Deck 1: Introduction to Management Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 1: Introduction to Management Accounting

1

merchandiser's purchases are equivalent to what for a manufacturer?

A) Materials inventory

B) Cost of goods manufactured

C) Work in process inventory

D) Cost of goods sold

A) Materials inventory

B) Cost of goods manufactured

C) Work in process inventory

D) Cost of goods sold

Cost of goods manufactured

2

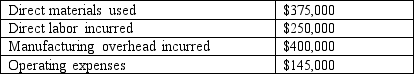

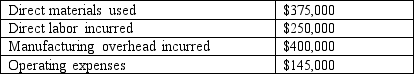

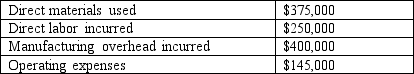

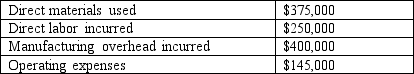

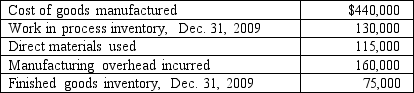

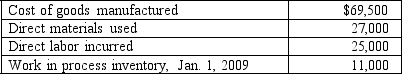

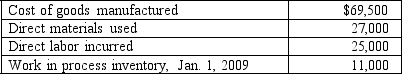

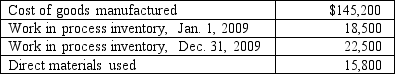

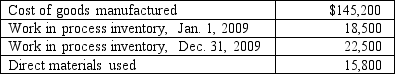

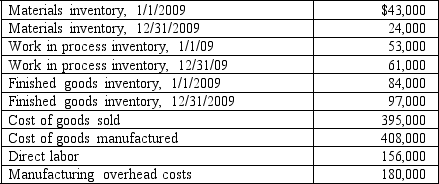

Wright Company reports production costs for 2009 as follows:

- How much are Wright Company's period costs for 2009?

A) $250,000

B) $575,000

C) $145,000

D) $375,000

- How much are Wright Company's period costs for 2009?

A) $250,000

B) $575,000

C) $145,000

D) $375,000

$145,000

3

Wright Company reports production costs for 2009 as follows:

-How much are Wright Company's inventoriable product costs for 2009?

A) $925,000

B) $605,000

C) $975,000

D) $1,025,000

-How much are Wright Company's inventoriable product costs for 2009?

A) $925,000

B) $605,000

C) $975,000

D) $1,025,000

$1,025,000

4

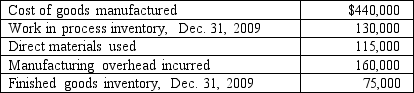

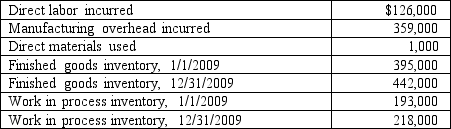

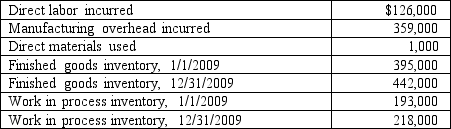

Fitness Company reports the following data for 2009, its first year of operations:

-What are the total manufacturing costs to be accounted for?

A) $300,000

B) $190,000

C) $160,000

D) $570,000

-What are the total manufacturing costs to be accounted for?

A) $300,000

B) $190,000

C) $160,000

D) $570,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fitness Company reports the following data for 2009, its first year of operations:

-EWhat is cost of goods sold for 2009?

A) $365,000

B) $480,000

C) $340,000

D) $240,000

-EWhat is cost of goods sold for 2009?

A) $365,000

B) $480,000

C) $340,000

D) $240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

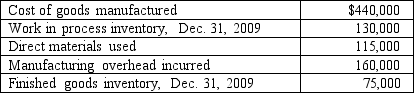

Redbird Company reports the following data for 2009:

Manufacturing overhead is 75% of the cost of direct labor. What is work in process inventory on Dec. 31, 2009?

Manufacturing overhead is 75% of the cost of direct labor. What is work in process inventory on Dec. 31, 2009?

A) $13,500

B) $10,200

C) $12,250

D) $22,500

Manufacturing overhead is 75% of the cost of direct labor. What is work in process inventory on Dec. 31, 2009?

Manufacturing overhead is 75% of the cost of direct labor. What is work in process inventory on Dec. 31, 2009?A) $13,500

B) $10,200

C) $12,250

D) $22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

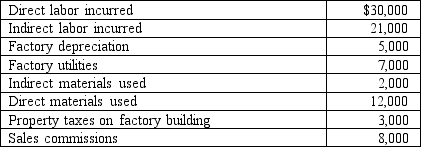

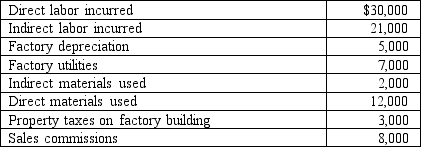

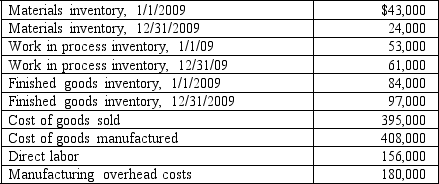

Selected data for Young Company for 2009 is presented below:

What is the manufacturing overhead for 2009?

What is the manufacturing overhead for 2009?

A) $47,000

B) $50,000

C) $38,000

D) $46,000

What is the manufacturing overhead for 2009?

What is the manufacturing overhead for 2009?A) $47,000

B) $50,000

C) $38,000

D) $46,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

Village Company's selected cost data for 2009 are shown below:

What are total manufacturing costs incurred by Village Company in 2009?

What are total manufacturing costs incurred by Village Company in 2009?

A) $149,200

B) $158,300

C) $139,800

D) $117,100

What are total manufacturing costs incurred by Village Company in 2009?

What are total manufacturing costs incurred by Village Company in 2009?A) $149,200

B) $158,300

C) $139,800

D) $117,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

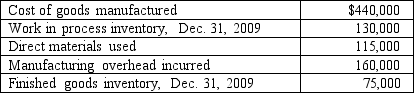

Given the following information, determine the cost of goods manufactured and the cost of goods sold for 2009.

A) $781,000 and $837,000

B) $461,000 and $414,000

C) $731,000 and $684,000

D) $765,000 and $709,000

A) $781,000 and $837,000

B) $461,000 and $414,000

C) $731,000 and $684,000

D) $765,000 and $709,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

Given the following information, calculate the direct materials purchased in 2009.

A) $67,000

B) $85,000

C) $61,000

D) $80,000

A) $67,000

B) $85,000

C) $61,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Robinson Company has provided the following information:

.Raw materials inventory increased $15,000.

.Work in process inventory decreased $29,000.

.Finished goods inventory decreased $47,000.

.Sales were $500,000.

.The gross profit ratio was 52.2%.

-

How much was Robinson's cost of goods manufactured?

A) $268,000

B) $192,000

C) $286,000

D) $239,000

.Raw materials inventory increased $15,000.

.Work in process inventory decreased $29,000.

.Finished goods inventory decreased $47,000.

.Sales were $500,000.

.The gross profit ratio was 52.2%.

-

How much was Robinson's cost of goods manufactured?

A) $268,000

B) $192,000

C) $286,000

D) $239,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

Robinson Company has provided the following information:

.Raw materials inventory increased $15,000.

.Work in process inventory decreased $29,000.

.Finished goods inventory decreased $47,000.

.Sales were $500,000.

.The gross profit ratio was 52.2%.

-

The manufacturing costs incurred by Robinson during the period were how much?

A) $221,000

B) $192,000

C) $163,000

D) $239,000

.Raw materials inventory increased $15,000.

.Work in process inventory decreased $29,000.

.Finished goods inventory decreased $47,000.

.Sales were $500,000.

.The gross profit ratio was 52.2%.

-

The manufacturing costs incurred by Robinson during the period were how much?

A) $221,000

B) $192,000

C) $163,000

D) $239,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

Savard Corporation reported the following:

.Raw material purchases totaling $100,000.

.Raw material inventory increased $5,000.

.Direct labor costs incurred totaled $150,000.

.Total factory overhead was $225,000.

.Work in process increased $20,000.

.Indirect labor was $7,000.

.Finished goods increased $40,000.

.Sales salaries were $75,000.

-

How much was Savard's cost of goods manufactured?

A) $450,000

B) $490,000

C) $457,000

D) $497,000

.Raw material purchases totaling $100,000.

.Raw material inventory increased $5,000.

.Direct labor costs incurred totaled $150,000.

.Total factory overhead was $225,000.

.Work in process increased $20,000.

.Indirect labor was $7,000.

.Finished goods increased $40,000.

.Sales salaries were $75,000.

-

How much was Savard's cost of goods manufactured?

A) $450,000

B) $490,000

C) $457,000

D) $497,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

Savard Corporation reported the following:

.Raw material purchases totaling $100,000.

.Raw material inventory increased $5,000.

.Direct labor costs incurred totaled $150,000.

.Total factory overhead was $225,000.

.Work in process increased $20,000.

.Indirect labor was $7,000.

.Finished goods increased $40,000.

.Sales salaries were $75,000.

- How much was Savard's cost of goods sold?

A) $410,000

B) $450,000

C) $407,000

D) $457,000

.Raw material purchases totaling $100,000.

.Raw material inventory increased $5,000.

.Direct labor costs incurred totaled $150,000.

.Total factory overhead was $225,000.

.Work in process increased $20,000.

.Indirect labor was $7,000.

.Finished goods increased $40,000.

.Sales salaries were $75,000.

- How much was Savard's cost of goods sold?

A) $410,000

B) $450,000

C) $407,000

D) $457,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

The following information has been provided by LeMaire Company:

.Direct labor: $50,000

.Direct materials used: $20,000

.Direct materials purchased: $27,000

.Cost of goods manufactured: $100,000

.Ending work in process: $16,000

.Corporate headquarters' property taxes: $6,000

.Manufacturing overhead: $39,000

The beginning work in process was:

A) $23,000.

B) $7,000.

C) $9,000.

D) $1,000.

.Direct labor: $50,000

.Direct materials used: $20,000

.Direct materials purchased: $27,000

.Cost of goods manufactured: $100,000

.Ending work in process: $16,000

.Corporate headquarters' property taxes: $6,000

.Manufacturing overhead: $39,000

The beginning work in process was:

A) $23,000.

B) $7,000.

C) $9,000.

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following information was obtained from Sizzler Company:

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much were Sizzler's period costs?

A) $27,690

B) $7,900

C) $19,790

D) $19,000

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much were Sizzler's period costs?

A) $27,690

B) $7,900

C) $19,790

D) $19,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

The following information was obtained from Sizzler Company:

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much were Sizzler's product costs?

A) $102,190

B) $99,500

C) $129,090

D) $101,400

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much were Sizzler's product costs?

A) $102,190

B) $99,500

C) $129,090

D) $101,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

The following information was obtained from Sizzler Company:

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much was Sizzler's factory overhead?

A) $24,190

B) $1,600

C) $23,400

D) $3,600

.Advertising costs: $7,900

.Indirect labor: $9,000

.Direct Labor: $31,000

.Indirect materials: $7,200

.Direct materials: $47,000

.Factory utilities: $3,000

.Factory supplies: $700

.Factory janitorial costs: $1,900

.Manufacturing equipment depreciation: $1,600

.Delivery vehicle depreciation: $790

.Administrative wages and salaries: $19,000

-How much was Sizzler's factory overhead?

A) $24,190

B) $1,600

C) $23,400

D) $3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck