Deck 12: Performance Evaluation and the Balanced Scorecard

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 12: Performance Evaluation and the Balanced Scorecard

1

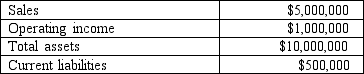

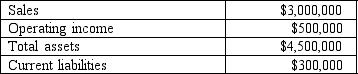

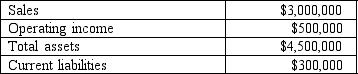

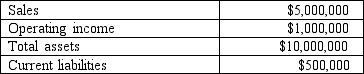

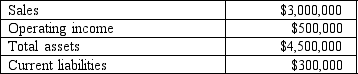

Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%.

-What is the division's return on investment?

A) 5%

B) 10%

C) 20%

D) 50%

-What is the division's return on investment?

A) 5%

B) 10%

C) 20%

D) 50%

10%

2

Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%.

- What is the division's economic value added?

A) $60,000

B) $130,000

C) $270,000

D) $430,000

- What is the division's economic value added?

A) $60,000

B) $130,000

C) $270,000

D) $430,000

$130,000

3

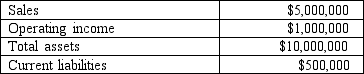

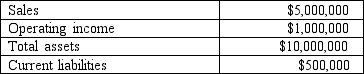

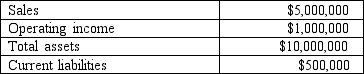

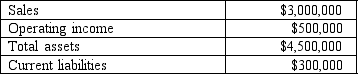

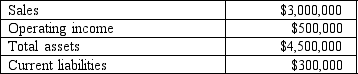

Assume the Apple division of the Gala Company had the following results last year (in thousands). Managements required rate of return is 10% and the weighted average cost of capital is 8%. Its effective tax rate is 30%.

What is Apple division's return on investment?

What is Apple division's return on investment?

A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

What is Apple division's return on investment?

What is Apple division's return on investment?A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

11.11%

4

Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%.

- What is the division's capital turnover?

A) 5%

B) 10%

C) 20%

D) 50%

- What is the division's capital turnover?

A) 5%

B) 10%

C) 20%

D) 50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Assume division 1 of the XYZ Company had the following results last year (in thousands). Management's required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%.

- What is the division's residual income?

A) $100,000

B) $200,000

C) $500,000

D) $800,000

- What is the division's residual income?

A) $100,000

B) $200,000

C) $500,000

D) $800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assume the Apple division of the Gala Company had the following results last year (in thousands). Managements required rate of return is 10% and the weighted average cost of capital is 8%. Its effective tax rate is 30%.

-What is Apple division's profit margin?

A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

-What is Apple division's profit margin?

A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume the Apple division of the Gala Company had the following results last year (in thousands). Managements required rate of return is 10% and the weighted average cost of capital is 8%. Its effective tax rate is 30%.

- What is Apple division's capital turnover?

A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

- What is Apple division's capital turnover?

A) 11.11%

B) 16.67%

C) 66.67%

D) 60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume the Apple division of the Gala Company had the following results last year (in thousands). Managements required rate of return is 10% and the weighted average cost of capital is 8%. Its effective tax rate is 30%.

- What is Apple division's residual income?

A) $50,000

B) $140,000

C) $336,000

D) $360,000

- What is Apple division's residual income?

A) $50,000

B) $140,000

C) $336,000

D) $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

The management of Mullen Division has provided the following information:

Operating assets: $600,000

Operating income: $90,000

Sales: $300,000

Management is considering investing in an additional project costing $60,000; it is estimated that the project will create operating income of $7,200. Mullen's minimum desired rate of return is 10%. Should Mullen's management invest in the project if management is evaluated using residual income?

A) Yes, because the operating income is positive.

B) No, because the return on investment for the project is less than Mullen's current return on investment.

C) No, because the investment will lower Mullen's residual income.

D) Yes, because the project's return on investment exceeds the minimum desired rate of return.

Operating assets: $600,000

Operating income: $90,000

Sales: $300,000

Management is considering investing in an additional project costing $60,000; it is estimated that the project will create operating income of $7,200. Mullen's minimum desired rate of return is 10%. Should Mullen's management invest in the project if management is evaluated using residual income?

A) Yes, because the operating income is positive.

B) No, because the return on investment for the project is less than Mullen's current return on investment.

C) No, because the investment will lower Mullen's residual income.

D) Yes, because the project's return on investment exceeds the minimum desired rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

Waddington Corporation currently has a return on investment of 12%. The Madrid division is Reporting residual income of $1,000,000 and a 14% return on investment. The Madrid division is Contemplating an investment opportunity which has an 11% return on investment and a positive Residual income. Should Madrid division's management make the investment if goal congruence is Important to the Waddington Corporation?

A) No, because Waddington Corporation's return on investment will decrease.

B) No, because Madrid division's return on investment will decrease.

C) Yes, because Waddington Corporation's residual income will increase.

D) Yes, because Waddington Corporation will be better off if any investment with a positive return on investment is made.

A) No, because Waddington Corporation's return on investment will decrease.

B) No, because Madrid division's return on investment will decrease.

C) Yes, because Waddington Corporation's residual income will increase.

D) Yes, because Waddington Corporation will be better off if any investment with a positive return on investment is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Canton Corporation currently has a return on investment of 14%. The Potsdam division is Reporting residual income of $500,000 and a 12% return on investment. The Potsdam division is Contemplating an investment opportunity which has a 13% return on investment and a positive Residual income. Should Potsdam division's management make the investment if goal congruence is

Important to the Canton Corporation?

A) Yes, because Potsdam division's return on investment will increase.

B) No, because Canton Corporation's return on investment will decrease.

C) Yes, because Canton Corporation's residual income will increase.

D) No, because Canton Corporation's residual income will decrease as a result of accepting an investment opportunity with a return on investment less than 14%.

Important to the Canton Corporation?

A) Yes, because Potsdam division's return on investment will increase.

B) No, because Canton Corporation's return on investment will decrease.

C) Yes, because Canton Corporation's residual income will increase.

D) No, because Canton Corporation's residual income will decrease as a result of accepting an investment opportunity with a return on investment less than 14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

Norwood Company has a return on investment of 10%, operating income of $200,000, and a capital Turnover of 4.0. How much were Norwood's total assets?

A) $2,000,000

B) $800,000

C) $8,000,000

D) $20,000

A) $2,000,000

B) $800,000

C) $8,000,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

Norwood Company has a return on investment of 10%, operating income of $200,000, and a capital Turnover of 4.0. How much were Norwood's sales?

A) $10,000,000

B) $8,000,000

C) $2,000,000

D) $200,000

A) $10,000,000

B) $8,000,000

C) $2,000,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

Madrid Company has a return on investment of 12.5%, sales of $4,000,000, and a profit margin of 5%. How much were Madrid's total assets?

A) $1,600,000

B) $2,000,000

C) $500,000

D) $4,000,000

A) $1,600,000

B) $2,000,000

C) $500,000

D) $4,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

Hancock Corporation has a capital turnover of 2, sales of $500,000, and a return on investment of 4%. What was Hancock's operating income??

A) $250,000

B) $500,000

C) $10,000

D) $20,000

A) $250,000

B) $500,000

C) $10,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

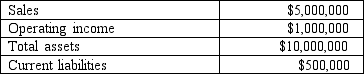

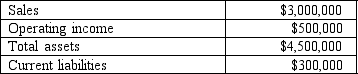

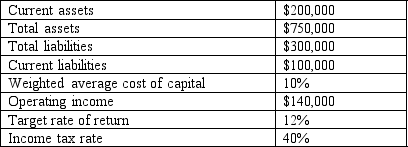

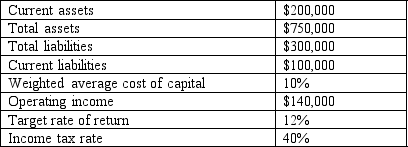

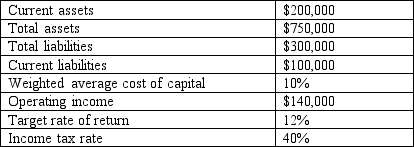

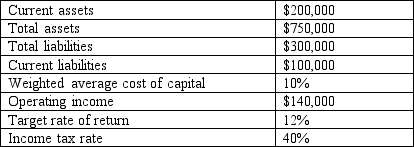

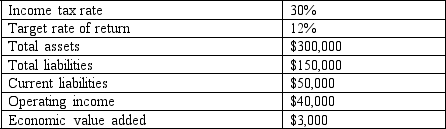

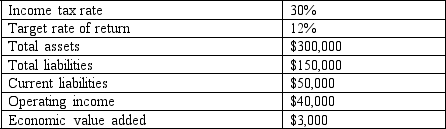

Herb Corporation has provided the following information:

-What is Herb Corporation's economic value added?

A) $65,000

B) $19,000

C) $50,000

D) $6,000

-What is Herb Corporation's economic value added?

A) $65,000

B) $19,000

C) $50,000

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

Herb Corporation has provided the following information:

- What is Herb Corporation's residual income?

A) $74,000

B) $62,000

C) $50,000

D) $65,000

- What is Herb Corporation's residual income?

A) $74,000

B) $62,000

C) $50,000

D) $65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

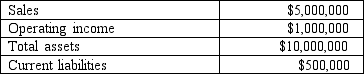

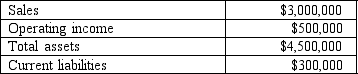

The Gnome Company has provided the following information:

-What was Gnome's weighted average cost of capital?

A) 8%

B) 10%

C) 14%

D) 12%

-What was Gnome's weighted average cost of capital?

A) 8%

B) 10%

C) 14%

D) 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck