Deck 8: Consolidated Financial Statements: Intercompany Transactions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/49

العب

ملء الشاشة (f)

Deck 8: Consolidated Financial Statements: Intercompany Transactions

1

A parent or subsidiary company's acquisition of its affiliate's outstanding bonds in the open market may result in an unrealized gain or loss to the consolidated entity.

False

2

Intercompany sales of merchandise by a parent company to a subsidiary are similar to the intracompany shipments of merchandise by a home office to a branch.

True

3

If a parent company has a partially owned subsidiary, there is no effect on the minority interest in net assets of the subsidiary if the subsidiary sells a plant asset to the parent company at a gain.

False

4

If a subsidiary sells merchandise to the parent company at a markup above subsidiary cost, the Cost of Goods Sold ledger account of the subsidiary is not affected by working paper eliminations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

5

Intercompany profits in both the beginning and the ending inventories of the purchasing affiliate are unrealized at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

6

The FASB requires the economic unit concept of consolidated financial statements with respect to the elimination of intercompany profits in inventories resulting from a partially owned subsidiary's sales of merchandise to the parent company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the preparation of consolidated financial statements subsequent to the year in which a subsidiary sold land to the parent company, the unrealized gain on the sale is removed by a working paper elimination (in journal entry format) that debits Intercompany Gain on Sale of Land-Subsidiary and credits Land-Parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

8

In working paper eliminations (in journal entry format) for the intercompany gain in a depreciable plant asset subsequent to the year in which the asset was sold, the credits to the acquirer's Plant Assets and Depreciation Expense ledger accounts always are the same for each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

9

Working paper eliminations are not required after the end of the economic life of a depreciable plant asset sold by a subsidiary to the parent company at a gain, although the asset is continued in use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

10

A gain or loss generally is realized if a parent company acquires outstanding bonds of the subsidiary in the open market at an amount that differs from the carrying amount of the bonds in the subsidiary's accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

11

The realized gain or loss on a subsidiary's acquisition of outstanding bonds of the parent company in the open market is recognized in the accounting records of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

12

A material realized gain or loss on an intercompany investment in bonds is displayed as an extraordinary item in the consolidated income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

13

Intercompany profits or losses in inventories resulting from sales of merchandise by a partially owned subsidiary need not be considered in the computation of minority interest in net income of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

14

Intercompany gains or losses on depreciable plant assets are realized through the annual depreciation expense of the acquiring affiliate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a parent company sells merchandise to a subsidiary at parent company cost, the inventories and cost of goods sold of the subsidiary are not affected by working paper eliminations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

16

The debit to Intercompany Liability under Capital Lease is for the same amount as the credit to Intercompany Lease Receivables in a working paper elimination (in journal entry format) for an intercompany sales-type/capital lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

17

A working paper elimination must be prepared to remove the intercompany profit element of intercompany management fee revenue and expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

18

The realized but unrecognized gain on extinguishment of debt resulting from a parent company's open-market acquisition of the subsidiary's outstanding bonds is recorded in subsequent journal entries by:

A) The parent company for intercompany interest revenue

B) The subsidiary for intercompany interest expense

C) Both a and b

D) Neither a nor b

A) The parent company for intercompany interest revenue

B) The subsidiary for intercompany interest expense

C) Both a and b

D) Neither a nor b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

19

Included in a working paper elimination (in journal entry format) for intercompany sales was a credit of $60,000 to Cost of Goods Sold-Subsidiary. The credit indicates that, for the accounting period involved:

A) The unrealized intercompany profit in the subsidiary's cost of goods sold was $60,000

B) The realized intercompany profit in the subsidiary's cost of goods sold was $60,000

C) The cost of goods sold by the subsidiary to the parent company was $60,000

D) The gross margin on intercompany sales was $60,000

E) None of the foregoing was true

A) The unrealized intercompany profit in the subsidiary's cost of goods sold was $60,000

B) The realized intercompany profit in the subsidiary's cost of goods sold was $60,000

C) The cost of goods sold by the subsidiary to the parent company was $60,000

D) The gross margin on intercompany sales was $60,000

E) None of the foregoing was true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

20

On March 31, 2006, Pong Corporation paid its wholly owned subsidiary, Sung Company, $222,500 for a plant asset having a carrying amount to Sung of $200,000. Pong established an economic life of five years, no residual value, and the sum-of-the-years'-digits method of depreciation for the plant asset. The appropriate working paper elimination (in journal entry format) for Pong Corporation and subsidiary for the fiscal year ended March 31, 2007, includes a credit to Depreciation Expense-Pong in the amount of:

A) $0

B) $4,500

C) $6,000

D) $7,500

E) Some other amount

A) $0

B) $4,500

C) $6,000

D) $7,500

E) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

21

A material realized gain on a subsidiary's open-market acquisition of its parent company's outstanding bonds at a discount is displayed in the consolidated income statement as:

A) An extraordinary item, net of income tax effects

B) An ordinary item, gross of income tax effects

C) Either an extraordinary item or an ordinary item, net or gross of income tax effects, depending on the circumstances

D) None of the foregoing

A) An extraordinary item, net of income tax effects

B) An ordinary item, gross of income tax effects

C) Either an extraordinary item or an ordinary item, net or gross of income tax effects, depending on the circumstances

D) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

22

Included in a working paper elimination (in journal entry format) for intercompany sales of merchandise was a debit to Minority Interest in Net Assets of Subsidiary. This debit indicates that:

A) The parent company sold merchandise to a partially owned subsidiary

B) A wholly owned subsidiary sold merchandise to a partially owned subsidiary

C) A partially owned subsidiary sold merchandise to the parent company or to another subsidiary

D) Either a or b took place

A) The parent company sold merchandise to a partially owned subsidiary

B) A wholly owned subsidiary sold merchandise to a partially owned subsidiary

C) A partially owned subsidiary sold merchandise to the parent company or to another subsidiary

D) Either a or b took place

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

23

From a consolidated point of view, the intercompany gain on a parent company's sale of a depreciable plant asset to the subsidiary is realized when:

A) The parent company sells the plant asset to the subsidiary

B) The subsidiary abandons the plant asset

C) The subsidiary resells the plant asset to the parent company

D) Some other transaction or event takes place

A) The parent company sells the plant asset to the subsidiary

B) The subsidiary abandons the plant asset

C) The subsidiary resells the plant asset to the parent company

D) Some other transaction or event takes place

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

24

On December 1, 2006, Passey Corporation sold a machine with a carrying amount of $150,000 to its 80%-owned subsidiary, Scully Company, for $200,000. Scully adopted a four-year economic life, no residual value, and the sum-of-the-years'-digits method of depreciation for the machine. If correct working paper eliminations are prepared for Passey Corporation and subsidiary on November 30, 2007, the end of the fiscal year, Passey's net income to be included in consolidated net income is (disregarding income taxes):

A) Decreased a net of $30,000

B) Increased a net of $20,000

C) Decreased a net of $50,000

D) Decreased a net of $40,000

A) Decreased a net of $30,000

B) Increased a net of $20,000

C) Decreased a net of $50,000

D) Decreased a net of $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

25

Stubbs Company, the 80%-owned subsidiary of Petrill Corporation, sells merchandise to Petrill at a gross margin rate of 25%. Intercompany sales during the fiscal year ended June 30, 2006, were $100,000. Petrill's ending inventory of merchandise obtained from Stubbs was $60,000 at billed prices, an amount $20,000 larger than the beginning inventory. The June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a:

A) Debit of $25,000 to Gross Margin on Sales-Stubbs

B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary

C) Debit of $80,000 to Sales-Stubbs

D) Credit of $10,000 to Inventories-Petrill

A) Debit of $25,000 to Gross Margin on Sales-Stubbs

B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary

C) Debit of $80,000 to Sales-Stubbs

D) Credit of $10,000 to Inventories-Petrill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

26

In APB No. 51 "Consolidated Financial Statements," the requirement for complete elimination of intercompany profit (gains) or losses is consistent with the:

A) Parent company concept of consolidated financial statements

B) Equity method of accounting

C) Economic unit concept of consolidated financial statements

D) Cost method of accounting

A) Parent company concept of consolidated financial statements

B) Equity method of accounting

C) Economic unit concept of consolidated financial statements

D) Cost method of accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the measurement of minority interest in net income of a partially owned subsidiary, the credit for Depreciation Expense-Parent in the working paper elimination (in journal entry format) for intercompany gain in a depreciable plant asset is attributed to net income of:

A) The parent company

B) The subsidiary

C) The consolidated entity

D) None of the foregoing

A) The parent company

B) The subsidiary

C) The consolidated entity

D) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

28

The working paper elimination (in journal entry format) for a second year of intercompany sales made at a markup over subsidiary cost by a partially owned subsidiary to the parent company includes:

A) A debit to Retained Earnings-Subsidiary

B) A credit to Minority Interest in Net Assets of Subsidiary

C) A credit to Cost of Goods Sold-Subsidiary

D) None of the foregoing

A) A debit to Retained Earnings-Subsidiary

B) A credit to Minority Interest in Net Assets of Subsidiary

C) A credit to Cost of Goods Sold-Subsidiary

D) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an effect of a working paper elimination for intercompany sales of merchandise by a parent company to a subsidiary?

A) It eliminates the overstatement of the subsidiary's Sales ledger account balance.

B) It removes the intercompany profit portion of the subsidiary's Cost of Goods Sold ledger account balance.

C) It reduces consolidated inventories to the cost incurred by the consolidated entity.

D) It eliminates the parent's Intercompany Sales and Intercompany Cost of Goods Sold ledger accounts balances.

E) None of the foregoing

A) It eliminates the overstatement of the subsidiary's Sales ledger account balance.

B) It removes the intercompany profit portion of the subsidiary's Cost of Goods Sold ledger account balance.

C) It reduces consolidated inventories to the cost incurred by the consolidated entity.

D) It eliminates the parent's Intercompany Sales and Intercompany Cost of Goods Sold ledger accounts balances.

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

30

If a gain on an intercompany transaction is attributable to a partially owned subsidiary, working paper eliminations (in journal entry format) for accounting periods subsequent to the period of the intercompany transaction will include a debit to Minority Interest in Net Assets of Subsidiary unless the gain arose from:

A) A sale of plant assets

B) A sale of merchandise

C) An acquisition of outstanding bonds in the open market

D) A sale of intangible assets

E) None of the foregoing

A) A sale of plant assets

B) A sale of merchandise

C) An acquisition of outstanding bonds in the open market

D) A sale of intangible assets

E) None of the foregoing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

31

The gross profit on an intercompany sale of merchandise costing $500,000 at a gross margin rate of 16 2/3% based on selling price is:

A) $100,000

B) $120,000

C) $200,000

D) $240,000

E) Some other amount

A) $100,000

B) $120,000

C) $200,000

D) $240,000

E) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

32

In the working paper elimination (in journal entry format) prepared on the date a parent company acquires outstanding bonds of its wholly owned subsidiary in the open market at a cost less than the subsidiary's carrying amount for the bonds, the difference between the subsidiary's carrying amount and the parent company's cost is:

A) Credited to Gain on Extinguishment of Bonds-Subsidiary

B) Credited to Investment in Subsidiary's Bonds-Parent

C) Credited to Retained Earnings-Subsidiary

D) Accounted for in some other manner

A) Credited to Gain on Extinguishment of Bonds-Subsidiary

B) Credited to Investment in Subsidiary's Bonds-Parent

C) Credited to Retained Earnings-Subsidiary

D) Accounted for in some other manner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

33

During the fiscal year ended March 31, 2006, Sol Company, the 90%-owned subsidiary of Pal Corporation, sold merchandise for the first time to Pal at a billed price of $160,000, representing a 25% markup on Sol's cost. On March 31, 2006, $40,000 of the merchandise remained unsold. There were no other intercompany transactions during the year ended March 31, 2006, and Sol had a net income of $80,000 for that year. In the working paper elimination (in journal entry format) of Pal Corporation and subsidiary for the year ended March 31, 2006, Minority Interest in Net Income of Subsidiary is debited for:

A) $0

B) $7,000

C) $7,200

D) $8,000

E) Some other amount

A) $0

B) $7,000

C) $7,200

D) $8,000

E) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

34

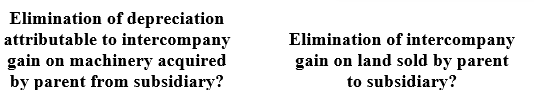

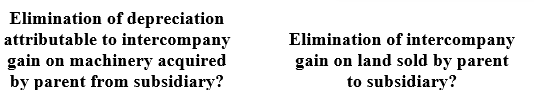

Is the minority interest in net income of a partially owned subsidiary affected by:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

35

A working paper elimination to remove an intercompany profit or gain is not relevant for an intercompany:

A) Sale of merchandise

B) Sale of plant asset or intangible asset

C) Sales-type/capital lease

D) Acquisition of an affiliate's outstanding bonds payable in the open market

A) Sale of merchandise

B) Sale of plant asset or intangible asset

C) Sales-type/capital lease

D) Acquisition of an affiliate's outstanding bonds payable in the open market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

36

On October 23, 2006, Pastore Corporation loaned $100,000 to its subsidiary, Selma Company, on a 60-day, 12% promissory note. On November 4, 2006, Pastore discounted the Selma note at Second State Bank at a discount rate of 15%. The cash proceeds of the discounting is computed as:

A) $100,000 - ($100,000 x 0.15 x 12/360)

B) $102,000 - ($102,000 x 0.15 x 12/360)

C) $102,000 - ($102,000 x 0.15 x 48/360)

D) $100,000 - ($100,000 x 0.15 x 48/360)

A) $100,000 - ($100,000 x 0.15 x 12/360)

B) $102,000 - ($102,000 x 0.15 x 12/360)

C) $102,000 - ($102,000 x 0.15 x 48/360)

D) $100,000 - ($100,000 x 0.15 x 48/360)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

37

Refer to the facts in 36. In its journal entry to record the discounting of the note, Selma:

A) Debits Interest Expense

B) Debits Notes Payable

C) Credits Interest Payable

D) Credits Intercompany Interest Payable

A) Debits Interest Expense

B) Debits Notes Payable

C) Credits Interest Payable

D) Credits Intercompany Interest Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

38

On March 1, 2006, Picadilly Corporation loaned $12,000 to its subsidiary, Soho Company, on a 90-day, 12% promissory note. On March 3l, 2006, Picadilly discounted the Soho note at National Bank at a 15% discount rate. In its journal entry to record the discounting, Picadilly credits Intercompany Interest Revenue in the amount of:

A) $0

B) $51

C) $120

D) $360

E) Some other amount

A) $0

B) $51

C) $120

D) $360

E) Some other amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

39

Intercompany loans, operating leases of property, and rendering of services do not include an element of intercompany profit gain or loss for the consolidated entity because:

A) The affiliated companies do not profit at each other's expense

B) The revenue of one affiliate exactly offsets the expense of the other affiliate

C) The transactions are not with outsiders

D) The intercompany amounts are eliminated in the working paper for consolidated financial statements

A) The affiliated companies do not profit at each other's expense

B) The revenue of one affiliate exactly offsets the expense of the other affiliate

C) The transactions are not with outsiders

D) The intercompany amounts are eliminated in the working paper for consolidated financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

40

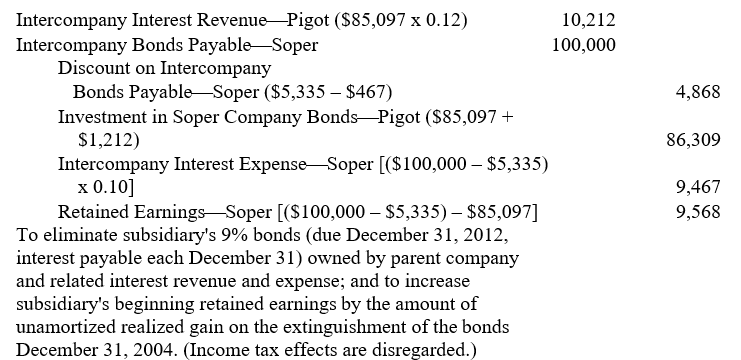

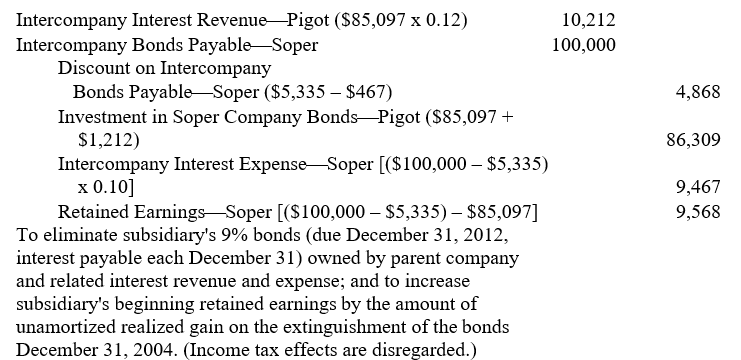

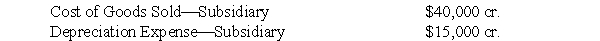

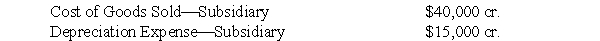

A working paper elimination (in journal entry format) for Pigot Corporation and its wholly owned subsidiary, Soper Company, on December 31, 2005, was as follows:

Prepare a comparable working paper elimination (in journal entry format) for Pigot Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination (in journal entry format) for Pigot Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination (in journal entry format) for Pigot Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination (in journal entry format) for Pigot Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

41

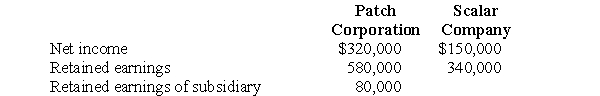

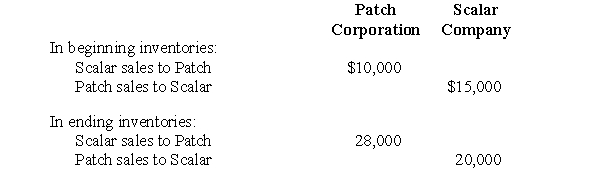

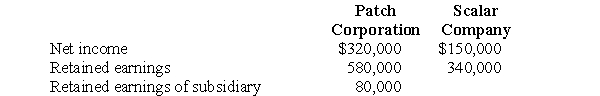

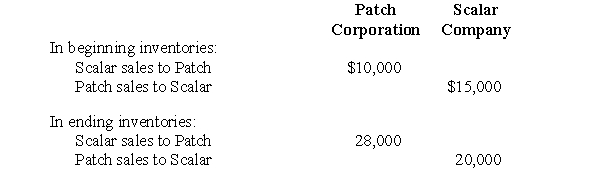

Patch Corporation accounts for the investment in its 70%-owned subsidiary, Scalar Company, by the equity method. Amounts in the financial statements of the two companies for the fiscal year ended December 31, 2006, after closing entries, included the following:

Working paper eliminations for the consolidated financial statements of Patch Corporation and subsidiary included the following intercompany profit items:

Working paper eliminations for the consolidated financial statements of Patch Corporation and subsidiary included the following intercompany profit items:

Prepare a working paper to compute the following:

Prepare a working paper to compute the following:

a. Consolidated net income for the year ended December 31, 2006

b. Consolidated retained earnings, December 31, 2006

Working paper eliminations for the consolidated financial statements of Patch Corporation and subsidiary included the following intercompany profit items:

Working paper eliminations for the consolidated financial statements of Patch Corporation and subsidiary included the following intercompany profit items: Prepare a working paper to compute the following:

Prepare a working paper to compute the following:a. Consolidated net income for the year ended December 31, 2006

b. Consolidated retained earnings, December 31, 2006

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

42

On May 1, 2003, Spe Company sold to Pub Corporation, its parent company, for $120,000 machinery with a carrying amount of $90,000 (net of $10,000 accumulated depreciation), a remaining economic life of six years, and no residual value. Pub adopted the straight-line method of depreciation for the machinery. Pub owns 80% of Spe's outstanding common stock.

a. Prepare Spe Company's May 1, 2003, journal entry to record the sale of the machinery. Omit explanation and disregard income taxes.

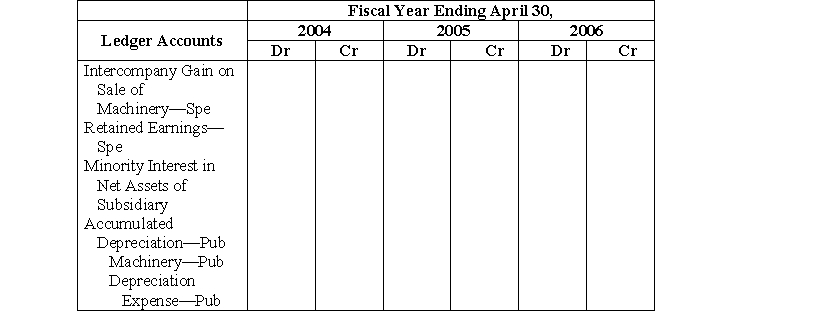

b. Prepare a working paper for Pub Corporation and subsidiary summarizing the working paper eliminations (in journal entry format) with respect to the machinery for the three fiscal years ending April 30, 2006. Omit explanations and disregard income taxes. Use the following format:

a. Prepare Spe Company's May 1, 2003, journal entry to record the sale of the machinery. Omit explanation and disregard income taxes.

b. Prepare a working paper for Pub Corporation and subsidiary summarizing the working paper eliminations (in journal entry format) with respect to the machinery for the three fiscal years ending April 30, 2006. Omit explanations and disregard income taxes. Use the following format:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

43

On November 1, 2005, Phaser Corporation issued to the public $1,000,000 face amount of 9%, 10-year bonds maturing November 1, 2015, for $1,067,100, a yield rate of 8%. Interest on the bonds was payable annually beginning November 1, 2006. On October 31, 2006, Sedd Company, the 70%-owned subsidiary of Phaser, acquired in the open market $300,000 face amount of Phaser's outstanding 9% bonds for $282,723, a yield rate of 10%, plus accrued interest.

a. Prepare journal entries for Phaser Corporation on November 1, 2005, and October 31, 2006, related to the bonds. Omit explanations for the journal entries and disregard bond issue costs and income taxes.

b. Prepare a working paper elimination (in journal entry format) for Phaser Corporation and subsidiary on October 31, 2006 (the date Sedd Company acquired the Phaser Corporation bonds and the fiscal year end). Omit explanation and disregard income taxes.

a. Prepare journal entries for Phaser Corporation on November 1, 2005, and October 31, 2006, related to the bonds. Omit explanations for the journal entries and disregard bond issue costs and income taxes.

b. Prepare a working paper elimination (in journal entry format) for Phaser Corporation and subsidiary on October 31, 2006 (the date Sedd Company acquired the Phaser Corporation bonds and the fiscal year end). Omit explanation and disregard income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

44

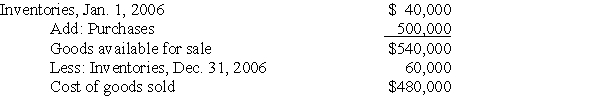

Purkle Corporation purchased merchandise from its 94%-owned subsidiary, Sterkel Company, at the subsidiary's normal gross margin rate of 25%. Purkle's accounting records for Fiscal Year 2006 show the following with respect to purchases from Sterkel:

Prepare a working paper elimination (in journal entry format) for Purkle Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a working paper elimination (in journal entry format) for Purkle Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a working paper elimination (in journal entry format) for Purkle Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

Prepare a working paper elimination (in journal entry format) for Purkle Corporation and subsidiary on December 31, 2006. Omit explanation and disregard income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

45

On July 1, 2001, Sixty Company, the 90%-owned subsidiary of Pandle Corporation, issued to the public $100,000 face amount of 7% bonds (interest payable annually) due July 1, 2006, for $92,221, a yield rate of 9%. On June 30, 2003, when the carrying amount of the bonds was $94,938, Pandle acquired $40,000 face amount of the outstanding 7% bonds in the open market for $37,016, a yield rate of 10%.

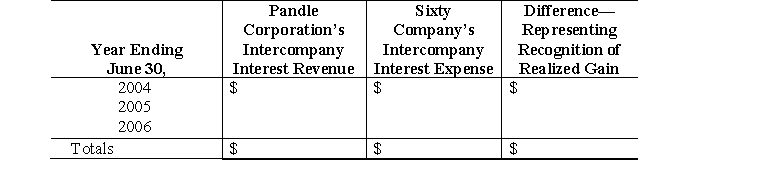

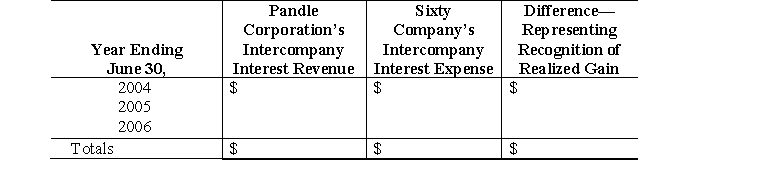

Prepare a working paper to show how the $959 intercompany gain realized by Sixty on June 30, 2003, will be recognized in the accounting records of Pandle Corporation and Sixty Company for the three years ending June 30, 2006. Use the following format:

Prepare a working paper to show how the $959 intercompany gain realized by Sixty on June 30, 2003, will be recognized in the accounting records of Pandle Corporation and Sixty Company for the three years ending June 30, 2006. Use the following format:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

46

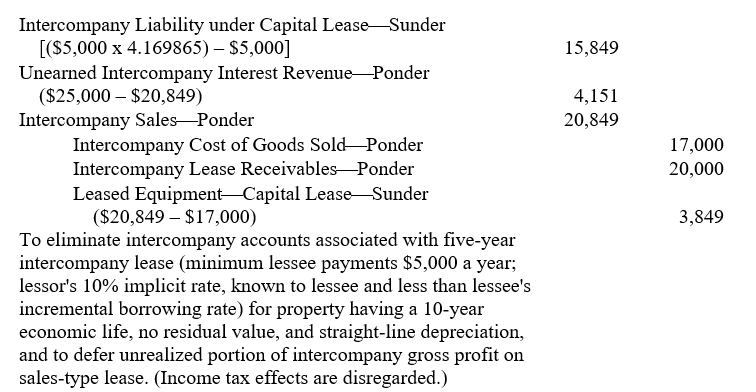

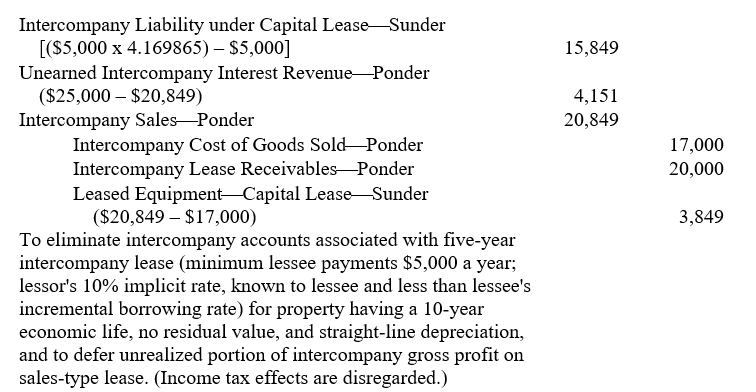

The working paper eliminations (in journal entry format) for Ponder Corporation and subsidiary for the fiscal year ended October 31, 2005, included the following:

Prepare a comparable working paper elimination for Ponder Corporation and subsidiary on October 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination for Ponder Corporation and subsidiary on October 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination for Ponder Corporation and subsidiary on October 31, 2006. Omit explanation and disregard income taxes.

Prepare a comparable working paper elimination for Ponder Corporation and subsidiary on October 31, 2006. Omit explanation and disregard income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

47

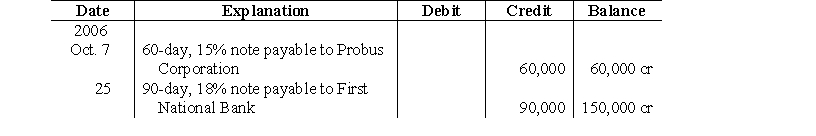

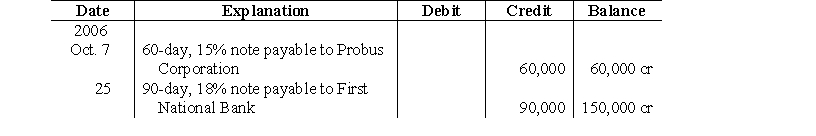

The Notes Payable ledger account of Santos Company, the 95%-owned subsidiary of Probus Corporation, is shown below for the month of October, 2006, the first month after the business combination. Santos did not accrue interest on October 31, 2006.

Prepare adjusting entries for Santos Company on October 31, 2006, the end of the fiscal year of both Probus Corporation and Santos Company.

Prepare adjusting entries for Santos Company on October 31, 2006, the end of the fiscal year of both Probus Corporation and Santos Company.

Prepare adjusting entries for Santos Company on October 31, 2006, the end of the fiscal year of both Probus Corporation and Santos Company.

Prepare adjusting entries for Santos Company on October 31, 2006, the end of the fiscal year of both Probus Corporation and Santos Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

48

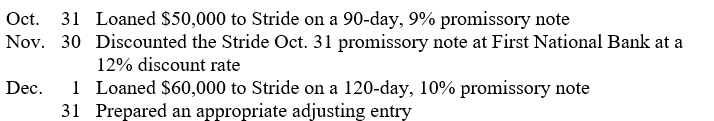

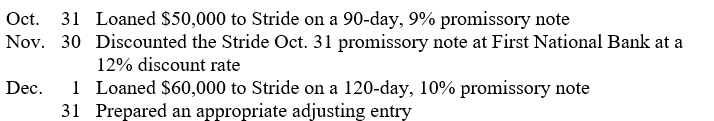

During the fiscal year ended December 31, 2006, Pride Corporation had the following loan transactions or events with its wholly owned subsidiary, Stride Company:

Prepare journal entries for the foregoing loan transactions and events in the accounting records of (a) Pride Corporation and (b) Stride Company. Omit explanations for the journal entries. Round amounts to the nearest dollar.

Prepare journal entries for the foregoing loan transactions and events in the accounting records of (a) Pride Corporation and (b) Stride Company. Omit explanations for the journal entries. Round amounts to the nearest dollar.

Prepare journal entries for the foregoing loan transactions and events in the accounting records of (a) Pride Corporation and (b) Stride Company. Omit explanations for the journal entries. Round amounts to the nearest dollar.

Prepare journal entries for the foregoing loan transactions and events in the accounting records of (a) Pride Corporation and (b) Stride Company. Omit explanations for the journal entries. Round amounts to the nearest dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

49

Included in the working paper eliminations (in journal entry format) for Parent Corp. and 93%-owned Subsidiary Company for the fiscal year ended May 31, 2006, were the following items related to Parent's sales to Subsidiary:

Explain the effect of the foregoing on consolidated net income of Parent Corp. and Subsidiary and on minority interest in net income of subsidiary for the year ended May 31, 2006.

Explain the effect of the foregoing on consolidated net income of Parent Corp. and Subsidiary and on minority interest in net income of subsidiary for the year ended May 31, 2006.

Explain the effect of the foregoing on consolidated net income of Parent Corp. and Subsidiary and on minority interest in net income of subsidiary for the year ended May 31, 2006.

Explain the effect of the foregoing on consolidated net income of Parent Corp. and Subsidiary and on minority interest in net income of subsidiary for the year ended May 31, 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck