Deck 5: Selecting Innovation Projects

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 5: Selecting Innovation Projects

1

Any innovation opportunity that generates a positive financial return is worth pursuing because it adds to the companies net worth.

False

2

Fixed costs are costs that are independent of your level of production.

True

3

Qualitative decision-making tools compare projects on the basis of scales or words.

True

4

The first step in the analytical hierarchy process is to calculate the priority vectors for each dimension.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

The net present value estimates the rate of return on a project, given the level of expenditure and the timing and amount of cash inflows and outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

At a 10 percent discount rate, a project that generates $1,000,000 a year for three years would have a net present value of $2,486,852.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

If you were to recalculate the net present value of a project with a higher discount rate, the resulting net present value would be higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

The internal rate of return is the discount rate that yields a net present value of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the rate on U.S. treasury securities, with a term similar to your project is greater than the internal rate of return for the project, the project most likely should be undertaken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

An advantage associated with discounted cash flow calculations is that they incorporate many important nonfinancial factors that influence decisions, such as the reaction of competitors, the relationship of one part of the business to another, or organizational learning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

Options have positive value if the expected cash flow from making the investment is more than the value of maintaining the option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Real options help to maintain flexibility and avoid committing valuable resources to infeasible alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

In general, real-options analysis generates a larger value than discounted cash flow analysis if the magnitude of the outcome is large relative to the magnitude of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Decision trees are a way to create a probability distribution of outcomes through the use of computer software that experiments with randomly selected values of inputs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Scenario analyses provide a visual representation of decisions and their effects on outcomes, costs and risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

When companies develop multiple products, they often use portfolio management tools to make decisions about innovation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Portfolio models take a wide variety of forms, including pie charts and bubble diagrams and are always based on quantitative data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

A breakthrough project would be one with a high degree of process change and a low degree of product change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

What type of uncertainty are companies facing when they need to choose between different innovation projects based on the value that can be captured from successful innovation?

A) technical uncertainty

B) financial uncertainty

C) market uncertainty

D) competitive uncertainty

A) technical uncertainty

B) financial uncertainty

C) market uncertainty

D) competitive uncertainty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is a way researches have identified as a strategic action to manage the uncertainty with innovation?

A) minimizing flexibility

B) seeking stable returns

C) reallocating uncertainty to others

D) maximizing investment

A) minimizing flexibility

B) seeking stable returns

C) reallocating uncertainty to others

D) maximizing investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

As part of which strategic action should you minimize your investment in nonsalvageable assets?

A) seeking high returns

B) minimizing investment

C) maintaining flexibility

D) reallocating uncertainty to others

A) seeking high returns

B) minimizing investment

C) maintaining flexibility

D) reallocating uncertainty to others

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

As part of which strategic action should you begin your operations on a small scale?

A) seeking high returns

B) minimizing investment

C) maintaining flexibility

D) reallocating uncertainty to others

A) seeking high returns

B) minimizing investment

C) maintaining flexibility

D) reallocating uncertainty to others

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

What costs are independent of your level of production?

A) total costs

B) fixed costs

C) labor costs

D) variable costs

A) total costs

B) fixed costs

C) labor costs

D) variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

What costs are dependent on the level of production of your good or service?

A) total costs

B) fixed costs

C) labor costs

D) variable costs

A) total costs

B) fixed costs

C) labor costs

D) variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Loan payments on a commercial building would be classified as which type of cost?

A) total costs

B) labor costs

C) fixed costs

D) variable costs

A) total costs

B) labor costs

C) fixed costs

D) variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

Given the following information, what is the contribution margin per unit?

Salary $200,000

Fixed costs $100,000

Variable costs $ 100 per item

Sales price $ 150 per item

A) $50

B) $150

C) $6,000

D) $12,000

Salary $200,000

Fixed costs $100,000

Variable costs $ 100 per item

Sales price $ 150 per item

A) $50

B) $150

C) $6,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Given the following information, what is the breakeven level of sales?

Salary $200,000

Fixed costs $100,000

Variable costs $ 100 per item

Sales price $ 150 per item

A) 50

B) 150

C) 6,000

D) 12,000

Salary $200,000

Fixed costs $100,000

Variable costs $ 100 per item

Sales price $ 150 per item

A) 50

B) 150

C) 6,000

D) 12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

What type of decision-making tool compares projects on the basis of scales or words?

A) qualitative

B) quantitative

C) comparative

D) scoring

A) qualitative

B) quantitative

C) comparative

D) scoring

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

What type of decision-making tool evaluates projects based on the basis of numerical calculations?

A) qualitative

B) quantitative

C) comparative

D) scoring

A) qualitative

B) quantitative

C) comparative

D) scoring

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the best explanation of comparative decision-making tools?

A) tools that compare projects on the basis of scales or words

B) tolls that evaluate projects based on the basis of numerical calculations

C) tools that pit projects against each other

D) tools that compare projects against standard scales

A) tools that compare projects on the basis of scales or words

B) tolls that evaluate projects based on the basis of numerical calculations

C) tools that pit projects against each other

D) tools that compare projects against standard scales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the best explanation of scoring model?

A) tools that compare projects on the basis of scales or words

B) tolls that evaluate projects based on the basis of numerical calculations

C) tools that pit projects against each other

D) tools that compare projects against standard scales

A) tools that compare projects on the basis of scales or words

B) tolls that evaluate projects based on the basis of numerical calculations

C) tools that pit projects against each other

D) tools that compare projects against standard scales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

If you are evaluating projects on whether or not they meet specific criteria, what type of scoring model are you most likely using?

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which decision-making tool breaks a problem down into a series of different criteria and choices?

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

What decision-making tool starts with a decision maker making pair-wise comparisons of the importance of each dimension versus another on a scale of 0 to 10?

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

A) analytic hierarchy process

B) net present value

C) internal rate of return

D) checklist

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

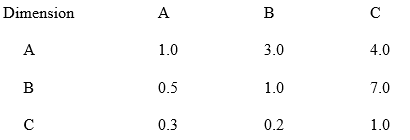

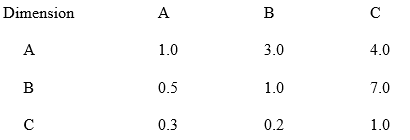

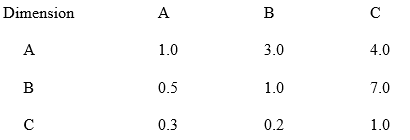

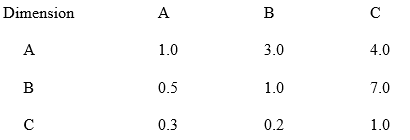

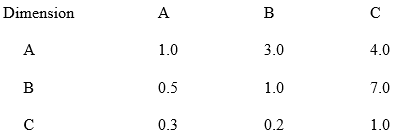

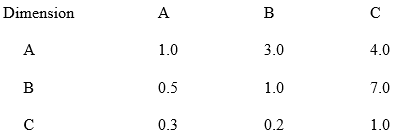

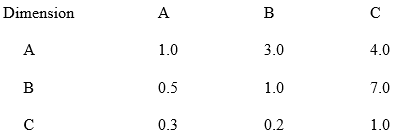

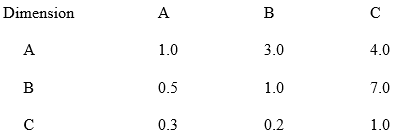

Given the following table of dimension weights, what is the priority vector for dimension A?

A) .54

B) .60

C) 1.80

D) 2.67

A) .54

B) .60

C) 1.80

D) 2.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Given the following table of dimension weights, what is the priority vector for dimension B?

A) .50

B) .36

C) 1.40

D) 1.00

A) .50

B) .36

C) 1.40

D) 1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Given the following table of dimension weights, what is the most important dimension?

A) A

B) B

C) C

D) can not tell from the information provided

A) A

B) B

C) C

D) can not tell from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

Given the following table of dimension weights, what is the least important dimension?

A) A

B) B

C) C

D) can not tell from the information provided

A) A

B) B

C) C

D) can not tell from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

When using the analytical hierarchy process of decision making, what is the weighted average of each attribute called?

A) inconsistency ratio

B) priority vector

C) net present value

D) real option

A) inconsistency ratio

B) priority vector

C) net present value

D) real option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

What quantitative method for evaluating innovative projects estimates the value of a project today given the amount and timing of cash outflows and inflows and the discount rate?

A) analytical hierarchy process

B) real options

C) net present value

D) internal rate of return

A) analytical hierarchy process

B) real options

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

What quantitative method for evaluating innovative projects estimates the rate of return on a project given the level of expenditure and the timing and amount of cash inflows and outflows?

A) analytical hierarchy process

B) real options

C) net present value

D) internal rate of return

A) analytical hierarchy process

B) real options

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

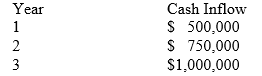

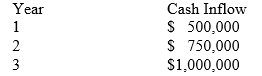

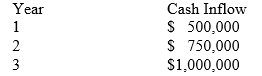

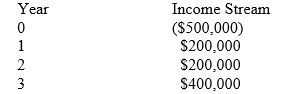

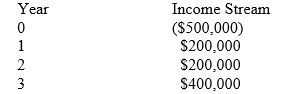

Given the following stream of cash flows assuming a current discount rate of 10 percent, what is the net present value of the project?

A) 1,000,000

B) 1,825,695

C) 2,137,980

D) 2,250,000

A) 1,000,000

B) 1,825,695

C) 2,137,980

D) 2,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

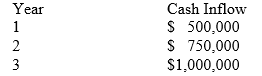

Given the following stream of cash flows assuming a current discount rate of 5 percent, what is the net present value of the project?

A) 1,000,000

B) 1,877,443

C) 2,020,300

D) 2,250,000

A) 1,000,000

B) 1,877,443

C) 2,020,300

D) 2,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

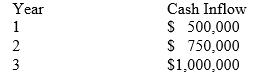

Given the following stream of cash flows assuming a current discount rate of 10 percent, if the initial investment were $1.8 million, what is the payback period?

A) 1 year

B) 2 years

C) 3 years

D) longer than 3 years

A) 1 year

B) 2 years

C) 3 years

D) longer than 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

When calculating the net present value of an innovative project and you decide to lower the discount rate, what would happen to the net present value?

A) it would increase

B) it would decrease

C) it wouldn't change

D) it's impossible to tell with the information provided

A) it would increase

B) it would decrease

C) it wouldn't change

D) it's impossible to tell with the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

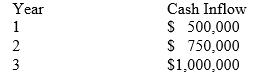

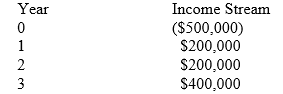

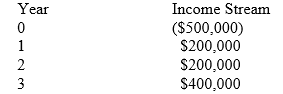

What is the internal rate of return on the following income stream?

A) 5 percent

B) 10 percent

C) 15 percent

D) 20 percent

A) 5 percent

B) 10 percent

C) 15 percent

D) 20 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Given the following income stream, if the rate of return on a three-year U.S. Treasury note was currently 5 percent, what decision would you make about the possible investment?

A) it would most likely be a poor investment

B) it would most likely be a good investment

C) it could be positive or negative

D) there is not enough information to be able to judge

A) it would most likely be a poor investment

B) it would most likely be a good investment

C) it could be positive or negative

D) there is not enough information to be able to judge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which decision making tool that provides the right but not the obligation to make a future investment?

A) analytical hierarchy process

B) net present value

C) internal rate of return

D) real options

A) analytical hierarchy process

B) net present value

C) internal rate of return

D) real options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which decision-making tool limits decision making to information known at the stage at which the decision is being made?

A) analytical hierarchy process

B) net present value

C) real options

D) internal rate of return

A) analytical hierarchy process

B) net present value

C) real options

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which tool for making decisions about innovation projects provides a representation of investments under different assumptions about key factors that influence those investments?

A) analytical hierarchy process

B) net present value

C) real options

D) scenario analysis

A) analytical hierarchy process

B) net present value

C) real options

D) scenario analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

What decision-making tool provides a way to create a probability distribution of outcomes through the use of computer software that experiments with randomly selected values of inputs?

A) analytical hierarchy process

B) net present value

C) Monte Carlo simulation

D) decision trees

A) analytical hierarchy process

B) net present value

C) Monte Carlo simulation

D) decision trees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

What decision-making tool provides a visual representation of decisions and their effects on outcomes, cost, and risks?

A) analytical hierarchy process

B) internal rate of return

C) Monte Carlo simulation

D) decision trees

A) analytical hierarchy process

B) internal rate of return

C) Monte Carlo simulation

D) decision trees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which decision-making tool provides a quantitative evaluation of a choice that is based on the value and probability of outcomes, and accounts for the influence of staged decision making on risk?

A) analytical hierarchy process

B) internal rate of return

C) Monte Carlo simulation

D) decision trees

A) analytical hierarchy process

B) internal rate of return

C) Monte Carlo simulation

D) decision trees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the most important portfolio management tool?

A) pie charts

B) project maps

C) bubble diagrams

D) bar charts

A) pie charts

B) project maps

C) bubble diagrams

D) bar charts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

Project maps show the placement of projects into what category?

A) derivative projects

B) platform projects

C) breakthrough projects

D) all of the above

A) derivative projects

B) platform projects

C) breakthrough projects

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which project map category would include efforts that extend existing projects?

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which project map category would include efforts based on fundamentally new ideas?

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which project map category would include efforts to create new product families?

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

If you were looking to maximize profits form your R&D investments, in which area would you be most likely to allocate more resources?

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

A) derivative projects

B) platform projects

C) creative projects

D) breakthrough projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

If you wanted to accelerate growth, in which area would you be most likely to allocate more resources?

A) derivative projects

B) platform projects

C) breakthrough projects

D) either platform or breakthrough projects

A) derivative projects

B) platform projects

C) breakthrough projects

D) either platform or breakthrough projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Discuss the various strategic actions that can be undertaken to manage the uncertainty associated with innovation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Describe the various tools available to assist in making choices about innovation project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain the step required to conduct the analytic hierarchy process of decision making. Describe how the results from the process can be used to make an informed decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Define and distinguish between net present value and the internal rate of return. What are some common problems associated with analyses based on discounted cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under what circumstances would a real-option analysis be preferable to a discounted cash flow analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Explain why companies need to manage product portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck