Deck 10: Managing the Multibusiness Firm

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/23

العب

ملء الشاشة (f)

Deck 10: Managing the Multibusiness Firm

1

Which of the following is not a key task of the multibusiness firm to add value to its business units?

A) allocating resources across the businesses

B) developing effective performance metrics for divisional reporting

C) facilitating the development of bottom up compliance initiatives

D) developing organization-wide control and coordination policies

A) allocating resources across the businesses

B) developing effective performance metrics for divisional reporting

C) facilitating the development of bottom up compliance initiatives

D) developing organization-wide control and coordination policies

facilitating the development of bottom up compliance initiatives

2

Traditionally, firms that have grown through unrelated diversification have faced which of the following problems?

A) the businesses were managed to support long-term corporate financial goals

B) the complexity of the business portfolio exceeded corporate management's capability

C) there was an economic rationale at the level of operations for the business units to be in the same corporation

D) none of the above

A) the businesses were managed to support long-term corporate financial goals

B) the complexity of the business portfolio exceeded corporate management's capability

C) there was an economic rationale at the level of operations for the business units to be in the same corporation

D) none of the above

the complexity of the business portfolio exceeded corporate management's capability

3

Systematic undervaluation of diversified firms is called:

A) the corporate loss function

B) the governance penalty

C) the diversification discount

D) none of the above

A) the corporate loss function

B) the governance penalty

C) the diversification discount

D) none of the above

the diversification discount

4

Which of the following dimensions are typically used in creating a corporate portfolio matrix?

A) business unit dimensions

B) industry dimensions

C) both of the above

D) neither of the above

A) business unit dimensions

B) industry dimensions

C) both of the above

D) neither of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

5

A transfer using a mandated market price is less effective when the downstream unit:

A) is attempting to establish its market position based on a cost advantage

B) is attempting to establish its market position based on a value advantage

C) has already achieved a dominant market position

D) has failed to achieve a dominant market position

A) is attempting to establish its market position based on a cost advantage

B) is attempting to establish its market position based on a value advantage

C) has already achieved a dominant market position

D) has failed to achieve a dominant market position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

6

A performance metric selected for division reporting should:

A) be easy to use in comparing divisions relative to competitors

B) applicable to a wide range of investments

C) enable effective decision making

D) all of the above

A) be easy to use in comparing divisions relative to competitors

B) applicable to a wide range of investments

C) enable effective decision making

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

7

Vertical integration, as represented among profit centers in a multibusiness firm, is:

A) always superior to transactions in the market

B) not necessarily superior to transactions in the market

C) never superior to transactions in the market

D) none of the above

A) always superior to transactions in the market

B) not necessarily superior to transactions in the market

C) never superior to transactions in the market

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a reason for centralizing technology development in a multi-business firm:

A) enable the outsourcing of R&D

B) achieve scope economies in manufacturing

C) achieve scale economies in research and development

D) none of the above

A) enable the outsourcing of R&D

B) achieve scope economies in manufacturing

C) achieve scale economies in research and development

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

9

The major problem with the ROI metric is:

A) it is not useful for comparing the performance of competitors

B) it can induce managers to make decisions that are not in the interest of shareholders

C) it requires managers to make risky assumptions

D) all of the above

A) it is not useful for comparing the performance of competitors

B) it can induce managers to make decisions that are not in the interest of shareholders

C) it requires managers to make risky assumptions

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

10

The worldwide product structure emerged because of:

A) a failure of the transnational structure

B) Japanese managers required more central control over operations

C) tension between domestic and non-domestic business units

D) geographical opportunities that lay hidden in the existing structure

A) a failure of the transnational structure

B) Japanese managers required more central control over operations

C) tension between domestic and non-domestic business units

D) geographical opportunities that lay hidden in the existing structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

11

Forming SBUs benefitted GE by sharpening management's attention on investment decisions that made the strongest contribution to a unit's market position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

12

A multibusiness firm's corporate infrastructure should be in strong alignment with the strategies of the firm's business units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

13

A diversification discount occurs because a business is willing to be acquired for a price that is lower than its market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

14

BCG's low-cost market share model applies poorly to multibusiness firms whose business are primarily value driven with strong sustainable market positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

15

Transfers based on exchange autonomy are typically used to handle ad hoc transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

16

Among metrics used for divisional reporting, the residual income metric developed by GE in the 1960s is superior to an ROI metric.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

17

A key condition for the BCG matrix to be effective is that the firm must be able to grow new businesses to dominance in their markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

18

When top management builds a corporate culture that promotes risk taking and double-loop learning, the corporate infrastructure can contribute markedly to the firm's performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

19

A major objective in choosing a divisional reporting metric is that it should allow for effective management appraisal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

20

The strategies of both the in-house buyer and supplier must be considered when a transfer price is set.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under what conditions might an internal capital market be superior to external sources of capital?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

22

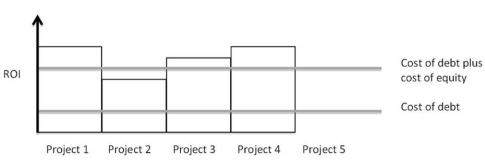

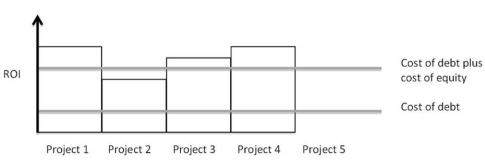

Suppose a manager was going to invest in the projects shown in the figure below and that the manager can select more than one project. Which should he/she choose if:

a) ROI is the most important objective;

b) improved earnings are the important objective; or

c) improving shareholder returns is the most important objective?

a) ROI is the most important objective;

b) improved earnings are the important objective; or

c) improving shareholder returns is the most important objective?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain why the assumptions behind the growth-share matrix make it inappropriate for most multibusiness firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck