Deck 22: Multinational Performance Measurement and Compensation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 22: Multinational Performance Measurement and Compensation

1

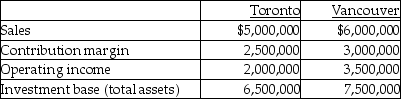

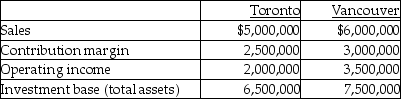

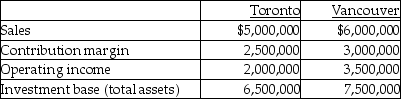

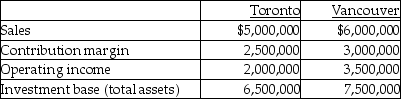

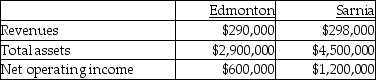

Use the information below to answer the following question(s).

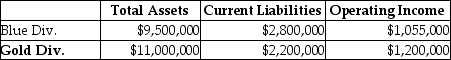

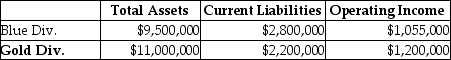

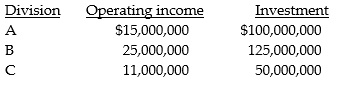

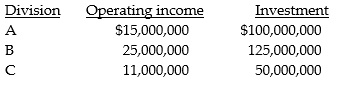

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-What are the respective return on investment ratios for the Toronto and Vancouver divisions?

A) 0.04; 0.58

B) 0.31; 0.47

C) 0.38; 0.40

D) 0.77; 1.25

E) 0.38; 0.45

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-What are the respective return on investment ratios for the Toronto and Vancouver divisions?

A) 0.04; 0.58

B) 0.31; 0.47

C) 0.38; 0.40

D) 0.77; 1.25

E) 0.38; 0.45

0.31; 0.47

2

Use the information below to answer the following question(s).

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-What are the respective residual incomes for the Toronto and Vancouver divisions?

A) $975,000; $1,125,000

B) $1,025,000; $1,125,000

C) $1,025,000; $2,375,000

D) $2,375,000; $1,025,000

E) $1,075,000; $1,125,000

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-What are the respective residual incomes for the Toronto and Vancouver divisions?

A) $975,000; $1,125,000

B) $1,025,000; $1,125,000

C) $1,025,000; $2,375,000

D) $2,375,000; $1,025,000

E) $1,075,000; $1,125,000

$1,025,000; $2,375,000

3

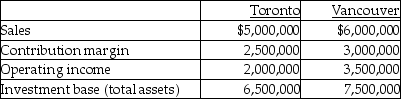

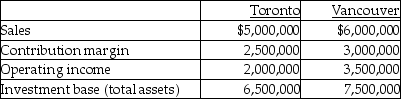

Use the information below to answer the following question(s).

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-During the past year Badger Company had a net income of $175,000. What is the ROI if the investment is $25,000?

A) 0.142

B) 2.500

C) 5.140

D) 7.000

E) 5.450

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

-During the past year Badger Company had a net income of $175,000. What is the ROI if the investment is $25,000?

A) 0.142

B) 2.500

C) 5.140

D) 7.000

E) 5.450

7.000

4

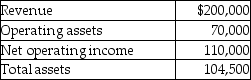

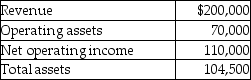

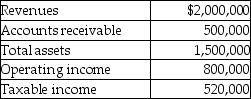

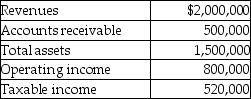

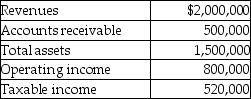

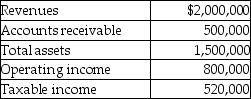

Paymaster Company provided the following information for the year just ended.

What is the return on investment?

A) 2.25

B) 1.57

C) 1.05

D) 0.59

E) 0.55

What is the return on investment?

A) 2.25

B) 1.57

C) 1.05

D) 0.59

E) 0.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the information below to answer the following question(s).

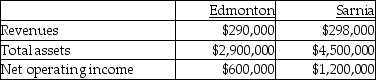

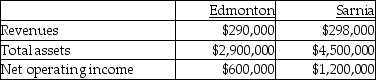

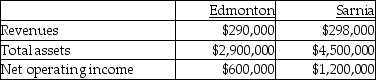

Thacker Company has two regional offices. The information for each is as follows:

-What is the Edmonton Division's return on investment?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

Thacker Company has two regional offices. The information for each is as follows:

-What is the Edmonton Division's return on investment?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

Use the information below to answer the following question(s).

Thacker Company has two regional offices. The information for each is as follows:

-What is the return on investment for the Sarnia division?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

Thacker Company has two regional offices. The information for each is as follows:

-What is the return on investment for the Sarnia division?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the information below to answer the following question(s).

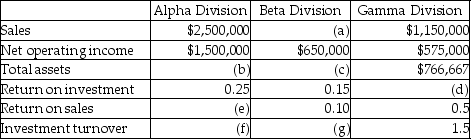

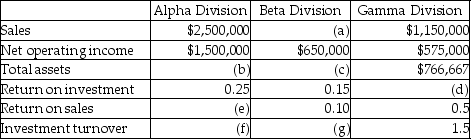

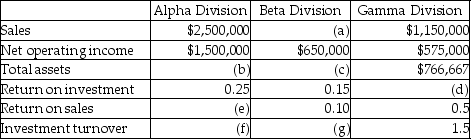

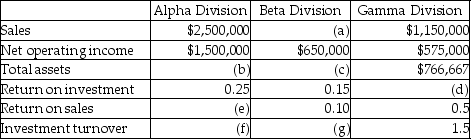

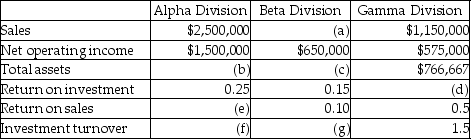

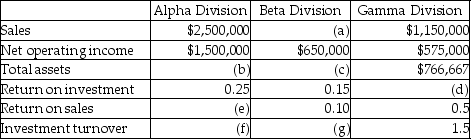

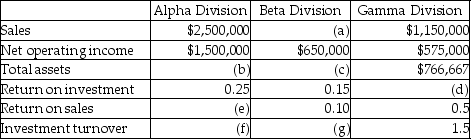

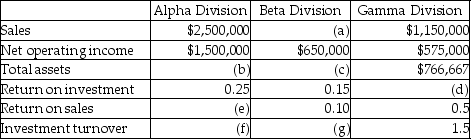

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's return on sales?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's return on sales?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's investment turnover?

A) .50

B) 1.0

C) 2.4

D) 3.5

E) 0.42

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's investment turnover?

A) .50

B) 1.0

C) 2.4

D) 3.5

E) 0.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Beta Division's investment turnover?

A) .50

B) 0.75

C) 0.67

D) 2.5

E) 1.5

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Beta Division's investment turnover?

A) .50

B) 0.75

C) 0.67

D) 2.5

E) 1.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the information below to answer the following question(s).

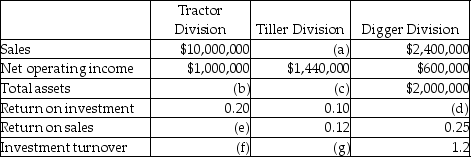

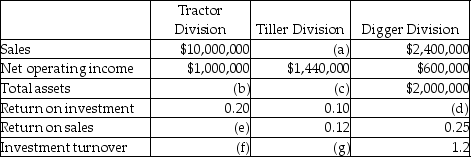

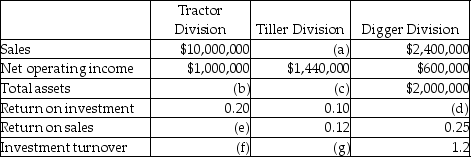

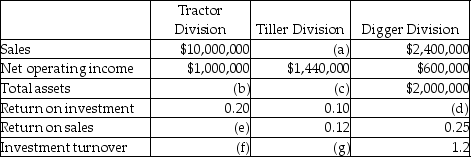

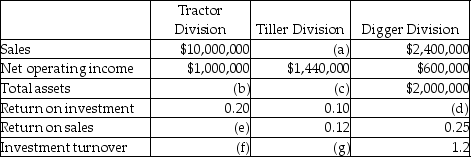

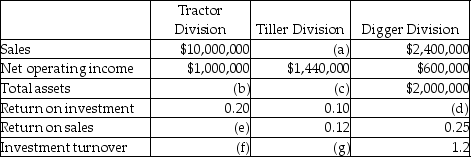

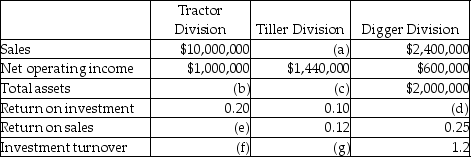

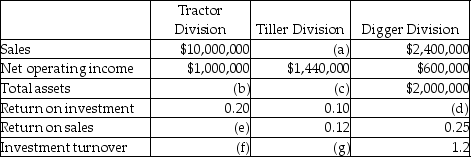

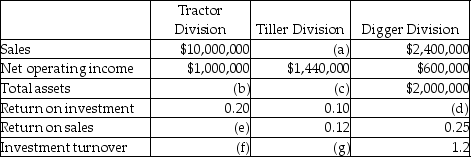

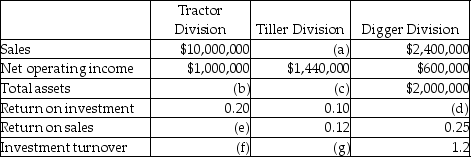

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Tiller Division?

A) $9,600,000

B) $12,000,000

C) $15,000,000

D) $15,500,000

E) $14,400,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Tiller Division?

A) $9,600,000

B) $12,000,000

C) $15,000,000

D) $15,500,000

E) $14,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the information below to answer the following question(s).

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the total assets belonging to the Tractor Division?

A) $ 3,500,000

B) $4,000,000

C) $4,500,000

D) $5,000,000

E) $2,000,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the total assets belonging to the Tractor Division?

A) $ 3,500,000

B) $4,000,000

C) $4,500,000

D) $5,000,000

E) $2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the information below to answer the following question(s).

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the total assets belonging to the Tiller Division?

A) $10,000,000

B) $ 12,000,000

C) $ 14,400,000

D) $ 15,000,000

E) $ 16,000,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the total assets belonging to the Tiller Division?

A) $10,000,000

B) $ 12,000,000

C) $ 14,400,000

D) $ 15,000,000

E) $ 16,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

Use the information below to answer the following question(s).

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's return on sales?

A) 0.10

B) 0.12

C) 0.15

D) 0.20

E) 0.25

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's return on sales?

A) 0.10

B) 0.12

C) 0.15

D) 0.20

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the information below to answer the following question(s).

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's investment turnover?

A) .50

B) 1.0

C) 2.0

D) 2.5

E) 3.0

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's investment turnover?

A) .50

B) 1.0

C) 2.0

D) 2.5

E) 3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

What disadvantage is there in using ROI and/or RI as performance measures?

A) A manager's bonus will decrease when ROI decreases.

B) ROI may decrease when business expands if income does not increase in line with the new investment.

C) RI and ROI are both single-period measures.

D) RI is measured in absolute dollars but ROI is in percentages.

E) Imputed costs that are deducted in the RI calculation, are not recognized in accrual accounting, and are therefore not included in the operating figure used in calculating ROI.

A) A manager's bonus will decrease when ROI decreases.

B) ROI may decrease when business expands if income does not increase in line with the new investment.

C) RI and ROI are both single-period measures.

D) RI is measured in absolute dollars but ROI is in percentages.

E) Imputed costs that are deducted in the RI calculation, are not recognized in accrual accounting, and are therefore not included in the operating figure used in calculating ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company has total assets of $500,000, a required rate of return of 10%, and operating income for the year was $200,000. What is the residual income?

A) $150,000

B) $200,000

C) $250,000

D) $480,000

E) $175,000

A) $150,000

B) $200,000

C) $250,000

D) $480,000

E) $175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

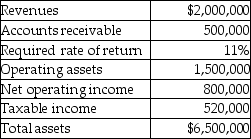

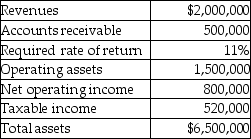

Miller Medical Services provided the following information for its operations in the Hospital Bed Division.

What is the Hospital Bed's residual income?

A) $30,000

B) $85,000

C) <$195,000>

D) $1,285,000

E) <$250,000>

What is the Hospital Bed's residual income?

A) $30,000

B) $85,000

C) <$195,000>

D) $1,285,000

E) <$250,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is NOT a reason for evaluating subunits over a multi-year time horizon?

A) Benefits of actions taken in the current period may not show up in a short-term performance measure.

B) Managers may curtail R & D or plant maintenance in order to increase short-term results.

C) Investments may actually decrease ROI and or RI in the short-term.

D) The NPV of the cash flows over the life of an investment equals [total assets ÷ ROI].

E) Investments may actually decrease ROI and or RI in the short-term, and benefits of actions taken in the current period may not show up in a short-term performance measure.

A) Benefits of actions taken in the current period may not show up in a short-term performance measure.

B) Managers may curtail R & D or plant maintenance in order to increase short-term results.

C) Investments may actually decrease ROI and or RI in the short-term.

D) The NPV of the cash flows over the life of an investment equals [total assets ÷ ROI].

E) Investments may actually decrease ROI and or RI in the short-term, and benefits of actions taken in the current period may not show up in a short-term performance measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

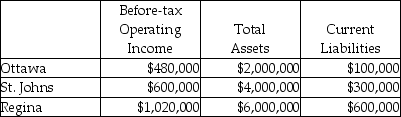

Use the information below to answer the following question(s).

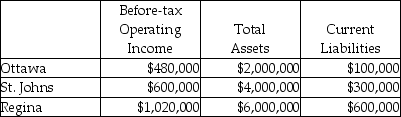

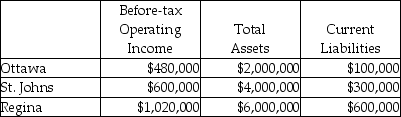

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Ottawa?

A) $218,200

B) $362,200

C) $163,200

D) $480,000

E) $140,000

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Ottawa?

A) $218,200

B) $362,200

C) $163,200

D) $480,000

E) $140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

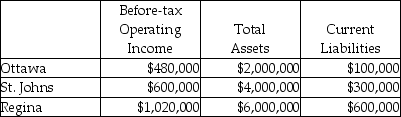

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St. Johns?

A) $142,200

B) $190,600

C) $310,600

D) $200,000

E) $145,000

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St. Johns?

A) $142,200

B) $190,600

C) $310,600

D) $200,000

E) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

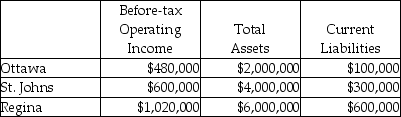

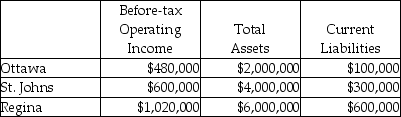

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Regina?

A) $685,200

B) $342,000

C) $379,200

D) $648,000

E) $218,200

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Regina?

A) $685,200

B) $342,000

C) $379,200

D) $648,000

E) $218,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

Answer the following question(s) using the information below:

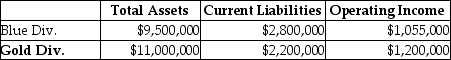

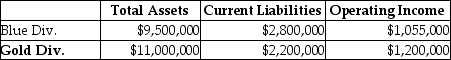

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

E) -$63,800

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

E) -$63,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

Answer the following question(s) using the information below:

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

Answer the following question(s) using the information below:

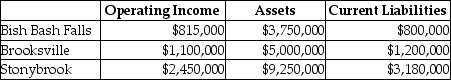

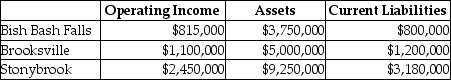

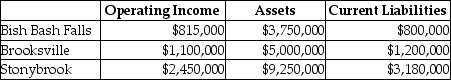

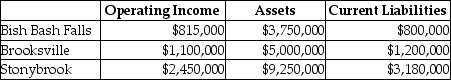

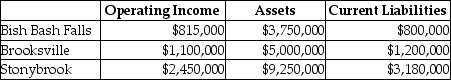

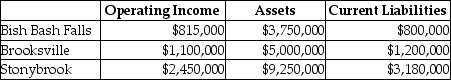

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Bish Bash Falls?

A) $338,563

B) $305,000

C) $275,500

D) $255,500

E) $220,188

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Bish Bash Falls?

A) $338,563

B) $305,000

C) $275,500

D) $255,500

E) $220,188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Brooksville?

A) $476,250

B) $428,000

C) $415,525

D) $390,000

E) $318,750

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Brooksville?

A) $476,250

B) $428,000

C) $415,525

D) $390,000

E) $318,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

A) $1,108,000

B) $1,168,700

C) $1,315,063

D) $1,403,063

E) $994,188

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

A) $1,108,000

B) $1,168,700

C) $1,315,063

D) $1,403,063

E) $994,188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

Novella Ltd. reported a return on investment of 16%, an asset turnover of 6, and income of $190,000. On the basis of this information, the company's invested capital was

A) $1,187,500.

B) $7,125,000.

C) $1,140,000.

D) $197,917.

E) $182,400.

A) $1,187,500.

B) $7,125,000.

C) $1,140,000.

D) $197,917.

E) $182,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

Answer the following question(s) using the information below:

Miller Medical Services provided the following information for it past year's operations in its Hospital Bed Division.

-What is the Hospital Bed Division's return on sales if income is defined as operating income?

A) 0.40

B) 0.53

C) 0.92

D) 1.33

E) 2.50

Miller Medical Services provided the following information for it past year's operations in its Hospital Bed Division.

-What is the Hospital Bed Division's return on sales if income is defined as operating income?

A) 0.40

B) 0.53

C) 0.92

D) 1.33

E) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

Answer the following question(s) using the information below:

Miller Medical Services provided the following information for it past year's operations in its Hospital Bed Division.

-What is the Hospital Bed Division's asset turnover?

A) 0.00

B) 0.53

C) 0.92

D) 1.33

E) 2.50

Miller Medical Services provided the following information for it past year's operations in its Hospital Bed Division.

-What is the Hospital Bed Division's asset turnover?

A) 0.00

B) 0.53

C) 0.92

D) 1.33

E) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

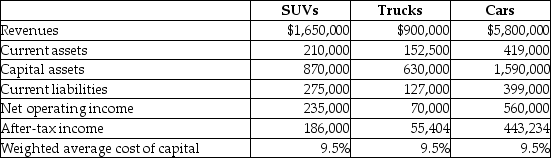

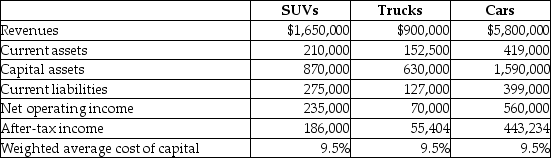

Jim's Quality Pre-owned Auto Sales Ltd. allows its divisions to operate as autonomous units. Their results for the current year were as follows:

Required:

For each division compute the

a. return on sales

b. return on investment based on total assets employed

c. economic value added

d. residual income based on net operating income

Required:

For each division compute the

a. return on sales

b. return on investment based on total assets employed

c. economic value added

d. residual income based on net operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Coffee Division of Canadian Products is planning the operating budget for next year. Average total assets of $1,500,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $400,000 while fixed costs are set at $250,000. The company's required rate of return is 18%.

Required:

a. Compute the volume necessary to achieve a 20% ROI.

b. The division manager receives a bonus of 50% of the residual income. What is his anticipated bonus for next year assuming he achieves the targeted operating income in part a. and the required return is based on 18%?

Required:

a. Compute the volume necessary to achieve a 20% ROI.

b. The division manager receives a bonus of 50% of the residual income. What is his anticipated bonus for next year assuming he achieves the targeted operating income in part a. and the required return is based on 18%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Tea Division of Canadian Products is planning the operating budget for next year. Average total assets of $1,700,000 will be used during the year and unit selling prices are expected to average $250 each. Variable costs of the division are budgeted at $600,000 while fixed costs are set at $450,000. The company's required rate of return is 10%.

Required:

a. Compute the volume necessary to achieve a 15% ROI.

b. The division manager receives a bonus of 50% of the residual income. What is his anticipated bonus for next year assuming he achieves the targeted operating income in part a. and the required return is based on 10%?

Required:

a. Compute the volume necessary to achieve a 15% ROI.

b. The division manager receives a bonus of 50% of the residual income. What is his anticipated bonus for next year assuming he achieves the targeted operating income in part a. and the required return is based on 10%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

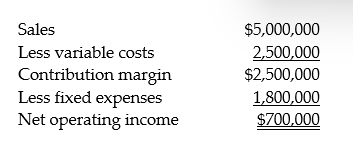

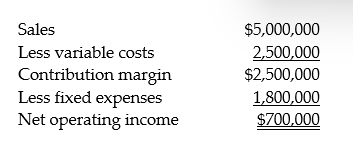

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for the upcoming year are budgeted as follows:

Total assets for the division are currently $3,600,000. For next year the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.

Required:

a. What will be the company's ROI after accepting the new product line?

b. If the company's required rate of return is 6 percent, and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Total assets for the division are currently $3,600,000. For next year the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.

Required:

a. What will be the company's ROI after accepting the new product line?

b. If the company's required rate of return is 6 percent, and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

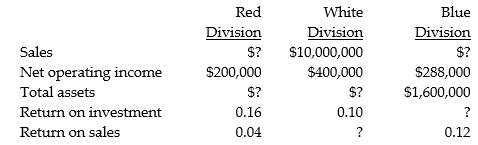

Capital Investments has three divisions. Each division's required rate of return is 15 percent. Planned operating results for next year are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

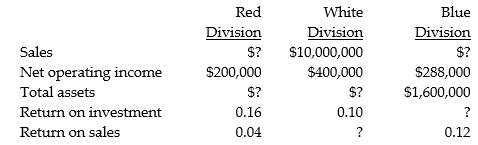

Provide the missing data for the following situations:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

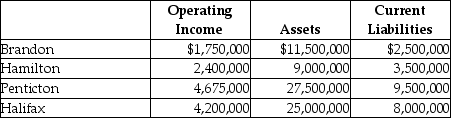

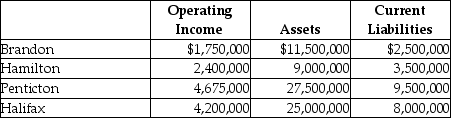

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million and book value of $8 million. The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centres in four divisions that operate autonomously. The company's results for the past year are as follows:

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

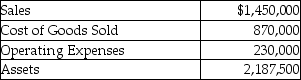

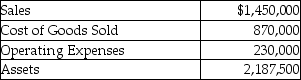

Last year Reynolds Ltd. reported the following results:

Required:

a. Using the DuPont method, calculate the company's return on investment for the year just ended.

b. Assuming the company's sales, operating expenses, and assets remain the same as last year, by how much would the gross margin percentage have to increase to achieve a 20% return on investment?

c. Assume the company sets a minimum required return of 13%, what would the residual income be?

Required:

a. Using the DuPont method, calculate the company's return on investment for the year just ended.

b. Assuming the company's sales, operating expenses, and assets remain the same as last year, by how much would the gross margin percentage have to increase to achieve a 20% return on investment?

c. Assume the company sets a minimum required return of 13%, what would the residual income be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

Chaucer Ltd. has current assets of $450,000 and capital assets of $630,000. Its budgeted production volume for the next fiscal year is 200,000 units. Fixed costs are projected at $400,000 and variable unit costs for the one product produced total $5/unit. The company defines ROI as Operating Income/Total Assets and its required rate of return is 14%.

Required:

a. What selling price should Chaucer charge for its product if it wishes to achieve a 25% ROI? What is the operating income at this price?

b. The general manager for Chaucer receives a bonus equal to 12% of the residual income for the period. Calculate the amount of the bonus assuming the selling price calculated in part

c. Prepare a brief memo to the President of Chaucer outlining the advantages and disadvantages of ROI and Residual Income. Include your recommendations for the most appropriate method for calculating the bonus.

Required:

a. What selling price should Chaucer charge for its product if it wishes to achieve a 25% ROI? What is the operating income at this price?

b. The general manager for Chaucer receives a bonus equal to 12% of the residual income for the period. Calculate the amount of the bonus assuming the selling price calculated in part

c. Prepare a brief memo to the President of Chaucer outlining the advantages and disadvantages of ROI and Residual Income. Include your recommendations for the most appropriate method for calculating the bonus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

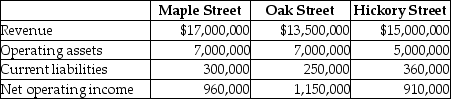

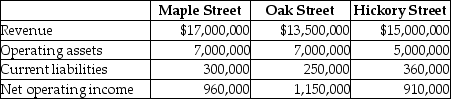

Consolidated Gas Supply Corporation uses the investment center concept for the gasoline stations that it manages in the city. Consolidated has a 15% required rate of return on investment in order for a branch station to be viable. Select operating data for three of its stations for the current year are as follows:

Required:

a. Compute the return on investment for each station.

b. Which station manager is doing best based only on ROI?

c. Are any of the stations under performing?

d. Should the required rate of return be the same for each station if the business risks are different? Explain.

Required:

a. Compute the return on investment for each station.

b. Which station manager is doing best based only on ROI?

c. Are any of the stations under performing?

d. Should the required rate of return be the same for each station if the business risks are different? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

Gasfield Maintenance Ltd. purchased equipment for $225,000 that was CCA Class 8 (CCA rate of 20%). The vehicle was the only item in the Class 8 capital cost allowance pool. The vehicle is expected to generate net cash income, prior to tax effect, in the amount of $75,000 per year. The company uses straight-line depreciation, estimates a 5 year useful life with a $25,000 salvage value for the new equipment at the end of year 5. The marginal tax rate is 35% and the company's average tax rate is 25%. Management requires a rate of return of 15.0%. Assume that cash flows occur at the end of the year.

Required:

a. What is the net present value of the investment in the vehicle? Include the effect of taxes in your calculation.

b. What is the anticipated residual income for the first year? The company uses net cash income for its' RI calculations.

c. What is the expected ROI for years one, two, and three assuming the company uses operating income and net book value for the calculations. What is the likely effect from using net book value in the ROI calculation on the management bonus system?

Required:

a. What is the net present value of the investment in the vehicle? Include the effect of taxes in your calculation.

b. What is the anticipated residual income for the first year? The company uses net cash income for its' RI calculations.

c. What is the expected ROI for years one, two, and three assuming the company uses operating income and net book value for the calculations. What is the likely effect from using net book value in the ROI calculation on the management bonus system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the information below to answer the following question(s).

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

-What is the net book value (NBV )of the long-term assets at current cost at the end of year 4?

A) $660,000

B) $800,000

C) $960,000

D) $1,180,000

E) $1,760,000

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"-What is the net book value (NBV )of the long-term assets at current cost at the end of year 4?

A) $660,000

B) $800,000

C) $960,000

D) $1,180,000

E) $1,760,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the information below to answer the following question(s).

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

-What is the current cost annual depreciation in year 4 dollars?

A) $165,000

B) $200,000

C) $240,000

D) $295,000

E) $440,000

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"-What is the current cost annual depreciation in year 4 dollars?

A) $165,000

B) $200,000

C) $240,000

D) $295,000

E) $440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the information below to answer the following question(s).

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

-What is the year 4 operating income using year-4 current cost amortization?

A) $(126,300)

B) $176,200

C) $73,700

D) $18,700

E) $148,700

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"-What is the year 4 operating income using year-4 current cost amortization?

A) $(126,300)

B) $176,200

C) $73,700

D) $18,700

E) $148,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the information below to answer the following question(s).

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

-What is the ROI using current cost?

A) (11.50)%

B) 16.00%

C) 22.5%

D) 12.00%

E) 11.25%

The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"-What is the ROI using current cost?

A) (11.50)%

B) 16.00%

C) 22.5%

D) 12.00%

E) 11.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the information below to answer the following question(s).

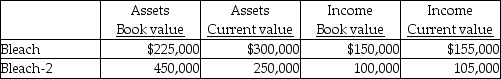

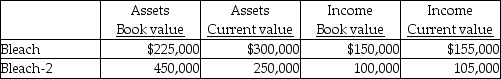

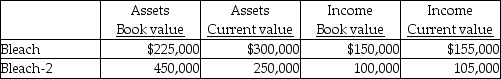

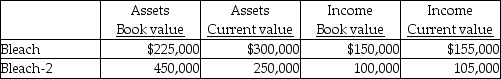

Ruth Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Bleach-2. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a required rate of return of 15 percent.

The company is currently using a required rate of return of 15 percent.

-What are Bleach's and Bleach-2's return on investment based on current values?

A) 0.22; 0.67

B) 0.42; 0.52

C) 0.52; 0.42

D) 0.67; 0.22

E) 0.50; 0.45

Ruth Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Bleach-2. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a required rate of return of 15 percent.

The company is currently using a required rate of return of 15 percent.-What are Bleach's and Bleach-2's return on investment based on current values?

A) 0.22; 0.67

B) 0.42; 0.52

C) 0.52; 0.42

D) 0.67; 0.22

E) 0.50; 0.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the information below to answer the following question(s).

Ruth Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Bleach-2. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a required rate of return of 15 percent.

The company is currently using a required rate of return of 15 percent.

-What are Bleach's and Bleach-2's residual incomes, based on current values, respectively?

A) $116,250; $37,500

B) $110,000; $67,500

C) $67,500; $110,000

D) $37,500; $116,250

E) $115,340; $80,000

Ruth Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Bleach-2. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a required rate of return of 15 percent.

The company is currently using a required rate of return of 15 percent.-What are Bleach's and Bleach-2's residual incomes, based on current values, respectively?

A) $116,250; $37,500

B) $110,000; $67,500

C) $67,500; $110,000

D) $37,500; $116,250

E) $115,340; $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

Answer the following question(s) using the information below:

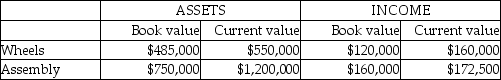

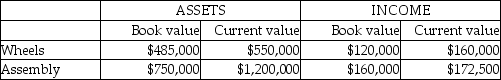

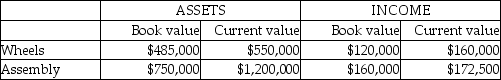

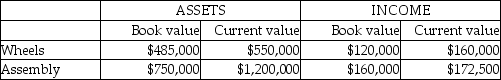

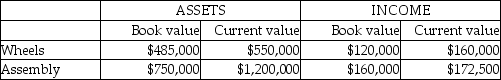

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.

-What are Wheels and Assembly Divisions' return on investment based on book values, respectively?

A) 0.21; 0.25

B) 0.25; 0.21

C) 0.14; 0.29

D) 0.29; 0.14

E) 0.33; 0.23

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.-What are Wheels and Assembly Divisions' return on investment based on book values, respectively?

A) 0.21; 0.25

B) 0.25; 0.21

C) 0.14; 0.29

D) 0.29; 0.14

E) 0.33; 0.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

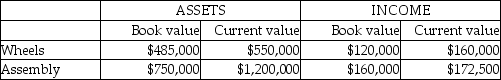

Answer the following question(s) using the information below:

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's return on investment based on current values, respectively?

A) 0.21; 0.25

B) 0.25; 0.21

C) 0.14; 0.29

D) 0.29; 0.14

E) 0.33; 0.23

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.-What are Wheels's and Assembly's return on investment based on current values, respectively?

A) 0.21; 0.25

B) 0.25; 0.21

C) 0.14; 0.29

D) 0.29; 0.14

E) 0.33; 0.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

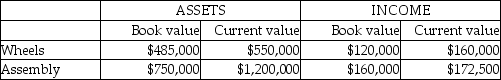

Answer the following question(s) using the information below:

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's residual incomes based on book values, respectively?

A) $74,000; $28,500

B) $61,800; $70,000

C) $63,500; $59.500

D) $28,500; $74,000

E) $101,800; $70,000

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.-What are Wheels's and Assembly's residual incomes based on book values, respectively?

A) $74,000; $28,500

B) $61,800; $70,000

C) $63,500; $59.500

D) $28,500; $74,000

E) $101,800; $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

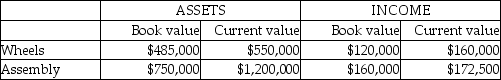

Answer the following question(s) using the information below:

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's residual incomes based on current values, respectively?

A) $70,000; $28,500

B) $94,000; $28,500

C) $94,000; $70,000

D) $28,500; $94,000

E) $61,800; $70,000

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.-What are Wheels's and Assembly's residual incomes based on current values, respectively?

A) $70,000; $28,500

B) $94,000; $28,500

C) $94,000; $70,000

D) $28,500; $94,000

E) $61,800; $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

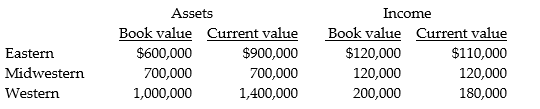

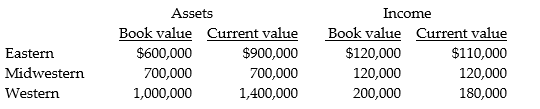

National Can Company has three divisions, Eastern, Midwestern, and Western. Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures. Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.

Required:

a. Compute the ROI using both book value and current value for all divisions. Round to three decimal places.

b. Compute residual income using book value and current value for all divisions.

c. Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

The company is currently using a required rate of return of 15 percent.

Required:

a. Compute the ROI using both book value and current value for all divisions. Round to three decimal places.

b. Compute residual income using book value and current value for all divisions.

c. Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

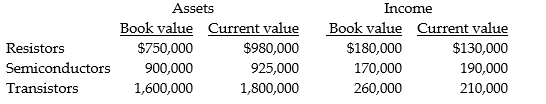

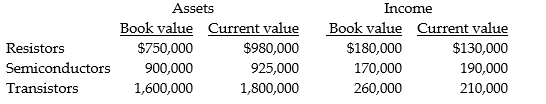

Holmes Electronics Ltd. has three divisions: Resistors, Semiconductors and Transistors, each located in a different geographic region. Data for its most recent year are presented below:

The company is currently using a required rate of return of 16 percent.

Required:

a. Compute the ROI using both book value and current value for all divisions. Round to four decimal places.

b. Compute residual income using book value and current value for all divisions.

c. Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

The company is currently using a required rate of return of 16 percent.

Required:

a. Compute the ROI using both book value and current value for all divisions. Round to four decimal places.

b. Compute residual income using book value and current value for all divisions.

c. Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the exchange rate at the end of the a foreign subsidiary's first year was 5 Fidgets to 1 Canadian dollar, and if it was 8 Fidgets to 1 Canadian dollar at the end of the second (current) year, what exchange rate should be used to convert total assets if we want to calculate the company's ROI in Canadian dollars?

A) the rate in effect when the ROI is calculated

B) the rate estimated to be in effect when the ROI is to be reported in the financial statements

C) the average rate for the year, assuming that the rate changed approximately evenly throughout the year

D) the rate in effect when the assets were acquired (ie. 5 to 1)

E) it would be double-counting to convert the assets - leave both assets and income in fidgets and the exchange rate for the numerator cancels out the exchange rate for the denominator

A) the rate in effect when the ROI is calculated

B) the rate estimated to be in effect when the ROI is to be reported in the financial statements

C) the average rate for the year, assuming that the rate changed approximately evenly throughout the year

D) the rate in effect when the assets were acquired (ie. 5 to 1)

E) it would be double-counting to convert the assets - leave both assets and income in fidgets and the exchange rate for the numerator cancels out the exchange rate for the denominator

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

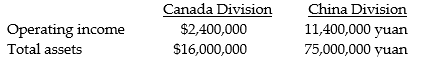

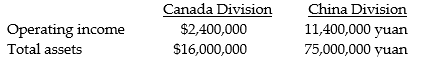

The Irnakk Corporation manufactures iPod covers in Canada and China. The operations are organized as decentralized divisions. The following information is available for the year just ended:

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations showing the China Division ROI in Canadian dollars.

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations showing the China Division ROI in Canadian dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

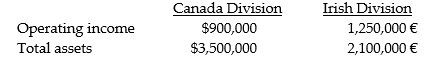

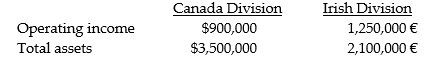

The Shamrock Corporation manufactures flower pots in Canada and Ireland. The operations are organized as decentralized divisions. The following information is available for the year just ended:

The exchange rate at the time of Shamrock's investment (the end of the previous year) in Ireland was $1.35 Canadian to 1.00 Euro. During the year, the Euro weakened steadily in value and the exchange rate at the end of the current year was 1.24 Canadian = $1.00 Euro. The average exchange rate during the year was 1.28 Canadian = $1.00 Euro.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Irish Division's ROI for last year based on Euros.

c. Which of Shamrock's two divisions earned the better ROI? Explain your answer, complete with supporting calculations showing the Irish Division ROI in Canadian dollars.

The exchange rate at the time of Shamrock's investment (the end of the previous year) in Ireland was $1.35 Canadian to 1.00 Euro. During the year, the Euro weakened steadily in value and the exchange rate at the end of the current year was 1.24 Canadian = $1.00 Euro. The average exchange rate during the year was 1.28 Canadian = $1.00 Euro.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Irish Division's ROI for last year based on Euros.

c. Which of Shamrock's two divisions earned the better ROI? Explain your answer, complete with supporting calculations showing the Irish Division ROI in Canadian dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

A multinational established a division in a South American country as a subsidiary corporation, with an initial investment in total assets of 13 million CU's (the local currency is CU's), which cost the company $3,250,000 Canadian at the time. The company sent an experienced manager to run the division, and gave her a target of 13% required rate of return, promising a bonus if this was met and/or exceeded.

After one year, the subsidiary manager was pleased to report a 20% ROI.

You have been able to determine the following data pertaining to the subsidiary:

? Exchange rate at end of year was 8 CU's to 1 Cdn dollar

? Operating income was earned evenly throughout the year

? The exchange rate changed approximately evenly throughout the year

Required:

a. Calculate the subsidiary's income in CU's.

b. Calculate the subsidiary's return on investment in Canadian dollars.

c. Calculate the subsidiary's residual income in Canadian dollars.

After one year, the subsidiary manager was pleased to report a 20% ROI.

You have been able to determine the following data pertaining to the subsidiary:

? Exchange rate at end of year was 8 CU's to 1 Cdn dollar

? Operating income was earned evenly throughout the year

? The exchange rate changed approximately evenly throughout the year

Required:

a. Calculate the subsidiary's income in CU's.

b. Calculate the subsidiary's return on investment in Canadian dollars.

c. Calculate the subsidiary's residual income in Canadian dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

Bob Cellular Phone uses ROI to measure divisional performance. Annual ROI calculations for each division have traditionally employed the ending amount of invested capital along with annual operating income and net revenue. The DuPont method is generally used. The company's Phone Accessories Division had the following results:

Previous Year ROI = ($2,000,000/$20,000,000) × ($20,000,000/$10,000,000) = 0.20

Current Year ROI = ($2,400,000/$25,000,000) × ($25,000,000/$15,000,000) = 0.16

Corporate management was disappointed in the performance of the division for the current year since it had made an additional investment in the division which was budgeted for a 23 percent ROI.

Required:

a. Discuss some factors that may have contributed to the decrease in ROI for the current year.

b. Assume total assets employed are 10% less than total assets. What is the effect of using total assets employed when calculating ROI?

Previous Year ROI = ($2,000,000/$20,000,000) × ($20,000,000/$10,000,000) = 0.20

Current Year ROI = ($2,400,000/$25,000,000) × ($25,000,000/$15,000,000) = 0.16

Corporate management was disappointed in the performance of the division for the current year since it had made an additional investment in the division which was budgeted for a 23 percent ROI.

Required:

a. Discuss some factors that may have contributed to the decrease in ROI for the current year.

b. Assume total assets employed are 10% less than total assets. What is the effect of using total assets employed when calculating ROI?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

Broughton Industries Ltd. is a publicly traded company and is organized into divisions. The company currently has a stock option plan for its head office executives only and it now is considering establishing an incentive program for its divisional managers. The proposal is to create a bonus pool based on a predetermined percentage of corporate net income after taxes. Divisional managers will be eligible for money from the bonus pool based on achievement of divisional return on investment (ROI). The calculation of the divisional ROI will be based on divisional net income (including an allocation of head office charges) and investment is defined as total assets.

Required:

Evaluate the proposed incentive plan. What changes would you recommend, if any, to the proposal?

Required:

Evaluate the proposed incentive plan. What changes would you recommend, if any, to the proposal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

How should environmental and ethical issues affect managers' performance evaluations?

A) Socially responsible companies set aggressive targets for income and ROI, which must be met before environmental and ethical issues become relevant.

B) Environmental responsibilities are met by adhering to the law of the land (e.g., pollution laws).

C) Issues that may be ethical concerns in Canada (e.g., bribery) may not be illegal in other countries, and multi-national companies must adhere to local custom.

D) Socially responsible companies include environmental and ethical targets in managers' performance evaluations.

E) Illegal behaviour is not part of management's concern, unless it affects the bottom line.

A) Socially responsible companies set aggressive targets for income and ROI, which must be met before environmental and ethical issues become relevant.

B) Environmental responsibilities are met by adhering to the law of the land (e.g., pollution laws).

C) Issues that may be ethical concerns in Canada (e.g., bribery) may not be illegal in other countries, and multi-national companies must adhere to local custom.

D) Socially responsible companies include environmental and ethical targets in managers' performance evaluations.

E) Illegal behaviour is not part of management's concern, unless it affects the bottom line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is a difference between a diagnostic control system and an interactive control system?

A) A diagnostic control system focuses on meeting expectations, while an interactive control system focuses on standards of ethical behaviour.

B) A diagnostic control system focuses on standards of ethical behaviour while an interactive control system focus on meeting expectations.

C) Both systems focus on standards of ethical behaviour and meeting expectations.

D) A diagnostic control system focuses on organizational attention and learning on key strategic issues, while an interactive control system focuses on meeting expectations.

E) A diagnostic control system focuses on meeting expectations, while an interactive control system focuses on organizational attention and learning on key strategic issues.

A) A diagnostic control system focuses on meeting expectations, while an interactive control system focuses on standards of ethical behaviour.

B) A diagnostic control system focuses on standards of ethical behaviour while an interactive control system focus on meeting expectations.

C) Both systems focus on standards of ethical behaviour and meeting expectations.

D) A diagnostic control system focuses on organizational attention and learning on key strategic issues, while an interactive control system focuses on meeting expectations.

E) A diagnostic control system focuses on meeting expectations, while an interactive control system focuses on organizational attention and learning on key strategic issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

Alpine Ltd. has two divisions. Division A manufactures components that can be sold in the external market place or transferred to Division B for further processing. The following data relate to Division A's component product.

Variable manufacturing costs/unit $925

Fixed costs/unit at capacity $275

Selling price/unit $1,800

The capacity of the plant is 2,500 units per year.

Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component. The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%. The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.

The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.

Required:

a. How many units must Division A sell in order to achieve its required ROR? What profit margin would be earned at this level of sales?

b. Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales. Evaluate the refusal of Division B's offer from the standpoint of the corporation as a whole and from Division A manager's perspective.

c. Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales. Calculate Division A's residual income with and without the sale to Division B.

d. What recommendations would you give to the President of Alpine Ltd. with respect to performance evaluation of the divisions?

Variable manufacturing costs/unit $925

Fixed costs/unit at capacity $275

Selling price/unit $1,800

The capacity of the plant is 2,500 units per year.

Division B has offered to purchase 350 units from Division A at a price of $1,600/unit, which is the market price of the component. The manager of Division A has refused this offer stating that it would only return a rate of 25.00%, when the divisional target return on sales is 28.00%. The Division A manager also states that additional fixed costs of $195,000 would be required to produce the 350 units.

The corporate required rate of return is 18% of assets and the existing asset base in Division A is $2,500,000.

Required:

a. How many units must Division A sell in order to achieve its required ROR? What profit margin would be earned at this level of sales?

b. Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales. Evaluate the refusal of Division B's offer from the standpoint of the corporation as a whole and from Division A manager's perspective.

c. Assume Division A currently sells 2,000 units to the external market and can accept Division B's offer without affecting its external sales. Calculate Division A's residual income with and without the sale to Division B.

d. What recommendations would you give to the President of Alpine Ltd. with respect to performance evaluation of the divisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck