Deck 13: Investing in Mutual Funds and Real Estate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/111

العب

ملء الشاشة (f)

Deck 13: Investing in Mutual Funds and Real Estate

1

An investment company that pools money from many investors and invests those funds in a variety of assets is called a

A) common stock.

B) preferred stock.

C) mutual fund.

D) portfolio fund.

A) common stock.

B) preferred stock.

C) mutual fund.

D) portfolio fund.

mutual fund.

2

The net asset value of a mutual fund is calculated as the

A) market value of assets less the market value of liabilities divided by the market value of the assets.

B) market value of assets less the market value of liabilities divided by the market value of the assets plus the market value of liabilities.

C) market value of assets plus the market value of liabilities divided by the number of shares outstanding.

D) market value of assets less the market value of liabilities divided by the number of shares outstanding.

A) market value of assets less the market value of liabilities divided by the market value of the assets.

B) market value of assets less the market value of liabilities divided by the market value of the assets plus the market value of liabilities.

C) market value of assets plus the market value of liabilities divided by the number of shares outstanding.

D) market value of assets less the market value of liabilities divided by the number of shares outstanding.

market value of assets less the market value of liabilities divided by the number of shares outstanding.

3

Assets minus liabilities, per share, is known as

A) net asset value.

B) open-end value.

C) unit investment.

D) return index.

A) net asset value.

B) open-end value.

C) unit investment.

D) return index.

net asset value.

4

ABC Fund has 9 million shares outstanding. The fund's portfolio is now valued at $300 million and the fund owes $18 million to the fund advisors and $5 million for rent and wages. What is the net asset value of the fund?

A) $30.78

B) $31.33

C) $33.00

D) $34.78

A) $30.78

B) $31.33

C) $33.00

D) $34.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

5

The net asset value of a mutual fund that is worth $100 million, has liabilities of $5 million, and has 5 million shares is

A) $100 million.

B) $95 million.

C) $19 per share.

D) $1 per share.

A) $100 million.

B) $95 million.

C) $19 per share.

D) $1 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

6

The increase in ______________ have directly contributed to the growth in mutual funds over the last few decades.

A) defined-benefit plans and pensions

B) defined-contribution retirement plans and IRAs

C) workers paying FICA taxes

D) advertising by financial services companies

A) defined-benefit plans and pensions

B) defined-contribution retirement plans and IRAs

C) workers paying FICA taxes

D) advertising by financial services companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is the best explanation for the recent increase in assets held by mutual funds and other investment companies?

A) Lower tax rate on mutual funds

B) Increased flow of funds into employer-sponsored plans and IRAs

C) Higher savings rate

D) Stock market increases

A) Lower tax rate on mutual funds

B) Increased flow of funds into employer-sponsored plans and IRAs

C) Higher savings rate

D) Stock market increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

8

Since mutual funds are investment companies, federal regulations

A) require less disclosure and reporting than is required of regular corporations.

B) does not require financial disclosure and reporting.

C) require similar disclosure and reporting that is required of regular corporations.

D) does have similar disclosure rules but not require the same reporting information as regular corporations.

A) require less disclosure and reporting than is required of regular corporations.

B) does not require financial disclosure and reporting.

C) require similar disclosure and reporting that is required of regular corporations.

D) does have similar disclosure rules but not require the same reporting information as regular corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

9

The _________ of an open-end fund provides the only market for buying or selling the shares of the fund.

A) primary market

B) secondary market

C) investment banker

D) issuing company

A) primary market

B) secondary market

C) investment banker

D) issuing company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which fund structure does not allow for the daily creation and redemption of shares by the issuer or its trustee?

A) Open-end fund

B) Closed-end fund

C) Exchange-traded fund

D) Unit investment trust

A) Open-end fund

B) Closed-end fund

C) Exchange-traded fund

D) Unit investment trust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

11

A closed-end fund is an investment company that

A) sells a variable number of shares based on public demand and buys them back on demand.

B) issues a fixed number of shares that are bought back by the company.

C) sells a variable number of shares that are traded in the secondary market.

D) issues a fixed number of shares that trade on a stock exchange or in the over-the-counter market.

A) sells a variable number of shares based on public demand and buys them back on demand.

B) issues a fixed number of shares that are bought back by the company.

C) sells a variable number of shares that are traded in the secondary market.

D) issues a fixed number of shares that trade on a stock exchange or in the over-the-counter market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

12

Closed-end funds trade primarily

A) through the fund company's custodian.

B) through the fund's issuing company.

C) by the fund's investment banker.

D) on major stock exchanges.

A) through the fund company's custodian.

B) through the fund's issuing company.

C) by the fund's investment banker.

D) on major stock exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is false regarding closed-end funds?

A) Closed-end funds always trade at their net asset value.

B) There are far fewer closed-end funds than there are open-end funds.

C) Closed-end funds have a fixed number of shares.

D) Closed-end funds may trade on organized exchanges or in the over-the-counter market.

A) Closed-end funds always trade at their net asset value.

B) There are far fewer closed-end funds than there are open-end funds.

C) Closed-end funds have a fixed number of shares.

D) Closed-end funds may trade on organized exchanges or in the over-the-counter market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

14

There are more ________ funds today, than there are __________ funds.

A) closed-end; open-end

B) open-end; closed-end

C) closed-end; exchange-traded

D) exchange-traded; open-end

A) closed-end; open-end

B) open-end; closed-end

C) closed-end; exchange-traded

D) exchange-traded; open-end

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is a characteristic of an exchange-traded fund (ETF)?

A) Shares are traded in the secondary market like shares in a closed-end fund.

B) Shares trade at the net asset value like shares in an open-end fund.

C) The number of shares outstanding is fixed as in a closed-end fund.

D) The shares are invested only in common stock of publicly traded corporations.

A) Shares are traded in the secondary market like shares in a closed-end fund.

B) Shares trade at the net asset value like shares in an open-end fund.

C) The number of shares outstanding is fixed as in a closed-end fund.

D) The shares are invested only in common stock of publicly traded corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is false regarding exchange-traded funds?

A) Many exchange-traded funds are designed to be index funds.

B) Exchange-traded funds are an example of a closed-end fund.

C) Share prices on an exchange-traded fund are determined by market forces.

D) All of the choices are true.

A) Many exchange-traded funds are designed to be index funds.

B) Exchange-traded funds are an example of a closed-end fund.

C) Share prices on an exchange-traded fund are determined by market forces.

D) All of the choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

17

A unit investment trust (UIT) is an unmanaged pool of investments that is often composed of

A) common stock.

B) preferred stock.

C) fixed-income securities.

D) real estate investments.

A) common stock.

B) preferred stock.

C) fixed-income securities.

D) real estate investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements regarding unit investment trust is false?

A) A portfolio manager of the trust actively manages the pool of investments.

B) Unit investment trust owners are issued redeemable trust certificates.

C) Unit investment trusts are essentially unmanaged investments.

D) The term of a unit investment trust depends on the maturities of the securities held.

A) A portfolio manager of the trust actively manages the pool of investments.

B) Unit investment trust owners are issued redeemable trust certificates.

C) Unit investment trusts are essentially unmanaged investments.

D) The term of a unit investment trust depends on the maturities of the securities held.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

19

By law, a REIT must have a(n) __________ strategy and have at least _______ stockholders.

A) buy-and-hold; 100

B) buy-and-hold; 1,000

C) actively managed; 1,000

D) actively managed; 10,000

A) buy-and-hold; 100

B) buy-and-hold; 1,000

C) actively managed; 1,000

D) actively managed; 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements regard REITs is false?

A) Unlike UITs, REITs have a limited life span.

B) Equity REITs make direct investments in rental and commercial property.

C) REITs are a type of closed-end investment company.

D) REITs must distribute 90 percent of taxable income to shareholders each year.

A) Unlike UITs, REITs have a limited life span.

B) Equity REITs make direct investments in rental and commercial property.

C) REITs are a type of closed-end investment company.

D) REITs must distribute 90 percent of taxable income to shareholders each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

21

The primary objective of a growth fund is

A) income.

B) tax-exempt income.

C) undervalued investments.

D) capital appreciation.

A) income.

B) tax-exempt income.

C) undervalued investments.

D) capital appreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

22

Growth and income funds are primarily invested in

A) defensive stocks.

B) high-grade stocks and bonds with stable returns.

C) growth-oriented blue-chip stocks

D) value-oriented blue-chip stocks.

A) defensive stocks.

B) high-grade stocks and bonds with stable returns.

C) growth-oriented blue-chip stocks

D) value-oriented blue-chip stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

23

A mutual fund that is focused more on reducing investment risk by investing in both stocks and bonds is called a

A) value fund.

B) income fund.

C) balanced fund.

D) growth and income fund.

A) value fund.

B) income fund.

C) balanced fund.

D) growth and income fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

24

A mutual fund that invests in a mix of equity and fixed income securities that provide current cash flows is a(n)

A) growth and income fund.

B) value fund.

C) growth fund.

D) income fund.

A) growth and income fund.

B) value fund.

C) growth fund.

D) income fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sometimes called a hybrid fund, a ________ fund provides investors the opportunity to benefit from stocks and bonds.

A) balanced

B) value

C) growth and income

D) value and income

A) balanced

B) value

C) growth and income

D) value and income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

26

The primary objective of ________ funds is capital appreciation.

A) growth

B) life-cycle

C) target-date

D) value

A) growth

B) life-cycle

C) target-date

D) value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

27

A focus on capital appreciation would match which of the following fund classifications?

A) Growth fund

B) Income fund

C) Balanced fund

D) Global fund

A) Growth fund

B) Income fund

C) Balanced fund

D) Global fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

28

A focus on assets that pay interest and/or dividends would match which of the following fund classifications?

A) Growth fund

B) Income fund

C) Balanced fund

D) Global fund

A) Growth fund

B) Income fund

C) Balanced fund

D) Global fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

29

A focus on a mixed portfolio of both stocks and bonds would match which of the following fund classifications?

A) Growth fund

B) Value fund

C) Balanced fund

D) Global fund

A) Growth fund

B) Value fund

C) Balanced fund

D) Global fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

30

A focus on only stocks of Chinese companies would match which of the following fund classifications?

A) Sector fund

B) Global fund

C) SRI fund

D) International fund

A) Sector fund

B) Global fund

C) SRI fund

D) International fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

31

A focus on only stocks of technology companies would match which of the following fund classifications?

A) Sector fund

B) Global fund

C) SRI fund

D) International fund

A) Sector fund

B) Global fund

C) SRI fund

D) International fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

32

A life-cycle fund holds assets designed to meet the needs of individuals who

A) plans to retire in 2050.

B) will need funds for college costs in 2030.

C) will retire at a particular age.

D) believes a recession is eminent.

A) plans to retire in 2050.

B) will need funds for college costs in 2030.

C) will retire at a particular age.

D) believes a recession is eminent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

33

A mutual fund entirely invested in companies in the health-care industry would be considered a(n)

A) global fund.

B) international fund.

C) SRI fund.

D) sector fund.

A) global fund.

B) international fund.

C) SRI fund.

D) sector fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

34

An example of a(n) ________ fund is one that invests exclusively in securities from Europe, Australasia, and Far East.

A) global

B) international

C) target-date

D) SRI

A) global

B) international

C) target-date

D) SRI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

35

A mutual fund that avoids securities issued by tobacco, alcohol and firearms related companies are

A) target funds.

B) life-cycle funds.

C) sector funds.

D) SRI funds.

A) target funds.

B) life-cycle funds.

C) sector funds.

D) SRI funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

36

A socially responsible fund is a type of mutual fund that will invest only in securities issued by companies that

A) meet certain ethical and moral standards.

B) have securities that highly appreciate in value.

C) pay high dividends.

D) produce a high total return.

A) meet certain ethical and moral standards.

B) have securities that highly appreciate in value.

C) pay high dividends.

D) produce a high total return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which fund would you expect to produce the greatest returns?

A) Income fund

B) Balanced fund

C) Growth fund

D) Growth and income fund

A) Income fund

B) Balanced fund

C) Growth fund

D) Growth and income fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

38

Of the following benefits of investing in mutual funds, which pertains to the ability to immediately sell your shares at market price?

A) Liquidity

B) Withdrawal option

C) Dividend reinvestment

D) Diversification

A) Liquidity

B) Withdrawal option

C) Dividend reinvestment

D) Diversification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

39

Compared with investing on their own, mutual funds provide small investors with

A) lower risk.

B) better diversification.

C) higher returns.

D) all of the above.

A) lower risk.

B) better diversification.

C) higher returns.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

40

Mutual funds allow the common investor without much initial capital to be able to ________, a strategy not easily employable among stocks and bonds unless you have large amounts of capital.

A) diversify

B) designate a beneficiary

C) liquidate holdings

D) withdraw with no penalties

A) diversify

B) designate a beneficiary

C) liquidate holdings

D) withdraw with no penalties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

41

One advantage of mutual funds is that their transactions cost per trade are likely to be __________ than what an individual investor would pay.

A) substantially higher

B) substantially lower

C) incrementally higher

D) incrementally lower

A) substantially higher

B) substantially lower

C) incrementally higher

D) incrementally lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

42

David Palmer has decided to take control of his financial life and go through his mutual fund statements. He notices his funds pay him a few pennies a month per share, but he has not seen a check for any of that money. He also notices a small fraction of a share purchased each month as well. What common feature of mutual funds is this scenario exhibiting?

A) Dividend reinvestment

B) Withdrawal options

C) Beneficiary designations

D) Liquidity

A) Dividend reinvestment

B) Withdrawal options

C) Beneficiary designations

D) Liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

43

Frank Thompson purchased $1,000 of a mutual fund with a front-end load of 5%. How much did he actually invest?

A) $900

B) $950

C) $995

D) $1,000

A) $900

B) $950

C) $995

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

44

Fees paid by mutual fund shareholders may include all the following except a(n)

A) 10 percent fee on excess returns.

B) one-time sales charge assessed at the time of purchase.

C) annual account maintenance fee.

D) exchange fee when the investor transfers money from one fund to another.

A) 10 percent fee on excess returns.

B) one-time sales charge assessed at the time of purchase.

C) annual account maintenance fee.

D) exchange fee when the investor transfers money from one fund to another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

45

A front-end load is a sales charge that is paid

A) at time of purchase.

B) at the time of sale.

C) annually at the anniversary of the purchase.

D) quarterly on the calendar year.

A) at time of purchase.

B) at the time of sale.

C) annually at the anniversary of the purchase.

D) quarterly on the calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

46

Open-end mutual funds charge an average front-end load of

A) 2 percent.

B) 3 percent

C) 5 percent.

D) 8.5 percent.

A) 2 percent.

B) 3 percent

C) 5 percent.

D) 8.5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

47

New Age Aggressive Growth fund has $250 million in total assets and paid $1.875 million in total fund expenses. What is its expense ratio?

A) 0.75%

B) 1.33%

C) 7.50%

D) 13.33%

A) 0.75%

B) 1.33%

C) 7.50%

D) 13.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

48

Maryanne invested $1,000 in a mutual fund three years ago and she wants to sell it online for $1,800. Her trade entry screen warns of a contingent deferred sales charge of 2%. What is the sales load?

A) $12

B) $16

C) $20

D) $36

A) $12

B) $16

C) $20

D) $36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

49

Evelyn owns a fund that has a contingent deferred sales charge that starts at 8% if held less than one year and reduces by 1% every year the fund is held. If she purchased the fund for $10,000 and wishes to sell it after 4 years for $20,000, what would the load be?

A) $400

B) $500

C) $800

D) $1,000

A) $400

B) $500

C) $800

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

50

A no-load fund is a mutual fund that

A) does not charge any load or fees.

B) does not charge a front-end or back-end load.

C) has an expense ratio equal to zero.

D) has an expense ratio that is less than 1 percent.

A) does not charge any load or fees.

B) does not charge a front-end or back-end load.

C) has an expense ratio equal to zero.

D) has an expense ratio that is less than 1 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

51

A mutual fund that does not charge either a front-end or a back-end load at the time of purchase or sale

A) is a no-load fund.

B) is a unit fund.

C) does not charge an annual management fee either.

D) always has a higher return than a load fund.

A) is a no-load fund.

B) is a unit fund.

C) does not charge an annual management fee either.

D) always has a higher return than a load fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

52

12b-1 fees are charged to pay for

A) operational expenses, such as printing and mailing, of a mutual fund.

B) distribution expenses, such as sales, marketing, and advertising, of the fund.

C) management fees, such as the fund's management and transactions.

D) taxes and regulatory fees, such as the SEC and FINRA fees and levies.

A) operational expenses, such as printing and mailing, of a mutual fund.

B) distribution expenses, such as sales, marketing, and advertising, of the fund.

C) management fees, such as the fund's management and transactions.

D) taxes and regulatory fees, such as the SEC and FINRA fees and levies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

53

Back-end loads generally decrease over time

A) in order to equal the average cost of front-end loads.

B) in order to provide an incentive for shareholders to stay in the fund.

C) due to federal regulations.

D) due to dollar cost averaging.

A) in order to equal the average cost of front-end loads.

B) in order to provide an incentive for shareholders to stay in the fund.

C) due to federal regulations.

D) due to dollar cost averaging.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

54

Discovery Growth and Income fund has $600 million in total assets; it paid $21 million in dividends and $3.4 million in total fund expenses. What is its expense ratio?

A) 0.57%

B) 0.59%

C) 3.50%

D) 4.07%

A) 0.57%

B) 0.59%

C) 3.50%

D) 4.07%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

55

When planning to minimize mutual fund costs, which investment would appeal to a very long-term buy-hold investor?

A) No-load, 0.87 percent expense ratio

B) 6 percent front-end load, 0.43 percent expense ratio

C) 8 percent back-end load (reduces 1% per year); 0.45 percent expense ratio

D) 1 percent front-end load; 0.30 percent expense ratio

A) No-load, 0.87 percent expense ratio

B) 6 percent front-end load, 0.43 percent expense ratio

C) 8 percent back-end load (reduces 1% per year); 0.45 percent expense ratio

D) 1 percent front-end load; 0.30 percent expense ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

56

A more actively managed mutual fund will generally have a _____ expense ratio than a fund that is ____ active.

A) lower; less

B) higher; less

C) higher; more

D) lower; not

A) lower; less

B) higher; less

C) higher; more

D) lower; not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which ETF would have the lowest expense ratio?

A) Diversified Core Bond Fund

B) Small-cap equity growth fund

C) Money market fund

D) Large-cap international equity fund

A) Diversified Core Bond Fund

B) Small-cap equity growth fund

C) Money market fund

D) Large-cap international equity fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

58

A fee charged to compensate sales professionals for the marketing and advertising of fund shares is known as a(n)

A) annual management fee.

B) annual 12b-1 distribution fee.

C) computerized account fee.

D) redemption fee.

A) annual management fee.

B) annual 12b-1 distribution fee.

C) computerized account fee.

D) redemption fee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

59

Another term for back-end load is

A) distribution load.

B) contingent deferred sales charge.

C) management load.

D) operational load.

A) distribution load.

B) contingent deferred sales charge.

C) management load.

D) operational load.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

60

Different share classes within a mutual fund differ with regard to

A) load type, expense ratio, and dividends paid.

B) expense ratio.

C) load type.

D) load type and expense ratio.

A) load type, expense ratio, and dividends paid.

B) expense ratio.

C) load type.

D) load type and expense ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a mutual fund offers more than one share class, this means

A) share classes differ in load and expenses.

B) the mutual fund is more diversified.

C) each share class invests in different securities.

D) this is a fund family.

A) share classes differ in load and expenses.

B) the mutual fund is more diversified.

C) each share class invests in different securities.

D) this is a fund family.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

62

Of the four steps in the mutual fund selection process, which of the following is the first?

A) Buying shares in the selected funds

B) Deciding which fund classifications are appropriate for your objective

C) Identifying your investment objective

D) Comparing funds based on risk and return, costs, and services

A) Buying shares in the selected funds

B) Deciding which fund classifications are appropriate for your objective

C) Identifying your investment objective

D) Comparing funds based on risk and return, costs, and services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

63

When a single company operates several separately managed mutual funds with different investment objectives, this is called a(n)

A) asset class.

B) share class.

C) fund family.

D) fund portfolio.

A) asset class.

B) share class.

C) fund family.

D) fund portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

64

Investing in large-cap equity funds from different fund families reduces

A) market risk.

B) fund expenses.

C) transaction costs.

D) default risk of fund sponsor.

A) market risk.

B) fund expenses.

C) transaction costs.

D) default risk of fund sponsor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which is an advantage of buying mutual funds through a "financial supermarket"?

A) Ability to purchase funds from different fund families

B) Easily switch funds from the same family at no cost

C) Receive break-point discounts for volume purchases

D) Better prices than NAV when selling back to the fund

A) Ability to purchase funds from different fund families

B) Easily switch funds from the same family at no cost

C) Receive break-point discounts for volume purchases

D) Better prices than NAV when selling back to the fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is not an advantage of buying fund shares through a financial supermarket?

A) Ability to purchase in larger increments

B) Ability to switch money from fund to fund easily

C) Consolidated financial report

D) Ability to purchase from several fund families

A) Ability to purchase in larger increments

B) Ability to switch money from fund to fund easily

C) Consolidated financial report

D) Ability to purchase from several fund families

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

67

With hundreds of funds to choose from, you need to screen based on key characteristics. Which is not a key risk and return characteristic?

A) Past performance

B) Manager tenure

C) Reinvestment of dividends

D) Income or capital gains

A) Past performance

B) Manager tenure

C) Reinvestment of dividends

D) Income or capital gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

68

What federal law gave banks and insurance companies the right to create and market mutual funds?

A) Financial Services Modernization Act of 1999

B) Investment Company Act of 1940

C) Financial Institutions Reform, Recovery, and Enforcement Act of 1989

D) Securities Acts Amendments of 1975

A) Financial Services Modernization Act of 1999

B) Investment Company Act of 1940

C) Financial Institutions Reform, Recovery, and Enforcement Act of 1989

D) Securities Acts Amendments of 1975

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

69

Buying a ________ represents a direct real estate investment.

A) home

B) REIT

C) mortgage-backed securities

D) limited partnership

A) home

B) REIT

C) mortgage-backed securities

D) limited partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

70

If you purchase a residential rental property for $250,000 that includes a building worth $100,000, how much will you be able to deduct per year from your rental income if the IRS allows you to spread the cost of your initial investment over 27.5 years?

A) $3,636

B) $5,455

C) $9,091

D) $12,727

A) $3,636

B) $5,455

C) $9,091

D) $12,727

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which is a disadvantage of direct real estate investments?

A) After-tax cash flows

B) Price appreciation

C) Liquidity

D) Leverage

A) After-tax cash flows

B) Price appreciation

C) Liquidity

D) Leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which is an advantage of direct real estate investments?

A) Large initial investment

B) Leverage

C) Transaction costs

D) Reduced diversification

A) Large initial investment

B) Leverage

C) Transaction costs

D) Reduced diversification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

73

Leverage occurs when you use borrowed funds to make an investment that will earn

A) more than the cost of the borrowed funds.

B) less than the cost of the borrowed funds.

C) more than the initial investment.

D) less than the initial investment.

A) more than the cost of the borrowed funds.

B) less than the cost of the borrowed funds.

C) more than the initial investment.

D) less than the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

74

Financing the purchase of investment real estate with a mortgage is using

A) price appreciation.

B) leverage.

C) diversification.

D) asset allocation.

A) price appreciation.

B) leverage.

C) diversification.

D) asset allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

75

The basic equation for real estate return on investment is the increase in value plus the net rental income minus the interest expense, all of which is divided by which financial component?

A) Beginning investment

B) Capital appreciation

C) Ending outlay

D) Market price

A) Beginning investment

B) Capital appreciation

C) Ending outlay

D) Market price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

76

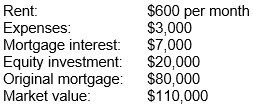

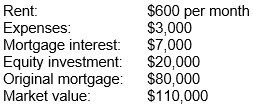

What is your annual return on investment for a rental property with the following income and expenses?

A) 7.2%

B) 30%

C) 36%

D) 136%

A) 7.2%

B) 30%

C) 36%

D) 136%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

77

Juanita purchased a rental property for $100,000, put a $20,000 down payment on the home, and borrowed $80,000 to finance the remainder. She rents the home for $1,000 per month and during the first year did not have any maintenance expenses on the home. She paid a total of $7,500 in interest on the loan the first year. The home appreciated 4% the first year. What is Juanita's total return on investment in the first year?

A) 8.5%

B) 12.5%

C) 26.5%

D) 42.5%

A) 8.5%

B) 12.5%

C) 26.5%

D) 42.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

78

Direct real estate investments lack _______because only a limited number of potential buyers exist and it can take months to find a buyer and close the deal.

A) tax benefits

B) high returns

C) liquidity

D) transaction costs

A) tax benefits

B) high returns

C) liquidity

D) transaction costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not a disadvantage of direct real estate investment?

A) After-tax cash flows

B) High transaction costs

C) Reduced diversification

D) Lack of liquidity

A) After-tax cash flows

B) High transaction costs

C) Reduced diversification

D) Lack of liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

80

Relative to other types of investments, real estate investments have very

A) low transaction costs.

B) high transaction costs.

C) low tax benefits.

D) high liquidity.

A) low transaction costs.

B) high transaction costs.

C) low tax benefits.

D) high liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck