Deck 9: Consolidated Financial Statements: Income Taxes, Cash Flows, and Installment Acquisitions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/31

العب

ملء الشاشة (f)

Deck 9: Consolidated Financial Statements: Income Taxes, Cash Flows, and Installment Acquisitions

1

In the installment acquisition of a subsidiary, the investor begins applying the equity method of accounting for the investee's operations when the investor's ownership interest is sufficient to control the investee.

False

2

Undistributed earnings of a domestic subsidiary included in consolidated net income are accounted for as a temporary difference between financial income and taxable income.

True

3

If a parent company and its subsidiary file separate income tax returns, a Deferred Income Tax Liability account is credited in the working paper elimination (in journal entry format) for income taxes attributable to an unrealized intercompany gain in land.

False

4

Income taxes accrued or paid on unrealized intercompany profits or gains, either by the parent company or by the subsidiary, are deferred in consolidated financial statements if parent and subsidiary file separate income tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a parent company acquires control of its subsidiary in a series of acquisitions of the subsidiary's common stock, a portion of the subsidiary's retained earnings is included in consolidated retained earnings on the date the parent company completes the acquisition of the controlling interest in the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

6

If income tax accounting for a business combination differs from financial accounting for the combination, temporary differences between financial income and taxable income may result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

7

Depreciation expense and amortization expense are added to consolidated net income in the computation of net cash provided by operating activities in the consolidated statement of cash flows for a parent company and its partially owned subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

8

A parent company's acquisition of a portion of the minority stockholders' interest in a subsidiary is reported in the consolidated statement of cash flows as a cash flow from financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

9

All dividends declared by a parent company and its subsidiaries are displayed in the cash flows from financing activities section of a consolidated statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

10

The deferred income tax liability attributable to a subsidiary's realized gain on the parent company's open-market acquisition of the subsidiary's serial bonds reverses when the subsidiary makes serial payments of the principal of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

11

Generally, several separate goodwill amounts are recognized in a parent company's installment acquisition of a subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

12

In the installment acquisition of a controlling interest in a subsidiary, the Retained Earnings of Subsidiary/Investee ledger account is first credited in a journal entry of the parent company/investor to:

A) Close the parent company/investor's revenue or investment income ledger account at the end of the accounting period that the first installment was acquired

B) Apply retroactively the equity method of accounting

C) Record the acquisition of a controlling interest in the subsidiary

D) Close the parent company's Intercompany Investment Income ledger account at the end of the accounting period in which a controlling interest in the subsidiary was acquired

A) Close the parent company/investor's revenue or investment income ledger account at the end of the accounting period that the first installment was acquired

B) Apply retroactively the equity method of accounting

C) Record the acquisition of a controlling interest in the subsidiary

D) Close the parent company's Intercompany Investment Income ledger account at the end of the accounting period in which a controlling interest in the subsidiary was acquired

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

13

Pomp Corporation and its wholly owned subsidiary Stage Company file separate income tax returns. Pomp's income taxes expense for 2006 included $60,000 attributable to $100,000 unrealized intercompany profits on sales of merchandise to Stage. In the preparation of consolidated financial statements for 2006, assuming the criteria for recognition of a deferred tax asset without a valuation allowance are met:

A) The entire intercompany profit is eliminated; income taxes expense is not adjusted

B) Income taxes of $60,000 are deferred

C) The intercompany profit is reduced by $60,000 before elimination, and income taxes of $60,000 are deferred

D) Income taxes are recomputed, and a revised income tax return is filed

E) None of the foregoing takes place

A) The entire intercompany profit is eliminated; income taxes expense is not adjusted

B) Income taxes of $60,000 are deferred

C) The intercompany profit is reduced by $60,000 before elimination, and income taxes of $60,000 are deferred

D) Income taxes are recomputed, and a revised income tax return is filed

E) None of the foregoing takes place

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

14

Generally, undistributed earnings of a domestic subsidiary are treated in the computation of parent company income taxes expense:

A) As a temporary difference between taxable income and financial income

B) As a permanent difference between taxable income and financial income

C) As a reduction of the subsidiary's net income

D) In some other manner

A) As a temporary difference between taxable income and financial income

B) As a permanent difference between taxable income and financial income

C) As a reduction of the subsidiary's net income

D) In some other manner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

15

On January 2, 2006, Pagan Corporation acquired 40% of the outstanding common stock of Sancto Company for $1,000,000. On that date, the current fair value of Sancto's identifiable net assets was $2,000,000, and Pagan did not attribute the excess of the cost of its investment in Sancto over its equity in Sancto's identifiable net assets to any one factor. Sancto's 2006 net income was $250,000. Pagan planned to increase its investment in Sancto to a controlling interest, and Pagan accounted for its investment in Sancto under the equity method of accounting. The maximum amount that may be included in Pagan's 2006 income before income taxes to reflect investment income from Sancto is:

A) $95,000

B) $100,000

C) $200,000

D) $245,000

A) $95,000

B) $100,000

C) $200,000

D) $245,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

16

In the preparation of a consolidated statement of cash flows, dividends declared and paid to minority shareholders of a subsidiary are:

A) Disregarded

B) Added to consolidated net income

C) Deducted from consolidated net income

D) Included with cash flows from financing activities

A) Disregarded

B) Added to consolidated net income

C) Deducted from consolidated net income

D) Included with cash flows from financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

17

Ply Corporation acquired the outstanding common stock of Simi Company as follows:

10%, Jan. 2, 2006

25%, June 1, 2006

25%, Aug. 1, 2006

40%, Sept. 30, 2006

The fiscal year of both companies ends on September 30. Simi's common stock was acquired by Ply at its carrying amount in Simi's accounting records. Consolidated net income for the year ended September 30, 2006, includes the following earnings of Simi:

A) 10% of earnings, January - May, 2006

B) 35% of earnings, June - July, 2006

C) 60% of earnings, August - September, 2006

D) 60% of earnings, January - September, 2006

E) None of the foregoing

10%, Jan. 2, 2006

25%, June 1, 2006

25%, Aug. 1, 2006

40%, Sept. 30, 2006

The fiscal year of both companies ends on September 30. Simi's common stock was acquired by Ply at its carrying amount in Simi's accounting records. Consolidated net income for the year ended September 30, 2006, includes the following earnings of Simi:

A) 10% of earnings, January - May, 2006

B) 35% of earnings, June - July, 2006

C) 60% of earnings, August - September, 2006

D) 60% of earnings, January - September, 2006

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not included in a consolidated statement of cash flows?

A) Acquisition by the parent company of additional shares of common stock directly from a subsidiary

B) Minority interest in net loss of a subsidiary

C) Acquisition by the parent company of additional shares of common stock from minority stockholders of a subsidiary

D) Cash dividends declared by a partially owned subsidiary to minority stockholders

A) Acquisition by the parent company of additional shares of common stock directly from a subsidiary

B) Minority interest in net loss of a subsidiary

C) Acquisition by the parent company of additional shares of common stock from minority stockholders of a subsidiary

D) Cash dividends declared by a partially owned subsidiary to minority stockholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

19

Included in the identifiable net assets of Sapphire Company on the date of its business combination with Palumbo Corporation was a building with an appraised value of $900,000 and a carrying amount of $600,000. If the Palumbo-Sapphire business combination met the requirements of a "tax-free corporate reorganization" for income tax purposes and the income tax rate was 40%, the current fair value of Sapphire's building for inclusion in the consolidated financial statements of Palumbo Corporation and subsidiary is:

A) $600,000

B) $720,000

C) $780,000

D) $900,000

E) Some other amount

A) $600,000

B) $720,000

C) $780,000

D) $900,000

E) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

20

The starting point for the computation of net cash provided by operating activities in a consolidated statement of cash flows (indirect method) for a parent company and its partially owned subsidiary is:

A) Consolidated net income

B) Combined net income, including minority interest in net income of subsidiary

C) Parent company net income

D) Intercompany investment income

A) Consolidated net income

B) Combined net income, including minority interest in net income of subsidiary

C) Parent company net income

D) Intercompany investment income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

21

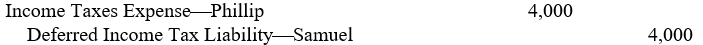

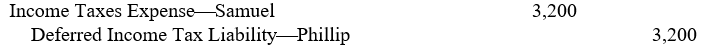

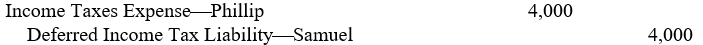

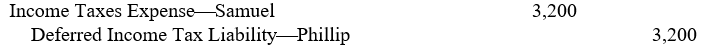

The unrealized intercompany profit in the February 28, 2006, end-of-fiscal year inventories of Samuel Company, the 80%-owned subsidiary of Phillip Corporation, was $10,000, based on billed prices of the merchandise received by Samuel from Phillip. If Phillip and Samuel file separate income tax returns, the criteria for recognizing a deferred tax asset without a valuation allowance are met, and the income tax rate is 40%, which of the following working paper eliminations (explanation omitted) is appropriate for Phillip Corporation and subsidiary on February 28, 2006?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

22

Included in the working paper eliminations for Pro Corporation and subsidiary for the fiscal year ended March 31, 2006, was the following (explanation omitted):

If both Pro and Sid (an 80%-owned subsidiary) file separate income tax returns and have a 40% income tax rate, an accompanying working paper elimination should include a(n):

If both Pro and Sid (an 80%-owned subsidiary) file separate income tax returns and have a 40% income tax rate, an accompanying working paper elimination should include a(n):

A) $640 credit to Minority Interest in Net Assets of Subsidiary

B) $800 debit to Income Taxes Expense-Pro

C) $3,200 debit to Deferred Income Tax Asset-Sid

D) $4,800 credit to Retained Earnings-Pro

If both Pro and Sid (an 80%-owned subsidiary) file separate income tax returns and have a 40% income tax rate, an accompanying working paper elimination should include a(n):

If both Pro and Sid (an 80%-owned subsidiary) file separate income tax returns and have a 40% income tax rate, an accompanying working paper elimination should include a(n):A) $640 credit to Minority Interest in Net Assets of Subsidiary

B) $800 debit to Income Taxes Expense-Pro

C) $3,200 debit to Deferred Income Tax Asset-Sid

D) $4,800 credit to Retained Earnings-Pro

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

23

Parle Corporation and its 80%-owned subsidiary, Sabe Company, file separate income tax returns, and each has a combined federal and state income tax rate of 40%. The working paper eliminations of Parle Corporation and Subsidiary on April 30, 2006, included the following:

If the working paper eliminations on October 31, 2006, for the subsidiary's bonds owned by the parent company included a debit to Intercompany Interest Revenue-Parle of $25,584 and a credit to Intercompany Interest Expense-Sabe of $23,070, an accompanying elimination should include:

If the working paper eliminations on October 31, 2006, for the subsidiary's bonds owned by the parent company included a debit to Intercompany Interest Revenue-Parle of $25,584 and a credit to Intercompany Interest Expense-Sabe of $23,070, an accompanying elimination should include:

A) A debit to Income Taxes Expense-Sabe of $9,228 ($23,070 x 0.40)

B) A credit to Income Taxes Expense-Parle of $2,234 ($5,584 x 0.40)

C) A credit to Income Taxes Expense-Sabe of $2,234 ($5,584 x 0.40)

D) A debit to Income Taxes Expense-Sabe of $1,006 ($2,514 x 0.40)

E) None of the foregoing

If the working paper eliminations on October 31, 2006, for the subsidiary's bonds owned by the parent company included a debit to Intercompany Interest Revenue-Parle of $25,584 and a credit to Intercompany Interest Expense-Sabe of $23,070, an accompanying elimination should include:

If the working paper eliminations on October 31, 2006, for the subsidiary's bonds owned by the parent company included a debit to Intercompany Interest Revenue-Parle of $25,584 and a credit to Intercompany Interest Expense-Sabe of $23,070, an accompanying elimination should include:A) A debit to Income Taxes Expense-Sabe of $9,228 ($23,070 x 0.40)

B) A credit to Income Taxes Expense-Parle of $2,234 ($5,584 x 0.40)

C) A credit to Income Taxes Expense-Sabe of $2,234 ($5,584 x 0.40)

D) A debit to Income Taxes Expense-Sabe of $1,006 ($2,514 x 0.40)

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

24

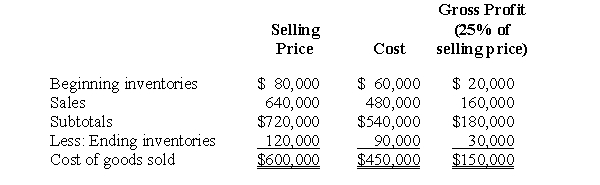

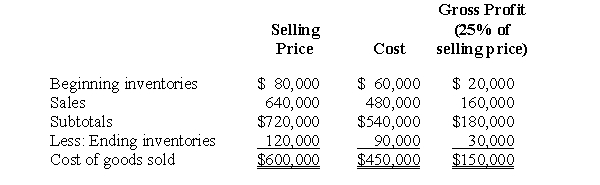

The sales of merchandise by Pater Corporation to its 80%-owned subsidiary, Sibling Company, during the fiscal year ended March 31, 2006, may be analyzed as follows:

Pater and Sibling file separate income tax returns; the income tax rate is 40%; and the criteria for recognizing a deferred tax asset without a valuation allowance are met.

Prepare working paper eliminations, including income taxes, (in journal entry format) for Pater Corporation and subsidiary on March 31, 2006. Omit explanations.

Prepare working paper eliminations, including income taxes, (in journal entry format) for Pater Corporation and subsidiary on March 31, 2006. Omit explanations.

Pater and Sibling file separate income tax returns; the income tax rate is 40%; and the criteria for recognizing a deferred tax asset without a valuation allowance are met.

Prepare working paper eliminations, including income taxes, (in journal entry format) for Pater Corporation and subsidiary on March 31, 2006. Omit explanations.

Prepare working paper eliminations, including income taxes, (in journal entry format) for Pater Corporation and subsidiary on March 31, 2006. Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

25

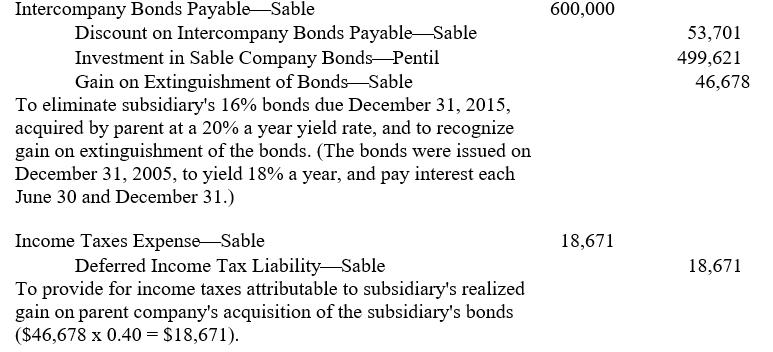

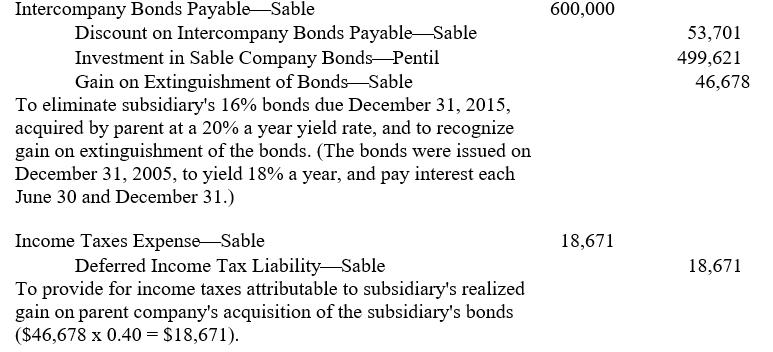

The working paper eliminations (in journal entry format) for Pentil Corporation and its wholly owned subsidiary on June 30, 2006, included the following:

Prepare comparable working paper eliminations (in journal entry format) for Pentil Corporation and subsidiary on December 31, 2006, but omit explanations. (Pentil prepares consolidated financial statements semiannually, and both Pentil and Sable use the interest method of accumulation or amortization of bond discount.)

Prepare comparable working paper eliminations (in journal entry format) for Pentil Corporation and subsidiary on December 31, 2006, but omit explanations. (Pentil prepares consolidated financial statements semiannually, and both Pentil and Sable use the interest method of accumulation or amortization of bond discount.)

Prepare comparable working paper eliminations (in journal entry format) for Pentil Corporation and subsidiary on December 31, 2006, but omit explanations. (Pentil prepares consolidated financial statements semiannually, and both Pentil and Sable use the interest method of accumulation or amortization of bond discount.)

Prepare comparable working paper eliminations (in journal entry format) for Pentil Corporation and subsidiary on December 31, 2006, but omit explanations. (Pentil prepares consolidated financial statements semiannually, and both Pentil and Sable use the interest method of accumulation or amortization of bond discount.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

26

On May 1, 2005, the beginning of a fiscal year, Peat Corporation acquired 25% of the outstanding common stock of Seal Company for $100,000. Both the carrying amounts and the current fair values of Seal's identifiable net assets totaled $300,000 on May 1, 2005. On April 30, 2006, Seal declared dividends of $15,000, payable May 18, 2006, to stockholders of record April 30, 2006, and reported a net income of $40,000 for the fiscal year ended April 30, 2006. On May 1, 2006, Peat acquired an additional 30% of the outstanding common stock of Seal for $120,000. The current fair values of Seal's identifiable net assets equaled their carrying amounts on May 1, 2006.

Prepare Peat Corporation's journal entries on May 1, 2005, April 30, 2006, and May 1, 2006, to account for its investments in Seal Company in accordance with generally accepted accounting principles. Omit closing entries and journal entry explanations and disregard out-of-pocket costs of the common stock acquisitions and income tax considerations.

Prepare Peat Corporation's journal entries on May 1, 2005, April 30, 2006, and May 1, 2006, to account for its investments in Seal Company in accordance with generally accepted accounting principles. Omit closing entries and journal entry explanations and disregard out-of-pocket costs of the common stock acquisitions and income tax considerations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

27

Pedro Corporation organized a 75%-owned subsidiary, Sanchez Company, on January 2, 2006. For the fiscal year ended December 31, 2006, Sanchez had a net income of $130,000 and declared and paid a dividend of $50,000 to Pedro. There were no temporary differences between Pedro's pre-tax financial income of $620,000 and taxable income from its own operations for the year ended December 31, 2006. Pedro's income tax rate is 40%.

Prepare a journal entry for Pedro Corporation on December 31, 2006, to provide for income taxes for 2006, including taxes applicable to Pedro's equity-method income from Sanchez. (Pedro is entitled to a dividend received deduction of 80% in its income tax returns.)

Prepare a journal entry for Pedro Corporation on December 31, 2006, to provide for income taxes for 2006, including taxes applicable to Pedro's equity-method income from Sanchez. (Pedro is entitled to a dividend received deduction of 80% in its income tax returns.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

28

Sonar Company, an 80%-owned subsidiary of Pinto Corporation, sells merchandise to Summer Company, a wholly owned subsidiary of Pinto, at a markup of 60% on Sonar cost. For the fiscal year ended December 31, 2006, Sonar's sales to Summer totaled $800,000 at billed prices. Summer's January 1, 2006, inventories included merchandise acquired from Sonar at billed prices of $56,000; the comparable amount in the December 31, 2006, inventories of Summer was $120,000. Pinto, Sonar, and Summer file separate income tax returns and are subject to an income tax rate of 40%, and the criteria for recognizing a deferred tax asset without a valuation allowance are met.

Prepare working paper eliminations, including applicable income taxes (in journal entry format), for Pinto Corporation and subsidiaries on December 31, 2006. Omit explanations.

Prepare working paper eliminations, including applicable income taxes (in journal entry format), for Pinto Corporation and subsidiaries on December 31, 2006. Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

29

Place an X in the appropriate column below to indicate whether each of the items is included in the indicated sections of a consolidated statement of cash flows or is excluded from the statement:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

30

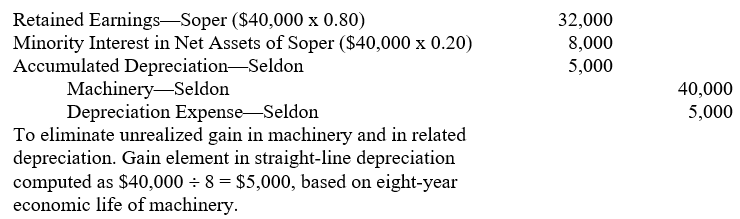

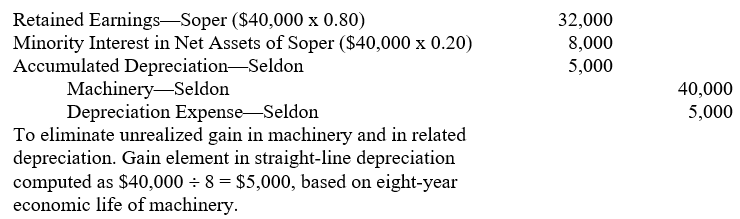

The accountant for Perris Corporation prepared the following working paper elimination (in journal entry format) on March 31, 2006, the end of the fiscal year for both Perris and its subsidiaries, Seldon Company (wholly owned) and Soper Company (80% owned):

Prepare an additional working paper elimination (in journal entry format) for Perris Corporation and subsidiaries on March 31, 2006, for the income tax effects of the foregoing elimination, assuming that (1) Perris and its two subsidiaries file separate income tax returns, (2) the income tax rate is 40%, and (3) the provisions of FASB Statement No. 109, "Accounting for Income Taxes" for recognizing a deferred tax asset without a valuation allowance are met. Omit an explanation for the elimination.

Prepare an additional working paper elimination (in journal entry format) for Perris Corporation and subsidiaries on March 31, 2006, for the income tax effects of the foregoing elimination, assuming that (1) Perris and its two subsidiaries file separate income tax returns, (2) the income tax rate is 40%, and (3) the provisions of FASB Statement No. 109, "Accounting for Income Taxes" for recognizing a deferred tax asset without a valuation allowance are met. Omit an explanation for the elimination.

Prepare an additional working paper elimination (in journal entry format) for Perris Corporation and subsidiaries on March 31, 2006, for the income tax effects of the foregoing elimination, assuming that (1) Perris and its two subsidiaries file separate income tax returns, (2) the income tax rate is 40%, and (3) the provisions of FASB Statement No. 109, "Accounting for Income Taxes" for recognizing a deferred tax asset without a valuation allowance are met. Omit an explanation for the elimination.

Prepare an additional working paper elimination (in journal entry format) for Perris Corporation and subsidiaries on March 31, 2006, for the income tax effects of the foregoing elimination, assuming that (1) Perris and its two subsidiaries file separate income tax returns, (2) the income tax rate is 40%, and (3) the provisions of FASB Statement No. 109, "Accounting for Income Taxes" for recognizing a deferred tax asset without a valuation allowance are met. Omit an explanation for the elimination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

31

Monica Sheldon, a staff assistant of the CPA firm Leeds & Co., asks Leonard Gaines, an audit manager of Leeds & Co., how the temporary differences arising from unrealized intercompany profits, gains, and losses from sales of merchandise, plant assets, or intangible assets reverse, assuming separate income tax returns filed by the affiliated enterprises.

How should Leonard Gaines answer Monica Sheldon? Explain.

How should Leonard Gaines answer Monica Sheldon? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck