Deck 10: Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 10: Cost-Volume-Profit Analysis

1

Answer the following questions using the information below:

Safiya's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

-Contribution margin per unit is:

A) $6.00

B) $4.29

C) $4.00

D) None of these answers are correct.

Safiya's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

-Contribution margin per unit is:

A) $6.00

B) $4.29

C) $4.00

D) None of these answers are correct.

$6.00

2

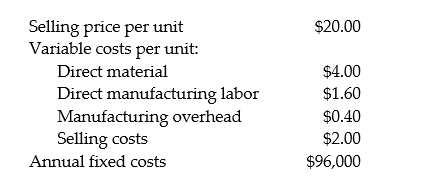

Dammam Drills Company sells several products. Information of average revenue and costs is as follows:

The contribution margin per unit is:

A) $14

B) $12

C) $8

D) $6

The contribution margin per unit is:

A) $14

B) $12

C) $8

D) $6

$12

3

Answer the following questions using the information below:

Nadya's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

-The contribution margin percentage is:

A) 37.5%

B) 75.0%

C) 25.0%

D) 12.5%

Nadya's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

-The contribution margin percentage is:

A) 37.5%

B) 75.0%

C) 25.0%

D) 12.5%

75.0%

4

Answer the following questions using the information below:

Idris's Ice Creams sells ice creams during the major holiday seasons. During the current year 11,000 ice creams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

-Breakeven point in units is:

A) 1,000 ice creams

B) 1,600 ice creams

C) 1,200 ice creams

D) None of these answers are correct.

Idris's Ice Creams sells ice creams during the major holiday seasons. During the current year 11,000 ice creams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

-Breakeven point in units is:

A) 1,000 ice creams

B) 1,600 ice creams

C) 1,200 ice creams

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

Answer the following questions using the information below:

Safiya's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

-The number of ice creams that must be sold to achieve $75,000 of operating income is:

A) 7,500 ice creams

B) 8,400 ice creams

C) 6,600 ice creams

D) None of these answers are correct.

Safiya's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

-The number of ice creams that must be sold to achieve $75,000 of operating income is:

A) 7,500 ice creams

B) 8,400 ice creams

C) 6,600 ice creams

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

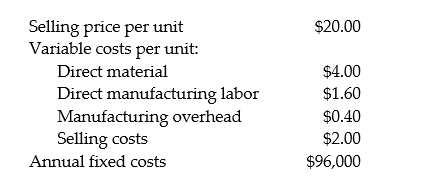

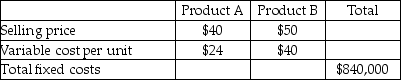

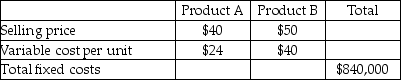

Answer the following questions using the information below:

The following information is for Khobar Glass Company:

-The number of units that Khobar Glass Company must sell to reach targeted operating income of $30,000 is:

A) 6,500 units

B) 4,334 units

C) 3,334 units

D) 5,000 units

The following information is for Khobar Glass Company:

-The number of units that Khobar Glass Company must sell to reach targeted operating income of $30,000 is:

A) 6,500 units

B) 4,334 units

C) 3,334 units

D) 5,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

Answer the following questions using the information below:

The following information is for Khobar Glass Company:

-If targeted operating income is $40,000, then targeted sales revenue is:

A) $166,667

B) $250,000

C) $350,000

D) $233,333

The following information is for Khobar Glass Company:

-If targeted operating income is $40,000, then targeted sales revenue is:

A) $166,667

B) $250,000

C) $350,000

D) $233,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

Nadya's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

The breakeven point in total sales dollars is:

A) $13,334

B) $100,000

C) $40,000

D) None of these answers are correct.

The breakeven point in total sales dollars is:

A) $13,334

B) $100,000

C) $40,000

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

Maha Manufacturing produces a single product that sells for $80. Variable costs per unit equal $32. The company expects total fixed costs to be $72,000 for the next month at the projected sales level of 2,000 units. In an attempt to improve performance, management is considering a number of alternative actions. Each situation is to be evaluated separately.

What is the current breakeven point in terms of number of units?

A) 2,250 units

B) 3,333 units

C) 1,500 units

D) None of these answers are correct.

What is the current breakeven point in terms of number of units?

A) 2,250 units

B) 3,333 units

C) 1,500 units

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

Badr Gulf Manufacturing produces a single product that sells for $100. Variable costs per unit equal $25. The company expects total fixed costs to be $60,000 for the next month at the projected sales level of 1,000 units. In an attempt to improve performance, management is considering a number of alternative actions. Each situation is to be evaluated separately.

What is the current breakeven point in terms of number of units?

A) 900 units

B) 800 units

C) 2,400 units

D) None of these answers are correct.

What is the current breakeven point in terms of number of units?

A) 900 units

B) 800 units

C) 2,400 units

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company with sales of $50,000, variable costs of $35,000, and fixed costs of $25,000 will reach its breakeven point if sales are increased by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

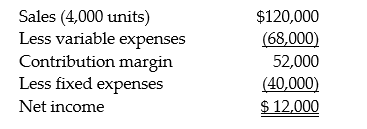

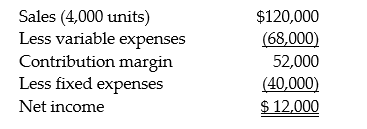

Sultan Suns sells a single product. The company's most recent income statement is given below.

Required:

a. Contribution margin per unit is $ ________ per unit

b. If sales are doubled to $240,000,

total variable costs will equal $ ________

c. If sales are doubled to $240,000,

total fixed costs will equal $ ________

d. If 10 more units are sold, profits will increase by $ ________

e. Compute how many units must be sold to break even. ________

f. Compute how many units must be sold

to achieve profits of $20,000. ________

Required:

a. Contribution margin per unit is $ ________ per unit

b. If sales are doubled to $240,000,

total variable costs will equal $ ________

c. If sales are doubled to $240,000,

total fixed costs will equal $ ________

d. If 10 more units are sold, profits will increase by $ ________

e. Compute how many units must be sold to break even. ________

f. Compute how many units must be sold

to achieve profits of $20,000. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

In 2014, Lulu & Latif Company has sales of $800,000, variable costs of $200,000, and fixed costs of $300,000. In 2015, the company expects annual property taxes to decrease by $15,000.

Required:

a. Calculate operating income and the breakeven point for 2011.

b. Calculate the breakeven point for 2012.

Required:

a. Calculate operating income and the breakeven point for 2011.

b. Calculate the breakeven point for 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

Riyadh Engines sells car batteries to service stations for an average of $30 each. The variable cost of each battery is $20 and monthly fixed manufacturing costs total $10,000. Other monthly fixed costs of the company total $8,000.

Required:

a. What is the breakeven point in batteries?

b. What is the margin of safety, assuming sales total $60,000?

c. What is the breakeven level in batteries, assuming variable costs increase by 20%?

d. What is the breakeven level in batteries, assuming the selling price goes up by 10%, fixed manufacturing costs decline by 10%, and other fixed costs decline by $100?

Required:

a. What is the breakeven point in batteries?

b. What is the margin of safety, assuming sales total $60,000?

c. What is the breakeven level in batteries, assuming variable costs increase by 20%?

d. What is the breakeven level in batteries, assuming the selling price goes up by 10%, fixed manufacturing costs decline by 10%, and other fixed costs decline by $100?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

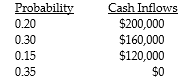

Mount Carmel Company sells only two products, Product A and Product B.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Required:

a. What is the breakeven point in units for each product assuming the sales mix is 2 units of Product A for each unit of Product B?

b. What is the breakeven point if Mount Carmel's tax rate is reduced to 25%, assuming the sales mix is 2 units of Product A for each unit of Product B?

c. How many units of each product would be sold if Mount Carmel desired an after-tax net income of $73,500, facing a tax rate of 30%?

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.Required:

a. What is the breakeven point in units for each product assuming the sales mix is 2 units of Product A for each unit of Product B?

b. What is the breakeven point if Mount Carmel's tax rate is reduced to 25%, assuming the sales mix is 2 units of Product A for each unit of Product B?

c. How many units of each product would be sold if Mount Carmel desired an after-tax net income of $73,500, facing a tax rate of 30%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

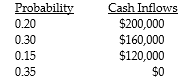

What would be the expected monetary value for the following data using the probability method?

A) $40,000

B) $106,000

C) $188,000

D) $60,000

A) $40,000

B) $106,000

C) $188,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck