Deck 13: Countercyclical Macroeconomic Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/177

العب

ملء الشاشة (f)

Deck 13: Countercyclical Macroeconomic Policy

1

The central bank conducts countercyclical ________ policies by manipulating ________.

A) monetary; interest rates and inflation rates

B) monetary; interest rates and bank reserves

C) fiscal; interest rates and bank reserves

D) fiscal; interest rates and inflation rates

A) monetary; interest rates and inflation rates

B) monetary; interest rates and bank reserves

C) fiscal; interest rates and bank reserves

D) fiscal; interest rates and inflation rates

monetary; interest rates and bank reserves

2

Which of the following economic variables is affected when the government adopts a countercyclical fiscal policy?

A) Expenditure on the maintenance of highways

B) Interest rates

C) Bank reserves

D) M2 measure of money supply

A) Expenditure on the maintenance of highways

B) Interest rates

C) Bank reserves

D) M2 measure of money supply

Expenditure on the maintenance of highways

3

Countercyclical policies may be used even in expansions to slow down the growth rate of real GDP.

True

4

Contractionary effects on the rate of GDP growth are always a by-product of other countercyclical policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

5

What do countercyclical fiscal and monetary policies have in common?

i.They are both used to reduce economic fluctuations.

ii.They both work by shifting the labor demand curve.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

i.They are both used to reduce economic fluctuations.

ii.They both work by shifting the labor demand curve.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is true?

A) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor demand curve to the left.

B) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor demand curve to the right.

C) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor supply curve to the left.

D) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor supply curve to the right.

A) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor demand curve to the left.

B) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor demand curve to the right.

C) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor supply curve to the left.

D) Countercyclical monetary policy stimulates an economy during a recession by shifting the labor supply curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is true?

A) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the left.

B) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the right.

C) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the right.

D) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the left.

A) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the left.

B) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the right.

C) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the right.

D) Countercyclical monetary policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

8

Countercyclical policies can be ________ and ________.

A) recessionary; expansionary

B) contractionary; expansionary

C) recessionary; contractionary

D) counter-expansionary; contractionary

A) recessionary; expansionary

B) contractionary; expansionary

C) recessionary; contractionary

D) counter-expansionary; contractionary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

9

A countercyclical fiscal policy is conducted by ________ with the overall goal of ________.

A) the government; reducing economic fluctuations

B) the central bank; increasing economic activity

C) the central bank; reducing economic fluctuations

D) the government; increasing economic activity

A) the government; reducing economic fluctuations

B) the central bank; increasing economic activity

C) the central bank; reducing economic fluctuations

D) the government; increasing economic activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is true?

A) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the left.

B) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the right.

C) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the right.

D) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the left.

A) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the left.

B) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the right.

C) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor demand curve to the right.

D) Countercyclical fiscal policy slows down the growth rate of an economy during an expansion by shifting the labor supply curve to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is true?

A) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor demand curve to the left.

B) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor demand curve to the right.

C) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor supply curve to the left.

D) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor supply curve to the right.

A) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor demand curve to the left.

B) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor demand curve to the right.

C) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor supply curve to the left.

D) Countercyclical fiscal policy stimulates an economy during a recession by shifting the labor supply curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

12

If nominal wages are downwardly rigid,a countercyclical policy during a recession leads to ________.

A) an increase in employment

B) an increase in tax rates

C) a fall in investment

D) a fall in consumption

A) an increase in employment

B) an increase in tax rates

C) a fall in investment

D) a fall in consumption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

13

Countercyclical policies are used exclusively to target a reduction in the effects of a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

14

Why would policymakers target a reduction in GDP growth by using contractionary policies?

i.The Fed fights inflation by increasing interest rates,which in turn causes a reduction in employment as a by-product.

ii.Excessive optimistic sentiments about the economy can result in an unsustainable economic expansion.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

i.The Fed fights inflation by increasing interest rates,which in turn causes a reduction in employment as a by-product.

ii.Excessive optimistic sentiments about the economy can result in an unsustainable economic expansion.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

15

During a recession,a countercyclical fiscal or monetary policy can be used to ________ the economy by shifting ________.

A) slow down; the labor demand curve to the left

B) stimulate; the labor demand curve to the left

C) stimulate; the labor demand curve to the right

D) slow down; the labor demand curve to the right

A) slow down; the labor demand curve to the left

B) stimulate; the labor demand curve to the left

C) stimulate; the labor demand curve to the right

D) slow down; the labor demand curve to the right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

16

What do countercyclical fiscal and monetary policies have in common?

i.They are both used to reduce economic fluctuations.

ii.They both work by shifting the labor supply curve.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

i.They are both used to reduce economic fluctuations.

ii.They both work by shifting the labor supply curve.

A) i) and ii) are both true

B) i) and ii) are both false

C) i) is true and ii) is false

D) i) is false and ii) is true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

17

A countercyclical fiscal policy is conducted by ________ by acting to change ________.

A) the government; taxes and interest rates

B) the central bank; interest rates and taxes

C) the government; taxes and government expenditures

D) the government; government expenditures and interest rates

A) the government; taxes and interest rates

B) the central bank; interest rates and taxes

C) the government; taxes and government expenditures

D) the government; government expenditures and interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following economic variables is affected when the central bank adopts a countercyclical monetary policy?

A) Government spending

B) Transfer payments

C) Tax rates

D) Interest rates

A) Government spending

B) Transfer payments

C) Tax rates

D) Interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

19

A countercyclical monetary policy is conducted by ________ with the overall goal of ________.

A) the government; reducing economic fluctuations

B) the central bank; increasing economic activity

C) the central bank; reducing economic fluctuations

D) the government; increasing economic activity

A) the government; reducing economic fluctuations

B) the central bank; increasing economic activity

C) the central bank; reducing economic fluctuations

D) the government; increasing economic activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

20

Countercyclical policies ________.

A) lead to hyperinflation

B) lower output below an economy's potential level

C) increase the intensity of economic fluctuations in an economy

D) smooth the rate of growth of an economy over time

A) lead to hyperinflation

B) lower output below an economy's potential level

C) increase the intensity of economic fluctuations in an economy

D) smooth the rate of growth of an economy over time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the Fed wants to stimulate an economy,it will ________.

A) sell Treasury bonds

B) lower short-term interest rates

C) increase the quantity of required reserves

D) reduce money supply

A) sell Treasury bonds

B) lower short-term interest rates

C) increase the quantity of required reserves

D) reduce money supply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

22

A fall in long-term interest rates leads to a ________.

A) leftward shift of the labor demand curve

B) rightward shift of the labor demand curve

C) leftward shift of the labor supply curve

D) rightward shift of the labor supply curve

A) leftward shift of the labor demand curve

B) rightward shift of the labor demand curve

C) leftward shift of the labor supply curve

D) rightward shift of the labor supply curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain the goal of a countercyclical monetary policy and how it is implemented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

24

Why do policymakers sometimes use policies to limit growth?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

25

An expansionary monetary policy ________ in an economy.

A) lowers interest rates

B) increases interest rates

C) lowers tax rates

D) increases tax rates

A) lowers interest rates

B) increases interest rates

C) lowers tax rates

D) increases tax rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

26

Barylia is hit by a recession.What will be the impact of a countercyclical policy on labor demand in Barylia if nominal wages are downwardly rigid?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the Fed increases the supply of bank reserves,________.

A) the federal funds rate falls

B) the inflation rate falls

C) consumption falls

D) investment falls

A) the federal funds rate falls

B) the inflation rate falls

C) consumption falls

D) investment falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

28

A ________ in long-term interest rates ________ households' demand for durable goods.

A) fall; decreases

B) fall; increases

C) rise; increases

D) rise; does not affect

A) fall; decreases

B) fall; increases

C) rise; increases

D) rise; does not affect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the central bank of a country responds to economic contractions by adopting an expansionary monetary policy,________.

A) interest rates will increase

B) access to credit will increase

C) government spending will fall

D) tax rates will increase

A) interest rates will increase

B) access to credit will increase

C) government spending will fall

D) tax rates will increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

30

The primary tool of monetary policy is ________.

A) the Fed's control of bank loans

B) the Fed's control of the inflation rate

C) the Fed's control of banks' assets

D) the Fed's control of the federal funds rate

A) the Fed's control of bank loans

B) the Fed's control of the inflation rate

C) the Fed's control of banks' assets

D) the Fed's control of the federal funds rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

31

Explain the goal of a countercyclical fiscal policy and how it is implemented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

32

The economy of Budopia is going through a recession.How will a countercyclical policy affect the labor market in Budopia if wages are downwardly rigid? Explain with a diagram.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

33

Briefly describe the sequence of events in a typical expansionary monetary policy process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following happens if long-term real interest rates fall?

A) The prices of long-term bonds fall.

B) Imports increase.

C) Employment opportunities increase.

D) The demand for loans falls.

A) The prices of long-term bonds fall.

B) Imports increase.

C) Employment opportunities increase.

D) The demand for loans falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

35

A countercyclical policy used to combat the effects of recession would shift the labor demand curve exactly back to its pre-recession level in an economy with downwardly rigid wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

36

The federal funds rate is the interest rate that ________.

A) banks use to make loans to one another

B) the Fed uses to lend money to households

C) the Fed uses to lend money to business firms

D) banks use to lend money to the Fed

A) banks use to make loans to one another

B) the Fed uses to lend money to households

C) the Fed uses to lend money to business firms

D) banks use to lend money to the Fed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

37

The ultimate goal of an expansionary monetary policy is to ________.

A) lower short-term interest rates

B) lower long-term interest rates

C) shift the labor demand curve to the right

D) shift the labor demand curve to the left

A) lower short-term interest rates

B) lower long-term interest rates

C) shift the labor demand curve to the right

D) shift the labor demand curve to the left

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

38

The economy is in a recession.The Fed could take direct action to stimulate economic activity by ________.

A) lowering short-term interest rates

B) lowering long-term interest rates

C) increasing short-term interest rates

D) increasing long-term interest rates

A) lowering short-term interest rates

B) lowering long-term interest rates

C) increasing short-term interest rates

D) increasing long-term interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

39

If long-term interest rates fall,________.

A) unemployment increases

B) the demand for loans decreases

C) investment by firms decreases

D) investment by firms increases

A) unemployment increases

B) the demand for loans decreases

C) investment by firms decreases

D) investment by firms increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the central bank wants to reduce the effects of a recession,it would adopt a(n)________.

A) expansionary fiscal policy

B) contractionary monetary policy

C) contractionary fiscal policy

D) expansionary monetary policy

A) expansionary fiscal policy

B) contractionary monetary policy

C) contractionary fiscal policy

D) expansionary monetary policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

41

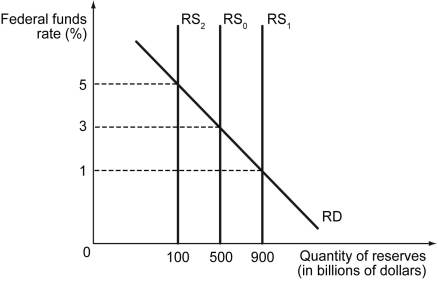

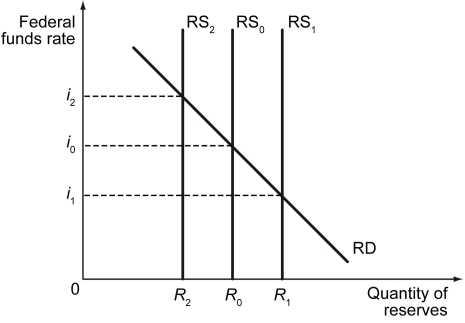

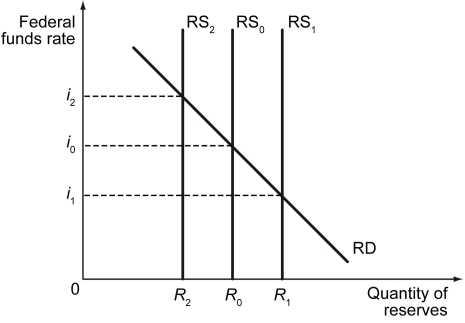

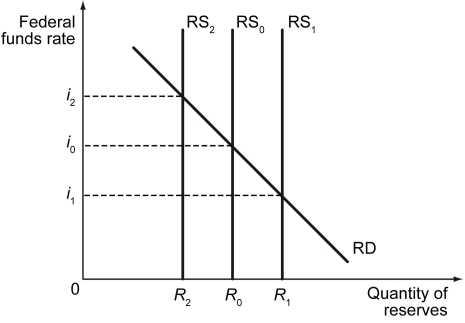

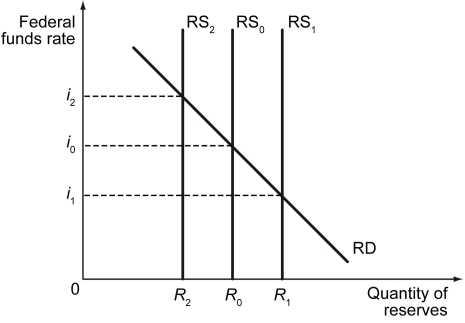

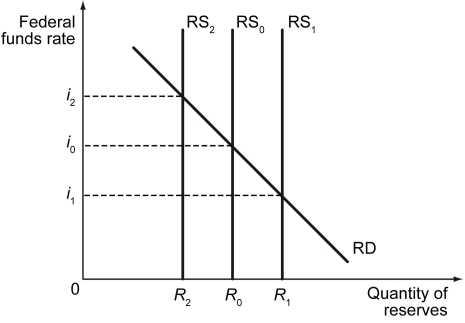

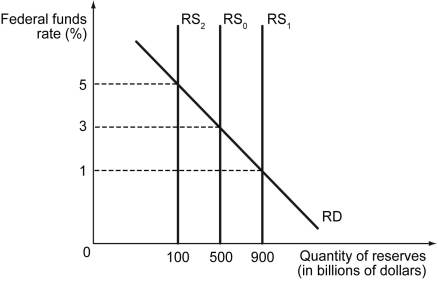

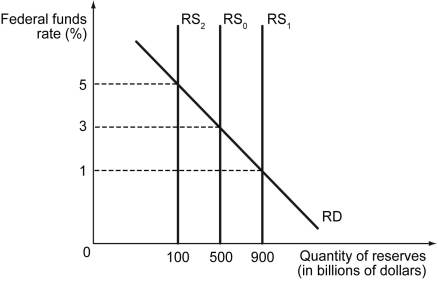

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

Refer to the scenario above.If the Fed completes an open market sale of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase to 5 percent

B) decrease to 1 percent

C) remain at 3 percent

D) more information is needed to determine the new federal funds rate

Refer to the scenario above.If the Fed completes an open market sale of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase to 5 percent

B) decrease to 1 percent

C) remain at 3 percent

D) more information is needed to determine the new federal funds rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

42

On a graph,if the x-axis measures the quantity of bank reserves and the y-axis measures the federal funds interest rate,the demand curve for bank reserves ________.

A) slopes upward

B) slopes downward

C) is perfectly elastic

D) is perfectly inelastic

A) slopes upward

B) slopes downward

C) is perfectly elastic

D) is perfectly inelastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the Fed wants to decrease the federal funds rate,it would

A) increase the supply of bank reserves

B) decrease the supply of bank reserves

C) decrease the demand for bank reserves

D) increase the demand for bank reserves

A) increase the supply of bank reserves

B) decrease the supply of bank reserves

C) decrease the demand for bank reserves

D) increase the demand for bank reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the Fed wants to increase the federal funds rate through open market operations,it will ________.

A) sell bonds

B) buy bonds

C) increase the quantity of required reserves

D) decrease the interest rate paid on borrowed reserves held at the Fed

A) sell bonds

B) buy bonds

C) increase the quantity of required reserves

D) decrease the interest rate paid on borrowed reserves held at the Fed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

45

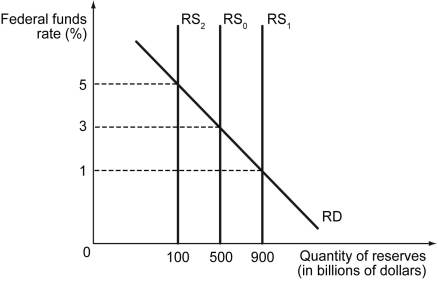

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

Refer to the scenario above.If the Fed completes an open market purchase of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase by 5 percent

B) decrease by 1 percent

C) decrease by 2 percent

D) increase by 2 percent

Refer to the scenario above.If the Fed completes an open market purchase of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase by 5 percent

B) decrease by 1 percent

C) decrease by 2 percent

D) increase by 2 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following happens if the Fed buys bonds from a private bank?

A) The private bank's total assets remain unchanged.

B) The private bank's composition of assets remain unchanged.

C) The Fed's total assets decrease.

D) The Fed's total liabilities remain unaffected.

A) The private bank's total assets remain unchanged.

B) The private bank's composition of assets remain unchanged.

C) The Fed's total assets decrease.

D) The Fed's total liabilities remain unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is likely to increase the federal funds rate?

A) An increase in the quantity of required reserves

B) A decrease in the supply of bank reserves

C) An increase in the interest paid on reserves deposited at the Fed

D) The purchase of long-term bonds in open market operations

A) An increase in the quantity of required reserves

B) A decrease in the supply of bank reserves

C) An increase in the interest paid on reserves deposited at the Fed

D) The purchase of long-term bonds in open market operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

48

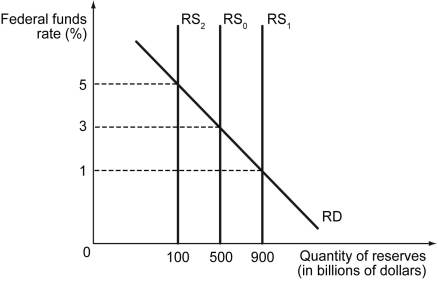

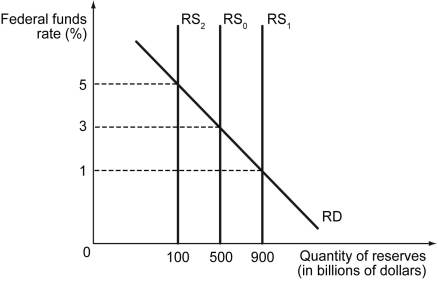

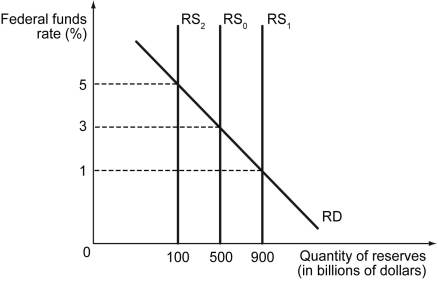

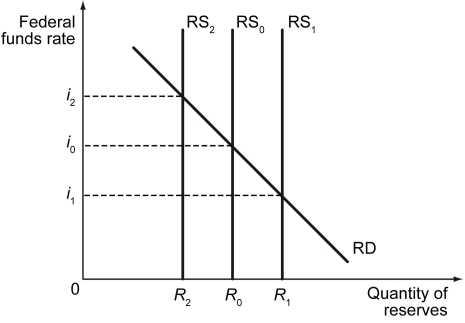

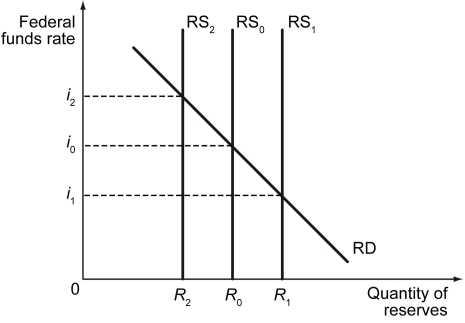

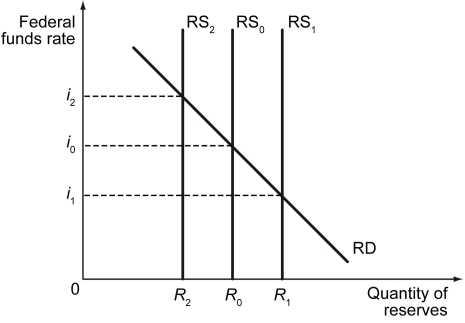

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at point (R₀, i₀).

Refer to the scenario above.If the Fed undertakes an open market purchase of bonds,________.

A) the reserves supply curve shifts from RS₁ to RS₀

B) the reserves supply curve shifts from RS₀ to RS₁

C) the reserves supply curve shifts from RS₀ to RS₂

D) the reserves supply curve shifts from RS₂ to RS₁

Refer to the scenario above.If the Fed undertakes an open market purchase of bonds,________.

A) the reserves supply curve shifts from RS₁ to RS₀

B) the reserves supply curve shifts from RS₀ to RS₁

C) the reserves supply curve shifts from RS₀ to RS₂

D) the reserves supply curve shifts from RS₂ to RS₁

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the Fed wants to lower the federal funds rate through open market operations,it will ________.

A) sell bonds

B) buy bonds

C) increase the quantity of required reserves

D) increase the interest rate paid on borrowed reserves held at the Fed

A) sell bonds

B) buy bonds

C) increase the quantity of required reserves

D) increase the interest rate paid on borrowed reserves held at the Fed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which among the following will happen if the Fed buys bonds from a private bank?

A) The Fed's total liabilities will increase.

B) The Fed's total assets will decrease.

C) The private bank's total assets will increase.

D) The private bank's total assets will decrease.

A) The Fed's total liabilities will increase.

B) The Fed's total assets will decrease.

C) The private bank's total assets will increase.

D) The private bank's total assets will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

51

An increase in reserves held by the Fed ________.

A) reduces the federal funds interest rate

B) reduces the price level

C) increases the tax rates

D) increases unemployment

A) reduces the federal funds interest rate

B) reduces the price level

C) increases the tax rates

D) increases unemployment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

52

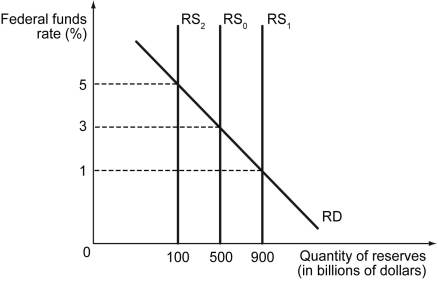

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

Refer to the scenario above.Suppose the Fed wants to lower the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

Refer to the scenario above.Suppose the Fed wants to lower the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

53

An increase in the bank reserves held by the Fed would ________.

A) decrease the federal funds interest rate

B) decrease the price level

C) increase the federal funds rate

D) decrease the inflation rate

A) decrease the federal funds interest rate

B) decrease the price level

C) increase the federal funds rate

D) decrease the inflation rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

54

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at point (R₀, i₀).

Refer to the scenario above.If the Fed uses a contractionary monetary policy,the new equilibrium quantity of reserves is ________ and the new federal funds rate is ________.

A) R₁; i₀

B) R₁; i₁

C) R₂; i₂

D) R₂; i₀

Refer to the scenario above.If the Fed uses a contractionary monetary policy,the new equilibrium quantity of reserves is ________ and the new federal funds rate is ________.

A) R₁; i₀

B) R₁; i₁

C) R₂; i₂

D) R₂; i₀

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the Fed buys bonds from a private bank,________.

A) the private bank's total assets will increase

B) the private bank's composition of assets will change

C) the Fed's total liabilities will remain unaffected

D) the Fed's total assets will remain unaffected

A) the private bank's total assets will increase

B) the private bank's composition of assets will change

C) the Fed's total liabilities will remain unaffected

D) the Fed's total assets will remain unaffected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

56

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at point (R₀, i₀).

Refer to the scenario above.If the Fed undertakes an open market sale of bonds,________.

A) the reserves supply curve shifts from RS₁ to RS₀

B) the reserves supply curve shifts from RS₀ to RS₁

C) the reserves supply curve shifts from RS₀ to RS₂

D) the reserves supply curve shifts from RS₁ to RS₂

Refer to the scenario above.If the Fed undertakes an open market sale of bonds,________.

A) the reserves supply curve shifts from RS₁ to RS₀

B) the reserves supply curve shifts from RS₀ to RS₁

C) the reserves supply curve shifts from RS₀ to RS₂

D) the reserves supply curve shifts from RS₁ to RS₂

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

57

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's total assets equal ________.

A) $110 million

B) $120 million

C) $130 million

D) $140 million

Refer to the scenario above.After this transaction,Bank A's total assets equal ________.

A) $110 million

B) $120 million

C) $130 million

D) $140 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

58

Open market operations refer to the Fed's transactions with ________.

A) households

B) firms

C) state governments

D) private banks

A) households

B) firms

C) state governments

D) private banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

59

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at point (R₀, i₀).

Refer to the scenario above.If the Fed uses an expansionary monetary policy,the new equilibrium quantity of reserves is ________ and the new federal funds rate is ________.

A) R₁; i₀

B) R₁; i₁

C) R₂; i₂

D) R₂; i₀

Refer to the scenario above.If the Fed uses an expansionary monetary policy,the new equilibrium quantity of reserves is ________ and the new federal funds rate is ________.

A) R₁; i₀

B) R₁; i₁

C) R₂; i₂

D) R₂; i₀

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

60

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

Refer to the scenario above.Suppose the Fed wants to raise the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

Refer to the scenario above.Suppose the Fed wants to raise the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

61

When does the Fed lend through the discount window?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

62

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's total liabilities equal ________.

A) $110 million

B) $120 million

C) $130 million

D) $140 million

Refer to the scenario above.After this transaction,Bank A's total liabilities equal ________.

A) $110 million

B) $120 million

C) $130 million

D) $140 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

63

Quantitative easing is likely to lead to a(n)________ in the economy.

A) increase in the federal funds rate

B) decrease in the interest rate on long-term bonds

C) increase in the unemployment rate

D) decrease in the price level

A) increase in the federal funds rate

B) decrease in the interest rate on long-term bonds

C) increase in the unemployment rate

D) decrease in the price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is likely to happen because of quantitative easing by the Fed?

A) A rightward shift of the demand curve for bank reserves

B) A leftward shift of the demand curve for bank reserves

C) A rightward shift of the supply curve of bank reserves

D) A leftward shift of the supply curve of bank reserves

A) A rightward shift of the demand curve for bank reserves

B) A leftward shift of the demand curve for bank reserves

C) A rightward shift of the supply curve of bank reserves

D) A leftward shift of the supply curve of bank reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

65

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,the Fed's Reserves equal ________.

A) $490

B) $500

C) $510

D) $530

Refer to the scenario above.After this transaction,the Fed's Reserves equal ________.

A) $490

B) $500

C) $510

D) $530

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

66

Banks in Perylia charge an interest rate of 4 percent for overnight loans to one another.How will this rate change if the central bank of Perylia engages in open market operations to purchase bonds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

67

How do specialized lending channels created by central banks affect the economy during a recession?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

68

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,the Fed's Treasury bonds equal ________.

A) $380

B) $390

C) $400

D) $410

Refer to the scenario above.After this transaction,the Fed's Treasury bonds equal ________.

A) $380

B) $390

C) $400

D) $410

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

69

The Bank of Romovia,which is the highest financial institution in Romovia,has bought treasury bonds worth $2.2 billion from a private bank.How will this transaction affect the balance sheets of the private bank and the Bank of Romovia?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

70

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,the Fed's reserves ________ and Treasury bonds ________.

A) increase by $10 million; increase by $10 million

B) increase by $10 million; decrease by $10 million

C) decrease by $10 million; decrease by $10 million

D) decrease by $10 million; increase by $10 million

Refer to the scenario above.After this transaction,the Fed's reserves ________ and Treasury bonds ________.

A) increase by $10 million; increase by $10 million

B) increase by $10 million; decrease by $10 million

C) decrease by $10 million; decrease by $10 million

D) decrease by $10 million; increase by $10 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

71

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's assets ________ and liabilities ________.

A) increase by $10 million; decrease by $10 million

B) remain unchanged; decrease by $10 million

C) increase by $10 million; remain unchanged

D) remain unchanged; remain unchanged

Refer to the scenario above.After this transaction,Bank A's assets ________ and liabilities ________.

A) increase by $10 million; decrease by $10 million

B) remain unchanged; decrease by $10 million

C) increase by $10 million; remain unchanged

D) remain unchanged; remain unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

72

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's deposits ________ and reserves ________.

A) increase by $10 million; increase by $10 million

B) increase by $10 million; decrease by $10 million

C) remain unchanged; decrease by $10 million

D) remain unchanged; increase by $10 million

Refer to the scenario above.After this transaction,Bank A's deposits ________ and reserves ________.

A) increase by $10 million; increase by $10 million

B) increase by $10 million; decrease by $10 million

C) remain unchanged; decrease by $10 million

D) remain unchanged; increase by $10 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is true of the bank reserves held at the Fed?

A) These reserves are an asset to both the bank and the Fed.

B) These reserves are a liability to both the bank and the Fed.

C) These reserves are an asset to the bank and a liability to the Fed.

D) These reserves are a liability to the bank and an asset to the Fed.

A) These reserves are an asset to both the bank and the Fed.

B) These reserves are a liability to both the bank and the Fed.

C) These reserves are an asset to the bank and a liability to the Fed.

D) These reserves are a liability to the bank and an asset to the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

74

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,the Fed's total liabilities equal ________.

A) $790 million

B) $800 million

C) $810 million

D) $820 million

Refer to the scenario above.After this transaction,the Fed's total liabilities equal ________.

A) $790 million

B) $800 million

C) $810 million

D) $820 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

75

If the Fed wants to decrease the federal funds rate,it can ________.

A) increase the quantity of required reserves

B) decrease the quantity of required reserves

C) increase the quantity of excess reserves

D) decrease the quantity of excess reserves

A) increase the quantity of required reserves

B) decrease the quantity of required reserves

C) increase the quantity of excess reserves

D) decrease the quantity of excess reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

76

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.Fill in the balance sheets for Bank A and the Fed after this transaction has occurred.

Refer to the scenario above.Fill in the balance sheets for Bank A and the Fed after this transaction has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

77

Quantitative easing occurs when the Fed ________.

A) buys short-term bonds

B) decreases the reserve requirement

C) buys long-term bonds

D) increases the reserve requirements

A) buys short-term bonds

B) decreases the reserve requirement

C) buys long-term bonds

D) increases the reserve requirements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

78

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,the Fed's total assets equal ________.

A) $790 million

B) $800 million

C) $810 million

D) $820 million

Refer to the scenario above.After this transaction,the Fed's total assets equal ________.

A) $790 million

B) $800 million

C) $810 million

D) $820 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

79

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's reserves equal ________.

A) $10 million

B) $20 million

C) $30 million

D) $40 million

Refer to the scenario above.After this transaction,Bank A's reserves equal ________.

A) $10 million

B) $20 million

C) $30 million

D) $40 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

80

Scenario: The following table shows the initial balance sheets of Bank A and the Fed. Suppose that the Fed then buys $10 million in bonds from Bank A.

Refer to the scenario above.After this transaction,Bank A's bonds equal ________.

A) $90 million

B) $100 million

C) $110 million

D) $120 million

Refer to the scenario above.After this transaction,Bank A's bonds equal ________.

A) $90 million

B) $100 million

C) $110 million

D) $120 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck