Deck 2: An Introduction to Cost Terms and Purposes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

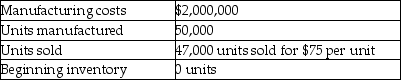

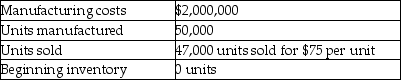

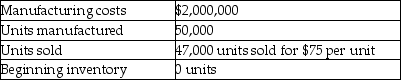

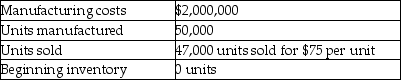

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 2: An Introduction to Cost Terms and Purposes

1

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-amortization on buildings and equipment

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-amortization on buildings and equipment

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

Cost pool - indirect factory operating costs

2

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-fringe benefits for factory workers

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-fringe benefits for factory workers

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

Cost pool - indirect factory labour

3

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-idle time wages

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-idle time wages

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

Cost pool - indirect factory labour

4

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-lubricants for machines

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-lubricants for machines

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-night security

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-night security

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-factory worker overtime premiums

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-factory worker overtime premiums

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-factory worker overtime premiums

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-factory worker overtime premiums

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-property insurance on the factory

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-property insurance on the factory

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-property taxes on the administration office

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-property taxes on the administration office

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-safety hats and shoes

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-safety hats and shoes

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-factory supervisor's salaries

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-factory supervisor's salaries

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-utilities on the administrative building

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-utilities on the administrative building

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-utilities on the factory

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

-utilities on the factory

A) Cost pool - indirect factory operating costs

B) Cost pool - direct factory labour

C) Cost pool - indirect factory labour

D) Period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

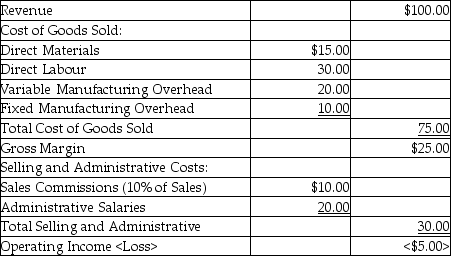

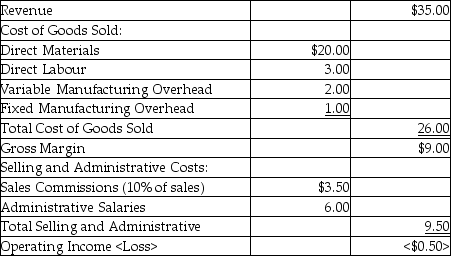

Use the information below to answer the following question(s).

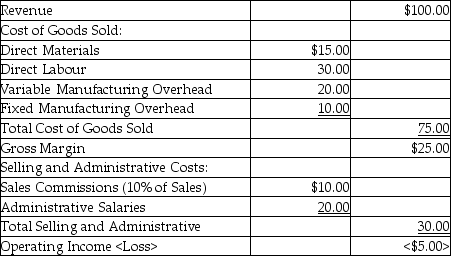

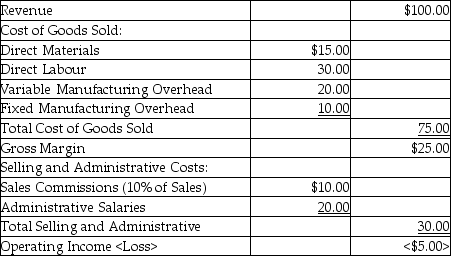

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 40,000 units.

A) $0

B) $<200,000>

C) $<500,000>

D) $<800,000>

E) $<1,000,000>

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 40,000 units.

A) $0

B) $<200,000>

C) $<500,000>

D) $<800,000>

E) $<1,000,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

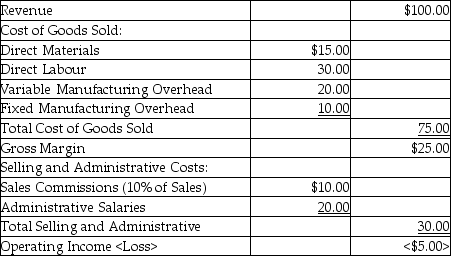

Use the information below to answer the following question(s).

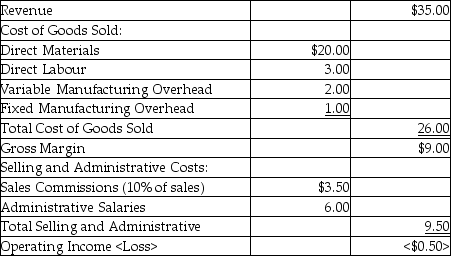

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 50,000 units.

A) $50,000

B) $0

C) $<250,000>

D) $<550,000>

E) $250,000

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 50,000 units.

A) $50,000

B) $0

C) $<250,000>

D) $<550,000>

E) $250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

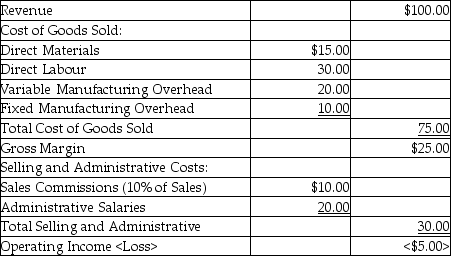

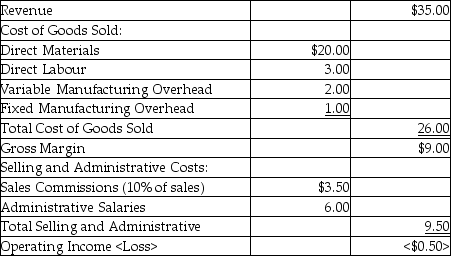

Use the information below to answer the following question(s).

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A) $150,000

B) $0

C) $<300,000>

D) $<650,000>

E) $300,000

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A) $150,000

B) $0

C) $<300,000>

D) $<650,000>

E) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the information below to answer the following question(s).

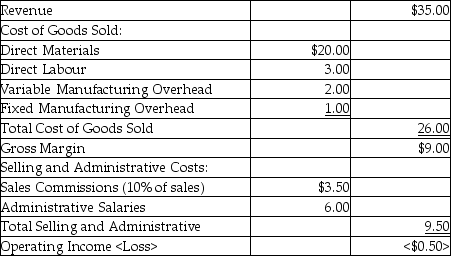

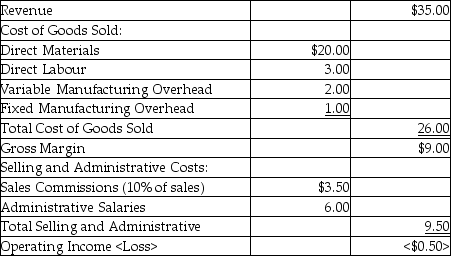

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 120,000 units.

A) $0

B) $<60,000>

C) $<500,000>

D) $<800,000>

E) $<1,000,000>

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 120,000 units.

A) $0

B) $<60,000>

C) $<500,000>

D) $<800,000>

E) $<1,000,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the information below to answer the following question(s).

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 200,000 units.

A) $460,000

B) $0

C) $<100,000>

D) $900,000

E) $980,000

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 200,000 units.

A) $460,000

B) $0

C) $<100,000>

D) $900,000

E) $980,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

Use the information below to answer the following question(s).

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A) $120,000

B) $0

C) $<30,000>

D) $<100,000>

E) $<450,000>

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A) $120,000

B) $0

C) $<30,000>

D) $<100,000>

E) $<450,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

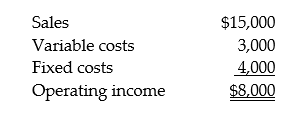

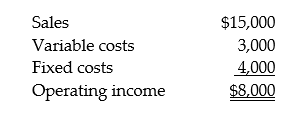

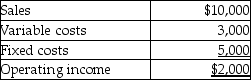

Combs, Inc., reports the following information for September:

Required:

If sales double in October, what is the projected operating income?

Required:

If sales double in October, what is the projected operating income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

A new employee in the accounting department is having difficulty understanding two sets of accounting terms-variable and fixed costs as opposed to period and product costs. He understands that variable costs change during an accounting period while fixed costs do not. However, he explains that a period cost implies that it is for a period of time and is, therefore, also fixed. Does his assumption imply that all product costs are then variable?

Required:

As part of your responsibility to train new staff, explain the difference between these terms.

Required:

As part of your responsibility to train new staff, explain the difference between these terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

A manufacturing company contracts with the labour union to guarantee full employment for all employees with at least 10 years seniority. The Company expects to be working at capacity for the next 2 years (the life of the contract), so this was seen as a bargaining concession without any cost to the company. On average, an employee earns $30 per hour, including benefits. The work force consists of 800 employees, with seniority ranging from 1 year to 18 years.

Required:

Analyze the direct labour cost in term of variable costs, fixed costs, and the relevant range.

Required:

Analyze the direct labour cost in term of variable costs, fixed costs, and the relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

Eichhorn Company's Process Engineering department has the responsibility of rearranging the individual work tasks for each assembly line worker, with the goal of utilizing each worker as much as possible. Currently, on average, each assembly line worker only has tasks that require 47 minutes per hour, and the plant manager wants this increased by at least 10 %. The company builds the Eichhorn Rocket Roadster, which is selling out of dealers' showrooms faster than the company's assembly plants can produce them. If production can't be increased, then sales will soon suffer.

Required:

Explain the effect on total costs of production, using the number of engineering changes (from Process Engineering) and at least two other cost drivers. Choose the cost driver that you think is most logical in the circumstances, and begin your answer with a brief explanation of a cost driver.

Required:

Explain the effect on total costs of production, using the number of engineering changes (from Process Engineering) and at least two other cost drivers. Choose the cost driver that you think is most logical in the circumstances, and begin your answer with a brief explanation of a cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

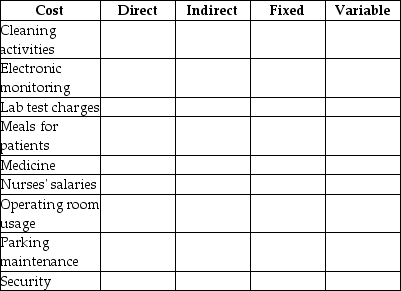

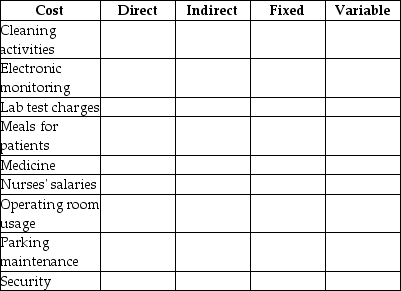

Boone Hospital wants to determine, to the extent possible, the actual cost for each patient stay. It is a general health care facility with all basic services but does not perform specialized services such as organ transplants.

Required:

Complete the following table by

a. Classifying each cost as a direct or indirect cost with respect to each patient.

b. Classifying each item as fixed or variable with respect to the number of patient days (sum of days each patient was in hospital) the hospital incurs.

Required:

Complete the following table by

a. Classifying each cost as a direct or indirect cost with respect to each patient.

b. Classifying each item as fixed or variable with respect to the number of patient days (sum of days each patient was in hospital) the hospital incurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

Whippany manufacturing wants to estimate costs for each product they produce at its Troy plant. The Troy plant produces three products at this plant, and runs two flexible assembly lines. Each assembly line can produce all three products.

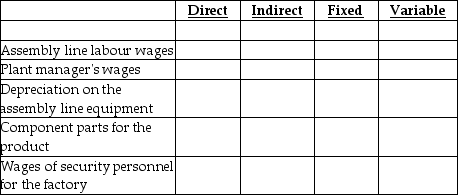

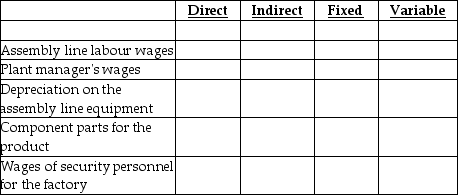

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

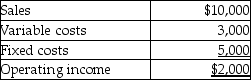

Christi Manufacturing provided the following information for last month:

If sales double next month, what is the projected operating income?

A) $4,000

B) $7,000

C) $9,000

D) $12,000

E) $6,000

If sales double next month, what is the projected operating income?

A) $4,000

B) $7,000

C) $9,000

D) $12,000

E) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

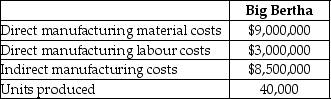

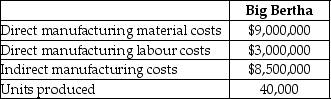

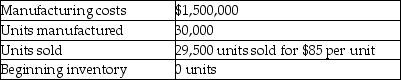

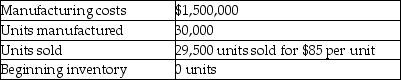

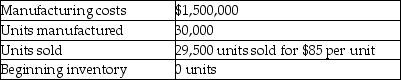

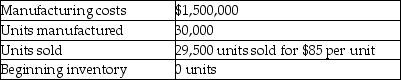

Springfield Manufacturing produces electronic storage devices, and uses the following three-part classification for its manufacturing costs: direct materials, direct manufacturing labour, and indirect manufacturing costs. Total indirect manufacturing costs for January were $300 million, and were allocated to each product on the basis of direct manufacturing labour costs of each line. Summary data for January for the most popular electronic storage device, the Big Bertha, was:

Required:

a. Compute the total manufacturing cost per unit for each product produced in January.

b. Suppose production will be reduced to 30,000 units in February. If indirect manufacturing costs include fixed costs then explain if the total cost per unit be higher or lower than in January.

Required:

a. Compute the total manufacturing cost per unit for each product produced in January.

b. Suppose production will be reduced to 30,000 units in February. If indirect manufacturing costs include fixed costs then explain if the total cost per unit be higher or lower than in January.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gimble Manufacturing Inc. makes vibration control springs for heating, ventilating, and air conditioning (HVAC) equipment. Materials cost $52 per spring set, and the machinists are paid $44 per hour. A machinist can produce four sets of springs per hour. Fixed manufacturing costs for springs are $5,000 per period. Non-manufacturing spring set costs are fixed at $11,000 per period. Each spring set sells for $75 and Gimble sells on average 4,000 spring sets per period.

Required:

a. Competition has entered the market and is selling spring sets for an introductory price of $66. Can Gimble Manufacturing Inc.meet this price and still make a profit?

b. How would your answer to requirement a. change if Gimble sells on average 8,000 spring sets per period.

c. What should Gimble Manufacturing Inc.'s management do in the short-run and for the long-term if it appears that $66 is going to be the new market price for the future.

Required:

a. Competition has entered the market and is selling spring sets for an introductory price of $66. Can Gimble Manufacturing Inc.meet this price and still make a profit?

b. How would your answer to requirement a. change if Gimble sells on average 8,000 spring sets per period.

c. What should Gimble Manufacturing Inc.'s management do in the short-run and for the long-term if it appears that $66 is going to be the new market price for the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

Things are not going well for the widget industry this year. The well-known cyclical nature of widget sales is in a downturn and your plant has been ordered to cut costs by its American parent corporation. The plant manager explains that he has shown the lead by negotiating a $1.50 hourly wage decrease with the production workers, based on a formula that pegs a $1.50 per hour wage increase/decrease to sales volume, and since sales are down this year, so are hourly wage costs. In the quarterly management meeting, the sales manager complained that sales could have been higher, but that somehow costs had increased, at least that's what the reports out of your office in management accounting, indicated. The Purchasing manager assured everyone that she was able to obtain raw materials at the same price as last year, and unfortunately, you as the management accountant, were not in attendance at the meeting. Your assistant, a new employee attended in your place, and promised at the meeting to redo the reports and find the errors. Your assistant has come to you as he cannot find any errors in the reports. Consequently, the plant manager wants you to redo the reports, find the error reports produced by your department for the last quarter and to explain to your boss, the plant manager, why average costs have increased.

Required:

Assuming there are no errors in the cost reports, explain to the plant manager how direct labour costs could be decreased and direct materials costs could be the same as last year, and yet the selling price cannot be lowered without sacrificing net income for the plant.

Required:

Assuming there are no errors in the cost reports, explain to the plant manager how direct labour costs could be decreased and direct materials costs could be the same as last year, and yet the selling price cannot be lowered without sacrificing net income for the plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

The vice president of production has just completed the January meeting with all production department heads. Everyone is upset that the production variances for the month were unfavourable. They do not understand why everything was unfavourable. January is typically the company's lowest production month of the year.

The company uses annual average unit costs for production evaluation purposes. The average costs are based on the prior year's actual performance with adjustments for any predicted changes in the coming year. Both production and economic items are considered in setting the averages for each new year.

Required:

Explain the problems with using average costs in evaluating production.

The company uses annual average unit costs for production evaluation purposes. The average costs are based on the prior year's actual performance with adjustments for any predicted changes in the coming year. Both production and economic items are considered in setting the averages for each new year.

Required:

Explain the problems with using average costs in evaluating production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the information below to answer the following question(s).

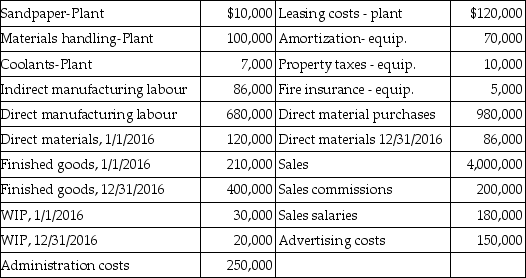

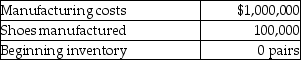

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials costs are for the production of 1,014,000 units?

A) $0.80

B) $0.95

C) $1.00

D) $1.08

E) $1.11

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials costs are for the production of 1,014,000 units?

A) $0.80

B) $0.95

C) $1.00

D) $1.08

E) $1.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the information below to answer the following question(s).

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the plant leasing costs for 2016 assuming plant leasing costs are for the production of 1,014,000 units?

A) $0.119

B) $0.118

C) $0.110

D) $0.900

E) $0.943

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the plant leasing costs for 2016 assuming plant leasing costs are for the production of 1,014,000 units?

A) $0.119

B) $0.118

C) $0.110

D) $0.900

E) $0.943

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the information below to answer the following question(s).

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials are for the production of 507,000 units?

A) $0.80

B) $0.95

C) $2.00

D) $1.08

E) $1.10

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials are for the production of 507,000 units?

A) $0.80

B) $0.95

C) $2.00

D) $1.08

E) $1.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the information below to answer the following question(s).

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the plant leasing cost for 2016 assuming plant leasing costs are for the production of 2,000,000 units?

A) 0.35

B) 0.18

C) 0.12

D) 0.06

E) 0.04

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the plant leasing cost for 2016 assuming plant leasing costs are for the production of 2,000,000 units?

A) 0.35

B) 0.18

C) 0.12

D) 0.06

E) 0.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the information below to answer the following question(s).

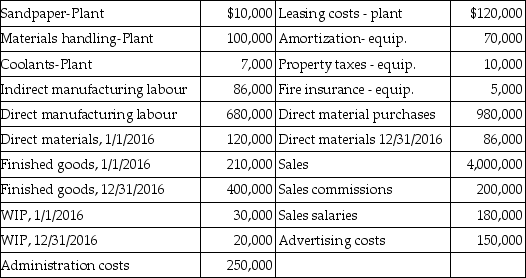

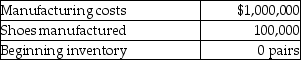

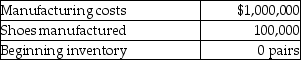

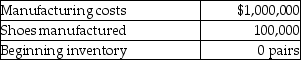

The following information pertains to Payton's Shoe Manufacturing:

99,500 pairs of shoes are sold during the year for $18.

-What is Payton's manufacturing cost per pair of shoes?

A) $10.00

B) $10.05

C) $100.00

D) $18.00

E) $9.95

The following information pertains to Payton's Shoe Manufacturing:

99,500 pairs of shoes are sold during the year for $18.

-What is Payton's manufacturing cost per pair of shoes?

A) $10.00

B) $10.05

C) $100.00

D) $18.00

E) $9.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the information below to answer the following question(s).

The following information pertains to Payton's Shoe Manufacturing:

99,500 pairs of shoes are sold during the year for $18.

-What is the amount of Payton's gross profit?

A) $995,000

B) $1,000,000

C) $1,791,000

D) $796,000

E) $896,000

The following information pertains to Payton's Shoe Manufacturing:

99,500 pairs of shoes are sold during the year for $18.

-What is the amount of Payton's gross profit?

A) $995,000

B) $1,000,000

C) $1,791,000

D) $796,000

E) $896,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

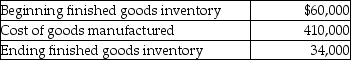

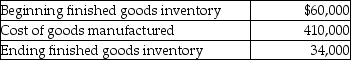

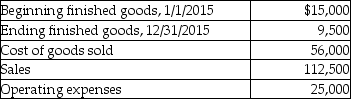

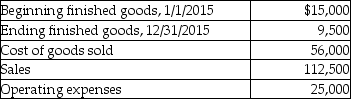

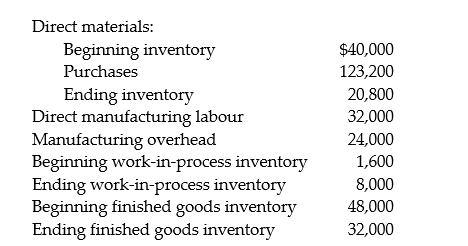

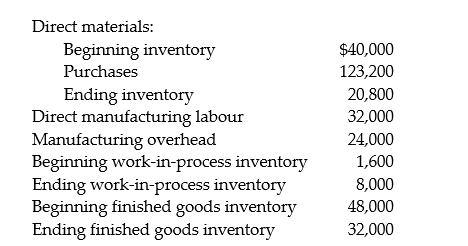

The following information pertains to the Stratford Company:

What is the cost of goods sold?

A) $436,000

B) $384,000

C) $376,000

D) $316,000

E) $444,000

What is the cost of goods sold?

A) $436,000

B) $384,000

C) $376,000

D) $316,000

E) $444,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the information below to answer the following question(s).

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of direct materials used during the year?

A) $204,000

B) $178,000

C) $128,000

D) $24,000

E) $218,000

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of direct materials used during the year?

A) $204,000

B) $178,000

C) $128,000

D) $24,000

E) $218,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the information below to answer the following question(s).

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of goods manufactured during the year?

A) $268,000

B) $248,000

C) $240,000

D) $238,000

E) $260,000

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of goods manufactured during the year?

A) $268,000

B) $248,000

C) $240,000

D) $238,000

E) $260,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the information below to answer the following question(s).

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of goods sold during the year?

A) $260,000

B) $232,000

C) $220,000

D) $200,000

E) $240,000

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of goods sold during the year?

A) $260,000

B) $232,000

C) $220,000

D) $200,000

E) $240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

Answer the following question using the information below.

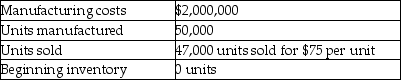

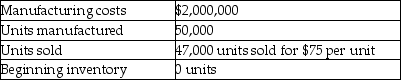

Pederson Company reported the following:

-What is the average manufacturing cost per unit?

A) $40.00

B) $42.55

C) $75.50

D) $35.00

E) $42.25

Pederson Company reported the following:

-What is the average manufacturing cost per unit?

A) $40.00

B) $42.55

C) $75.50

D) $35.00

E) $42.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer the following question using the information below.

Pederson Company reported the following:

-What is the amount of gross margin?

A) $1,750,000

B) $3,525,000

C) $3,405,000

D) $1,645,000

E) $1,525,000

Pederson Company reported the following:

-What is the amount of gross margin?

A) $1,750,000

B) $3,525,000

C) $3,405,000

D) $1,645,000

E) $1,525,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Answer the following question using the information below.

Pederson Company reported the following:

-What is the amount of finished goods inventory?

A) $2,000,000

B) $12,000

C) $225,000

D) $127,659

E) $120,000

Pederson Company reported the following:

-What is the amount of finished goods inventory?

A) $2,000,000

B) $12,000

C) $225,000

D) $127,659

E) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

Answer the following question(s) using the information below.

The following information pertains to Alleigh's Mannequins:

-What is the average manufacturing cost per unit?

A) $50.00

B) $50.85

C) $17.65

D) $85.00

E) $49.50

The following information pertains to Alleigh's Mannequins:

-What is the average manufacturing cost per unit?

A) $50.00

B) $50.85

C) $17.65

D) $85.00

E) $49.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

Answer the following question(s) using the information below.

The following information pertains to Alleigh's Mannequins:

-What is the amount of ending finished goods inventory?

A) $42,500

B) $24,750

C) $25,000

D) $25,425

E) $42,500.

The following information pertains to Alleigh's Mannequins:

-What is the amount of ending finished goods inventory?

A) $42,500

B) $24,750

C) $25,000

D) $25,425

E) $42,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the information below to answer the following question(s).

Frazer Inc. had the following activities in the year:

-What is Frazer's cost of goods manufactured?

A) $536,000

B) $496,000

C) $480,000

D) $476,000

E) $512,000

Frazer Inc. had the following activities in the year:

-What is Frazer's cost of goods manufactured?

A) $536,000

B) $496,000

C) $480,000

D) $476,000

E) $512,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the information below to answer the following question(s).

Frazer Inc. had the following activities in the year:

-What is Frazer's cost of goods sold?

A) $520,000

B) $464,000

C) $440,000

D) $400,000

E) $516,000

Frazer Inc. had the following activities in the year:

-What is Frazer's cost of goods sold?

A) $520,000

B) $464,000

C) $440,000

D) $400,000

E) $516,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following formulas determine cost of goods sold in a manufacturing entity?

A) Beginning work-in-process inventory + Cost of goods manufactured - Ending work-in-process inventory = Cost of goods sold

B) Beginning work-in-process inventory + Cost of goods manufactured + Ending work-in-process inventory = Cost of goods sold

C) Cost of goods manufactured - Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

D) Cost of goods manufactured + Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

E) Beginning work-in-process inventory - Cost of goods manufactured + Ending work-in-process inventory = Cost of goods sold

A) Beginning work-in-process inventory + Cost of goods manufactured - Ending work-in-process inventory = Cost of goods sold

B) Beginning work-in-process inventory + Cost of goods manufactured + Ending work-in-process inventory = Cost of goods sold

C) Cost of goods manufactured - Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

D) Cost of goods manufactured + Beginning finished goods inventory - Ending finished goods inventory = Cost of goods sold

E) Beginning work-in-process inventory - Cost of goods manufactured + Ending work-in-process inventory = Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

The following information pertains to Tom's Country Wood Shop:

What is the cost of goods manufactured for 2015?

A) $56,500

B) $31,500

C) $50,500

D) $61,500

E) $66,500

What is the cost of goods manufactured for 2015?

A) $56,500

B) $31,500

C) $50,500

D) $61,500

E) $66,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the information below to answer the following question(s).

Ontario Industries Inc. had the following activities during the year:

-What is the amount of Ontario Industries Inc.'s ending finished goods inventory?

A) $55,000

B) $75,000

C) $70,000

D) $65,000

E) $60,000

Ontario Industries Inc. had the following activities during the year:

-What is the amount of Ontario Industries Inc.'s ending finished goods inventory?

A) $55,000

B) $75,000

C) $70,000

D) $65,000

E) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information below to answer the following question(s).

Ontario Industries Inc. had the following activities during the year:

-What is the amount of direct materials used by Ontario Industries Inc.?

A) $168,000

B) $165,000

C) $173,000

D) $205,000

E) $170,000

Ontario Industries Inc. had the following activities during the year:

-What is the amount of direct materials used by Ontario Industries Inc.?

A) $168,000

B) $165,000

C) $173,000

D) $205,000

E) $170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the information below to answer the following question(s).

Ontario Industries Inc. had the following activities during the year:

-What is the amount of the manufacturing overhead incurred at Ontario Industries Inc.?

A) $16,000

B) $41,000

C) $35,000

D) $23,000

E) $29,000

Ontario Industries Inc. had the following activities during the year:

-What is the amount of the manufacturing overhead incurred at Ontario Industries Inc.?

A) $16,000

B) $41,000

C) $35,000

D) $23,000

E) $29,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the information below to answer the following question(s).

Ontario Industries Inc. had the following activities during the year:

-What is the amount of the beginning work-in-process inventory at Ontario Industries Inc.?

A) $1,000

B) $5,000

C) $12,000

D) $6,000

E) $4,000

Ontario Industries Inc. had the following activities during the year:

-What is the amount of the beginning work-in-process inventory at Ontario Industries Inc.?

A) $1,000

B) $5,000

C) $12,000

D) $6,000

E) $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

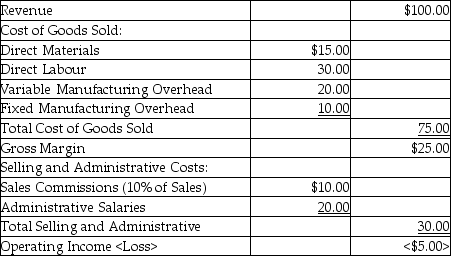

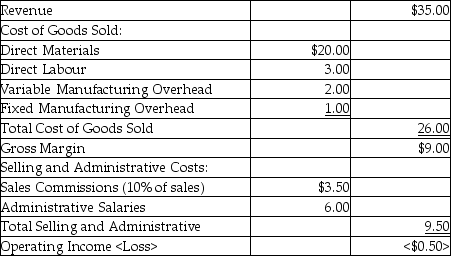

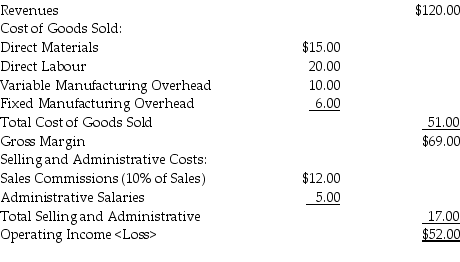

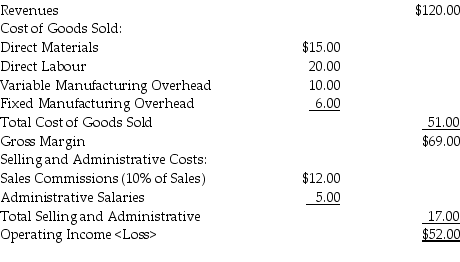

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.

Required:

Prepare a statement of operating income assuming the leasing proposal is accepted.

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.

The Fixed Manufacturing Overhead provides a capacity of 50,000 units. The Production Manager has proposed leasing a new machine at a cost of $80,000 per year. This will reduce Direct Labour by 30% and improve quality so the the selling price per unit can be increased by $10. Production and sales are expected to remain the same as last year.Required:

Prepare a statement of operating income assuming the leasing proposal is accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

Big Bird Pet Store had the following financial activities for June. Revenue was $860,000 with cost of goods sold equalling $440,000. Salaries and wages of all employees were $100,000. Fringe benefits were 15 percent of salaries and wages. Rent on the building was $100,000 and equipment amortization was $46,000. Office supplies and utilities totalled $28,000. Income taxes withheld from employees totalled $46,000 for the month while ending accounts payable were $24,680. Cash flows from accounts receivable totalled $880,000.

Required:

Using an income statement format, determine the operating income of the store.

Required:

Using an income statement format, determine the operating income of the store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ames Power Point had sales in October of $28,000,000 for its three stores in Toronto. The beginning merchandise inventories for October and November were $5,000,000 and $4,000,000, respectively. October purchases totalled $19,000,000. All sales are on account (terms 2/15, net 30 days) and are collected 50 percent in the month of the sale and 50 percent in the following month. One-half of all sales discounts are taken for a total of $265,000. September sales totalled $25,000,000 while November sales were $30,000,000. Additional information for October is as follows:

Required:

Using an appropriately formatted income statement, determine the operating income of the company.

Required:

Using an appropriately formatted income statement, determine the operating income of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

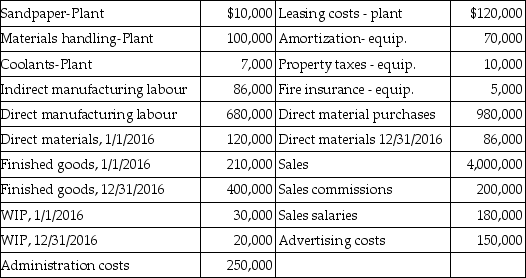

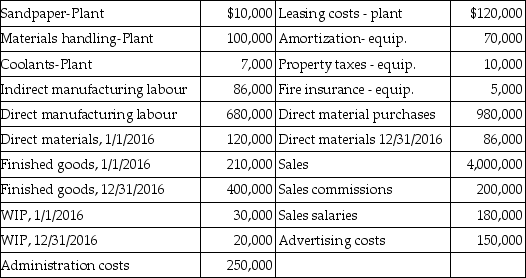

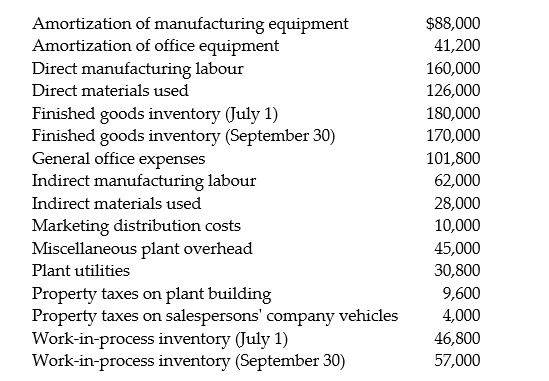

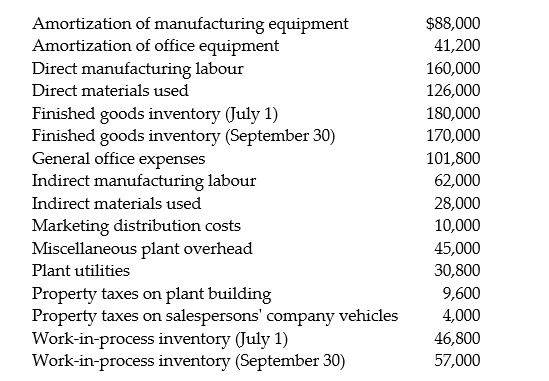

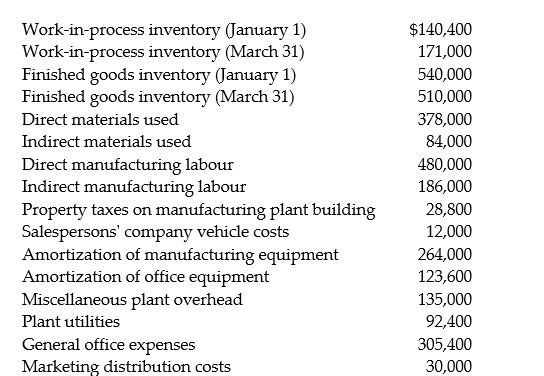

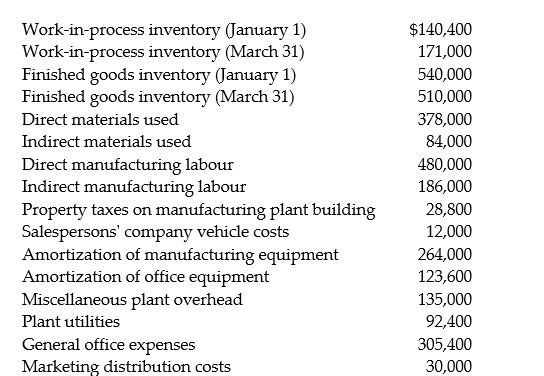

Eschliman Manufacturing Company had the following account balances for the quarter ending September 30, unless otherwise noted:

Required:

a. Prepare a cost of goods manufactured schedule for the quarter.

b. Prepare a cost of goods sold schedule for the quarter.

Required:

a. Prepare a cost of goods manufactured schedule for the quarter.

b. Prepare a cost of goods sold schedule for the quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

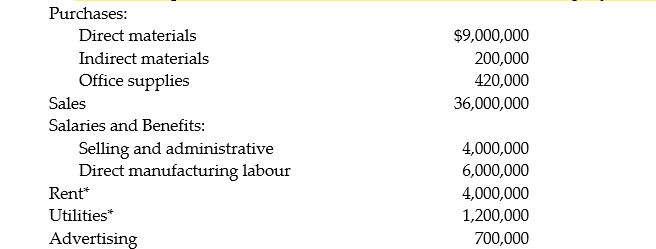

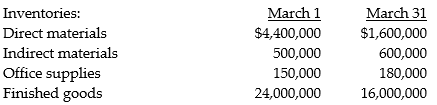

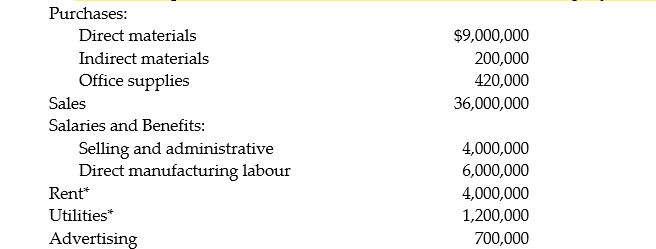

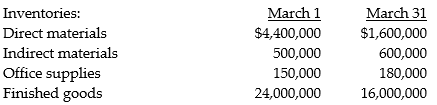

The following information is taken from the records of Britton Company for March:

* Of these costs, 60 percent are assigned to manufacturing and 40 percent to selling and administration.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Prepare an income statement for the month.

c. Compute the prime costs using a two-part production costing system, conversion costs, and indirect manufacturing costs.

* Of these costs, 60 percent are assigned to manufacturing and 40 percent to selling and administration.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Prepare an income statement for the month.

c. Compute the prime costs using a two-part production costing system, conversion costs, and indirect manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

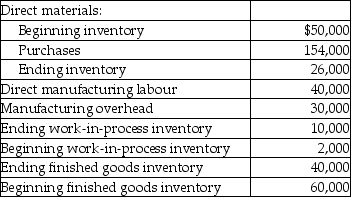

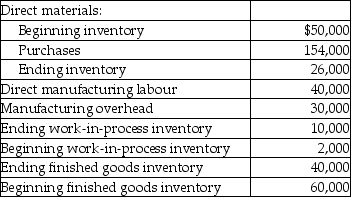

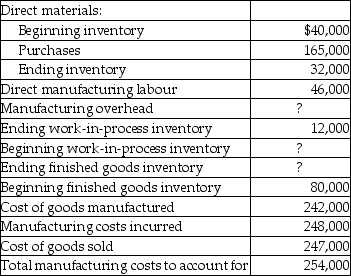

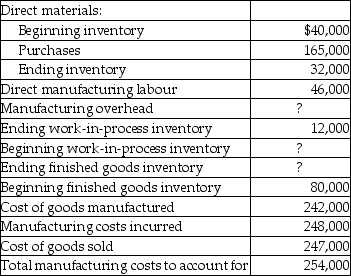

Evans Inc., had the following activities during 2015:

Required:

a. What is the cost of direct materials used during 2015?

b. What is cost of goods manufactured for 2015?

c. What is cost of goods sold for 2015?

Assume that Evans uses a two-part classification system for prime and conversion costs.

d. What amount of prime costs was added to production during 2015?

e. What amount of conversion costs was added to production during 2015?

Required:

a. What is the cost of direct materials used during 2015?

b. What is cost of goods manufactured for 2015?

c. What is cost of goods sold for 2015?

Assume that Evans uses a two-part classification system for prime and conversion costs.

d. What amount of prime costs was added to production during 2015?

e. What amount of conversion costs was added to production during 2015?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

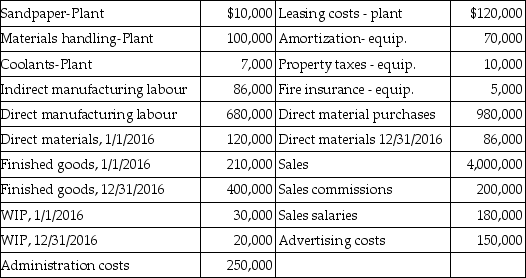

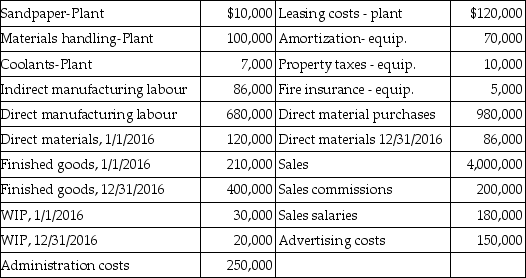

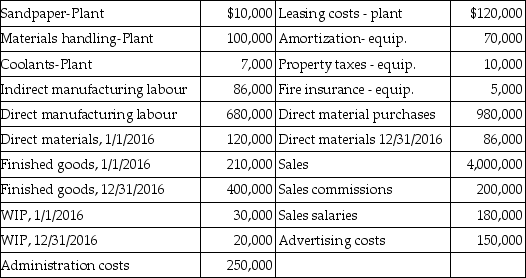

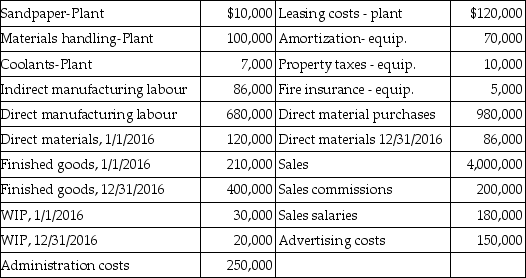

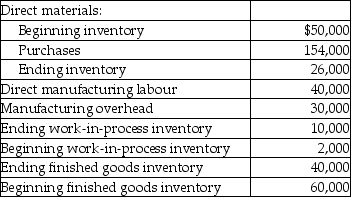

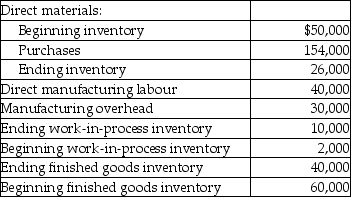

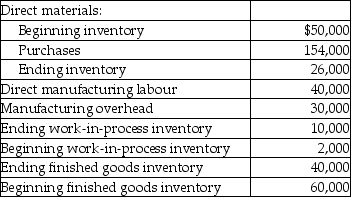

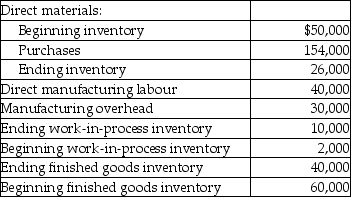

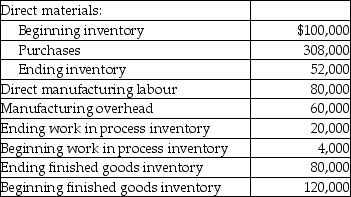

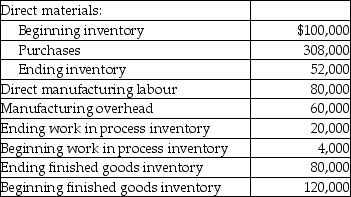

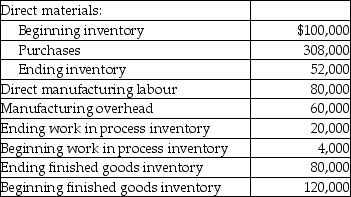

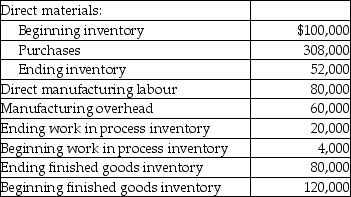

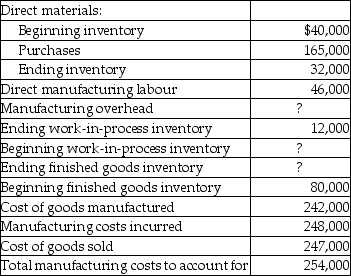

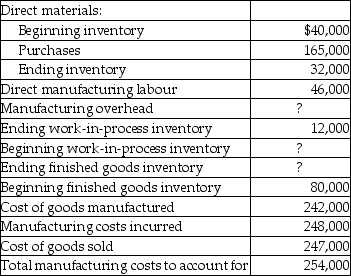

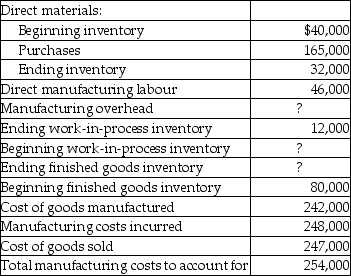

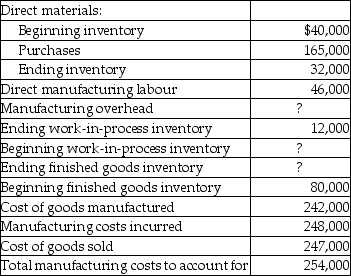

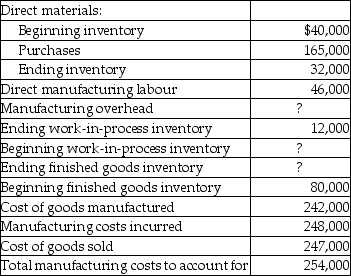

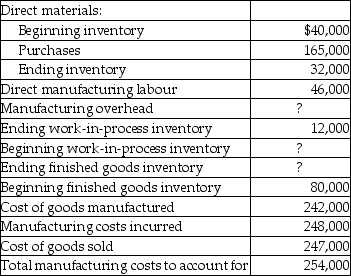

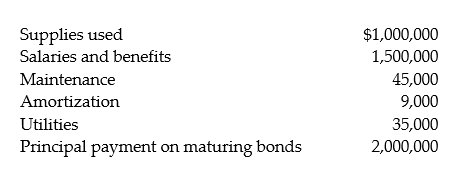

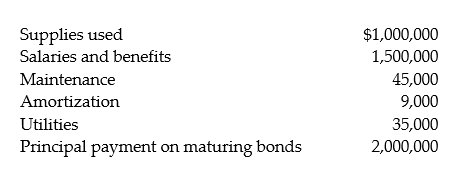

Messinger Manufacturing Company had the following account balances for the quarter ending March 31, unless otherwise noted:

Required:

a. Prepare a cost of goods manufactured schedule for the quarter.

b. Prepare a cost of goods sold schedule for the quarter.

Required:

a. Prepare a cost of goods manufactured schedule for the quarter.

b. Prepare a cost of goods sold schedule for the quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck