Deck 18: Inventory Costing and Capacity Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 18: Inventory Costing and Capacity Analysis

1

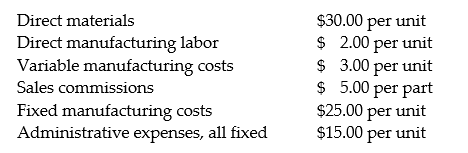

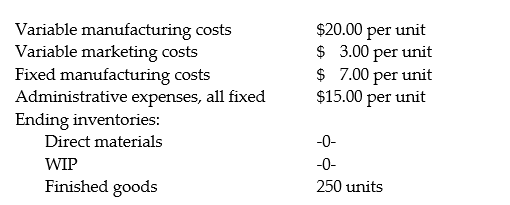

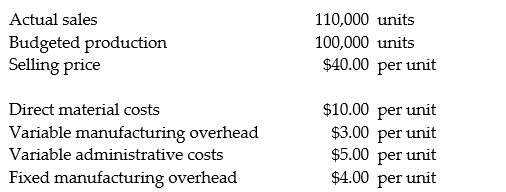

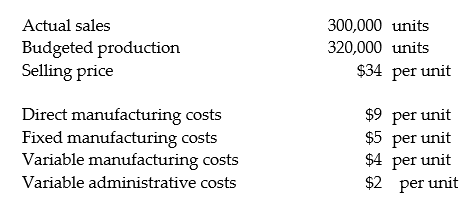

Answer the following questions using the information below:

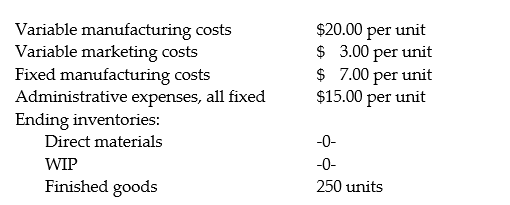

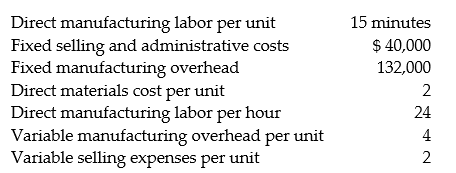

Fahim's Auto produces and sells an auto part for $60.00 per unit. In 2014, 100,000 parts were produced and 75,000 units were sold. Other information for the year includes:

-What is the inventoriable cost per unit using variable costing?

A) $28.50

B) $36.00

C) $43.50

D) $30.00

Fahim's Auto produces and sells an auto part for $60.00 per unit. In 2014, 100,000 parts were produced and 75,000 units were sold. Other information for the year includes:

-What is the inventoriable cost per unit using variable costing?

A) $28.50

B) $36.00

C) $43.50

D) $30.00

$30.00

2

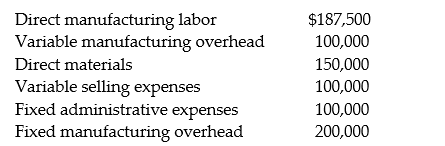

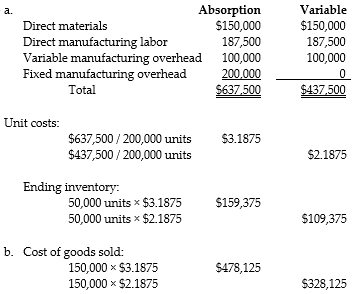

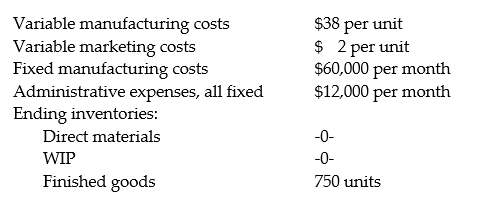

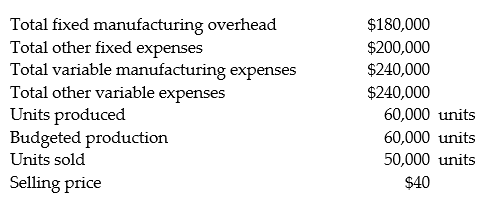

For 2014, Nasim Company had sales of 150,000 units and production of 200,000 units. Other information for the year included:

There was no beginning inventory.

Required:

a. Compute the ending finished goods inventory under both absorption and variable costing.

b. Compute the cost of goods sold under both absorption and variable costing.

There was no beginning inventory.

Required:

a. Compute the ending finished goods inventory under both absorption and variable costing.

b. Compute the cost of goods sold under both absorption and variable costing.

3

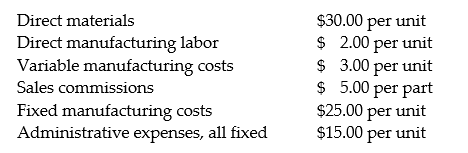

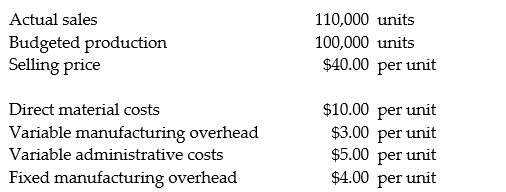

Answer the following questions using the information below:

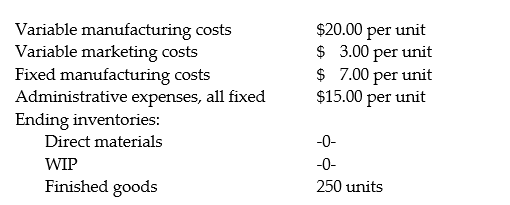

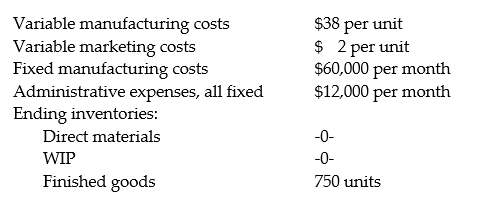

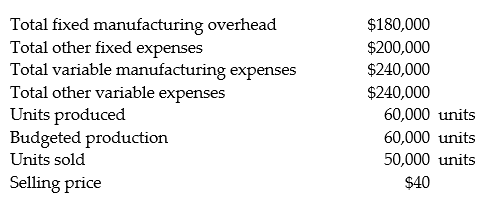

Qamar Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold using variable costing?

A) $47,250

B) $40,000

C) $54,000

D) $35,000

Qamar Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold using variable costing?

A) $47,250

B) $40,000

C) $54,000

D) $35,000

$35,000

4

Answer the following questions using the information below:

Qamar Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is contribution margin using variable costing?

A) $110,000

B) $91,000

C) $104,000

D) $96,250

Qamar Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is contribution margin using variable costing?

A) $110,000

B) $91,000

C) $104,000

D) $96,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

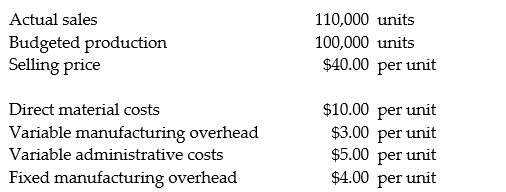

Answer the following questions using the information below:

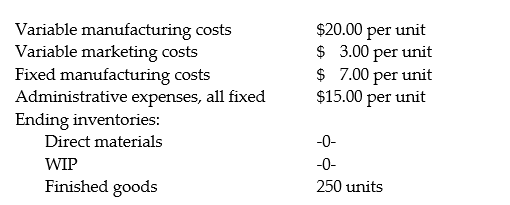

Bassim's Hobbies produces and sells a luxury animal pillow for $80.00 per unit. In the first month of operation, 3,000 units were produced and 2,250 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is operating income when using absorption costing?

A) $37,500

B) ($23,500)

C) $33,000

D) $8,000

Bassim's Hobbies produces and sells a luxury animal pillow for $80.00 per unit. In the first month of operation, 3,000 units were produced and 2,250 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is operating income when using absorption costing?

A) $37,500

B) ($23,500)

C) $33,000

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

Answer the following questions using the information below:

Sharifa Corporation incurred fixed manufacturing costs of $12,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-The production-volume variance is:

A) $4,000

B) 0

C) $3,000

D) $4,800

Sharifa Corporation incurred fixed manufacturing costs of $12,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-The production-volume variance is:

A) $4,000

B) 0

C) $3,000

D) $4,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

Answer the following questions using the information below:

Sharifa Corporation incurred fixed manufacturing costs of $12,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-Operating income using absorption costing will be ________ than operating income if using variable costing.

A) $1,800 higher

B) $7,200 lower

C) $4,800 higher

D) $4,800 lower

Sharifa Corporation incurred fixed manufacturing costs of $12,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-Operating income using absorption costing will be ________ than operating income if using variable costing.

A) $1,800 higher

B) $7,200 lower

C) $4,800 higher

D) $4,800 lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

Answer the following questions using the information below:

Dawud Corporation incurred fixed manufacturing costs of $6,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-The production-volume variance totals:

A) $2,000

B) 0

C) $1,500

D) $2,400

Dawud Corporation incurred fixed manufacturing costs of $6,000 during 2014. Other information for 2014 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-The production-volume variance totals:

A) $2,000

B) 0

C) $1,500

D) $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

Gulf Giants Corporation planned to be in operation for three years.

∙ During the first year, 2011, it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

∙ In 2012, it sold half of the finished goods inventory from 2011 for $200,000 but it had no manufacturing costs.

∙ In 2013, it sold the remainder of the inventory for $240,000, had no manufacturing expenses and went out of business.

∙ Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a. Prepare an income statement for each year using absorption costing.

b. Prepare an income statement for each year using variable costing.

∙ During the first year, 2011, it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

∙ In 2012, it sold half of the finished goods inventory from 2011 for $200,000 but it had no manufacturing costs.

∙ In 2013, it sold the remainder of the inventory for $240,000, had no manufacturing expenses and went out of business.

∙ Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a. Prepare an income statement for each year using absorption costing.

b. Prepare an income statement for each year using variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

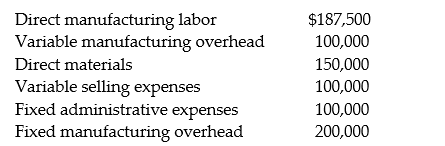

Sharjah Golf Company sells a special putter for $20 each. In March, it sold 28,000 putters while manufacturing 30,000. There was no beginning inventory on March 1. Production information for March was:

Required:

a. Compute the cost per unit under both absorption and variable costing.

b. Compute the ending inventories under both absorption and variable costing.

c. Compute operating income under both absorption and variable costing.

Required:

a. Compute the cost per unit under both absorption and variable costing.

b. Compute the ending inventories under both absorption and variable costing.

c. Compute operating income under both absorption and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

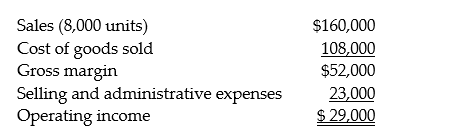

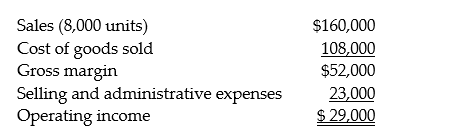

Zayed Company prepared the following absorption-costing income statement for the year ended May 31, 2014.

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold. There was no beginning inventory, and 8,750 units were produced. Variable manufacturing costs were $11 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required:

Prepare a variable-costing income statement for the same period.

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold. There was no beginning inventory, and 8,750 units were produced. Variable manufacturing costs were $11 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required:

Prepare a variable-costing income statement for the same period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

Answer the following questions using the information below:

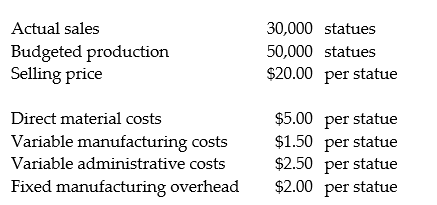

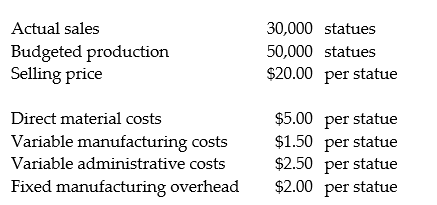

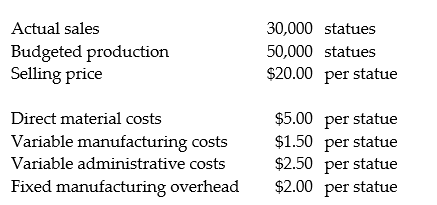

Randa Company produces wood statues. Management has provided the following information:

-What is the cost per statue if throughput costing is used?

A) $7.50

B) $5.00

C) $11.00

D) $9.50

Randa Company produces wood statues. Management has provided the following information:

-What is the cost per statue if throughput costing is used?

A) $7.50

B) $5.00

C) $11.00

D) $9.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

Answer the following questions using the information below:

Randa Company produces wood statues. Management has provided the following information:

-What is the total throughput contribution?

A) $750,000

B) $450,000

C) $1,000,000

D) $2,000,000

Randa Company produces wood statues. Management has provided the following information:

-What is the total throughput contribution?

A) $750,000

B) $450,000

C) $1,000,000

D) $2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

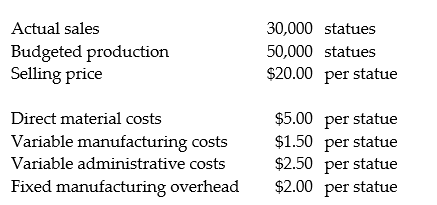

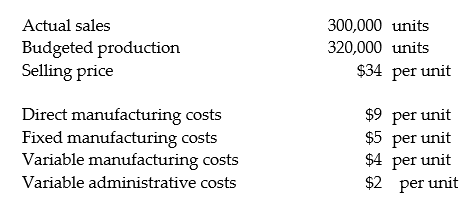

Answer the following questions using the information below:

-What is the cost per statue if throughput costing is used?

A) $22.00

B) $10.00

C) $19.00

D) $15.00

-What is the cost per statue if throughput costing is used?

A) $22.00

B) $10.00

C) $19.00

D) $15.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

Answer the following questions using the information below:

-What is the total throughput contribution?

A) $2,530,000

B) $3,300,000

C) $2,750,000

D) $2,970,000

-What is the total throughput contribution?

A) $2,530,000

B) $3,300,000

C) $2,750,000

D) $2,970,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

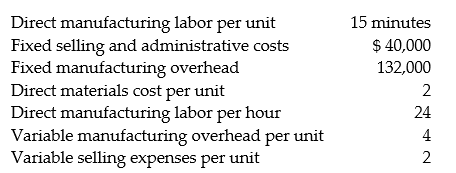

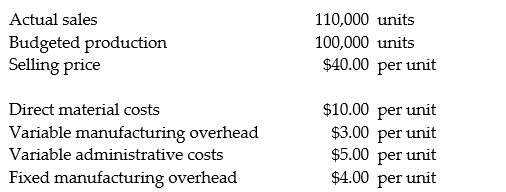

Gamil Company produces a specialty statue item. The following information has been provided by management:

Required:

a. What is the cost per statue if absorption costing is used?

b. What is the cost per statue if "super-variable costing"

is used?

c. What is the total throughput contribution?

Required:

a. What is the cost per statue if absorption costing is used?

b. What is the cost per statue if "super-variable costing"

is used?

c. What is the total throughput contribution?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

Match each of the following items with one or more of the denominator-level capacity concepts by putting the appropriate letter(s) by each item:

-Ideal goal of capacity utilization

A) Theoretical capacity

B) Practical capacity

C) Normal capacity utilization

D) Master-budget capacity utilization

-Ideal goal of capacity utilization

A) Theoretical capacity

B) Practical capacity

C) Normal capacity utilization

D) Master-budget capacity utilization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

Answer the following questions using the information below:

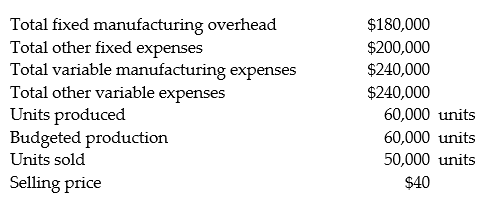

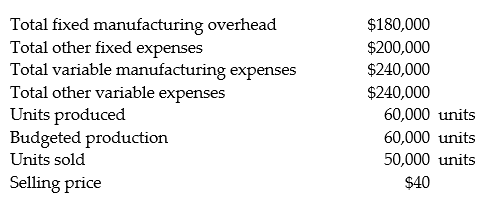

Ms. Jamila Habib, the company president, has heard that there are multiple breakeven points for every product. She does not believe this and has asked you to provide the evidence of such a possibility. Some information about the company for 2014 is as follows:

-What are breakeven sales in units using variable costing?

A) 5,625 units

B) 5,769 units

C) 12,180 units

D) 11,875 units

Ms. Jamila Habib, the company president, has heard that there are multiple breakeven points for every product. She does not believe this and has asked you to provide the evidence of such a possibility. Some information about the company for 2014 is as follows:

-What are breakeven sales in units using variable costing?

A) 5,625 units

B) 5,769 units

C) 12,180 units

D) 11,875 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

Answer the following questions using the information below:

Ms. Jamila Habib, the company president, has heard that there are multiple breakeven points for every product. She does not believe this and has asked you to provide the evidence of such a possibility. Some information about the company for 2014 is as follows:

-What are breakeven sales in units using absorption costing?

A) 5,625 units

B) 6,667 units

C) 8,000 units

D) 6,897 units

Ms. Jamila Habib, the company president, has heard that there are multiple breakeven points for every product. She does not believe this and has asked you to provide the evidence of such a possibility. Some information about the company for 2014 is as follows:

-What are breakeven sales in units using absorption costing?

A) 5,625 units

B) 6,667 units

C) 8,000 units

D) 6,897 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck