Deck 2: Concepts and Elements Underlying Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

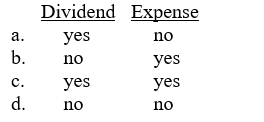

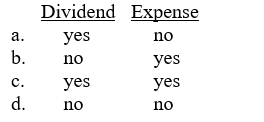

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

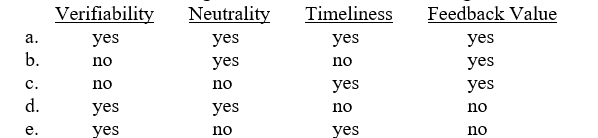

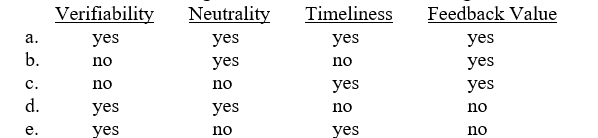

سؤال

سؤال

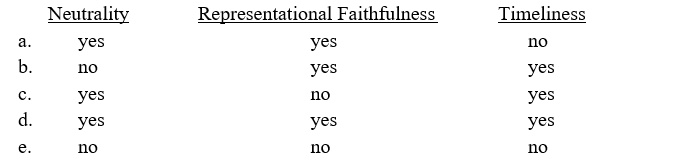

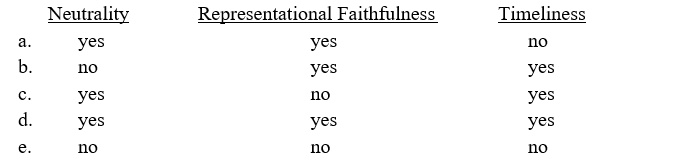

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/109

العب

ملء الشاشة (f)

Deck 2: Concepts and Elements Underlying Accounting

1

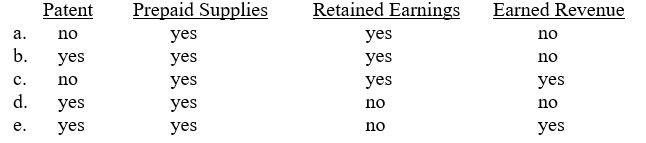

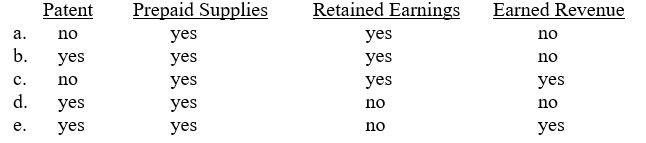

Which of the following are assets?

D

2

A current asset must

I. be easily converted into cash.

II. have future economic benefit.

III. be used up or converted into cash within the next year or operating cycle, whichever is shorter.

A) I is true.

B) I and II are true.

C) II and III are true.

D) I and III are true.

E) I, II, and III are true.

I. be easily converted into cash.

II. have future economic benefit.

III. be used up or converted into cash within the next year or operating cycle, whichever is shorter.

A) I is true.

B) I and II are true.

C) II and III are true.

D) I and III are true.

E) I, II, and III are true.

I and II are true.

3

Which of the following statements is false?

A) A business's operating cycle is the average time a company takes to buy inventory, sell that inventory, and collect cash from customers.

B) Operating cycles can be shorter or longer than one year.

C) A current asset is cash or any other asset that will be converted into cash, sold, or used up within the next year.

D) Cash and inventory are current assets.

E) Current assets are listed in descending order of liquidity.

A) A business's operating cycle is the average time a company takes to buy inventory, sell that inventory, and collect cash from customers.

B) Operating cycles can be shorter or longer than one year.

C) A current asset is cash or any other asset that will be converted into cash, sold, or used up within the next year.

D) Cash and inventory are current assets.

E) Current assets are listed in descending order of liquidity.

A current asset is cash or any other asset that will be converted into cash, sold, or used up within the next year.

4

Amounts owed to a business by customers are called

A) cash.

B) short-term investments.

C) accounts payable.

D) accounts receivable.

E) revenue.

A) cash.

B) short-term investments.

C) accounts payable.

D) accounts receivable.

E) revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

5

Q Company paid $3,600 for a two-year insurance policy on January 2, 2010. On that date, Q Company considers the $3,600 payment a(an)

A) account payable.

B) prepaid asset.

C) expense.

D) revenue.

E) short-term investment.

A) account payable.

B) prepaid asset.

C) expense.

D) revenue.

E) short-term investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

6

On May 15, 2010, R Co. purchased land for $150,000. R Co. intends to build a new headquarters building on that land in 2015. On May 15, 2010, R Co. considers the land a(an)

A) prepaid asset.

B) property, plant and equipment item.

C) expense.

D) short-term investment.

E) long-term investment.

A) prepaid asset.

B) property, plant and equipment item.

C) expense.

D) short-term investment.

E) long-term investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements about property, plant, and equipment and depreciation is true?

A) Plant, property, and equipment assets are sold to customers in the normal course of business.

B) Accounting requires that the cost of a depreciable asset be recorded as an expense over time periods benefited by that asset.

C) Accumulated depreciation is the total amount of depreciation that has been recorded on a depreciable asset in the current period.

D) Accounting and general usages of the term depreciation are the same.

E) All of the above statements are true.

A) Plant, property, and equipment assets are sold to customers in the normal course of business.

B) Accounting requires that the cost of a depreciable asset be recorded as an expense over time periods benefited by that asset.

C) Accumulated depreciation is the total amount of depreciation that has been recorded on a depreciable asset in the current period.

D) Accounting and general usages of the term depreciation are the same.

E) All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

8

On Jan. 2, 2010, Sivan Corporation acquires a truck for $500,000. Cash of $400,000 is paid and a note payable for the remaining $100,000 was signed at acquisition. The truck is depreciated over a 10 year period at $50,000 per year. What is the historical cost recorded on the year-end 2013 balance sheet?

A) $ 50,000

B) $150,000

C) $350,000

D) $400,000

E) $500,000

A) $ 50,000

B) $150,000

C) $350,000

D) $400,000

E) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

9

On Jan. 2, 2010, Sivan Corporation acquires a truck for $500,000. Cash of $400,000 is paid and a note payable for the remaining $100,000 was signed at acquisition. The truck is depreciated over a 10 year period at $50,000 per year. What is the accumulated depreciation at January 1, 2012?

A) $ 50,000

B) $100,000

C) $150,000

D) $400,000

E) $500,000

A) $ 50,000

B) $100,000

C) $150,000

D) $400,000

E) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

10

On Jan. 2, 2010, Wright Construction Co. purchased equipment for $50,000. Wright expects to use the equipment for three years, at which time it will have an estimated salvage value of $27,500. What is the depreciation expense for 2010?

A) $ 7,500

B) $ 9,167

C) $16,667

D) $27,500

E) $50,000

A) $ 7,500

B) $ 9,167

C) $16,667

D) $27,500

E) $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

11

On Jan. 2, 2010, Doric Company purchased a machine for $75,000. Doric expects the machine to have a useful life of 10 years and $5,000 salvage value. What is the book value of machine at the end of 2011?

A) $56,000

B) $60,000

C) $61,000

D) $70,000

E) $75,000

A) $56,000

B) $60,000

C) $61,000

D) $70,000

E) $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

12

On Jan. 2, 2010, Doric Company purchased a new machine for $75,000. Doric expects the machine to have a useful life of 10 years and $5,000 salvage value. What is the accumulated depreciation on the machine at the end of 2012?

A) $ 7,000

B) $ 7,500

C) $14,000

D) $21,000

E) $22,500

A) $ 7,000

B) $ 7,500

C) $14,000

D) $21,000

E) $22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following are examples of intangible assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

14

Amounts owed by businesses to third parties are known as

A) assets.

B) liabilities.

C) stockholders' equity.

D) revenues.

E) expenses.

A) assets.

B) liabilities.

C) stockholders' equity.

D) revenues.

E) expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

15

A debt or obligation that will be eliminated by giving up current assets or incurring a current liability is a

A) prepaid asset.

B) current asset.

C) current liability.

D) long-term asset.

E) long-term liability.

A) prepaid asset.

B) current asset.

C) current liability.

D) long-term asset.

E) long-term liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

16

When a company determines that there is an amount that it currently owes but has not yet recorded, that company will record a(an)

A) prepaid asset acount.

B) current asset account.

C) intangible asset account.

D) accrued liability account.

E) equity account.

A) prepaid asset acount.

B) current asset account.

C) intangible asset account.

D) accrued liability account.

E) equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

17

Lima Co. has received $12,000 for future subscriptions to The Bean Magazine. Lima should record this amount as a(an)

A) long-term investment.

B) earned revenue.

C) account receivable.

D) expense.

E) unearned revenue.

A) long-term investment.

B) earned revenue.

C) account receivable.

D) expense.

E) unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

18

In 2007, Alca Co. issued a long-term note payable that would come due on May 15, 2011. On its December 31, 2010 balance sheet, this note should be classified as a(an)

A) long-term liability.

B) short-term liability.

C) intangible asset.

D) long-term investment.

E) expense.

A) long-term liability.

B) short-term liability.

C) intangible asset.

D) long-term investment.

E) expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

19

The owners' interest in a corporation is represented by

A) total assets.

B) long-term liabilities.

C) total stockholders' equity.

D) common stock.

E) revenues.

A) total assets.

B) long-term liabilities.

C) total stockholders' equity.

D) common stock.

E) revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

20

A share of ownership in a corporation is known as

A) common stock.

B) par value.

C) additional paid-in capital.

D) retained earnings.

E) an expense.

A) common stock.

B) par value.

C) additional paid-in capital.

D) retained earnings.

E) an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

21

The specific dollar amount printed on each stock certificate is the

A) book value.

B) par value.

C) net realizable value.

D) net present value.

E) market value.

A) book value.

B) par value.

C) net realizable value.

D) net present value.

E) market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a share of stock is first sold, the amount received by the company may be different from the amount printed on the stock certificate. Any amount over that printed amount will be recognized in which of the following accounts?

A) Common Stock.

B) Retained Earnings

C) Revenue from Stock Sales

D) Additional Paid-In Capital

E) Long-Term Investment

A) Common Stock.

B) Retained Earnings

C) Revenue from Stock Sales

D) Additional Paid-In Capital

E) Long-Term Investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

23

Barrington Industries recently sold 1,000 shares of common stock with a par value of $0.10 per share and a market price of $15.00 per share.

-As a result of this sale, Barrington's additional paid-in capital should increase by

A) $100.

B) $14,900.

C) $15,000.

D) $15,100.

E) none of the above

-As a result of this sale, Barrington's additional paid-in capital should increase by

A) $100.

B) $14,900.

C) $15,000.

D) $15,100.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

24

Barrington Industries recently sold 1,000 shares of common stock with a par value of $0.10 per share and a market price of $15.00 per share.

-As a result of this sale, Barrington's total stockholders' equity should increase by

A) $100.

B) $14,900.

C) $15,000.

D) $15,100.

E) none of the above

-As a result of this sale, Barrington's total stockholders' equity should increase by

A) $100.

B) $14,900.

C) $15,000.

D) $15,100.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

25

The total amount of profits generated by a company and not distributed as dividends to stockholders is called

A) revenue.

B) common stock.

C) par value.

D) additional paid-in capital.

E) retained earnings.

A) revenue.

B) common stock.

C) par value.

D) additional paid-in capital.

E) retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

26

A distribution of a corporation's profits to owners is a

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

27

Inflows of new assets into a business that have been generated by business operating activities are included in

A) common stock.

B) liabilities.

C) additional paid-in capital.

D) revenues.

E) expenses.

A) common stock.

B) liabilities.

C) additional paid-in capital.

D) revenues.

E) expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

28

When Deliteful Bites sells the gourmet food that it makes, the company should record a(an)

A) accounts payable if cash was not collected at the point of sale.

B) unearned revenue if cash was not collected at the point of sale.

C) operating revenue regardless of whether cash was collected at the point of sale.

D) non-operating revenue if cash was not collected at the point of sale.

E) operating revenue only if cash was collected at the point of sale.

A) accounts payable if cash was not collected at the point of sale.

B) unearned revenue if cash was not collected at the point of sale.

C) operating revenue regardless of whether cash was collected at the point of sale.

D) non-operating revenue if cash was not collected at the point of sale.

E) operating revenue only if cash was collected at the point of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

29

On March 13, 2010, Strauss Department Store purchased five sweaters from Charter Manufacturers for $20 each. On April 1, 2010, Lela Landers purchased all of those sweaters from Strauss for $35 each. Strauss should recognize a

A) $75 increase in revenue for the sale of the sweaters to Landers.

B) $100 increase in revenue for the sale of the sweaters to Landers.

C) $75 increase in cost of goods sold for the sale of sweaters to Landers.

D) $100 increase in cost of goods sold for its sale of sweaters to Landers.

E) $175 increase in cost of goods sold for its sale of sweaters to Landers.

A) $75 increase in revenue for the sale of the sweaters to Landers.

B) $100 increase in revenue for the sale of the sweaters to Landers.

C) $75 increase in cost of goods sold for the sale of sweaters to Landers.

D) $100 increase in cost of goods sold for its sale of sweaters to Landers.

E) $175 increase in cost of goods sold for its sale of sweaters to Landers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

30

Salaries paid to employees working at cash registers in a grocery store would be considered part of

A) dividends.

B) operating expenses.

C) non-operating expenses.

D) cost of good sold.

E) none of the above

A) dividends.

B) operating expenses.

C) non-operating expenses.

D) cost of good sold.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

31

Cool Dudes, a chain of record stores, is expanding and has obtained loans from several major banks. Cool Dude should record all interest associated with the loans as

A) operating revenues.

B) non-operating revenues.

C) operating expenses.

D) non-operating expenses.

E) cost of goods sold.

A) operating revenues.

B) non-operating revenues.

C) operating expenses.

D) non-operating expenses.

E) cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

32

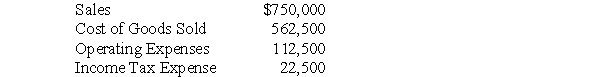

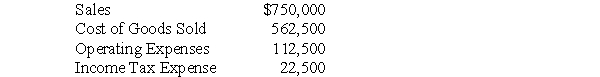

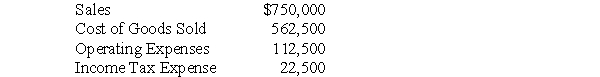

Shelton Corp., a local manufacturer, reported the following information for 2010:

-

What is Shelton Corp.'s gross profit percentage?

A) 7%

B) 10%

C) 15%

D) 25%

E) 30%

-

What is Shelton Corp.'s gross profit percentage?

A) 7%

B) 10%

C) 15%

D) 25%

E) 30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

33

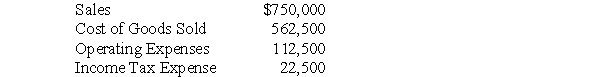

Shelton Corp., a local manufacturer, reported the following information for 2010:

-

What is Shelton Co.'s operating income?

A) $ 52,500

B) $ 75,000

C) $ 90,000

D) $187,500

E) $615,000

-

What is Shelton Co.'s operating income?

A) $ 52,500

B) $ 75,000

C) $ 90,000

D) $187,500

E) $615,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

34

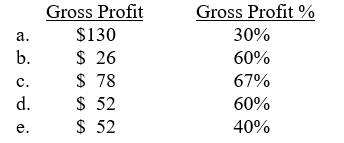

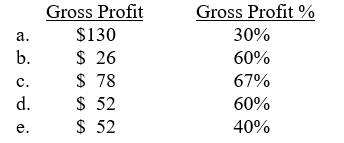

On September 25, 2010, Fox Department Store purchased five bottles of perfume from Bloomington Manufacturers for $39 each. On October 1, 2010, Janet Wyatt purchased two bottles of the perfume from Fox for $65 each. For this sale, Fox's gross profit and gross profit percentage were

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following formulas is correct?

A) Revenues - Gross Profit - Non-Operating Expenses = Net Income

B) Gross Profit - Non-Operating Expenses - Income Tax Expense = Net Income

C) Revenues - Cost of Goods Sold - Non-Operating Expenses - Income Tax Expense = Net Income

D) Revenues - Cost of Goods Sold - Other Operating Expenses - Non-Operating Expenses - Income Tax Expense = Net Income

E) Revenues - Unearned Revenues - Cost of Goods Sold - Non-Operating Expenses - Income Tax Expense = Net Income

A) Revenues - Gross Profit - Non-Operating Expenses = Net Income

B) Gross Profit - Non-Operating Expenses - Income Tax Expense = Net Income

C) Revenues - Cost of Goods Sold - Non-Operating Expenses - Income Tax Expense = Net Income

D) Revenues - Cost of Goods Sold - Other Operating Expenses - Non-Operating Expenses - Income Tax Expense = Net Income

E) Revenues - Unearned Revenues - Cost of Goods Sold - Non-Operating Expenses - Income Tax Expense = Net Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

36

In the U.S., the income generated by

A) sole proprietorships and partnerships is never taxed.

B) corporations is taxed using a graduated scale.

C) sole proprietorships, partnerships, and corporations is taxed using a flat rate.

D) sole proprietorships and partnerships is taxed to the individual stockholders at their personal income tax rates.

E) both a and b are correct.

A) sole proprietorships and partnerships is never taxed.

B) corporations is taxed using a graduated scale.

C) sole proprietorships, partnerships, and corporations is taxed using a flat rate.

D) sole proprietorships and partnerships is taxed to the individual stockholders at their personal income tax rates.

E) both a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

37

The primary purpose of financial reports is to

A) reflect a company's profitability.

B) measure a company's current market value.

C) indicate to users the best organization in which to invest.

D) provide useful information in making economic decisions.

E) reflect a company's ability to generate cash.

A) reflect a company's profitability.

B) measure a company's current market value.

C) indicate to users the best organization in which to invest.

D) provide useful information in making economic decisions.

E) reflect a company's ability to generate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

38

In its simplest form, earnings per share for a company is calculated as

A) gross profit divided by the number of shares of stock held by that company's stockholders.

B) net income divided by the number of shares of stock held by that company's stockholders.

C) net income divided by the number of shares of stock traded for that company on the stock exchange at the end of the company's fiscal year.

D) operating income divided by the number of shares of stock held by that company's stockholders.

E) operating income divided by the number of shares of stock that the company is allowed to sell.

A) gross profit divided by the number of shares of stock held by that company's stockholders.

B) net income divided by the number of shares of stock held by that company's stockholders.

C) net income divided by the number of shares of stock traded for that company on the stock exchange at the end of the company's fiscal year.

D) operating income divided by the number of shares of stock held by that company's stockholders.

E) operating income divided by the number of shares of stock that the company is allowed to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements about the objectives of financial reporting is false?

A) The financial reporting objectives indicate that accrual accounting provides the best information for decision makers and there is no need for information related to cash.

B) Financial reports should provide information that is useful in making investing, lending, and other economic decisions.

C) Financial reports should provide information that is useful to decision makers in predicting the future cash flows of businesses and future cash dividends from those businesses.

D) Financial reports should provide information about the assets and liabilities of businesses and the transactions and other events that have resulted in changes in those assets and liabilities.

E) Statements a and c are false.

A) The financial reporting objectives indicate that accrual accounting provides the best information for decision makers and there is no need for information related to cash.

B) Financial reports should provide information that is useful in making investing, lending, and other economic decisions.

C) Financial reports should provide information that is useful to decision makers in predicting the future cash flows of businesses and future cash dividends from those businesses.

D) Financial reports should provide information about the assets and liabilities of businesses and the transactions and other events that have resulted in changes in those assets and liabilities.

E) Statements a and c are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

40

The concept that states that financial reports should be comprehensible to people who are reasonably perceptive about business and economic activities and are willing to study the information with reasonable diligence is

A) understandability.

B) relevance.

C) reliability.

D) materiality.

E) comparability.

A) understandability.

B) relevance.

C) reliability.

D) materiality.

E) comparability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

41

The most important qualitative characteristic that accounting information should possess is

A) relevance.

B) reliability.

C) accuracy.

D) representation faithfulness.

E) decision usefulness.

A) relevance.

B) reliability.

C) accuracy.

D) representation faithfulness.

E) decision usefulness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about relevant accounting information is true?

A) Predictive value helps decision makers confirm or correct earlier expectations.

B) Predictive value implies that accounting data should portray the true nature of a business's economic resources, obligations, and transactions.

C) Relevant information is provided to decision makers in a time frame that will influence their decisions.

D) Feedback value allows a user to forecast future occurrences from a current situation.

E) Information that is provided to stockholders within one month of its occurrence would always be considered timely.

A) Predictive value helps decision makers confirm or correct earlier expectations.

B) Predictive value implies that accounting data should portray the true nature of a business's economic resources, obligations, and transactions.

C) Relevant information is provided to decision makers in a time frame that will influence their decisions.

D) Feedback value allows a user to forecast future occurrences from a current situation.

E) Information that is provided to stockholders within one month of its occurrence would always be considered timely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

43

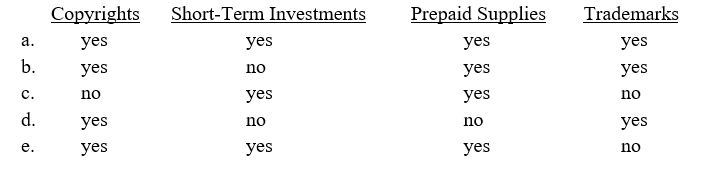

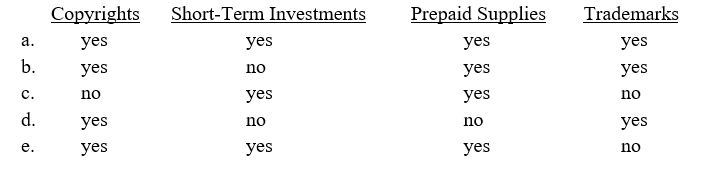

Which of the following characteristics make accounting information relevant?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements about reliable accounting information is true?

A) Reliable accounting information is timely and has predictive and feedback value.

B) Neutrality implies that accounting data should portray the true nature of a business's economic resources, obligations, and transactions.

C) A set of financial statements that contains only a balance sheet and an income statement would be considered representationally faithful.

D) Verifiability means that the accounting data could be duplicated by multiple people.

E) Reliable accounting information is completely free from errors.

A) Reliable accounting information is timely and has predictive and feedback value.

B) Neutrality implies that accounting data should portray the true nature of a business's economic resources, obligations, and transactions.

C) A set of financial statements that contains only a balance sheet and an income statement would be considered representationally faithful.

D) Verifiability means that the accounting data could be duplicated by multiple people.

E) Reliable accounting information is completely free from errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

45

Reliability in accounting indicates the possession by information of which of the following traits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

46

The concept indicating that specific items of accounting information are important is

A) understandability.

B) relevance.

C) reliability.

D) materiality.

E) comparability.

A) understandability.

B) relevance.

C) reliability.

D) materiality.

E) comparability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

47

The situation of accountants preparing meaningful financial reports for on-going businesses by dividing their lives into reporting intervals of equal length reflects the

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rules.

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

48

The requirement for publicly owned companies to issue quarterly and annual financial statements is mandated by the

A) Securities and Exchange Commission.

B) Financial Accounting Standards Board.

C) New York Stock Exchange.

D) Internal Revenue Service.

E) American Institute of CPAs.

A) Securities and Exchange Commission.

B) Financial Accounting Standards Board.

C) New York Stock Exchange.

D) Internal Revenue Service.

E) American Institute of CPAs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

49

In the U.S., the historical cost principle

A) states that all assets be shown on the financial statements at the company's original cost.

B) allows assets to be shown on the financial statements at the most reliable financial value.

C) allows the balance sheet amount of stockholders' equity to reflect the organization's market value.

D) is not affected by the conservatism principle.

E) provides values that are more verifiable and less subject to estimation or opinion than current values.

A) states that all assets be shown on the financial statements at the company's original cost.

B) allows assets to be shown on the financial statements at the most reliable financial value.

C) allows the balance sheet amount of stockholders' equity to reflect the organization's market value.

D) is not affected by the conservatism principle.

E) provides values that are more verifiable and less subject to estimation or opinion than current values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

50

Tipple Co. is located in southern Mississippi and the property value of the company's headquarters was reduced after a hurricane uprooted all the trees and caused significant erosion. Tipple Co. should

A) nake no adjustments to its financial statements because of the historical cost principle.

B) nake no adjustments to its financial statements but provide full disclosure of the incident in the footnotes.

C) write up the property value for the planting of new trees based on the going concern principle.

D) write down the property value to fair market value based on the matching principle.

E) write down the property value to fair market value based on the conservatism principle.

A) nake no adjustments to its financial statements because of the historical cost principle.

B) nake no adjustments to its financial statements but provide full disclosure of the incident in the footnotes.

C) write up the property value for the planting of new trees based on the going concern principle.

D) write down the property value to fair market value based on the matching principle.

E) write down the property value to fair market value based on the conservatism principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following concepts is of highest importance in recording asset values in recessionary times?

A) Unit of measurement

B) Historical cost

C) Going concern

D) Conservatism

E) Materiality

A) Unit of measurement

B) Historical cost

C) Going concern

D) Conservatism

E) Materiality

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

52

The concept that mandates that businesses use a common unit in accounting for their transactions is the

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

53

The belief that an entity will continue to operate, unless there is evidence to the contrary, is the

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

A) accounting period concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

54

Requiring the transactions of a business be accounted for separately from the personal transactions of its owners reflects the

A) entity concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

A) entity concept.

B) historical cost principle.

C) unit of measurement concept.

D) going concern assumption.

E) revenue recognition rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

55

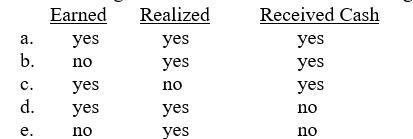

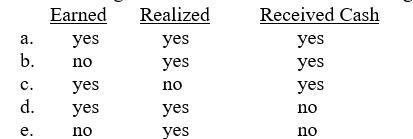

Before being recorded in a business's accounting records, revenue should be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

56

Tyler Tours provides transportation services and requires clients to book trips at least one month in advance. Tyler Tours bills its customers on the first day of the month and requires payments to be made on the last day of the month. When should Tyler Tours recognize revenue from its services?

A) On the first day of the month of billing

B) On the last day of the month of billing

C) When customer places order

D) When customers travel

E) When customers pay for their trips

A) On the first day of the month of billing

B) On the last day of the month of billing

C) When customer places order

D) When customers travel

E) When customers pay for their trips

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

57

O'Connor Inc. provides apartments to local university students under different revenue packages. One popular package allows students to pay the annual rent in advance and take a 25% discount over the monthly rate. O'Connor should recognize the related revenue for students who choose this package

A) when the cash is collected at the beginning of the contract period.

B) at the end of the year after the contract period has ended.

C) evenly over the contract period.

D) when the contract is signed by the student.

E) for the amount received at the beginning of the contract period and a 25 percent additional revenue amount each month of the contract period.

A) when the cash is collected at the beginning of the contract period.

B) at the end of the year after the contract period has ended.

C) evenly over the contract period.

D) when the contract is signed by the student.

E) for the amount received at the beginning of the contract period and a 25 percent additional revenue amount each month of the contract period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

58

An internet service provider requires customers to prepay for six months' service. On August 1, 2010 Ricky Roberts paid $480 for internet service for the next six-month period. On August 1, how will the internet service record the amount received from Roberts?

A) Prepaid expense

B) Unearned revenue

C) Accrued revenue

D) Earned revenue

E) Long-term liability

A) Prepaid expense

B) Unearned revenue

C) Accrued revenue

D) Earned revenue

E) Long-term liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements about expense recognition rules is true?

A) Expenses may be recognized in any period, including those periods unrelated to the related revenue recognition.

B) To recognize an expense, a company must either pay out cash or incur a revenue.

C) When no direct cause and effect can be determined and no clear expected benefit time frame can be identified, an expenditure should be recorded as an asset and remain on a business's books indefinitely.

D) Cash need not be paid by a company for an item to be recognized as an expense.

E) The matching principle indicates that all expenses can be clearly associated with particular revenues.

A) Expenses may be recognized in any period, including those periods unrelated to the related revenue recognition.

B) To recognize an expense, a company must either pay out cash or incur a revenue.

C) When no direct cause and effect can be determined and no clear expected benefit time frame can be identified, an expenditure should be recorded as an asset and remain on a business's books indefinitely.

D) Cash need not be paid by a company for an item to be recognized as an expense.

E) The matching principle indicates that all expenses can be clearly associated with particular revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

60

The basis that reflects a transaction's economic impact, regardless of whether cash is involved, is the

A) revenue recognition basis of accounting.

B) cash basis of accounting.

C) tax basis of accounting.

D) fair value basis of accounting.

E) accrual basis of accounting.

A) revenue recognition basis of accounting.

B) cash basis of accounting.

C) tax basis of accounting.

D) fair value basis of accounting.

E) accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

61

In March 2010, a company salesperson sold some inventory and would receive a commission on those sales in April. The commission should be recognized as

A) an expense in April under the accrual principle.

B) an expense in April under the matching principle.

C) an expense in March under the matching principle.

D) an asset until April under the going concern principle.

E) a dividend in March under the entity principle.

A) an expense in April under the accrual principle.

B) an expense in April under the matching principle.

C) an expense in March under the matching principle.

D) an asset until April under the going concern principle.

E) a dividend in March under the entity principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

62

During 2010, a high-tech company spent $1,000,000 on research and development; however, no new products have been completed as of the end of the year. This amount will be shown in the company's financial statements as a(an)

A) immediate expense under the expense recognition rules.

B) long-term intangible asset until a patentable item is produced.

C) inventory in the current asset category of the balance sheet.

D) long-term investment.

E) part of cost of goods sold on the income statement.

A) immediate expense under the expense recognition rules.

B) long-term intangible asset until a patentable item is produced.

C) inventory in the current asset category of the balance sheet.

D) long-term investment.

E) part of cost of goods sold on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

63

Requiring a company to include all information necessary for a thorough understanding of a company's financial affairs in its financial statements or accompanying footnotes is an application of the

A) entity concept.

B) historical cost principle.

C) matching principle.

D) going concern assumption.

E) full disclosure principle.

A) entity concept.

B) historical cost principle.

C) matching principle.

D) going concern assumption.

E) full disclosure principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

64

The accounting system

A) provides a systematic approach to collecting, processing, and communicating financial information to decision makers.

B) provides a means for companies to increase the market price of their common stock on the stock exchanges.

C) is comprised of T-accounts and financial statements.

D) uses a general ledger to record all transactions in chronological order.

E) keeps track of all transactions engaged in by a business organization.

A) provides a systematic approach to collecting, processing, and communicating financial information to decision makers.

B) provides a means for companies to increase the market price of their common stock on the stock exchanges.

C) is comprised of T-accounts and financial statements.

D) uses a general ledger to record all transactions in chronological order.

E) keeps track of all transactions engaged in by a business organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

65

A chart of accounts is

A) a T-account containing all business assets.

B) a numerical listing of all the accounts of a business.

C) prepared from the transactions in the general journal.

D) the same accounting document as the general ledger.

E) the listing of the financial statements that must be prepared by a business.

A) a T-account containing all business assets.

B) a numerical listing of all the accounts of a business.

C) prepared from the transactions in the general journal.

D) the same accounting document as the general ledger.

E) the listing of the financial statements that must be prepared by a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

66

Each transaction of a business is initially recorded in a

A) chart of accounts.

B) general journal.

C) general ledger.

D) set of financial statements.

E) none of the above

A) chart of accounts.

B) general journal.

C) general ledger.

D) set of financial statements.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

67

An accounting record that contains all the transactional information for the individual accounts for a business is a

A) balance sheet.

B) chart of accounts.

C) general journal.

D) general ledger.

E) set of financial statements.

A) balance sheet.

B) chart of accounts.

C) general journal.

D) general ledger.

E) set of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

68

A trial balance is prepared at the end of the accounting period

A) and lists all accounts contained in the chart of accounts.

B) and lists all general ledger accounts and their balances.

C) and, if debits equal credits, verifies that the accounting records are correct.

D) to determine that revenues and expenses are equal.

E) to determine that the balance sheet is in balance.

A) and lists all accounts contained in the chart of accounts.

B) and lists all general ledger accounts and their balances.

C) and, if debits equal credits, verifies that the accounting records are correct.

D) to determine that revenues and expenses are equal.

E) to determine that the balance sheet is in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

69

Businesses that allow their customers to charge their purchases on national credit cards usually collect the credit card charges, less a service fee, daily from the credit card companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

70

Companies often invest in the stocks or bonds of another company so that they can receive a stream of income from that investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

71

An asset's book value minus its accumulated depreciation is equal to its historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

72

Many companies that have valuable patents do not show a value for those patents in the asset section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

73

Businesses may recognize money received in advance of selling a profit or performing a service in current period operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

74

The par value of a corporation's stock often has little relationship to its market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

75

A manufacturing company that charges employees a nominal amount to park in a close-in parking garage would report those parking fees as operating revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

76

Corporations report earnings per share each period to assist stockholders in determining the profit that period that is attributable to their ownership interest in the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

77

The SEC's "plain English" rules apply to all financial statements submitted to that agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

78

Usefulness in decision making is the most important qualitative characteristic that accounting information should possess.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

79

To qualify as useful to decision makers, accounting information should be understandable, relevant, and reliable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

80

Verifiability means that the accounting information presented can be checked and confirmed for accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck