Deck 2: Financial Planning Tools: Personal Financial Statements and the Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 2: Financial Planning Tools: Personal Financial Statements and the Time Value of Money

1

It is recommended that tax records be kept

A) 3 years, because most IRS audits occur within three years of filing a return.

B) 5 years, because most IRS audits occur within five years of filing a return.

C) 7 years, because most IRS audits occur within three years of filing a return.

D) 7 years, because most IRS audits occur within five years of filing a return.

A) 3 years, because most IRS audits occur within three years of filing a return.

B) 5 years, because most IRS audits occur within five years of filing a return.

C) 7 years, because most IRS audits occur within three years of filing a return.

D) 7 years, because most IRS audits occur within five years of filing a return.

7 years, because most IRS audits occur within three years of filing a return.

2

Bills for utilities, telephone, car expenses, and other irregular expenses that are not tax deductible should be kept for

A) one month.

B) one year.

C) five years.

D) seven years.

A) one month.

B) one year.

C) five years.

D) seven years.

one year.

3

A ______ is considered more secure than a _______ because it is a locked box at a remote location, which means thieves cannot access it during a home robbery.

A) safe deposit box; lockbox

B) lockbox; safe deposit box

C) lockbox; dropbox

D) dropbox; safe deposit box

A) safe deposit box; lockbox

B) lockbox; safe deposit box

C) lockbox; dropbox

D) dropbox; safe deposit box

safe deposit box; lockbox

4

Which of the following is an asset?

A) Student loans

B) Home mortgage

C) Automobile

D) Credit card balance

A) Student loans

B) Home mortgage

C) Automobile

D) Credit card balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following information is included on a household's personal balance sheet? (Select any two.)

A) The total annual earnings

B) The value of everything that the household owns

C)The total annual debt payments

D)The amount of all debts owed to others

E) Household income

F)Household expenses

G) Household budget

A) The total annual earnings

B) The value of everything that the household owns

C)The total annual debt payments

D)The amount of all debts owed to others

E) Household income

F)Household expenses

G) Household budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Liquid assets are

A) cash or near-cash assets that can be easily converted to cash without loss of value.

B) assets you can easily sell.

C) assets related to water and mineral rights.

D) assets that are used for investment purposes.

A) cash or near-cash assets that can be easily converted to cash without loss of value.

B) assets you can easily sell.

C) assets related to water and mineral rights.

D) assets that are used for investment purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following best defines market value?

A) The price that was paid for the asset

B) The price that an asset could be sold for today

C) The purchase price of an asset minus depreciation

D) The purchase price of an asset plus depreciation

A) The price that was paid for the asset

B) The price that an asset could be sold for today

C) The purchase price of an asset minus depreciation

D) The purchase price of an asset plus depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

If you borrow to buy a new car with a note, which of the following items on the balance sheet will be affected?

A) Assets Only

B) Debts Only

C) Assets and Debts

D) Unable to Determine

A) Assets Only

B) Debts Only

C) Assets and Debts

D) Unable to Determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

If you lease a new car, which of the following items on the balance sheet will be affected?

A) Assets only

B) Debts only

C) Assets and debts

D) Unable to determine

A) Assets only

B) Debts only

C) Assets and debts

D) Unable to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

If you have an insurance policy that has a cash surrender value,

A) this represents an asset for you.

B) this represents a liability for you.

C) no value is entered on the balance sheet unless the policy is surrendered.

D) the premiums still due are subtracted from the surrender value to arrive at market value.

A) this represents an asset for you.

B) this represents a liability for you.

C) no value is entered on the balance sheet unless the policy is surrendered.

D) the premiums still due are subtracted from the surrender value to arrive at market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

A _______ shows only a single point in time, whereas a ________ reflects transactions that occur over a period of time.

A) personal cash flow statement; personal balance sheet

B) personal balance sheet; personal cash flow statement

C) personal cash flow statement; net worth

D) personal balance sheet; net worth

A) personal cash flow statement; personal balance sheet

B) personal balance sheet; personal cash flow statement

C) personal cash flow statement; net worth

D) personal balance sheet; net worth

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which assets are considered liquid assets? (Select any two.)

A) Money market accounts

B) Market value of automobile(s)

C) Home furnishings

D) Cash value of life insurance

E) Individual retirement account(s)

A) Money market accounts

B) Market value of automobile(s)

C) Home furnishings

D) Cash value of life insurance

E) Individual retirement account(s)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

You purchased a car at the beginning of the year for $35,000 and you noticed a similar used car just sold for $28,000. You financed the purchased with a $30,000 auto loan and paid $5,000 from your savings. If your loan balance is currently $23,635, what is the current market value?

A) $28,000

B) $28,635

C) $35,000

D) $21,635

A) $28,000

B) $28,635

C) $35,000

D) $21,635

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following formulas is used to calculate personal net worth?

A) Total assets + Total debts

B) Total assets - Total debts

C) Total debts - Total assets

D) Liabilities - Unpaid bills

A) Total assets + Total debts

B) Total assets - Total debts

C) Total debts - Total assets

D) Liabilities - Unpaid bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

Your assets total $100,000. Your total debts are $80,000. Your net worth is

A) $20,000.

B) $180,000.

C) 0.8%.

D) 1.2%.

A) $20,000.

B) $180,000.

C) 0.8%.

D) 1.2%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is Veronica's net worth if her assets total $15,000, her gross income is $40,000, her student loan debt is $20,000 (she has no other debts), and her annual expenses (including taxes) total $38,000?

A) $2,000

B) $5,000

C) -$5,000

D) -$18,000

A) $2,000

B) $5,000

C) -$5,000

D) -$18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

Carlos has a net worth of $450,000 and debts worth $300,000. What amount of assets does Carlos have?

A) $750,000

B) $300,000

C) $150,000

D) No debt

A) $750,000

B) $300,000

C) $150,000

D) No debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

Jane has liquid financial assets of $25,000, real estate assets of $125,000, credit card debt of $1,000, and an $89,000 mortgage. Calculate her net worth.

A) $240,000

B) $150,000

C) $90,000

D) $60,000

A) $240,000

B) $150,000

C) $90,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

Insolvency occurs when a person

A) has a positive net worth but is unable to pay his or her debt obligations with current income.

B) has positive net worth but must sell existing assets to pay his or her debt obligations.

C) is unable to pay his or her debt obligations as they come due.

D) has spending exceeding income.

A) has a positive net worth but is unable to pay his or her debt obligations with current income.

B) has positive net worth but must sell existing assets to pay his or her debt obligations.

C) is unable to pay his or her debt obligations as they come due.

D) has spending exceeding income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

A financial statement used to evaluate the relationship between your income and expenditures is known as a

A) personal balance sheet.

B) personal cash flow statement.

C) cost-benefit statement.

D) liquidity statement.

A) personal balance sheet.

B) personal cash flow statement.

C) cost-benefit statement.

D) liquidity statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

A personal cash flow statement

A) shows income and expenditures at one specific point in time.

B) uses the same information needed for the personal balance sheet.

C) shows income and expenditures over a period of time.

D) is necessary for calculating one's net worth.

A) shows income and expenditures at one specific point in time.

B) uses the same information needed for the personal balance sheet.

C) shows income and expenditures over a period of time.

D) is necessary for calculating one's net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

When recording inflows and outflows of cash for the cash flow statement, it is important to

A) monitor your spending for at least two years to get an accurate picture.

B) continue your normal spending behavior.

C) record assets at their market value.

D) track inflows more than outflows.

A) monitor your spending for at least two years to get an accurate picture.

B) continue your normal spending behavior.

C) record assets at their market value.

D) track inflows more than outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following information is included on a household's personal cash flow statement? (Select any two.)

A) The value of all household assets

B) The amount of all debts owed to others

C) Household income

D) Household expenses

E) Value of your car

F) Mortgage balance

A) The value of all household assets

B) The amount of all debts owed to others

C) Household income

D) Household expenses

E) Value of your car

F) Mortgage balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which is not a source of income in a personal cash flow statement?

A) Scholarships

B) Cash allowances or gifts from your parents or others

C) Tax refund

D) Alimony received

A) Scholarships

B) Cash allowances or gifts from your parents or others

C) Tax refund

D) Alimony received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

Fixed expenses are

A) different dollar amounts each month.

B) the same percentage of a person's income each month.

C) the same dollar amount in each payment period.

D) more common than variable expenses.

A) different dollar amounts each month.

B) the same percentage of a person's income each month.

C) the same dollar amount in each payment period.

D) more common than variable expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

To get a realistic picture of actual expenditures, it is recommended that you keep a _____ spending log for at least a _____.

A) daily; week

B) daily; month

C) weekly; month

D) monthly; year

A) daily; week

B) daily; month

C) weekly; month

D) monthly; year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is Veronica's net cash flow if her assets total $15,000, her gross income is $40,000, her student loan debt is $20,000 (she has no other debts), and her annual expenses (including taxes) total $38,000?

A) $2,000

B) $5,000

C) -$5,000

D) -$18,000

A) $2,000

B) $5,000

C) -$5,000

D) -$18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

The savings ratio will be negative if

A) cash inflows exceed cash outflows.

B) cash outflows exceed cash inflows.

C) assets exceed debts.

D) debts exceed assets.

A) cash inflows exceed cash outflows.

B) cash outflows exceed cash inflows.

C) assets exceed debts.

D) debts exceed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

The liquidity ratio measures

A) how many years you could pay your monthly expenses from your assets.

B) how many months you could pay your monthly expenses from your liquid assets.

C) the number of times that your liquid assets exceed your water bill.

D) the number of times that your assets exceed your debts.

A) how many years you could pay your monthly expenses from your assets.

B) how many months you could pay your monthly expenses from your liquid assets.

C) the number of times that your liquid assets exceed your water bill.

D) the number of times that your assets exceed your debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Don has assets of $5,000, of which $1,800 are in checking and savings accounts. His annual expenses are $15,000. Don's liquidity ratio would be

A) 0.120.

B) 0.333.

C) 1.440.

D) 4.000.

A) 0.120.

B) 0.333.

C) 1.440.

D) 4.000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

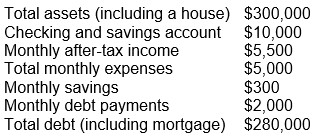

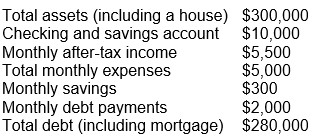

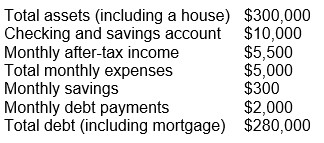

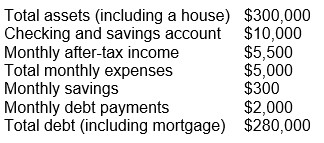

You have the following financial information on the Haring family:

What is the Haring family's liquidity ratio?

What is the Haring family's liquidity ratio?

A) 1.5

B) 2.0

C) 2.5

D) 3.0

What is the Haring family's liquidity ratio?

What is the Haring family's liquidity ratio?A) 1.5

B) 2.0

C) 2.5

D) 3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

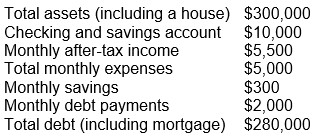

You have the following financial information on the Haring family:

What is the Haring family's debt payment ratio?

What is the Haring family's debt payment ratio?

A) 25%

B) 28%

C) 30%

D) 36%

What is the Haring family's debt payment ratio?

What is the Haring family's debt payment ratio?A) 25%

B) 28%

C) 30%

D) 36%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

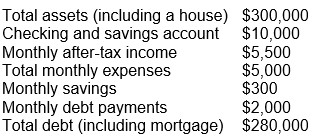

You have the following financial information on the Haring family:

What is the Haring family's savings ratio?

What is the Haring family's savings ratio?

A) 4%

B) 5%

C) 10%

D) 18%

What is the Haring family's savings ratio?

What is the Haring family's savings ratio?A) 4%

B) 5%

C) 10%

D) 18%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which personal financial ratio measures the percent of your total assets that you've financed with debt?

A) Debt ratio

B) Debt payment ratio

C) Mortgage debt service ratio

D) Liquidity ratio

A) Debt ratio

B) Debt payment ratio

C) Mortgage debt service ratio

D) Liquidity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

Gross monthly income = $3,500

After-tax monthly income = $2,970

Total debt = $86,000

Total monthly debt payments = $402

Total assets = $113,000

Based on the information given, what is the debt ratio?

A) 3%

B) 47%

C) 76%

D) 131%

After-tax monthly income = $2,970

Total debt = $86,000

Total monthly debt payments = $402

Total assets = $113,000

Based on the information given, what is the debt ratio?

A) 3%

B) 47%

C) 76%

D) 131%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

The debt payment ratio estimates the percentage of __________ that is used to cover required monthly ________ on all debts.

A) after-tax income; minimum payments

B) total income; minimum payments

C) after-tax income; average payments

D) total income; average payments

A) after-tax income; minimum payments

B) total income; minimum payments

C) after-tax income; average payments

D) total income; average payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

The mortgage debt service ratio measures the percentage of your gross income that you pay in

A) mortgage payments.

B) mortgage payments and property taxes.

C) mortgage payments and homeowner's insurance.

D) mortgage payments, property taxes, and homeowner's insurance.

A) mortgage payments.

B) mortgage payments and property taxes.

C) mortgage payments and homeowner's insurance.

D) mortgage payments, property taxes, and homeowner's insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

If interest rates increase significantly in the future, in what ways will your borrowing decisions and financial ratios be impacted?

A) Higher rates will increase the amount of loan you can obtain because your debt payment ratios will increase.

B) Higher rates will increase the amount of loan you can obtain because your debt payment ratios will decrease.

C) Higher rates will reduce the amount of loan you can obtain because your debt payment ratios will increase.

D) Higher rates will reduce the amount of loan you can obtain because your debt payment ratios will decrease.

A) Higher rates will increase the amount of loan you can obtain because your debt payment ratios will increase.

B) Higher rates will increase the amount of loan you can obtain because your debt payment ratios will decrease.

C) Higher rates will reduce the amount of loan you can obtain because your debt payment ratios will increase.

D) Higher rates will reduce the amount of loan you can obtain because your debt payment ratios will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

You estimate your monthly mortgage principal and interest will be $1,000, property taxes will be $160 per month, and homeowner's insurance will be $50 per month. If your gross monthly income is $4,000 per month and your tax rate is 20 percent, what is your mortgage debt service ratio?

A) 30.25%

B) 37.80%

C) 60.50%

D) 65.20%

A) 30.25%

B) 37.80%

C) 60.50%

D) 65.20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

Borrowing at _________ is a major reason for the ______ standard of living in the United States.

A) low interest rates; declining

B) high interest rates; declining

C) low interest rates; rising

D) high interest rates; rising

A) low interest rates; declining

B) high interest rates; declining

C) low interest rates; rising

D) high interest rates; rising

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

Tyler's monthly gross income is $4,200 and his monthly after-tax income is $3,400. He saves approximately $300 a month. What is his savings ratio?

A) 7.14%

B) 8.80%

C) 18.00%

D) 38.00%

A) 7.14%

B) 8.80%

C) 18.00%

D) 38.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

The basic idea of time value of money is that $1 to be received in the ________ is worth ______$1 received today because of the value of the compound interest.

A) past; less than

B) future; less than

C) future; more than

D) past; the same as

A) past; less than

B) future; less than

C) future; more than

D) past; the same as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

________ occurs when you earn interest on your investment balance and then leave the interest in the account so that you earn future interest on the__.

A) Compounding; original balance

B) Discounting; original balance

C) Compounding; original balance plus the accumulated interest earnings

D) Discounting; original balance plus the accumulated interest earnings

A) Compounding; original balance

B) Discounting; original balance

C) Compounding; original balance plus the accumulated interest earnings

D) Discounting; original balance plus the accumulated interest earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

The time value of money is a good argument against saving money in a piggy bank at home, because the money will

A) gain purchasing power over time due to inflation.

B) lose purchasing power over time due to inflation.

C) maintain purchasing power over time despite inflation.

D) maintain purchasing power over time due to inflation.

A) gain purchasing power over time due to inflation.

B) lose purchasing power over time due to inflation.

C) maintain purchasing power over time despite inflation.

D) maintain purchasing power over time due to inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

You want to know how much $10,000 invested today is going to be worth 10 years from now. Which type of time value of money calculation should be used to solve this problem?

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

You invest $1,000 today and earn 10% interest, compounded annually. How much will you have in five years?

A) $1,475.19

B) $1,550.26

C) $1,610.51

D) $1,720.82

A) $1,475.19

B) $1,550.26

C) $1,610.51

D) $1,720.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

You deposit $200 today into a bank account. If the account earns 8% annually, how much will you have at the end of 10 years.

A) $93

B) $432

C) $2,897

D) $3,329

A) $93

B) $432

C) $2,897

D) $3,329

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

If you receive a series of equal end-of-year payments over several years, this is an example of

A) a perpetuity.

B) an ordinary annuity.

C) an annuity due.

D) compounding.

A) a perpetuity.

B) an ordinary annuity.

C) an annuity due.

D) compounding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

An annuity is a series of _____ payments made at ________, for a period of time.

A) equal; monthly intervals

B) equal; regular intervals

C) increasing; regular intervals

D) decreasing; regular intervals

A) equal; monthly intervals

B) equal; regular intervals

C) increasing; regular intervals

D) decreasing; regular intervals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

An annuity due is a type of annuity in which each payment is made or received at

A) the end of a period

B) the beginning of a period

C) predetermined intervals within a period

D) any time

A) the end of a period

B) the beginning of a period

C) predetermined intervals within a period

D) any time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is true regarding future value, all else equal?

A) The longer the term, the lower the future value.

B) The higher the interest rate, the lower the future value.

C) The shorter the term, the higher the future value.

D) The lower the interest rate, the lower the future value.

A) The longer the term, the lower the future value.

B) The higher the interest rate, the lower the future value.

C) The shorter the term, the higher the future value.

D) The lower the interest rate, the lower the future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

In order to determine how much, you would need to save annually to finance your child's college education in 10 years, you would use the

A) future value of a lump sum.

B) future value of an annuity.

C) present value of a lump sum.

D) present value of an annuity.

A) future value of a lump sum.

B) future value of an annuity.

C) present value of a lump sum.

D) present value of an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

You save $250 at the end of every month from your paycheck. If you can earn 6% APY, compounded monthly, how much will you have saved in 5 years?

A) $15,000

B) $16,911

C) $17,443

D) $20,406

A) $15,000

B) $16,911

C) $17,443

D) $20,406

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

If you are investing $2,500 a year (end-of-year payments) into a retirement account that earns 9% interest annually, how much will you have at the end of 20 years?

A) $14,011

B) $127,900

C) $139,400

D) $141,911

A) $14,011

B) $127,900

C) $139,400

D) $141,911

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

You plan to invest $2,000 every year (end-of-year payments) from now until you retire in 30 years. If you can earn 7% annually on your invested funds, how much will you have when you retire?

A) $15,225

B) $25,081

C) $188,922

D) $204,146

A) $15,225

B) $25,081

C) $188,922

D) $204,146

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

You plan to invest $1,500 every year (beginning-of-year payments) for the next 10 years. If you can earn 9% on your invested funds, how much will you have in 10 years?

A) $22,789

B) $24,840

C) $28,391

D) $22,406

A) $22,789

B) $24,840

C) $28,391

D) $22,406

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

The process of calculating present value is known as

A) compounding.

B) discounting.

C) annuitizing.

D) averaging.

A) compounding.

B) discounting.

C) annuitizing.

D) averaging.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

One year from now, you need to have $5,000 to pay your tuition. How much do you need to invest today if you can earn 10% interest, compounded annually?

A) $3,355.75

B) $3,875.25

C) $4,000.55

D) $4,545.45

A) $3,355.75

B) $3,875.25

C) $4,000.55

D) $4,545.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

You expect to receive a sum of money 10 years from now, and you want to know how much it is worth today. Which time value of money calculation should be used to solve this problem?

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

You can afford to make $100 monthly payments for three years, and you want to know how much you can borrow based on this payment amount. Which type of time value of money calculation should be used to solve this problem?

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

A) Present value of a lump sum

B) Future value of a lump sum

C) Present value of an annuity

D) Future value of an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

You just won a $20 million lottery. You can choose either receiving $8 million today or $800,000 per year for 25 years. Which time value of money calculation should you use to decide between these two alternatives?

A) Future value of a lump sum

B) Present value of a lump sum

C) Future value of an annuity

D) Present value of an annuity

A) Future value of a lump sum

B) Present value of a lump sum

C) Future value of an annuity

D) Present value of an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

You just won a $20 million lottery. You can choose either receiving $8 million today or $800,000 per year for 25 years. Assuming you think you, can earn 8% per year on your investments, compounded annually, which of these alternatives is preferable?

A) $8 million lump sum is preferable because the annuity is worth $2,920,358.

B) $8 million lump sum is preferable because the annuity is worth $7,854,518.

C) Annuity is preferable because it is worth $8,539,821 to you.

D) Annuity is preferable because it's worth $20 million

A) $8 million lump sum is preferable because the annuity is worth $2,920,358.

B) $8 million lump sum is preferable because the annuity is worth $7,854,518.

C) Annuity is preferable because it is worth $8,539,821 to you.

D) Annuity is preferable because it's worth $20 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

You want to receive payments of $20,000 each year (end-of-year payments) for 15 years. If you can earn 8% on your funds, how much would you have to invest today in order to reach your goal?

A) $54,304

B) $63,055

C) $171,190

D) $184,885

A) $54,304

B) $63,055

C) $171,190

D) $184,885

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

Loan amortization is based upon

A) future value.

B) future value of an annuity.

C) present value.

D) present value of an annuity.

A) future value.

B) future value of an annuity.

C) present value.

D) present value of an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

You borrow $10,000 from your bank at 7% APR for 4 years, what will be your monthly payment?

A) $239

B) $253

C) $376

D) $421

A) $239

B) $253

C) $376

D) $421

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

You are considering two amortized loans with the same number of months to repay and the same initial amount borrowed. If the interest rate on Loan A is ______ than the rate on Loan B, then the payment on Loan A will be _______ the payment on Loan B.

A) higher; higher than

B) higher; lower than

C) lower; higher than

D) lower; same as

A) higher; higher than

B) higher; lower than

C) lower; higher than

D) lower; same as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

You are considering two amortized loans with the same interest rate and the same initial amount borrowed. If the number of months to repay Loan × is _____ than the number of months to repay Loan Y, the monthly payment on Loan × will be ________ the payment on Loan Y.

A) greater; higher than

B) greater; lower than

C) less; lower than

D) less; same as

A) greater; higher than

B) greater; lower than

C) less; lower than

D) less; same as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck