Deck 11: Stockholders Equity: Paid-In Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 11: Stockholders Equity: Paid-In Capital

1

Lewis Corporation issued 125,000 shares of $5 par value capital stock at date of incorporation for cash at a price of $9 per share. During the first year of operations, the company earned $140,000 and declared a dividend of $100,000. At the end of this first year of operations, the balance of the Capital Stock account is:

A) $765,000.

B) $1,000,000.

C) $625,000.

D) $665,000.

A) $765,000.

B) $1,000,000.

C) $625,000.

D) $665,000.

$625,000.

2

Perez Corporation has 100,000 shares of $1 par value common stock and 20,000 shares of 8% cumulative preferred stock, $100 par value, outstanding. The balance in Retained Earnings at the beginning of the year was $1,600,000, and one year's dividends were in arrears. Net income for the current year was $870,000. If Perez Corporation paid a dividend of $2 per share on its common stock, what is the balance in Retained Earnings at the end of the year?

A) $2,150,000.

B) $2,270,000.

C) $2,110,000.

D) $1,950,000.

A) $2,150,000.

B) $2,270,000.

C) $2,110,000.

D) $1,950,000.

$1,950,000.

3

Pike Corporation has total stockholders' equity of $8,690,000 as of December 31, Year 1. The company has 300,000 shares of $2 par value common stock and 20,000 shares of 8% cumulative preferred stock, $100 par value, outstanding. Due to lower-than-expected net income, no dividends were declared by Pike's board of directors for Year 1. The book value per share of common stock is:

A) $25.00.

B) $21.77.

C) $23.00.

D) $25.60.

A) $25.00.

B) $21.77.

C) $23.00.

D) $25.60.

$21.77.

4

Which of the following most likely explains why a corporation declares a stock split?

A) To make the price of the stock more affordable to investors.

B) To increase the market price of the stock.

C) To increase the number of shares outstanding and increase retained earnings.

D) To increase the par value of the stock.

A) To make the price of the stock more affordable to investors.

B) To increase the market price of the stock.

C) To increase the number of shares outstanding and increase retained earnings.

D) To increase the par value of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not a characteristic of most preferred stocks?

A) Preference as to dividends.

B) No voting power.

C) Convertible into common stock.

D) Preference as to assets in the event of liquidation of the company.

A) Preference as to dividends.

B) No voting power.

C) Convertible into common stock.

D) Preference as to assets in the event of liquidation of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

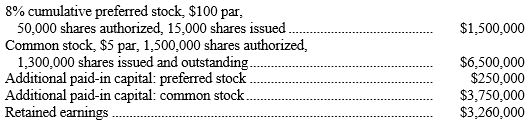

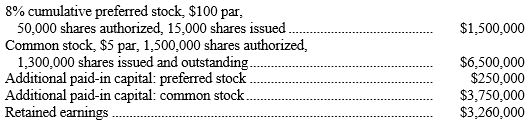

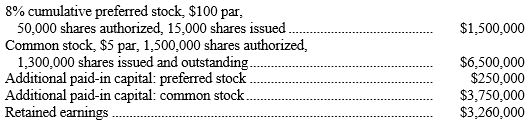

Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, Year 1.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.

-Refer to the above data. The average issue price per share (rounded to the nearest dollar) of Revere's preferred stock was:

A) $117.

B) $100.

C) $110.

D) $34.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.-Refer to the above data. The average issue price per share (rounded to the nearest dollar) of Revere's preferred stock was:

A) $117.

B) $100.

C) $110.

D) $34.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, Year 1.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.

-Refer to the above data. The total amount of Revere's paid-in capital at December 31, Year 1, is:

A) $ 8,000,000.

B) $15,260,000.

C) $12,000,000.

D) $ 4,000,000.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.-Refer to the above data. The total amount of Revere's paid-in capital at December 31, Year 1, is:

A) $ 8,000,000.

B) $15,260,000.

C) $12,000,000.

D) $ 4,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, Year 1.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.

-Refer to the above data. Revere's total legal capital at December 31, Year 1, is:

A) $12,000,000.

B) $15,260,000.

C) $11,260,000.

D) $ 8,000,000.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.-Refer to the above data. Revere's total legal capital at December 31, Year 1, is:

A) $12,000,000.

B) $15,260,000.

C) $11,260,000.

D) $ 8,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, Year 1.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.

-Refer to the above data. The book value per share of common stock, assuming current-year preferred dividends have been paid, is:

A) $9.23.

B) $10.39.

C) $8.66.

D) $6.15.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.-Refer to the above data. The book value per share of common stock, assuming current-year preferred dividends have been paid, is:

A) $9.23.

B) $10.39.

C) $8.66.

D) $6.15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

Shown below is information relating to the stockholders' equity of Revere Corporation at December 31, Year 1.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.

-Refer to the above data. The balance in Retained Earnings at the beginning of the year was $2,710,000, and there were no dividends in arrears. Net income for Year 1 was $2,250,000. What was the amount of dividend declared on each share of common stock during Year 1?

A) $1.30.

B) $2.40.

C) $1.21.

D) $3.72.

Answer the following questions based on the stockholders' equity section given above.

Answer the following questions based on the stockholders' equity section given above.-Refer to the above data. The balance in Retained Earnings at the beginning of the year was $2,710,000, and there were no dividends in arrears. Net income for Year 1 was $2,250,000. What was the amount of dividend declared on each share of common stock during Year 1?

A) $1.30.

B) $2.40.

C) $1.21.

D) $3.72.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

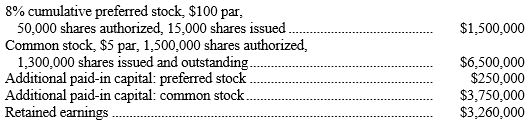

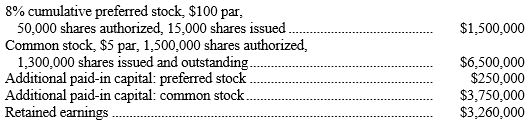

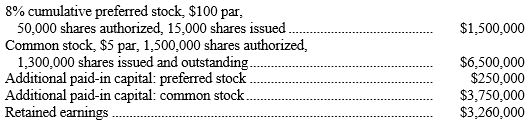

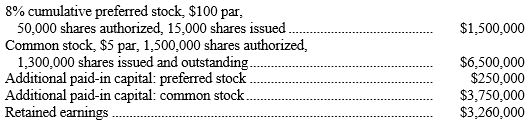

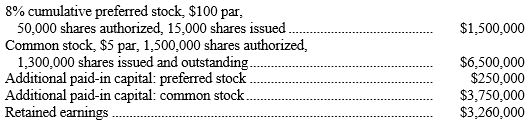

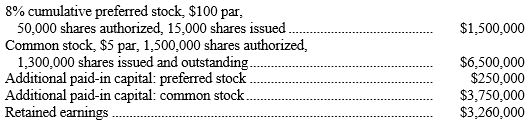

Shown below is information relating to the stockholders' equity of Novake Corporation at December 31, Year 1:

From the above information, compute the following:

From the above information, compute the following:

-The total amount of legal capital: $__________

From the above information, compute the following:

From the above information, compute the following:-The total amount of legal capital: $__________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

Shown below is information relating to the stockholders' equity of Novake Corporation at December 31, Year 1:

From the above information, compute the following:

From the above information, compute the following:

-The total amount of paid-in capital: $__________

From the above information, compute the following:

From the above information, compute the following:-The total amount of paid-in capital: $__________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

Shown below is information relating to the stockholders' equity of Novake Corporation at December 31, Year 1:

From the above information, compute the following:

From the above information, compute the following:

-The average issue price per share of preferred stock: $_____ per share

From the above information, compute the following:

From the above information, compute the following:-The average issue price per share of preferred stock: $_____ per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

Shown below is information relating to the stockholders' equity of Novake Corporation at December 31, Year 1:

From the above information, compute the following:

From the above information, compute the following:

-The book value per share of common stock (assume current-year preferred dividends have been paid) $_____ per share

From the above information, compute the following:

From the above information, compute the following:-The book value per share of common stock (assume current-year preferred dividends have been paid) $_____ per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

Shown below is information relating to the stockholders' equity of Novake Corporation at December 31, Year 1:

From the above information, compute the following:

From the above information, compute the following:

-The balance in Retained Earnings at the beginning of the year was $650,000, and there were no dividends in arrears. Net income for Year 1 was $475,000. What was the amount of dividend declared on each share of common stock during Year 1? $_____ per share

From the above information, compute the following:

From the above information, compute the following:-The balance in Retained Earnings at the beginning of the year was $650,000, and there were no dividends in arrears. Net income for Year 1 was $475,000. What was the amount of dividend declared on each share of common stock during Year 1? $_____ per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

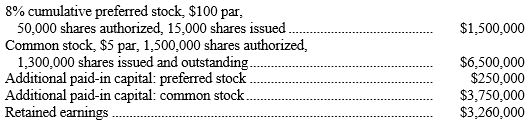

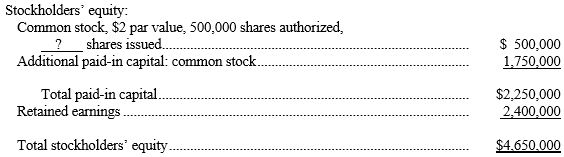

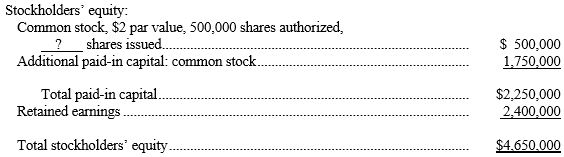

Shown below is the stockholders' equity section of Powell's balance sheet at December 31, Year 1:

In Year 2, the following events occurred:

In Year 2, the following events occurred:

Powell issued 2,500 shares of $2 par common stock as payment for legal services. Although Powell's stock is not traded on any exchange, the agreed-upon value of the legal services is $80,000.

Powell issued 4,500 shares out of 10,000 shares authorized of 6% cumulative preferred stock, $100 par value, for $106 per share.

The board of directors declared a dividend of $1.25 per share on the common stock. Powell's net income for Year 2 was $675,000.

Instructions

Complete in good form the stockholders' equity section of a balance sheet prepared for Powell at December 31, Year 2.

In Year 2, the following events occurred:

In Year 2, the following events occurred:Powell issued 2,500 shares of $2 par common stock as payment for legal services. Although Powell's stock is not traded on any exchange, the agreed-upon value of the legal services is $80,000.

Powell issued 4,500 shares out of 10,000 shares authorized of 6% cumulative preferred stock, $100 par value, for $106 per share.

The board of directors declared a dividend of $1.25 per share on the common stock. Powell's net income for Year 2 was $675,000.

Instructions

Complete in good form the stockholders' equity section of a balance sheet prepared for Powell at December 31, Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck