Deck 1: An Introduction to the Role of Accounting in the Business World

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/73

العب

ملء الشاشة (f)

Deck 1: An Introduction to the Role of Accounting in the Business World

1

A business attempts to earn a profit by

A) selling goods or services for more than they are worth.

B) performing services at cost.

C) selling goods or services for more than they cost to buy, make, or perform.

D) distributing cash to stockholders and investors.

E) selling goods or services that satisfy the needs of investors and creditors.

A) selling goods or services for more than they are worth.

B) performing services at cost.

C) selling goods or services for more than they cost to buy, make, or perform.

D) distributing cash to stockholders and investors.

E) selling goods or services that satisfy the needs of investors and creditors.

selling goods or services for more than they cost to buy, make, or perform.

2

Businesses are typically categorized as

A) industrial, service, and not-for-profit companies.

B) service, manufacturing, and limited liability companies.

C) for-profit and not-for-profit.

D) manufacturing, merchandising, and service companies.

E) wholesalers, retailers, and manufacturers.

A) industrial, service, and not-for-profit companies.

B) service, manufacturing, and limited liability companies.

C) for-profit and not-for-profit.

D) manufacturing, merchandising, and service companies.

E) wholesalers, retailers, and manufacturers.

manufacturing, merchandising, and service companies.

3

A _______ acts as a middleman and resells goods to others.

A) limited liability company

B) service company

C) Sub S corporation

D) partnership

E) wholesaler

A) limited liability company

B) service company

C) Sub S corporation

D) partnership

E) wholesaler

wholesaler

4

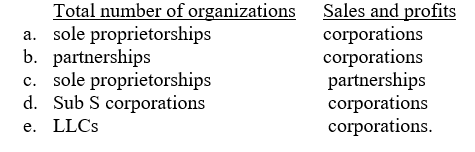

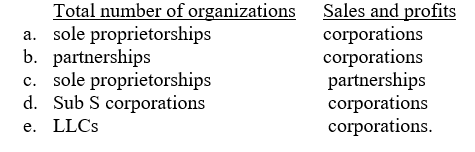

Which of the following are the most common forms of business organization in the U.S. in terms of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

5

The profits of ___ are taxed to the owners as individuals; the business organization itself pays no taxes.

A) sole proprietorships and corporations

B) sole proprietorships and partnerships

C) partnerships and corporations

D) Sub S corporations and corporations

E) LLCs and corporations

A) sole proprietorships and corporations

B) sole proprietorships and partnerships

C) partnerships and corporations

D) Sub S corporations and corporations

E) LLCs and corporations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

6

Each owner of the Swift Bakery pays taxes on her/her share of the firm's net income and may be held personally liable for the firm's debts. The Swift Family Bakery is a

A) sole proprietorship

B) partnership

C) corporation

D) LLC

E) either a or b.

A) sole proprietorship

B) partnership

C) corporation

D) LLC

E) either a or b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

7

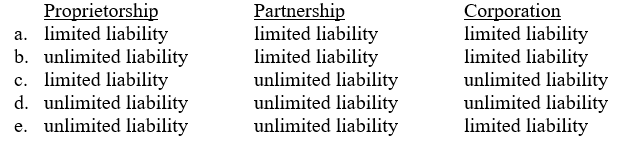

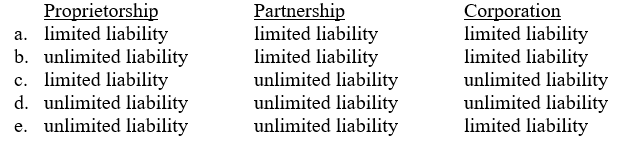

Owners of each type of the following organizations have what type of liability for debts of that organization?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

8

Limited liability means that owners are limited in their responsibility for organizational debts to their

A) personal assets.

B) personal net worth.

C) current organizational investment.

D) original organizational investment minus the income taxes paid on the dividends they have received.

E) current organizational investment plus the dividends they have received from the organization.

A) personal assets.

B) personal net worth.

C) current organizational investment.

D) original organizational investment minus the income taxes paid on the dividends they have received.

E) current organizational investment plus the dividends they have received from the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

9

Joe and Mia are 50:50 partners in the J&M Shop. The Shop has experienced financial difficulty over the past three years. After liquidating all its assets, the Shop still owes $15,000 to creditors. Joe has $20,000 of net worth and Mia has $5,000 of net worth. Creditors can collect

A) $10,000 from Joe and $5,000 from Mia.

B) $15,000 from Joe and $5,000 from Mia.

C) $15,000 from Joe and $0 from Mia.

D) $0 from Joe and $0 from Mia (since the partnership has no assets).

E) either a or c.

A) $10,000 from Joe and $5,000 from Mia.

B) $15,000 from Joe and $5,000 from Mia.

C) $15,000 from Joe and $0 from Mia.

D) $0 from Joe and $0 from Mia (since the partnership has no assets).

E) either a or c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

10

Laurie Boone is forming a new business that will protect her from unlimited liability. She does not want to claim her personal and business information together on the same tax return. The best form of business organization for Boone's purposes is a

A) sole proprietorship.

B) partnership.

C) corporation.

D) LLC

E) either c or d

A) sole proprietorship.

B) partnership.

C) corporation.

D) LLC

E) either c or d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements about corporations is true?

A) Individual owners of a corporation are called directors.

B) A corporation may have any number of owners, as long as that number is consistent with the laws of the state of incorporation.

C) A corporation has few of the same rights and duties as an individual.

D) In the event of a lawsuit, an individual owner of a corporation may be held liable for more than his or her current investment.

E) One owner of a corporation could be forced to pay all the corporation's debts if the other owners were unable to pay their "fair" share.

A) Individual owners of a corporation are called directors.

B) A corporation may have any number of owners, as long as that number is consistent with the laws of the state of incorporation.

C) A corporation has few of the same rights and duties as an individual.

D) In the event of a lawsuit, an individual owner of a corporation may be held liable for more than his or her current investment.

E) One owner of a corporation could be forced to pay all the corporation's debts if the other owners were unable to pay their "fair" share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

12

The primary function of accounting is to provide

A) quantitative information about the transactions of a business so that investors can determine future profitability.

B) financial information about a business so determine the proper amount of taxes to be paid by a business.

C) financial information about a business so that users can make economic decisions.

D) qualitative and quantitative information about a business so that users can predict future stock prices.

E) information about the assets of a business so that users know the worth of a business enterprise.

A) quantitative information about the transactions of a business so that investors can determine future profitability.

B) financial information about a business so determine the proper amount of taxes to be paid by a business.

C) financial information about a business so that users can make economic decisions.

D) qualitative and quantitative information about a business so that users can predict future stock prices.

E) information about the assets of a business so that users know the worth of a business enterprise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

13

An internal user of accounting information is

A) one of the company's investors.

B) a stock market analyst who is selling the company's securities.

C) the Internal Revenue Service agent auditing the company's tax return.

D) the company's purchasing agent.

E) both a and d.

A) one of the company's investors.

B) a stock market analyst who is selling the company's securities.

C) the Internal Revenue Service agent auditing the company's tax return.

D) the company's purchasing agent.

E) both a and d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not an internal use of accounting information?

A) An internal auditor analyzes current and prior year balance sheet activity for any unusual trends or variances.

B) The sales manager of a major department chain uses sales revenue information to calculate sales commissions.

C) A Chief Financial Officer uses an income statement to identify opportunities to reduce total operating expenses.

D) The Securities and Exchange Commission reviews an organization's financial statements for fraudulent activity.

E) The marketing department of an internet retailer uses sales revenue information, aggregated by state, to develop new marketing strategies.

A) An internal auditor analyzes current and prior year balance sheet activity for any unusual trends or variances.

B) The sales manager of a major department chain uses sales revenue information to calculate sales commissions.

C) A Chief Financial Officer uses an income statement to identify opportunities to reduce total operating expenses.

D) The Securities and Exchange Commission reviews an organization's financial statements for fraudulent activity.

E) The marketing department of an internet retailer uses sales revenue information, aggregated by state, to develop new marketing strategies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

15

The accounting information used by internal decision makers

A) is quantitative and is not reported on external financial statements.

B) is monetary and is reported on external financial statements.

C) may be monetary or nonmonetary and is reported on financial statements using generally accepted accounting principles.

D) may be monetary or nonmonetary, may be in a variety of formats, and may or may not be reported on financial statements.

E) may be in a variety of formats, is not reported on financial statements, and is presented in a standardized format.

A) is quantitative and is not reported on external financial statements.

B) is monetary and is reported on external financial statements.

C) may be monetary or nonmonetary and is reported on financial statements using generally accepted accounting principles.

D) may be monetary or nonmonetary, may be in a variety of formats, and may or may not be reported on financial statements.

E) may be in a variety of formats, is not reported on financial statements, and is presented in a standardized format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

16

An external user of accounting information is

A) the loan officer at the company's bank.

B) an internal auditor of the company.

C) a manager at one of the company's branch locations.

D) a company's payroll manager.

E) both a and c.

A) the loan officer at the company's bank.

B) an internal auditor of the company.

C) a manager at one of the company's branch locations.

D) a company's payroll manager.

E) both a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not an external use of accounting information?

A) The Internal Revenue Service reviews the taxpaying company's annual return.

B) As part of a company's annual employee evaluation process, the human resources manager reviews payroll information to determine each employee's raise for the upcoming year and annual bonus.

C) A loan officer uses a customer's recent financial statements to determine whether to approve that customer's loan application.

D) A potential investor reviews an organization's most recent annual report to determine whether to invest in that company.

E) A supplier reviews a new customer's credit application to determine whether that customer is credit-worthy.

A) The Internal Revenue Service reviews the taxpaying company's annual return.

B) As part of a company's annual employee evaluation process, the human resources manager reviews payroll information to determine each employee's raise for the upcoming year and annual bonus.

C) A loan officer uses a customer's recent financial statements to determine whether to approve that customer's loan application.

D) A potential investor reviews an organization's most recent annual report to determine whether to invest in that company.

E) A supplier reviews a new customer's credit application to determine whether that customer is credit-worthy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

18

The rule-making authority within the U.S. that is responsible for promulgating new financial accounting standards is the

A) Federal Accounting Standards Board.

B) American Institute of Certified Public Accountants.

C) International Accounting Standards Board.

D) Institute of Management Accountants.

E) Financial Accounting Standards Board.

A) Federal Accounting Standards Board.

B) American Institute of Certified Public Accountants.

C) International Accounting Standards Board.

D) Institute of Management Accountants.

E) Financial Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

19

The FASB is a

A) private sector body that is funded by public accounting firms, industry, and the financial community.

B) private sector body that is funded by public accounting firms.

C) governmental entity that is funded by the Securities and Exchange Commission.

D) public sector body that is funded by taxpayers.

E) private sector body that is funded by corporate members of the New York Stock Exchange.

A) private sector body that is funded by public accounting firms, industry, and the financial community.

B) private sector body that is funded by public accounting firms.

C) governmental entity that is funded by the Securities and Exchange Commission.

D) public sector body that is funded by taxpayers.

E) private sector body that is funded by corporate members of the New York Stock Exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

20

The four primary financial statements included in corporate annual reports are the

A) Balance Sheet, Income Statement, Statement of Retained Earnings, and Statement of Working Capital.

B) Income Statement, Statement of Assets, Cash Flow Statement, and Statement of Fund Balance.

C) Statement of Equity, Statement of Income, Statement of Cash Flows, and Balance Sheet.

D) Balance Sheet, Income Statement, Statement of Stockholders' Equity, and Statement of Cash Flows.

E) Statement of Fund Balance, Statement of Equity, Balance Sheet, and Income Statement.

A) Balance Sheet, Income Statement, Statement of Retained Earnings, and Statement of Working Capital.

B) Income Statement, Statement of Assets, Cash Flow Statement, and Statement of Fund Balance.

C) Statement of Equity, Statement of Income, Statement of Cash Flows, and Balance Sheet.

D) Balance Sheet, Income Statement, Statement of Stockholders' Equity, and Statement of Cash Flows.

E) Statement of Fund Balance, Statement of Equity, Balance Sheet, and Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

21

The financial statement that summarizes the assets, liabilities, and stockholders' equity of an entity at a specific point in time is the

A) Balance Sheet.

B) Income Statement.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

A) Balance Sheet.

B) Income Statement.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

22

The balance sheet is also called the statement of

A) stockholders' equity.

B) resources and debts.

C) profitability.

D) owners' capital.

E) financial position.

A) stockholders' equity.

B) resources and debts.

C) profitability.

D) owners' capital.

E) financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

23

Respectively, ___ are resources that an organization owns; ___ is/are debts that an organization owes; and ___ is/are amounts that owners have contributed and what the entity has earned for them.

A) assets; liabilities; revenues

B) assets; liabilities; stockholders' equity

C) assets; stockholders' equity; liabilities

D) revenues; liabilities; expenses

E) revenues; liabilities; stockholders' equity

A) assets; liabilities; revenues

B) assets; liabilities; stockholders' equity

C) assets; stockholders' equity; liabilities

D) revenues; liabilities; expenses

E) revenues; liabilities; stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

24

At December 31, 2009, Rob's Home Store has $100,000 of assets and $40,000 of liabilities, and $60,000 of stockholders' equity. On January 15, 2010, Rob's purchased $30,000 of assets by incurring a liability. Rob's total assets, liabilities, and stockholders' equity after the purchase are, respectively,

A) $100,000; $40,000; $60,000.

B) $100,000; $60,000; $40,000.

C) $130,000; $40,000; $70,000.

D) $130,000; $60,000; $70,000.

E) $130,000; $70,000; $60,000.

A) $100,000; $40,000; $60,000.

B) $100,000; $60,000; $40,000.

C) $130,000; $40,000; $70,000.

D) $130,000; $60,000; $70,000.

E) $130,000; $70,000; $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

25

At December 31, 2009, Itah Inc. has $80,000 of assets and $45,000 of stockholders' equity. On January 5, 2010, the company bought $25,000 of assets by incurring a liability. Itah's liabilities and stockholders' equity after the purchase are, respectively,

A) $0 and $15,000.

B) $0 and $70,000.

C) $60,000 and $20,000.

D) $60,000 and $45,000.

E) $105,000 and $20,000.

A) $0 and $15,000.

B) $0 and $70,000.

C) $60,000 and $20,000.

D) $60,000 and $45,000.

E) $105,000 and $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

26

At March 31, 2010, Gaffer's Department Store, had $1,000,000 of assets and $325,000 of liabilities. On April 10, 2010, Gaffer's paid off $125,000 of its liabilities. Total stockholders' equity at April 10, 2010, after the payment, is

A) $ 550,000.

B) $ 600,000.

C) $ 675,000.

D) $1,000,000.

E) $1,125,000.

A) $ 550,000.

B) $ 600,000.

C) $ 675,000.

D) $1,000,000.

E) $1,125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

27

The financial statement that summarizes a business's revenues and expenses for a specific time period is the

A) Balance Sheet.

B) Income Statement.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

A) Balance Sheet.

B) Income Statement.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

28

Respectively, ___ generally result from selling merchandise or providing services that a company has chosen for its primary activity and ___ are legitimate costs of doing business.

A) revenues; expenses

B) expenses; revenues

C) assets; expenses

D) revenues; liabilities

E) revenues; dividends

A) revenues; expenses

B) expenses; revenues

C) assets; expenses

D) revenues; liabilities

E) revenues; dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

29

Gadsden Lawn Service began operations on January 1, 2010, when Doug Gadsden contributed $100,000 of cash and equipment. During the year, the company earned $200,000 of revenue, incurred $120,000 of expenses, and paid $10,000 of dividends. Total owner's equity at December 31, 2010 is

A) $ 0.

B) $100,000.

C) $170,000.

D) $180,000.

E) $190,000.

A) $ 0.

B) $100,000.

C) $170,000.

D) $180,000.

E) $190,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

30

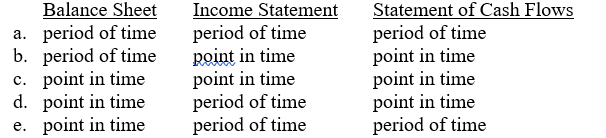

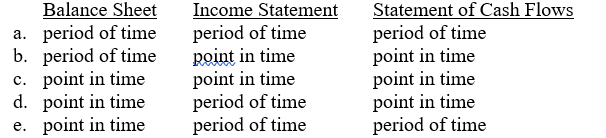

Which of the following indicates the dating of the specified financial statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements reveals how a business generated and spent cash during a given accounting period?

A) Balance Sheet

B) Income Statement

C) Statement of Stockholders' Equity

D) Statement of Cash Flows

E) Statement of Fund Balance

A) Balance Sheet

B) Income Statement

C) Statement of Stockholders' Equity

D) Statement of Cash Flows

E) Statement of Fund Balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

32

Respectively, ___ activities are cash flows earned by providing a product or service; ___ activities are cash flows related to the buying and selling of long-term assets; and ___ activities are cash flows related to obtaining and repaying additional funds from creditors and investors.

A) operating; investing; financing

B) operating; financing; investing

C) investing; operating; financing

D) financing; operating; investing

E) financing; investing; operating

A) operating; investing; financing

B) operating; financing; investing

C) investing; operating; financing

D) financing; operating; investing

E) financing; investing; operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

33

Successful companies should generally produce the majority of their cash flow from

A) investing activities.

B) financing activities.

C) operating activities.

D) stock activities.

E) production activities.

A) investing activities.

B) financing activities.

C) operating activities.

D) stock activities.

E) production activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

34

The statement that reconciles the dollar amounts of a corporation's ownership equity components from the beginning to the end of the accounting period is the

A) Statement of Revenues and Expenses.

B) Statement of Retained Earnings.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

A) Statement of Revenues and Expenses.

B) Statement of Retained Earnings.

C) Statement of Stockholders' Equity.

D) Statement of Cash Flows.

E) Statement of Fund Balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

35

The ending balance of cash appears on the

A) income statement for the year, the year-end balance sheet, and the statement of cash flows.

B) beginning-of-the-year balance sheet, the statement of cash flows, and the year-end balance sheet.

C) statement of stockholders' equity, the statement of cash flows, and the year-end balance sheet.

D) income statement and the year-end balance sheet.

E) statement of cash flows and the year-end balance sheet.

A) income statement for the year, the year-end balance sheet, and the statement of cash flows.

B) beginning-of-the-year balance sheet, the statement of cash flows, and the year-end balance sheet.

C) statement of stockholders' equity, the statement of cash flows, and the year-end balance sheet.

D) income statement and the year-end balance sheet.

E) statement of cash flows and the year-end balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following might not typically be located in the financial statement footnotes?

A) Specific accounting methods used

B) Significant accounting policies

C) Key assumptions about estimates

D) Specific internal business strategies

E) Descriptions of pending lawsuits

A) Specific accounting methods used

B) Significant accounting policies

C) Key assumptions about estimates

D) Specific internal business strategies

E) Descriptions of pending lawsuits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

37

An accountant employed in public accounting is often a(an)

A) controller.

B) cost analyst.

C) external auditor.

D) financial analyst.

E) internal auditor.

A) controller.

B) cost analyst.

C) external auditor.

D) financial analyst.

E) internal auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

38

The most important professional service provided by large public accounting firms is

A) auditing organizational financial statements.

B) preparation of organizational financial statements.

C) developing tax regulations for business enterprises.

D) projecting future prices of an organization's stock.

E) all of the above.

A) auditing organizational financial statements.

B) preparation of organizational financial statements.

C) developing tax regulations for business enterprises.

D) projecting future prices of an organization's stock.

E) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements is false?

A) Controllers are responsible for preparing financial statements, while external auditors are responsible for issuing opinions about financial statements.

B) A principal objective of an independent audit is to determine whether an entity's financial statements have been prepared in accordance with generally accepted accounting principles (GAAP).

C) Both internal and external auditors share the same audit objectives and degree of independence.

D) If a company's financial statements have been prepared in accordance with GAAP, those financial statements are presumed to fairly reflect company's financial affairs.

E) Independent examination of a set of financial statements increases third-party confidence in those financial statements.

A) Controllers are responsible for preparing financial statements, while external auditors are responsible for issuing opinions about financial statements.

B) A principal objective of an independent audit is to determine whether an entity's financial statements have been prepared in accordance with generally accepted accounting principles (GAAP).

C) Both internal and external auditors share the same audit objectives and degree of independence.

D) If a company's financial statements have been prepared in accordance with GAAP, those financial statements are presumed to fairly reflect company's financial affairs.

E) Independent examination of a set of financial statements increases third-party confidence in those financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

40

The authenticity of the information contained in the financial statements is the responsibility of the

A) external auditor.

B) organization's management.

C) Securities and Exchange Commission.

D) Internal Revenue Service.

E) company's cost analyst(s).

A) external auditor.

B) organization's management.

C) Securities and Exchange Commission.

D) Internal Revenue Service.

E) company's cost analyst(s).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

41

The primary responsibility of an external auditor is to determine whether

A) all financial transactions of the organization have been properly recorded.

B) management has committed fraud in preparing the financial statements.

C) assess compliance by the organization's employees with company policies and procedures.

D) the organization's financial statements are fairly presented.

E) the organization has properly recorded and paid its tax liabilities to the appropriate taxing authorities.

A) all financial transactions of the organization have been properly recorded.

B) management has committed fraud in preparing the financial statements.

C) assess compliance by the organization's employees with company policies and procedures.

D) the organization's financial statements are fairly presented.

E) the organization has properly recorded and paid its tax liabilities to the appropriate taxing authorities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about accounting certifications is false?

A) The term "accountant" is a generic term that can be applied to anyone who works in the field of accounting.

B) Three common accounting certifications include the CPA, CIA, and CMA.

C) Obtaining accounting certifications provides accountants with additional job opportunities.

D) For most certifications, candidates are required to pass standardized examinations and meet a minimum experience requirement.

E) Earning one certification prohibits an individual from seeking other certifications.

A) The term "accountant" is a generic term that can be applied to anyone who works in the field of accounting.

B) Three common accounting certifications include the CPA, CIA, and CMA.

C) Obtaining accounting certifications provides accountants with additional job opportunities.

D) For most certifications, candidates are required to pass standardized examinations and meet a minimum experience requirement.

E) Earning one certification prohibits an individual from seeking other certifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements about the Securities and Exchange Commission (SEC) is false?

A) The SEC assesses the investment quality of securities issued by the companies that it regulates and prohibits the sale of highly speculative securities.

B) Congress established the SEC to deter abusive accounting and financial reporting practices that contributed to the 1929 stock market collapse.

C) Entities that sell their securities on an interstate basis are known as "publicly owned entities."

D) The SEC closely monitors the accounting profession's rule-making processes and has the authority to override any new rules issued by the FASB to the extent that those rules apply to publicly owned entities.

E) The SEC ensures that publicly owned companies provide third parties with sufficient information to make informed economic decisions regarding the securities these firms sell.

A) The SEC assesses the investment quality of securities issued by the companies that it regulates and prohibits the sale of highly speculative securities.

B) Congress established the SEC to deter abusive accounting and financial reporting practices that contributed to the 1929 stock market collapse.

C) Entities that sell their securities on an interstate basis are known as "publicly owned entities."

D) The SEC closely monitors the accounting profession's rule-making processes and has the authority to override any new rules issued by the FASB to the extent that those rules apply to publicly owned entities.

E) The SEC ensures that publicly owned companies provide third parties with sufficient information to make informed economic decisions regarding the securities these firms sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

44

The U.S. Congress passed which of the following legislative acts to enhance the accuracy and reliability of corporate financial reporting, strengthen corporate governance, and improve public accounting regulation?

A) Public Company Accounting Oversight Act

B) Financial Accounting Standards Responsibility Act

C) Sarbanes-Oxley Act

D) IASB Conformity Act

E) Securities and Exchange Act

A) Public Company Accounting Oversight Act

B) Financial Accounting Standards Responsibility Act

C) Sarbanes-Oxley Act

D) IASB Conformity Act

E) Securities and Exchange Act

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

45

The two types of merchandising companies are wholesalers and retailers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

46

Wholesalers typically sell directly to consumers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

47

In a corporation, stockholders have limited liability with respect to the debts of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

48

Taxes associated with a corporation are combined with the stockholders' personal taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

49

Sole proprietorship and partnership organizations do not pay taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

50

Accounting provides quantitative information about economic entities that is intended to be useful in making economic decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

51

The form and content of financial statements are specified by generally accepted auditing principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Federal Accounting Standards Board is the primary accounting rule-making authority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

53

The balance sheet equation for a corporation can be expressed as assets - liabilities = stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

54

For a profitable corporation, stockholders' equity is equal to the amounts contributed by investors plus the net revenues earned by the organization since its inception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

55

Expenses can decrease assets or increase liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

56

A net loss decreases a corporation's assets and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

57

In any given period, a company's cash flow from operating activities is directly correlated with its net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

58

The ending cash balance per the statement of cash flows should agree with the cash balance per the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

59

The investing activities section of the statement of cash flows provides information on the amounts invested by stockholders into the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

60

The net income shown on the income statement is equal to the ending equity total on the statement of stockholder's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

61

Footnotes to the financial statements provide crucial information that should be used by readers to make informed decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

62

The most important characteristic that differentiates an internal auditor from an external auditor is independence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

63

The principal objective of an external audit is to determine if the financial statements show correct information about the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

64

An independent, external auditor's unqualified audit opinion indicates that no material misstatements exist within a set of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

65

The most common reason for an audit to uncover financial statement errors is management fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

66

Certified public accountants (CPAs) work in both public and private accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Securities and Exchange Commission regulates the sale and subsequent trading of stocks of all U.S. corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

68

Through its extensive oversight, the Securities and Exchange Commission prohibits the sale of highly speculative securities in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

69

The Public Company Accounting Oversight Board is the governmental equivalent of the Financial Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

70

International financial accounting standards and U.S. financial accounting standards are in the process of converging to create global consistency in accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

71

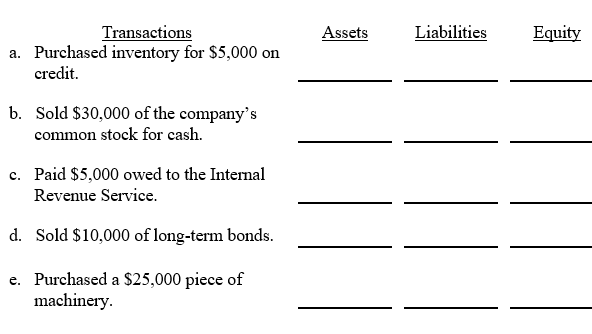

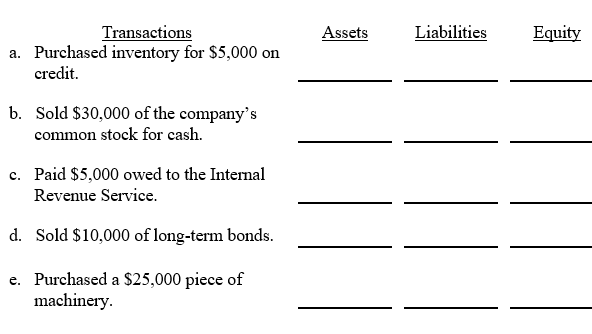

During 2010, Green Corporation incurred the following transactions.

Required:

Analyze the effects of each of the following transactions on Green Corporation's assets, liabilities, and stockholders' equity. Identify increases with a "+" and decreases with a "-". Identify no effect with a "0".

Required:

Analyze the effects of each of the following transactions on Green Corporation's assets, liabilities, and stockholders' equity. Identify increases with a "+" and decreases with a "-". Identify no effect with a "0".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

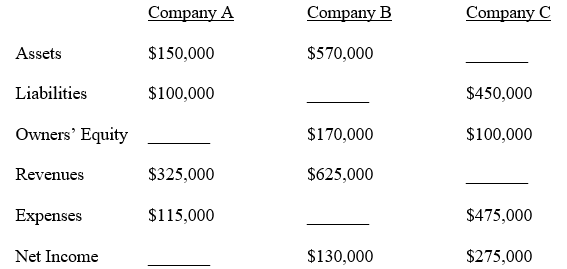

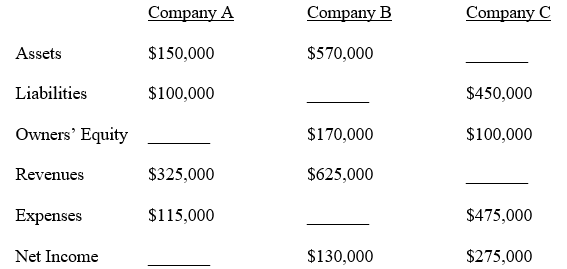

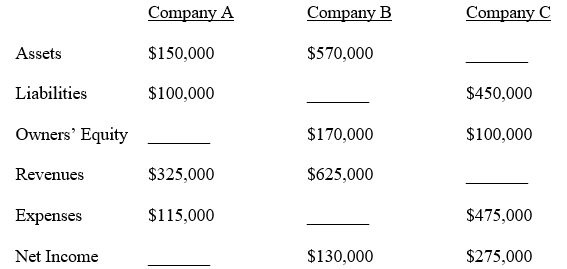

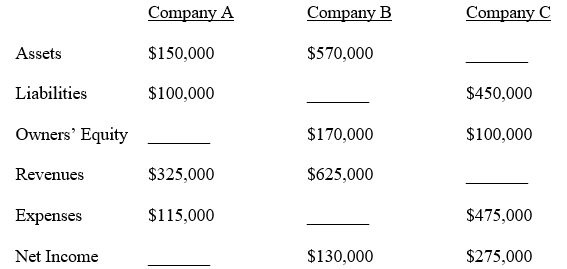

72

The following financial information for three different companies has some missing amounts.

Required:

For each of the companies listed above, find the missing amounts.

Required:

For each of the companies listed above, find the missing amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following transactions occurred in Wimberly Corp. during 2010:

Required:

Indicate whether each of these transactions would be shown as an operating, investing, or financing activity on Wimberly's statement of cash flows for 2010.

Required:

Indicate whether each of these transactions would be shown as an operating, investing, or financing activity on Wimberly's statement of cash flows for 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck