Deck 21: Key Performance Indicators, Compensation, and Multinational Considerations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 21: Key Performance Indicators, Compensation, and Multinational Considerations

1

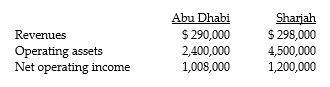

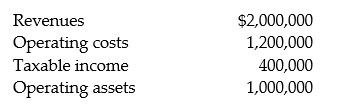

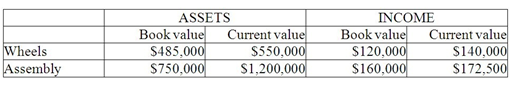

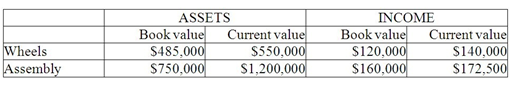

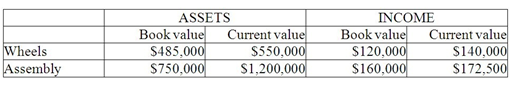

Samir Company has two regional offices. The data for each are as follows:

What is the Abu Dhabi Division's return on investment?

What is the Abu Dhabi Division's return on investment?

A) 0.54

B) 4.12

C) 0.42

D) 0.96

What is the Abu Dhabi Division's return on investment?

What is the Abu Dhabi Division's return on investment?A) 0.54

B) 4.12

C) 0.42

D) 0.96

0.42

2

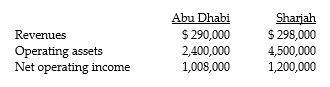

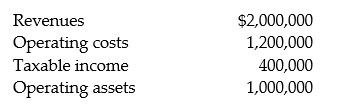

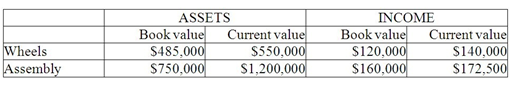

Thamina Company has two regional offices. The data for each are as follows:

What is the return on investment for the Sharjah Division?

What is the return on investment for the Sharjah Division?

A) 0.21

B) 0.48

C) 0.27

D) 2.06

What is the return on investment for the Sharjah Division?

What is the return on investment for the Sharjah Division?A) 0.21

B) 0.48

C) 0.27

D) 2.06

0.27

3

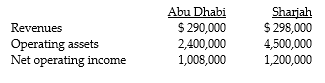

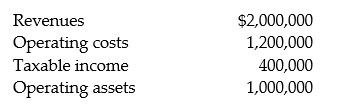

Answer the following questions using the information below:

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's investment turnover ratio?

A) 2.50

B) 0.80

C) 3.33

D) 2.00

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's investment turnover ratio?

A) 2.50

B) 0.80

C) 3.33

D) 2.00

2.00

4

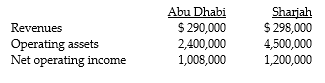

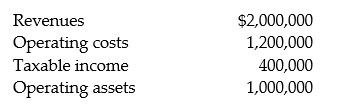

Answer the following questions using the information below:

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's return on investment?

A) 0.5

B) 0.2

C) 0.8

D) 0.4

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

-What is the Cyclotron Division's return on investment?

A) 0.5

B) 0.2

C) 0.8

D) 0.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Answer the following questions using the information below:

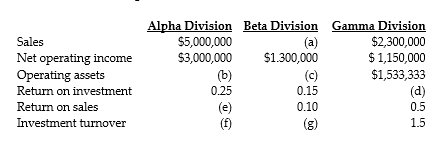

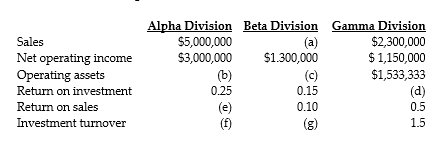

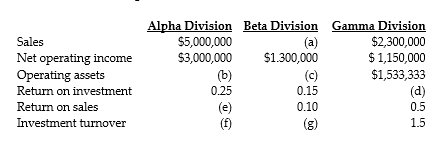

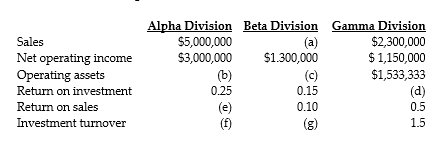

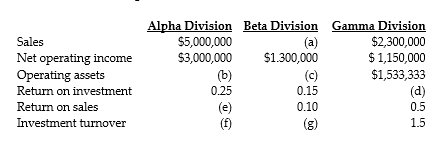

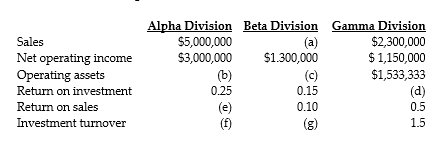

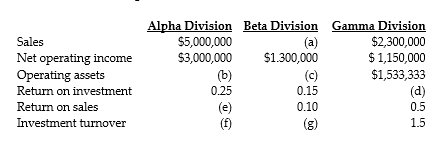

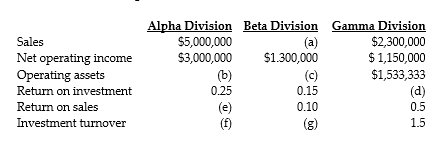

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Beta Division?

A) $14,303,600

B) $11,904,760

C) $13,000,000

D) $8,666,667

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Beta Division?

A) $14,303,600

B) $11,904,760

C) $13,000,000

D) $8,666,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the operating assets belonging to the Beta Division?

A) $13,000,000

B) $14,303,600

C) $11,904,760

D) $8,666,667

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the value of the operating assets belonging to the Beta Division?

A) $13,000,000

B) $14,303,600

C) $11,904,760

D) $8,666,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

A) 0.25

B) 0.60

C) 0.42

D) 0.75

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

A) 0.25

B) 0.60

C) 0.42

D) 0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's return on sales?

A) 0.60

B) 0.42

C) 0.25

D) 0.75

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Alpha Division's return on sales?

A) 0.60

B) 0.42

C) 0.25

D) 0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Answer the following questions using the information below:

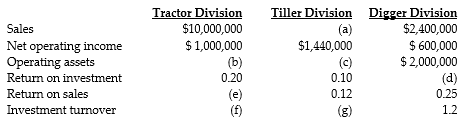

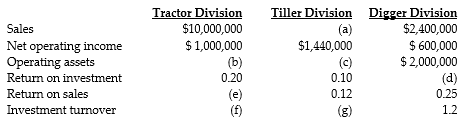

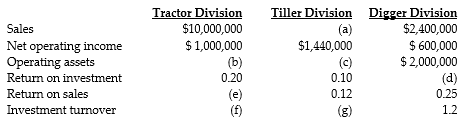

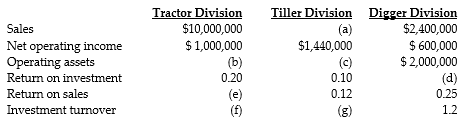

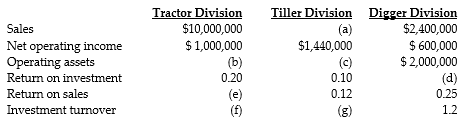

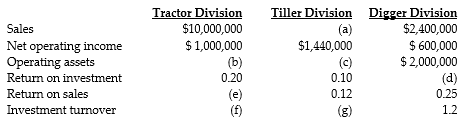

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Tiller Division?

A) $15,500,000

B) $15,000,000

C) $9,600,000

D) $12,000,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What were the sales for the Tiller Division?

A) $15,500,000

B) $15,000,000

C) $9,600,000

D) $12,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's return on sales?

A) 0.12

B) 0.10

C) 0.20

D) 0.15

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's return on sales?

A) 0.12

B) 0.10

C) 0.20

D) 0.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's investment turnover?

A) 2.0

B) 1.0

C) .50

D) 2.5

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Tractor Division's investment turnover?

A) 2.0

B) 1.0

C) .50

D) 2.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

Answer the following questions using the information below:

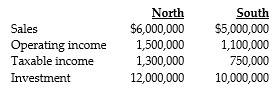

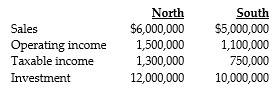

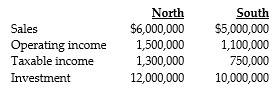

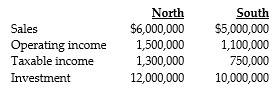

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2014 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.

-What are the respective return-on-investment ratios for the North and South Divisions?

A) 0.125 and 0.110

B) 0.125 and 0.150

C) 0.108 and 0.075

D) 0.110 and 0.125

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2014 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.-What are the respective return-on-investment ratios for the North and South Divisions?

A) 0.125 and 0.110

B) 0.125 and 0.150

C) 0.108 and 0.075

D) 0.110 and 0.125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

Answer the following questions using the information below:

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2014 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.

-What are the respective residual incomes for the North and South Divisions?

A) $300,000 and $60,000

B) $300,000 and $100,000

C) $100,000 and a negative $300,000

D) $60,000 and $100,000

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2014 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.-What are the respective residual incomes for the North and South Divisions?

A) $300,000 and $60,000

B) $300,000 and $100,000

C) $100,000 and a negative $300,000

D) $60,000 and $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

Answer the following questions using the information below:

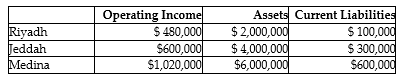

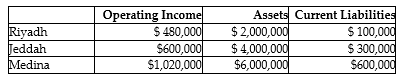

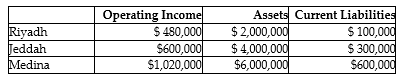

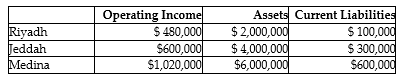

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Riyadh?

A) $163,730

B) $196,270

C) $360,000

D) $127,870

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Riyadh?

A) $163,730

B) $196,270

C) $360,000

D) $127,870

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

Answer the following questions using the information below:

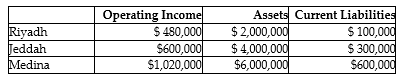

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Jeddah?

A) $110,000

B) $67,790

C) $152,500

D) $117,000

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Jeddah?

A) $110,000

B) $67,790

C) $152,500

D) $117,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

Answer the following questions using the information below:

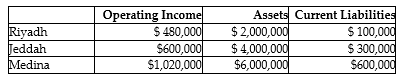

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Medina?

A) $557,820

B) $207,180

C) $765,000

D) $225,000

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Medina?

A) $557,820

B) $207,180

C) $765,000

D) $225,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

Answer the following questions using the information below:

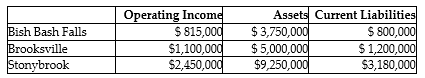

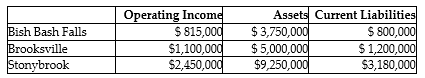

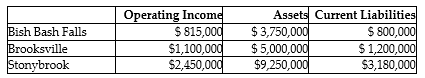

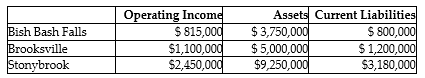

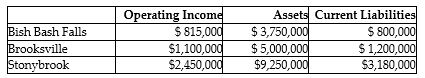

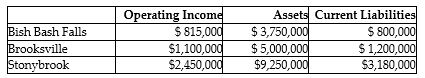

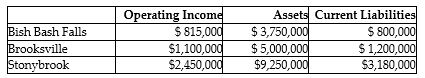

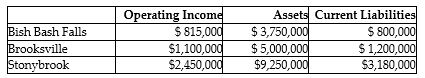

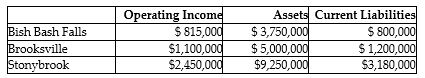

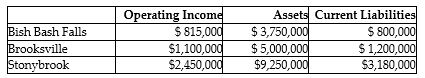

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Brooksville?

A) $415,525

B) $390,000

C) $476,250

D) $428,000

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Brooksville?

A) $415,525

B) $390,000

C) $476,250

D) $428,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

Answer the following questions using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

A) $1,315,063

B) $1,403,063

C) $1,108,000

D) $1,168,700

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

A) $1,315,063

B) $1,403,063

C) $1,108,000

D) $1,168,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

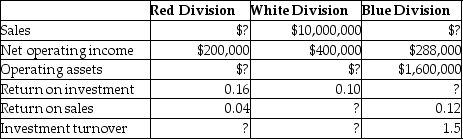

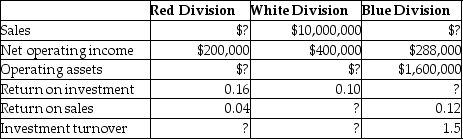

Provide the missing data for the following situations:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on book values, respectively?

A) 0.52; 0.42

B) 0.42; 0.52

C) 0.22; 0.67

D) 0.67; 0.22

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on book values, respectively?

A) 0.52; 0.42

B) 0.42; 0.52

C) 0.22; 0.67

D) 0.67; 0.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

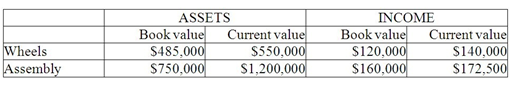

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on current values, respectively?

A) 0.52; 0.42

B) 0.67; 0.22

C) 0.22; 0.67

D) 0.42; 0.52

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's return on investment based on current values, respectively?

A) 0.52; 0.42

B) 0.67; 0.22

C) 0.22; 0.67

D) 0.42; 0.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Answer the following questions using the information below:

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's residual incomes based on book values, respectively?

A) $110,000; $67,500

B) $116,250; $32,500

C) $37,500; $116,250

D) $67,500; $110,000

Haifa Cleaning Products manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Bleach's and Cleanser's residual incomes based on book values, respectively?

A) $110,000; $67,500

B) $116,250; $32,500

C) $37,500; $116,250

D) $67,500; $110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

Answer the following questions using the information below:

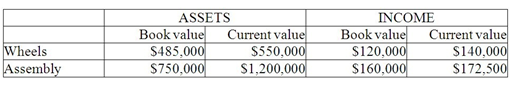

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on book values, respectively?

A) 0.14; 0.25

B) 0.25; 0.14

C) 0.21; 0.25

D) 0.25; 0.21

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on book values, respectively?

A) 0.14; 0.25

B) 0.25; 0.14

C) 0.21; 0.25

D) 0.25; 0.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

Answer the following questions using the information below:

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on current values, respectively?

A) 0.14; 0.25

B) 0.21; 0.25

C) 0.25; 0.14

D) 0.25; 0.21

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's return on investment based on current values, respectively?

A) 0.14; 0.25

B) 0.21; 0.25

C) 0.25; 0.14

D) 0.25; 0.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Answer the following questions using the information below:

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's residual incomes based on book values, respectively?

A) $28,500; $74,000

B) $63,500; $59.500

C) $74,000; $28,500

D) $61,800; $70,000

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2014:

-What are Wheels's and Assembly's residual incomes based on book values, respectively?

A) $28,500; $74,000

B) $63,500; $59.500

C) $74,000; $28,500

D) $61,800; $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Coffee Division of Arabian Coffee Products is planning the 2015 operating budget. Average operating assets of $1,500,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $400,000, while fixed costs are set at $250,000. The company's required rate of return is 18%.

Required:

a. Compute the sales volume necessary to achieve a 20% ROI.

b. The division manager receives a bonus of 50% of residual income. What is his anticipated bonus for 2015, assuming he achieves the 20% ROI from part (a)?

Required:

a. Compute the sales volume necessary to achieve a 20% ROI.

b. The division manager receives a bonus of 50% of residual income. What is his anticipated bonus for 2015, assuming he achieves the 20% ROI from part (a)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

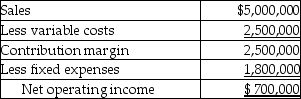

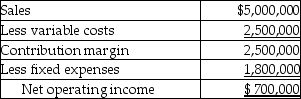

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for 2015 are budgeted as follows:

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Operating assets for the division are currently $3,600,000. For 2015, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck