Deck 8: Life Insurance and Long-Term Care Planning

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/93

العب

ملء الشاشة (f)

Deck 8: Life Insurance and Long-Term Care Planning

1

Mortality risk is a

A) speculative risk.

B) pure risk.

C) liability risk.

D) comprehensive risk.

A) speculative risk.

B) pure risk.

C) liability risk.

D) comprehensive risk.

pure risk.

2

Life insurance is based on the concept of

A) diversification.

B) actuarial science.

C) risk pooling.

D) mortality intermediation.

A) diversification.

B) actuarial science.

C) risk pooling.

D) mortality intermediation.

risk pooling.

3

Compared to property insurance policies, life insurance policies generally have a

A) shorter term.

B) longer term.

C) similar term and risk classifications.

D) similar term but different risk classifications.

A) shorter term.

B) longer term.

C) similar term and risk classifications.

D) similar term but different risk classifications.

longer term.

4

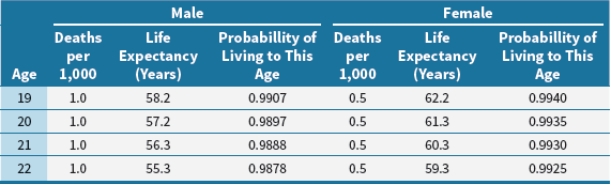

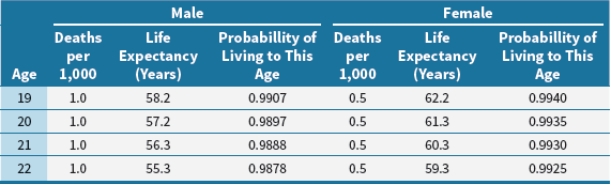

Phil is a 21-year-old male. What is his life expectancy?

A) 56.3 years

B) 55.3 years

C) 77.2 years

D) 77.3 years

A) 56.3 years

B) 55.3 years

C) 77.2 years

D) 77.3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following factors do not affect life insurance premiums?

A) Expenses incurred by the insurer

B) Quality of health-care insurance, of the person seeking the insurance

C) Risk classification of the person seeking the insurance

D) Profitability of the insurance company

A) Expenses incurred by the insurer

B) Quality of health-care insurance, of the person seeking the insurance

C) Risk classification of the person seeking the insurance

D) Profitability of the insurance company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

6

Life insurers use different tables to estimate the mortality risk for

A) cancer patients.

B) overweight people.

C) smokers.

D) athletic people.

A) cancer patients.

B) overweight people.

C) smokers.

D) athletic people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

7

Larger insurers can often provide lower rates than small insurers because they

A) are more profitable.

B) earn better returns on their investments.

C) provide larger policies to their customers.

D) can spread their costs across a bigger group of policyholders.

A) are more profitable.

B) earn better returns on their investments.

C) provide larger policies to their customers.

D) can spread their costs across a bigger group of policyholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

8

Your life insurance ________ is/are based on the insurer's estimate of the probability that you will die during the policy period.

A) longevity risk

B) risk classification

C) deductible

D) beneficiaries

A) longevity risk

B) risk classification

C) deductible

D) beneficiaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

9

The likelihood of an individual dying in the next year is called _____ risk.

A) liability

B) mortality

C) speculative

D) systemic

A) liability

B) mortality

C) speculative

D) systemic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

10

There are separate standardized mortality tables for women and men, because

A) men systemically live longer.

B) women systemically live longer.

C) insurers want to increase more business with women to balance their risk pool.

D) of the Affordable Care Act.

A) men systemically live longer.

B) women systemically live longer.

C) insurers want to increase more business with women to balance their risk pool.

D) of the Affordable Care Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

11

Half of all life insurance policies sold today are

A) short-term policies that mature well before retirement.

B) short-term policies that accumulate cash value over time.

C) long-term policies that do not accumulate cash value.

D) long-term policies that accumulate cash value over time.

A) short-term policies that mature well before retirement.

B) short-term policies that accumulate cash value over time.

C) long-term policies that do not accumulate cash value.

D) long-term policies that accumulate cash value over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

12

Hank Johnson named his three kids and nephew as people to whom his life insurance should be paid out upon his death. This is an example of designating _____________.

A) riders

B) accidental death benefits

C) beneficiaries

D) a participating policy

A) riders

B) accidental death benefits

C) beneficiaries

D) a participating policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is not a benefit of life insurance?

A) Protection against business losses due to the death of a key person in the business

B) Protection against household losses

C) The ability to purchase large amounts of coverage

D) Protection from creditors for a spouse

A) Protection against business losses due to the death of a key person in the business

B) Protection against household losses

C) The ability to purchase large amounts of coverage

D) Protection from creditors for a spouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

14

Insurers estimate a person's risk of dying by using

A) a standardized mortality table.

B) the insured's family history.

C) experience in the life insurance business.

D) a record of that person's diet and exercise habits.

A) a standardized mortality table.

B) the insured's family history.

C) experience in the life insurance business.

D) a record of that person's diet and exercise habits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

15

The most important category addressed in a needs analysis is

A) household savings.

B) the cost of death.

C) income replacement.

D) using the emergency fund.

A) household savings.

B) the cost of death.

C) income replacement.

D) using the emergency fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

16

A life insurance needs analysis includes estimating your

A) risk tolerance.

B) business needs.

C) parent's needs.

D) dependents' financial needs.

A) risk tolerance.

B) business needs.

C) parent's needs.

D) dependents' financial needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

17

If all other factors are equal, how will your life insurance needs change if you and your spouse adopt a child?

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

18

If all other factors are equal, how will your life insurance needs change if your youngest child graduates from college and gets a well-paying job?

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

19

If all other factors are equal, how will your life insurance needs change after you have paid off your mortgage?

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

A) They will increase.

B) They will decrease.

C) They will remain unchanged.

D) There's not enough information to know.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

20

An advantage of the income-multiple method to determining how much life insurance is needed is its

A) complexity.

B) simplicity.

C) accuracy.

D) popularity.

A) complexity.

B) simplicity.

C) accuracy.

D) popularity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

21

The most effective method for determining how much life insurance is needed is the

A) income-multiple method.

B) mortality multiplier method.

C) percent of debt method.

D) financial needs method.

A) income-multiple method.

B) mortality multiplier method.

C) percent of debt method.

D) financial needs method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

22

A weakness of the income-multiple method used to determine life insurance needs is its assumption that

A) everyone with the same income has the same life insurance needs.

B) individuals have different life insurance needs.

C) existing household resources can be used for support by the surviving family members

D) the more insurance you can afford, the better.

A) everyone with the same income has the same life insurance needs.

B) individuals have different life insurance needs.

C) existing household resources can be used for support by the surviving family members

D) the more insurance you can afford, the better.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following would not be eligible for survivor benefits under Social Security?

A) A 59-year-old employed wife with no children under age 18

B) A 40-year-old unemployed wife with a 10-year-old daughter

C) A 17-year-old son

D) All would receive survivor benefits.

A) A 59-year-old employed wife with no children under age 18

B) A 40-year-old unemployed wife with a 10-year-old daughter

C) A 17-year-old son

D) All would receive survivor benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

24

The __________ method allows you to analyze your life insurance needs by simply multiplying your income by a factor of 5 to 10.

A) financial needs

B) income-multiple

C) surviving spouse

D) Social Security survivor

A) financial needs

B) income-multiple

C) surviving spouse

D) Social Security survivor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

25

The __________method analyzes your life insurance needs by estimating how much money your dependents will need after your death, while taking into account existing household resources.

A) financial needs

B) income-multiple

C) surviving spouse

D) duel income, no kids

A) financial needs

B) income-multiple

C) surviving spouse

D) duel income, no kids

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jason earns $50,000 per year. If he uses the income-multiple method to estimate his life insurance needs, he will need approximately what range of life insurance?

A) $50,000 to $100,000

B) $100,000 to $200,000

C) $250,000 to $500,000

D) $750,000 to $1,000,000

A) $50,000 to $100,000

B) $100,000 to $200,000

C) $250,000 to $500,000

D) $750,000 to $1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

27

Violet earns $160,000 per year and has a family who depends on her financially. Violet has a life insurance policy through her job that will pay benefits of one year's salary. Based on the income-multiple method, how much more does Violet need in life insurance?

A) $640,000 to $1,440,000

B) $640,000 to $1,600,000

C) $800,000 to $1,440,000

D) $800,000 to $1,600,000

A) $640,000 to $1,440,000

B) $640,000 to $1,600,000

C) $800,000 to $1,440,000

D) $800,000 to $1,600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

28

If you have no dependents and insufficient assets to cover funeral costs, you

A) do not need life insurance.

B) should consider comprehensive coverage on your PAP.

C) should consider buying long-term care insurance.

D) should consider buying life insurance.

A) do not need life insurance.

B) should consider comprehensive coverage on your PAP.

C) should consider buying long-term care insurance.

D) should consider buying life insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

29

Nicole is a single parent who earns $60,000 per year after taxes. Her household expenses are $50,000 per year. If she were to die, she estimates that death costs would total $10,000. She wants to provide $50,000 for an education fund for each of her twin children, who are currently 10 years old. She does not qualify for Social Security benefits, so she needs $25,000 per year in addition to household expenses for child care for her twins until they reach 18. She currently has savings of $20,000 but should also have an emergency fund (3 months' expenses). Using the financial needs approach, how much life insurance would you recommend?

A) $652,500

B) $690,000

C) $702,500

D) $722,500

A) $652,500

B) $690,000

C) $702,500

D) $722,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

30

Marc is 32 and married to Estella, who is 30. Estella is a stay-at-home mom to their two children, ages 1 and 4. They currently live on Marc's salary of $110,000 (after taxes) that just about meets their household expenses. They would like to make sure that if Marc dies, they replace his income for 17 years, which would match their mortgage maturity and their kids would be well off to college; fund the children's college education ($300,000); establish a retirement fund for Estella ($250,000) to supplement Marc's Social Security retirement benefits; cover funeral costs ($10,000); and establish a 3-month emergency fund. If Estella dies, they want to have enough insurance to be able to pay for child care ($36,000 per year) and housekeeping services ($12,000 per year) for 17 years, to establish an emergency fund, and for funeral costs. They have the following financials:

Marc's employer provides a year's salary life insurance.

Family is eligible for Social Security survivor benefits of $55,000 if Marc dies.

Household expenses would be 20% lower if either parent dies.

Current savings and investments of $23,000.

Using the financial needs approach, how much life insurance would you recommend?

A) $487,500 on Marc; $340,500 on Estella

B) $905,500 on Marc; $778,500 on Estella

C) $1,015,500 on Marc; $756,500 on Estella

D) $1,063,500 on Marc; $708,500 on Estella

Marc's employer provides a year's salary life insurance.

Family is eligible for Social Security survivor benefits of $55,000 if Marc dies.

Household expenses would be 20% lower if either parent dies.

Current savings and investments of $23,000.

Using the financial needs approach, how much life insurance would you recommend?

A) $487,500 on Marc; $340,500 on Estella

B) $905,500 on Marc; $778,500 on Estella

C) $1,015,500 on Marc; $756,500 on Estella

D) $1,063,500 on Marc; $708,500 on Estella

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

31

Term life insurance allows a particular individual to buy a larger amount of insurance with a(n) _________ than whole life insurance.

A) larger premium

B) smaller premium

C) identical premium

D) comparable

A) larger premium

B) smaller premium

C) identical premium

D) comparable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

32

A disadvantage of term life insurance is that as an individual gets older,

A) they become uninsurable.

B) their premium will go up.

C) their premiums will go down.

D) the face value declines.

A) they become uninsurable.

B) their premium will go up.

C) their premiums will go down.

D) the face value declines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is the key characteristic of term life insurance?

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Valid for an unlimited amount of time

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Valid for an unlimited amount of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

34

The major advantage of term life insurance over whole life insurance for young people is that term life

A) is available without proof of insurability, whole life is not.

B) always has a constant premium, whole life does not.

C) tends to have lower premiums than whole life for the same face value.

D) has a choice of investments, whole life does not.

A) is available without proof of insurability, whole life is not.

B) always has a constant premium, whole life does not.

C) tends to have lower premiums than whole life for the same face value.

D) has a choice of investments, whole life does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

35

A term life insurance policy that the insured person can extend for another term without taking a medical exam has

A) convertibility.

B) decreasing protection.

C) permanent life protection.

D) guaranteed renewability.

A) convertibility.

B) decreasing protection.

C) permanent life protection.

D) guaranteed renewability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

36

The right to renew a term life insurance policy without additional proof of insurability is known as

A) permanent life protection.

B) level-premium guarantee.

C) guaranteed renewability.

D) the extended life rider.

A) permanent life protection.

B) level-premium guarantee.

C) guaranteed renewability.

D) the extended life rider.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which life insurance policy will offer the cheapest method to insure your life for $3 million for at least 20 years?

A) Universal life

B) whole life

C) Convertible term life

D) Level-premium term life

A) Universal life

B) whole life

C) Convertible term life

D) Level-premium term life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

38

If a term policy is convertible, the insured has the right to convert to

A) permanent life insurance for the same premiums.

B) permanent life insurance without additional proof of insurability.

C) long-term care insurance for the same premiums.

D) long-term care insurance without additional proof of insurability.

A) permanent life insurance for the same premiums.

B) permanent life insurance without additional proof of insurability.

C) long-term care insurance for the same premiums.

D) long-term care insurance without additional proof of insurability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which value of a life insurance policy does the beneficiary receive upon death of the insured?

A) Cash value

B) Surrender value

C) Face value

D) Market value

A) Cash value

B) Surrender value

C) Face value

D) Market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

40

Nadine is shopping for a ten-year term life insurance policy. She wants her premium to stay the same each year for the entire 10-year term. What type of life insurance should she buy?

A) Decreasing-term

B) Convertible term

C) Level-premium term

D) Guaranteed renewable term

A) Decreasing-term

B) Convertible term

C) Level-premium term

D) Guaranteed renewable term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

41

Premiums for permanent insurance are more expensive than premiums for term insurance when you are younger because

A) your risk of dying is higher.

B) the policy is shorter term.

C) the premiums do not increase with age.

D) the investment returns are lower.

A) your risk of dying is higher.

B) the policy is shorter term.

C) the premiums do not increase with age.

D) the investment returns are lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements is true about cash value life insurance?

A) The cash value includes all of the premiums the policyholder pays for the policy.

B) The extra cash from premiums is invested in the policy and eventually used to offset the increased costs of providing death protection at older ages.

C) The cash value is paid out only if the policyholder dies.

D) The premium declines over time as the cash value increases.

A) The cash value includes all of the premiums the policyholder pays for the policy.

B) The extra cash from premiums is invested in the policy and eventually used to offset the increased costs of providing death protection at older ages.

C) The cash value is paid out only if the policyholder dies.

D) The premium declines over time as the cash value increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a whole life insurance policy has premiums paid over the insured's whole life, this is an

A) limited-payment life insurance.

B) ordinary life insurance policy.

C) single-premium whole life insurance.

D) multi-premium whole life insurance.

A) limited-payment life insurance.

B) ordinary life insurance policy.

C) single-premium whole life insurance.

D) multi-premium whole life insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which type of life insurance allows policyholders to direct the investment component of their policies?

A) Universal life

B) Variable life

C) Whole life

D) Both universal life and variable life

A) Universal life

B) Variable life

C) Whole life

D) Both universal life and variable life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a criticism of whole life insurance?

A) Higher tax rate than on comparable investments.

B) Premiums do not increase with age.

C) Generally low investment returns.

D) Accumulation of cash value.

A) Higher tax rate than on comparable investments.

B) Premiums do not increase with age.

C) Generally low investment returns.

D) Accumulation of cash value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

46

Corey has not paid the premium on his universal life, flexible-premium policy for one month. His insurance company has yet to cancel the policy. Why?

A) He has not passed the two-month free look period.

B) His policy allows him to use accumulated cash value to cover mortality costs for the period.

C) His insurance company is too large to notice.

D) His insurer is a mutual company rather than a stock company.

A) He has not passed the two-month free look period.

B) His policy allows him to use accumulated cash value to cover mortality costs for the period.

C) His insurance company is too large to notice.

D) His insurer is a mutual company rather than a stock company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is the key characteristic of variable life insurance?

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Low cost

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Low cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is not a feature of variable life insurance?

A) It allows policyholders to select the type of investments that their premiums will be used for.

B) It has tax advantages compared with taxable savings accounts because the buildup of cash value is tax-deferred.

C) It does not accumulate a cash value.

D) It is riskier than whole life insurance.

A) It allows policyholders to select the type of investments that their premiums will be used for.

B) It has tax advantages compared with taxable savings accounts because the buildup of cash value is tax-deferred.

C) It does not accumulate a cash value.

D) It is riskier than whole life insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following types of life insurance is the riskiest for the insured?

A) Variable life insurance

B) Whole life insurance

C) Universal life insurance

D) Term life insurance

A) Variable life insurance

B) Whole life insurance

C) Universal life insurance

D) Term life insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is the key characteristic of universal life insurance?

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Lack of permanence

A) Flexible premiums

B) Selection of investment options

C) No cash value

D) Lack of permanence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

51

The rate of return on most permanent life policies is _________ rates earned on other investments.

A) comparable with

B) lower than

C) higher than

D) not comparable with

A) comparable with

B) lower than

C) higher than

D) not comparable with

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

52

Consumers considering the purchase of life insurance should research the financial strength rating for the insurance company they plan to purchase from. Which of the following has the highest financial strength?

A) Allstate Life Insurance Company

B) First Penn-Pacific Life Insurance Company

C) Great-West Life Assurance Company

D) Guardian Life Insurance Company of America

A) Allstate Life Insurance Company

B) First Penn-Pacific Life Insurance Company

C) Great-West Life Assurance Company

D) Guardian Life Insurance Company of America

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

53

Life insurance policies issued by a mutual company are called

A) participating policies.

B) convertible policies.

C) shareholder policies.

D) partner policies.

A) participating policies.

B) convertible policies.

C) shareholder policies.

D) partner policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

54

Stock life insurance companies pay a dividend to

A) policyholders.

B) beneficiaries.

C) the insured.

D) shareholders.

A) policyholders.

B) beneficiaries.

C) the insured.

D) shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not one of the characteristics you should consider when choosing a life insurance agent?

A) Profitability

B) Education

C) Reputation

D) Responsiveness

A) Profitability

B) Education

C) Reputation

D) Responsiveness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is an ethical life insurance practice?

A) Suggesting you convert a term policy into a whole life policy

B) Using the highest rates of return in determining expected cash value

C) Encouraging replacement of an existing cash-value policy with an identical one

D) Suggesting borrowing from a whole life policy to buy a variable annuity

A) Suggesting you convert a term policy into a whole life policy

B) Using the highest rates of return in determining expected cash value

C) Encouraging replacement of an existing cash-value policy with an identical one

D) Suggesting borrowing from a whole life policy to buy a variable annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

57

You have been quoted a premium of $1,200 per year for $1,000,000 in term life insurance, with the premium fixed for 20 years, and a premium of $4,175 per year for a permanent life insurance policy with an equivalent face value. If you decided to implement the "buy term insurance and invest the difference" strategy, how much will you accumulate after 20 years at a 6% APY?

A) $109,437

B) $116,003

C) $153,580

D) $162,795

A) $109,437

B) $116,003

C) $153,580

D) $162,795

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

58

You have been quoted a premium of $1,200 per year for $1,000,000 in level-premium term life insurance for 20 years and a premium of $5,375 per year for a permanent life insurance policy with an equivalent face value. If the insurer's rate of return is 5% APY, at what point will the permanent policy generate enough cash value to pay the premiums?

A) 13.7 years

B) 14.2 years

C) 16.4 years

D) 17.0 years

A) 13.7 years

B) 14.2 years

C) 16.4 years

D) 17.0 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

59

Adelaide has purchased a new life insurance policy. Her agent sent her a document that states the face amount of the policy, policy issue date, key features of the policy, and the insurer's promise to pay. This is an example of a(n)

A) rider.

B) incontestable representation.

C) policy declarations page.

D) viatical settlement.

A) rider.

B) incontestable representation.

C) policy declarations page.

D) viatical settlement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

60

How long is the typical grace period on a fixed-premium policy?

A) One week

B) One month

C) Sixty days

D) One year

A) One week

B) One month

C) Sixty days

D) One year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which life insurance policy does not allow policyholders to borrow against the accumulated value of the policy?

A) Whole life

B) Level-term life

C) Variable life

D) Universal life

A) Whole life

B) Level-term life

C) Variable life

D) Universal life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

62

Insurers might be tempted to do very limited investigations before issuing a policy if a life insurance policy did not have a(n)

A) convertibility provision.

B) guaranteed renewability provision.

C) incontestable provision.

D) nonforfeiture provision.

A) convertibility provision.

B) guaranteed renewability provision.

C) incontestable provision.

D) nonforfeiture provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

63

Barry's life insurance company is refusing to pay his beneficiaries because they say he never disclosed the fact that he was a smoker when he purchased his policy 20 years ago. Do Barry's beneficiaries have grounds to sue the insurance company?

A) Yes, the company has violated the entire contract clause.

B) Yes, the company has violated the incontestable clause.

C) No, Barry violated the incontestable clause.

D) No, Barry violated the nonforfeiture clause.

A) Yes, the company has violated the entire contract clause.

B) Yes, the company has violated the incontestable clause.

C) No, Barry violated the incontestable clause.

D) No, Barry violated the nonforfeiture clause.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

64

Nonforfeiture laws require that insurers must ____________ the permanent life insurance policy after a minimum number of years, if the contract lapses.

A) reinstate

B) allow for term conversion of

C) provide a grace period for

D) refund a fair amount of the cash value of

A) reinstate

B) allow for term conversion of

C) provide a grace period for

D) refund a fair amount of the cash value of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements is correct about reinstatement provisions on life insurance policies that have lapsed?

A) All life insurance policies allow lapsed policies to be reinstated.

B) Reinstatement of a life insurance policy typically requires proof of insurability and payment of any missed premiums with interest.

C) Reinstatement requires the forfeiture of the cash value of the policy.

D) Reinstatement provisions typically allow for missed premiums to be waived upon reinstatement.

A) All life insurance policies allow lapsed policies to be reinstated.

B) Reinstatement of a life insurance policy typically requires proof of insurability and payment of any missed premiums with interest.

C) Reinstatement requires the forfeiture of the cash value of the policy.

D) Reinstatement provisions typically allow for missed premiums to be waived upon reinstatement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

66

Stella is permanently disabled and unable to work. When she bought her life insurance policy, she included a(n) _____________ provision, so that she is allowed to keep the policy in force without further payment of premium.

A) entire contract

B) reinstatement

C) living benefits

D) waiver of premium

A) entire contract

B) reinstatement

C) living benefits

D) waiver of premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

67

Most life insurance policies ____ pay out on policies if the insured commits suicide.

A) never

B) always

C) partially

D) may

A) never

B) always

C) partially

D) may

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

68

The suicide clause in a life insurance policy

A) does not allow your beneficiary to collect if you commit suicide.

B) spells out whether or not your beneficiary can collect if you commit suicide.

C) allows you to collect if a beneficiary commits suicide.

D) allows the insurer to automatically deny the claim.

A) does not allow your beneficiary to collect if you commit suicide.

B) spells out whether or not your beneficiary can collect if you commit suicide.

C) allows you to collect if a beneficiary commits suicide.

D) allows the insurer to automatically deny the claim.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

69

Under a(n) ________, you can buy interest in someone else's life insurance policy.

A) beneficiary clause

B) viatical settlement

C) convertibility settlement

D) entire contract clause

A) beneficiary clause

B) viatical settlement

C) convertibility settlement

D) entire contract clause

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

70

Life insurance policies with an __________ will double the amount of the death benefit if the insured dies as a result of an accident.

A) accelerated living benefit

B) accidental death benefit

C) incontestable clause

D) entire contract clause

A) accelerated living benefit

B) accidental death benefit

C) incontestable clause

D) entire contract clause

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

71

Accelerated or living benefits are options that

A) double the proceeds of your policy.

B) allow anyone to collect the proceeds of your policy before death.

C) allow some terminally ill people to collect part of their policy proceeds before death.

D) outline how long you need to live before you can collect on the policy.

A) double the proceeds of your policy.

B) allow anyone to collect the proceeds of your policy before death.

C) allow some terminally ill people to collect part of their policy proceeds before death.

D) outline how long you need to live before you can collect on the policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not one of the common settlement options for beneficiaries of life insurance policies?

A) Lump sum plus interest

B) Periodic interest only

C) Income for life

D) Lump sum

A) Lump sum plus interest

B) Periodic interest only

C) Income for life

D) Lump sum

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

73

Chris and Marla are married and have a universal life insurance policy on Chris. He just passed away, and Marla wishes to receive the earnings on the settlement and leave the face amount to their grown children. Which of the following settlement options should she choose?

A) Lump sum

B) Periodic interest only

C) Income for a period of time

D) Income of a specific amount

A) Lump sum

B) Periodic interest only

C) Income for a period of time

D) Income of a specific amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

74

Long-term care (LTC) is a term that is broadly used to describe

A) all medical care needed by people that extend beyond their medical insurance coverage.

B) medical care needed by people that extend beyond one year.

C) all supportive medical, personal, and social services needed by people who are unable to meet their basic living needs for an extended period of time.

D) all supportive medical, and personal services needed by people who are unable to meet their basic living needs beyond one year

A) all medical care needed by people that extend beyond their medical insurance coverage.

B) medical care needed by people that extend beyond one year.

C) all supportive medical, personal, and social services needed by people who are unable to meet their basic living needs for an extended period of time.

D) all supportive medical, and personal services needed by people who are unable to meet their basic living needs beyond one year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is true about long-term care costs?

A) As baby boomers are getting older, the cost of long-term care is going down due to greater availability of nursing home facilities.

B) The cost of long-term care does not vary much from state to state.

C) A financial plan should include a plan for paying for future long-term care costs.

D) The demand for long-term care is decreasing.

A) As baby boomers are getting older, the cost of long-term care is going down due to greater availability of nursing home facilities.

B) The cost of long-term care does not vary much from state to state.

C) A financial plan should include a plan for paying for future long-term care costs.

D) The demand for long-term care is decreasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

76

Meals on Wheels serves meals to the elderly who cannot prepare meals. This is an example of what type of long-term care source?

A) Medicare

B) Medicaid

C) Community resources

D) Household resources

A) Medicare

B) Medicaid

C) Community resources

D) Household resources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which federally supported program provides long-term care for the elderly that cannot afford institutional services, such as assistance with activities of daily living?

A) Community resources

B) Medicare

C) Medicaid

D) Long-term care insurance

A) Community resources

B) Medicare

C) Medicaid

D) Long-term care insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

78

Long-term care insurance is a financial product that pays health-care expenses associated with

A) long-term hospital care.

B) hospice care.

C) incapacity.

D) physical and occupational therapy.

A) long-term hospital care.

B) hospice care.

C) incapacity.

D) physical and occupational therapy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

79

Most long-term care insurance includes a ______ period, which is the number of days you receive and pay for care out of pocket before the insurance begins to pay for care.

A) benefit

B) waiting

C) services covered

D) deductible

A) benefit

B) waiting

C) services covered

D) deductible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

80

Long-term care insurance is a relatively ___ product whose costs to insurers have been fairly ____ to predict.

A) older; easy

B) new; easy

C) new; difficult

D) older; difficult

A) older; easy

B) new; easy

C) new; difficult

D) older; difficult

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck