Deck 13: Components; Interim Reports; Reporting for the Sec

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/40

العب

ملء الشاشة (f)

Deck 13: Components; Interim Reports; Reporting for the Sec

1

FASB Statement No. 131, "Disclosures about Segments . . . ," replaced the term industry segment with operating segment.

True

2

The trading of securities on national securities exchanges and over the counter is governed by the Securities Act of 1933.

False

3

FASB Statement No. 131, "Disclosures about Segments . . . ," defined major customers of a segmented business enterprise as those who provide 15% or more of the enterprise's total revenues.

False

4

The gain or loss on disposal of an operating segment, including the results of operations of the discontinued segment, is reported separately as a component of income before extraordinary items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

5

The gross margin method of estimating inventories may be used in the preparation of interim reports; however, the lower-of-cost-or-market rule may not be applied to inventory costs determined by the gross margin method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Securities Act of 1933 governs interstate issuances of securities to the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

7

The standards established in FASB Statement No. 131, "Disclosures about Segments…," provide far less segment information to users of financial reports than was required by FASB Statement No. 14, "Financial Reporting for Segments of a Business Enterprise."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

8

Lower-of-cost-or-market write-downs of inventories must be provided for interim accounting periods unless the interim date market declines in inventories are considered to be temporary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

9

In FASB Statement No. 131, "Disclosures about Segments . . . ," the FASB provided accounting standards for allocating nontraceable expenses to segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

10

A Form 10-K Annual Report must be filed with the SEC within 60 days after the close of each fiscal year of a company subject to the Securities Exchange Act of 1934.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company may issue a Form 8-K to the SEC for an event that it is not required legally to report to the SEC but that it considers to be important to its stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

12

Management of a business enterprise has the responsibility for identifying the operating segments of the enterprise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

13

In APB Opinion No. 28, "Interim Financial Reporting," the Accounting Principles Board adopted the viewpoint that interim accounting periods are to be accounted for as integral parts of the annual accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

14

Staff Accounting Bulletins issued by the SEC bear the SEC's official approval.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a new effective income tax rate is computed for the second quarter of a business enterprise's fiscal year, the new rate is applied retroactively to restate the income taxes expense for the first quarter of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

16

Both Regulation S-K and Regulation S-X deal with the form and content of financial statements filed with the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

17

On April 30, 2006, Raye Company, which has a fiscal year ending September 30, adopted a plan to discontinue the operations of Bello Division, an operating segment, on November 30, 2006. Bello had contributed a major portion of Raye's sales volume. Raye estimated that Bello would sustain a loss of $460,000 from May 1, 2006, through September 30, 2006, and would sustain an additional loss of $220,000 from October 1, 2006, to November 30, 2006. Raye also estimated that it would realize a gain of $600,000 on the disposal of Bello's net assets. On September 30, 2006, Raye determined that Bello had an operating loss of $1,120,000 for the year ended that date, of which $420,000 represented the loss from May 1 to September 30, 2006.

Disregarding income tax effects, the amount that Raye reports in its September 30, 2006, income statement as gain or loss on disposal of Bello is:

A) $40,000 loss

B) $80,000 loss

C) $180,000 gain

D) $600,000 gain

E) Some other gain or loss

Disregarding income tax effects, the amount that Raye reports in its September 30, 2006, income statement as gain or loss on disposal of Bello is:

A) $40,000 loss

B) $80,000 loss

C) $180,000 gain

D) $600,000 gain

E) Some other gain or loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not used as a basis for allocating among interim accounting periods an enterprise's costs and expenses other than product costs?

A) Cost of goods sold

B) Time expired

C) Benefit received

D) Activity associated with the period

E) None of the foregoing

A) Cost of goods sold

B) Time expired

C) Benefit received

D) Activity associated with the period

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

19

FASB Statement No. 131, "Disclosures about Segments . . . ," includes a concept of segment reporting termed the:

A) Industry approach

B) Management approach

C) Operating approach

D) Disaggregation approach

A) Industry approach

B) Management approach

C) Operating approach

D) Disaggregation approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

20

If an operating segment has been discontinued during the year, the gain or loss on disposal:

A) Is displayed as an extraordinary item in the income statement

B) Excludes operating losses during the accounting period

C) Excludes operating losses of the current year up to the disposal date

D) Is displayed net of applicable income taxes in the income statement

A) Is displayed as an extraordinary item in the income statement

B) Excludes operating losses during the accounting period

C) Excludes operating losses of the current year up to the disposal date

D) Is displayed net of applicable income taxes in the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

21

For interim reports, an inventory loss from a temporary market decline in the first quarter, which may reasonably be expected to be restored in the fourth quarter, is:

A) Recognized as a loss proportionately in each of the first, second, third, and fourth quarters

B) Recognized as a loss proportionately in each of the first, second, and third quarters

C) Not recognized as a loss in the first quarter

D) Recognized as a loss in the first quarter

A) Recognized as a loss proportionately in each of the first, second, third, and fourth quarters

B) Recognized as a loss proportionately in each of the first, second, and third quarters

C) Not recognized as a loss in the first quarter

D) Recognized as a loss in the first quarter

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under FASB Statement No. 131, "Disclosures about Segments . . . ," segment profit or loss is measured by:

A) Compliance with generally accepted accounting principles

B) A formula specified by the Statement

C) A pro-rata portion of the enterprise's pre-tax financial income

D) The internal financial reporting system of the enterprise

A) Compliance with generally accepted accounting principles

B) A formula specified by the Statement

C) A pro-rata portion of the enterprise's pre-tax financial income

D) The internal financial reporting system of the enterprise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not required by APB Opinion No. 28, "Interim Financial Reporting," to be included in public companies' interim financial reports to stockholders?

A) Sales or gross revenue

B) Costs and expenses (other than seasonal costs and expenses)

C) Cumulative effect of a change in accounting principle

D) Contingent items

E) None of the foregoing

A) Sales or gross revenue

B) Costs and expenses (other than seasonal costs and expenses)

C) Cumulative effect of a change in accounting principle

D) Contingent items

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

24

Do the disclosures related to segment profit or loss required by FASB Statement No. 131, "Disclosures about Segments . . . ,"include:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

25

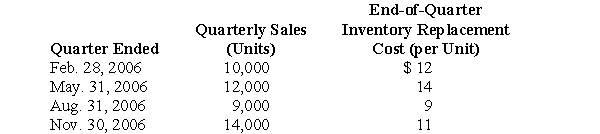

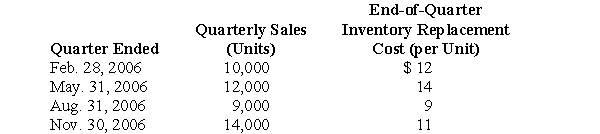

Selected quarterly data for Canby Company were as follows for the fiscal year ended November 30, 2006:  Canby purchased no merchandise during the year ended November 30, 2006. The first-in, first-out cost of its November 30, 2005, inventory of 50,000 units was $500,000.

Canby purchased no merchandise during the year ended November 30, 2006. The first-in, first-out cost of its November 30, 2005, inventory of 50,000 units was $500,000.

If the market decline in the quarter ended August 31, 2006, was not considered to be temporary, Canby's cost of goods sold for that quarter is:

A) $90,000

B) $81,000

C) $109,000

D) Some other amount

Canby purchased no merchandise during the year ended November 30, 2006. The first-in, first-out cost of its November 30, 2005, inventory of 50,000 units was $500,000.

Canby purchased no merchandise during the year ended November 30, 2006. The first-in, first-out cost of its November 30, 2005, inventory of 50,000 units was $500,000.If the market decline in the quarter ended August 31, 2006, was not considered to be temporary, Canby's cost of goods sold for that quarter is:

A) $90,000

B) $81,000

C) $109,000

D) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

26

The computation of a business enterprise's third-quarter income taxes expense should be based on pre-tax financial income:

A) For the quarter at the expected annual effective income tax rate

B) For the quarter at the statutory income tax rate

C) To date at the expected annual effective income tax rate less prior quarters' income taxes expense

D) To date at the statutory income tax rate less prior quarters' income taxes expense

A) For the quarter at the expected annual effective income tax rate

B) For the quarter at the statutory income tax rate

C) To date at the expected annual effective income tax rate less prior quarters' income taxes expense

D) To date at the statutory income tax rate less prior quarters' income taxes expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

27

The annual report filed with the SEC within 60 days after the close of each fiscal year is:

A) Form 8-K

B) Form 10-K

C) Form 10

D) Form 10-Q

E) None of the foregoing

A) Form 8-K

B) Form 10-K

C) Form 10

D) Form 10-Q

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following SEC requirements generally does not appear in an annual report to stockholders?

A) Disclosures regarding income taxes expense

B) Schedules

C) Income statements for three years

D) Quarterly financial information

A) Disclosures regarding income taxes expense

B) Schedules

C) Income statements for three years

D) Quarterly financial information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

29

Methods that have been used to allocate nontraceable expenses to segments include all the following ratios except:

A) Segment liabilities to total enterprise liabilities

B) Segment revenues to total enterprise revenues

C) Segment total payrolls to enterprise total payrolls

D) Segment average plant assets and inventories to enterprise average plant assets and inventories

A) Segment liabilities to total enterprise liabilities

B) Segment revenues to total enterprise revenues

C) Segment total payrolls to enterprise total payrolls

D) Segment average plant assets and inventories to enterprise average plant assets and inventories

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

30

In its interim report for the three months ended January 31, 2006, the first quarter of its fiscal year ending October 31, 2006, Wister Company had income taxes expense of $52,800 ($100,000 x 0.528). On April 30, 2006, Wister estimated that its effective income tax rate for the year ending October 31, 2006, would be 50.9%. If Wister's pre-tax financial income for the three months ended April 30, 2006, was $110,000, Wister's income taxes expense for the three months ended April 30, 2006, is:

A) $55,990 ($110,000 x 0.509)

B) $54,090 [($210,000 x 0.509) - $52,800]

C) $58,080 ($110,000 x 0.528)

D) $106,890 ($210,000 x 0.509)

A) $55,990 ($110,000 x 0.509)

B) $54,090 [($210,000 x 0.509) - $52,800]

C) $58,080 ($110,000 x 0.528)

D) $106,890 ($210,000 x 0.509)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Forms and proxy statements filed with the SEC are reviewed by the SEC's:

A) Chief accountant

B) Division of Corporate Finance

C) Division of Enforcement

D) Division of Market Regulation

A) Chief accountant

B) Division of Corporate Finance

C) Division of Enforcement

D) Division of Market Regulation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

32

To disclose a recent business combination, a company subject to the jurisdiction of the Securities and Exchange Commission (SEC) reports to the SEC in a:

A) Form 10-Q

B) Form 10-K

C) Form 8-K

D) Definitive proxy statement

A) Form 10-Q

B) Form 10-K

C) Form 8-K

D) Definitive proxy statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

33

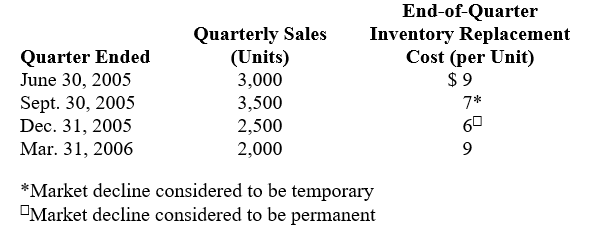

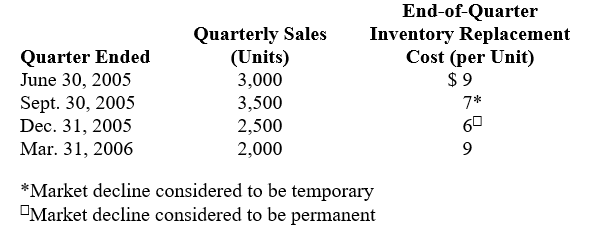

Wasco Company, which has a March 31 fiscal year, issues interim financial reports. Wasco sells a single unit of merchandise; the merchandise inventory, at first-in, first-out cost, was 14,000 units, $112,000, on April 1, 2005. Wasco purchased no merchandise during the year ended March 31, 2006. Quarterly sales and end-of-quarter merchandise replacement costs for the year ended March 31, 2006, were as follows:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

Prepare a working paper to compute Wasco Company's cost of goods sold for the four quarters of the year ended March 31, 2006. Use the following headings:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

34

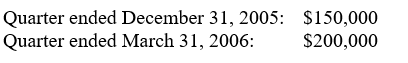

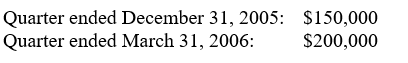

On October 1, 2005, Anaconda Company estimated an effective income tax rate of 42% for the fiscal year ending September 30, 2006. On January 2, 2006, Anaconda changed the estimate to 38%. Pre-tax financial income for Anaconda for the first two quarters of the fiscal year ending September 30, 2006, was as follows:

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

Prepare journal entries for income taxes expense for Anaconda Company on December 31, 2005, and March 31, 2006. Show supporting computations in explanations for the journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

35

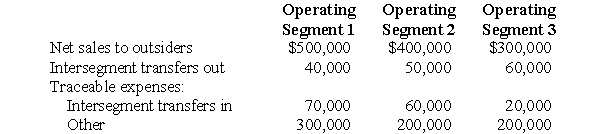

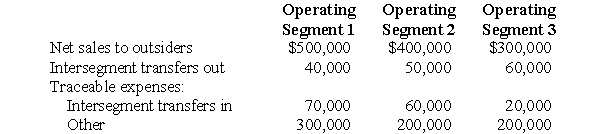

Switzer Company's accounting records for the fiscal year ended May 31, 2006, included the following information for its three operating segments:

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.

Prepare a working paper to compute the profit or loss of each of Switzer's three operating segments for the year ended May 31, 2006.

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.

Nontraceable expenses of Switzer were $120,000 for the year ended May 31, 2006. Switzer allocates these expenses on the basis of segment sales to outsiders.Prepare a working paper to compute the profit or loss of each of Switzer's three operating segments for the year ended May 31, 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

36

Chan Company's statutory income tax rate is 40%. Chan forecasted pre-tax income of $200,000 for 2006, with no temporary differences between financial income and taxable income. Chan forecasted the following permanent differences between financial income and taxable income for 2006: Dividend received deduction, $40,000; Premiums on officers' life insurance, $30,000.

Prepare a working paper to compute Chan Company's estimated effective income tax rate for 2006.

Prepare a working paper to compute Chan Company's estimated effective income tax rate for 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

37

Zero Company had three business segments. Because Garson Segment had been operating at a pre-tax loss during Fiscal Year 2006, Zero accepted an offer to sell the net assets of Garson Segment, which had a carrying amount of $400,000 on October 31, 2006, the end of the fiscal year, to Thrice Company (an unrelated business enterprise) for $340,000 on November 30, 2006. Garson Segment was expected to operate at a loss (before income tax considerations) of $40,000 during the month of November, 2006. Zero's income tax rate is 40%.

Prepare a working paper to compute the loss on the disposal of Garson Segment to be displayed in Zero Company's income statement for the fiscal year ended October 31, 2006.

Prepare a working paper to compute the loss on the disposal of Garson Segment to be displayed in Zero Company's income statement for the fiscal year ended October 31, 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

38

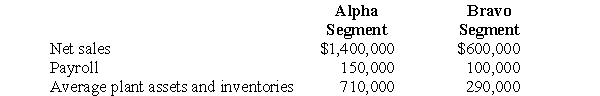

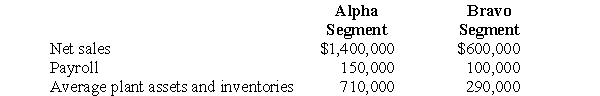

The nontraceable expenses of Wick Company's corporate (home) office for 2006 amounted to $360,000. The net sales, payroll, and average plant assets and inventories for the two operating segments of Wick were as follows:

Prepare a working paper to compute the amount of corporate (home) office nontraceable expenses to be allocated to Alpha Segment, assuming that such expenses are allocated to the segments on the basis of the arithmetic average of the percentage of net sales, payroll, and average plant assets and inventories applicable to each segment.

Prepare a working paper to compute the amount of corporate (home) office nontraceable expenses to be allocated to Alpha Segment, assuming that such expenses are allocated to the segments on the basis of the arithmetic average of the percentage of net sales, payroll, and average plant assets and inventories applicable to each segment.

Prepare a working paper to compute the amount of corporate (home) office nontraceable expenses to be allocated to Alpha Segment, assuming that such expenses are allocated to the segments on the basis of the arithmetic average of the percentage of net sales, payroll, and average plant assets and inventories applicable to each segment.

Prepare a working paper to compute the amount of corporate (home) office nontraceable expenses to be allocated to Alpha Segment, assuming that such expenses are allocated to the segments on the basis of the arithmetic average of the percentage of net sales, payroll, and average plant assets and inventories applicable to each segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

39

For the fiscal year ended June 30, 2006, Disc-Seg Company:

(1) Had income from continuing operations of $1,000,000 before income taxes

(2) Had no temporary differences between pre-tax financial income and taxable income

(3) Was subject to an income tax rate of 40%

(4) Disposed of an operating segment having net assets of $600,000 for $550,000 cash. For the period July 1, 2005, through the disposal date, the discontinued segment had a pre-tax operating loss of $140,000.

Prepare the bottom portion of Disc-Seg Company's income statement for the year ended June 30, 2006, beginning with income from continuing operations before income taxes. Disregard earnings per share data.

(1) Had income from continuing operations of $1,000,000 before income taxes

(2) Had no temporary differences between pre-tax financial income and taxable income

(3) Was subject to an income tax rate of 40%

(4) Disposed of an operating segment having net assets of $600,000 for $550,000 cash. For the period July 1, 2005, through the disposal date, the discontinued segment had a pre-tax operating loss of $140,000.

Prepare the bottom portion of Disc-Seg Company's income statement for the year ended June 30, 2006, beginning with income from continuing operations before income taxes. Disregard earnings per share data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

40

In Section 101 of Codification of Financial Reporting Policies, the Securities and Exchange Commission indicated that it would concentrate on pronouncements on disclosures in reports filed by enterprises subject to its jurisdiction, leaving the establishment of financial accounting standards to the Financial Accounting Standards Board.

In your opinion, has the SEC adhered to the policy stated above? Explain.

In your opinion, has the SEC adhered to the policy stated above? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck