate Baker's major products.

Using activity-based costing, which one of the following statements is correct?

Using activity-based costing, which one of the following statements is correct?

A) The muffins are $2,000 more profitable.

B) The cheesecakes are $75 more profitable.

C) The muffins are $1,925 more profitable.

D) The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.

Using activity-based costing, which one of the following statements is correct?

Using activity-based costing, which one of the following statements is correct?A) The muffins are $2,000 more profitable.

B) The cheesecakes are $75 more profitable.

C) The muffins are $1,925 more profitable.

D) The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

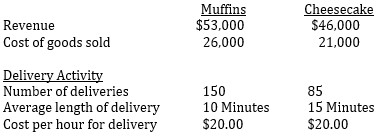

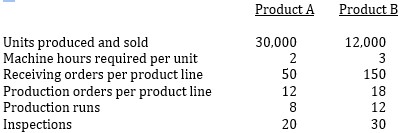

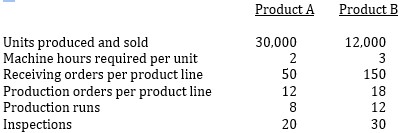

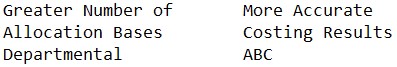

Atmel, Inc., manufactures and sells two products. Data with regard to these products is given below.

Total budgeted machine hours are 100,000. The budgeted overhead costs are shown below.

Total budgeted machine hours are 100,000. The budgeted overhead costs are shown below.

Using activity-based costing, the per-unit overhead cost allocation of receiving costs for product A is:

Using activity-based costing, the per-unit overhead cost allocation of receiving costs for product A is:

A) $3.75

B) $10.75

C) $19.50

D) $28.13

Total budgeted machine hours are 100,000. The budgeted overhead costs are shown below.

Total budgeted machine hours are 100,000. The budgeted overhead costs are shown below. Using activity-based costing, the per-unit overhead cost allocation of receiving costs for product A is:

Using activity-based costing, the per-unit overhead cost allocation of receiving costs for product A is:A) $3.75

B) $10.75

C) $19.50

D) $28.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

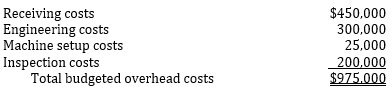

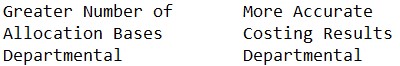

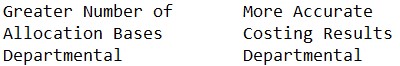

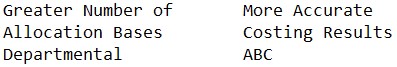

A profitable company with five departments uses plant-wide overhead rates for its highly diversified operation. The firm is studying a change to either allocating overhead by using departmental rates or using activity-based costing (ABC). Which one of these two methods will likely result in the use of a greater number of cost allocation bases and more accurate costing results?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

Birds in Your Backyard produces a line of premium birdseed. Two of its products, flaxseed and safflower seed, are blended in the same machine center. This machine center operates two 2,000-hour shifts per year. Last year, the center processed 300,000 pounds of flaxseed and 650,000 pounds of safflower seed. The flaxseed has a cycle time of 20 seconds per pound and the safflower seed has a cycle time of 10 seconds per pound.

Required

a) Compute the productive capacity of the machine center measured in time.

b) Compute the nonproductive capacity measured in time that the center experienced last year.

c) What was the amount of idle time experienced by the machine center?

Required

a) Compute the productive capacity of the machine center measured in time.

b) Compute the nonproductive capacity measured in time that the center experienced last year.

c) What was the amount of idle time experienced by the machine center?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

Birds in Your Backyard produces a line of premium birdseed. Two of its products, flaxseed and safflower seed, are blended in the same machine center. This machine center operates two 2,000-hour shifts per year. Last year, the center processed 300,000 pounds of flaxseed and 650,000 pounds of safflower seed. The flaxseed has a cycle time of 20 seconds per pound and the safflower seed has a cycle time of 10 seconds per pound. Managed capacity costs last year were $2,000,000 and committed capacity costs were $1,533,000.

Required

a) Compute the machine center's cost per available hour.

b) Compute the total nonproductive cost.

Required

a) Compute the machine center's cost per available hour.

b) Compute the total nonproductive cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

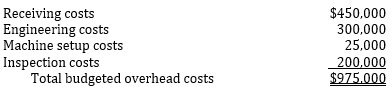

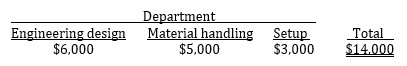

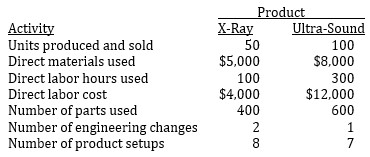

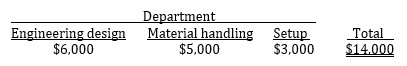

(CMA Adapted) Pelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based on different technologies, x-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing costs of the x-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows.

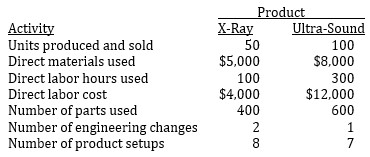

Pelder has identified cost drivers for the three departments as follows: Engineering costs are driven by the number of engineering change orders; material handling by the number of parts; and setup by the number of production setups. Pelder's budgeted manufacturing activities and costs by product line for the period are as follows.

Pelder has identified cost drivers for the three departments as follows: Engineering costs are driven by the number of engineering change orders; material handling by the number of parts; and setup by the number of production setups. Pelder's budgeted manufacturing activities and costs by product line for the period are as follows.

Required

Required

a) Compute the activity cost rate for each of the three support departments.

b) Compute the budgeted cost to manufacture one ultrasound machine using the activity-based costing method.

Pelder has identified cost drivers for the three departments as follows: Engineering costs are driven by the number of engineering change orders; material handling by the number of parts; and setup by the number of production setups. Pelder's budgeted manufacturing activities and costs by product line for the period are as follows.

Pelder has identified cost drivers for the three departments as follows: Engineering costs are driven by the number of engineering change orders; material handling by the number of parts; and setup by the number of production setups. Pelder's budgeted manufacturing activities and costs by product line for the period are as follows. Required

Requireda) Compute the activity cost rate for each of the three support departments.

b) Compute the budgeted cost to manufacture one ultrasound machine using the activity-based costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck